Introduction

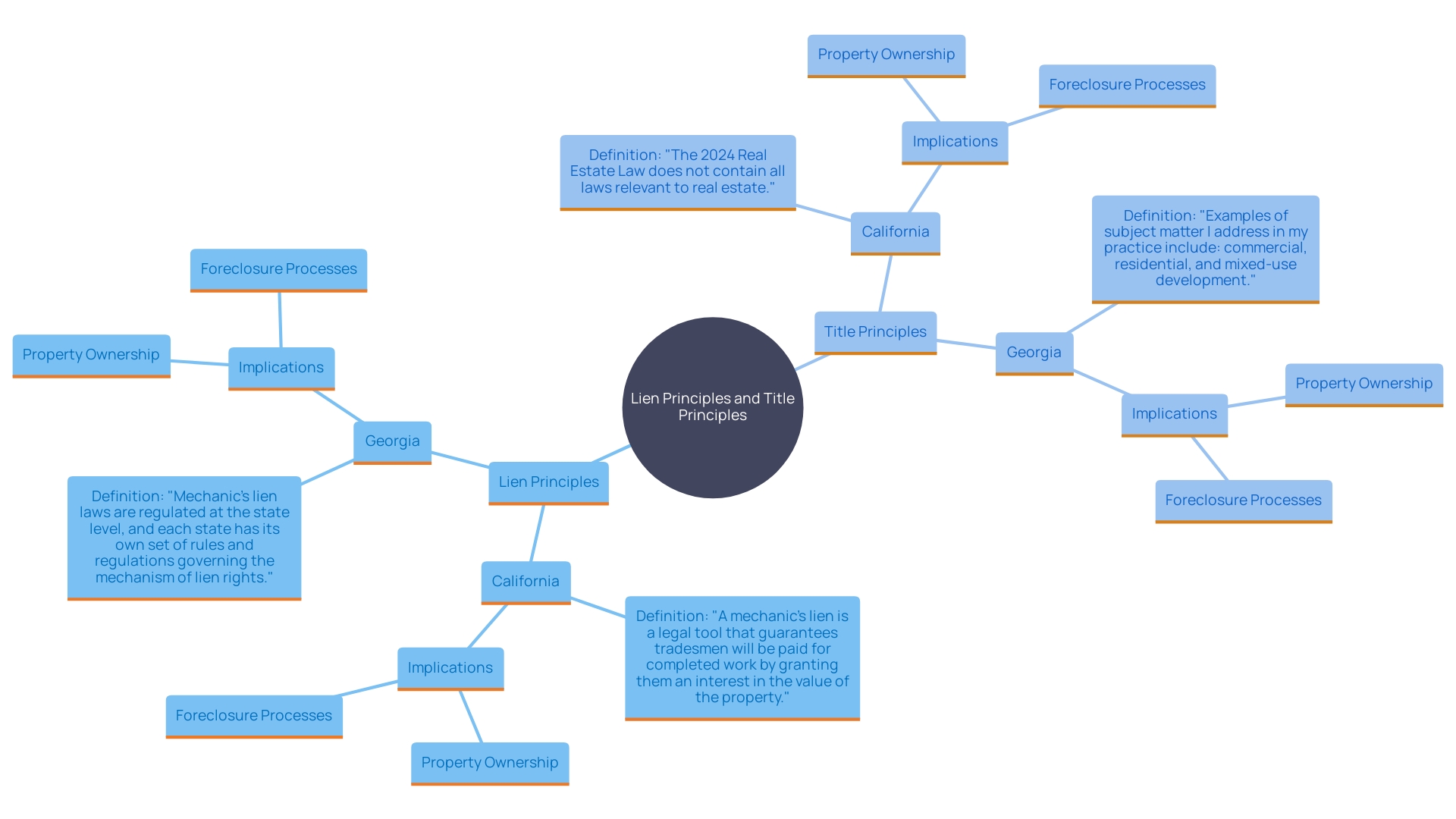

Navigating the complexities of mortgage law is essential for professionals in the real estate and title industries. Central to this understanding are the concepts of lien theory and title theory, two distinct legal frameworks that govern property ownership during a mortgage. These theories significantly affect foreclosure processes, borrower protections, and overall property rights.

