Overview

Understanding house titles is crucial for homeowners as it establishes legal ownership and protects against potential disputes and fraud. The article emphasizes the importance of maintaining a clear title, conducting thorough searches before transactions, and obtaining title insurance to safeguard investments, thereby ensuring that homeowners are well-informed and prepared to navigate the complexities of property ownership.

Introduction

In the realm of real estate, understanding the intricacies of house titles is paramount for homeowners and prospective buyers alike. A house title not only signifies ownership but also encapsulates critical information regarding property rights, liens, and encumbrances that can directly impact one's ability to sell or finance their home. With the alarming rise in title fraud and the complexities surrounding various title holding methods, it becomes essential for individuals to navigate this landscape with diligence and informed decision-making.

This article delves into the significance of house titles, the nuances of title searches, and the protective measures offered by title insurance, while also addressing common title issues and strategies for maintaining clear ownership. By equipping homeowners with the knowledge needed to safeguard their investments, the importance of proactive title management becomes evident in today's dynamic real estate market.

What is a House Title and Why is it Important?

A house title serves as a fundamental legal document that outlines ownership of real estate. It encompasses crucial details such as a comprehensive description of the asset, the names of the current owners, and any existing liens or encumbrances that may affect the asset. Mastery of your house title is essential, as it directly influences your rights and privileges as a homeowner, including your capacity to sell the property or secure financing.

Moreover, possessing is essential for establishing undisputed ownership, thereby minimizing the likelihood of legal disputes in the future. Given the recent data indicating that 28% of companies faced attempts at seller impersonation fraud, as highlighted in a 2023 study, the importance of diligent verification cannot be overstated. Homeowners who proactively check their ownership information and address potential issues can significantly streamline real estate transactions, saving both time and financial resources.

Furthermore, vacant real estate, such as investment or vacation residences, are prime targets for home ownership theft, as these assets are less monitored and can be sold online with minimal verification. Criminals often list these assets at below-market prices to attract unsuspecting buyers, increasing the risk of fraud.

Common Ways to Hold Title on Your Home

There are several common methods for holding title to a home, each with distinct legal and financial implications:

- Sole Ownership: This structure enables one individual to hold title, granting them complete control and responsibility for the asset, including any associated debts and liabilities.

- Joint Tenancy: In this arrangement, two or more individuals share equal rights to the asset. A key feature is the right of survivorship, which ensures that if one owner passes away, their interest automatically transfers to the surviving owner(s). This is especially important in states with communal asset laws, such as Alaska, Arizona, California, Nevada, Texas, and Wisconsin, where communal assets with the right of survivorship are acknowledged, enabling the transfer of ownership without the requirement for probate.

- Tenancy in Common: This method permits several individuals to hold ownership, but each owner can possess unequal shares. Upon the death of one owner, their share does not automatically transfer to the other owners; instead, it is passed on according to their will or state law. This can lead to complex estate planning considerations.

- Community Property: In certain states, property obtained during marriage is regarded as jointly owned by both partners, regardless of whose name is listed. This can have significant implications for estate planning and asset division.

- Other Forms of Ownership: Additional methods include holding ownership through corporations, partnerships, trusts, and limited liability companies (LLCs). Each of these structures has specific regulatory requirements and implications, necessitating proper documentation and professional advice.

Given , it is crucial for homeowners to carefully assess their options related to their house title. The selection of how ownership is vested has important legal consequences, making it advisable to consult with legal professionals to ensure that their decision aligns with their personal circumstances and objectives. As Weldon Copeland from Rainbow Properties emphasizes, "Understanding the nuances of ownership can significantly impact your estate planning and asset management strategies."

Each method of holding presents unique considerations for estate planning, taxation, and liability management.

Understanding Title Searches

A document review is an essential analysis of public records intended to establish the [legal possession of a house title](https://nar.realtor/research-and-statistics/quick-real-estate-statistics) and uncover any liens, claims, or encumbrances that may influence rights. This essential process typically involves reviewing local tax records, court documents, and other pertinent files. With the advanced machine learning tools provided by Parse AI, the document search process can be expedited, ensuring thorough document processing and interpretation.

Homeowners should conduct a property search prior to closing on , as it can uncover potential issues that threaten the house title, such as unpaid taxes, unresolved disputes, or competing claims that could jeopardize their ownership. Engaging with a qualified property company or a real estate attorney is highly advisable, as these professionals possess the expertise necessary to identify and address any problems that might arise during the house title search process. Recent advancements in search methodologies, including the customizable document labeling and data extraction capabilities of Parse AI's interactive features, further enhance accuracy and efficiency, contributing to improved completion rates and client satisfaction.

