Overview

The article focuses on the significance of understanding the chain of title in real estate for both buyers and agents, emphasizing its role in confirming ownership and preventing disputes. It highlights that a clear chain of title is essential for securing ownership insurance and mitigating risks associated with liens, discrepancies, and other challenges, thereby streamlining property transactions.

Introduction

In the intricate world of real estate, the chain of title serves as a foundational element, tracing the lineage of property ownership through documented transfers. This vital record not only establishes the legitimacy of ownership but also reveals potential claims or encumbrances that could affect a transaction.

With the complexities of property law and the rise of cybersecurity threats, understanding and verifying the chain of title has never been more critical. Real estate professionals must navigate a landscape where clarity and diligence are paramount, ensuring that buyers are protected from unforeseen disputes and legal complications.

This article delves into the significance of a clear chain of title, the common challenges encountered, and the essential role title companies play in safeguarding property transactions. By equipping industry stakeholders with the knowledge to effectively manage title issues, the path to successful real estate dealings becomes significantly clearer.

Defining the Chain of Title in Real Estate

The chain of title real estate is the documented history of ownership, detailing the sequential transfers of title from one owner to the next. This record is essential in dealings, as it not only confirms the validity of ownership but also reveals any existing claims or burdens on the asset. Each link in this chain comprises vital documents such as deeds, wills, and court records, which collectively create a transparent pathway of ownership.

It is crucial for real estate professionals to meticulously verify the chain of title real estate during property transactions to prevent potential disputes. As R. Seth Hampton, an associate with Quattlebaum, Grooms & Tull PLLC, emphasizes, understanding these documents is fundamental in navigating the complexities of ownership. Moreover, with the increase of cybersecurity threats, including email impersonation scams—where fraudsters create seemingly legitimate email addresses to trick targets—maintaining a clear and secure chain of title real estate is more crucial than ever.

Ensuring proactive communication about potential issues can mitigate risks and streamline the process, ultimately benefiting all parties involved. Notably, the blog post discussing these topics has garnered significant interest, evidenced by its 189 Likes, indicating that the importance of chain of ownership resonates widely. Furthermore, the case study titled 'Best Practices for Property Professionals' illustrates how proactive communication regarding potential red flags can prevent delays, leading to smoother property transactions for clients.

The Importance of a Clear Chain of Title for Buyers and Agents

For purchasers and real estate representatives, ensuring a clear chain of ownership is essential. It not only confirms the rightful ownership of the asset but also acts as a safeguard against possible disputes or claims from third parties. A clear chain of ownership is essential for acquiring ownership insurance, which serves as a protection for the buyer's investment.

In fact, a clear and marketable designation indicates that the property is free from legal claims that could encumber the buyer's ownership. On the other hand, ambiguous headings can lead to expensive legal disputes and substantial delays in the process. Therefore, it is imperative to conduct a thorough assessment of the chain of ownership prior to finalizing any purchase, thereby mitigating the risk of future complications.

As stated by industry leaders, selecting a trustworthy firm, such as Turner Title, guarantees a redefined standard of efficiency and clarity in every deal. Furthermore, real estate experts play a significant role in informing clients about the importance of a clear chain of ownership and should actively encourage clients to obtain owner’s insurance. This proactive method is illustrated in the case study 'Identifying Issues Early,' which emphasizes how tackling possible concerns before completing a transaction can spare both parties from future legal complications.