This article delves into the fundamental principles of lien and title theory, explores their key characteristics, and offers a detailed comparison to highlight their implications. Furthermore, it examines foreclosure proceedings under each framework, provides a state-by-state breakdown, and discusses practical considerations for investors and homebuyers. By comprehensively understanding these theories, professionals can better manage property transactions and navigate the legal landscape effectively.

What is Lien Theory?

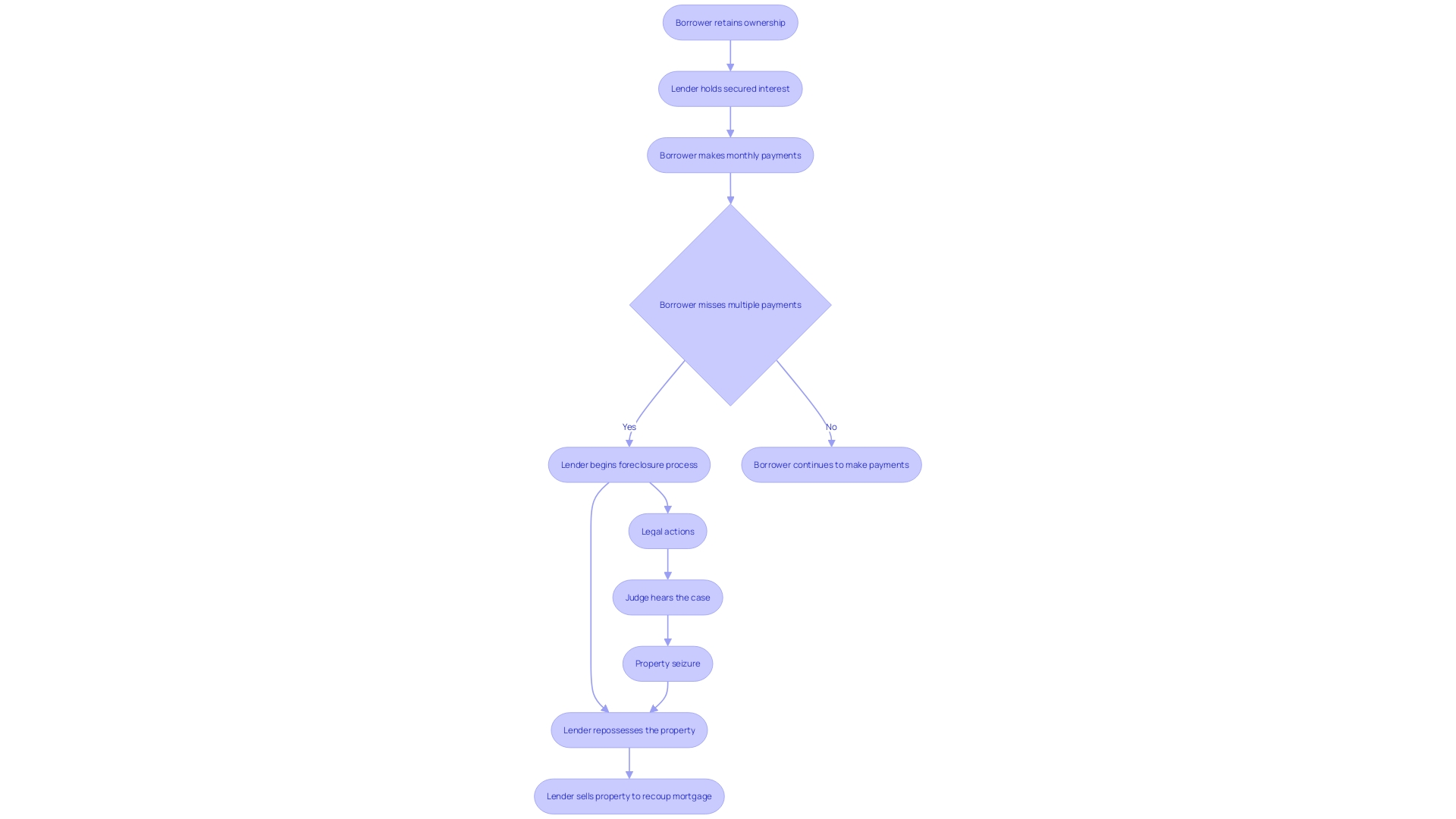

In , a on rather than a transfer of ownership to the creditor. This framework enables the receiving funds to maintain complete ownership of the property, while the entity providing the funds holds a . If the individual who took a loan fails to meet their obligations, the lender can initiate to reclaim the unpaid amount by selling the asset. Nevertheless, the individual who took the loan stays the rightful possessor until the property seizure is finalized. 'As stated by CoreLogic, which encompasses about 75% of U.S. default data, this process guarantees that the individual's rights are upheld during the legal proceedings.'.

