Introduction

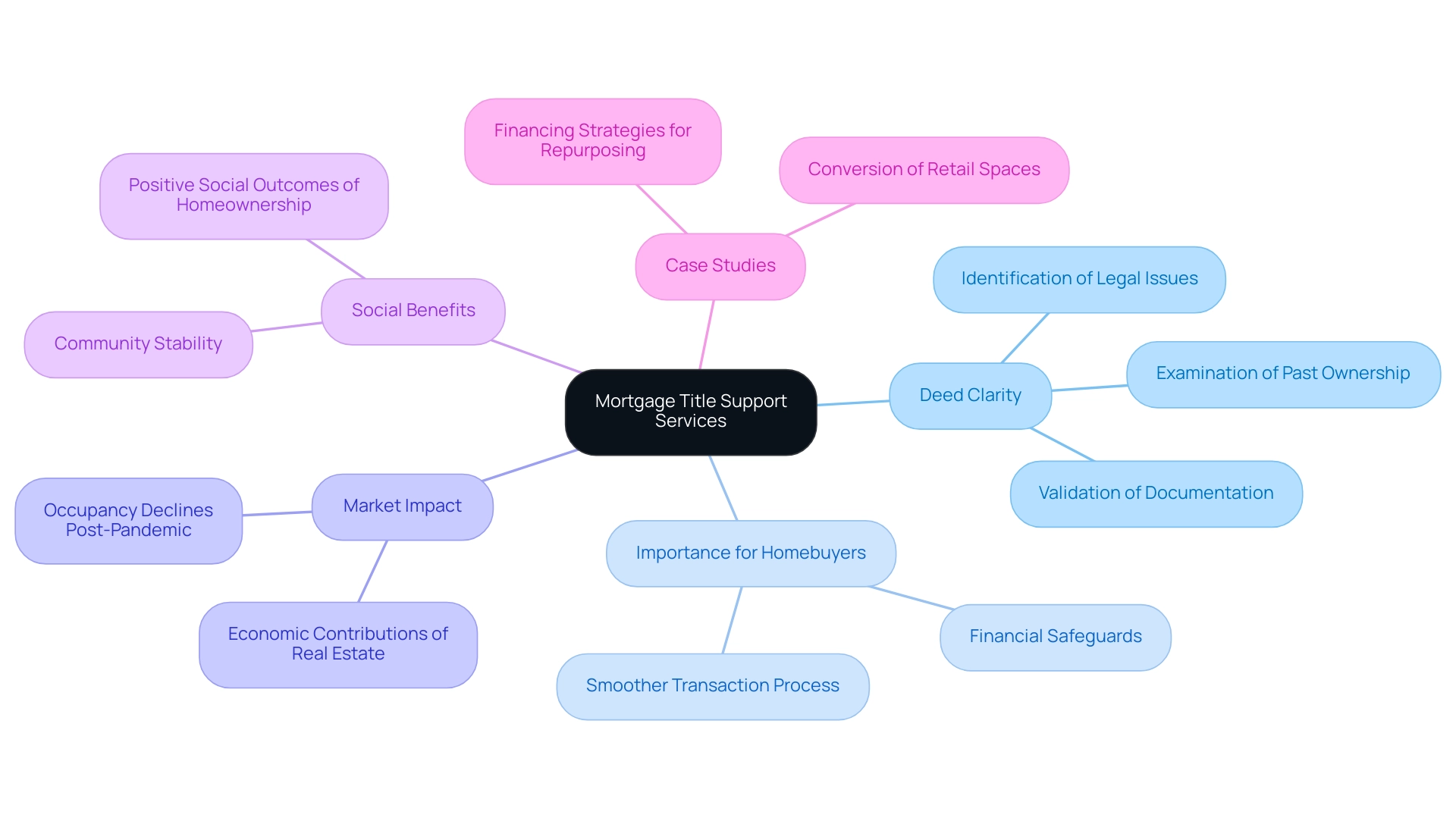

In the intricate landscape of real estate transactions, mortgage title support services emerge as a critical component in ensuring secure property ownership. These services not only navigate the complexities of property titles but also serve as a protective barrier against potential legal disputes and financial losses that can arise from unclear titles.

As homebuyers face an increasingly competitive market, the role of title support services becomes even more pronounced, particularly in light of recent trends that reveal significant declines in occupancy rates across various regions.

