Introduction

Ensuring the legitimacy and clarity of property ownership is paramount in the realm of real estate transactions. A comprehensive property title search serves as the backbone of this process, meticulously examining public records to confirm rightful ownership and identify any potential claims, liens, or encumbrances that could impact the transfer. This article delves into the intricacies of property title searches, exploring their purpose, key components, and the meticulous steps involved.

It underscores the significance of title insurance and addresses common issues that may arise, emphasizing the critical role of accuracy and reliability in fostering trust and efficiency in real estate dealings.

What is a Property Title Search?

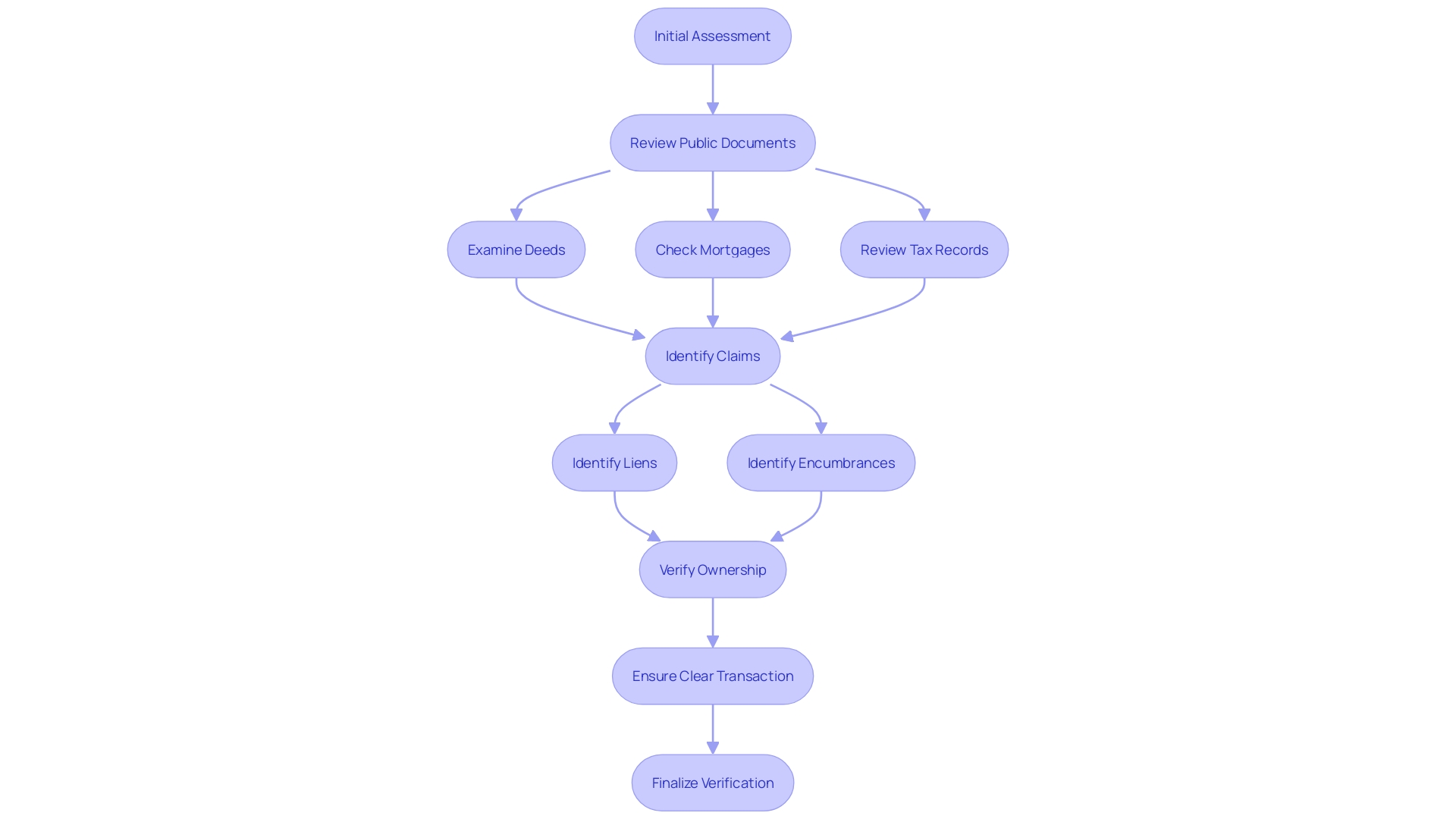

A deed examination is a careful assessment of public documents to establish the legitimate ownership of . This essential process involves scrutinizing various documents, including deeds, mortgages, and tax records, to verify that the seller has the to transfer ownership. 'Moreover, the inquiry aims to reveal any assertions, liens, or encumbrances that could affect the ownership, ensuring a straightforward and sellable transaction. Establishing a reputation for precision and dependability in is essential for success in the industry, as it plays a vital role in real estate by offering insurance and performing detailed assessments of .

