Introduction

An estoppel certificate serves as a critical tool in real estate transactions, particularly when a property, such as a rental house, is changing hands. This document is a snapshot of the relationship between a tenant and landlord, confirming the validity of a lease and clarifying the terms, responsibilities, and any outstanding obligations. Its importance is underscored in scenarios where the property status must be transparent to potential buyers or financial institutions.

Additionally, in the burgeoning realm of Real-world assets (RWAs) tokenized on blockchain platforms, the estoppel certificate becomes a bridge between tangible property rights and their digital representations. This ensures token holders are protected against risks, including the fraudulent behaviors sometimes encountered in traditional real estate dealings. In a market where understanding the nuances of transactions is paramount, the reliability of an estoppel certificate is backed by statistics from leading real estate service providers like Savills.

With a global presence and a wealth of experience, these organizations underscore the importance of detailed research and analysis in facilitating secure real estate decisions. Real estate law experts also emphasize the value of such documentation in transactions. A qualified attorney can use the information within an estoppel certificate to review and negotiate contracts, providing clients with the expertise necessary to navigate the complexities of property law.

This role is vital in protecting the interests of all parties involved, from tenants and landlords to buyers and investors.

What is an Estoppel Certificate?

An serves as a critical tool in , particularly when a property, such as a rental house, is changing hands. This document is a snapshot of the relationship between a tenant and landlord, confirming the validity of a lease and clarifying the terms, responsibilities, and any outstanding obligations. Its importance is underscored in scenarios where the property status must be transparent to potential buyers or financial institutions.

For example, consider a rental home put on the market; the estoppel certificate would provide a clear picture of the lease conditions, safeguarding the rights of the current tenants and informing the potential new owners. It could highlight any specific requests or concerns, such as maintaining the privacy of personal items during the sale process, as expressed by tenants like Anabel and her family.

Additionally, in the burgeoning realm of Real-world assets (RWAs) tokenized on blockchain platforms, the estoppel certificate becomes a bridge between tangible and their digital representations. This ensures are protected against risks, including the fraudulent behaviors sometimes encountered in traditional real estate dealings.

In a market where understanding the nuances of transactions is paramount, the reliability of an estoppel certificate is backed by statistics from leading like Savills. With a global presence and a wealth of experience, these organizations underscore the importance of detailed research and analysis in facilitating secure real estate decisions.

also emphasize the value of such in transactions. A qualified attorney can use the information within an estoppel certificate to review and negotiate contracts, providing clients with the expertise necessary to navigate the complexities of property law. This role is vital in protecting the interests of all parties involved, from tenants and landlords to buyers and investors.

Purpose and Components of Estoppel Certificates

An functions as a key instrument to ensure transparency and safeguard interests in dealings. It serves as an authoritative snapshot of the lease's current status, capturing critical details like the lease term, rent payments, security deposits, and maintenance duties, along with any modifications or ancillary accords. The certificate is a pivotal document that provides assurances not only about the but also about the absence of disputes between the landlord and tenant.

For instance, in the sale of a rental property, the estoppel certificate would confirm that the landlord has fulfilled their obligations, and the tenant has no claims that could affect the transaction. Such assurances are particularly valuable in complex situations like acquiring Akiya properties in Japan or when involve remote notarization and registration, as is becoming common in regions like Uzbekistan. As real-world assets increasingly intertwine with digital realms through blockchain tokenization, the role of estoppels becomes even more critical, offering a layer of legal protection against discrepancies and fraudulent activities.

This utility is underscored by the expertise of , whose role in reviewing, drafting, and negotiating real estate contracts is indispensable. Their specialized knowledge in real estate law, as highlighted by industry-leading firms like Savills, ensures that all contractual terms are precise and enforceable. Thus, an is a strategic tool that complements the skills of legal professionals in providing clarity and stability to the dynamic landscape of real estate transactions.

