Overview

Residential title services play a critical role in verifying property ownership and ensuring that transactions are devoid of legal encumbrances. This essential function protects both buyers and lenders from potential disputes. The article underscores that these services not only facilitate smoother real estate transactions through comprehensive searches and insurance but are also adapting to technological advancements. Innovations such as AI and machine learning are being integrated to enhance efficiency and accuracy in ownership verification processes.

Introduction

In the intricate world of real estate, the importance of residential title services is paramount. These essential services form the backbone of property transactions, ensuring that ownership is legitimate and free from encumbrances. With the market poised for substantial growth and technological advancements reshaping the landscape, understanding the role of title services is crucial for both buyers and lenders.

As the industry evolves—leveraging AI to streamline processes and addressing the challenges of title research—the significance of these services in safeguarding investments and facilitating smooth transactions becomes increasingly clear.

This article explores the multifaceted nature of residential title services, highlighting their critical functions, the benefits of title insurance, and the innovations driving the industry forward.

What Are Residential Title Services?

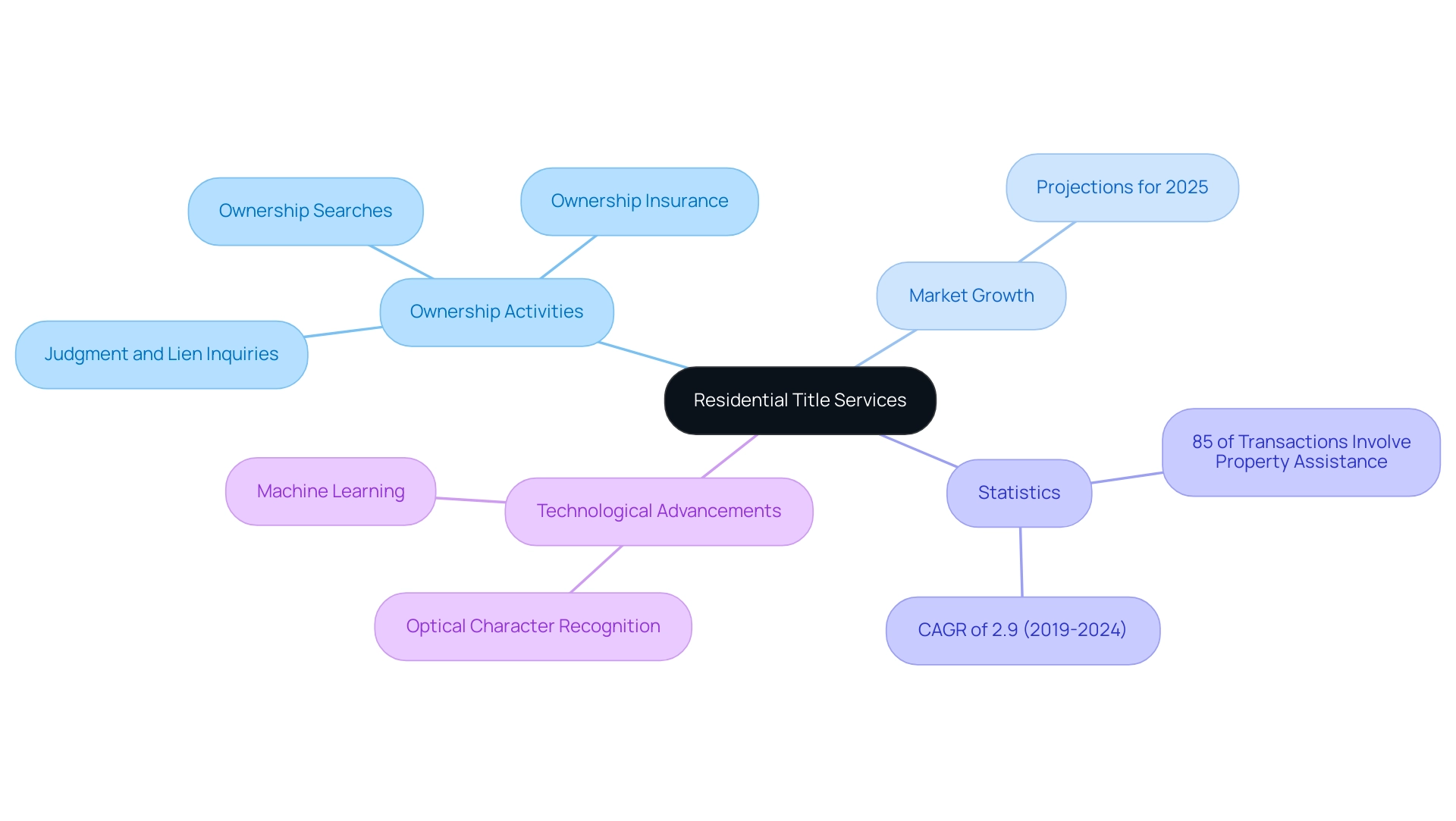

Residential ownership assistance is pivotal in verifying the legitimacy of property ownership during transactions. These services encompass essential activities, including:

