Overview

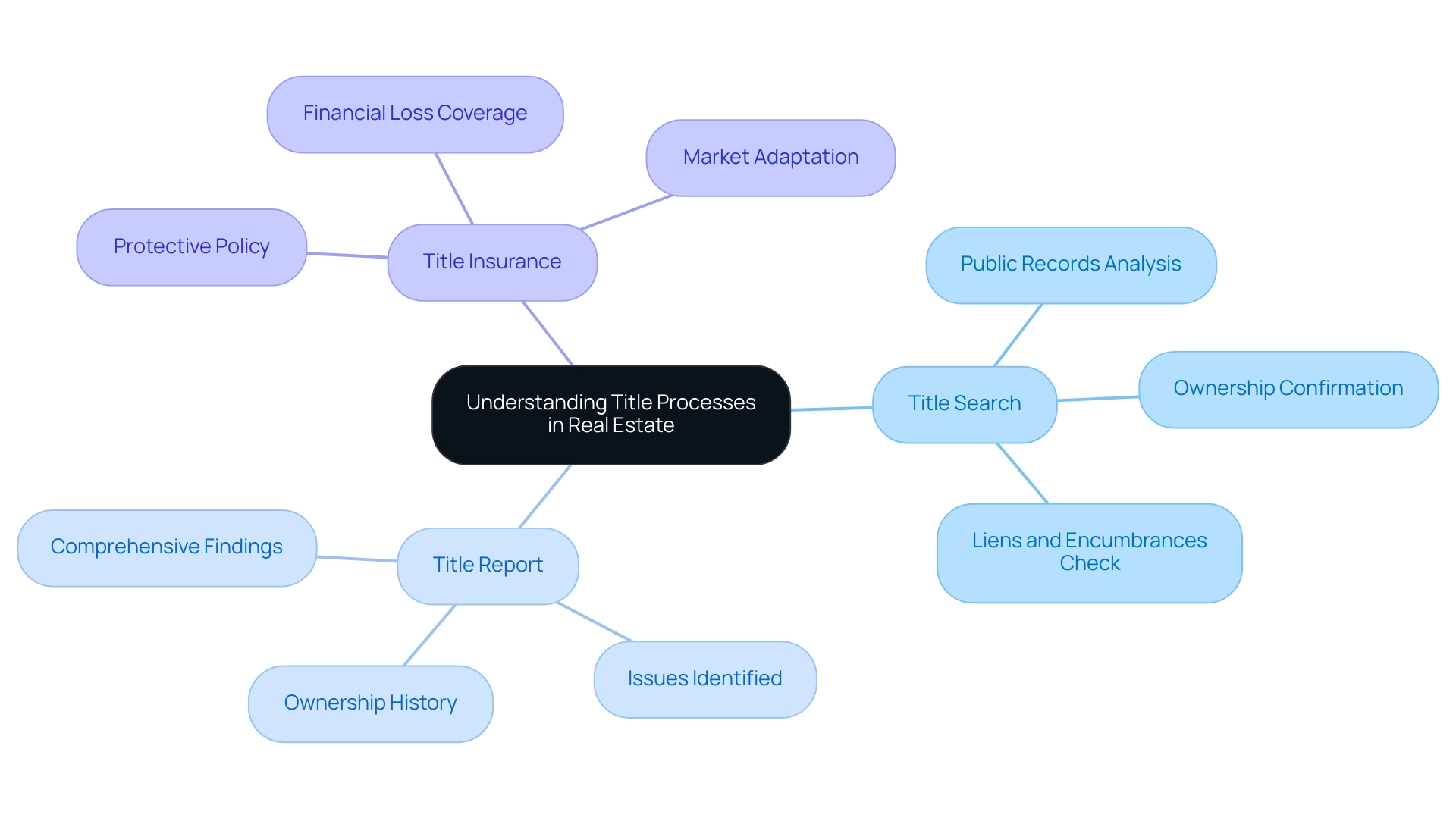

The article underscores the critical importance of title search reports in real estate transactions, highlighting their essential role in confirming ownership and identifying potential legal issues.

