Introduction

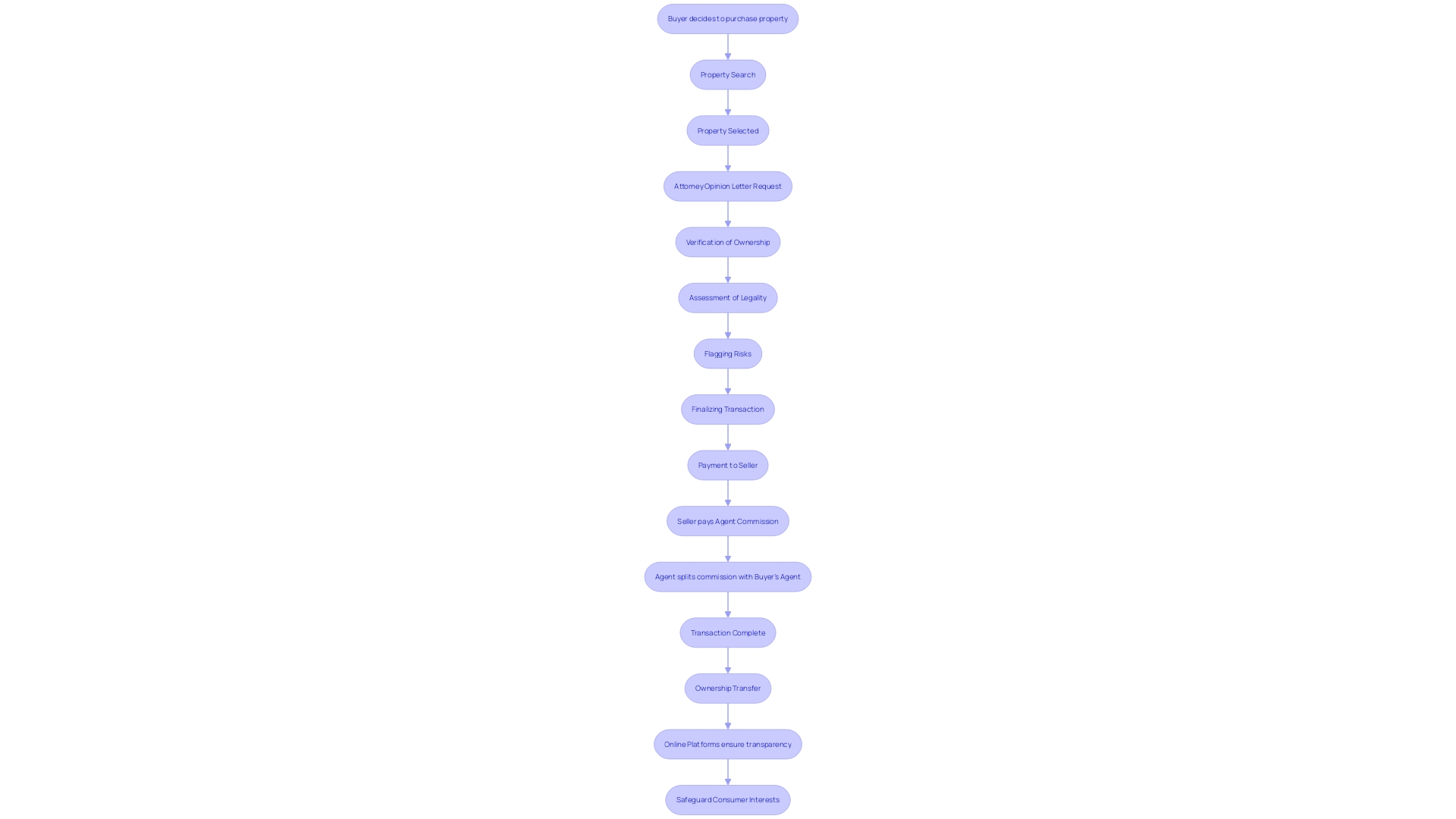

Attorney Opinion Letters (AOLs) are vital in real estate transactions, providing an attorney's professional judgment on a property's title. These legal opinions play a critical role in confirming the legitimacy and transferability of a property title, offering a deep dive into ownership intricacies and identifying potential risks. In a market where traditional commission structures are being questioned, AOLs provide transparency and protect consumer interests.

With the increasing use of online platforms for homebuying, AOLs are essential in certifying title soundness. This article explores the advantages of AOLs, key differences between AOLs and title insurance, risks and limitations of AOLs, guidelines for AOLs set by Fannie Mae, eligibility criteria, and regulatory considerations and industry perspectives on AOLs. Understanding the importance of AOLs in real estate transactions is crucial for navigating the evolving landscape and ensuring the protection of property rights.

What are Attorney Opinion Letters (AOLs) in Real Estate?

In the domain of property transactions, (AOLs) are essential instruments that communicate an attorney's professional assessment regarding the ownership of a property. Such evaluations are created by specialists in property law and are crucial for lenders, buyers, and sellers to verify the legality and transferability of a . They act as a safeguard, providing a deep dive into the and flagging possible risks that could impact the transaction.

These legal opinions are becoming increasingly significant in a market where traditional commission structures are under scrutiny. Recent legal challenges, such as the case of Burnett et al. v. NAR et al., have brought to light concerns about inflated commissions through the use of multiple-listings services. This highlights the significance of in ensuring transparency and safeguarding consumer interests.