- Conducting thorough ownership searches

- Providing ownership insurance

- Executing judgment and lien inquiries

The primary aim is to ensure that the seller has the legal authority to transfer ownership and that the property is free from encumbrances.

In 2025, the residential ownership assistance sector is projected to experience significant growth, driven by an increase in property transactions and rising asset values. Recent statistics reveal that approximately 85% of real estate transactions involve property assistance, underscoring their critical role in the industry. Additionally, the insurance sector has recorded a compound annual growth rate (CAGR) of 2.9% from 2019 to 2024, reflecting overall market expansion.

The effectiveness of residential ownership solutions is evident in their capacity to protect buyers and lenders from potential disputes over property rights. By ensuring that all title-related issues are resolved prior to closing, these services facilitate a more seamless transaction process. Recent advancements in the field, particularly the integration of cutting-edge technologies such as machine learning and optical character recognition, are further enhancing the efficiency and accuracy of searches.

Moreover, expert insights highlight that the ongoing transformation of the industry, especially through the adoption of AI, presents both opportunities and challenges. While AI streamlines various processes, it also raises concerns regarding fraud and security, necessitating a balanced approach to innovation. As stated by the American Land Title Association (ALTA), there exists a "false promise of savings" associated with these advancements, emphasizing the need for caution as the industry evolves.

In summary, residential title services are indispensable in the property market, ensuring legitimacy in ownership and contributing to the overall stability of transactions. The competitive forces analysis underscores the significance of pricing and product customization to meet consumer demands, further stressing the necessity for ongoing improvement and adaptation to emerging trends. As the industry progresses, maintaining the integrity and efficiency of these offerings will be crucial.

The Importance of Title Services in Real Estate Transactions

Residential title services play a crucial role in real estate transactions, ensuring the accuracy and proper drafting of all legal documents. They are instrumental in identifying potential issues with property ownership, such as liens or claims from third parties, which could complicate or even derail a sale. Through thorough property searches and the provision of residential title services, these offerings protect both purchasers and lenders from financial losses arising from ownership defects.

Statistics indicate that financial losses due to ownership defects can significantly impact transaction outcomes, underscoring the necessity of thorough property assessments.

The guarantee provided by residential title services promotes confidence in the transaction process, rendering them an essential part of property dealings. As the sector develops, especially with the incorporation of cutting-edge technologies such as machine learning and optical character recognition, the efficiency and precision of title-related processes are anticipated to enhance further. This evolution is essential, particularly in a competitive environment where the success rates of real estate dealings are increasingly linked to the dependability of ownership verification.

Notably, Stewart Information Services Corp reported a profit margin of 11.7% in 2024, reflecting the financial health of the industry.

Furthermore, case studies have demonstrated that the introduction of AI tools in the real estate sector has streamlined tasks such as data entry and document review, enhancing the overall efficiency of property operations. However, professionals must remain vigilant against potential risks, including fraud and misinformation, as these technologies continue to reshape the industry. As noted by SoftPro, 'Overall, the price increase in 2025 indicates a steadier, more sustainable path for home values, which benefits all,' emphasizing the current market conditions and their effects on property transactions.

Ultimately, the proactive engagement of residential title services not only mitigates risks but also contributes to smoother and more successful real estate transactions, emphasizing the need for a proactive approach to navigate uncertainties in the evolving landscape.

Understanding the Benefits of Title Insurance

Title protection serves as a vital safeguard for property owners and lenders, primarily shielding them from financial losses due to ownership defects. These defects can manifest as undisclosed liens, fraudulent claims, or inaccuracies in public records that may emerge after a purchase. A significant advantage of ownership protection lies in its coverage of legal expenses incurred while defending against claims on the deed, empowering buyers to maintain their ownership without the constant threat of unforeseen disputes.