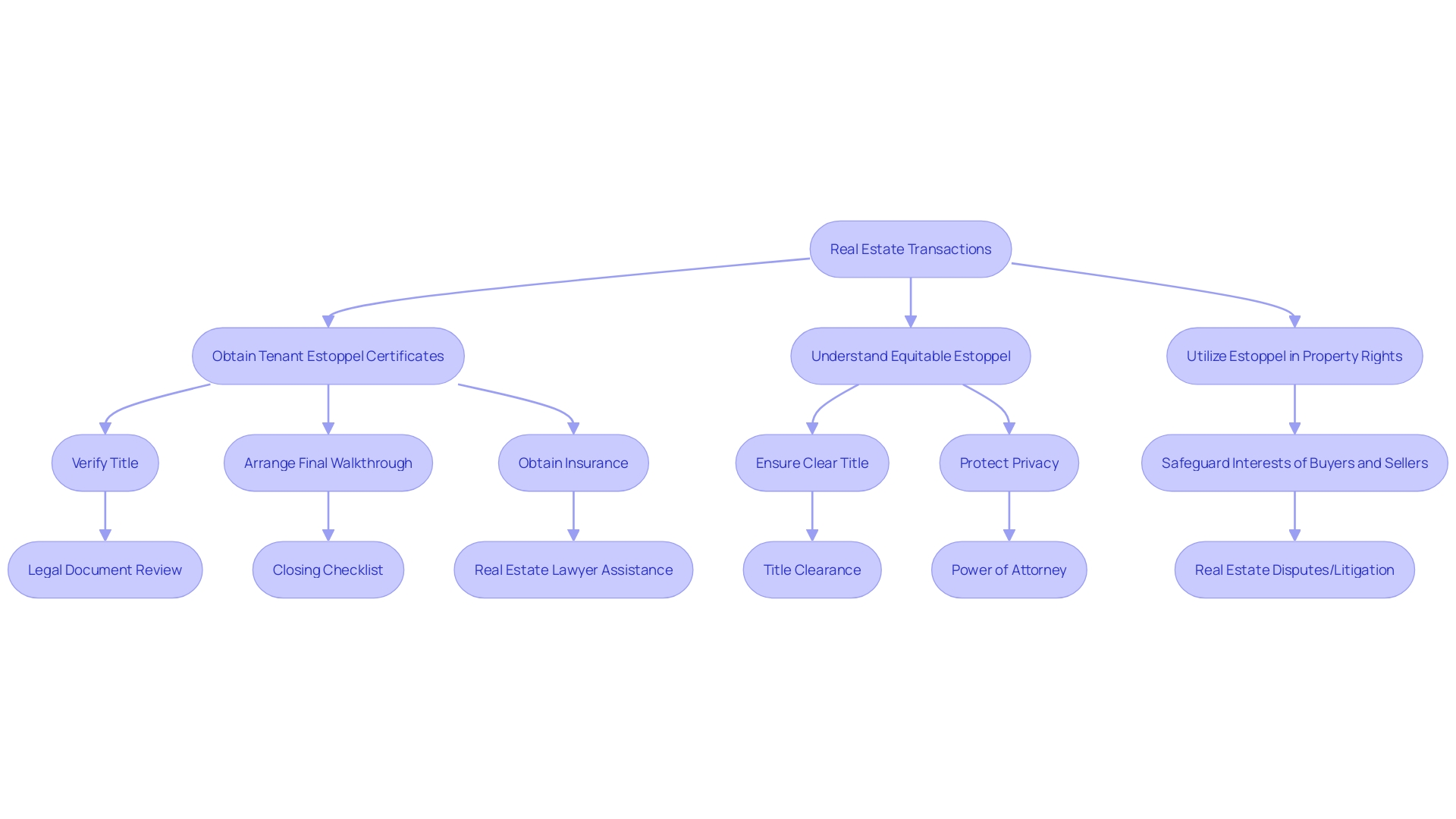

Types of Estoppel in Real Estate

In the realm of real estate transactions, navigating the nuances of estoppel certificates is crucial. For instance, serve as a key form of assurance, wherein tenants confirm the particulars of their lease agreement, which can be pivotal during the sale or financing of the property.

In a case where a family residing in a rented home faced the prospect of their personal space being publicly displayed online due to a sale, a tenant estoppel might have formally outlined the tenant's rights and the landlord's obligations, thus safeguarding the family's privacy.

is another essential concept that plays a defensive role, barring parties from contradicting previous statements or actions if it would harm the other party who relied on those representations. This principle ensures fairness and consistency, especially in complex transactions involving property rights and ownership claims.

Understanding the intricacies of these is not just academic; it has practical implications. For instance, a warranty deed, which is fundamental in property sales, guarantees that the seller holds clear title to the property. An estoppel could further reinforce this by preventing the seller from later claiming otherwise, thus protecting the buyer's interests.

The importance of such legal safeguards is echoed by , who emphasize the significance of expertise in property law. As one expert puts it, 'Real estate law is intricate and varies from state to state. A qualified real estate attorney possesses in-depth knowledge of the legalities involved in property transactions, ensuring that your rights and interests are protected throughout the process.'

Statistics underscore the relevance of understanding legal instruments like estoppel; for example, recent data shows that only 28% of Americans who aimed to buy a home in 2023 succeeded, and a significant number of non-homeowners (83%) are barred from purchasing due to financial constraints. In such a competitive market, clear and enforceable legal agreements are more important than ever to ensure transactions proceed smoothly and without dispute.