By meticulously verifying title records and addressing any encumbrances, these services foster confidence in the homebuying process, enabling smoother transactions and promoting community stability.

With the added insights from case studies and expert opinions, the importance of these services cannot be overstated, making them indispensable for anyone looking to secure their real estate investments.

Introduction to Mortgage Title Support Services

Mortgage title support services are essential for ensuring that a real estate acquisition is made with a clear deed, free from any liens, disputes, or claims that could threaten possession. These offerings carefully assist home purchasers with the intricacies of property documentation by providing mortgage title support services, delivering essential validation and investigation of record details. This process often includes an examination of past ownership, potential legal issues, and any encumbrances that could affect the transaction.

The significance of these mortgage title support services cannot be overstated; they not only safeguard the homebuyer’s financial investment but also ensure a smoother transaction process. In the present market, the National Association of Realtors has examined notable decreases in occupancy across 27 markets after the pandemic, emphasizing the necessity for strong support solutions. Furthermore, the 'Social Benefits of Homeownership and Stable Housing' report highlights the positive social results linked to stable housing, further stressing the essential role of ownership assistance in promoting community stability.

Moreover, findings from case studies on repurposing empty retail malls demonstrate how mortgage title support services are crucial in managing intricate transactions, ensuring that properties can be successfully converted to new purposes. By protecting against possible ownership problems, these offerings instill confidence in homebuyers, ultimately contributing to a more stable real estate environment.

Exploring Different Types of Mortgage Title Services

Homebuyers should familiarize themselves with several essential types of mortgage title support services that play a crucial role in the acquisition process:

- Ownership Examination: This essential service involves a thorough examination of public records to confirm the ownership history of the asset and reveal any problems that could affect the ownership deed, including existing liens, conflicts, or encumbrances. A thorough examination is vital for ensuring that the buyer is fully aware of any potential risks before proceeding with the purchase.

- Ownership Protection: Ownership protection acts as a shield for home purchasers against monetary loss arising from flaws in the deed that may not have been detected during the review process. This policy provides essential protection against claims and legal fees arising from unforeseen issues, thereby securing the buyer's investment and peace of mind.

- Heading Commitment: Issued by a company, a heading commitment is a foundational document that outlines the terms of coverage and confirms that the property ownership is clear. It signifies a commitment to offer ownership protection upon closing, thereby ensuring that the buyer's interests are safeguarded throughout the transaction.

In the present market, where Excalibur One Mortgage indicates a purchase volume of 2,105 transactions, representing 49% of their overall transactions, the importance of these support functions becomes even more apparent. Eric Capehart, an MMI Enterprise Customer, emphasizes this importance by stating, "An MMI feature I cannot live without is simply being able to, at a glance, view most recent transaction history and look for those trends in the names." Moreover, comprehending the dynamics of supply and demand in property protection is essential, as variations in the economy can influence the cost framework of companies and the offerings they deliver.

In markets with high real estate activity, charges may increase, while in depressed regions, it becomes challenging for companies to adjust costs. Understanding mortgage title support services is essential, particularly considering the current market dynamics influencing insurance providers and the overall real estate landscape.

Understanding Title Search Process

The examination process is a crucial procedure that includes several vital steps to guarantee a clear ownership for the asset in question:

- Researching Public Records: Title researchers meticulously examine land records housed in local government offices, such as deeds, tax documentation, and court filings. This thorough examination aids in building a comprehensive ownership history of the asset, which is essential for establishing clear rights and identifying any potential issues. Recent news suggests that ownership searches are often performed by lawyers or title firms, emphasizing the significance of professional engagement in mortgage title support services.

- Identifying Liens and Encumbrances: An essential element of the search involves identifying any existing liens, encumbrances, or legal claims against the asset. These factors can significantly impact ownership rights and the usability of the property. Recent insights from research professionals emphasize the importance of accurately identifying these encumbrances, as they can lead to substantial legal complications if overlooked. Carmel Woodman, a seasoned ghostwriter with a portfolio of over 200 articles on real estate topics, notes that understanding these complexities, including mortgage title support services, is essential for all stakeholders in the industry.

