Introduction

Title Theory vs. Mortgage Theory: Understanding Property Ownership in Real Estate Transactions

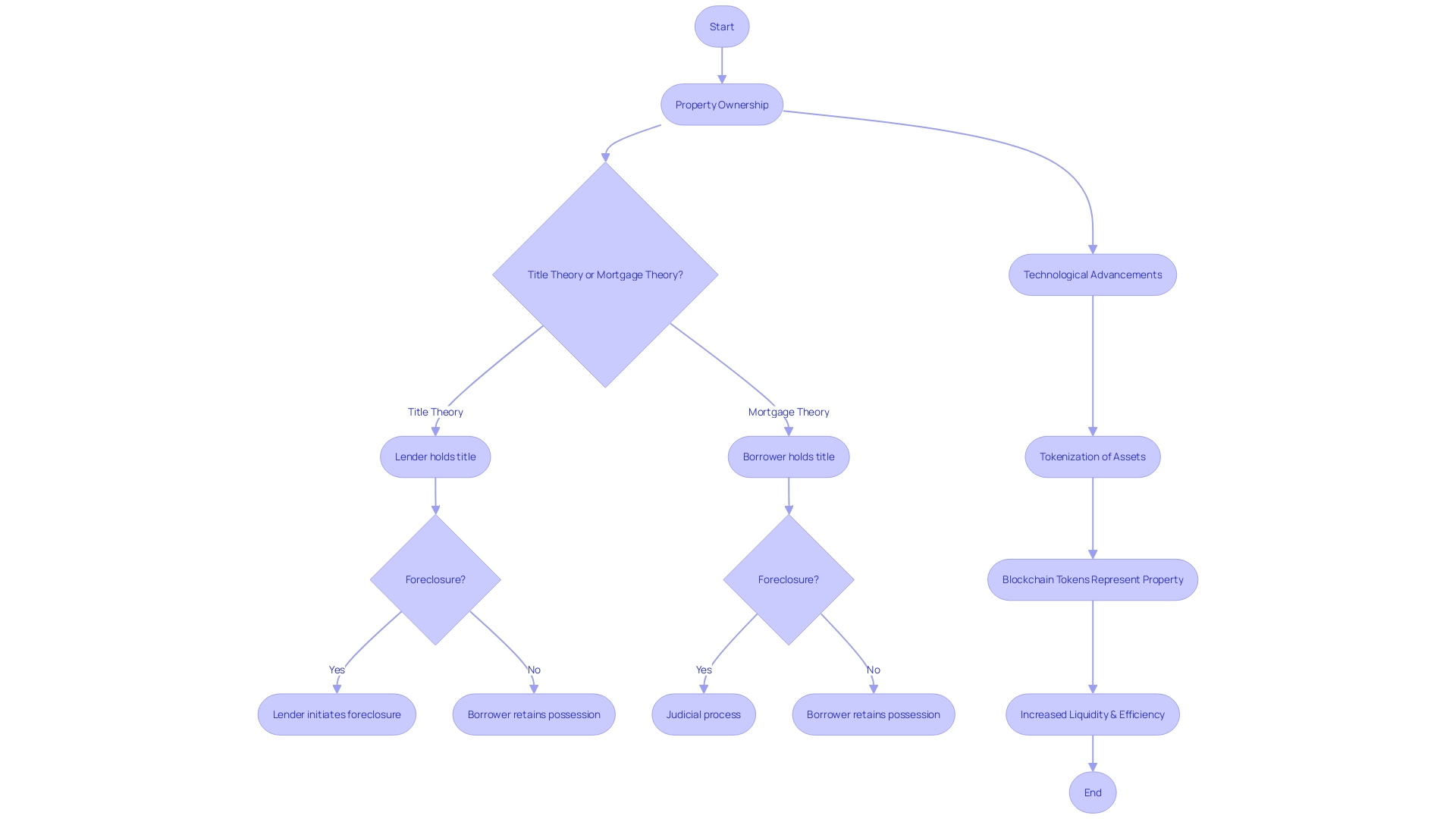

Property ownership in real estate transactions is governed by two distinct frameworks: title theory and mortgage theory. These theories outline the relationship between lenders and borrowers and have significant implications for property rights and transactional dynamics. While title theory grants legal ownership to the lender and equitable title to the borrower, mortgage theory places legal and equitable title in the hands of the borrower.

