Overview

The significance of title accuracy in leasing is paramount, as it ensures that the lessor possesses the legal authority to rent the property. This not only protects both parties from potential legal conflicts but also mitigates financial losses. Furthermore, the necessity of verifying ownership and addressing challenges such as incomplete records and fraud cannot be overstated. These steps are crucial for maintaining the integrity of leasing agreements, thereby safeguarding transactions and fostering trust in real estate dealings.

Introduction

The integrity of property leasing hinges on a critical yet often overlooked element: title accuracy. Ensuring that ownership records are precise and free from encumbrances not only legitimizes rental agreements but also protects both lessors and lessees from potential legal disputes and financial pitfalls. Furthermore, navigating the complexities of title research can present significant challenges, raising the question: how can real estate professionals leverage technology to safeguard against inaccuracies that could jeopardize their transactions?

Define Title Accuracy and Its Relevance in Leasing

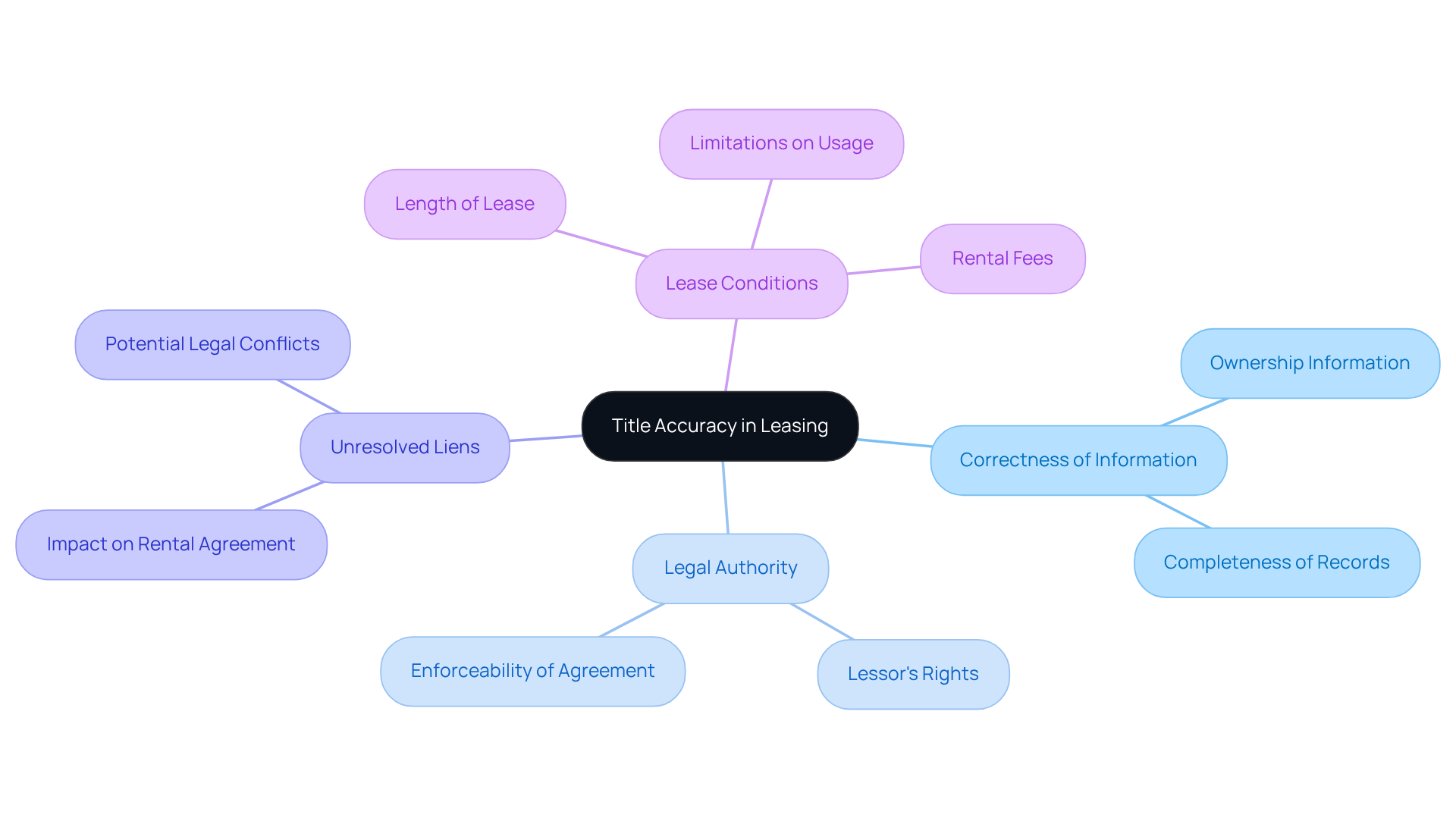

The importance of title accuracy in leasing relates to the correctness and completeness of the information concerning ownership and any existing encumbrances. In renting, the importance of title accuracy in leasing is essential, as it ensures that the lessor has the legal authority to rent the property. This involves confirming that there are no unresolved liens, claims, or disputes that could influence the rental agreement. A distinct heading highlights the importance of title accuracy in leasing, providing confidence to both the lessor and lessee that the agreement is valid and enforceable, thus avoiding possible legal conflicts in the future. Furthermore, precise ownership records assist in defining the conditions of the lease, including length, rental fees, and any limitations on usage.