Such diligence not only protects the buyer's investment but also boosts confidence in the real estate transaction, emphasized by the fact that 72% of sellers would select the same agent again, illustrating how comprehensive property searches contribute to overall satisfaction in securing the house title during the buying process. Furthermore, given that 66.1% of families possessed their primary residence in 2022, the importance of performing a thorough property search for securing the house title becomes even more evident for homeowners. Moreover, the Producer Price Index (PPI) Trends case study illustrates how economic factors can influence search processes and outcomes, further emphasizing the need for comprehensive searches in today's market.

Furthermore, Parse AI's platform is backed by founders with over 50 years of industry experience in energy, real estate, and technology, ensuring that the services provided are both credible and innovative. The digital interface for searching county clerk records is designed with user-friendliness in mind, featuring a search bar at the top and a table that lists various records, making it easy for users to navigate and access public records effectively.

The Role of Title Insurance

Title insurance acts as an essential shield for property owners and lenders, safeguarding them from financial losses resulting from flaws in the house title. Such defects may include issues like undisclosed heirs, fraud, or errors in public records, which can significantly affect the house title and ownership rights. The two primary types of insurance for ownership are:

- Owner's Title Insurance: This policy safeguards homeowners from losses arising from ownership issues that may emerge after the purchase. It provides essential coverage against claims that could arise, ensuring that the homeowner's investment remains secure.

- Lender's Title Insurance: Typically required when obtaining a mortgage, this insurance protects the lender's financial interest in the property. It protects the lender's investment in case any ownership defects arise, ensuring that the loan remains secure against unforeseen claims.

Acquiring ownership insurance is a crucial step in the home-buying process to secure the house title. According to recent estimates, the cost of homeowner insurance for a $1,000,000 mortgage at Wells Fargo is approximately $2,403. Such an investment provides peace of mind, as it protects homeowners and lenders from potential financial setbacks due to issues related to the house title.

Furthermore, a review of historical data highlights that as of 2008, the top three insurance underwriters faced significant financial losses, contrasting sharply with the profitability seen in the leading homeowners insurance companies. This highlights the necessity of insurance for property in today's real estate landscape. Notably, ATGF has maintained a Financial Stability Rating (FSR) of A, Exceptional, from Demotech, Inc., reflecting the resilience and stability of the insurance sector.

As the insurance sector continues to evolve, with insights expected from ALTA regarding Q1 2023 market trends, understanding the role and benefits of this coverage remains paramount for informed decision-making. Additionally, the case study on in the U.S. from 1980 to 2023 provides valuable projections for future housing development, further aiding market analysis.

Common Title Issues and How to Resolve Them

Common issues with house titles can significantly affect ownership and must be addressed promptly to prevent complications. Here are some of the most prevalent challenges:

-

Liens: These are claims against the asset for unpaid obligations, such as taxes or contractor bills.

Resolving a lien typically requires the homeowner to either pay it off or negotiate a settlement with the creditor. Failure to do so can result in foreclosure.

-

Boundary Disputes: Conflicts may arise between neighbors regarding land lines.

To resolve such disputes, homeowners should consider consulting a licensed surveyor or a real estate attorney to establish boundaries and ensure compliance with local regulations. Recent articles have highlighted the increasing frequency of these disputes, underscoring the need for clear demarcation.

-

Undisclosed Heirs: Occasionally, individuals may come forward asserting ownership rights due to familial ties, which can complicate property transactions.

In these situations, acquiring professional advice is crucial to navigate the claims and protect one’s investment effectively. As noted by legal experts, when you buy a home, make sure you protect your investment with house title insurance, emphasizing the importance of safeguarding against such unexpected claims.

-

Clerical Errors: Mistakes in public records can lead to confusion regarding property rights.

Homeowners should proactively contact the relevant office to correct any errors to avoid disputes about property rights. The recent increase in settlements, where Fidelity National Financial and First American Title Insurance Co. agreed to pay $22.7 million to consumers, exemplifies the repercussions of such clerical inaccuracies.

-

Rent-Back Agreements: These arrangements permit sellers to stay in their residences after closing, which can lead to complications concerning transfer of ownership.

Understanding the pros and cons of such arrangements is essential for both buyers and sellers to avoid potential disputes.