Understanding these theories is crucial for real estate professionals navigating the complexities of property ownership and ensuring smooth transactions. In this article, we will delve into the nuances of title theory and mortgage theory, explore their comparative analysis, examine the benefits and drawbacks of each, and address the evolving landscape of digital property rights. With the convergence of traditional and emerging technologies, it is essential to have a comprehensive understanding of these theories and the legal framework that underpins real estate transactions.

What is Title Theory in Real Estate?

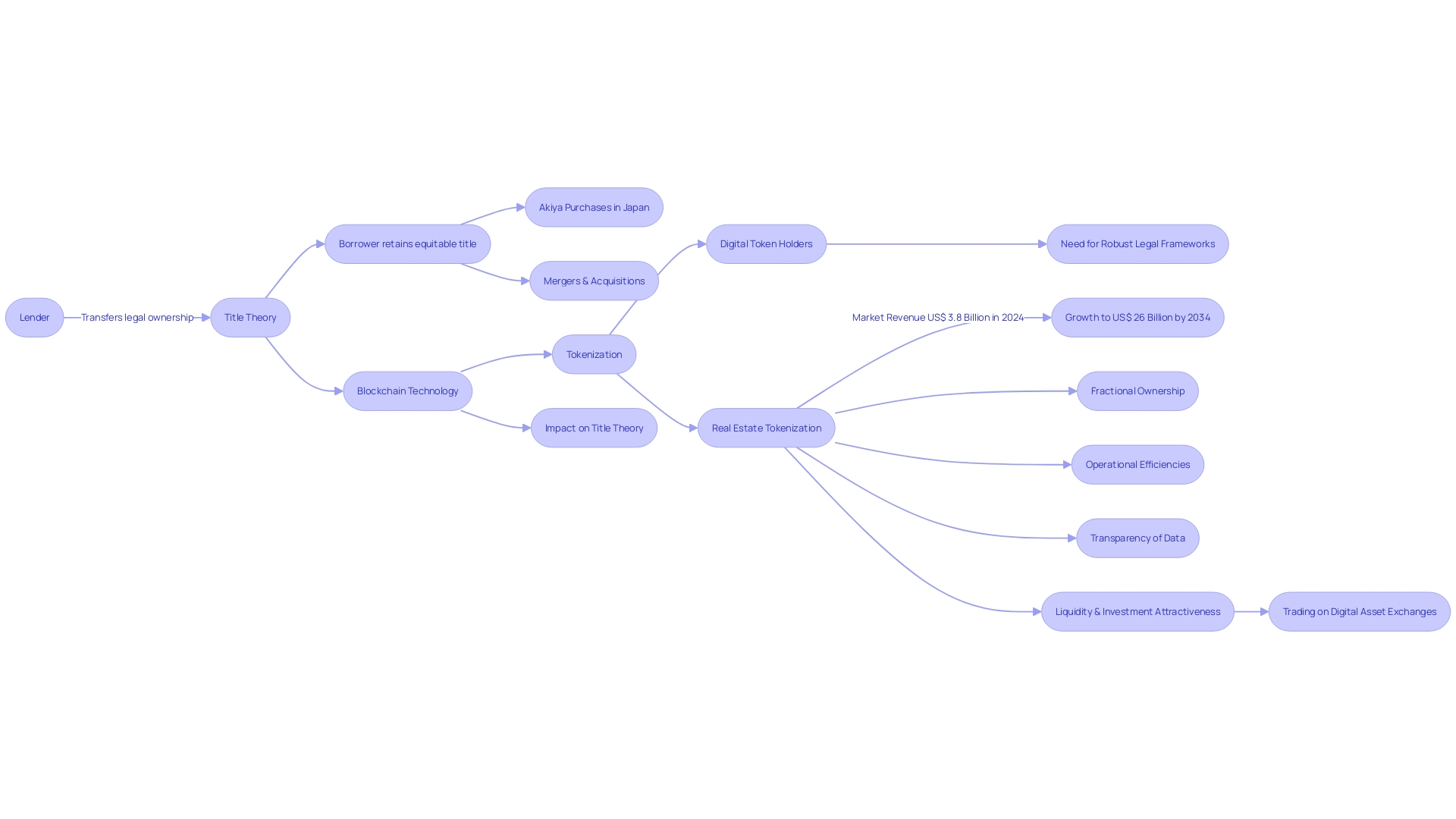

in real estate delineates the complex relationship between a lender and a borrower concerning . Within jurisdictions adhering to , upon mortgaging a property, . The borrower, while responsible for the mortgage, retains , granting them the ability to occupy and utilize the property. This legal framework stands in contrast to deed of trust systems, which are prevalent in other states. The nuances of title theory are not merely academic; they reflect in real-world applications and influence transactional dynamics, such as in the case of Akiya purchases in Japan, where the legal title is a critical component of the property's provenance and ownership certainty.

