Overview

The article emphasizes the critical distinctions between assessor and recorder data in real estate, underscoring their unique roles and the paramount importance of precise information for property transactions.

- Assessors are tasked with evaluating property values and determining tax obligations.

- Recorders are responsible for maintaining official ownership records.

Both functions are vital for facilitating efficient real estate transactions and conducting accurate title research. Inaccuracies in these areas can result in disputes and significant financial losses, making it imperative for stakeholders to understand and rely on the accuracy of this information.

Introduction

Understanding the nuances between assessor and recorder data is crucial for anyone navigating the complex landscape of real estate. These two types of information not only influence property valuations but also play a pivotal role in ensuring accurate ownership records and tax assessments.

As real estate professionals delve into the intricacies of these data sets, they may find themselves questioning: how do discrepancies in these records impact transactions and ownership rights? This exploration reveals the critical functions of assessors and recorders, as well as the potential pitfalls of relying on flawed information in the ever-evolving real estate market.

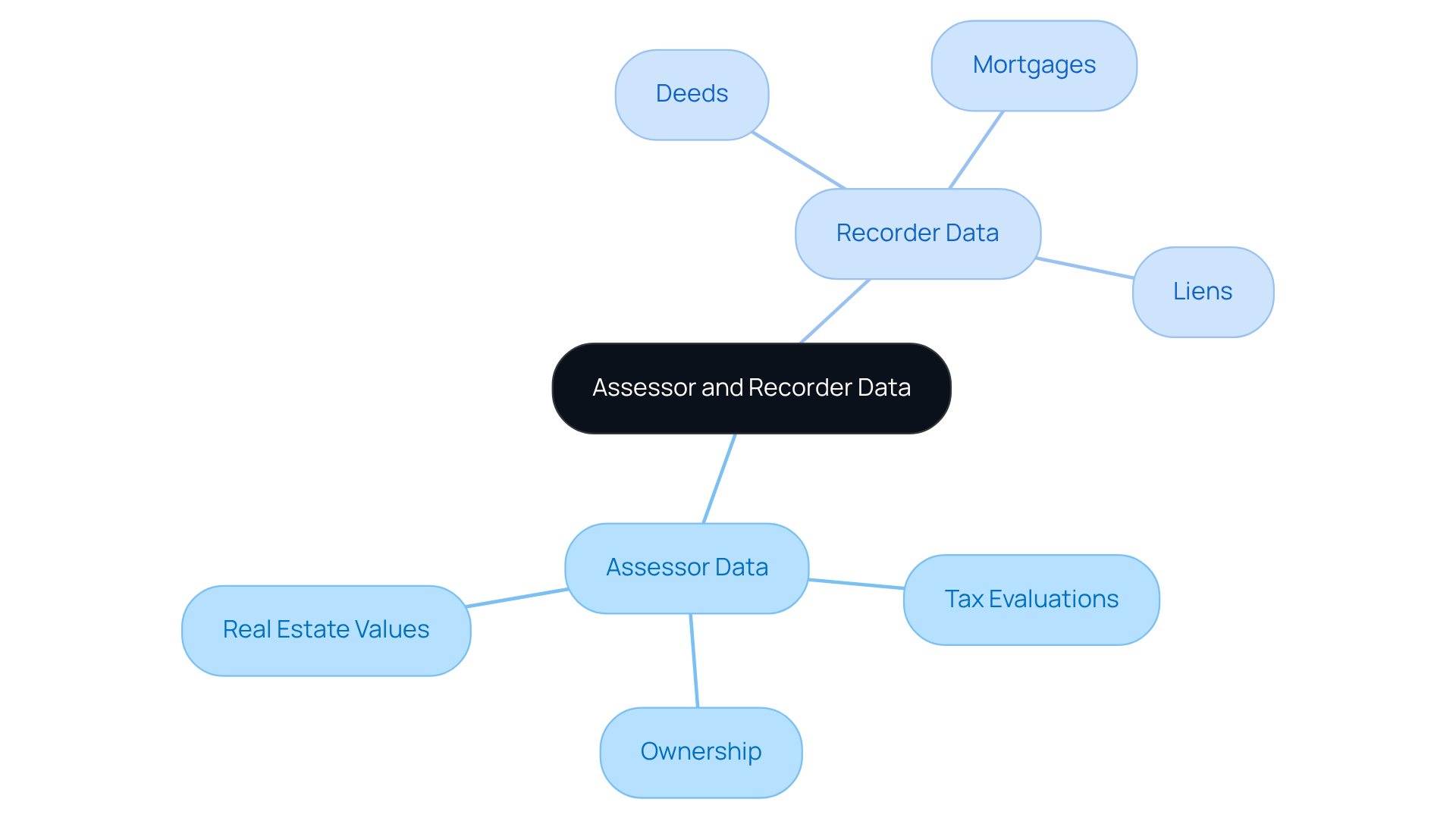

Define Assessor and Recorder Data

Information collected by local government evaluators pertains to real estate values, ownership, and tax evaluations. This information is crucial for establishing the fair market worth of assets, directly impacting tax obligations. Inconsistencies in evaluator information can significantly influence real estate, leading to potential errors in appraisal and taxation.

