Overview

The article delivers a comprehensive overview of the meaning and significance of first liens in secured lending, emphasizing their role as primary claims held by lenders against specific assets, primarily real estate. These claims not only secure loans but also dictate the order of compensation in foreclosure situations. Furthermore, they influence interest rates and overall financing stability. This underscores the necessity for both borrowers and lenders to grasp the complexities associated with first liens in the current market landscape.

Introduction

In the intricate world of real estate finance, first liens serve as a crucial backbone for secured lending and property transactions. These legal claims not only protect lenders by ensuring their priority in recovering debts but also significantly influence the financial landscapes of borrowers. As the market evolves, understanding the nuances of first liens becomes essential for both parties involved. This article explores the mechanics of how these liens function, alongside the risks and advantages they present. By shedding light on their multifaceted nature, we aim to clarify the implications for stakeholders navigating the complex terrain of real estate financing.

Defining First Liens: An Overview of Key Concepts

A primary claim signifies a legal right held by a lender over a specific asset, most commonly , which secures a loan. This illustrates the essence of . Such legal standing empowers the lender with the primary right to seize the asset in the event of , thereby facilitating the recovery of the outstanding debt. The significance of within the realms of , particularly in grasping , is paramount, as they delineate the hierarchy of rights against a property.

In scenarios of liquidation or foreclosure, primary holders are compensated prior to any subsequent creditors, further exemplifying the first lien meaning and underscoring their critical role in risk management for lenders. As highlighted by the Mortgage Bankers Association (MBA), a thorough understanding of first lien meaning and its implications is essential for participants in , especially given the complexities of current market conditions. The MBA and Fannie Mae project that the Housing Price Index (HPI) will decrease by less than one percent by Q1 2024, indicating potential shifts in property values that could influence primary positions.

Furthermore, as of Q1 2023, the Government-backed mortgage segment revealed a notable 8.3% of low equity mortgages, contrasting with 1.5% in Enterprise acquisitions and 2.0% in Other Conventional mortgages. This disparity highlights how primary positions can and funding options. Additionally, the case study titled '' demonstrates that the elevated percentage of low equity in Government-backed mortgages is due to lower down payment requirements, which correlate with reduced initial home equity.

Consequently, it is imperative for professionals in the field to comprehend the intricacies of primary security dynamics as the landscape transitions into 2024.

How First Liens Work: Mechanics and Functionality

serve as a crucial security interest for lenders, establishing their legal right to a property should a debtor default on . Upon initiating a mortgage, the lender records against the property in public , accessible online 24/7, dating back to Book 106 from 1976. This recording process is vital, solidifying the lender's priority claim over the property in question.

In cases where an individual fails to meet repayment requirements, the lender has the right to initiate to recover outstanding debt through property sale. This mechanism not only protects lenders from potential losses but also facilitates access to , enabling them to purchase or enhance their properties. Recent insights from mortgage specialists underscore that understanding the complexities of primary claims is essential for navigating the evolving landscape of foreclosure procedures, as lenders increasingly rely on these methods to safeguard their investments.

Furthermore, historical precedents, such as the 1780 Maryland Confiscated Property Legislation, underscore the significance of in regulating land transactions and preserving . As Mrs. Adame-Clark recently stated, 'The is a testament to the ongoing relevance of land records in managing property rights.' As the mortgage lending landscape continues to evolve, maintaining knowledge of primary processes is essential for both lenders and borrowers.

To further illustrate the application of primary claims, additional case studies on how lenders utilize these mechanisms for property financing could provide valuable insights.

Advantages of First Liens: Why They Matter in Financing

offer several key benefits, making them a preferred choice for both homeowners and investors. One of the most compelling advantages is the typically reduced interest rates associated with in comparison to secondary claims or unsecured obligations. This lower rate is primarily due to lenders perceiving as less risky, given their precedence in the repayment order.

For instance, in Europe, average margins on primary institutional credits were reported at 3.96% in Q3, a decrease from 4.47% at the end of the previous year, indicating a positive trend for borrowers. Furthermore, in the unfortunate event of foreclosure, are the , significantly enhancing their security. This priority status not only boosts investor confidence but also cultivates a more stable financing environment.