In the context of mergers and acquisitions, the concept of title and ownership takes on additional layers of complexity, as deal terms often involve nuanced negotiations over the fair market value, contingent payments, and earn-outs, all of which hinge on . 's emergence in real estate, specifically through tokenization, introduces a novel dimension to title theory, requiring rigorous legal frameworks to ensure the protection of digital token holders' property rights.

This evolving landscape is underscored by industry shifts and regulatory scrutiny, as seen with the National Association of Realtors navigating challenges and exploring the potential of blockchain to revolutionize property registration and transaction processes. Similarly, Israel's exploration of blockchain in the real estate sector signifies a global trend towards digitizing property rights, necessitating a re-examination of traditional title theories to adapt to a digital future. As the real estate industry continues to modernize, the principles of title theory remain central to understanding and navigating property ownership, with a growing need to reconcile these enduring concepts with the capabilities and risks introduced by emerging technologies.

Understanding Mortgage Theory in Real Estate

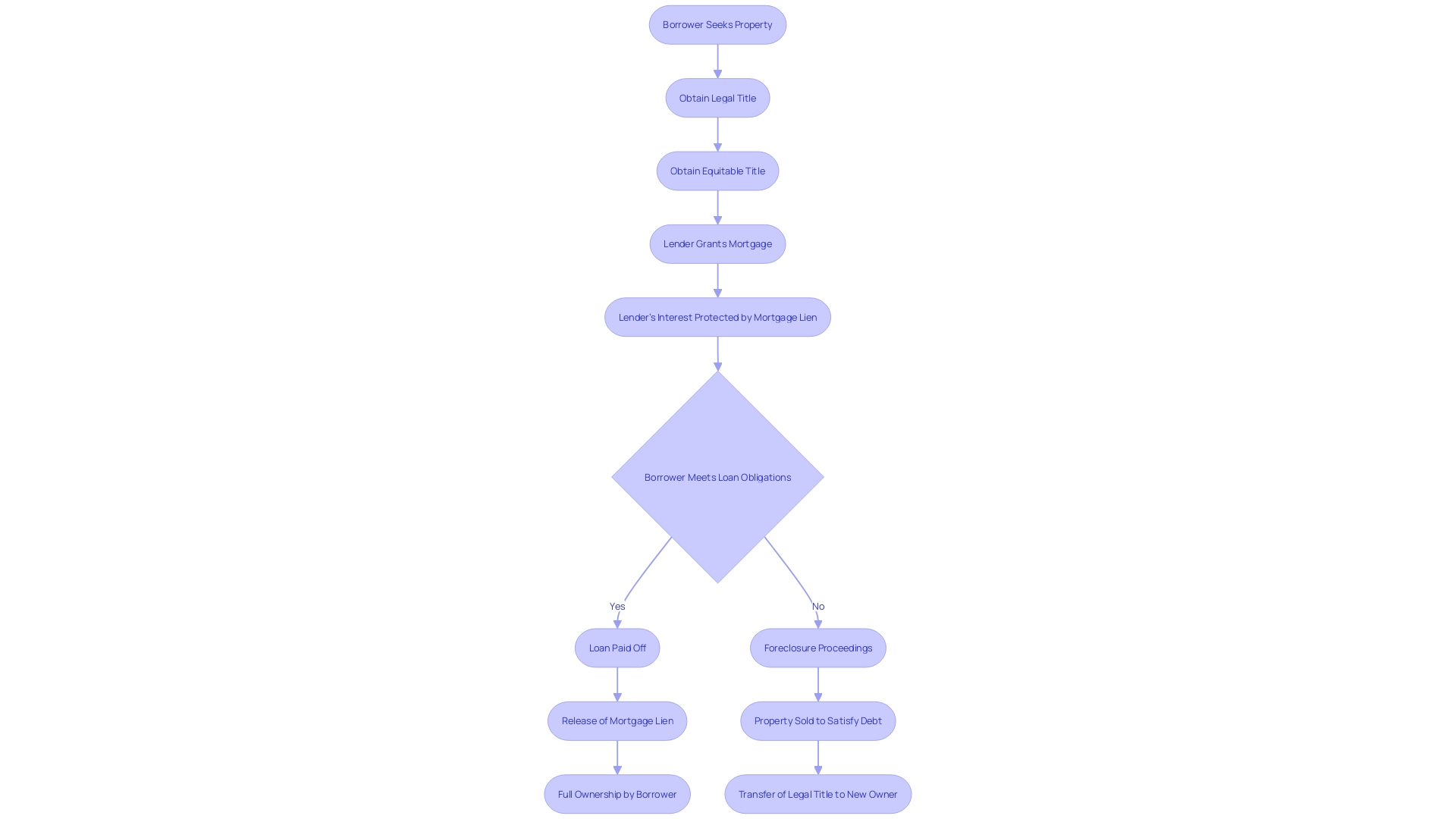

Mortgage theory, in contrast to title theory, offers a distinct framework for property ownership in real estate transactions. This concept places both legal and equitable title to the property squarely in the hands of the borrower, while the lender's interest is protected through a mortgage lien. This lien is not just a formality; it constitutes a powerful right to initiate foreclosure proceedings should the borrower fail to meet their loan obligations, effectively allowing the lender to reclaim the property. States that favor the deed of trust system often employ mortgage theory as their standard approach.

is vital in this context. A title is not a document but a term signifying legal ownership of property, while a property deed is the actual legal document that lists the owner. Holding a title means you legally own the property, and without it being in your name, or that of your entity, you do not possess legal ownership, regardless of any deeds.

The reality of the housing market, as it wavers between a buyer's and seller's market, further underlines the . With recent predictions of a 'mild recession' and the financial barriers preventing a significant percentage of non-homeowners from purchasing a home, understanding the becomes even more crucial. on housing as a means to generate debt is a reminder of the sophisticated dynamics at play in real estate transactions. This sophistication is reflected in how financial products are constructed and marketed, a strategy that has been evolving since initiatives like the National Partners in Homeownership in the 1990s.

The state of the housing market, influenced by economic conditions and consumer confidence, impacts lending activity significantly. Recent statistics show a downward trend in mortgage issuance, with a sharp decline from the previous year, underscoring the challenges many face in securing homeownership. For those in the real estate sector, especially those navigating the complexities of property titles and mortgage concepts, staying informed and understanding the underlying theories is not just beneficial—it's essential.

