Overview

This article delves into the critical nature of title search costs within real estate transactions, underscoring the necessity of comprehensive title searches to prevent legal complications and affirm clear property ownership. It elucidates that these costs fluctuate based on several factors, including property type, geographic location, and the complexity of inquiries. Consequently, it is imperative for both buyers and sellers to procure estimates from multiple firms to effectively manage their expenses.

Introduction

In the intricate realm of real estate, the significance of a title search is paramount. This essential process not only elucidates legal ownership of a property but also reveals potential claims and encumbrances that could impede transactions. As the dynamics of property buying and selling evolve, grasping the intricacies of title searches becomes vital for both buyers and sellers.

With the rise of complex legal disputes and the financial ramifications they entail, the necessity for thorough title investigations has never been more urgent. From the costs associated with various property types to the advantages of regular searches, this article explores the critical elements that define the title search process, empowering stakeholders to navigate real estate transactions with confidence and clarity.

What is a Title Search and Why is it Important?

A property examination involves a meticulous analysis of public records to verify the legal ownership of real estate and to identify any claims, liens, or encumbrances that may impact ownership. This process is essential in real estate transactions, as it confirms the seller's right to sell the property and protects the buyer against potential future disputes. By uncovering any issues prior to finalizing the transaction, a property investigation plays a critical role in averting costly legal complications down the line, ultimately reducing title search expenses.

Moreover, it is often a prerequisite for lenders when approving a mortgage, ensuring that all parties involved are adequately protected.

In 2025, the importance of conducting a thorough examination of ownership cannot be overstated. Recent legal disputes surrounding property investigations underscore the necessity of this procedure, as they can lead to significant financial repercussions for both buyers and sellers. Expert opinions consistently affirm that a comprehensive examination of ownership is vital for substantiating legal claims and facilitating a seamless transaction.

Furthermore, an exhaustive document review is crucial for securing ownership insurance, which protects buyers from financial loss stemming from undisclosed issues.

Data reveals that the average hourly wage for Title Examiners, Abstractors, and Investigators in the Southwest New York nonmetropolitan area is $31.05, highlighting the specialized expertise required in this field. This knowledge is indispensable, as caveats serve as warnings that others have an interest in the asset, obstructing certain actions such as selling. Case studies, particularly those from Louisville, KY, illustrate the unique challenges associated with real estate ownership investigations, including the necessity to review the past 30 years of ownership and verify for liens or legal restrictions.

These comprehensive investigations are vital to preventing obstacles in real estate transactions, assisting in managing and facilitating a smooth process for both buyers and sellers.

Ultimately, a deed examination not only protects buyers and sellers but also serves as a fundamental element in real estate transactions, ensuring that all parties can proceed with confidence.

Factors Influencing Title Search Costs

The expense of a title examination can be influenced by several critical factors:

- Property Category: The type of real estate significantly impacts . Typically, residential properties incur lower costs, ranging from $100 to $250. Conversely, commercial properties often require more extensive investigations due to their complexity, with fees starting at $250 and potentially exceeding $500. Additionally, inquiries regarding unoccupied land can vary widely based on location and any existing liabilities.

- Area: The geographic location plays a crucial role in determining ownership investigation costs. Urban areas usually face higher charges due to increased demand and competition among firms. For instance, conducting an ownership inquiry in a city may result in higher fees compared to a rural setting, reflecting local market dynamics.

- Inquiry Complexity: The complexity of a property's ownership history can lead to variations in inquiry expenses. Properties with intricate documentation, numerous liens, or unresolved legal issues require more time and resources for investigation, resulting in elevated fees. Understanding these complexities is vital for real estate professionals to anticipate costs accurately.

- Company Fees: Different firms have varying pricing structures, which can affect the overall investigation cost. A reputable document verification company should be licensed, have a strong reputation, and provide transparent pricing without hidden fees. This transparency is essential for clients to make informed decisions.

- Time Needed for Document Reviews: It is important to recognize that the duration of document reviews can differ significantly. Some inquiries may be completed within a few hours, while others could take up to two weeks, depending on the complexity and type of asset.