-

Remote Online Notarization: With remote online notarization now legal in 44 states, this legal change enhances convenience and security for real estate transactions.

However, it is crucial for homeowners and buyers to understand how this affects their ownership security and the verification of documents.

-

: The increase of AI voice impersonation scams presents a new risk to asset transactions and ownership security.

Scammers using technology to clone voices can deceive individuals into making unauthorized transactions, emphasizing the need for vigilance in verifying identities during property transactions.

Addressing these issues promptly is crucial to maintaining a clear house title, which ensures peace of mind for property owners and prevents potential legal challenges in the future.

Maintaining Your House Title

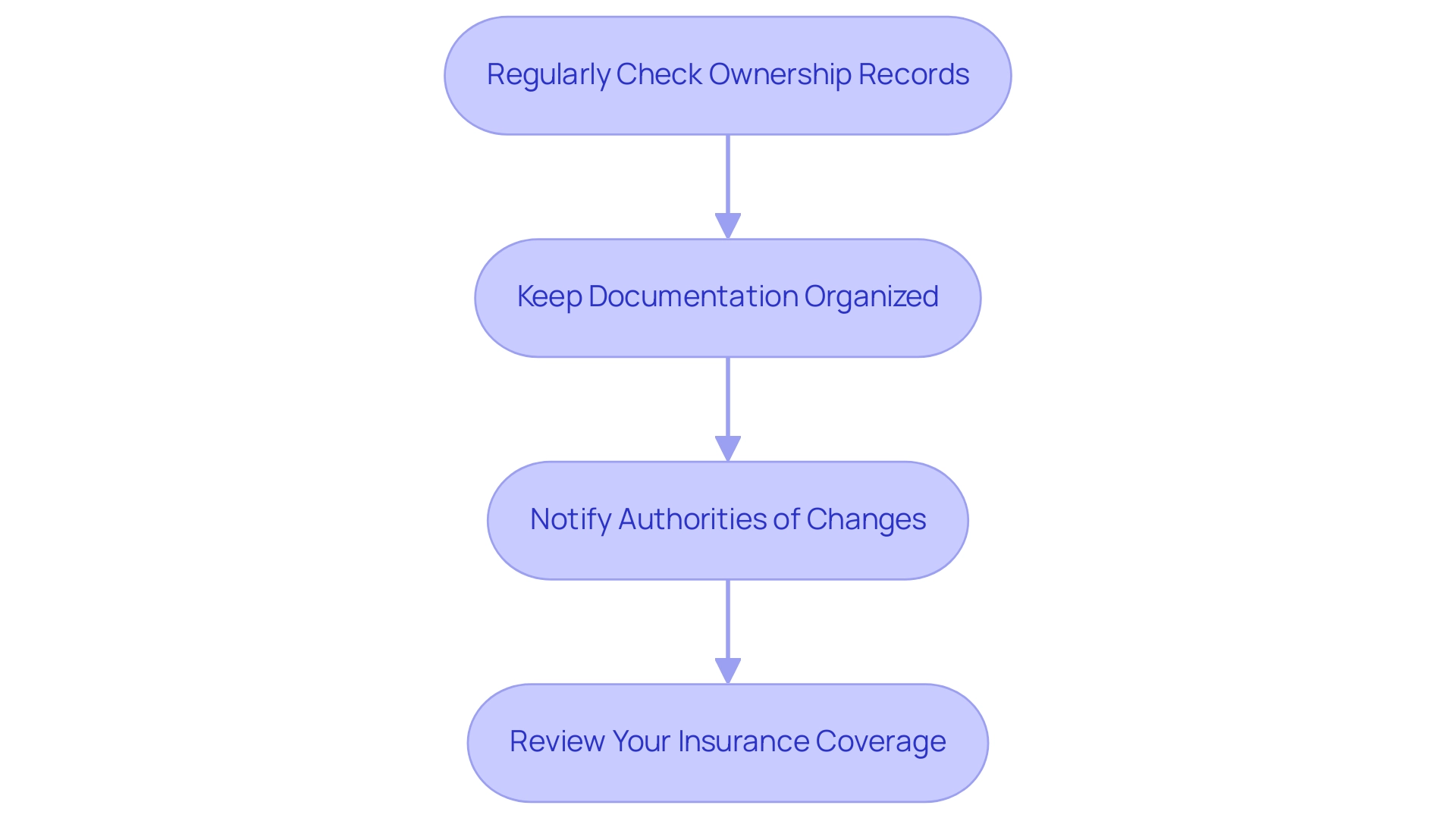

To effectively uphold your property rights and protect your possession, consider the following essential steps:

- Regularly Check Ownership Records: It is crucial to periodically review public records to verify that your ownership information is accurate and reflects any changes in ownership. A proactive approach can help identify discrepancies early, minimizing potential disputes.