Identify Challenges in Title Research and Verification

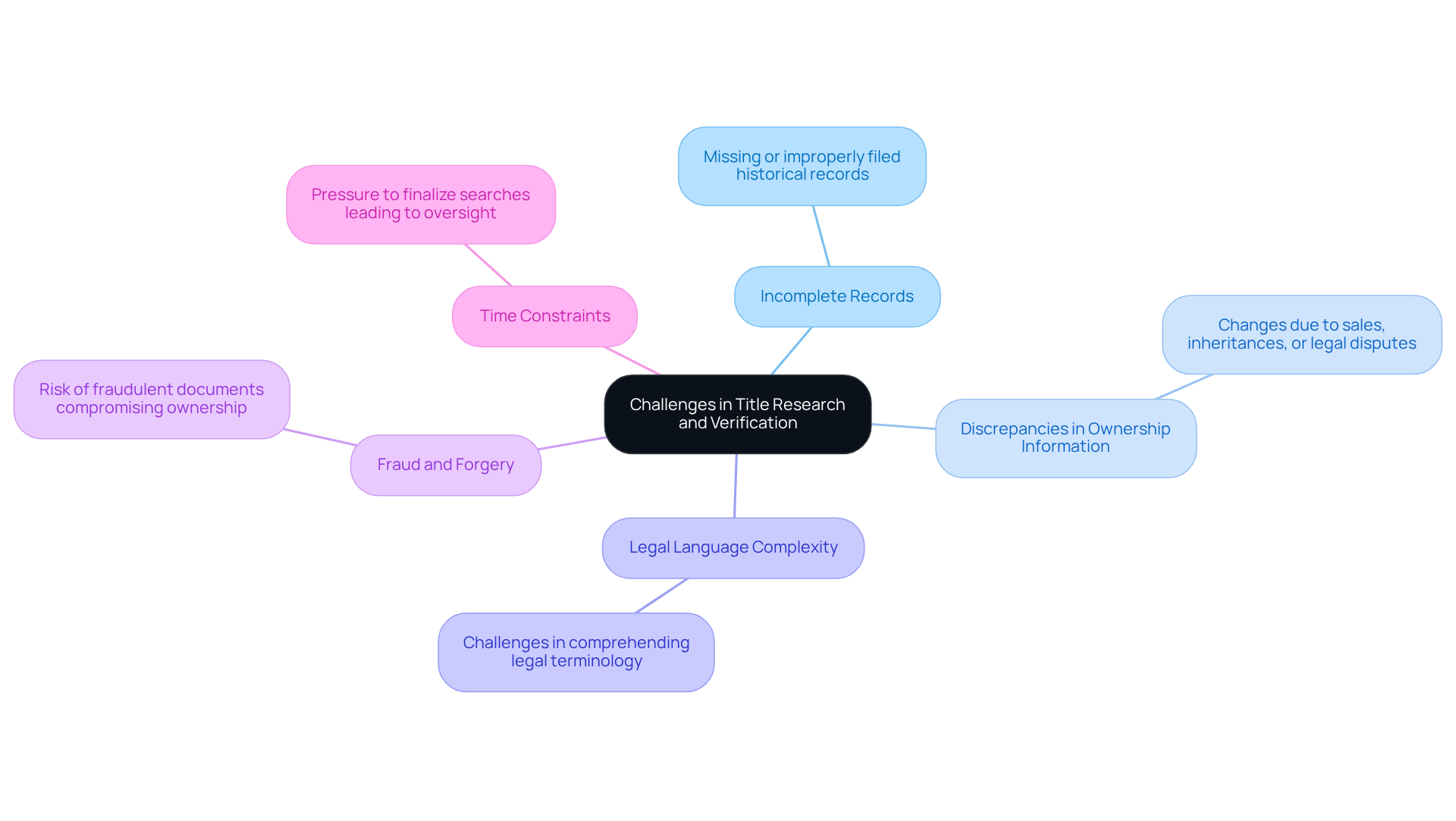

Several challenges can arise during title research and verification, each posing significant implications for property transactions:

- Incomplete Records: Many properties have historical records that may be missing or improperly filed, leading to gaps in ownership history.

- Discrepancies in Ownership Information: Changes in ownership can occur due to sales, inheritances, or legal disputes, which may not be accurately reflected in public records.

- Legal Language Complexity: Comprehending the legal terminology utilized in property documents can be challenging, resulting in misinterpretations that impact leasing agreements.

- Fraud and Forgery: The risk of fraudulent documents can compromise the integrity of ownership information, necessitating thorough verification processes.

- Time Constraints: The pressure to finalize property searches swiftly can result in oversight and mistakes, affecting the precision of leasing agreements.

Addressing these challenges is crucial for highlighting the importance of title accuracy in leasing, ultimately safeguarding property transactions.