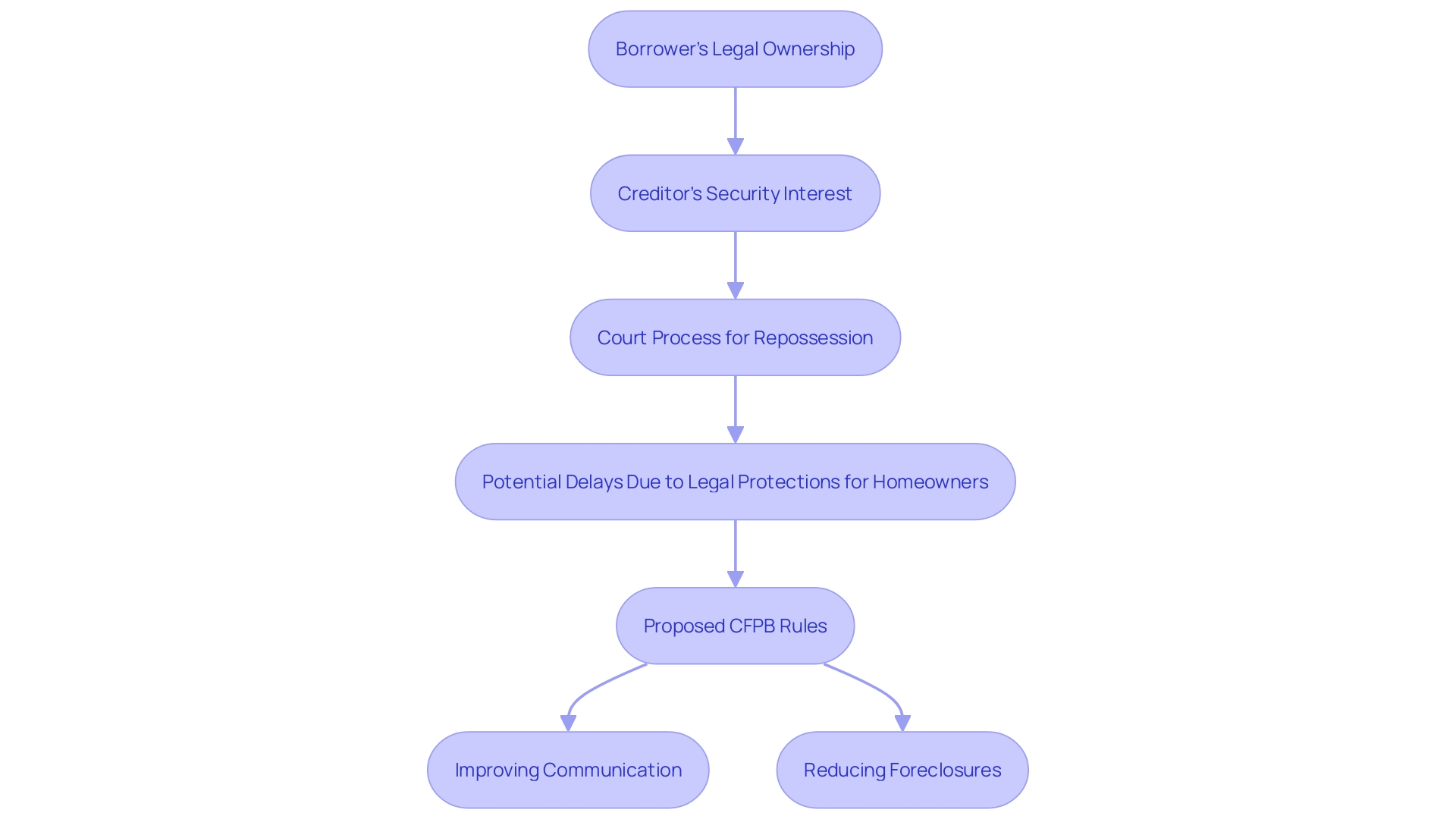

Key Characteristics of Lien Theory States

In lien theory states, the borrower maintains legal ownership of the property, while the mortgage acts as a security interest for the creditor. This legal structure requires a court process for repossession, which can greatly prolong the duration needed for financiers to regain their investments. According to CoreLogic, these delays can be particularly pronounced, with some property repossessions taking several months to years to complete. Additionally, these states often provide robust legal protections for homeowners, further complicating the ability of creditors to seize properties. The Consumer Financial Protection Bureau (CFPB) has also and flexibility between mortgage servicers and clients, aiming to reduce foreclosures and provide alternatives for struggling homeowners.

What is Title Theory?