Purpose of a Title Search

The main aim of a document examination is to confirm that the asset being acquired is clear of any disputes and claims. It helps buyers and lenders understand the , ensuring that there are no outstanding debts or legal issues that could jeopardize the transaction. By clarifying , an ownership review also facilitates smoother . 'With total revenue of $7.6 billion in 2022, First American Financial Corporation exemplifies the and insurance, which are fundamental to the real estate industry.'. 'The precision and dependability of ownership firms are crucial for sustaining confidence and effectiveness in real estate dealings.'.

Key Components in Determining Clear Title

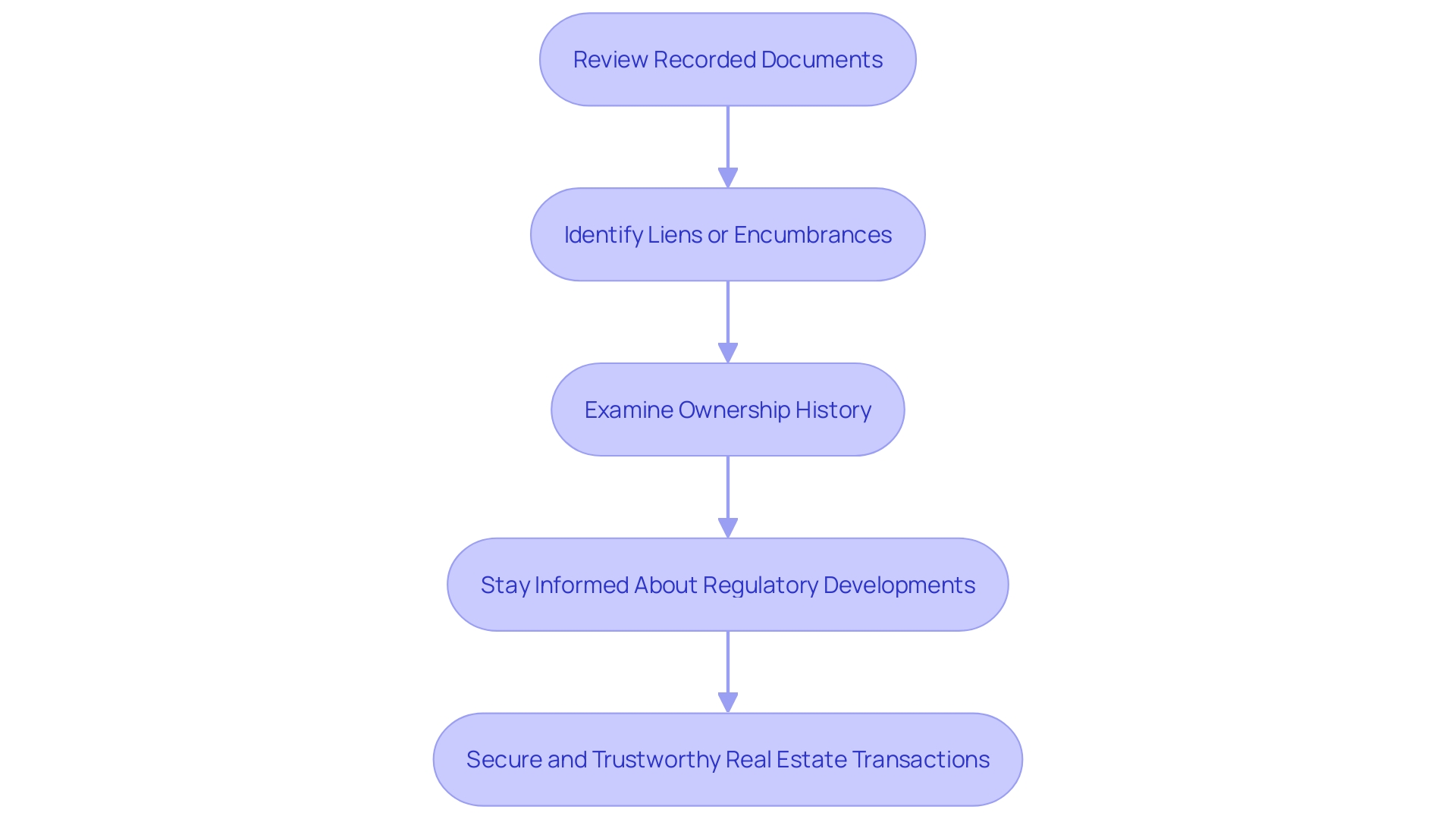

A clear title hinges on several critical components. Initially, the review of recorded documents is essential to determine the asset's official status. This includes verifying deeds, mortgages, and any other relevant documentation. Identifying any , such as unpaid taxes or claims by creditors, is vital to ensure the that could affect ownership. Furthermore, adherence to must be thoroughly examined to prevent any judicial setbacks.

A thorough examination of the is indispensable. This involves tracing the ownership lineage and identifying any potential claims or disputes that could jeopardize the current ownership status. For instance, historical discrepancies or boundary issues often uncovered through detailed land surveys can prevent conflicts and judicial challenges. 'According to First American Financial Corporation, the ownership industry is evolving with advancements like to enhance the accuracy and efficiency of these processes, reflecting the industry's commitment to innovation and reliability.'.

Furthermore, staying informed about recent and industry news is crucial. The American Land Insurance Association (ALTA) offers practical regulatory analysis and updates on claims and court rulings affecting the insurance sector. This guarantees that certification experts are equipped with the latest information to navigate intricate regulatory environments efficiently. By integrating these elements, a clear designation not only secures legal ownership but also fosters confidence and trust in real estate transactions.