- Compiling a Report: Following the research and identification phases, a detailed report is compiled. This report synthesizes all relevant findings, highlighting any potential issues that must be resolved prior to closing. It serves as a pivotal document that guides both buyers and lenders in understanding the asset’s status. Significantly, data indicate that the coverage premium can vary from 0.5% to 1% of the purchase price, emphasizing the financial consequences of comprehensive property searches. The expenses linked to ownership insurance further highlight the importance of performing thorough ownership investigations, as any missed issues can result in considerable financial consequences.

For real estate investors, carrying out careful ownership investigations can avert expensive legal troubles and financial setbacks related to problematic assets. A case study named 'Searches for Real Estate Investors' exemplifies this point, showing how investors frequently utilize title searches when evaluating discounted assets to ensure no concealed issues could threaten their investments. By following these steps in the examination process, stakeholders can protect against unexpected challenges and enhance the overall integrity of real estate transactions through mortgage title support services.

The Role of Title Insurance in Protecting Homebuyers

Ownership protection acts as an essential shield for home purchasers against monetary losses resulting from flaws in the ownership record that might go unnoticed during a typical ownership search. This coverage includes a variety of potential issues, such as:

- Unknown Liens: Unforeseen liens might arise if a previous owner failed to resolve taxes or payments to contractors, jeopardizing the new owner's rights.

- Errors in Public Records: Inaccuracies in real estate records can lead to disputes over ownership, creating significant legal challenges.

- Fraud or Forgery: Instances of deceptive transactions can happen, where an individual unlawfully attempts to sell a dwelling they do not legally possess.

Securing ownership protection is crucial for homebuyers, as it provides financial security against these risks, thereby strengthening its vital role in mortgage title support services. According to Diane Tomb, the chief executive officer of the American Land Association (ALTA), the industry remains resilient, even amid a 37% decrease in premium volume, emphasizing the ongoing commitment of professionals to protect property rights and facilitate real estate transactions. The ALTA represents over 6,500 property guarantee firms and related professionals, emphasizing the sector's extensive network and support framework.

Moreover, recent statistics show that Pennsylvania reported premium costs of $145,440,429 in Q2 2023, while the top five states for premium costs during the same period included:

- Texas ($594.2 million)

- Florida ($511.2 million)

- California ($358.8 million)

- New York ($216.4 million)

- Pennsylvania

This data reflects broader market trends and emphasizes the significance of strong insurance coverage in today’s challenging environment, as illustrated by the case study on the top five states in premium volume.

The Importance of Timely Title Services in Real Estate Transactions

Prompt mortgage title support services are crucial for ensuring a smooth home buying process, thereby reducing the likelihood of unnecessary delays. Here's a closer look at their critical role:

- Avoiding Closing Delays: Unexpected document issues can emerge at any stage of the transaction. Addressing these concerns promptly is crucial; the longer they remain unresolved, the greater the risk of delaying the closing process. A common example includes errors in ownership records, such as incorrect names or missing documents, which can necessitate corrective actions that are often time-consuming and lead to significant delays. According to a case study titled "Common Delays in the Title Search Process," such errors can severely impact the transaction timeline.

- Securing Financing: Lenders usually demand assurance that ownership work is complete before finalizing mortgage title support services for financing. Prompt documentation assistance is thus not only advantageous; it is crucial for guaranteeing that mortgage title support services are acquired effectively and without eleventh-hour issues. Significantly, insurance premiums can range from 0.5 to 1% of the purchase price, emphasizing the financial consequences of prompt ownership assistance.

- Peace of Mind: The swift finalization of ownership documentation reassures homebuyers that all required evaluations have been meticulously performed. This guarantee allows buyers to proceed confidently with their purchase, knowing that potential ownership issues have been addressed. As industry expert Carmel Woodman states, 'Grasping the complexities of mortgage title support services is essential for making informed choices in property dealings,' highlighting the significance of prompt title-related assistance.

Given the potential for closing delays resulting from ownership issues, which can impact overall transaction timelines, prioritizing timely documentation services in real estate is not just advisable; it is imperative in 2024 and beyond.

Working with Title Support Professionals

Interacting with support experts is essential for improving the home buying experience. When selecting these experts, consider the following key attributes:

-

Experience and Knowledge: Opt for professionals with a robust background in real estate and document research, similar to the capabilities offered by Parse Ai's advanced machine learning tools that expedite document processing.