In 2025, it is essential to recognize that certain situations legally necessitate a document review, such as mortgage applications, asset transfers, and real estate transactions. Lenders and local regulations often require these inquiries to confirm ownership and identify any liens. By understanding when a document examination is necessary, real estate professionals can ensure compliance with legal requirements and protect buyers and investors from potential ownership disputes.

Understanding the Average Costs of Title Searches

In 2025, the average costs associated with title searches for property investigations in residential areas typically range from $75 to $250. This range is influenced by factors such as geographic location and the complexity of ownership history. Most property investigations require a commitment of 10 to 14 days to complete, underscoring the importance of thorough research.

In contrast, investigations into commercial property ownership often incur significantly higher costs, frequently exceeding $1,000 due to the extensive research and documentation required. To effectively manage title search expenses, it is crucial for buyers and sellers to obtain estimates from multiple firms. This approach not only promotes competitive pricing but also aids in identifying the best value for services rendered.

Furthermore, certain companies engaged in property transactions offer bundled options that include insurance, which can yield substantial savings for clients. The cost of insurance premiums typically ranges from $500 to $3,500, depending on the home's purchase price and location, further emphasizing the importance of understanding overall expenses.

Grasping pricing trends is essential; for instance, while residential inquiries are generally more affordable, the title search costs associated with commercial inquiries reflect the increased diligence required. By comparing prices from various companies and considering the specific nuances of each inquiry type, stakeholders can make informed decisions that align with their financial and operational needs. Additionally, in regions such as Ohio, home buyer assistance initiatives may impact examination costs and the overall process for purchasers, making it vital to stay informed about available resources.

Finally, it is imperative to understand the difference between ; ownership records signify rights, while deeds facilitate the transfer of those rights during a sale.

Title Search Costs by Property Type and Location

Title examination expenses can differ significantly based on real estate category and geographic area.

Residential Properties: For single-family homes, title examinations typically range from $75 to $200. However, properties with larger square footage or complex ownership histories may incur higher fees, reflecting the additional investigation required.

Commercial Properties: The costs for title searches in commercial real estate can be considerably higher, usually varying from $300 to over $1,000. This increase in expenses is associated with the complexities involved, including potential legal challenges and the need for thorough due diligence, which can escalate title search costs.

Geographic Variations: are also influenced by regional real estate activity. In states with vigorous markets, such as California and New York, fees tend to be elevated due to increased demand and stringent regulatory requirements. For example, urban areas often face higher expenses compared to rural locations, where market dynamics and competition may lead to more competitive pricing. As Tony Mariotti noted, while over two-thirds (71%) of new developments in the western region are part of an HOA, only 38% are affiliated with HOAs in the northeastern region, highlighting significant regional disparities that can impact property research expenses.

Understanding these differences is crucial for real estate professionals, as they can significantly affect transaction budgets, timelines, and title search costs. Furthermore, with the anticipated expense of student loans issued in 2025 projected to be $3.3 billion lower than last year's estimated figure, financial factors in real estate deals may shift. Additionally, upcoming regulatory changes, including Wisconsin's revision of closed-end installment loan guidelines effective January 1, 2025, along with the potential end of tax benefits related to mortgage and student loan forgiveness at the close of 2025, may also influence expenses associated with property assessments.

By comprehending the typical expenses linked to various real estate types and locations, researchers can better prepare for the financial aspects of their tasks.