As we enter 2025, the landscape of ownership protection is evolving, with statistics revealing that claims and payouts remain substantial, underscoring the necessity of this coverage. For instance, the average cost of property protection policies for residential properties is approximately $1,500, reflecting the value it provides in safeguarding investments. Furthermore, expert insights highlight that ownership protection not only enhances the security of real estate transactions but also fosters trust among buyers, making it an indispensable aspect of the home-buying experience.

Real-world examples illustrate the protective nature of ownership protection, showcasing numerous instances where buyers have successfully defended their rights against claims stemming from ownership issues. Notably, the Suggested Maximum Risk for WFG National Title Protection Company stands at $41,200,000, emphasizing the financial stakes inherent in property policies. Additionally, California exemplifies a state that does not impose a limit on the amount a policy provider may hold on a single policy, as noted by Hayley Sandoval, a law student at Benjamin N. Cardozo School of Law.

As the policy market adapts to evolving regulations and market dynamics, its role in facilitating smooth and secure transactions remains essential. Key players in the property guarantee sector, including First American Financial Corp, Fidelity National Financial, Inc., and Old Republic General Insurance Group, contribute to a competitive landscape, reinforcing the need for residential title services in both commercial and residential property transactions. Moreover, technology, as illustrated by Parse AI, is revolutionizing ownership research, enhancing the efficiency of insurance processes and addressing the challenges faced by property professionals.

Challenges in Title Research and Verification

Title research and verification pose a myriad of challenges that can significantly impact real estate transactions. In 2025, prevalent issues encompass:

- Incomplete or inconsistent ownership records

- Discrepancies in property ownership information

- Complexities of interpreting intricate legal language

These obstacles not only result in transaction delays but also escalate expenses for companies and their clients.

Notably, 17% of professionals identify a lack of executive support as a barrier to effective research, underscoring the necessity for robust organizational backing.

Furthermore, the evolving landscape of property ownership—particularly in scenarios involving inheritance or divorce—complicates the verification process. Incomplete documentation records can severely hinder real estate transactions, leading to potential disputes and financial losses. For instance, advanced statistics projects utilizing machine learning have demonstrated the ability to predict property values with up to 85% accuracy, highlighting the critical importance of precise data in the research process.

This aligns with the insights of Andy Crestodina, who emphasizes the need for detailed and visually rich content in addressing complex topics. He states, "Fill your content with visuals. Include lots of contributor quotes. Embed a few videos. Make it long and detailed. Inject a few strong opinions. That’s what the social platforms do. That’s why they are so compelling."

Specialists in research efficiency, such as those at Parse AI, leverage advanced technologies like machine learning and optical character recognition (OCR) to tackle these challenges. Parse AI's platform offers sophisticated machine learning tools specifically designed for document processing and research automation. A standout feature is the example manager, which allows users to swiftly annotate even a single example to extract critical information from extensive unstructured documents.

By streamlining the extraction of essential information from document titles—incorporating features like full-text search and interactive labeling—researchers can complete abstracts and reports more swiftly and accurately. This innovative approach not only enhances efficiency but also delivers significant cost savings compared to traditional methods, ultimately benefiting real estate professionals who rely on timely and precise information.

Innovations in Title Services: The Role of Technology

The services sector related to property is undergoing a significant transformation driven by technological progress, particularly through the integration of artificial intelligence (AI) and machine learning. These innovations are revolutionizing research processes by facilitating rapid and precise data extraction from extensive collections of documents. Consequently, companies can conduct thorough searches with remarkable efficiency in residential title services, significantly reducing both the time and resources typically required for verifying property ownership.

In 2025, it is projected that 25 percent of the insurance industry will transition to automated procedures powered by machine learning and AI analytics, underscoring a broader trend towards automation in related fields. Companies such as Parse AI are at the forefront of this change, establishing new benchmarks for accuracy and efficiency in research. By leveraging these advanced technologies, Parse AI not only accelerates the speed of document searches but also enhances the overall quality of the data extracted, ultimately benefiting real estate professionals and their clients.

The impact of AI on naming processes is evident in the increased efficiency reported by organizations utilizing these technologies. For instance, 58% of HR leaders have observed improvements in overall productivity due to AI integration. This trend is mirrored in the conveyancing sector of residential title services, where machine learning is optimizing workflows and enabling researchers to finalize abstracts and reports with greater precision and efficiency.