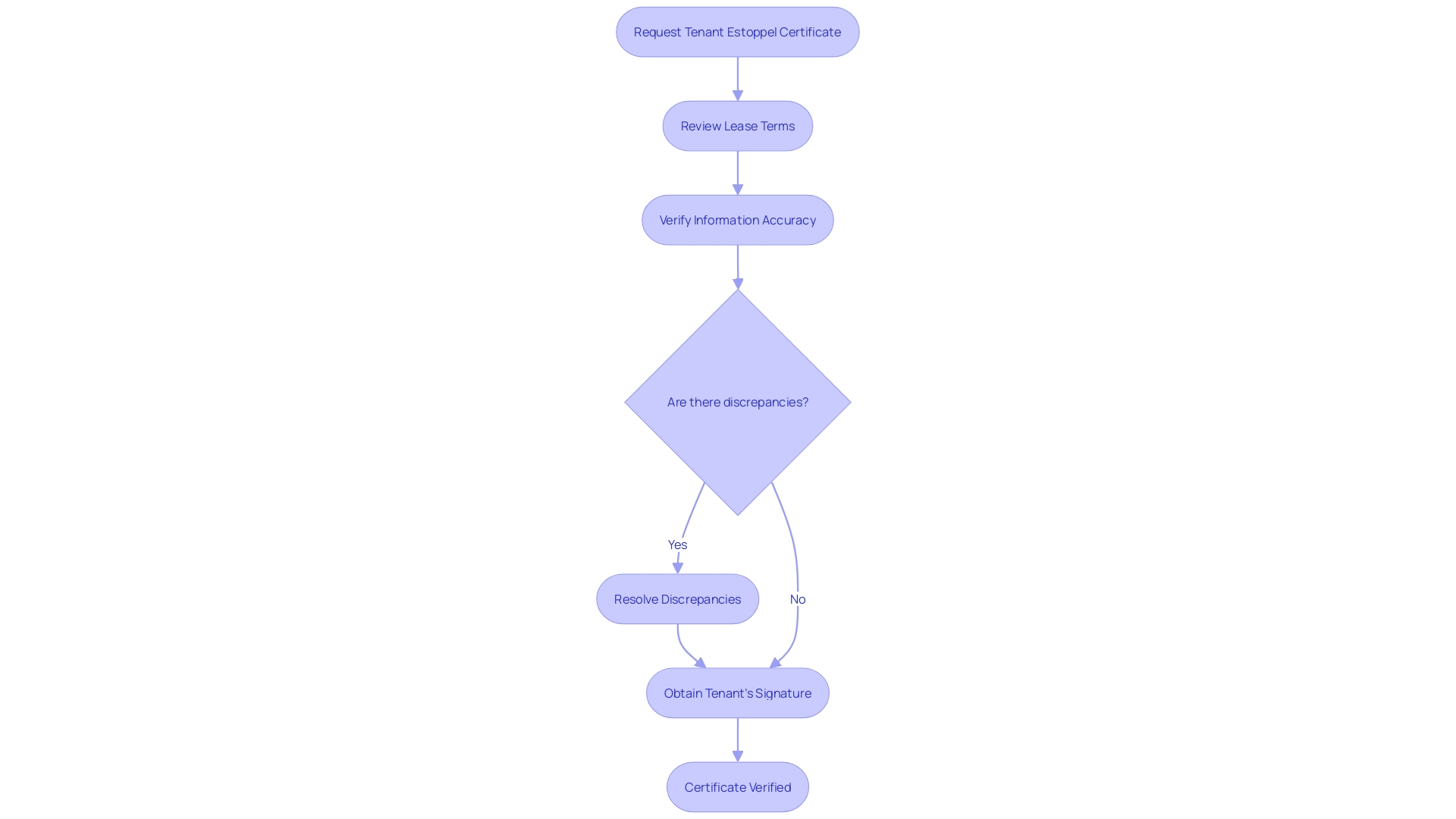

Tenant Estoppel Certificates: Protecting Interests

are a pivotal component in safeguarding the rights and responsibilities within a . They serve not only as a confirmation for tenants to acknowledge their current but also offer a layer of security to buyers and lenders by affirming the lease's validity and enforceability. This documentation becomes especially relevant in light of the complex history and evolving legal landscape surrounding property rights and tenant protections.

For example, the intricate details of Sec. 51, which applies to specific property conversions, underscore the necessity for clear and precise documentation in real estate dealings. Similarly, cases like the one involving Jovita Cuevas' apartment—rooted in a rich historical context—highlight the importance of understanding the particularities of each property's history.

With the dynamics of the housing market, as reflected in recent news about significant sales in San Jose and the challenges faced by renters across the U.S. due to financial constraints, stand as a critical tool. They ensure tenants are well-informed about their lease obligations while providing crucial assurance to other parties involved in the transaction. Tenants should scrutinize the estoppel certificate meticulously before signing to confirm its accuracy, thus avoiding any potential disputes or misunderstandings that could arise from inaccuracies in the lease agreement.

Estoppel Clauses in Lease Agreements

are critical tools in , functioning as legally binding confirmations that certain facts associated with a lease are correct as of the date of the certificate's issuance. They serve to clarify and confirm the current status of a lease, particularly for landlords, prospective purchasers, or financial institutions involved in a property. The inclusion of an within a lease agreement obligates a tenant to provide this certificate when requested, often within a specified period.

Failure to comply with such a request can lead to significant for the tenant.

The significance of these clauses is underpinned by the potential legal and financial ramifications of lease terms that are either misunderstood or inaccurately recorded. As evidenced in a situation described in 'Next Level Real Estate Asset Protection,' Dan's experience with a lease option agreement highlights the complexities inherent in such arrangements. Inaccuracies or misinterpretations in contract terms can lead to costly disputes and legal challenges, as seen in the case of the Barrington Plaza eviction proceedings.

The term 'permanent' became a point of legal contention, illustrating how the precise language used in contracts can dramatically affect the outcomes of real estate dealings.

The importance of estoppel certificates extends beyond individual cases to the broader . Savills, a leading real estate service provider, emphasizes the imperative of having to make informed decisions and unlock real estate value. The company's global experience reinforces the notion that understanding the intricacies of and the role of estoppel certificates is not a mere formality but a fundamental aspect of safeguarding property transactions.

For professionals engaged in the transfer or financing of leasehold interests, such as business brokers and sellers, the estoppel certificate provides a layer of protection. It assures that the lease terms, as represented, are indeed as stated, and that there are no undisclosed conditions that could affect the transaction. As the legal landscape of real estate continues to evolve, the emphasis on precise contract terms and the use of estoppel certificates will remain pivotal in maintaining the integrity and reliability of property transactions.