How to Research and Verify the Chain of Title

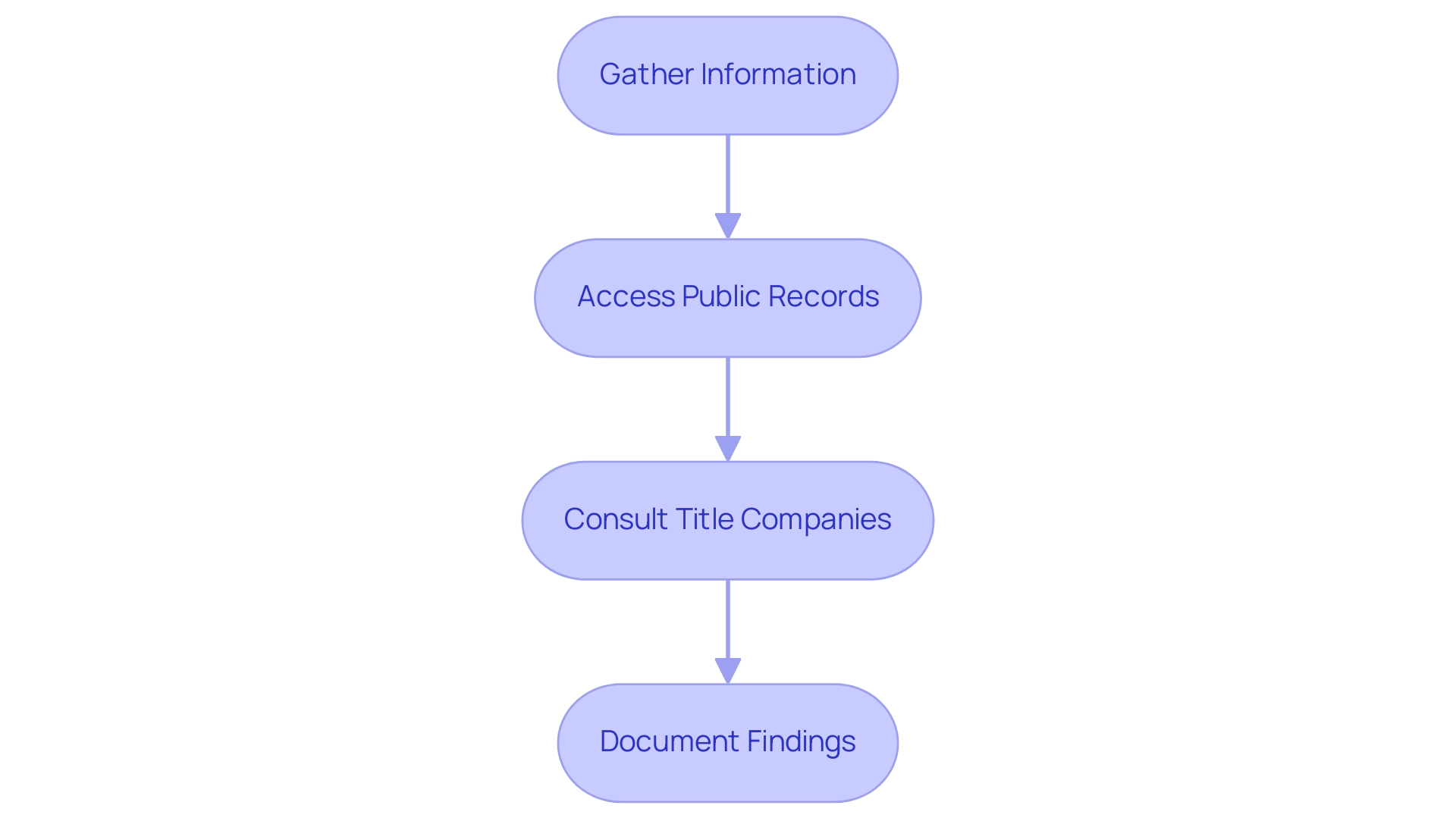

To effectively research and verify the chain of ownership, adhere to the following structured steps:

- Gather Information: Begin with the address and the name of the current owner to establish a foundation for your search.

- Access Public Records: Navigate to the local county recorder's office, whether in-person or through their online portal, to retrieve essential real estate documents, including deeds and ownership papers. Be aware that unrecorded easements can lead to potential ownership issues if rights of way are not properly documented, making it crucial to ensure all easements are recorded during your research.