Implement Strategies for Ensuring Title Accuracy Using Technology

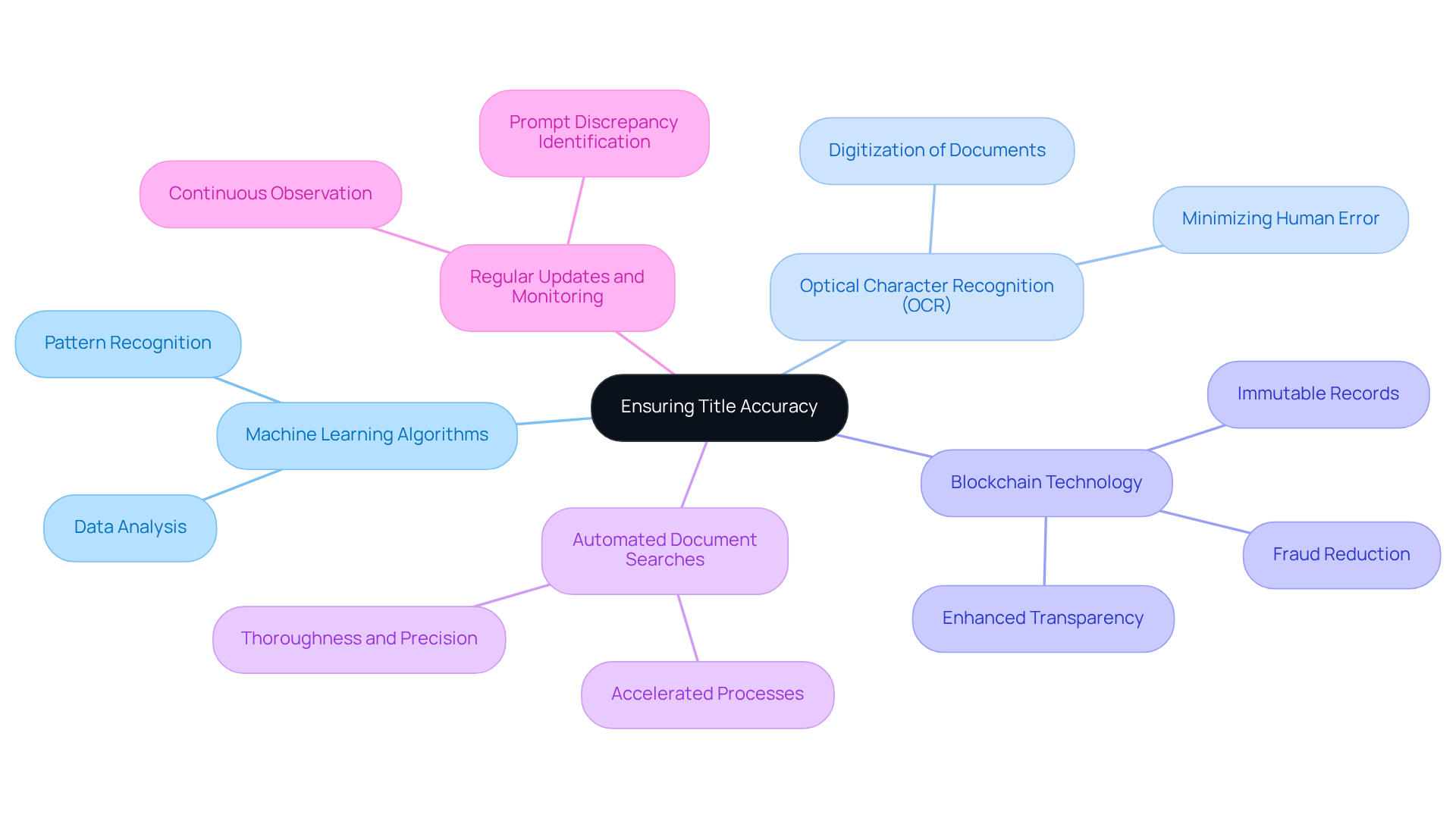

To ensure title accuracy, real estate professionals can adopt several technology-driven strategies that reinforce the reliability of their solutions:

- Machine Learning Algorithms: Employ machine learning to examine extensive datasets of document titles, recognizing patterns and inconsistencies that may not be readily visible.

- Optical Character Recognition (OCR): Utilize OCR technology to digitize and extract information from physical document titles, thereby minimizing the risk of human error during data entry.

- Blockchain Technology: Explore blockchain solutions for maintaining an immutable record of property ownership, which can significantly enhance transparency and reduce fraud.

- Automated Document Searches: Implement automated systems to perform document searches, greatly accelerating the process while ensuring thoroughness and precision.

- Regular Updates and Monitoring: Establish systems for continuous observation of record files to promptly identify and rectify any changes or discrepancies.

These strategies not only highlight the importance of title accuracy in leasing but also provide a pathway toward greater efficiency and trust in real estate transactions.

