Overview

Title searches on homes are essential for homebuyers, as they verify legal ownership and uncover any claims or liens that could affect the transaction. Conducting a thorough title search significantly reduces the risk of legal disputes and financial losses. This process's importance is underscored by statistics and case studies that demonstrate its protective benefits for buyers.

Introduction

In the intricate world of real estate, the significance of a title search cannot be overstated. This essential process involves a thorough examination of public records to confirm the legal ownership of a property, safeguarding buyers from potential disputes and financial pitfalls.

With an impressive 85% of homebuyers opting for title searches before completing their transactions, understanding the steps involved, the critical information uncovered, and the common challenges faced is paramount.

Furthermore, as the landscape of property ownership evolves, so too does the importance of title searches, making it an indispensable aspect of any successful real estate transaction.

What is a Title Search and Why is it Important?

An ownership investigation represents a meticulous review of public records aimed at verifying the legal possession of an asset. This process is crucial for homebuyers, as it affirms that the seller possesses the legal authority to sell the asset and that no outstanding claims or liens threaten the transaction. By conducting a comprehensive examination of property ownership, buyers can significantly reduce the risk of encountering legal disputes and financial losses stemming from ambiguous property documentation.

The examination of records typically involves a detailed assessment of various documents, including deeds, mortgages, and tax records, to establish a clear and uninterrupted chain of possession. In 2025, the importance of this procedure is underscored by the fact that approximately 85% of homebuyers engage in property investigations prior to finalizing their purchases. This statistic illustrates the proactive stance buyers adopt to protect their investments.

Moreover, expert opinions underscore the critical need for legal ownership verification in property transactions. frequently assert that a thorough property investigation not only protects purchasers but also enhances the overall credibility of the real estate market. Notably, the average annual salary for Title Examiners, Abstractors, and Searchers in Southwest New York stands at $64,590, reflecting the professional landscape surrounding property examinations.

Recent trends indicate that companies and investors increasingly rely on unconventional data sources to gain deeper insights into real estate, further emphasizing the evolving nature of ownership research.

Case studies illustrate the vital role of document reviews in confirming legal ownership verification. For instance, a recent case involving a property dispute revealed that a thorough ownership examination uncovered a previously unknown lien, allowing the buyer to negotiate a resolution before the transaction was completed. Such instances exemplify the tangible benefits of comprehensive property research for homebuyers.

Furthermore, a client described their experience with Baker Law Group as exceptional, highlighting the team's professionalism and compassion, which underscores the importance of having supportive experts during the property investigation process. As Carl Snider remarked, "Carl was always available to discuss everything and even calm my worries, so almost a therapist as well!"

In summary, title searches on homes are an essential step in real estate transactions, providing crucial protection for buyers and fostering confidence in ownership.