- Examine the Documents: Scrutinize each document within the chain for accuracy, completeness, and any recorded liens. Pay close attention to the dates of transfer, as discrepancies can complicate ownership verification. For example, the case study named 'Identifying Previous Owners' emphasizes that the ownership chain may not correctly identify prior owners because of erroneous or outdated real estate transactions, highlighting the significance of careful analysis.

- Consult Title Companies: Should you encounter complexities, do not hesitate to reach out to title companies. Their expertise can be invaluable in conducting thorough searches, particularly for assets with a complicated history. As Jovana Stankovic emphasizes,

We are here to help you understand the whole concept behind these terms and see how it impacts real estate owners.

Title companies play a critical role in ensuring that real estate transfers are legal and that buyers do not inherit unwanted debts. - Document Findings: Maintain a meticulous record of your findings. This documentation will prove essential for future reference and can assist in resolving any issues that may arise during the process. Implementing efficient verification procedures is essential in guaranteeing the legality of asset transfers and protecting against undesired debts assumed by purchasers.

Common Issues and Challenges in the Chain of Title

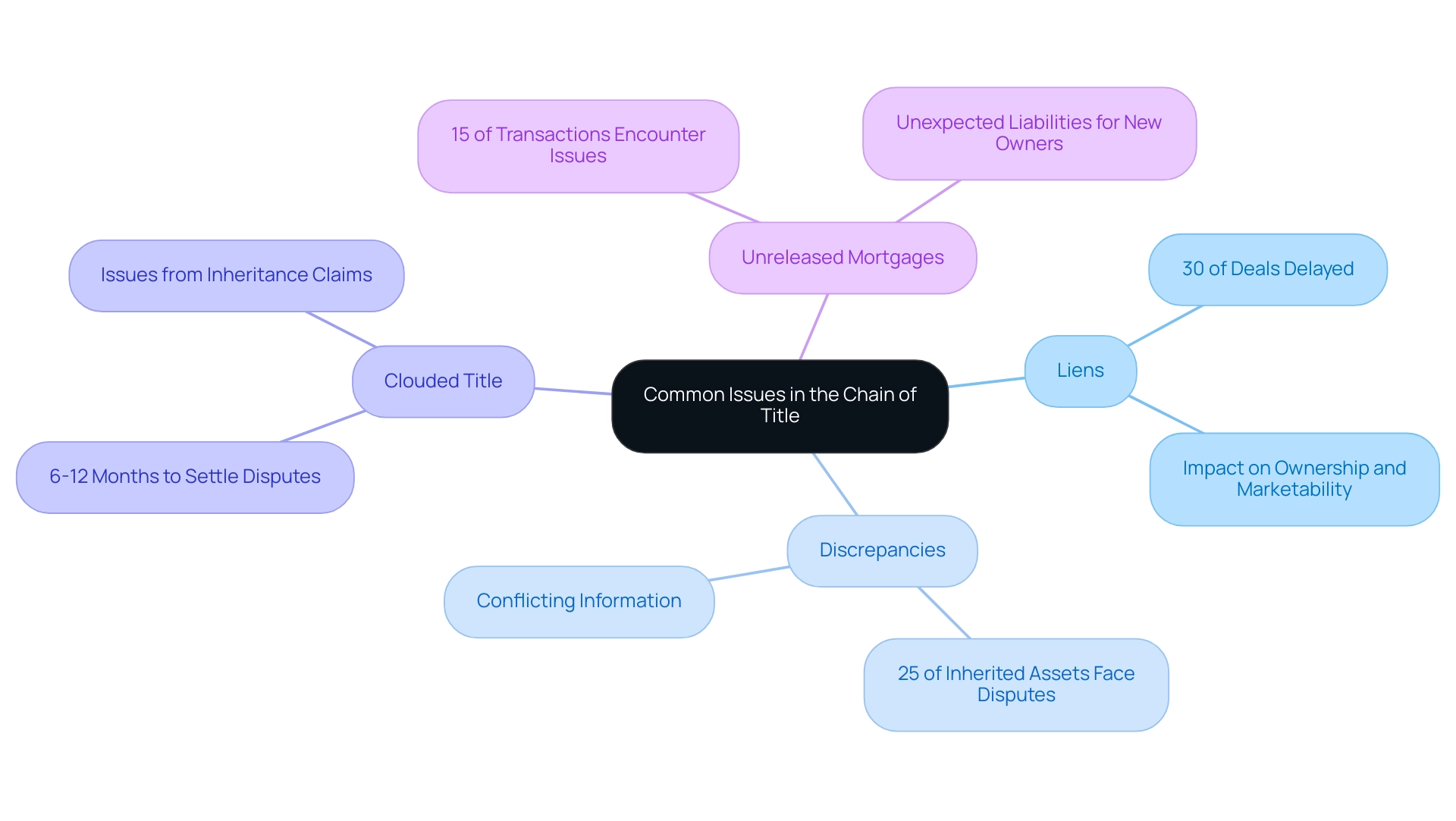

The chain of title real estate can be fraught with various challenges that may hinder property dealings. Among these, the most common issues include:

- Liens: Outstanding debts associated with an asset can lead to claims from creditors, which may jeopardize ownership and marketability. Recent trends indicate that liens are increasingly being scrutinized, with statistics showing that approximately 30% of real estate deals are delayed due to unresolved liens, complicating sales, especially in foreclosure scenarios.

- Discrepancies: Errors in legal documents or conflicting information can create substantial confusion regarding ownership. Such discrepancies are notable in the context of inheritance claims, where nearly 25% of inherited assets face disputes, or when multiple parties assert rights over the same asset.

- Clouded Title: Complications arise from issues like inheritance claims or disputes over boundaries. A disputed ownership can considerably postpone dealings, frequently demanding an average of 6-12 months to settle, requiring extensive legal actions.