As Derek E. Brink, Vice President and Research Fellow at Aberdeen Strategy & Research, observes, "Today’s IT and Cybersecurity professionals are feeling the pressure of managing and supporting dynamic, complex computing infrastructures, relentless cybersecurity- and compliance-related risks, higher end-user expectations, and the pinch of limited resources." This sentiment resonates within the industry as professionals strive to navigate similar challenges.

Furthermore, the commitment to continuous improvement and collaboration with land management experts ensures that advancements in technology related to ownership documents align with the industry's most pressing challenges. As the landscape evolves, the role of AI and machine learning in enhancing research processes will continue to expand, paving the way for a more efficient and effective services industry.

Navigating the Process of Obtaining Title Insurance

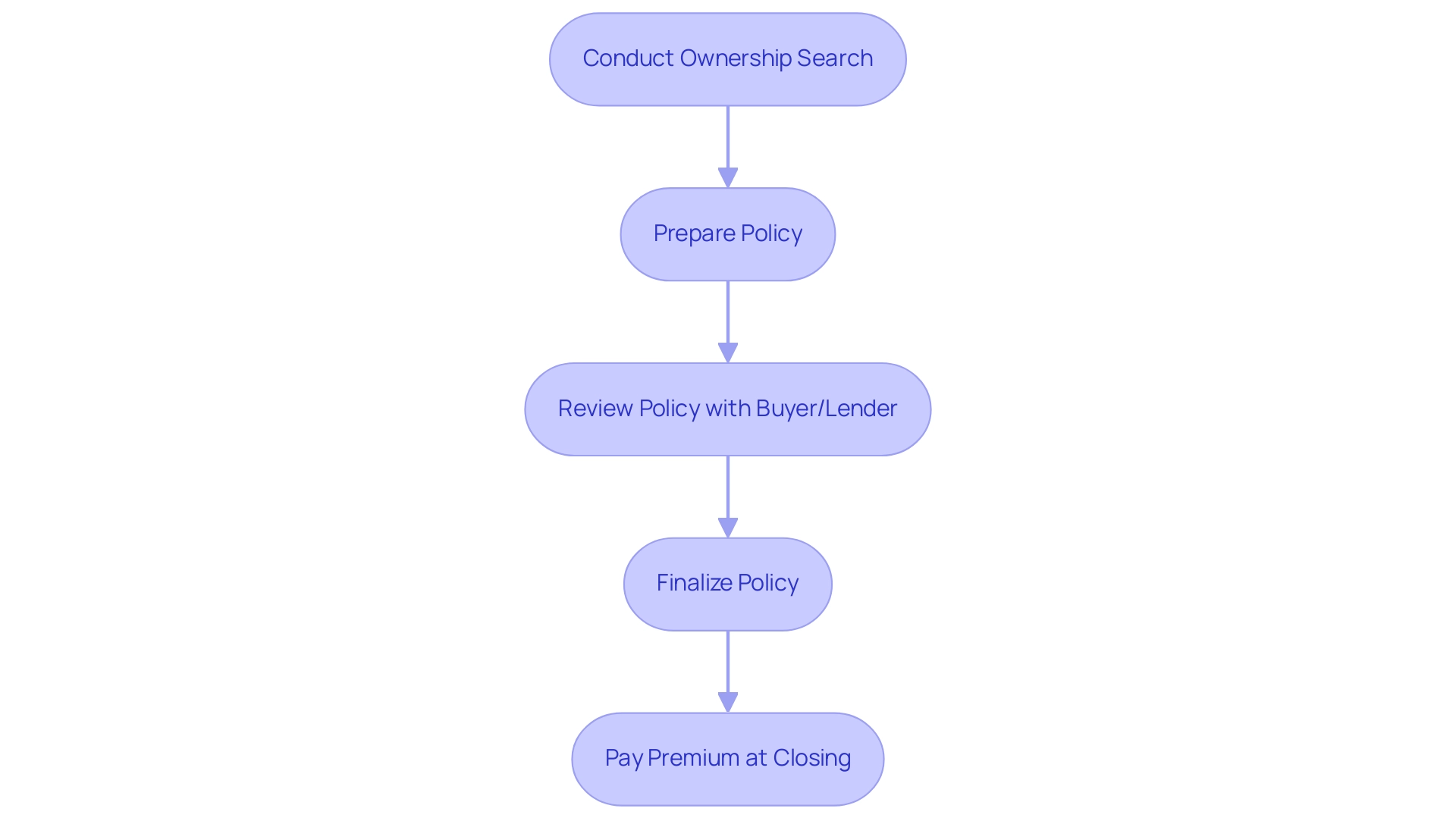

Acquiring ownership protection involves several essential steps that guarantee the safeguarding of property rights. Initially, a company conducts an extensive search to confirm the property's ownership history and reveal any potential issues, such as liens or claims. This comprehensive assessment is crucial, as consumers allocate approximately $22 billion each year on property protection, underscoring its significance in property dealings.