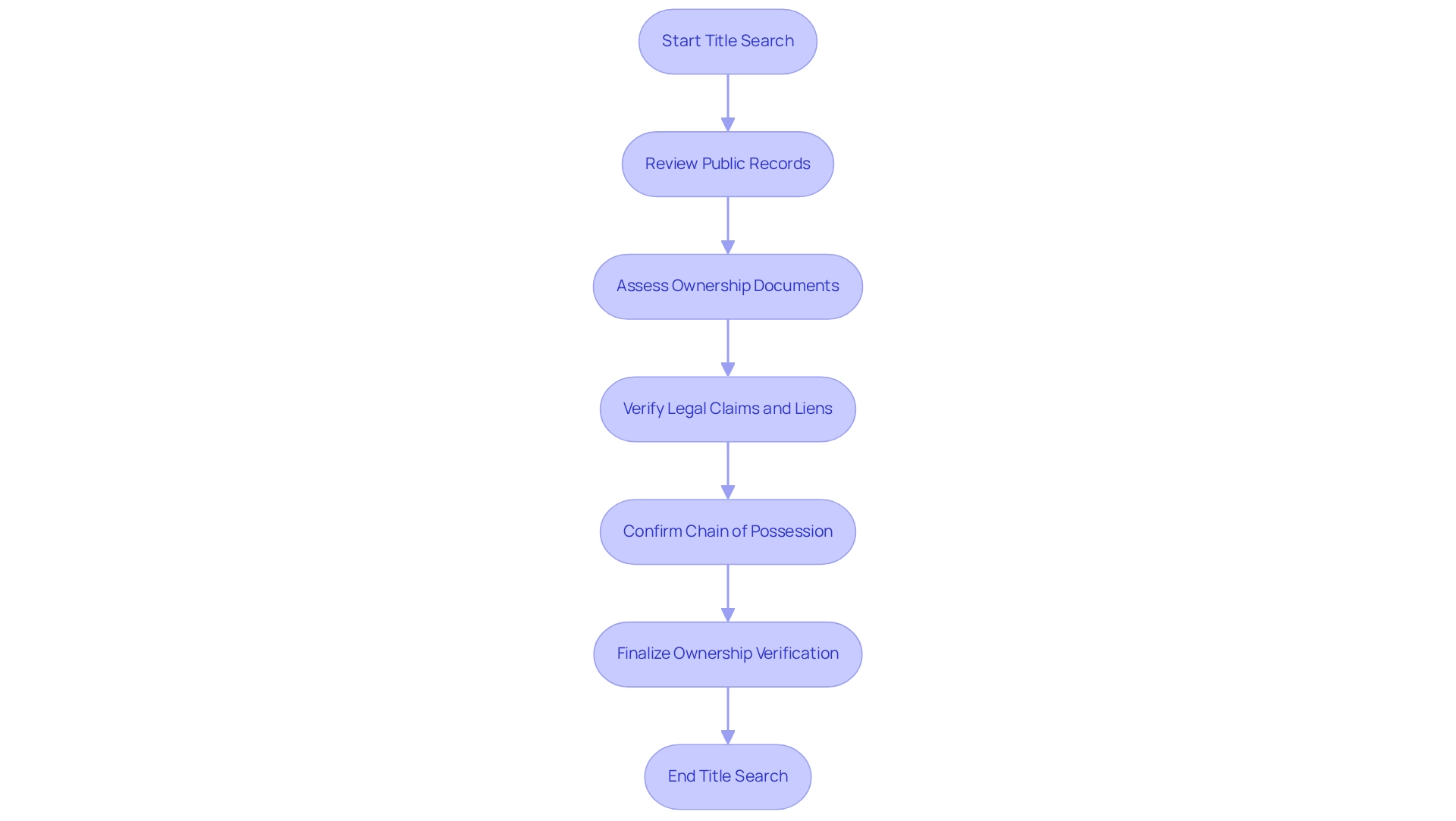

The Step-by-Step Process of Conducting a Title Search

- : Begin by collecting essential details about the real estate, including its address, parcel number, and the current owner's name. This foundational step is crucial for ensuring accurate searches.

- Search Public Records: Access local government databases to review real estate records, such as deeds and tax assessments. This step is vital as it provides the official documentation required to confirm possession and details of the asset.

- Trace Title History: Investigate the chain of title to confirm the property's title history. This requires analyzing previous transactions to pinpoint any gaps or inconsistencies that could influence the current title status.

- Check for Liens and Encumbrances: Look for any outstanding liens, including mortgages or tax liens, that may impact ownership. Understanding these financial obligations is essential for potential buyers to avoid unexpected liabilities.

- Review Easements and Restrictions: Identify any easements or restrictions that may limit the use of the land. This includes understanding rights of way or other legal restrictions that could influence future land use.

- Compile Findings: Record all discoveries in a detailed report that summarizes the status and emphasizes any concerns that require attention. This report serves as a critical tool for real estate professionals and homebuyers alike, ensuring informed decision-making throughout the transaction process.