- Keep Documentation Organized: Maintaining organized records of all documents related to your property—such as purchase agreements, title insurance policies, and communications regarding title issues—is vital. A report from the National Association of REALTORS highlights that while homeownership is increasing, the Black-White homeownership rate gap is the largest in a decade, indicating that many homeowners do not adequately manage their documentation, leaving them vulnerable to complications.

- Notify Authorities of Changes: When making significant modifications to your premises, including renovations or additions, it is essential to inform local authorities. This ensures that tax records are updated accurately, reflecting the true nature of your property and its value.

- Review Your Insurance Coverage: Regularly assessing your insurance protection is important to ensure it adequately safeguards your interests. This is particularly pertinent when changes occur in your life—such as marriage or divorce—or when home improvements are made. According to Bankrate, the cost of owning and maintaining a home exceeds $18,000 annually. This financial stake highlights the significance of efficient ownership management, particularly given the median selling price of homes, which is $435,000.

By remaining proactive about your property documentation, you can assist in preventing possible disputes and ensuring that your ownership stays secure. Recent trends indicate that as home equity can increase passively due to rising property values, staying informed about is crucial. By doing so, you can benefit from increased equity without requiring direct intervention, solidifying the case for diligent title record management.

Conclusion

A comprehensive understanding of house titles is essential for anyone involved in real estate, whether as a homeowner or a prospective buyer. The significance of a house title extends beyond mere ownership; it encompasses vital information regarding property rights, liens, and encumbrances that can affect financial transactions and legal standing. By mastering the various methods of holding title, conducting thorough title searches, and securing appropriate title insurance, homeowners can protect their investments against potential fraud and disputes.

Addressing common title issues, such as:

- Liens

- Boundary disputes

- Clerical errors

is critical for maintaining clear ownership and preventing future complications. Moreover, the rise of sophisticated scams necessitates increased vigilance in verifying identities and ensuring the integrity of property transactions. By adopting proactive measures—such as regularly checking title records and keeping documentation organized—homeowners can safeguard their titles and enhance their peace of mind.

In today's dynamic real estate market, the importance of diligent title management cannot be overstated. Equipping oneself with the knowledge and resources to navigate potential title challenges not only preserves ownership rights but also contributes to a smoother real estate experience. As the landscape continues to evolve, the commitment to maintaining a clear and secure house title will remain a cornerstone of successful homeownership.

Frequently Asked Questions

What is a house title and why is it important?

A house title is a legal document that outlines ownership of real estate, including details such as a description of the asset, current owners' names, and any liens or encumbrances. It is essential for establishing ownership rights, selling the property, and securing financing.

What are the risks associated with house titles?

Risks include potential legal disputes over ownership and the threat of home ownership theft, particularly for vacant properties that are less monitored. Criminals may attempt to sell these properties fraudulently, often at below-market prices.

What percentage of companies faced attempts at seller impersonation fraud recently?

A 2023 study indicated that 28% of companies faced attempts at seller impersonation fraud.

What are the common methods for holding title to a home?

The common methods include: 1. Sole Ownership 2. Joint Tenancy 3. Tenancy in Common 4. Community Property 5. Other Forms of Ownership (e.g., corporations, partnerships, trusts, LLCs)

What is Sole Ownership?

Sole Ownership allows one individual to hold title, granting them complete control and responsibility for the asset, including debts and liabilities.

What is Joint Tenancy?

Joint Tenancy allows two or more individuals to share equal rights to the asset, with the right of survivorship ensuring that an owner's interest transfers automatically to surviving owners upon their death.

How does Tenancy in Common differ from Joint Tenancy?

In Tenancy in Common, multiple individuals can hold ownership with unequal shares, and upon the death of an owner, their share is passed on according to their will or state law, rather than automatically transferring to other owners.

What does Community Property mean?

Community Property refers to property acquired during marriage that is considered jointly owned by both partners, regardless of whose name is on the title, affecting estate planning and asset division.

Why is it important to consult legal professionals regarding house title ownership?

Consulting legal professionals is crucial because the method of holding title has significant legal consequences, impacting estate planning, taxation, and liability management.