Comparative Analysis of Title Theory and Mortgage Theory

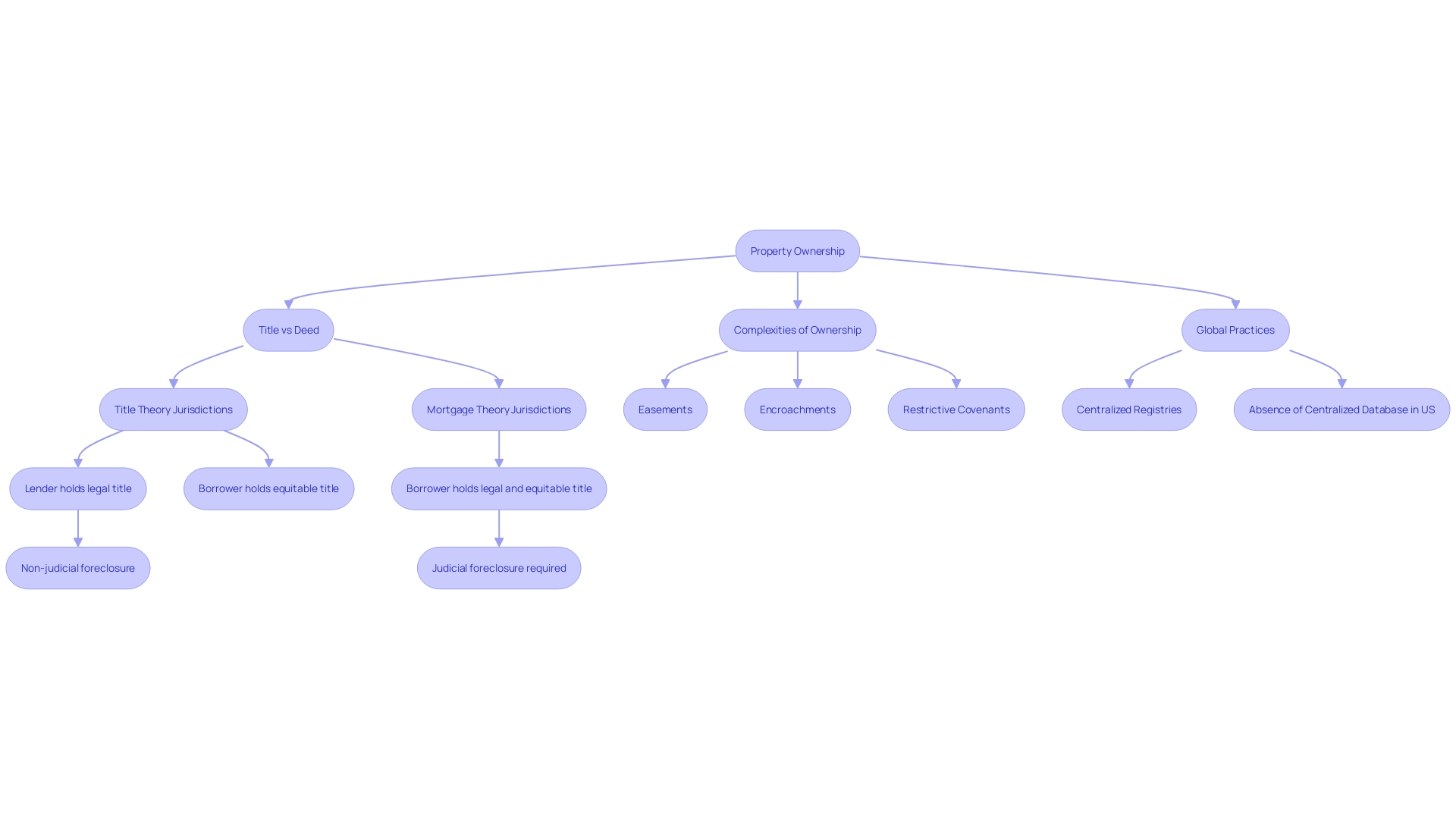

Understanding the intricacies of is crucial in real estate. Title theory states contrast with mortgage theory jurisdictions in how they delineate the control and rights associated with property under a loan agreement. In , the lender retains the , serving as a form of security for the loan, while the borrower maintains equitable title, reflecting their right to acquire full ownership upon satisfying the loan terms.

Conversely, in mortgage theory states, the borrower does not relinquish legal title; they hold both legal and equitable title from the outset, with the mortgage serving as a lien against the property. This distinction fundamentally affects the foreclosure process. Title theory allows lenders to foreclose on a property without court intervention, streamlining the procedure. Mortgage theory states, however, typically require judicial foreclosure, involving court proceedings and potentially elongating the process.

Furthermore, the United States presents a unique case where property ownership is not universally confirmed by a centralized government database. Instead, the concept of title in real property encompasses a collection of rights, agreements, and obligations that define one's claim to ownership. This complexity is evident in the nuances of easements, encroachments, and restrictive covenants that can affect title clarity. For instance, determining the rightful owner of a property may not always be as straightforward as consulting a single, definitive database.

In examining the broader landscape, global practices vary significantly. Some countries maintain centralized registries that can conclusively verify ownership, akin to checking a bank balance. For example, in Japan, ownership confirmation is a deterministic process yielding a document from the Legal Affairs Bureau, which is nearly irrefutable.