- Unreleased Mortgages: Situations where prior mortgages have not been adequately cleared present substantial difficulties. These lingering attachments can encumber the property and lead to unexpected liabilities for new owners, with about 15% of transactions encountering this issue.

Understanding these challenges is crucial for buyers and property professionals involved in the chain of title real estate. As R. Seth Hampton insightfully observes,

Nothing is worse in the eyes of a real estate professional than discovering a problem with the ownership documentation of a property on the heels of a scheduled closing.

This emphasizes the significance of performing comprehensive due diligence, including examining commitment documents and current surveys, to identify possible ownership issues early in the process. Proactive steps, such as acquiring insurance for ownership or seeking legal support, can reduce risks and promote smoother dealings, ultimately ensuring the marketability of the asset. Moreover, as detailed in the case study named 'Best Practices for Property Professionals,' building solid connections with document firms and actively tackling possible concerns can result in more seamless property dealings for clients.

The Role of Title Companies in Managing the Chain of Title

Title firms are essential to the efficient administration of the chain of ownership in property dealings, performing several crucial functions:

- Conducting Ownership Searches: Title firms carry out thorough ownership searches to reveal any claims, liens, or encumbrances against the property, ensuring that possible issues are recognized before a deal moves forward. This thorough examination is essential, as Rande Yeager, president of the American Land Association, emphasizes, because it clearly demonstrates the importance of a professional search in the chain of title real estate for all transactions, whether buying a new home or refinancing an existing mortgage. Utilizing Parse Ai's sophisticated machine learning tools can greatly accelerate this process, enabling quicker and more precise document processing through features like the example manager, which aids in the annotation of unstructured documents.

By providing ownership insurance, these firms safeguard both purchasers and lenders from unexpected losses arising from defects in the chain of title real estate. This insurance serves as a safeguard, enabling stakeholders to reduce financial risks related to ownership discrepancies.