The document examination process generally includes these six crucial steps and can take an average of 10 to 14 days to finalize, although older properties may require additional time. Financial implications are also significant, as insurance for property in Texas ranges from $238 to $875 for policies up to $100,000. By adopting this organized method, real estate experts can perform property investigations effectively, reducing risks and guaranteeing a more seamless transaction process.

As Ryan Thompson, an expert in the back office field, observes, "Concise and practical advice empowers businesses to thrive efficiently," emphasizing the significance of a well-executed name investigation.

Key Information Revealed in a Title Search

An ownership examination unveils vital details essential for prospective home purchasers, including:

- Ownership History: This encompasses a comprehensive record of all prior owners of the asset, establishing a clear chain of ownership. Understanding ownership history is crucial, as discrepancies can lead to disputes or challenges in ownership claims. In 2022, 66.1% of families owned their primary residence, according to the Federal Reserve's Survey of Consumer Finances, underscoring the importance of title searches for a significant segment of the population.

- Liens: Title searches reveal any outstanding debts associated with the asset, such as mortgages, tax liens, or mechanic's liens. Recent statistics indicate that approximately 30% of real estate may have some type of outstanding lien, which can substantially impact the buyer's financial responsibilities and the asset's marketability. Recognizing these liens is essential to avert .

- Easements: These rights allow others to utilize a portion of the land for specific purposes, such as utility access or shared driveways. Easements can affect how a purchaser uses their land, making it imperative to identify them during the deed examination process.

- Restrictions: Legal limitations may dictate how the land can be used or developed. These may include zoning regulations or agreements that specify permissible alterations, which is particularly crucial for purchasers planning renovations or expansions.

- Pending Legal Matters: Title examinations can uncover ongoing disputes or claims related to the asset, such as lawsuits or unresolved claims that could affect possession. Understanding these issues is vital for buyers to avoid potential legal entanglements post-purchase. The increasing complexity of real estate ownership and the possibility of historical inconsistencies highlight the necessity of thorough deed examinations in 2025. Furthermore, with governments imposing substantial penalties on entities that fail to comply with data protection laws, a meticulous examination not only protects purchasers but also enhances their confidence in the transaction, ultimately facilitating a smoother closing process.

Insights from case studies on wealth accumulation reveal that the history of possession and liens can significantly influence financial stability, particularly for marginalized groups who may face additional challenges in acquiring real estate. Real estate experts assert that grasping these critical details is essential for informed decision-making.

Common Challenges and Issues Found in Title Searches

Homebuyers frequently encounter numerous obstacles during a property examination, significantly influencing their buying experience. Key issues include:

- Incomplete Records: A substantial percentage of title searches reveal incomplete documentation, leading to uncertainty about property ownership. This lack of clarity can hinder the transaction process and create potential legal complications.

- Discrepancies in Title: Conflicting information regarding real estate often arises from clerical errors or outdated records. Such discrepancies complicate the verification process, necessitating thorough investigation to resolve any inconsistencies.

- Liens and Encumbrances: Unexpected liens can surface during a title search, complicating the sale. These financial claims against the asset must be addressed and resolved before closing, as they can influence the buyer's rights of possession.

- Legal Disputes: Ongoing legal issues associated with the asset can delay or even derail a transaction. Purchasers need to be informed of any ongoing conflicts that could affect their control or the asset's marketability. Furthermore, unfamiliar or uninformed heirs may emerge after a real estate acquisition, potentially causing legal issues if all heirs are not aware of and consent to the sale.

- Fraudulent Claims: Instances of fraud, including forged documents, pose significant risks to buyers. Such fraudulent activities can lead to and legal challenges if not identified and addressed promptly.

Addressing these challenges requires diligence and expertise. For instance, property investigations can reveal concealed ownership problems, including claims from heirs of deceased proprietors or unlawful ownership grants. By disclosing these potential conflicts, ownership investigations safeguard purchasers from impending legal issues and confirm that the seller possesses the legal authority to transfer the asset.

