Overview

Title gap coverage plays a vital role in real estate transactions, as it shields property owners and lenders from potential claims or ownership disputes that may emerge between the closing of a property transaction and the official recording of the deed. This coverage is essential, as it protects against risks such as undisclosed liens and claims from previous owners. By ensuring financial security for all parties involved during this vulnerable period, title gap coverage reinforces the reliability of real estate transactions.

Introduction

In the intricate world of real estate transactions, the stakes are high, with the potential for unforeseen complications looming large. Title gap coverage emerges as a critical safeguard, protecting both property owners and lenders from claims or defects that may arise during the vulnerable period between closing a deal and the official recording of the deed.

As the complexities of real estate evolve, so too does the necessity for this specialized insurance. It not only provides peace of mind but also ensures that the financial interests of all parties are well protected against any legal challenges that may unexpectedly surface.

Understanding the nuances of title gap coverage is essential for navigating the risks inherent in property ownership and investment.

Define Title Gap Coverage

Title insurance serves as a vital form of , shielding them from potential claims or ownership issues that may arise during the interval between the closing of a property transaction and the official documentation of the deed. This critical gap, as title gap coverage explained, can occur due to various factors, including delays in recording or unforeseen challenges that may surface after the ownership search has concluded but before new ownership is officially recorded. Essentially, title insurance acts as a safeguard against any legal complications that could threaten the ownership rights of either the buyer or the lender during this vulnerable timeframe.

Contextualize the Importance of Title Gap Coverage

The significance of title gap coverage explained is paramount, especially in real estate transactions where significant financial investments are at stake. Without this , both purchasers and lenders face considerable risks, including undisclosed liens, claims from previous owners, and other document flaws that may arise during the gap period.

For example, should a lien be filed against the property after closing but prior to the deed's recording, the new owner could encounter legal challenges that jeopardize their ownership.

The concept of title gap coverage explained not only provides peace of mind but also ensures that any unforeseen issues that emerge during this critical period are effectively addressed, thereby safeguarding the financial interests of all parties involved.

