Introduction

Involuntary liens can have a significant impact on property owners, representing legal claims against a property due to unpaid obligations or debts. These liens can arise from various situations, such as unpaid property taxes, mechanic's liens filed by contractors seeking payment, or judgment liens resulting from court decisions. The creation and resolution of involuntary liens involve complex legal processes that vary by jurisdiction.

Understanding these liens is crucial for property owners, as they can restrict property rights and affect the property's value. Involuntary liens can also complicate property transactions and financing, making it essential for owners to stay informed and seek legal guidance. By proactively managing their financial responsibilities and engaging with legal professionals, property owners can mitigate the risk of involuntary liens and protect their assets.

Definition of Involuntary Liens

represent a significant encumbrance on , often arising from a creditor's due to unpaid obligations or legal judgments. Such liens can attach to real estate without the owner's consent, contrasting with voluntary liens where the owner agrees to the lien, typically during financing arrangements. An example of the impact of involuntary liens can be seen in the case of Orlando Capote, who for two decades has been embroiled in disputes to safeguard his family home amid surrounding real estate development in Coral Gables, Florida. His experience reflects the broader challenges property owners face when confronted with involuntary claims against their properties.

As the financial landscape evolves, institutions have lobbied for legislative changes to position themselves with priority claims over assets, including those in investment accounts. The amendment of Article 8 of the UCC, for instance, has potential implications for property rights over investments, highlighting the complex interplay between financial institutions and individual property holders.

Liens, derived from the Latin 'ligare,' to bind, effectively anchor a debtor's property, restricting actions such as sale until the lien is resolved. This financial claim extends beyond real estate to other assets such as vehicles and equipment. The is a specialized form that ensures payment for tradesmen by granting them an interest in the property's value. The rules governing mechanic's liens vary by state, each with its own requirements for notices, forms, and filing deadlines.

The legal landscape of property claims is underscored by cases like the one mentioned by Ryan Hardy, a staff lawyer for the Advocacy Center for Tenants Ontario, citing the rarity of cases relying on arcane sections of law. This accentuates the necessity for property owners to be vigilant and informed about the that can affect their property rights.

The significance of these legal predicaments is further emphasized by recent developments, such as the Canada Revenue Agency's underused housing tax, which, although targeting foreign investors, also imposes filing obligations on Canadian citizens in certain scenarios. Failing to file, even to claim exemption, can result in substantial penalties, illustrating how legislative changes can have unforeseen consequences on homeowners.

In the realm of property data and analytics, companies like ATTOM are collecting extensive information from thousands of U.S. counties, offering insights into foreclosure activities and the property market. Such data plays a crucial role in maintaining transparency and supporting informed decisions in real estate transactions.

In conclusion, involuntary liens represent a crucial aspect of property law, with far-reaching implications for property owners. They serve as a reminder of the intricate legal frameworks governing property ownership and the importance of staying informed to navigate the potential challenges that may arise.