As Jane F. Bolin, Esq. notes, failing to uncover these burdens can lead to financial difficulties, as buyers may inadvertently assume debts after the transaction.

In 2025, the landscape of ownership investigations continues to evolve, with 83% of ownership specialists employed at independent agencies encountering these common difficulties. The necessity for additional digitization of state and local records is essential to enhance efficiency and reduce expenses in insurance, ultimately aiding homebuyers in navigating the intricacies of real estate. This is underscored by the case study titled 'Consequences of Hidden Ownership Issues,' which illustrates how ownership investigations can uncover concealed claims and protect purchasers from future legal complications.

Who Conducts Title Searches and Their Role?

Searches for ownership are generally conducted by three main participants in the real estate sector:

- Title Firms: These organizations focus on investigating ownership records and providing insurance for ownership, ensuring that purchasers are protected against any potential claims or disputes regarding possession. Their expertise is crucial in navigating the complexities of property records and ensuring compliance with local regulations. In a competitive environment where the insurance sector is experiencing a decline in rivalry, the role of insurance firms becomes increasingly essential in maintaining service quality. With the advanced machine learning tools offered by Parse AI, firms can expedite document processing and analysis, enhancing their efficiency and accuracy in property evaluations. Parse AI's solutions not only streamline workflows but also reduce the time required to complete property investigations, ultimately leading to improved service delivery.

- Real Estate Attorneys: In certain regions, buyers may opt to engage attorneys to conduct property investigations, particularly in states where legal representation is mandated during real estate transactions. These experts contribute a legal perspective to , identifying any potential legal issues that could affect ownership. Notably, statistics indicate that a significant percentage of property inquiries are conducted by real estate attorneys, underscoring their importance in the process. Amanda Farrell noted in a LinkedIn poll that 41% of industry professionals felt they were 'tricked' into the business, highlighting the diverse backgrounds of those involved in searches. By utilizing Parse AI's automated document processing capabilities, attorneys can enhance their workflows, ensuring thorough and timely property examinations. The integration of Parse AI's tools allows lawyers to improve their accuracy in identifying legal matters related to title searches on properties, thereby safeguarding their clients' interests.

- Abstractors: These specialists focus on gathering property records and summarizing title history. Their role is essential in producing a clear and concise report that outlines the chain of ownership, which is necessary for confirming possession and identifying any encumbrances. The annual mean wage for Title Examiners, Abstractors, and Searchers in Southwest New York is $64,590, reflecting the economic significance of these roles in the industry. With Parse AI's interactive labeling and OCR technology, abstractors can enhance , enabling more efficient and precise title inquiries. The application of Parse AI's tools not only improves the quality of reports generated by abstractors but also contributes to their overall efficiency.

Each of these roles is vital to ensuring that the document examination is thorough and accurate, ultimately protecting the buyer's interests. By 2025, collaboration among title firms, real estate attorneys, and abstractors remains crucial for facilitating title searches on properties and collectively contributing to a comprehensive review of ownership records. Successful document searches conducted by abstractors further demonstrate the effectiveness of their specialized skills in this critical area of real estate transactions.

The evolving market dynamics, particularly the trends in direct insurance premiums influenced by rising real estate values, continue to shape the responsibilities and interactions of these key players, with Parse AI providing the essential tools to advance their efforts.

The Importance of Title Insurance in Real Estate Transactions

In real estate dealings, title searches on homes are crucial as they ensure that title insurance provides essential protection against potential flaws in ownership records. This insurance safeguards buyers from significant financial losses that may arise from various issues, including:

- Undiscovered Liens: Title insurance provides coverage for losses stemming from liens that were overlooked during . If a prior owner failed to pay taxes on the estate, the new homeowner might encounter unforeseen financial pressures. Title insurance ensures that such hidden liabilities do not fall on the buyer.

- Property Disputes: In instances where a third party asserts rights to the property after the sale, insurance can aid in resolving these conflicts. This protection is vital, as ownership claims can lead to lengthy and costly legal battles.