It elaborates on the comprehensive nature of title searches, the significant risks associated with neglecting them, and the integration of technology to enhance both efficiency and accuracy in the title search process.

Ultimately, these elements work together to safeguard the interests of buyers, sellers, and lenders.

Introduction

In the intricate world of real estate, the significance of a title search report cannot be overstated. This essential document reveals the legal status of a property, detailing ownership history and uncovering any liens or encumbrances that may jeopardize a transaction. As the global real estate market is poised for significant growth, comprehending the nuances of title searches becomes critical for buyers, sellers, and lenders alike.

Furthermore, the potential for legal disputes arising from undiscovered title issues amplifies the need for thorough due diligence. In a landscape increasingly shaped by technology and evolving market dynamics, navigating the complexities of title research is vital for safeguarding investments and ensuring seamless transactions.

What is a Title Search Report and Why is it Important?

A title search report is an indispensable document that delineates the legal status of an asset, encompassing its ownership history, any existing liens, encumbrances, or potential legal issues that could impact the title. This report is vital for buyers, sellers, and lenders alike, as it confirms that the seller holds the legal authority to transfer ownership and that the property is devoid of any claims that could jeopardize the transaction. With the global estate market projected to reach $5,388.87 billion in 2025, growing at a CAGR of 9.6%, the importance of these reports cannot be overstated.

Without a meticulous title search report, parties engaged in a property transaction expose themselves to the risk of legal disputes or financial losses stemming from undiscovered issues. Recent data indicates that a significant portion of property transactions encounters legal conflicts due to ownership discrepancies, underscoring the necessity of thorough due diligence. Furthermore, the National Association of Realtors (NAR) has noted a growing reliance on data collectors in the valuation process, reflecting the evolving landscape of research.

In New Jersey, conducting a property examination is crucial to protect investments, as most mortgage providers mandate it prior to loan approval to identify potential property concerns. As cyber threats escalate, particularly in 2025, firms must prioritize the protection of sensitive client and transaction information, highlighting the need for expert advice and robust examination practices. Ultimately, the key components of a title search report—ownership history, liens, and encumbrances—are essential in safeguarding the interests of all parties involved in property transactions.

Moreover, real estate constitutes nearly 17% of the U.S. GDP, with public concerns regarding inflation and tariffs impacting market recovery, further accentuating the critical role of property examination reports.

The Title Search Process: Steps and Key Information

The search process for ownership is a meticulous procedure that encompasses several essential steps, ensuring a clear and marketable ownership. Initially, the researcher identifies the asset in question, gathering crucial details such as the legal description and current ownership information. This foundational step establishes the groundwork for a thorough examination of public records.

Subsequently, the researcher delves into various public records, including deeds, tax records, and court documents. This examination is vital for establishing the chain of ownership and identifying potential issues that may arise. Common concerns include liens, easements, or restrictions that could affect the asset's value or usability.

In 2025, document reviews are anticipated to involve examining an average of 50 to 100 public records, contingent on the intricacy and age of the asset.

Furthermore, buyers are typically required to acquire a lender's insurance policy, a one-time expense determined by the state. This requirement underscores the significance of a comprehensive examination, as it safeguards both the buyer and lender from possible claims related to the asset.

The final step involves compiling the findings into a comprehensive title search report. This report is not merely a formality; it serves as a critical document for all parties involved in the transaction, summarizing the asset's mortgage status, tax obligations, and any potential encumbrances. The synthesis of this information is crucial, as it informs buyers and lenders about the risks associated with the property.

Carmel Woodman, a former Content Manager with over 8 years of expertise, emphasizes that "a comprehensive examination of records is essential for ensuring that all potential issues are identified before a transaction is finalized." Recent advancements in document examination methods have highlighted the importance of efficiency and precision. For instance, inquiries for newer properties typically take between 10 to 14 days, while older properties may require additional time due to a more complex ownership chain.

The integration of advanced technologies, such as machine learning and optical character recognition, has significantly streamlined this process, enabling researchers to complete their work more quickly and accurately than ever before. This development in the document retrieval process not only enhances the quality of the reports but also leads to substantial cost reductions for real estate professionals, particularly through the innovative solutions provided by Parse AI.