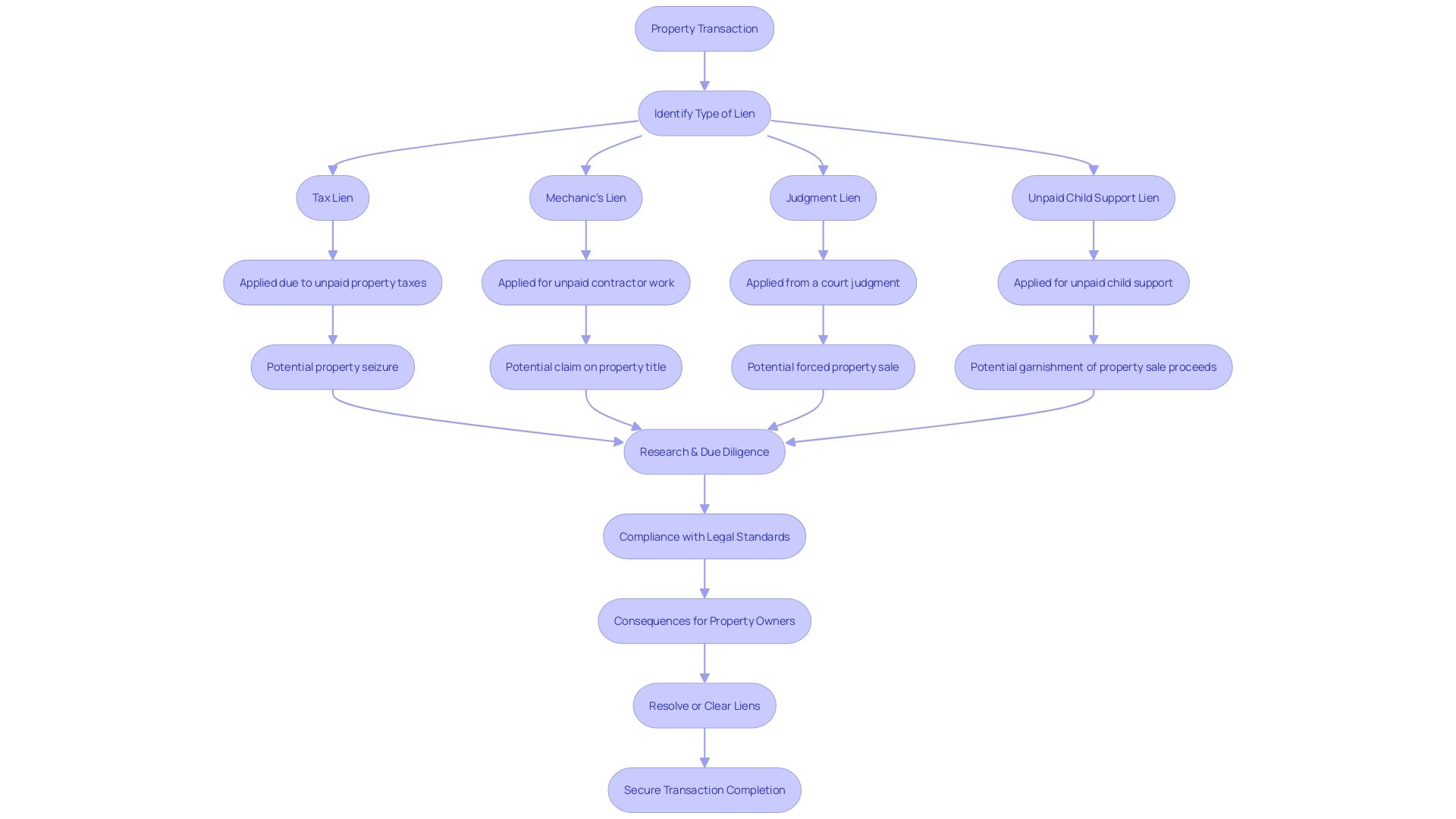

Types of Involuntary Liens

Properties can be subject to various , which serve as legal claims against assets for unsatisfied obligations or debts. are particularly prevalent; these are levied by governmental entities when property taxes remain unpaid. Contractors or subcontractors who haven't received compensation for their services may file what's known as a . Judgment liens may arise from a court's decision when a property owner loses a lawsuit, and these often lead to a mandatory sale of the property to satisfy the judgment. Additionally, liens for unpaid child support can be placed on a property, prioritizing the fulfillment of family responsibilities.

The mechanics of involuntary liens are multifaceted and reflect the diverse ways in which they can be applied. For instance, a mechanic's lien is a protective measure ensuring that tradespeople receive due payment for their work by granting them an interest in the property's value. These liens are governed by state-specific laws, outlining who may claim lien rights, necessary notices, and deadlines for filing against a property. Such rights typically extend to suppliers, laborers, and others contributing to a project's completion. Upon payment for services rendered, property owners should secure from the tradespeople involved.

In the realm of real estate transactions, the alienation clause is another critical aspect to consider. This clause in a mortgage agreement entitles the lender to demand immediate repayment of the loan, encompassing both principal and interest, upon the sale or transfer of the property. The alienation clause necessitates clearing the mortgage balance before the property's title can shift to a new owner, regardless of the nature of the sale or transfer.

Involuntary liens can significantly impact property transactions, necessitating thorough research and due diligence. Comprehensive property data reports and robust search tools like DataTree help stakeholders access property characteristics and ownership history, facilitating informed decisions and risk mitigation. This level of diligence and the ability to harness detailed real estate data are crucial in navigating the complex landscape of property liens and ensuring compliance with legal standards.

Examples of Involuntary Liens

can greatly impact , as they represent a legal claim against a property due to unpaid obligations. Take, for example, the concept of 'zombie' mortgages, which are debts that homeowners believe have been resolved but can suddenly re-emerge. These debts often arise when lenders write off debts and sell them to collectors, leading to unexpected claims against the property.

Similarly, homeowners who neglect to pay their property taxes may find themselves facing a . This situation grants the government the right to to recuperate owed taxes. This was reflected in a significant rise in property taxes, with a report showing a 6.9% increase to $363.3 billion in 2023, signaling the largest increase in the past five years.