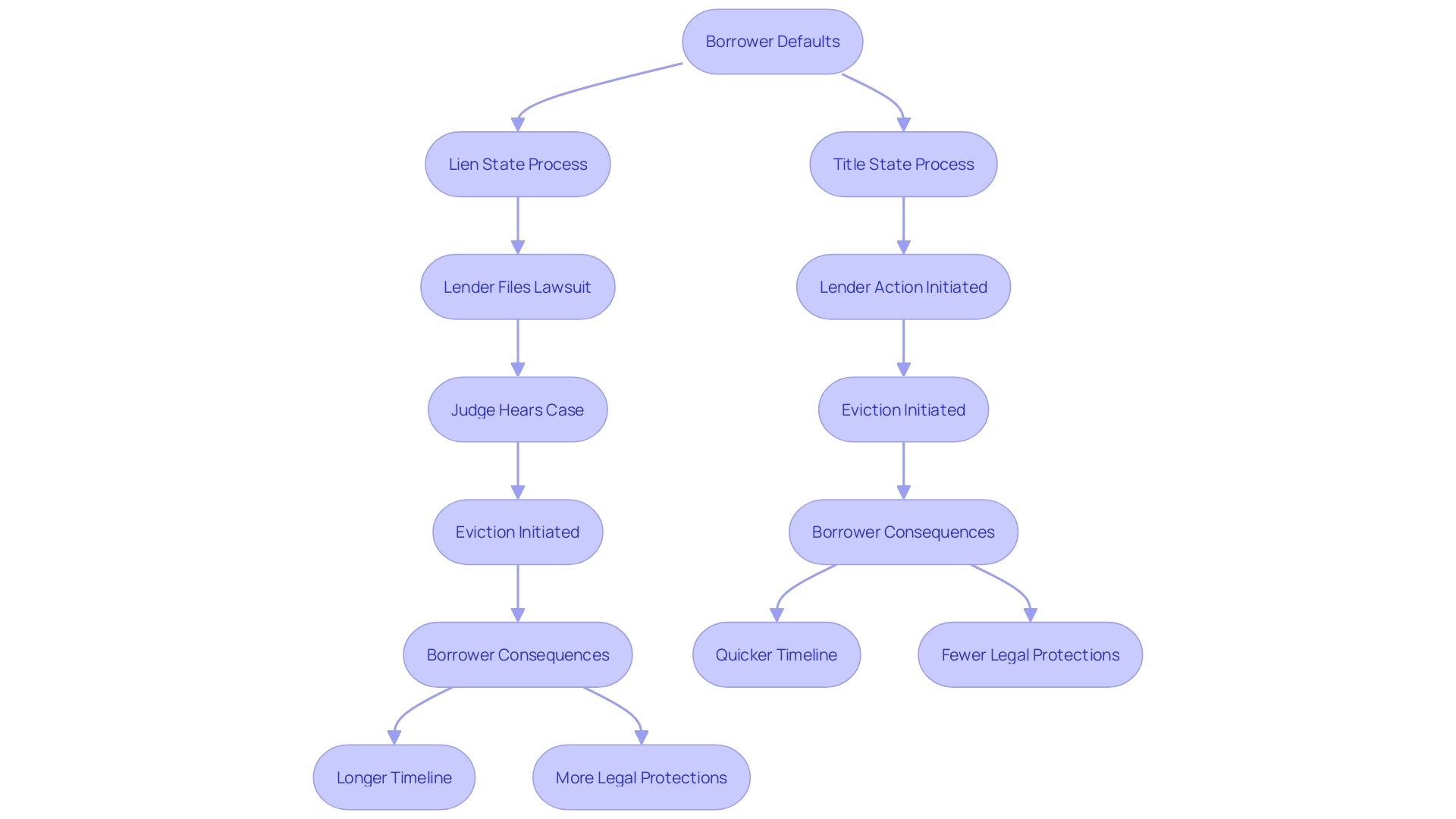

Under , the mortgage provider maintains to the property throughout the mortgage term. When an individual obtains a loan, they transfer the title to the while retaining . This setup enables the creditor to acquire the property if the , circumventing the frequently prolonged and unwieldy as the creditor already possesses the title.

Key Characteristics of Title Theory States

In , the borrower's ownership of the deed enables a quicker repossession process. This efficient method arises from the financial institution's power to take prompt measures following the client's default, leading to considerably compared to lien concepts. As a result, borrowers in title states face fewer , as the lender's title provides them with substantial control. For instance, in cases where buyers fall behind on payments under a contract for deed, sellers can initiate eviction almost immediately, often retaining all the money and efforts invested by the buyer. 'This lack of protection highlights the significance of comprehending the legal consequences and risks related to title states.'.