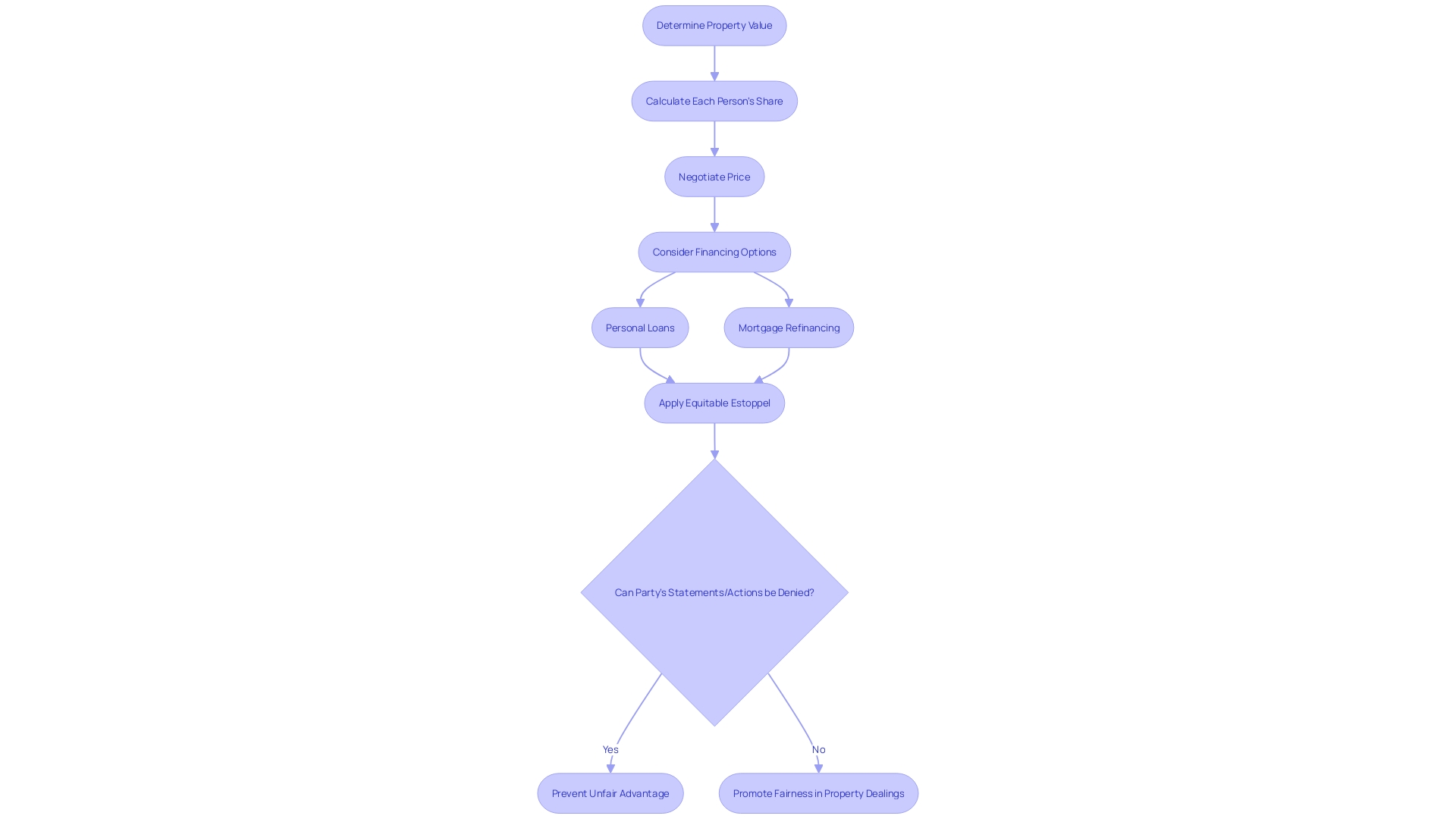

Equitable Estoppel: Preventing Unjust Enrichment

The concept of equitable estoppel plays a critical role in real estate transactions, acting as a safeguard against inconsistencies and unfair advantages. At its core, this legal doctrine prevents a party from denying or contradicting their previous statements or actions if another party has reasonably relied on them to their detriment. For instance, if a landlord has agreed to certain lease terms with a tenant, equitable estoppel could prevent the landlord from later asserting different terms that would unfairly disadvantage the tenant.

This principle enforces fairness and protects against .

Real-world examples underscore the importance of equitable estoppel in property disputes. Take, for example, the historic case of Bruce's Beach in California, where Willa and Charles Bruce had their property unjustly seized through eminent domain in the 1920s, despite their efforts to maintain their rightful ownership. Similarly, Orlando Capote's battle in Coral Gables to preserve his family home against overwhelming development pressure illustrates the tension between individual property rights and broader commercial interests.

These cases, along with countless others, highlight the complexities of property rights and the need for legal mechanisms like equitable estoppel to maintain fairness in real estate dealings. The principle not only supports individuals in retaining their property interests but also provides a framework for ensuring transactions are conducted ethically and equitably, reflecting the industry's integrity and the values upheld by professionals within it.

