Overview

The article titled "Understanding Title on a House: An In-Depth Tutorial for Homeowners" highlights the critical importance of comprehending house titles for homeowners. It underscores that a clear title is essential for protecting property rights and preventing legal disputes. This assertion is reinforced by statistics indicating a significant prevalence of real estate issues stemming from misunderstandings regarding property documents.

Introduction

In the realm of real estate, comprehending the intricacies of house titles is paramount for homeowners and potential buyers alike. A house title signifies ownership and encompasses a myriad of rights and responsibilities that can significantly impact financial investments and property management. The complexities surrounding titles can lead to disputes, legal challenges, and unforeseen complications if not navigated carefully.

Furthermore, as the landscape of property ownership evolves, the necessity for individuals to be well-informed about their titles, the implications of different ownership structures, and the vital role of title insurance grows. This article delves into the significance of house titles, common ownership methods, legal implications, and practical steps homeowners can take to protect their investments, ensuring a clearer path in the often convoluted world of property ownership.

What is a House Title and Why is it Important?

is an essential legal document that confirms possession of a property, outlining the rights of the possessor, such as the capability to sell, lease, or alter the property. Comprehending your property document is crucial for several reasons. Firstly, it protects your property rights, ensuring that you can legally transfer possession when necessary.

A clear title on a house is vital; without it, you may face disagreements or challenges concerning your assets, which can lead to expensive legal conflicts.

Statistics reveal that real estate disputes are not uncommon, with recent data suggesting that a significant percentage of homeowners encounter issues related to ambiguous documentation. In 2025, the frequency of legal disputes over property ownership increased, underscoring the importance of thorough ownership research and understanding. For instance, a case study from 2024 indicated that 74% of purchasers financed their home acquisitions, yet many were unaware of the implications of their property documents, leading to complications during the transfer of possession.

This trend highlights the financial ramifications of understanding home ownership documents, particularly the significance of the title on a house for individuals financing their residences.

Moreover, expert opinions emphasize that grasping the legal documents that establish the title on house ownership is critical for homeowners. As industry expert Dax Junker states, "For consumers, understanding the role that insurance plays in protecting their homes is also essential." This underscores the importance of insurance for ownership in safeguarding against potential conflicts.

In fact, 79% of purchasers believe that home acquisitions are a better financial investment than holding stocks, emphasizing the necessity of securing clear ownership documents to protect these investments.

Furthermore, the trend of all-cash transactions reaching a record level, with 26% of purchasers opting for this option, further highlights the importance of transparent ownership for both financed and cash purchasers. In this context, Parse AI offers substantial cost reductions compared to conventional research methods, facilitating the navigation of complexities related to real estate by individuals and researchers.

In summary, the importance of property documents extends beyond mere possession; it encompasses the safeguarding of rights and the avoidance of conflicts, making it essential for homeowners to be well-informed about their documents and the related legalities.