For instance, Parse Ai's example manager allows users to quickly annotate documents, facilitating the extraction of critical information from a large set of unstructured documents. Experience plays a vital role in ensuring a thorough understanding of potential issues that may arise in property titles.

-

Attention to Detail: Title research demands meticulous scrutiny.

Professionals should demonstrate a proven track record of conducting comprehensive investigations, as even minor oversights can lead to significant legal complications. Harbinger Land’s refined procedures and quality control exemplify the importance of accuracy in research, ensuring that clients receive detailed information in an easily digestible format.

-

Communication Skills: Clear and effective communication is vital.

As Eleanor Roosevelt wisely stated, 'To handle yourself, use your head; to handle others, use your heart.' Title support professionals must be adept at guiding homebuyers through the intricate processes involved, addressing any questions or concerns promptly and effectively. By employing methodologies that prioritize transparency and responsiveness, real estate professionals can enhance the homebuyer experience.

Additionally, referencing the case study 'Critique with Sensitivity,' Jeff Miller advises that providing honest feedback while maintaining employees' self-esteem can enhance relationships. This principle can be applied to mortgage title support services, where effective communication fosters trust and satisfaction among homebuyers.

By collaborating with knowledgeable mortgage title support services, empowered by tools like those from Parse AI, including the example manager for document annotation, and the thorough research capabilities of Harbinger Land, homebuyers can navigate the complexities of title research with enhanced confidence and clarity. This ultimately improves their satisfaction and trust in the home buying process.

Conclusion

Mortgage title support services play an indispensable role in ensuring secure property ownership, particularly in today’s complex real estate landscape. By meticulously examining title records and identifying potential encumbrances, these services protect homebuyers from future disputes and financial losses. The ongoing decline in occupancy rates across various markets underscores the necessity of such services, as they promote not only individual confidence in property transactions but also contribute to broader community stability.

Understanding the various facets of title support—ranging from title examination and insurance to the critical title search process—highlights the importance of engaging knowledgeable professionals in the field. These experts not only facilitate smoother transactions but also provide peace of mind, allowing homebuyers to navigate the complexities of property ownership with assurance. Timely title services are crucial in avoiding unnecessary delays, ensuring that financing is secured efficiently, and ultimately protecting the buyer’s investment.

As the real estate market continues to evolve, the reliance on comprehensive title support services will only grow. By prioritizing these services, homebuyers can safeguard their investments and contribute to a more stable real estate environment, reinforcing the essential nature of these services in achieving successful property transactions.

Frequently Asked Questions

What are mortgage title support services?

Mortgage title support services are essential for ensuring that a real estate acquisition is made with a clear deed, free from any liens, disputes, or claims that could threaten possession. They assist home purchasers with property documentation, validation, and investigation of record details.

Why are mortgage title support services important?

These services safeguard the homebuyer’s financial investment and ensure a smoother transaction process by examining past ownership, potential legal issues, and any encumbrances affecting the transaction.

What are the key types of mortgage title support services?

The key types include: 1. Ownership Examination: A thorough examination of public records to confirm ownership history and identify potential issues. 2. Ownership Protection: A policy that protects home purchasers against monetary loss from flaws in the deed. 3. Heading Commitment: A foundational document outlining the terms of coverage and confirming clear property ownership.

How does the examination process work?

The examination process involves: 1. Researching Public Records: Title researchers examine local government records to build ownership history. 2. Identifying Liens and Encumbrances: Identifying any existing legal claims against the asset that could impact ownership rights. 3. Compiling a Report: A detailed report synthesizing findings and highlighting potential issues to be resolved before closing.

What risks does ownership protection cover?

Ownership protection covers risks such as unknown liens, errors in public records, and potential fraud or forgery that could jeopardize the new owner's rights.

How do prompt mortgage title support services benefit homebuyers?

Prompt services help avoid closing delays, secure financing by providing assurance to lenders, and provide peace of mind to homebuyers that all evaluations have been conducted properly.

What attributes should homebuyers look for in mortgage title support experts?

Homebuyers should consider: 1. Experience and Knowledge: Professionals with a strong background in real estate and document research. 2. Attention to Detail: A proven track record in conducting thorough investigations to avoid legal complications. 3. Communication Skills: The ability to guide homebuyers effectively and address their concerns promptly.