Comparison of Lien vs Title Theory

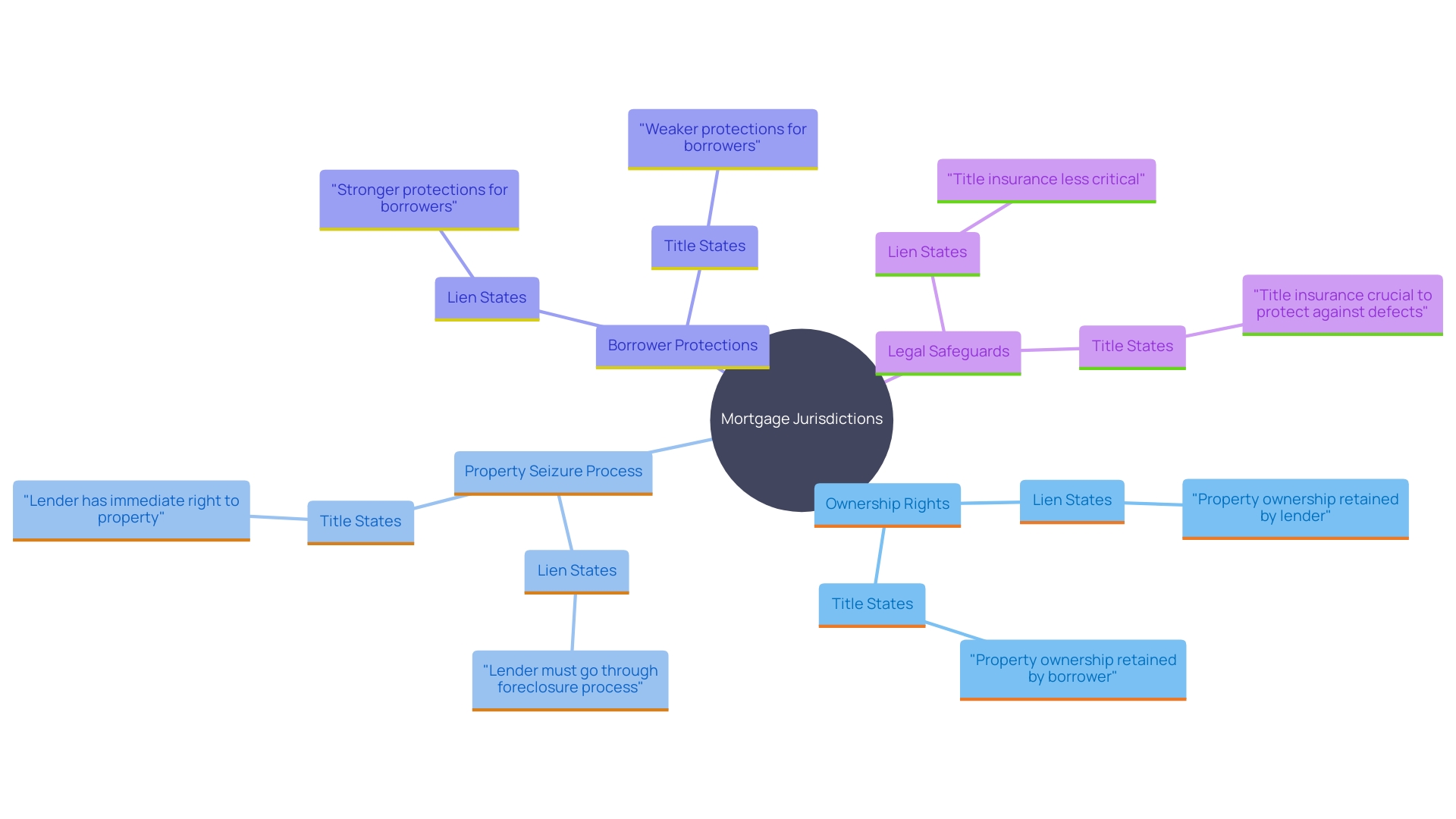

'The main distinction between lien and title concepts revolves around who possesses the ownership rights during the mortgage period.'. In , the individual obtaining the loan retains ownership of the property, while in , the lender possesses the title until the mortgage is completely settled. This distinction greatly affects the property seizure process, legal safeguards for loan recipients, and overall .

In lien theory jurisdictions, individuals who take loans are typically granted greater security against rapid property seizure actions. This is due to the fact that the individual obtaining the loan retains ownership, while the lender possesses only a claim (lien) on the property. Consequently, the property repossession process can be more prolonged, giving the borrower extra time to rectify the default or discuss alternatives. As per CoreLogic, encompass around 75% of U.S. repossession information, highlighting the significance and necessity of comprehending this legal structure.

On the other hand, in title states, the creditor has greater control over the property because they possess the title. This setup indicates that if the individual taking out a loan fails to repay, the institution can more effectively start and finalize the property seizure procedure. The creditor's increased authority can result in faster solutions in property seizure situations, but it also indicates that debtors have less security when contrasted with their peers in lien-based jurisdictions.

Understanding these differences is crucial for professionals in the real estate and title industries, as it influences the strategies and precautions necessary to navigate property transactions effectively. As mentioned by industry specialists, the subtleties of lien and title concepts can greatly influence financial results and legal processes associated with property ownership and default.