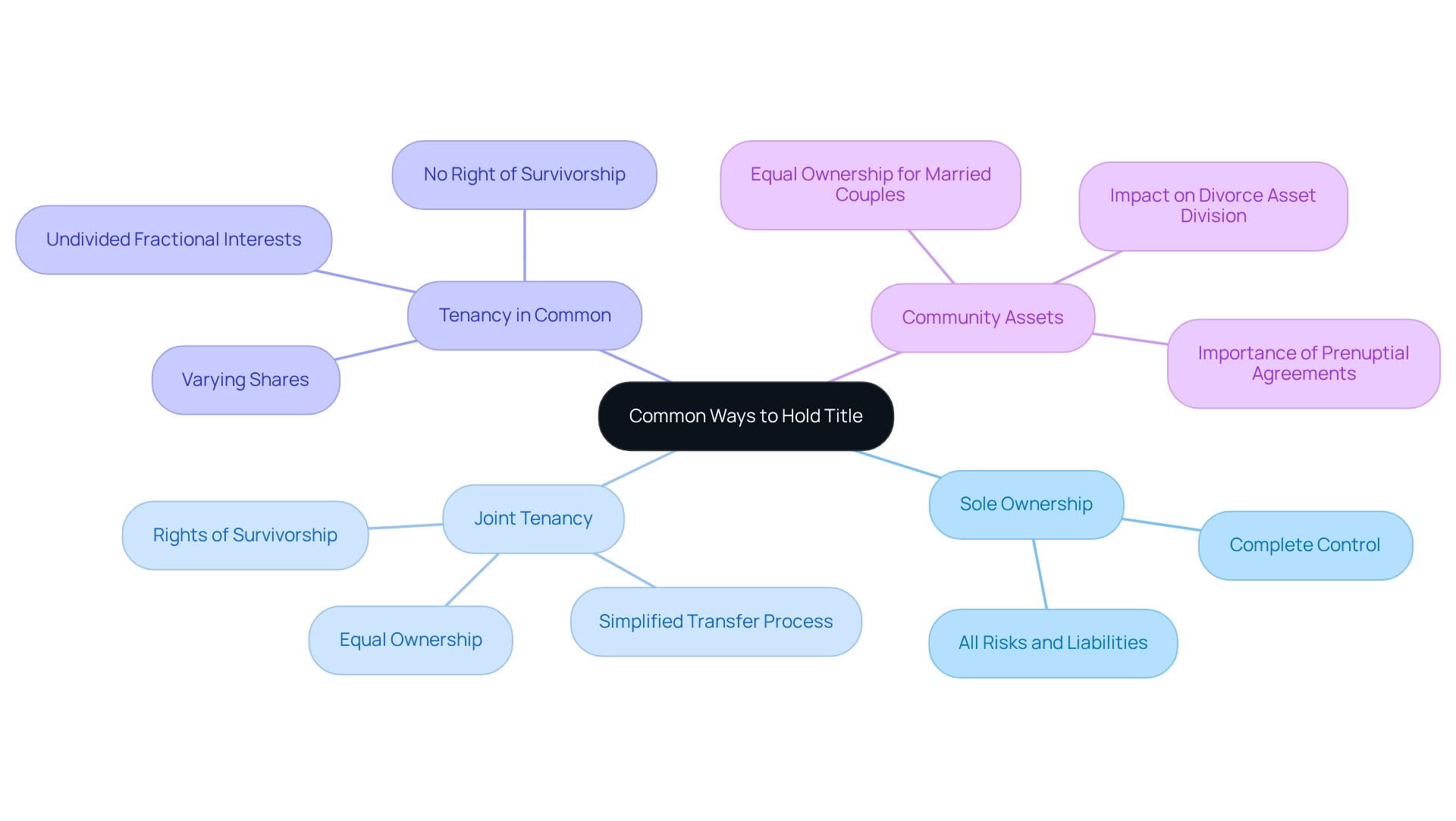

Common Ways to Hold Title: Understanding Your Options

When it comes to possessing a house, several common frameworks exist, each with its own implications for rights and responsibilities:

- Sole Ownership: This structure allows one individual to hold the asset entirely, providing complete control over the resource. However, it also signifies that the sole owner assumes all the risks and liabilities linked to the asset.

- Joint Tenancy: In this arrangement, two or more individuals own the asset equally, with the added benefit of rights of survivorship. This means that upon the death of one owner, their share automatically transfers to the surviving owner(s), simplifying the transfer process and avoiding probate. Significantly, after the passing of one partner, the remaining partner obtains complete rights to the assets, which can be a considerable benefit in estate planning.

- Tenancy in Common: This type of arrangement allows several individuals to possess shares of the asset, which may vary in amount or duration. Tenancy in common permits undivided fractional interests, indicating that owners can possess varying percentages of stake. Unlike joint tenancy, there is no right of survivorship, allowing owners to bequeath their shares to heirs, which can complicate inheritance matters.

- Community Assets: Primarily utilized by married couples, community assets laws dictate that both partners equally own all belongings acquired during the marriage, regardless of who purchased them. This structure can significantly impact asset division in the event of divorce and underscores the importance of prenuptial agreements to safeguard individual investments. For example, comprehending community asset laws can assist couples in managing the distribution of resources during a divorce, highlighting the importance of meticulous planning.