Furthermore, recorder information comprises official records maintained by county recorders, covering documents related to real estate such as deeds, mortgages, and liens. This information is essential for confirming asset possession and ensuring precise evaluations.

As highlighted by industry specialists, the integrity of recorder information plays a crucial role in real estate transactions, providing the foundational documentation necessary for establishing ownership and facilitating transfers.

Comprehending the difference between assessor and recorder data is essential for real estate experts, as both types of information are vital to efficient asset valuation and transaction procedures.

Explore the Roles of Assessors and Recorders

Assessors hold a critical responsibility in determining the value of real estate within their jurisdiction. This task involves the meticulous collection of data on various characteristics, conducting thorough assessments, and ensuring that taxes are levied fairly. Their role is pivotal in maintaining accurate records that reflect current market conditions. For instance, evaluators scrutinize recent sales and prevailing real estate conditions to establish fair market values, which directly influence the taxes owed by property owners. Conversely, recorders are tasked with the preservation of public records related to real estate, which includes the documentation of deeds, mortgages, and other legal documents that affirm ownership and encumbrances. Both roles are indispensable in guaranteeing that asset records remain accurate and current, a necessity for effective title research and real estate transactions.

Effective cooperation between evaluators and record keepers significantly enhances the efficiency of real estate transactions. When assessors and recorders collaborate, they streamline the process of updating land records, ensuring that changes in ownership or characteristics are promptly reflected. This partnership not only bolsters the accuracy of asset evaluations but also facilitates smoother transactions for both purchasers and vendors.

Recent advancements in real estate record management have further improved the efficiency of these roles. Recorders are increasingly adopting advanced technologies, such as electronic recording systems, enabling faster and more secure handling of documents. This modernization minimizes delays in real estate transactions and enhances the overall reliability of real estate records.

Understanding the difference between assessor and recorder data is essential for real estate professionals, as it directly impacts transaction efficiency and valuation accuracy. With approximately 6,900 job openings projected annually for real estate appraisers and evaluators, alongside a median annual salary of $65,420 as of May 2024, the economic significance of these roles is undeniable. Furthermore, evaluators utilize Computer Assisted Mass Appraisal (CAMA) methods to enhance the efficiency of asset value estimations, underscoring their critical role in the real estate market.