Title Search vs. Title Report vs. Title Insurance: Understanding the Differences

A title search report involves a meticulous analysis of public records to ascertain the legal ownership of a real estate asset and to uncover any existing claims against it. This process is vital for confirming that the asset is devoid of liens or other encumbrances that could compromise ownership rights. As emphasized by IBISWorld, analysts commence with official, verified, and publicly accessible data sources to construct the most accurate representation of each industry, underscoring the importance of thoroughness in the examination process.

Conversely, the title search report serves as a comprehensive document that encapsulates the findings of the examination, offering a detailed account of the ownership history and any issues identified during the review.

Ownership insurance, on the other hand, represents a protective policy designed to shield buyers and lenders from potential financial losses arising from defects that may not have been disclosed during the examination. The insurance sector underwrites policies that protect against financial losses resulting from ownership defects and mortgage lien enforcement issues. While the title investigation and search report are proactive measures taken prior to a transaction, title protection acts as an essential safety net, addressing unforeseen issues that may emerge post-sale.

In 2025, the title insurance sector continues to adapt to market dynamics, as indicated by the title search report, with a significant portion of transactions—estimated at over 80%—utilizing title protection to mitigate risks associated with ownership. This trend highlights the growing awareness of the importance of insurance in providing peace of mind to both buyers and lenders. Additionally, the geographical distribution of insurance firms, primarily situated in the West, Southeast, and Southwest regions, reflects the industry's environment and its responsiveness to market conditions.

Moreover, case studies reveal that assets subjected to thorough examinations and title search reports tend to encounter fewer post-transaction disputes, illustrating the effectiveness of these processes in facilitating seamless transactions. The upward trend in real estate values is driving the increase in direct ownership insurance premiums, showcasing the sector's adaptability to market fluctuations. As the sector evolves, it remains imperative for real estate professionals to comprehend the subtle distinctions between document inquiries, title search reports, and insurance, enabling them to navigate the complexities of ownership with confidence.

Furthermore, as price is a pivotal factor influencing consumer perceptions of value within the insurance sector, customizing products to address unique risk needs is becoming increasingly essential.

Common Challenges in Title Searches and Their Implications

Title investigations frequently encounter a variety of challenges, particularly those detailed in a title search report, such as:

- Incomplete or inconsistent records

- Undisclosed liens

- Discrepancies in property ownership information

These obstacles can result in significant transaction delays, legal disputes, and potential financial repercussions for both buyers and sellers, as highlighted in the title search report. For instance, if a lien is uncovered post-sale, the new owner may become liable for that debt, leading to unexpected financial burdens.

Furthermore, unclear ownership due to missing heirs or fraudulent documentation complicates the transfer process, creating additional hurdles for ownership researchers who depend on a title search report.

In 2025, the impact of incomplete documents on property inquiries is particularly pronounced, as market fluctuations necessitate a more adaptable strategy for real estate dealings. Companies managing property must be prepared for this volatility; statistics show that a substantial percentage of searches reveal issues related to undisclosed liens, which can further delay transactions and erode trust between parties. Case studies demonstrate that organizations addressing these challenges through enhanced digital document management systems not only improve access speed but also reduce errors, facilitating quicker document retrieval and smoother transactions.

The rising demand for transparency and efficiency, especially among millennials—the largest group of homebuyers—underscores the necessity for researchers to adopt user-friendly platforms that streamline payments, document sharing, and communication. As Marsha Nix emphasizes, "With ongoing changes in real estate laws and regulations, staying compliant is crucial." By proactively tackling these common challenges and integrating CRM, project management, and document management systems to create a seamless workflow, researchers can mitigate risks and ensure a more streamlined experience for all stakeholders involved.

The case study titled "Meeting Evolving Client Expectations" further illustrates how organizations can satisfy millennials' demands for faster and more transparent transactions, thereby enhancing the relevance of the discussion on user-friendly platforms.

Leveraging Technology for Efficient Title Searches

Technology is fundamentally transforming the document retrieval process, significantly enhancing both efficiency and precision. Advanced tools such as machine learning and optical character recognition (OCR) empower researchers to swiftly extract pertinent information from extensive collections of documents. For instance, Parse Ai's innovative platform exemplifies this transformation by enabling rapid data extraction, which not only shortens the time required to complete title search reports but also reduces the likelihood of human error.