The release of total statistics from NMDB fulfills legal obligations and bolsters the credibility of discussions surrounding primary borrowing. In addition, the ongoing expansion of activity in the Asia-Pacific region—where green volumes rose by 8% and sustainability-linked issuance increased by 10% year-on-year—demonstrates in environmentally conscious funding. As Singapore and Hong Kong emerge as vital centers for these credit products, primary claims remain an attractive funding option for individuals looking to .

Investors are advised to review product offering materials and seek guidance from their own advisors before engaging with products associated with , as understanding the meaning of first lien is essential for making a well-informed investment decision.

Understanding the Risks: Drawbacks of First Liens

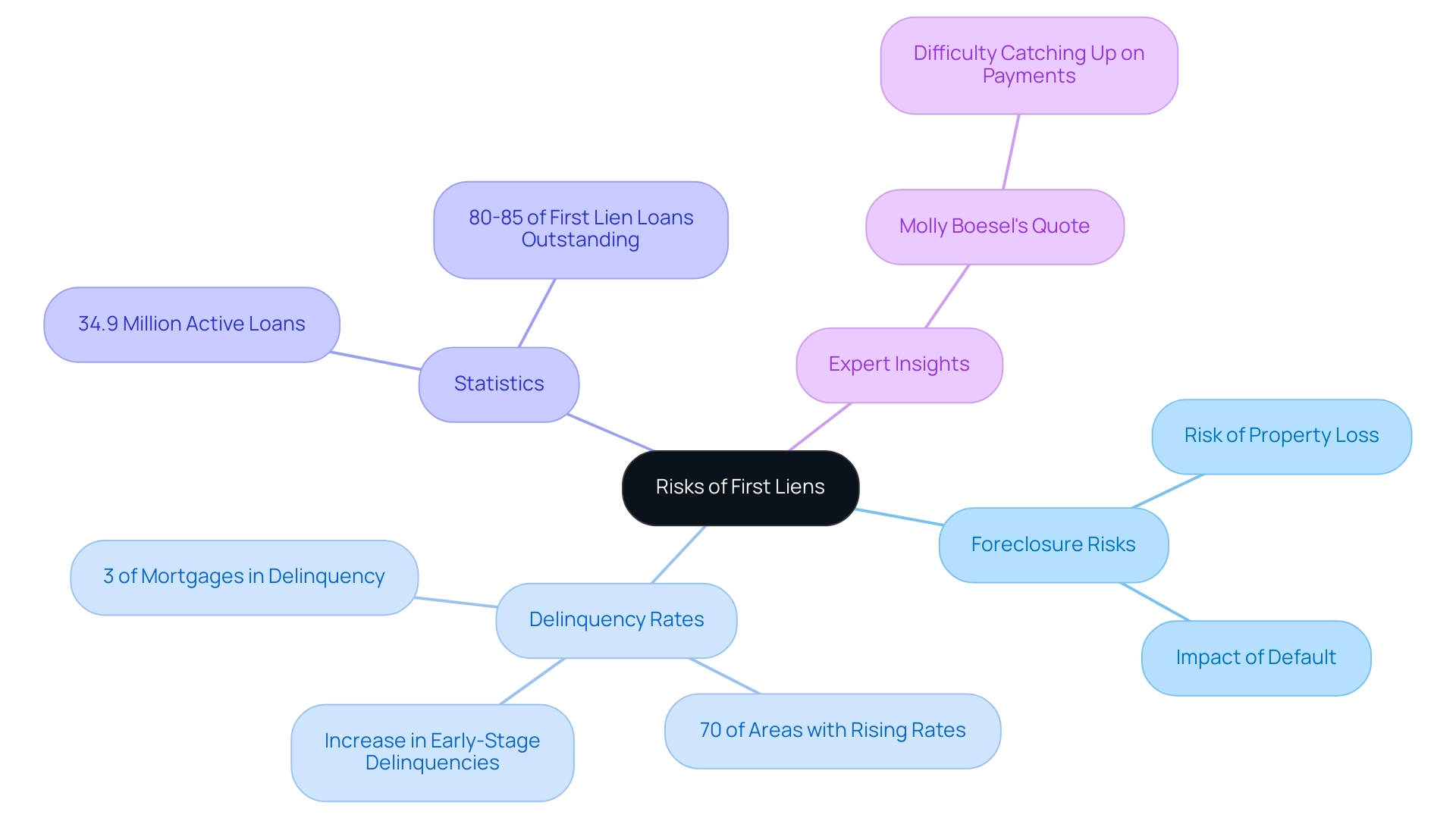

The encompasses numerous benefits for lenders, yet it also carries substantial risks that can significantly impact borrowers. One of the most pressing concerns is the , which becomes a reality if an individual defaults on their mortgage. In such scenarios, the lender is entitled to take ownership of the property, leading to the potential loss of the homeowner's residence.

Recent statistics underscore this concern; as of September 2024, , reflecting a 0.2% increase from the previous year. This trend highlights the vulnerabilities faced by , particularly with 70% of metropolitan areas experiencing . Notably, a survey represents 80 to 85 percent of all 'first lien' residential mortgage loans outstanding, emphasizing the prevalence of first lien meaning in the market.

Furthermore, while the serious delinquency rate remained unchanged, the rise in early-stage delinquencies indicates that individuals are facing mounting challenges. Molly Boesel, a senior principal economist at CoreLogic, stated, > The rise in the serious delinquency rate indicates that individuals who enter the delinquency pipeline are having difficulty catching up on their late payments <. Additionally, there are approximately 34.9 million active credits in the United States, illustrating the scale of the issue and the significance of the delinquency rates discussed.

The existence of a primary claim frequently complicates an individual's financial situation by limiting their capacity to obtain further funding. Future lenders might be reluctant to offer , placing individuals in a difficult situation when they require funds for renovations or other necessary expenses. This combination of foreclosure risks and limited financing options highlights the that individuals with primary claims often face.