- Handling Closing Processes: Title companies are frequently tasked with facilitating the closing process, ensuring that all required documents are accurately executed and recorded. Incorporating Parse Ai's research automation tools, which are developed from the founders' extensive industry knowledge and connections, can enhance efficiency in this role, particularly considering the upcoming changes in commission regulations set to influence the real estate market in 2024, which require that companies adjust to a changing regulatory environment. Successful companies in the industry typically aim for a revenue-per-employee benchmark of $150,000 to $200,000 annually, highlighting their financial health and operational efficiency in this evolving market.

- Resolving Issues: When discrepancies or challenges arise during the verification process, companies leverage their expertise to address these issues promptly. Utilizing Parse Ai's interactive labeling and OCR technology can further streamline resolution processes, ensuring that complications are effectively managed. The competitive advantages provided by Parse Ai's tools position companies to thrive in a dynamic market.

Engaging with a reputable company not only enhances the efficiency of property transactions but also significantly increases security for all parties involved in the chain of title real estate. As the industry evolves, particularly with the pressure to manage competitive environments and changing buyer expectations, firms must prepare for the upcoming regulatory changes discussed in the case study named 'Preparing for August 17th: Essential Information on the NAR Broker Commission Changes.' This preparation is essential for ensuring smooth and successful real estate dealings, as the role of title companies remains paramount in navigating buyer and supplier power.

Conclusion

A clear chain of title is indispensable in the realm of real estate, serving as the backbone of property ownership verification and transaction integrity. By meticulously tracing the documented history of ownership, real estate professionals can identify potential claims, liens, or encumbrances that may threaten a buyer's investment. The importance of conducting thorough research and engaging reputable title companies cannot be overstated, as they play a critical role in safeguarding against disputes and facilitating smooth transactions.

As highlighted throughout the article, challenges such as unresolved liens, discrepancies in documentation, and clouded titles pose significant risks to both buyers and agents. Proactive measures, including:

- Obtaining title insurance

- Maintaining open communication with all parties involved

are essential in mitigating these risks. By fostering a culture of diligence and transparency, real estate professionals can ensure that clients are well-informed and protected, ultimately leading to successful property transactions.

In conclusion, understanding and managing the chain of title is paramount in today’s complex real estate landscape. Stakeholders must prioritize due diligence and leverage the expertise of title companies to navigate potential pitfalls effectively. By doing so, they not only enhance the security of property transactions but also contribute to a more stable and trustworthy real estate market.

Frequently Asked Questions

What is the chain of title in real estate?

The chain of title in real estate is the documented history of ownership, detailing the sequential transfers of title from one owner to the next. It confirms the validity of ownership and reveals any existing claims or burdens on the asset.

Why is it important to verify the chain of title during property transactions?

Verifying the chain of title is crucial to prevent potential disputes and ensure a clear understanding of ownership. It helps real estate professionals navigate the complexities of ownership and maintain a secure record, especially in light of increasing cybersecurity threats.

What types of documents are included in the chain of title?

The chain of title comprises vital documents such as deeds, wills, and court records, which collectively create a transparent pathway of ownership.

How does a clear chain of ownership benefit buyers?

A clear chain of ownership confirms rightful ownership and acts as a safeguard against possible disputes or claims from third parties. It is also essential for acquiring ownership insurance, protecting the buyer's investment.

What are the risks associated with an ambiguous chain of ownership?

An ambiguous chain of ownership can lead to expensive legal disputes and substantial delays in the property transaction process.

What role do real estate professionals play in ensuring a clear chain of ownership?

Real estate professionals are responsible for informing clients about the importance of a clear chain of ownership and should encourage them to obtain owner’s insurance to mitigate future complications.

What proactive measures can be taken to ensure a clear chain of title?

Proactive communication about potential issues and conducting a thorough assessment of the chain of ownership before finalizing any purchase can mitigate risks and streamline the transaction process.

How can selecting a trustworthy firm impact real estate transactions?

Choosing a reputable firm, such as Turner Title, can guarantee a redefined standard of efficiency and clarity in every deal, enhancing the overall transaction experience for all parties involved.