Grasping these possession frameworks is essential for homeowners as they handle choices concerning inheritance, liability, and asset management. Recent trends indicate a growing preference for joint tenancy among couples due to its straightforward transfer of ownership upon death, while tenancy in common remains popular among investors seeking flexibility in ownership shares. Additionally, statistics reveal that can influence the division of assets, highlighting the need for careful planning in marital property agreements.

By considering these factors, property owners can choose for their unique circumstances. As researchers in the field, utilizing tools like Parse AI can offer substantial cost reductions compared to conventional research methods, improving efficiency in the workflow.

Legal Implications of Title Ownership: What Homeowners Should Know

Possessing a deed entails considerable [legal obligations and consequences](https://blog.parseai.co/10-essential-tools-for-automating-land-registry-tasks) that property owners must navigate to safeguard their interests. It is essential for homeowners to verify that their ownership document is free from liens, disputes, or claims from other parties. Harbinger Land provides comprehensive and precise property research, enabling clients to confidently acquire land rights and assets in their areas of interest through refined procedures and rigorous quality control measures.

Common legal issues that can arise include:

- Liens: Claims against the property due to unpaid debts can hinder the ability to sell or refinance. Statistics indicate that approximately 30% of real estate may have some form of lien, according to Antonoplos & Associates, underscoring the necessity of thorough title searches for property ownership.

- Boundary Disputes: Conflicts over land boundaries with neighbors can lead to costly legal battles. Such disputes often stem from or changes in land use, making it vital for homeowners to possess accurate surveys and documentation.

- Title Defects: Mistakes in public records, such as misspellings or inaccurate legal descriptions, can significantly impact rights of possession. Resolving these defects typically requires legal intervention, which can be both time-consuming and expensive.

Understanding these matters is crucial for maintaining clear authority and preventing legal difficulties. Recent case studies highlight the importance of proactively addressing these challenges. For instance, a case titled "Transferring Legal Ownership: Chain of Title and Title Insurance" emphasized that effective management of the transfer process, including the use of ownership insurance and escrow, mitigates risks and protects the interests of purchasers and lenders in real estate transactions.

Moreover, the legal responsibilities of ownership extend beyond mere possession; homeowners must also be vigilant in resolving any disputes or claims that may arise. As Rande Yeager, president of the American Land Association, states, "This clearly demonstrates the importance of a professional search in all real estate transactions, whether acquiring a new home or refinancing an existing mortgage." Engaging with , such as firms like Harbinger Land and legal professionals, can provide valuable assistance in navigating these complexities and ensuring compliance with legal standards.

How to Transfer Title: A Step-by-Step Guide

Transferring a title involves several critical steps that ensure a seamless transition of ownership:

- Determine the Type of Transfer: Identify the nature of the transfer—whether it involves selling, gifting, or placing the asset into a trust. Each type has specific legal implications and requirements.

- Conduct a Title Search: This step is crucial to confirm that the property is free from liens or claims. can uncover any claims that may influence the transfer, ensuring that the new owner obtains a clear ownership record. Employing Parse AI's sophisticated machine learning tools can greatly improve this process, enabling and precise extraction of essential information from the title on the house. The example manager feature allows users to swiftly annotate documents, simplifying the search process for titles. As noted by industry experts, conducting a thorough search of the title on the house is essential to avoid future legal complications and ensure a smooth transfer process.

- Prepare the Deed: Draft a legal document that clearly outlines the terms of the property transfer. The deed must include essential details such as the names of the parties involved, a description of the property, and the type of transfer.

- Sign the Deed: Both the grantor (seller) and grantee (buyer) must sign the deed in the presence of a notary public. This step is vital for validating the document and ensuring that all parties agree to the terms of the transfer.

- Record the Deed: Finally, file the signed deed with the local county recorder's office. This action officially records the transfer of the title on the house and safeguards the rights of the new possessor.