Upon completion of the ownership search, the company prepares a policy that outlines the coverage offered. This policy is presented to the buyer or lender for review, allowing for any necessary adjustments. After finalizing the policy, the premium is paid at closing, marking the completion of the process.

Understanding these steps is vital for both buyers and real estate professionals, as it facilitates smoother transactions and safeguards investments through residential title services. For instance, in Maryland, deed protection plays a crucial role in the home purchasing process, safeguarding against potential claims and ensuring secure property ownership. As Demetrios Berdousis notes, "IBISWorld has been a leading provider of trusted industry research for over 50 years to the most successful companies worldwide," highlighting the importance of reliable information in navigating these transactions.

Furthermore, Parse AI prides itself on being a trusted source of industry information, with a comprehensive database built over 50 years. In a fiercely competitive market for coverage, it is crucial for stakeholders to adjust to elevated interest rates and decreased liquidity. By grasping the intricacies of obtaining residential title services, stakeholders can navigate real estate transactions with greater confidence and efficiency.

Conclusion

The exploration of residential title services underscores their pivotal role in the real estate landscape, ensuring the legitimacy of property ownership and safeguarding against potential disputes. These services encompass critical tasks, including:

- Conducting thorough title searches

- Issuing title insurance

- Addressing any liens or claims that may impact transactions

As the market anticipates growth, with projections indicating a significant rise in real estate transactions, the importance of these services cannot be overstated.

Furthermore, the integration of advanced technologies such as AI and machine learning is transforming the title services industry, enhancing efficiency and accuracy in title research. While these innovations promise to streamline processes, they also introduce challenges, including concerns about fraud and the need for robust organizational support. Nonetheless, the proactive engagement of title services mitigates risks and fosters trust, ultimately facilitating smoother transactions for buyers and lenders alike.

In summary, as the real estate industry continues to evolve, understanding the multifaceted nature of residential title services is essential. Emphasizing their critical functions and the protective benefits of title insurance reinforces the message that these services are indispensable in safeguarding investments and ensuring the stability of property transactions. Stakeholders must remain vigilant and adaptable to navigate the complexities of the evolving landscape, ensuring that the integrity and efficiency of title services are prioritized for future success.

Frequently Asked Questions

What is the role of residential ownership assistance in property transactions?

Residential ownership assistance verifies the legitimacy of property ownership during transactions by conducting ownership searches, providing ownership insurance, and executing judgment and lien inquiries. Its primary aim is to ensure that the seller has the legal authority to transfer ownership and that the property is free from encumbrances.

How significant is the residential ownership assistance sector projected to be in the coming years?

The residential ownership assistance sector is projected to experience significant growth in 2025, driven by an increase in property transactions and rising asset values. Approximately 85% of real estate transactions involve property assistance, highlighting its critical role in the industry.

What advancements are being made in residential ownership solutions?

Recent advancements include the integration of technologies such as machine learning and optical character recognition, which enhance the efficiency and accuracy of ownership searches, thereby improving the overall transaction process.

What are the benefits of using residential title services?

Residential title services protect buyers and lenders from potential disputes over property rights by resolving title-related issues prior to closing. They also ensure the accuracy and proper drafting of legal documents, which is essential for smooth real estate transactions.

What challenges does the adoption of AI present in the residential title services industry?

While AI streamlines processes and enhances efficiency, it raises concerns regarding fraud and security. The American Land Title Association (ALTA) warns of a 'false promise of savings' associated with these advancements, indicating the need for caution as the industry evolves.

How do financial losses due to ownership defects impact real estate transactions?

Financial losses from ownership defects can significantly affect transaction outcomes, emphasizing the necessity of thorough property assessments to mitigate risks and ensure successful property dealings.

What is the current financial health of the residential title services industry?

Stewart Information Services Corp reported a profit margin of 11.7% in 2024, reflecting the industry's financial health and capacity for growth amidst evolving market conditions.

Why is a proactive approach important in the residential title services sector?

A proactive approach is essential for mitigating risks and navigating uncertainties in the evolving landscape of real estate transactions, ultimately contributing to smoother and more successful dealings.