Requirements for Securing a First Lien: What You Need to Know

Obtaining a involves several essential criteria that applicants must fulfill to demonstrate their creditworthiness. This includes supplying proof of income, maintaining a satisfactory credit score—typically around 700 or above for primary mortgage borrowers—and having a . Lenders meticulously assess the borrower’s to evaluate their ability to repay the debt.

Furthermore, the property in question must meet specific criteria, such as appraised value and condition, to confirm its adequacy as collateral. As noted by industry expert Chris Cordone, Both creditors are considered pari passu, or on equal footing, regarding their seniority in the capital structure for the payment and repayment of mandatory interest and principal. This underscores the importance of understanding the within the broader lending process.

In addition, have gained traction among homebuyers with limited down payment funds, contributing to increased levels of low equity within that segment. In 2022, there were 7,087 originations reported under the Home Ownership and Equity Protection Act (HOEPA), which included 3,506 home purchase credits, 272 home improvement credits, and 3,309 refinance credits. This reflects ongoing compliance and highlights the significance of consumer protections in .

By comprehending these requirements and trends, borrowers can streamline their application process and enhance their chances of securing favorable loan terms.

First Liens vs. Second Liens: Understanding Lien Hierarchy

Within the structure of claim hierarchy, primary claims hold paramount priority, superseding secondary claims and any subordinate demands. This hierarchy is essential; it dictates that in the event of foreclosure or liquidation, indicates that the first creditor is compensated before any subsequent claim holders. For instance, an investor acquiring a tax certificate at a county auction not only earns interest but also has the option to initiate foreclosure proceedings, illustrating the practical implications of priority.

In contrast, second mortgages, although secured by the property, carry elevated risk due to their subordinate status. This increased risk results in , particularly if property values decline or if the borrower fails to meet obligations. As Robert A. Riva aptly articulates,

In this series, Robert Riva navigates the nuanced and often confusing world of commercial real estate finances in New York, with practical guidance on challenges and considerations.