Following these steps not only facilitates a smooth transfer of ownership but also minimizes potential legal issues in the future. Statistics indicate that a well-executed ownership transfer process can significantly reduce the average time to complete the transfer, enhancing efficiency for all parties involved. Interacting with experts who focus on research can further streamline this process, ensuring compliance and precision throughout.

Moreover, utilizing platforms such as Parse AI can offer substantial cost reductions compared to conventional research methods, enhancing the overall efficiency of the process. To learn more about how Parse AI can assist you in your title research needs, consider reaching out to us today.

Title vs. Deed: Clarifying the Key Differences

Although the terms 'title on house' and 'deed' are frequently used interchangeably, they represent distinct concepts in real estate. Title refers to the legal right to own and utilize an asset, encompassing all rights related to possession, including the ability to sell, lease, or alter the property.

Comprehending ownership is essential, particularly the title on house, as it can be complicated by factors such as liens, encumbrances, or competing claims. In contrast, a deed is a physical document that facilitates the transfer of possession from one party to another. For a deed to be valid, it must be signed by the grantor and recorded with the appropriate governmental authority.

The document acts as evidence of ownership transfer but does not necessarily ensure that the ownership is free from issues. Understanding the distinction between ownership and the title on house is crucial for property owners, especially when dealing with . Misunderstandings related to the title on house can lead to significant complications; studies indicate that a notable percentage of homeowners confuse these terms, resulting in legal challenges or financial loss.

For example, while a deed transfers possession, it does not always resolve potential issues, emphasizing the significance of a comprehensive investigation into the title on house. In real estate, various types of deeds—such as , Special Warranty Deeds, Grant Deeds, Quitclaim Deeds, and Bargain and Sale Deeds—offer differing levels of protection for buyers. The Bargain and Sale Deed, for instance, is frequently utilized in tax sales or foreclosures and conveys real estate without clearing ownership or safeguards for the purchaser.

Each type has its implications for property rights and responsibilities, making it crucial for homeowners to understand these distinctions related to the title on house. As the DSL Mortgage Team appropriately notes, 'The deed confirms your ownership, the document signifies your legal entitlement to the asset, and the mortgage safeguards the lender’s interest in the asset as collateral for your loan.' This clarity is essential for making informed choices about the title on house in real estate transactions.

Furthermore, when selling a house, the title on the house is transferred to the new buyer, and sale proceeds typically pay off the mortgage, highlighting the practical aspects of deeds in real estate transactions. It is essential to recognize that although a deed conveys ownership, issues with a deed do not necessarily suggest complications with the ownership itself, emphasizing the need for clarity in real estate transactions.

The Role of Title Insurance: Protecting Your Investment

Title insurance serves as essential protection for homeowners and lenders, shielding them from financial losses arising from flaws in the title on house documents. Common issues covered by title insurance include:

- Unpaid Liens: Claims against the property due to unpaid debts, which can jeopardize ownership.

- Fraudulent Claims: Instances where individuals falsely assert possession, leading to significant legal challenges.

- Errors in Public Records: Mistakes in official documents can create confusion regarding ownership rights, potentially resulting in costly disputes.

The importance of having title insurance cannot be overstated; it offers homeowners essential protection against these risks, ensuring peace of mind in their investment. In fact, a significant portion of homeowners—around 80%—possess ownership insurance, reflecting its critical role in the real estate market.

Furthermore, expert opinions underscore that title insurance is crucial for protecting the title on houses, not merely serving as a safety net but as a vital component of real estate transactions. As Diane Tomb, CEO of , states, "Title professionals nationwide persist in steering their businesses through this challenging and volatile real estate cycle, committed to serving their clients, safeguarding ownership rights, and supporting their communities despite the unpredictability of the marketplace." This highlights the dedication of industry professionals in maintaining property rights and protecting investments.

Historically, before ownership insurance became common, homebuyers often employed attorneys to examine and resolve issues concerning the title on houses. Currently, they can depend on insurance underwriters for claims, illustrating the industry's development and the effectiveness it provides to real estate transactions.