The Title Search Process

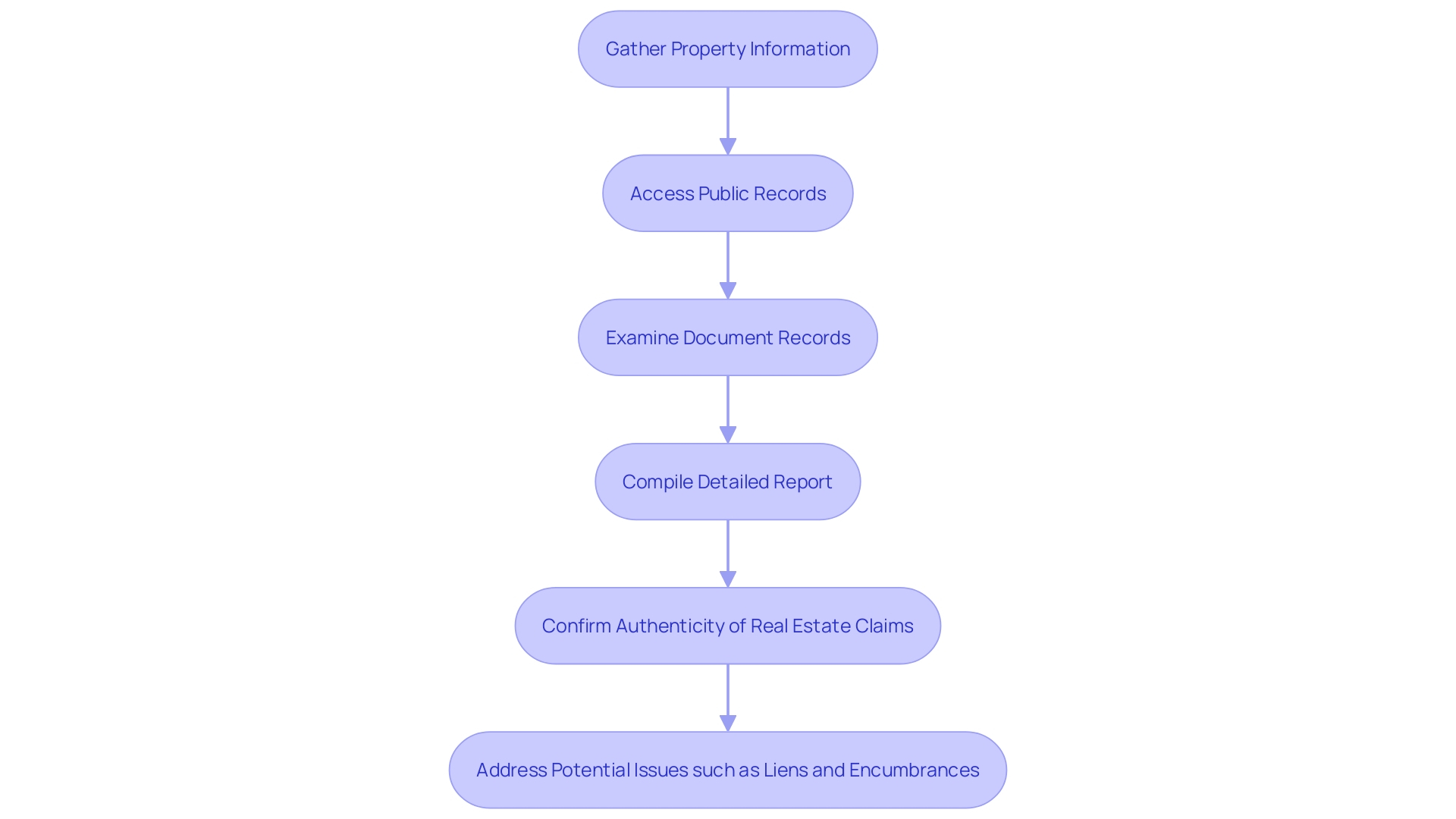

The is a careful series of actions designed to confirm the authenticity of real estate claims. It begins with gathering comprehensive information about the property, which includes details on previous owners, transfers, and any encumbrances. Accessing public records is crucial at this stage, as these documents hold the key to uncovering potential issues such as liens, easements, and other encumbrances.

Following this, the examination of document records is conducted. This step is essential as it involves examining deeds, mortgages, and other relevant records to verify the accuracy and completeness of the ownership history. The primary objective here is to identify any discrepancies or legal challenges that could affect the marketability of the asset.

Once the analysis is complete, a is compiled. This report outlines the discoveries and offers a clear view of the asset's ownership status. Depending on the intricacy of the designation and the transaction's requirements, this process may be carried out by , property firms, or lawyers. For example, in situations where real estate has a rich historical background or numerous transactions, as observed in regions like Drexel Hill, a comprehensive and expert-led examination of ownership is essential.

The sector's continuous struggle against wire fraud and identity theft further highlights the significance of precise and dependable ownership searches. With annual losses in the U.S. exceeding $81 billion due to falsified records and forged signatures, firms are increasingly adopting advanced tools and technologies to mitigate these risks, ensuring safer and more secure transactions.