Contractors who have not received payment for their services may issue a , putting pressure on the property's sale to receive compensation. This is especially pertinent in areas with rapid real estate development, such as Coral Gables, Florida, where unique cases like that of Orlando Capote arise. Capote's fight to protect his inherited family home amidst encroaching development highlights the complexities of property rights and the potential for disputes over liens and ownership.

Additionally, the alienation clause in real estate is a crucial term to understand. It requires the property's mortgage balance to be settled before the , applicable in both voluntary and involuntary sales. This provision can activate upon the sale or transfer of the property, demanding the full repayment of the loan.

As counties across the U.S. file various foreclosure documents, it's essential for property owners and stakeholders to remain vigilant regarding the potential for involuntary liens. Foreclosure data shows that even if a property has been previously filed against, new filings can still occur, demonstrating the persistent risk of involuntary liens.

How Involuntary Liens Are Created

Involuntary liens serve as a legal mechanism to secure debts against property when obligations are not met. These liens can arise from different situations. For example, tax liens come into play when property taxes remain unpaid. In such cases, the taxing authority can file a lien to secure the owed amount. Mechanic's liens are another form, arising when contractors, subcontractors, or suppliers who have provided labor or materials to improve a property are not compensated. They must file a claim to have a legal interest in the property's value. Judgment liens stem from legal rulings where a court grants a creditor's claim against a debtor's property.

The specifics of how an involuntary lien is established can vary by lien type and local laws. For instance, mechanic's lien laws differ across states, each with unique requirements for notices, filings, and releases. Despite the variation in processes, the fundamental purpose of these lines is consistent: they act as a financial anchor, limiting the use and transferability of the property until the debt is resolved or the lien is released.

An illustrative case of the complexities surrounding property transactions involved an individual who attempted to claim ownership of a hotel by filing deceptive documents. This situation underscores the critical role of in verifying the legitimacy of property deeds and the potential for fraudulent activity when vigilance is lax.

The legal landscape surrounding property and liens is continually evolving. Recent proposals aim to expand regulations to cover all real estate transactions irrespective of value, requiring thorough reporting of ownership transfers, with certain exceptions. This is a response to a broader initiative to increase transparency and clamp down on illicit activities in the real estate sector.

The creation of involuntary liens is a process deeply entwined with legal protocols and safeguards. With the legal profession having experienced significant growth, there is an increased capacity for legal expertise to navigate these complex areas. It is essential for those involved in real estate transactions to understand the implications of liens and to engage with competent legal counsel to ensure compliance and protect their interests.

Impact of Involuntary Liens on Property Owners

Understanding is crucial for property owners, as these financial claims can significantly affect their rights and the . , such as or tax liens, serve as a legal claim against a property by an individual or entity over unpaid debts or services. These liens can prevent the sale or transfer of the property until the outstanding debt is settled. In more severe cases, if the debt remains unpaid, the lienholder may have the legal right to force a sale of the property through foreclosure to recoup the owed amount.

For example, mechanic's liens are a common type of involuntary lien used by contractors to secure payment for their work. Simply by filing the necessary paperwork and obtaining court approval, a contractor can significantly impact a property owner's rights. Similarly, government entities, like local or state governments and the IRS, can place [involuntary liens](https://blog.parseai.co/what-are-land-and-title-services-importance-and-key-features-explained) for unpaid taxes, further complicating a property's legal status.

The presence of involuntary liens can also adversely affect a property's market value, making it challenging for owners to secure financing or loans. This is because liens are considered financial anchors that limit what can be done with a property. In some unfortunate cases, properties can inadvertently become subject to hidden liens, which may not be discovered during standard title searches, leading to unexpected legal responsibilities for new owners.

Recent data underscores the prevalence of these issues, with CoreLogic reporting significant coverage of U.S. foreclosure data, indicating that many properties are affected by such liens. It is evident that understanding and managing these liens is essential for maintaining a property's value and ensuring clear ownership rights.

Resolving Involuntary Liens

Addressing successfully means engaging with the legal and financial roots that brought the lien into being. This can be done by paying the debt entirely, reaching a settlement with the creditor, or disputing the lien's legitimacy in a judicial setting. Once the underlying issue is resolved, the creditor is obliged to remove the lien, reinstating the owner's unrestricted rights to their property. For instance, Orlando Capote of Coral Gables, Florida, battled for two decades to maintain ownership of his family home amidst a large-scale development. With real estate transactions like these being complex and fraught with potential risks, it's beneficial to consider . Attorneys specializing in real estate can provide expert advice on local laws, assist in contract reviews, and offer negotiation expertise to protect your interests. As the data indicates, with 83% of non-homeowners citing , the importance of managing and any associated liens with legal precision becomes even more critical.