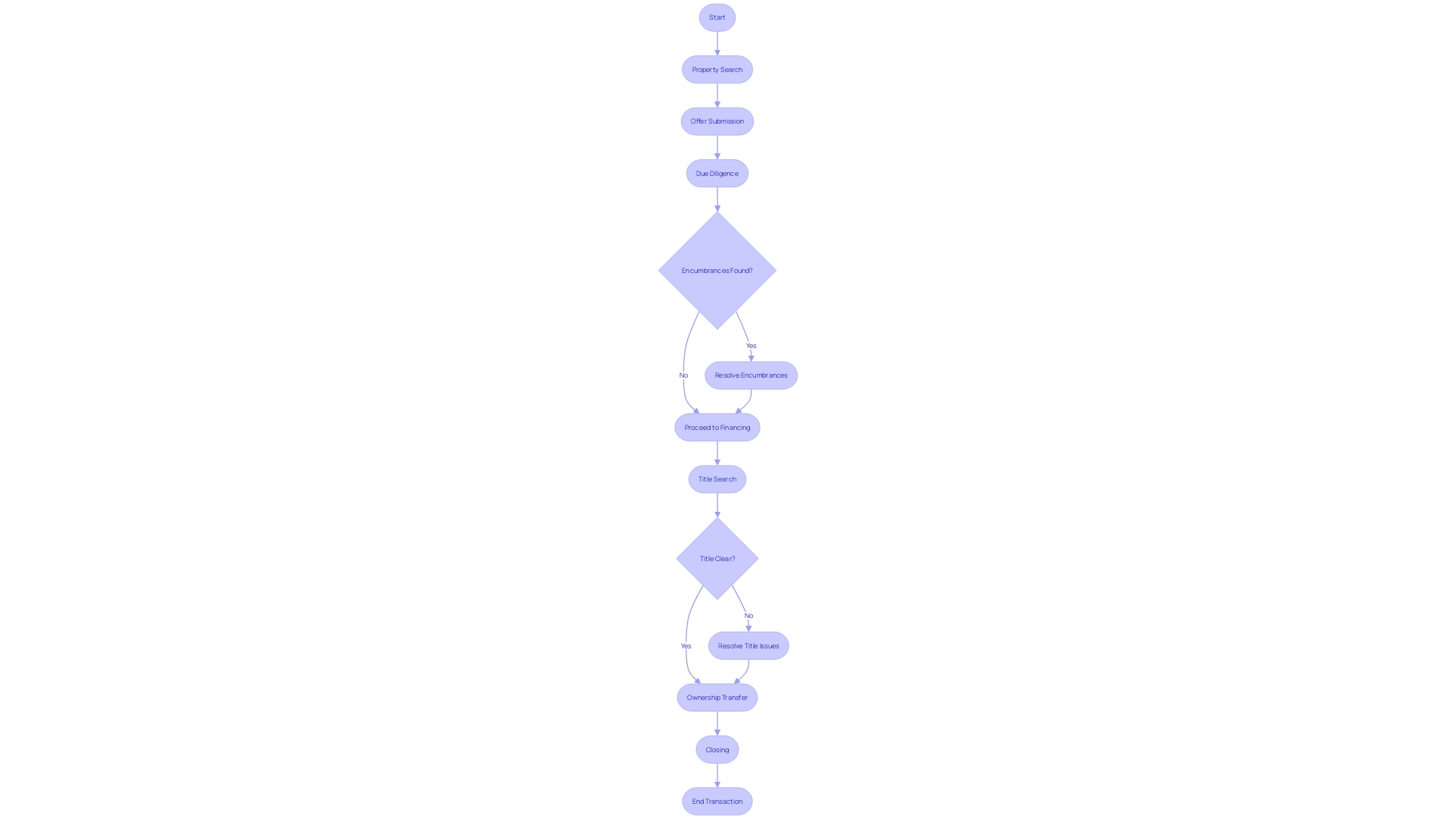

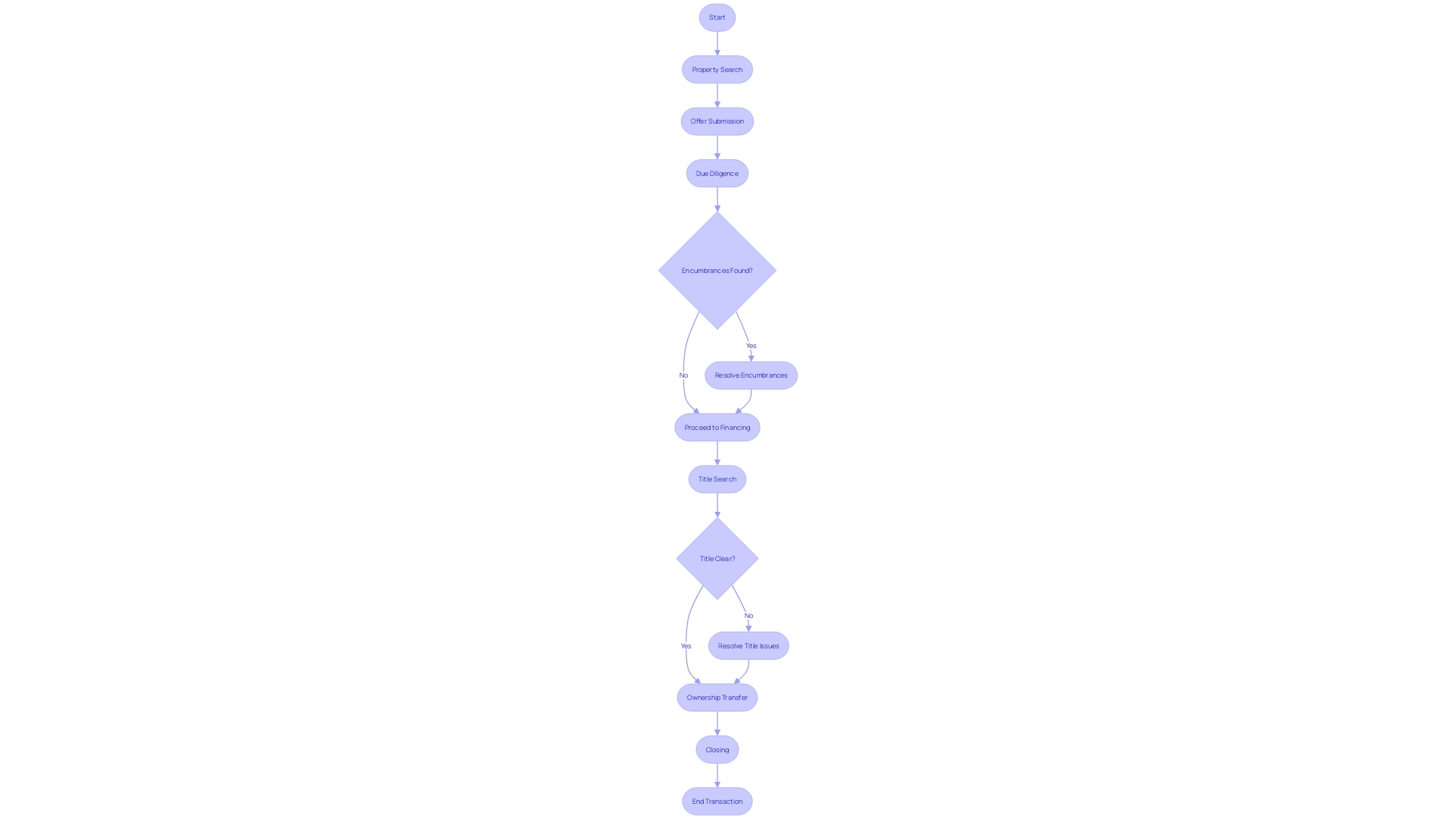

Use Cases for Estoppel Certificates

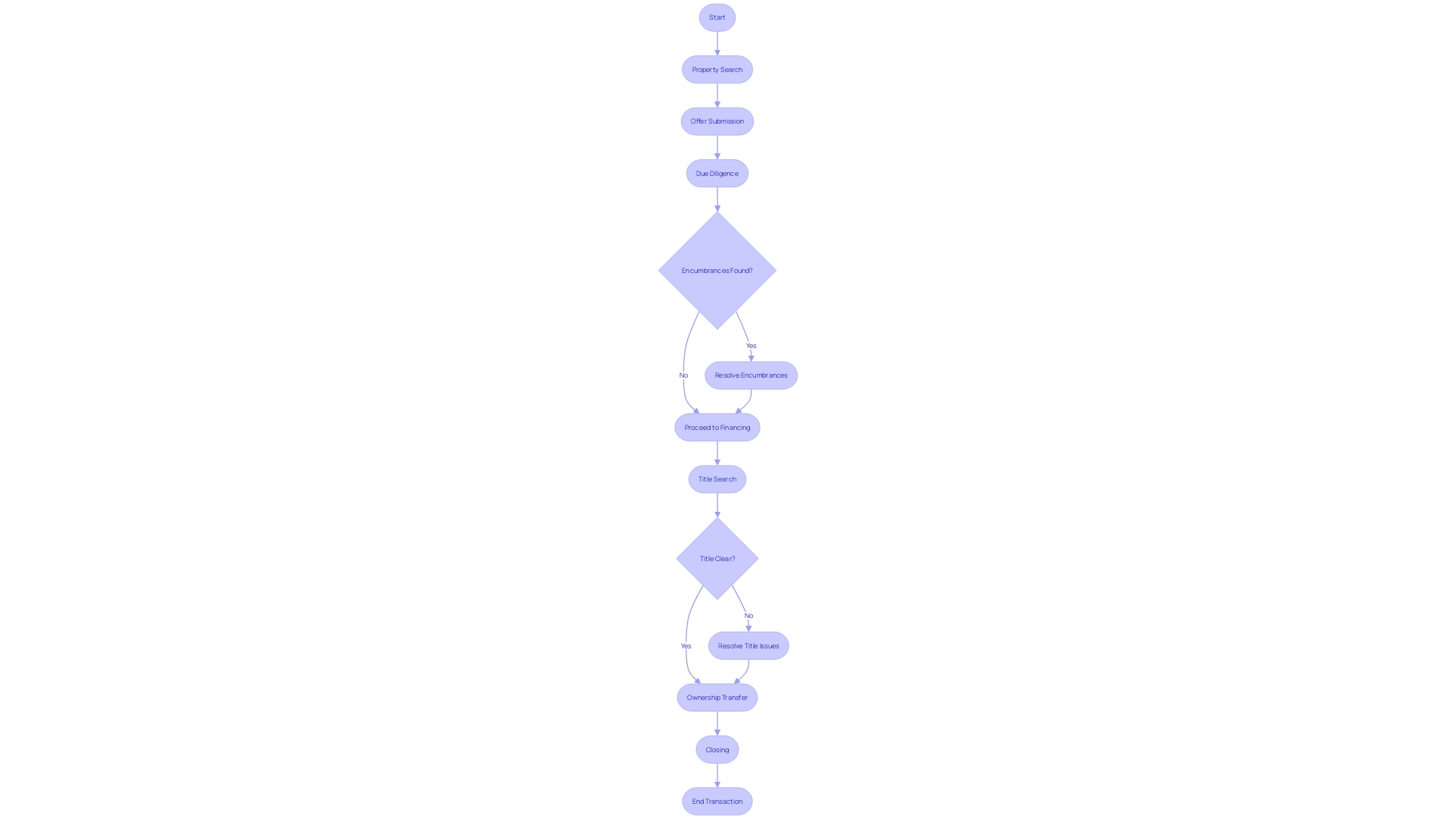

Estoppel certificates play a pivotal role in the realm of real estate, serving as critical documents during transactions that involve leased properties. These certificates are particularly indispensable when it comes to the sale of properties that have existing tenants, the refinancing of properties bound by current leases, and the meticulous verification of lease terms amid the due diligence phase of property transactions.

Fundamentally, an estoppel certificate is a document that clarifies and confirms the status and terms of a lease between tenants and landlords. This can be instrumental in preemptively addressing potential conflicts by providing an accurate representation of the lease terms agreed upon by both parties. For instance, a tenant's acknowledgment of not having any claims against the landlord, such as unaddressed maintenance issues, can prevent future legal disputes.

The certificate conveys crucial information, such as the lease commencement and expiration dates, rent amounts, security deposit details, and any amendments or concessions that may have been negotiated. By memorializing these particulars, estoppel certificates safeguard the interests of all parties involved in the transaction, including buyers, sellers, and lenders.

This documentation is not only a practical tool for confirming existing lease terms but also serves as an assurance for lenders and buyers by attesting that there are no hidden clauses or disputes that could jeopardize the transaction. Its significance is further underscored by case studies demonstrating the complexities that can arise from ambiguous property rights and entitlements.

For example, in the case of Orlando Capote, who valiantly defended his family home against encroaching development, the precise documentation and understanding of property rights could have potentially eased the conflict. Similarly, legal precedents emphasize the importance of clear entitlements and the role they play in property development and transactions.