Foreclosure Proceedings: Lien Theory vs Title Theory

between lien and title states, considerably affecting the timeline and procedure for both creditors and debtors. In lien frameworks, the , enabling individuals to challenge the action, which can prolong the foreclosure schedule. This judicial process provides an additional level of security for those taking loans but can postpone resolution for those providing funds. On the other hand, without court involvement, expediting the process. This faster resolution benefits lenders by allowing them to reclaim properties more swiftly, but it also means borrowers have fewer opportunities to contest the property seizure. According to CoreLogic, which covers about 75% of U.S. foreclosure data, these contribute to the varying foreclosure rates and timelines observed across different states.

State-by-State Breakdown: Lien Theory, Title Theory, and Intermediary Theory

In the U.S., states follow either or regarding , with some adopting hybrid approaches. Comprehending these differences is crucial for real estate experts as they outline the rights and responsibilities of both parties involved in a loan. For instance, California functions mainly under lien principles, where the individual obtaining the loan maintains ownership of the property while the financial institution possesses a lien as collateral for the loan. This indicates that in the event of default, the creditor must undergo legal processes to assert ownership. On the other hand, Georgia adheres to title principles, where the lender retains the title until the mortgage is completely settled, streamlining the foreclosure process if the individual fails to meet payments. These variations significantly impact and legal proceedings, making it crucial for industry professionals to be well-versed in their state's specific regulations.