- Fraudulent Claims: Title insurance also protects against losses resulting from fraudulent claims or forged documents. This aspect is increasingly important in today's digital age, where the risk of identity theft and document forgery is on the rise.

The importance of ownership insurance is underscored by recent trends in the industry. In 2024, the insurance sector for property experienced a resurgence in premiums, reversing prior declines, indicating a growing acknowledgment of its value among homebuyers. Significantly, around 85% of homebuyers choose to purchase ownership insurance, which underscores the importance of title searches on homes in safeguarding their investments.

Furthermore, First American Title Insurance Co. holds a 21.5% market share as the largest individual underwriter in Q2 2024, highlighting the competitive landscape of the industry.

Expert opinions further emphasize the necessity of insurance for property ownership. As Diane Tomb, CEO of ALTA, states, "As we progress, the industry remains committed to delivering outstanding service and reassurance to homebuyers and lenders." This commitment highlights the industry's role in ensuring that buyers are safeguarded from unexpected legal issues related to their assets.

Moreover, case studies demonstrate the financial consequences of lacking insurance for property ownership. For example, a homeowner who discovered an undisclosed lien after purchasing a property faced a loss of over $50,000 in legal fees and back taxes. The integration of blockchain and smart contracts in property transfers is also being examined to improve efficiency and security in management, further showcasing the industry's innovative strategies.

Such scenarios highlight the essential role of ownership insurance in real estate dealings, offering buyers the confidence that they are protected from possible hazards.

What Happens After a Title Search? Understanding the Outcomes

Upon completion of , several significant outcomes can arise, each playing a crucial role in the real estate transaction process:

- Clear Title: When a title search reveals no issues, the buyer can confidently proceed with the purchase. This result is crucial, as roughly 80% of document inquiries lead to clear ownership, facilitating a smooth transaction.

- Title Defects: If the search reveals problems such as liens, disputes over possession, or other encumbrances, these must be resolved before closing. Addressing ownership defects may require discussions with lienholders or correcting inconsistencies in ownership records. Significantly, 62% of firms that handle ownership matters outsource tax research, including liens, exemptions, and certificates. This emphasizes a prevalent industry practice that can influence the resolution of ownership defects. For example, in a case study involving , the company employed advanced technology to identify and rectify document defects quickly, ensuring that transactions stayed on track. Their technology-driven solutions improve accuracy and accelerate the resolution process, showcasing the advantages of modernizing property searches.

- Ownership Insurance Issuance: Once any identified issues are resolved, ownership insurance can be issued. This insurance protects the buyer against potential future claims, providing peace of mind in the investment. The issuance of ownership insurance is a critical step, as it guards against unforeseen complications that may arise post-transaction.

As Molly Grace, a mortgage journalist for Business Insider, mentions, "Your lender will request a property examination on any asset you plan to purchase," highlighting the significance of this procedure in homebuying. Understanding title searches on homes is essential for homebuyers as they navigate the complexities of the closing process. Expert insights illustrate that being aware of possible defects in ownership and the required actions to address them can greatly influence the overall success of a real estate transaction.

Furthermore, clients can monitor the progress of their document inquiries through user-friendly digital platforms, ensuring transparency and boosting their confidence in the process.

Best Practices for a Successful Title Search Experience

To ensure a successful title search experience, homebuyers must adhere to the following best practices:

- Engage Professionals: Hiring a reputable title company or real estate attorney specializing in title searches is crucial. Statistics indicate that a significant percentage of homebuyers opt for professional assistance, underscoring the importance of expert involvement. Their expertise can significantly diminish the risk of errors and guarantee a comprehensive review of the title history.

- Provide Complete Information: Homebuyers should ensure that all property details are accurate and comprehensive. This includes the correct names of persons or organizations involved, as discrepancies can lead to difficulties during the inquiry process. A case study titled 'Confirming Names in Title Investigations' emphasizes the necessity of verifying the accuracy of names in the deed against the inquiry order. By doing so, researchers can examine the relevant parties, enhancing trust in the document evaluation outcomes and minimizing possible errors.