Step-by-Step Breakdown of a Title Search

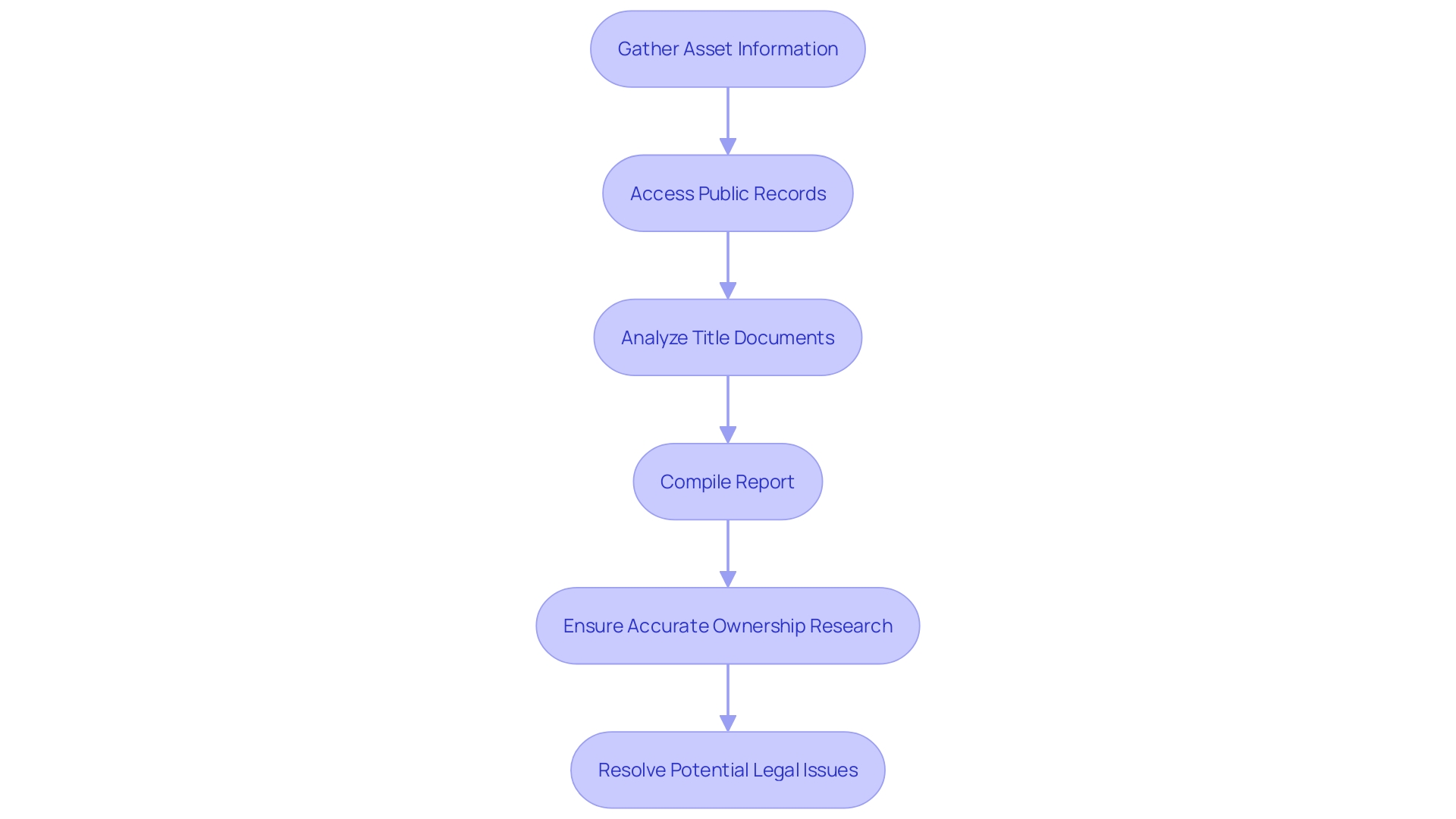

- Gather Asset Information: Start by collecting essential details such as the location's address, legal description, and current owner information. This foundational step is crucial for on ownership.

- : Utilize local government offices or online databases to obtain relevant documents. These records include deeds, mortgages, tax records, and any other public filings that provide insights into the property's history.

- : Carefully review all retrieved documents to identify any discrepancies, liens, or claims. This analysis ensures that the name is clear and free of any legal issues that could affect ownership.

- : Summarize your findings in a comprehensive report. Highlight any issues that need resolution, such as outstanding liens or unclear ownership claims. This report is essential for informing stakeholders and guiding them through the next steps in the real estate transaction.

Importance of Title Insurance

is an essential protection against monetary loss resulting from hidden flaws in real estate ownership records. It offers protection to both buyers and lenders from complications such as undisclosed heirs, fraudulent claims, and inaccuracies in public records. For instance, First American Financial Corporation, a key player in the real estate sector, provides robust ownership transfer, settlement, and risk solutions, leveraging over 130 years of industry experience and advanced proprietary technologies.

The importance of ownership insurance cannot be emphasized enough, particularly considering possible problems such as mortgages, judgments, and mechanic's liens that could jeopardize . As noted by industry professionals, understanding and securing insurance for ownership is crucial for new homeowners to ensure their property rights are protected from the outset. 'Unlike other insurance products, property insurance involves a one-time payment at closing, offering comprehensive coverage and working proactively to resolve issues before they become claims.'. This proactive approach results in lower claims rates and a smoother transaction process, underscoring the essential role of in real estate.

Common Issues Found in Title Searches

Title searches frequently face a range of problems that can obstruct the seamless transfer of ownership. Outstanding claims are a frequent issue, where prior obligations on the asset have not been settled, resulting in possible judicial complications. Conflicts regarding property limits can also occur, often necessitating detailed surveys and potential judicial action to resolve. Fraudulent claims, such as falsified documents or false ownership assertions, can severely disrupt transactions and necessitate thorough verification processes. Errors in public records, including misspellings, incorrect information, or outdated data, can further complicate matters.