Amidst this backdrop, it's important to recognize that the term 'title' is distinct from a 'property deed'—the former being a concept of rightful ownership, while the latter is a tangible legal document. Holding a title signifies legal ownership, and without one's name or entity being on the title, legal ownership is not established. This principle underscores the vital role of and the necessity for accurate, complete records to navigate the complexities of real estate ownership and transaction.

Benefits and Drawbacks of Title Theory and Mortgage Theory

Title theory and represent two approaches to property ownership that carry distinct implications for lenders and borrowers within real estate transactions. In , the lender holds the legal title to a property until the borrower pays off the mortgage, offering lenders added security and streamlining foreclosure processes. Conversely, borrowers retain equitable title, which grants them rights to the property's use and profits, but not full control.

Mortgage theory, prevalent in other jurisdictions, affords the borrower legal ownership and thus greater command over the property. This ownership includes the bundle of rights associated with real estate, such as the right to use, lease, or sell the property. The lender, meanwhile, holds a lien against the property, which can lead to more complex and protracted foreclosure proceedings if the borrower defaults.

Understanding these theories is crucial for who must navigate the intricacies of property rights and the associated legalities. The distinction between a title and a property deed is especially pertinent; while the deed is a document that transfers ownership, the title signifies legal ownership. Without a proper title in one's name, legal ownership is not established.