Trace the Origins and Evolution of Title Gap Coverage

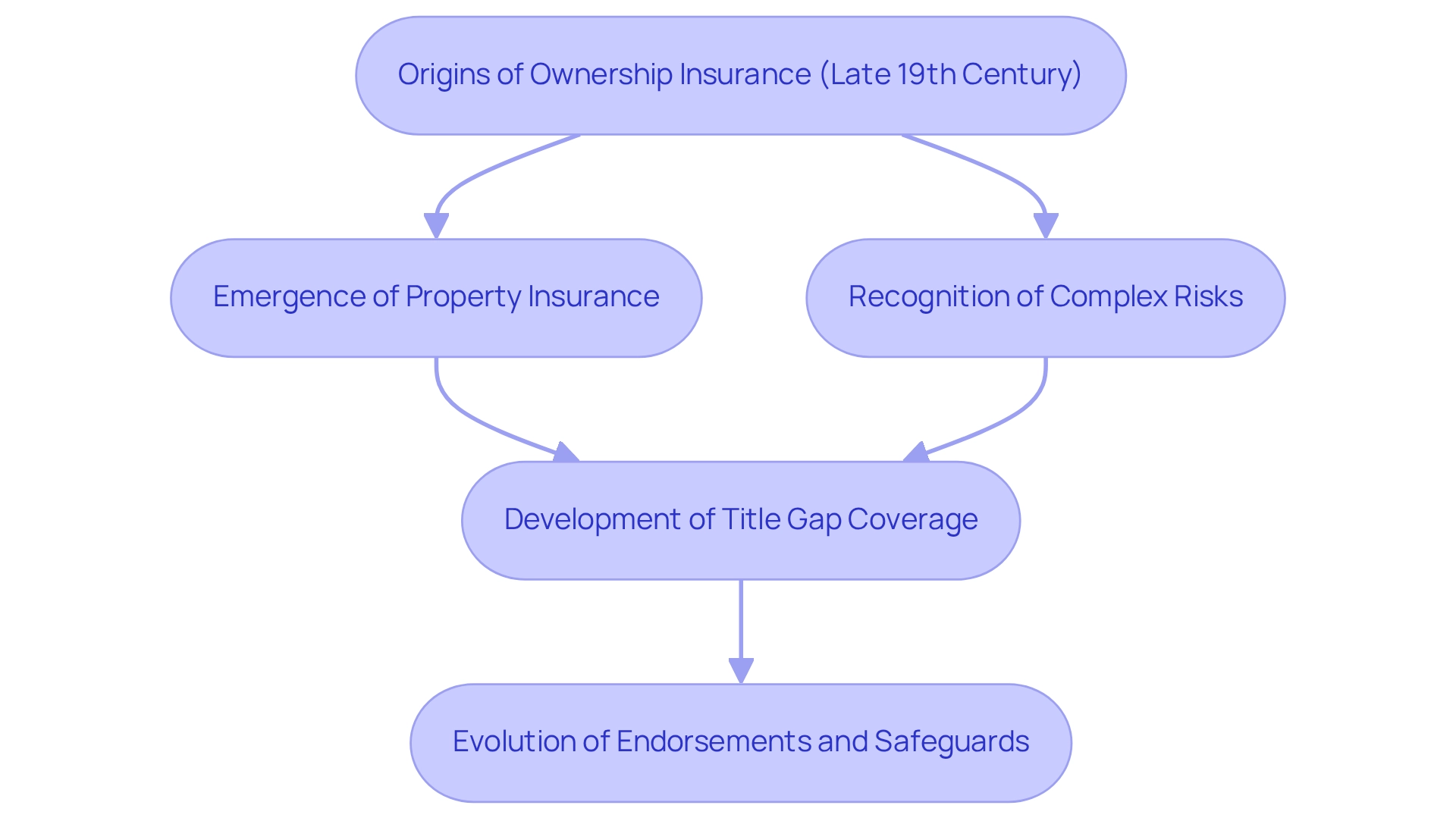

The concept of gap protection originates from the broader field of , which emerged in the late 19th century to address the need for safeguarding property purchasers against ownership flaws. Initially, property insurance focused on recognized risks; however, as property transactions became more complex, the demand for additional safeguards became evident. Consequently, title gap coverage explained was developed to address the specific vulnerabilities that arise during the interval between closing and recording. Over the years, as real estate practices and legal frameworks have evolved, the concept of title gap coverage explained has also expanded, adapting to include various endorsements and safeguards that meet the needs of modern real estate transactions.