The utility of estoppel certificates extends beyond individual cases and into broader market trends, where they ensure transactional transparency and contribute to the overall integrity of real estate dealings. In a fast-paced market, where substantial investments like the reported $3.4 million home sale in San Jose are commonplace, the clarity provided by these certificates is invaluable.

In essence, estoppel certificates are essential instruments that enable smoother and more informed real estate transactions by providing a transparent snapshot of lease obligations and rights, thus fostering trust and confidence among all parties involved.

Benefits for Landlords, Tenants, Buyers, and Lenders

Estoppel certificates play a pivotal role in real estate transactions by providing assurance and transparency to various stakeholders. Landlords utilize these documents to validate lease agreements and safeguard their property rights. For tenants, estoppels serve as a clear record of their responsibilities, reducing ambiguities and disputes.

In the realm of property sales, buyers and financiers leverage estoppel certificates to evaluate the investment quality and potential liabilities of real estate assets. The certificates act as a snapshot of the , revealing any discrepancies or encumbrances that could affect the transaction. This level of clarity is invaluable for all parties, contributing to smoother and more confident exchanges in the property market.

Timeframes and Deadlines for Submitting Estoppel Certificates

In real estate transactions, the adherence to specific timeframes and deadlines for submitting estoppel certificates is crucial. These deadlines are often clearly defined within and play a pivotal role in ensuring a seamless transaction flow. An example highlighting the significance of timely actions in real estate can be drawn from a residential property that was put up for sale.