Furthermore, with economists anticipating a cooling U.S. housing market in 2023, becomes increasingly relevant for financial decision-making. A thorough grasp of and how first and second claims operate within this hierarchy can significantly influence financial decisions and risk assessment strategies. Additionally, case studies such as contractor claims—where builders and contractors utilize mechanic's claims to recover unpaid dues—highlight how claim hierarchy operates in practice, reinforcing the importance of this knowledge for both lenders and borrowers.

The Role of First Liens in Real Estate Transactions and Title Research

, particularly during the title research phase. Title researchers bear the responsibility of verifying that the primary claim is accurately documented and that no other claims take precedence, which could jeopardize the transaction. This verification is essential for ensuring that the buyer secures a clear title to the property and that the lender's investment remains safeguarded.

As noted by David McMillin, a participant in personal finance discussions,

This type of financing must be repaid when the individual no longer resides in the home.

This underscores the importance of . Moreover, with , borrowers incur an upfront premium alongside annual premiums, highlighting the and their verification. A thorough understanding of primary claims also aids in uncovering potential risks linked to property ownership, such as outstanding claims or disputes over ownership rights.

Furthermore, investors must be cognizant of the , which can differ by type and jurisdiction, adding another layer of complexity for title researchers. As illustrated in the case study on mortgages, comprehending the various types of mortgages, such as fixed-rate and adjustable-rate options, is vital for recognizing the broader effects of primary claims in real estate transactions. Thus, the meaning of constitutes a fundamental aspect of title research and real estate due diligence, emphasizing the necessity of of real estate transactions.

Conclusion

First liens represent a crucial element of real estate finance, offering a structured mechanism that safeguards lenders while shaping the financial landscape for borrowers. By establishing a legal claim over a property, first liens grant lenders the primary right to recover debts in the event of default, highlighting their importance in mortgage transactions. This article elucidates the mechanics of first liens, their benefits in securing lower interest rates, and the risks they present to borrowers, particularly in foreclosure situations.

As the market evolves, it becomes imperative for stakeholders to grasp the implications of first liens. The hierarchy of claims, wherein first liens supersede second liens, significantly influences financial decision-making and risk assessment. Furthermore, the prerequisites for obtaining a first lien mortgage—such as creditworthiness and adequate down payments—underscore the complexities inherent in real estate financing.

In conclusion, understanding the multifaceted nature of first liens is essential for anyone navigating the real estate market. Whether one is a lender, borrower, or investor, awareness of first lien dynamics can profoundly affect financial outcomes and investment strategies. As the landscape shifts, remaining informed about these nuances will empower stakeholders to make informed decisions, ultimately enhancing their positions in the competitive realm of real estate finance.

Frequently Asked Questions

What is a primary claim in the context of lending?

A primary claim signifies a legal right held by a lender over a specific asset, typically real estate, which secures a loan. It allows the lender to seize the asset in the event of borrower default to recover outstanding debt.

Why are primary claims significant in mortgages and secured lending?

Primary claims are crucial as they delineate the hierarchy of rights against a property. In cases of liquidation or foreclosure, primary holders are compensated before subsequent creditors, emphasizing their critical role in risk management for lenders.

How do primary claims affect the foreclosure process?

If a borrower fails to meet repayment requirements, the lender can initiate foreclosure proceedings to recover the outstanding debt through the sale of the property. This protects lenders from potential losses and provides borrowers access to essential funding.

What recent trends have been observed in the Government-backed mortgage segment?

As of Q1 2023, there was an 8.3% rate of low equity mortgages in the Government-backed segment, compared to 1.5% in Enterprise acquisitions and 2.0% in Other Conventional mortgages. This indicates how primary positions can influence overall property equity and funding options.

What historical significance do primary claims hold?

Historical precedents, such as the 1780 Maryland Confiscated Property Legislation, highlight the importance of accurately documented claims in regulating land transactions and preserving property rights.

How can professionals benefit from understanding primary claims?

A thorough understanding of primary claims and their implications is essential for navigating the evolving landscape of foreclosure procedures and mortgage lending, enabling both lenders and borrowers to manage their rights and investments effectively.