Identify Key Characteristics of Title Gap Coverage

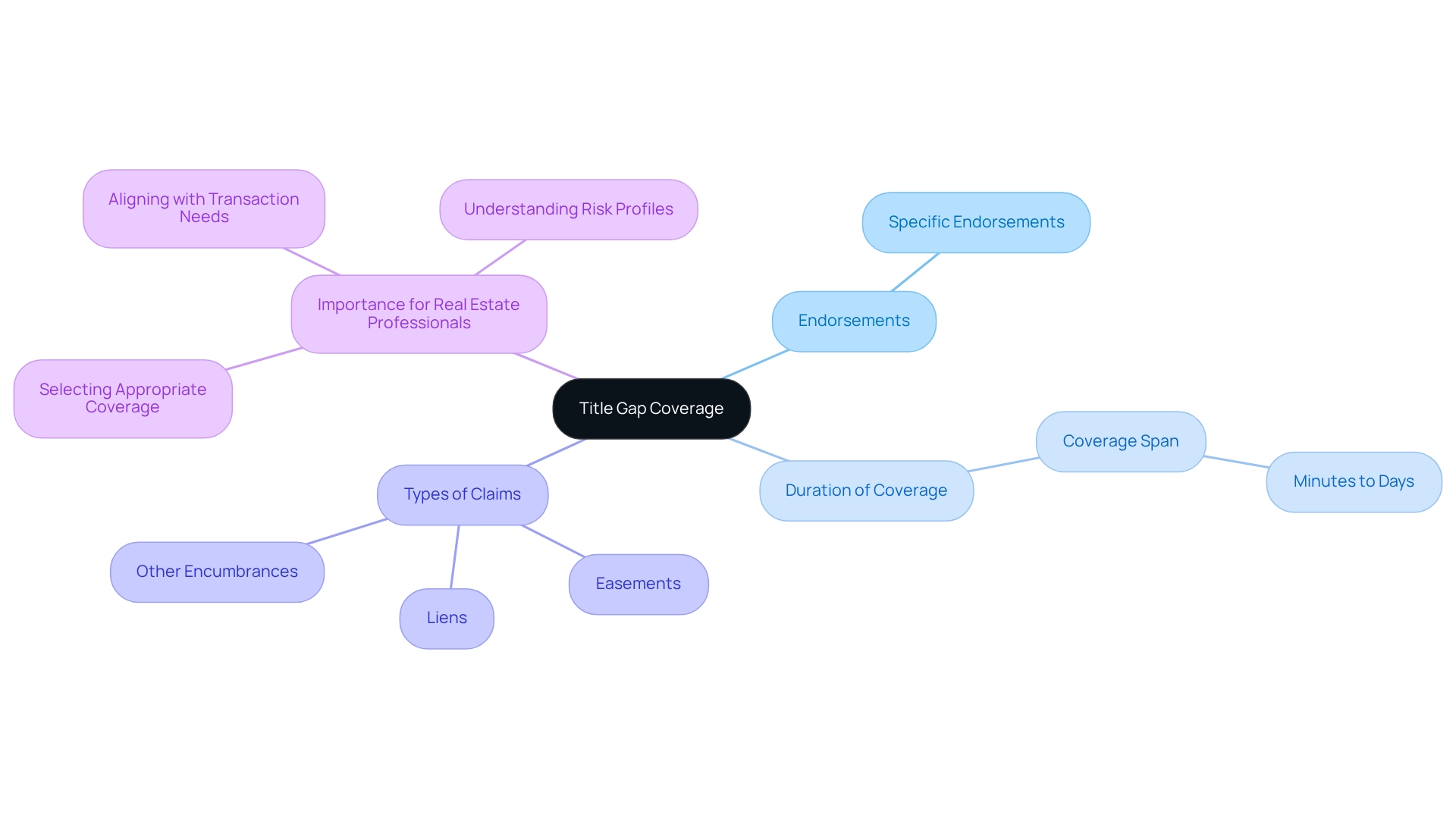

Understanding the key characteristics of title gap coverage explained is essential for safeguarding against claims that arise during the gap period. This protection includes specific endorsements that may be included in a policy and the duration of coverage. Typically, gap insurance protects against any defects that arise between the closing date and the recording of the deed, which can span from minutes to days. Furthermore, policies may vary in terms of the types of claims covered, such as liens, easements, or other encumbrances. Understanding these characteristics is crucial for real estate professionals, as it enables them to select the , which is part of the title gap coverage explained, that aligns with their specific transaction needs and risk profiles.

Conclusion

Title gap coverage stands as a vital component in the realm of real estate transactions, serving as a protective measure for both property owners and lenders during a precarious period. By addressing potential claims or defects that may arise between the closing of a deal and the official recording of the deed, this specialized insurance mitigates significant risks that could otherwise jeopardize ownership rights.

The necessity of title gap coverage is underscored by the complexities of modern real estate, where financial stakes are high and unforeseen issues can surface unexpectedly. Without this coverage, buyers and lenders expose themselves to various threats, including undisclosed liens or claims from previous owners. Thus, title gap coverage not only provides essential peace of mind but also fortifies the financial interests of all parties involved in a transaction.

As the landscape of real estate continues to evolve, so too does the role of title gap coverage. Its origins trace back to the early days of title insurance, adapting over time to meet the changing needs of property transactions. Understanding the characteristics and importance of this coverage is crucial for real estate professionals, enabling them to safeguard their interests effectively. In an industry fraught with potential complications, title gap coverage remains an indispensable tool for navigating the intricate world of property ownership and investment.

Frequently Asked Questions

What is title gap coverage?

Title gap coverage is a form of protection provided by title insurance for property owners and lenders, safeguarding them from potential claims or ownership issues that may arise between the closing of a property transaction and the official documentation of the deed.

Why is title gap coverage important?

It is important because it protects against legal complications that could threaten the ownership rights of the buyer or lender during the vulnerable period between closing and recording the new ownership.

What factors can lead to a title gap?

Title gaps can occur due to various factors, including delays in recording the deed or unforeseen challenges that may arise after the ownership search has concluded but before new ownership is officially recorded.