Analyze the Consequences of Title Inaccuracies in Leasing

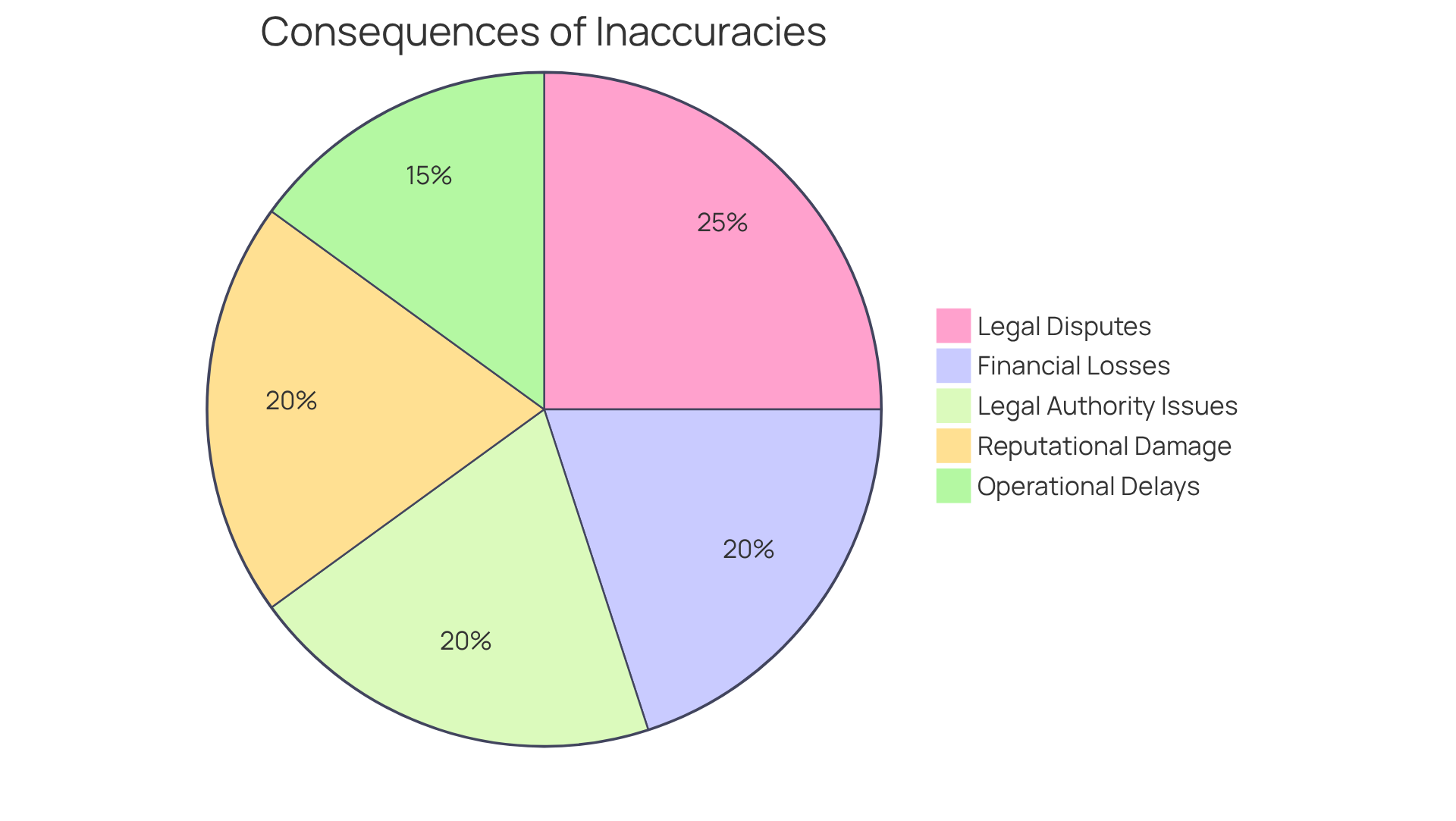

Inaccuracies in title information can lead to severe consequences in leasing, including:

- Legal Disputes: Discrepancies in ownership can result in legal battles over asset rights, potentially leading to costly litigation.

- Financial Losses: Lessees may encounter unforeseen expenses if they uncover liens or encumbrances after signing a rental agreement, which could impact their financial stability.

- The importance of title accuracy in leasing is highlighted by the fact that if a lessor lacks the legal authority to lease the asset due to ownership issues, the lease may be considered invalid, leaving the lessee without options.

- Reputational Damage: Real estate professionals may suffer reputational harm if they are associated with properties that have unresolved title issues, impacting future business opportunities.

- Operational delays can occur due to title inaccuracies, which affect timelines and potentially lead to lost revenue for both parties involved, underscoring the importance of title accuracy in leasing.

Conclusion

Ensuring title accuracy in leasing is fundamental to establishing trust and legality in property transactions. Accurate title information not only validates the lessor's authority to lease a property but also protects both parties from potential legal conflicts and financial losses. By emphasizing the significance of precise ownership records, the integrity of leasing agreements is upheld, fostering a secure environment for all involved.

Throughout the discussion, various challenges in title research and verification were identified, including:

- Incomplete records