Recent case studies illustrate the financial repercussions of ownership defects, with examples showing losses that can exceed tens of thousands of dollars due to unresolved claims. Significantly, Parse AI is transforming research on property ownership by utilizing machine learning and optical character recognition to extract essential information from documents, enabling researchers to complete abstracts and reports more quickly and accurately. This technological advancement not only improves efficiency but also provides significant cost savings for real estate professionals.

In the present real estate environment, where uncertainties are prevalent, the function of ownership insurance remains crucial. It not only protects individual investments but also supports the broader stability of the housing market, allowing professionals to serve their clients with confidence.

Common Title Issues and How to Resolve Them

Homeowners frequently encounter various problems related to the title on their house, complicating property possession and transactions. Among the most prevalent issues are:

- Public Record Errors: These mistakes in official records can obscure true ownership, leading to potential disputes and complications during sales. Statistics suggest that public record errors are a frequent problem, impacting numerous property owners.

- Liens: Claims against the asset for unpaid debts can hinder the sale process and affect the homeowner's financial standing. These liens are often a significant barrier to clear ownership of real estate.

- Boundary Disputes: Conflicts with neighbors regarding property lines can escalate into legal battles if not addressed promptly.

To effectively resolve these issues, homeowners should take the following steps:

- Conduct a thorough search for the title on the house: This initial step helps identify any existing issues, such as liens or errors in public records, that could affect ownership. Employing advanced machine learning tools from Parse AI, including the example manager, can accelerate this process, ensuring a more thorough and precise search for names.

- Collaborate with a title firm: Partnering with can assist in rectifying defects and guarantee that the title on the house is suitable for the market. Parse Ai's research automation for property documents can enhance the efficiency and precision of this process, allowing researchers to complete abstracts and reports more quickly.

- Consult a Real Estate Attorney: If complications arise, seeking legal assistance can provide clarity and help navigate disputes.

Addressing these ownership issues related to the title on the house quickly is vital, as unresolved problems can result in major complications during real estate transactions. For example, a case study featuring Gina Miller demonstrates the wider consequences of complicated ownership; she was unable to access crucial repair programs because of ambiguous ownership, emphasizing the significance of keeping clear records for residents, particularly in low-income neighborhoods. Parse Ai's solutions can play a crucial role in addressing such problems, ensuring that homeowners possess the essential tools to manage their real estate documents efficiently.

Insufficient estate planning in Black households contributes to the prevalence of complicated ownership issues in these communities, highlighting the necessity for proactive measures.

Tim Carpenter, Senior Director of Community Impact, remarked, "These insights and other discoveries from our research will keep guiding us as we contemplate how to address heirs' land in the future." This emphasizes the significance of comprehending ownership issues in the context of estate planning.

Furthermore, in specific situations, individuals may request the Orphans' Court to acquire ownership of a property without undergoing probate, with a filing fee of $90.25 that can be waived for low-income applicants. This offers a practical solution for property owners encountering ownership problems. By understanding and proactively managing these challenges, property owners can safeguard their investments and ensure smoother transactions.

How to Protect Your House Title: Essential Tips

To efficiently protect your home ownership, homeowners must adopt the following strategies:

- Acquire Title Insurance: Title insurance is vital, offering protection against potential flaws in ownership documentation. This ensures that unexpected claims or issues are handled without considerable financial strain.

- Frequently Review Public Records: It is crucial to remain vigilant by examining public records for any alterations or claims against your residence. Utilizing advanced digital interfaces, such as those offered by Parse AI, facilitates efficient searches of county clerk records. This user-friendly platform features a search bar at the top and a comprehensive table listing various records, including viewer, name, grantor, grantee, book volume, book page, instrument type, instrument date, file date, and legal description. Users can conduct full-text searches and leverage machine learning to extract pertinent document details, ensuring thorough monitoring of records. provide ongoing observation, notifying you of unauthorized changes, allowing for swift action against potential fraud. Registering for such services enables property owners to receive prompt notifications regarding questionable activities, thus safeguarding their property rights.