The agent informed the tenants that photographs would be taken for online listing purposes. The tenants, aware of the process, engaged with the photographer to address privacy concerns well before the scheduled photo session, thereby demonstrating proactive management of the transaction-related activity. In this vein, overlooking the submission deadlines for estoppel certificates can lead to unnecessary delays, and in some instances, may even jeopardize the transaction altogether.

The importance of adhering to these timelines cannot be understated, as they are the foundation for a successful and prompt conclusion of real estate dealings.

Consequences of Not Signing or Returning an Estoppel Certificate

The role of estoppel certificates in real estate transactions is both pivotal and multifaceted. Tenants and landlords need to be acutely aware of their contractual obligations, as non-compliance can lead to severe ramifications. Tenants, for example, may find themselves in violation of their lease terms, potentially inviting legal repercussions.

Landlords, on the other hand, might encounter impediments when attempting to sell or refinance their properties, given that estoppel certificates are frequently a prerequisite for the due diligence efforts of prospective buyers or financial institutions.

An estoppel certificate serves as a confirmation of the current lease terms and conditions, and it clarifies the relationship between the landlord and tenant. It's a snapshot of the lease's status, confirming that it is in effect and there are no undisclosed issues. Notably, during a property sale, if a lease option—a contract permitting a tenant the choice to purchase the property later—is in place, precision in contract language is critical.

Any oversight might lead to disputes and complicate the transaction.

Moreover, contingencies, which are conditions outlined in a purchase agreement that must be met before a real estate transaction can proceed, play a vital part in safeguarding the interests of both parties. A real estate contingency might encompass a multitude of scenarios, such as securing a mortgage, satisfactory home inspections, or the sale of a prior home. If contingencies are not met, they offer a legitimate basis for withdrawing from the deal with minimal consequences.

Real estate transactions are complex, and the significance of legal expertise cannot be overstated. A real estate attorney's proficiency in navigating property law, local regulations, and contract negotiations is invaluable. They ensure that the interests of their clients are comprehensively .

Lastly, the real estate market is dynamic, as evidenced by notable sales like a recent $3.4 million home transaction in San Jose, indicating the high-stakes nature of property dealings. In this ever-evolving landscape, staying informed and understanding the intricacies of real estate documents such as estoppel certificates can mean the difference between a successful transaction and an entangled legal situation.

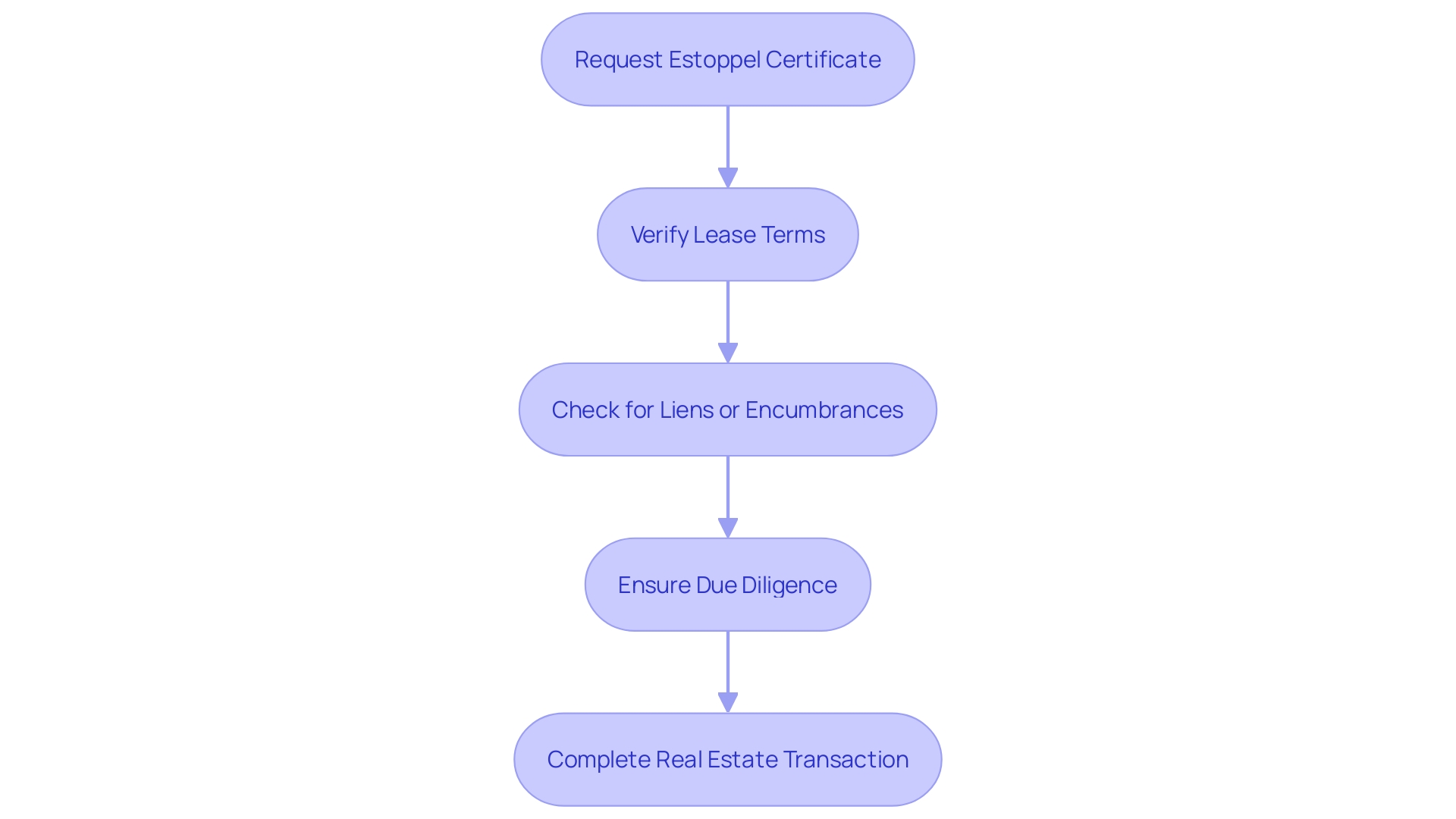

Best Practices for Handling Estoppel Certificates

Navigating the complexities of requires a meticulous approach to legal documents, with estoppel certificates being a prime example. These certificates play a crucial role in confirming the status of property leases and identifying any outstanding obligations. For a transaction to proceed without hindrances, it is imperative that all parties involved meticulously review, verify, and address any issues within these documents in a timely manner.