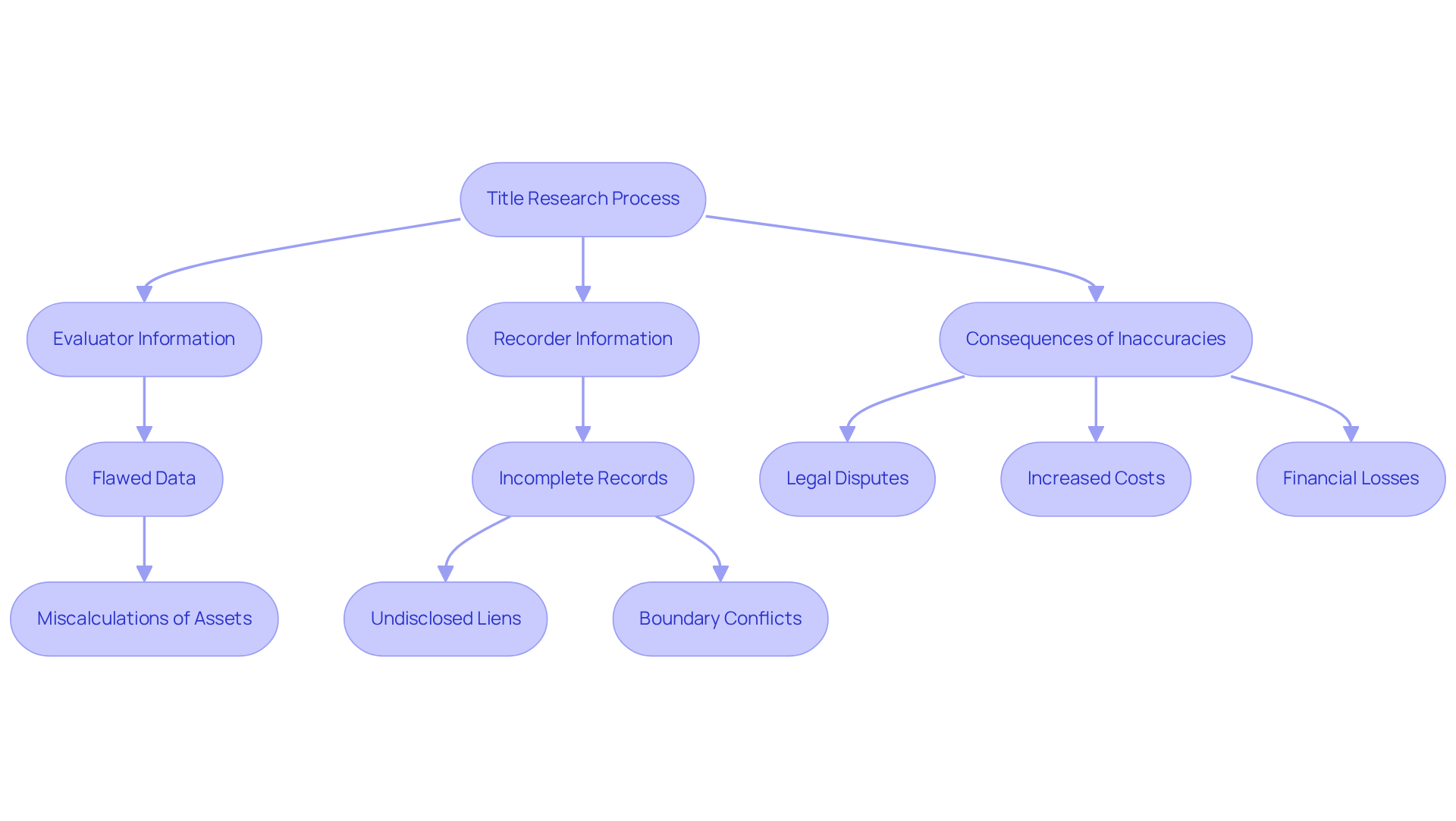

Analyze the Impact on Title Research

The accuracy and completeness of evaluator and recorder information are paramount to the title research process. Flawed evaluator information can lead to miscalculations of assets, adversely affecting tax evaluations and potentially igniting disputes. For instance, a study revealed that 6.25% of transactions contained inflated HUD1 information, with the most significant inflated error reaching 21.44% of the HUD-reported price. This statistic underscores the prevalence of inaccuracies that can complicate the verification of property rights.

Furthermore, incomplete or incorrect recorder information can create unresolved issues regarding asset possession, such as undisclosed liens or boundary conflicts. These discrepancies not only prolong legal disputes but also escalate costs, as errors in public records frequently result in delays, legal complications, and financial losses for all parties involved.

Legal experts emphasize that inaccuracies in real estate deeds can lead to disputes over possession, complicating transactions further. Consequently, it is imperative for real estate professionals to access reliable and comprehensive data to discern the difference between assessor and recorder data. This diligence is crucial to facilitate seamless property transactions and mitigate risks associated with title issues, ultimately safeguarding investments and ensuring clear ownership.

Conclusion

Understanding the distinctions between assessor and recorder data is crucial for anyone involved in real estate. These two types of information serve different yet complementary purposes, impacting property valuation and ownership verification. Recognizing their roles allows real estate professionals to navigate transactions more effectively and mitigate potential risks associated with inaccuracies.

Key insights discussed include:

- The responsibilities of assessors in determining property values

- The role of recorders in maintaining public documentation

The collaboration between these two entities enhances the accuracy of asset evaluations and streamlines transactions, ultimately benefiting buyers and sellers alike. Furthermore, modern advancements in technology are improving the efficiency and reliability of both roles, reflecting the ongoing evolution of real estate practices.

In conclusion, the importance of accurate assessor and recorder data cannot be overstated. Real estate professionals must prioritize access to reliable information to ensure successful transactions and safeguard investments. By understanding the implications of both data types, stakeholders can better navigate the complexities of real estate, promoting transparency and efficiency in the market.

Frequently Asked Questions

What is assessor data?

Assessor data is information collected by local government evaluators regarding real estate values, ownership, and tax evaluations. It is crucial for establishing the fair market worth of assets and directly impacts tax obligations.

Why is assessor data important?

Assessor data is important because inconsistencies in this information can significantly influence real estate, leading to potential errors in appraisal and taxation.

What does recorder data consist of?

Recorder data consists of official records maintained by county recorders, which include documents related to real estate such as deeds, mortgages, and liens.

How does recorder data affect real estate transactions?

Recorder data is essential for confirming asset possession and ensuring precise evaluations, as it provides the foundational documentation necessary for establishing ownership and facilitating transfers.

Why is it important to understand the difference between assessor and recorder data?

Understanding the difference between assessor and recorder data is essential for real estate experts, as both types of information are vital for efficient asset valuation and transaction procedures.