The Benefits of Regular Title Searches and Cost Savings

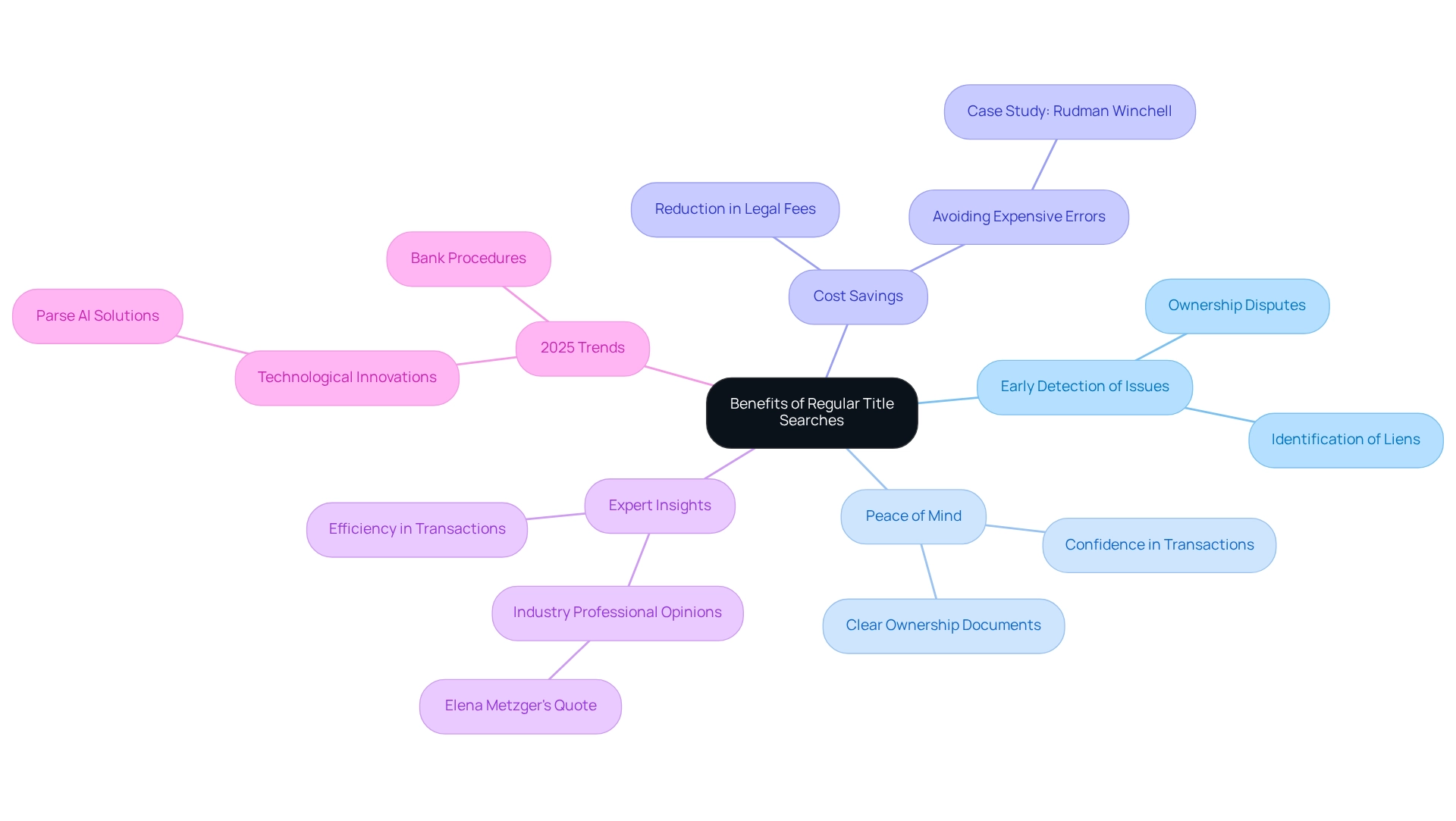

Conducting presents a multitude of advantages that can significantly influence real estate transactions.

- Early Detection of Issues: Regular title searches are instrumental in identifying potential problems, such as liens or ownership disputes, before they escalate into costly legal battles. This proactive approach not only mitigates risks but also preserves the integrity of the transaction process.

- Peace of Mind: A clear property ownership document instills confidence in both buyers and sellers, facilitating smoother transactions. Understanding that the designation is free from encumbrances enables parties to move forward with assurance, alleviating concerns related to possible disputes.

- Cost Savings: Addressing ownership issues proactively can lead to substantial reductions in title search costs, legal fees, and potential losses from unresolved claims. For instance, a case analysis involving a comprehensive document review demonstrated that thorough inquiries can avert expensive errors, saving clients hundreds of thousands of dollars over time. As highlighted by Rudman Winchell, they saved a client hundreds of thousands of dollars by avoiding a significant error, underscoring the financial prudence of investing in regular property examinations.