- Discrepancies in ownership information

- Complexities of legal language

Furthermore, the article highlighted the risks of fraud and the urgency of thorough verification processes. To combat these issues, technology-driven strategies such as:

- Machine learning

- OCR

- Blockchain solutions

were proposed, showcasing how innovation can enhance accuracy and efficiency in real estate transactions.

In light of the potential consequences stemming from title inaccuracies—ranging from legal disputes to financial setbacks—the importance of meticulous title verification cannot be overstated. Real estate professionals and stakeholders are encouraged to adopt these strategies and remain vigilant in their title research practices. By prioritizing title accuracy, the integrity of leasing agreements can be safeguarded, ultimately contributing to a more reliable and transparent real estate landscape.

Frequently Asked Questions

What is title accuracy in leasing?

Title accuracy in leasing refers to the correctness and completeness of information regarding property ownership and any existing encumbrances.

Why is title accuracy important in leasing?

Title accuracy is crucial because it ensures that the lessor has the legal authority to rent the property and confirms that there are no unresolved liens, claims, or disputes that could affect the rental agreement.

How does title accuracy benefit both lessor and lessee?

It provides confidence to both parties that the agreement is valid and enforceable, helping to avoid potential legal conflicts in the future.

What role do ownership records play in leasing?

Precise ownership records help define the conditions of the lease, including the length, rental fees, and any limitations on usage.