- Secure Important Documents: Safeguarding ownership documents is essential. Keep them in a secure location to prevent loss or theft, as these documents are crucial for demonstrating ownership.

- Consult Experts: Collaborating with a property agency or a real estate lawyer can provide valuable advice on maintaining a clear ownership record. Their expertise can assist in navigating complex situations and ensuring compliance with local laws.

By implementing these strategies, homeowners can significantly strengthen their defense against challenges related to the title of their house, thereby safeguarding their property rights and investment. In 2025, the significance of ownership insurance and monitoring public records cannot be overstated, serving as the first line of defense against potential threats to property ownership. Furthermore, with the rise of title fraud cases, it is imperative to remain proactive in protecting your title.

Conclusion

Understanding the complexities of house titles is essential for anyone involved in real estate, whether as a homeowner or a potential buyer. A house title is not merely a legal document; it embodies ownership rights and responsibilities that can significantly influence financial investments and property management. The various ownership structures, from sole ownership to community property, each carry unique implications that necessitate careful consideration.

Navigating the legal landscape surrounding titles is equally important. Issues such as liens, boundary disputes, and title defects can arise, potentially leading to costly legal battles. Engaging with professionals and utilizing advanced tools can streamline the title research process, ensuring homeowners are well-informed and prepared to tackle any challenges that may emerge.

Furthermore, the role of title insurance cannot be overstated; it serves as a crucial safeguard against potential defects and claims, providing peace of mind for homeowners and lenders alike. By adopting proactive measures—such as obtaining title insurance, regularly monitoring public records, and securing important documents—homeowners can protect their investments and maintain clear ownership.

In a world where property ownership is increasingly complex, staying informed and proactive is vital. Homeowners must prioritize understanding their titles and the legal implications to navigate the real estate landscape successfully. By doing so, they can ensure that their property investments remain secure and free from unforeseen complications.

Frequently Asked Questions

What is a property deed?

A property deed is a legal document that confirms possession of a property and outlines the rights of the possessor, such as the ability to sell, lease, or alter the property.

Why is it important to understand your property documents?

Understanding your property documents is crucial as it protects your property rights, ensures legal transfer of possession when necessary, and helps avoid disputes or expensive legal conflicts related to ownership.

What are the potential consequences of unclear property titles?

Without a clear title, homeowners may face disagreements or challenges regarding their assets, which can lead to costly legal disputes.

What statistics highlight the prevalence of real estate disputes?

Recent data suggests a significant percentage of homeowners encounter issues related to ambiguous documentation, with an increase in legal disputes over property ownership noted in 2025.

What financial implications are associated with understanding property documents?

Many purchasers, particularly those financing their homes, are often unaware of the implications of their property documents, which can lead to complications during the transfer of possession.

What are the common frameworks for property ownership?

Common frameworks include Sole Ownership, Joint Tenancy, Tenancy in Common, and Community Assets, each with distinct rights and responsibilities.

What is Sole Ownership?

Sole Ownership allows one individual to hold the property entirely, giving them complete control but also full responsibility for risks and liabilities.

How does Joint Tenancy work?

Joint Tenancy involves two or more individuals owning the property equally, with rights of survivorship, meaning that upon the death of one owner, their share automatically transfers to the surviving owner(s).

What is Tenancy in Common?

Tenancy in Common allows multiple individuals to own shares of the property, which can vary in amount or duration, and does not include rights of survivorship, allowing owners to bequeath their shares to heirs.

What are Community Assets?

Community Assets laws dictate that married couples equally own all belongings acquired during the marriage, impacting asset division in the event of divorce.

Why is it important to understand possession frameworks?

Understanding possession frameworks is essential for homeowners to make informed decisions regarding inheritance, liability, and asset management.

What recent trends are seen in property ownership preferences?

There is a growing preference for Joint Tenancy among couples for its straightforward transfer of ownership, while Tenancy in Common remains popular among investors seeking flexibility.