- Expert Insights: Industry professionals emphasize that routine document reviews not only safeguard investments but also enhance overall transaction efficiency. Elena Metzger, owner of a real estate firm, states, "We have relied on Rudman Winchell for years. They have competently and affordably assisted us with everything from our business issues to ensuring that our family is protected should anything happen." By identifying issues early, stakeholders can avoid delays and additional expenses associated with title search costs when rectifying ownership problems later in the process.

- 2025 Trends: As the real estate landscape evolves, the advantages of routine ownership examinations continue to expand. Innovations in technology, such as those embraced by firms like Parse AI, are streamlining the research process, making it more efficient and cost-effective than ever before. Banks typically conduct ownership investigations when managing mortgages to ensure the property possesses a clear deed, emphasizing the customary procedure and importance of ownership investigations in the sector.

In summary, the benefits of performing regular document reviews extend beyond mere compliance; they are essential for protecting investments and facilitating seamless real estate dealings.

Choosing the Right Title Search Company: Key Considerations

When selecting a company for property research, it is essential to consider several critical aspects that significantly influence the effectiveness and reliability of your real estate transactions:

- Reputation: The company's reputation is paramount. Seek firms with positive reviews and a proven track record in the industry. A reputable company not only demonstrates quality service but also fosters trust in their ability to manage your property inquiry needs efficiently.

- Experience: Opt for a company that possesses substantial expertise in your specific geographic area and property type. Local knowledge is invaluable, often leading to a deeper understanding of regional regulations and potential ownership issues.

- Services Offered: Ensure that the company provides a comprehensive suite of services. This should include not only document examinations but also ownership insurance and legal assistance, if necessary. A single-source provider simplifies the process and reduces the need for multiple suppliers.

- Price Clarity: Choose firms that prioritize price transparency. Clear and upfront pricing without hidden fees is crucial for budgeting and avoiding unexpected expenses. Understanding the full range of involved enables informed decision-making.

- Key Considerations: In 2025, it is vital to assess how effectively a company specializing in property checks aligns with the evolving expectations of younger buyers, who increasingly seek a streamlined, online home purchasing process. This demographic shift underscores the importance of selecting a company that embraces technology and efficiency in their operations. Younger homebuyers anticipate a more efficient and digital home purchasing experience, which contrasts with traditional approaches.

- Successful Examples: Investigate case studies of successful companies that have demonstrated their capability to meet client needs effectively. For instance, the proposed maximum risk for insurance firms highlights the correlation between a company's surplus and the risk they are permitted to accept, providing a framework for evaluating risk in insurance policies. These examples offer insight into the services available and the overall customer experience.

- Statistics: Recent data indicates that firms with a strong reputation and established success in document reviews tend to exhibit higher client retention rates and satisfaction levels. For example, reports a revenue of $2,216.0 million and a profit margin of 11.7%, reflecting their financial health and reliability in the industry. This underscores the significance of reputation and experience in your selection process.

- Expert Insight: If you have questions regarding the application of the recommended Maximum Risk schedule or other aspects of formulating requirements for property insurance and/or reinsurance, it is prudent to consult with specialists in the field, such as Paul G. Mackey from ArentFox Schiff LLP. By thoroughly evaluating these elements, you can select a company that not only meets your immediate needs but also aligns with your long-term objectives in real estate transactions.

Common Mistakes to Avoid in Title Searches

To guarantee a successful examination of ownership, it is crucial to avoid the following common errors:

- Neglecting to Verify All Records: Overlooking pertinent public records can lead to significant oversights, such as missed liens or claims that could jeopardize ownership. A comprehensive review of all available records is essential to mitigate risks associated with . Statistics indicate that real estate characteristics, evaluations, and tax information are typically refreshed each year, underscoring the importance of checking all records to prevent reliance on outdated data.

- Selecting Inexperienced Company Firms: Choosing a company without a proven track record can result in inadequate investigations and costly mistakes. Engaging skilled experts ensures a thorough understanding of the complexities associated with property research, ultimately safeguarding the transaction.