In 2025, the integration of these technologies is more critical than ever, as the estate sector increasingly relies on data-driven solutions. The capacity to process large volumes of information quickly allows estate professionals to streamline their workflows, enhance turnaround times, and ultimately deliver superior service to clients. Current statistics indicate that the number of internet users has surged to approximately 5.56 billion, underscoring the growing reliance on digital solutions across various industries, including real estate.

Furthermore, specialist perspectives underscore the significant impact of machine learning on the effectiveness of document reviews. Tom Bradbury, a content marketing specialist, observes, "The story of technology in document inquiries is compelling, as it not only improves efficiency but also alters the manner in which professionals approach their work." By automating routine tasks, professionals can concentrate on more complex aspects of their responsibilities, leading to improved outcomes.

Case studies, such as 'Parse AI: Revolutionizing Research,' illustrate that companies utilizing machine learning in searches have reported substantial cost savings and enhanced operational efficiency, reinforcing the necessity of adopting these technologies.

As the industry continues to evolve, embracing technological innovations will be essential for maintaining a competitive edge. The ongoing collaboration between technology providers and land service professionals ensures that the solutions developed are tailored to address the most pressing challenges faced in title search report research today.

Conclusion

A title search report is an indispensable tool in the real estate landscape, revealing the legal status of a property and ensuring a smooth transaction for buyers, sellers, and lenders. As the global real estate market grows, understanding the title search process, its components, and the importance of thorough due diligence becomes paramount. The complexities involved in title searches underscore the necessity for meticulous examination of public records to avoid potential legal disputes and financial losses.

Furthermore, the integration of technology in the title search process has transformed how professionals conduct their work. Advanced tools such as machine learning and optical character recognition have not only expedited the search process but also enhanced accuracy. This technological evolution allows for quicker data extraction and better management of title information, ultimately benefiting all parties involved in real estate transactions.

In addition, recognizing the distinctions between title searches, title reports, and title insurance is vital for navigating the complexities of property ownership. Title insurance acts as a safety net against unforeseen issues, highlighting the importance of comprehensive title searches and reports in minimizing post-transaction disputes. As the real estate market continues to evolve amidst challenges and technological advancements, prioritizing thorough title research will remain essential for safeguarding investments and ensuring seamless transactions.

Frequently Asked Questions

What is a title search report?

A title search report is a crucial document that outlines the legal status of an asset, including its ownership history, existing liens, encumbrances, and potential legal issues that may affect the title.

Why is a title search report important?

It is vital for buyers, sellers, and lenders as it confirms the seller's legal authority to transfer ownership and ensures that the property is free from claims that could jeopardize the transaction.

What are the risks of not having a title search report?

Without a thorough title search report, parties involved in a property transaction risk facing legal disputes or financial losses due to undiscovered issues, such as ownership discrepancies.

What role does a title search report play in the real estate market?

It serves as a safeguard for transactions, especially with the real estate market projected to grow significantly, highlighting the necessity of due diligence in property dealings.

What steps are involved in the title search process?

The process includes identifying the asset, examining public records (such as deeds and tax records), identifying potential issues, and compiling the findings into a comprehensive title search report.

How many public records are typically reviewed during a title search in 2025?

It is anticipated that document reviews will involve examining an average of 50 to 100 public records, depending on the complexity and age of the asset.

What is the significance of a lender's insurance policy in property transactions?

Buyers are usually required to obtain a lender's insurance policy, which protects both the buyer and lender from potential claims related to the asset, emphasizing the need for a thorough examination.

How long does the title search process take?

Inquiries for newer properties typically take between 10 to 14 days, while older properties may require additional time due to more complex ownership chains.

What advancements have improved the title search process?

The integration of technologies such as machine learning and optical character recognition has streamlined the title search process, enhancing efficiency and accuracy while reducing costs for real estate professionals.

What are the key components of a title search report?

The key components include ownership history, liens, encumbrances, mortgage status, and tax obligations, all of which are essential for safeguarding the interests of all parties involved in property transactions.