Prevention and Mitigation Strategies

Mitigating the risk of requires a proactive and informed approach. should prioritize maintaining accurate financial records and ensuring timely payment of debts and taxes. Addressing legal disputes or judgments quickly is crucial to prevent potential liens from attaching to property. Given the complexity of involuntary liens, such as mechanics' or judgment liens, it's beneficial to engage with legal and financial professionals.

For instance, mechanics' liens secure payment for tradesmen, arising from state-specific laws with detailed requirements for lien rights, notices, and filing deadlines. Similarly, judgment liens, which can result from small claims court decisions, highlight the need for expert legal advice to navigate the intricacies of lien resolution.

In the realm of real estate investing, the 1031 exchange process demonstrates the value of meticulous adherence to legal procedures to defer capital gains taxes, a principle that equally applies to managing lien risks. Just as investors leverage expert advice to optimize tax benefits, property owners can benefit from specialized guidance to safeguard against involuntary liens.

The , aiming to increase transparency in the real estate sector, underscores the importance of understanding current regulations and their implications on property ownership. As the real estate landscape evolves, staying informed through reliable news sources and expert commentary is indispensable for property owners looking to protect their assets from unforeseen encumbrances.

In conclusion, property owners should actively seek out , much like the way real estate attorneys provide indispensable knowledge and negotiation skills in transactions, to mitigate the risk of involuntary liens. By doing so, they can navigate the legal landscape with confidence, ensuring their property remains unencumbered and their financial interests secure.

Conclusion

In conclusion, involuntary liens have a significant impact on property owners, restricting property rights, affecting property value, and complicating transactions and financing. To mitigate the risk of involuntary liens, property owners should stay informed, seek legal guidance, and proactively manage their financial responsibilities.

Types of involuntary liens include tax liens, mechanic's liens, and judgment liens. Resolving these liens requires engaging with the legal and financial roots, such as paying the debt, reaching a settlement, or disputing the lien's legitimacy.

Involuntary liens can prevent property sales or transfers, adversely affect market value, and create hidden liens. Property owners should maintain accurate financial records, timely pay debts and taxes, and address legal disputes promptly.

To mitigate the risk, property owners should proactively manage financial responsibilities, seek legal and financial professionals' guidance, and stay informed about regulations. Engaging with real estate experts can provide valuable advice on local laws, contract reviews, and negotiation expertise.

In conclusion, by understanding and actively managing involuntary liens, property owners can protect their rights, maintain value, and ensure clear ownership. Proactive measures, such as accurate record-keeping, timely payments, and legal guidance, are essential in mitigating the risk of involuntary liens and safeguarding property interests.

Frequently Asked Questions

What are involuntary liens?

Involuntary liens are legal claims against a property that arise without the owner's consent, usually due to unpaid obligations, legal judgments, or tax delinquencies. They restrict the owner's ability to sell or transfer the property until the lien is resolved.

How do involuntary liens differ from voluntary liens?

Unlike voluntary liens, which are agreed upon by the property owner (often during financing arrangements), involuntary liens are imposed as a result of legal actions by creditors or government entities due to unpaid debts or obligations.

What are some common types of involuntary liens?

Common types of involuntary liens include tax liens, mechanic's liens, judgment liens, and liens for unpaid child support.

What is a mechanic's lien?

A mechanic's lien is a claim filed by contractors, subcontractors, or suppliers who have not been paid for labor or materials provided to improve a property. It grants them a legal interest in the property's value until they receive compensation.

Can involuntary liens impact investment accounts?

Yes, legislative changes, such as those to Article 8 of the UCC, can have implications for property rights over investments, reflecting the complex relationship between financial institutions and individual property holders.

How can involuntary liens affect property owners?

Involuntary liens can severely impact property owners by restricting property sales, affecting market value, complicating legal status, and potentially leading to forced property sale through foreclosure if debts remain unpaid.

What steps can be taken to resolve involuntary liens?

To resolve an involuntary lien, one can pay off the debt in full, reach a settlement with the creditor, or legally dispute the lien's validity. After resolving the underlying issue, the creditor must remove the lien.

What is an alienation clause?

An alienation clause in a mortgage agreement requires the loan balance to be paid in full before the property title can be transferred, whether through sale or other means.

How does one navigate the process of involuntary liens?

It is crucial to conduct thorough research and due diligence, understand state-specific laws for liens, and possibly engage a real estate attorney for expert advice and assistance.

What preventative measures can property owners take against involuntary liens?

Property owners should maintain accurate financial records, ensure timely payment of all debts and taxes, address legal disputes promptly, and consult with legal and financial professionals to prevent involuntary liens.