These complications are not merely theoretical; they have real-world implications. For instance, insurance firms specializing in have encountered considerable obstacles and even financial setbacks due to connections with mortgage fraud schemes, emphasizing the essential requirement for thorough . In one instance, a person admitted to wire fraud, highlighting the serious repercussions that can arise from deceitful actions.

To mitigate these risks, industry professionals rely on certified products and comprehensive . This approach aids in ensuring compliance and providing peace of mind at the closing table. The American Land Title Association (ALTA) plays a crucial role in representing the industry's interests, advocating at both national and state levels, and offering practical legal analysis of claims and court decisions related to property insurance. Their efforts, alongside those of the Title Insurance Political Action Committee (TIPAC), highlight the continuous necessity for vigilance and advocacy in the property insurance sector.

Addressing these issues promptly and effectively is essential for ensuring successful property transfers. By staying informed and utilizing robust due diligence practices, professionals can navigate the complexities of title searches and safeguard real estate transactions.

Conclusion

The significance of a comprehensive property title search cannot be overstated in the realm of real estate transactions. By meticulously reviewing public records, this process establishes rightful ownership and identifies any potential claims, liens, or encumbrances that could impact the transfer of property. Knowing the history of a property and confirming its legal standing ensures that buyers and lenders can proceed with confidence, thereby facilitating smoother transactions.

Key components of a title search include the thorough examination of recorded documents and compliance with local regulations, which are essential for establishing a clear title. The integration of advanced technologies and ongoing education ensures that title professionals remain adept at navigating the complexities of property ownership. The role of title insurance further underscores the importance of these searches, as it protects against financial losses stemming from undiscovered defects, providing peace of mind to both buyers and lenders.

In conclusion, the meticulous nature of title searches directly contributes to the integrity and efficiency of real estate transactions. By addressing common issues such as unresolved liens, boundary disputes, and fraudulent claims, industry professionals can safeguard property transfers. The commitment to accuracy and reliability in title research not only enhances trust among stakeholders but also reinforces the foundational principles of the real estate industry.

Frequently Asked Questions

What is a deed examination?

A deed examination is a detailed assessment of public documents to confirm legitimate ownership of real estate. It involves reviewing documents such as deeds, mortgages, and tax records to ensure the seller has the legal authority to transfer ownership.

Why is a deed examination important?

This process helps to identify any claims, liens, or encumbrances that could affect ownership, ensuring a clear and sellable transaction. It also builds trust and reliability in real estate dealings.

What documents are typically reviewed during a deed examination?

Key documents include deeds, mortgages, tax records, and any other public filings relevant to the property’s history.

What does ownership verification entail?

Ownership verification involves a series of actions designed to confirm the authenticity of real estate claims. It includes gathering information about the property, accessing public records, examining document records, and compiling a detailed report on ownership status.

What is the main goal of the ownership verification process?

The primary aim is to ensure that the property being acquired is free from disputes and claims. This clarity helps buyers and lenders understand the property’s history and mitigate risks associated with outstanding debts or legal issues.

How can issues like liens or encumbrances affect ownership?

Liens or encumbrances, such as unpaid taxes or creditor claims, can jeopardize ownership by creating financial obligations that need resolution before a transaction can proceed smoothly.

What role does ownership insurance play in real estate transactions?

Ownership insurance protects against financial loss arising from hidden flaws in ownership records. It safeguards buyers and lenders from complications such as undisclosed heirs or fraudulent claims, ensuring property rights are protected.

What challenges can arise during title searches?

Common challenges include outstanding claims on the asset, disputes over property boundaries, fraudulent claims or falsified documents, and errors in public records, such as misspellings or outdated information.

How can industry professionals mitigate risks associated with ownership verification?

Professionals rely on certified products, comprehensive due diligence solutions, and staying informed about regulatory developments. Organizations like the American Land Title Association (ALTA) advocate for industry interests and provide legal analysis to help navigate complex regulatory environments.

Why is precision and dependability crucial in the ownership examination process?

Accurate and reliable document reviews are essential for maintaining confidence in real estate transactions. They ensure compliance, help prevent potential legal issues, and foster trust between parties involved.