The cannot be overstated. An estoppel certificate, when correctly executed, serves as a legally binding affirmation of the lease's status, which can prevent future disputes. Therefore, parties must ensure that the information is a true reflection of the lease terms, and any discrepancies must be addressed immediately to protect all stakeholders involved.

Moreover, is often advisable. Real estate attorneys are equipped to navigate the legal intricacies of property law, offering a safeguard against potential legal pitfalls. They are adept at drafting, reviewing, and negotiating the terms within these certificates to ensure that they align with current laws and regulations.

The dynamic landscape of real estate law calls for a collaborative effort to maintain fluid transactions. Open communication throughout the process is paramount, as it fosters a transparent environment where concerns can be promptly resolved. This cooperative approach is akin to the to mitigate the risk of catastrophic wildfires in California, where understanding and addressing the sources of risk are critical for safety and reputation.

In essence, the handling of estoppel certificates is a delicate balancing act that demands attention to detail, proactive communication, and, when necessary, professional legal intervention. By adhering to these best practices, parties can ensure a more secure and efficient real estate transaction process.

HOA Estoppels: Ensuring Clear Title and Smooth Transactions

Homeowners Association (HOA) estoppels are indispensable documents in property transactions, especially for homes within HOA-governed communities. These certificates detail any pending fees, assessments, or financial responsibilities tied to the property. The is underscored by the that in Texas alone, 1 in 3 owner-occupied homes fall under the jurisdiction of an HOA.

The clarity provided by HOA estoppels is not only about financial dues but also adherence to community rules which 'run with the land,' as highlighted by attorney Nick Veach, emphasizing the gravity of these documents for . In complex real estate landscapes, where developments like the case in Coral Gables occur, where homes become encircled by commercial structures, or where the legality of HOA policies like annual garage inspections are questioned, HOA estoppels serve as a definitive resource for within the community, ensuring transparency and facilitating smoother transactions for all stakeholders.

Conclusion

Estoppel certificates are critical tools in real estate transactions, providing a snapshot of the relationship between tenants and landlords and confirming the validity of a lease. They ensure transparency, safeguard interests, and protect against fraudulent behaviors. Backed by leading real estate service providers like Savills, estoppel certificates are reliable and backed by extensive research and analysis.

Real estate law experts emphasize the value of estoppel certificates in transactions. Attorneys use the information within them to review and negotiate contracts, protecting the interests of all parties involved. These certificates capture critical lease details and confirm the absence of disputes, providing assurance to buyers and lenders.

Different types of estoppel, such as tenant estoppel certificates and equitable estoppel, play significant roles in safeguarding property rights and maintaining fairness. Tenant estoppel certificates affirm the validity and enforceability of leases, while equitable estoppel prevents parties from contradicting previous statements or actions that would harm others who relied on them.

Adhering to specific timeframes and deadlines for submitting estoppel certificates is crucial for seamless transactions. Non-compliance can lead to delays or jeopardize the transaction. Accuracy and legal expertise are essential in navigating the complexities of property law and protecting all parties involved.

In conclusion, estoppel certificates are pivotal in real estate transactions, providing assurance, transparency, and protection. They enable smoother transactions, foster trust and confidence, and ensure clarity, integrity, and efficiency. With their reliability and ability to safeguard interests, estoppel certificates are indispensable in the dynamic landscape of real estate.

Frequently Asked Questions

What is an estoppel certificate?

An estoppel certificate is a document that outlines the relationship between a tenant and landlord, confirming the validity of a lease and detailing terms, responsibilities, and obligations. It is crucial in real estate transactions, ensuring transparency for potential buyers and financial institutions.

Why is an estoppel certificate important in real estate transactions?

Estoppel certificates provide a clear picture of lease conditions, protecting tenants' rights and informing prospective buyers about any obligations or claims. They are especially important in situations such as property sales or financing.

What are the main components of an estoppel certificate?

Key components include: Lease term and expiration dates, Rent payment details, Security deposits, Maintenance responsibilities, Confirmation of any disputes or modifications to the lease.

How do estoppel certificates protect tenants?

Tenant estoppel certificates confirm lease terms and landlord obligations, safeguarding tenants' rights during property transactions and helping to prevent future disputes.

What role do equitable estoppels play in real estate?

Equitable estoppel prevents parties from contradicting previous statements or actions if another party relied on them to their detriment. This principle ensures fairness and consistency in property rights.

What are the consequences of not signing or returning an estoppel certificate?

Failure to comply can lead to legal ramifications for tenants, such as lease violations, and may hinder landlords from selling or refinancing properties, as estoppel certificates are often required for due diligence.

How do estoppel clauses in lease agreements function?

Estoppel clauses obligate tenants to provide an estoppel certificate upon request, often within a specified timeframe. Non-compliance can lead to significant legal implications.

What are HOA estoppels, and why are they important?

HOA estoppels detail any pending fees or responsibilities related to properties within Homeowners Association-governed communities. They ensure clarity regarding financial obligations and adherence to community rules, which is vital for maintaining clear property titles.

What best practices should be followed when handling estoppel certificates?

Best practices include: Thoroughly reviewing and verifying the information in the certificate, Addressing discrepancies immediately, Seeking legal expertise to navigate complexities and ensure compliance with laws.

How do estoppel certificates contribute to smoother transactions?

Estoppel certificates provide a transparent snapshot of lease obligations and rights, fostering trust and confidence among all parties involved, thus facilitating smoother real estate transactions.