- Ask Questions: Homebuyers should feel empowered to inquire with the deed company or lawyer about and any discoveries. Understanding the nuances of the document can clarify potential issues and foster confidence in the transaction.

- Examine the Document Report: A thorough examination of the document report is crucial. Homebuyers should look for any discrepancies or issues that may need addressing, as this step is vital in safeguarding their investment.

- Obtain Ownership Insurance: Securing ownership insurance is a critical step in protecting against potential future claims. This insurance offers reassurance, guaranteeing that any unexpected problems with ownership are addressed.

Furthermore, homebuyers are encouraged to explore the white paper titled 'In Pursuit of The Error-Free Close,' which offers comprehensive information and practical tips to enhance title-searching skills. By adhering to these best practices, homebuyers can navigate the property examination process with increased assurance and understanding, ultimately resulting in a more seamless real estate transaction. As with SEO, which is a long-term investment, continuous improvement in title search practices is essential for success.

Conclusion

The title search process stands as a pivotal element in real estate transactions, one that warrants unwavering attention. It acts as a safeguard for buyers, ensuring properties are devoid of legal encumbrances while affirming rightful ownership prior to purchase. By comprehending the intricacies of conducting a title search, including the critical information it unveils and the prevalent challenges faced, homebuyers can navigate the complexities of property ownership with enhanced confidence.

Engaging professionals, supplying accurate information, and actively participating in the title search process are indispensable actions for buyers aiming to protect their investments. The significance of title insurance further accentuates the necessity of thorough title searches, as it provides a safety net against unforeseen legal disputes and financial liabilities.

As the real estate landscape evolves, the importance of title searches remains paramount in cultivating confidence and security within property transactions. By prioritizing diligence in this domain, homebuyers can effectively mitigate risks, facilitating a smoother and more successful closing process. Ultimately, a meticulously executed title search not only protects individual investments but also bolsters the overall integrity of the real estate market.

Frequently Asked Questions

What is an ownership investigation?

An ownership investigation is a meticulous review of public records aimed at verifying the legal possession of an asset, which is crucial for homebuyers to ensure the seller has the legal authority to sell and that there are no outstanding claims or liens.

Why is an ownership investigation important for homebuyers?

It helps reduce the risk of legal disputes and financial losses by confirming that the seller legally owns the property and that there are no hidden claims against it.

What documents are typically assessed during an ownership investigation?

The investigation involves a detailed assessment of documents such as deeds, mortgages, and tax records to establish a clear chain of possession.

How common are property investigations among homebuyers?

Approximately 85% of homebuyers engage in property investigations prior to finalizing their purchases, highlighting the proactive approach buyers take to protect their investments.

What role do real estate professionals play in ownership verification?

Real estate professionals emphasize the critical need for thorough property investigations to protect buyers and enhance the credibility of the real estate market.

How long does the document examination process usually take?

The document examination process generally takes an average of 10 to 14 days to finalize, although older properties may require additional time.

What steps are involved in the document examination process?

The process includes gathering real estate information, searching public records, tracing title history, checking for liens and encumbrances, reviewing easements and restrictions, and compiling findings into a detailed report.

What are the financial implications of property insurance in Texas?

Insurance for property in Texas ranges from $238 to $875 for policies up to $100,000, reflecting the financial considerations involved in property transactions.

Can you provide an example of the importance of document reviews in property transactions?

A recent case revealed that a thorough ownership examination uncovered a previously unknown lien, allowing the buyer to negotiate a resolution before completing the transaction, demonstrating the value of comprehensive property research.

How did a client describe their experience with the Baker Law Group during the property investigation process?

A client highlighted the exceptional professionalism and compassion of the team at Baker Law Group, noting that they provided support and reassurance throughout the investigation process.