Real estate encompasses not just the land and permanent fixtures but also the rights that come with the property. These rights are not just conceptual; they have tangible implications for ownership and control. In a dynamic market, staying abreast of these legal distinctions is indispensable for ensuring that the interests of all parties are protected and that transactions proceed smoothly.

Moreover, with technological advancements, such as the tokenization of real-world assets, the convergence of digital and traditional property rights is further complicating the landscape. Tokenization involves converting the rights of a property into , which requires careful consideration to ensure legal protection for token holders. Risks such as fraudulent actions by real estate owners must be mitigated through clear rules of engagement and corporate resolutions that uphold the rights of all stakeholders.

These evolving dynamics underscore the importance of a comprehensive understanding of title theory and mortgage theory, as well as the broader legal framework governing real estate. [Real estate professionals](https://blog.parseai.co/the-importance-of-a-title-ma-understanding-the-degrees-impact-in-real-estate) must be equipped with this knowledge to safeguard transactions, ensure compliance, and adapt to the changing intersection of digital and physical property rights.

Conclusion

In conclusion, understanding title theory and mortgage theory is crucial for real estate professionals navigating property ownership in real estate transactions.

Title theory grants legal ownership to the lender and equitable title to the borrower, while mortgage theory places both legal and equitable title in the hands of the borrower.

Comparing the two theories, title theory allows lenders to foreclose on a property without court intervention, while mortgage theory typically requires judicial foreclosure.

It is essential for professionals to be aware of the benefits and drawbacks of each theory. Title theory provides added security for lenders and streamlines foreclosure processes, while mortgage theory gives borrowers legal ownership and greater control over the property.

As the real estate industry evolves, professionals must also consider the impact of emerging technologies, such as tokenization, on property rights.

In summary, a comprehensive understanding of title theory and mortgage theory is necessary to navigate property ownership, protect the interests of all parties involved, and adapt to the changing landscape of real estate transactions.

Frequently Asked Questions

What is Title Theory in real estate?

Title Theory in real estate refers to a legal framework in certain jurisdictions where, upon mortgaging a property, legal ownership is vested in the lender. The borrower retains equitable title, which allows them to occupy and use the property but not full control.

How does Title Theory differ from Mortgage Theory?

In Title Theory, the lender holds the legal title to the property until the mortgage is paid off, while in Mortgage Theory, the borrower holds both legal and equitable title from the beginning, with the lender's interest protected by a lien.

What is a mortgage lien in the context of Mortgage Theory?

A mortgage lien is a legal claim on a property that allows the lender to initiate foreclosure proceedings if the borrower fails to meet their loan obligations.

Can lenders foreclose without court intervention in Title Theory states?

Yes, Title Theory allows lenders to foreclose on a property without court intervention, which can streamline the foreclosure process.

Do Mortgage Theory states require judicial foreclosure?

Typically, yes. Mortgage Theory states usually require judicial foreclosure, which involves court proceedings and can extend the time it takes to complete the process.

What is the role of a property deed?

A property deed is a legal document that transfers ownership of a property. It lists the owner and is different from a title, which is the concept signifying legal ownership.

What rights do borrowers have under Title Theory?

Borrowers retain equitable title, which grants them the right to use the property and benefit from it, but they do not have full control or the ability to make all decisions regarding the property.

What rights are included in the 'bundle of rights' in real estate ownership?

The 'bundle of rights' includes the right to use, lease, sell, or occupy the property, among other rights associated with real estate ownership.

How does blockchain technology impact Title Theory in real estate?

Blockchain technology, through practices like tokenization, introduces new dimensions to title theory by converting property rights into digital tokens. This requires rigorous legal frameworks to ensure the protection of digital token holders' property rights.

What are some global variations in title and property ownership?

Some countries have centralized registries that conclusively verify ownership, unlike the U.S. system where property ownership comprises a collection of rights, agreements, and obligations.

What are the benefits of Title Theory for lenders?

Title Theory offers lenders added security and a simplified foreclosure process, as they hold legal title to the property until the mortgage is paid in full.

How does Mortgage Theory impact borrowers?

Mortgage Theory gives borrowers greater control over the property since they retain legal ownership, but it also means that foreclosures can be more complex and time-consuming.

Why is understanding Title Theory and Mortgage Theory essential for real estate professionals?

Real estate professionals must navigate the intricacies of property rights and legalities, ensuring that transactions are smooth, compliant, and that the interests of all parties are protected. Understanding these theories is critical in this context.