Practical Considerations for Real Estate Investors and Homebuyers

For real estate investors and homebuyers, is crucial for informed decision-making. In , investors may face more obstacles in recovering investments if debtors fail to meet obligations, often resulting in extended legal procedures. , on the other hand, might expedite property possession but carry the risk of borrower equity loss, which can affect the overall investment return. Understanding these distinctions can significantly shape investment strategies and purchasing choices, helping stakeholders more effectively.

Conclusion

The exploration of lien theory and title theory underscores the critical legal frameworks that govern property ownership in the context of mortgages. Lien theory allows borrowers to retain ownership while providing lenders with a secured interest, resulting in a more protracted foreclosure process that emphasizes borrower protections. In contrast, title theory grants lenders legal title, enabling quicker foreclosure proceedings but offering borrowers fewer safeguards.

The implications of these theories extend to foreclosure processes, which differ markedly between states. In lien theory states, judicial intervention adds layers of protection for borrowers, while title theory states allow lenders to act swiftly in reclaiming properties. This divergence is pivotal for understanding the risks and legalities involved in property transactions, as it shapes the strategies that real estate professionals must employ.

Ultimately, a comprehensive grasp of these theories is indispensable for anyone involved in the real estate and title industries. Awareness of the nuances between lien and title theory can inform decision-making, influence investment strategies, and enhance the management of property transactions. As the landscape of mortgage law continues to evolve, staying informed about these frameworks will remain essential for navigating the complexities of property ownership and foreclosure.

Frequently Asked Questions

What is lien theory in relation to mortgages?

In lien theory, a mortgage is considered a lien on the property, allowing the borrower to retain full ownership while the lender has a secured interest. If the borrower defaults, the lender can initiate legal actions to reclaim the unpaid amount by selling the property, but the borrower remains the rightful possessor until the seizure is finalized.

How does lien theory affect property ownership during a mortgage?

In lien theory states, the borrower maintains legal ownership of the property throughout the mortgage term. This legal structure provides the borrower with greater security against rapid property seizure actions.

What are the legal implications if a borrower fails to meet their mortgage obligations in lien theory states?

If a borrower defaults, the lender must go through a court process to repossess the property. This process can take several months or even years, providing the borrower additional time to rectify the default or explore alternatives.

What protections do homeowners have in lien theory states?

Homeowners in lien theory states generally benefit from robust legal protections, which can complicate the lender's ability to seize properties. These protections include the requirement of court involvement in foreclosure proceedings, allowing the borrower to challenge actions taken against them.

What is title theory in relation to mortgages?

Under title theory, the mortgage provider retains legal title to the property for the duration of the mortgage. The borrower retains equitable rights to use the property but does not possess the title. This means the lender can more efficiently reclaim the property if the borrower defaults.

How does title theory impact the repossession process?

In title theory states, the lender's possession of the title allows for a quicker repossession process. The lender can initiate foreclosure without court involvement, which can lead to significantly faster resolution times compared to lien theory states.

What are the main differences between lien and title theory?

The primary distinction is ownership rights during the mortgage period. In lien theory, the borrower holds ownership while the lender has a lien. In title theory, the lender holds the title, allowing for quicker repossession but providing less security for the borrower.

How do foreclosure processes differ between lien and title states?

Foreclosure in lien theory generally requires court involvement, allowing the borrower to contest the action, which can prolong the process. In title theory, creditors can foreclose without court involvement, leading to quicker outcomes but fewer opportunities for borrowers to contest.

Why is it important for real estate professionals to understand these concepts?

Understanding lien and title theories is crucial for real estate experts, as it influences the rights and responsibilities of both lenders and borrowers, affecting property transactions, foreclosure processes, and overall investment strategies.

How do these theories impact real estate investors and homebuyers?

Investors in lien theory states may face more challenges in recovering investments due to extended legal procedures, while title theory states can expedite property possession but carry risks of equity loss for borrowers. Understanding these factors can significantly shape investment strategies and purchasing decisions.