- Neglecting Local Laws and Regulations: Each state has unique regulations regarding property ownership, and ignoring these can lead to insufficient inquiries. Familiarity with local regulations is vital for conducting a thorough and compliant examination.

- Underestimating the Importance of Follow-Up: It is imperative to follow up on any findings from the examination. Addressing issues promptly ensures that all potential problems are resolved before completion, thus facilitating a smoother transaction.

In 2025, statistics reveal that a considerable percentage of search failures contribute to title search costs, emphasizing the need for diligence in the process. For instance, neglecting probate records has been identified as a common error with serious repercussions. As noted by Dave from TitleSearch.com, 'the third error involves overlooking probate records.'

By adhering to best practices and leveraging advanced technologies, such as those offered by Parse AI, researchers can enhance both accuracy and efficiency. Parse AI addresses the challenges associated with the time and resources required for confirming real property ownership, enabling title researchers to complete abstracts and reports more swiftly and accurately, ultimately leading to an error-free closing.

Conclusion

A thorough title search is indispensable in the real estate landscape, serving as a foundational step that ensures legal ownership and uncovers potential claims or encumbrances. By meticulously reviewing public records, a title search protects buyers and sellers while acting as a safeguard against future disputes arising from unresolved issues. The significance of this process cannot be overstated, particularly given the increasing complexities in property transactions and the financial ramifications of legal disputes.

Understanding the various factors influencing title search costs—such as property type, location, and complexity of ownership history—is crucial for stakeholders navigating the financial aspects of real estate. Regular title searches offer significant benefits, including early detection of issues, peace of mind, and potential cost savings, ultimately facilitating smoother transactions. Furthermore, the evolution of technology continues to enhance the efficiency and effectiveness of title searches, simplifying the management of investments for buyers and sellers.

Choosing the right title search company is equally critical, as it can greatly impact the success of a transaction. By considering factors such as reputation, experience, and cost transparency, stakeholders can ensure they are working with a reliable partner. Moreover, avoiding common pitfalls—like neglecting to verify all records or overlooking local laws—can prevent costly mistakes that jeopardize property ownership.

In conclusion, the complexities of real estate transactions necessitate a comprehensive understanding of title searches. By prioritizing thorough investigations and selecting qualified professionals, buyers and sellers can navigate the real estate landscape with confidence, ensuring their investments are protected and transactions proceed smoothly.

Frequently Asked Questions

What is a property examination?

A property examination is a meticulous analysis of public records to verify the legal ownership of real estate and identify any claims, liens, or encumbrances that may impact ownership.

Why is a property examination essential in real estate transactions?

It confirms the seller's right to sell the property, protects the buyer against potential future disputes, and helps uncover any issues prior to finalizing the transaction, thereby reducing title search expenses.

How does a property examination benefit lenders?

It is often a prerequisite for lenders when approving a mortgage, ensuring that all parties involved are adequately protected.

What recent developments highlight the importance of property examinations?

Recent legal disputes surrounding property investigations underscore the necessity of thorough examinations, as they can lead to significant financial repercussions for both buyers and sellers.

What role does document review play in property examinations?

An exhaustive document review is crucial for securing ownership insurance, which protects buyers from financial loss stemming from undisclosed issues.

What factors influence the cost of a title examination?

Key factors include property category (residential vs. commercial), geographic area, inquiry complexity, company fees, and the time needed for document reviews.

What are the typical costs for title examinations based on property type?

Residential properties typically incur costs ranging from $100 to $250, while commercial properties often require more extensive investigations with fees starting at $250 and potentially exceeding $500.

How does the geographic location affect title examination costs?

Urban areas usually face higher charges due to increased demand and competition among firms compared to rural settings.

Why is understanding inquiry complexity important for real estate professionals?

Properties with intricate documentation, numerous liens, or unresolved legal issues require more time and resources for investigation, leading to elevated fees.

When is a document review legally necessary?

Document reviews are legally necessary in situations such as mortgage applications, asset transfers, and real estate transactions to confirm ownership and identify any liens.