Furthermore, in the ever-changing field of real estate transactions, where 41% of purchasers begin their search online and 95% utilize digital tools in their quest for a home, the is crucial. As online platforms become the primary avenue for homebuying, the clarity and assurance offered by online listing services are invaluable assets for navigating this evolving digital terrain.

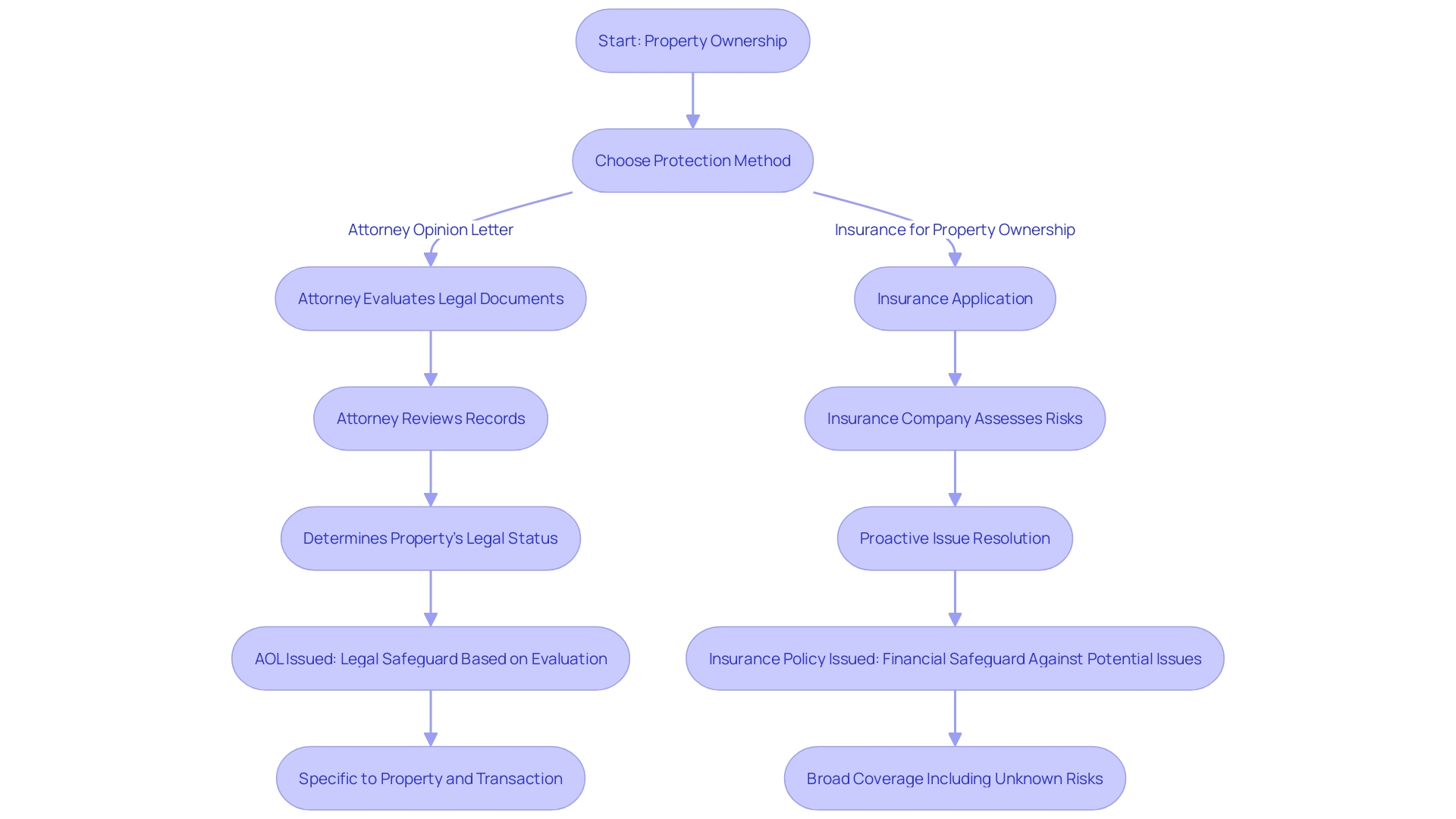

Key Differences Between Attorney Opinion Letters and Title Insurance

(AOLs) and insurance both play pivotal roles in safeguarding property ownership, yet they differ fundamentally in approach and coverage. An AOL represents the attorney's expert evaluation of the property's legal status based on an examination of , offering a professional judgment on the validity of the property's ownership. On the other hand, is a risk management instrument that offers a financial protection against losses caused by defects in ownership, such as unresolved liens, fraud, or errors in the public record. It ensures that any pre-existing issues are addressed before a property transaction concludes. Furthermore, insurance of ownership stands out due to its —companies specializing in ownership matters work diligently to resolve potential issues before they become problematic, which is reflected in the lower claim rates compared to other insurance types. This unique approach of proactively safeguarding ownership rights emphasizes the importance of insurance in . Significantly, , a prominent entity in the industry, has played a key role in of property and settlement solutions by utilizing more than a century of experience, advanced technologies, and comprehensive data assets, contributing to a more secure and efficient market for property owners.

Advantages of Using Attorney Opinion Letters in Real Estate Transactions

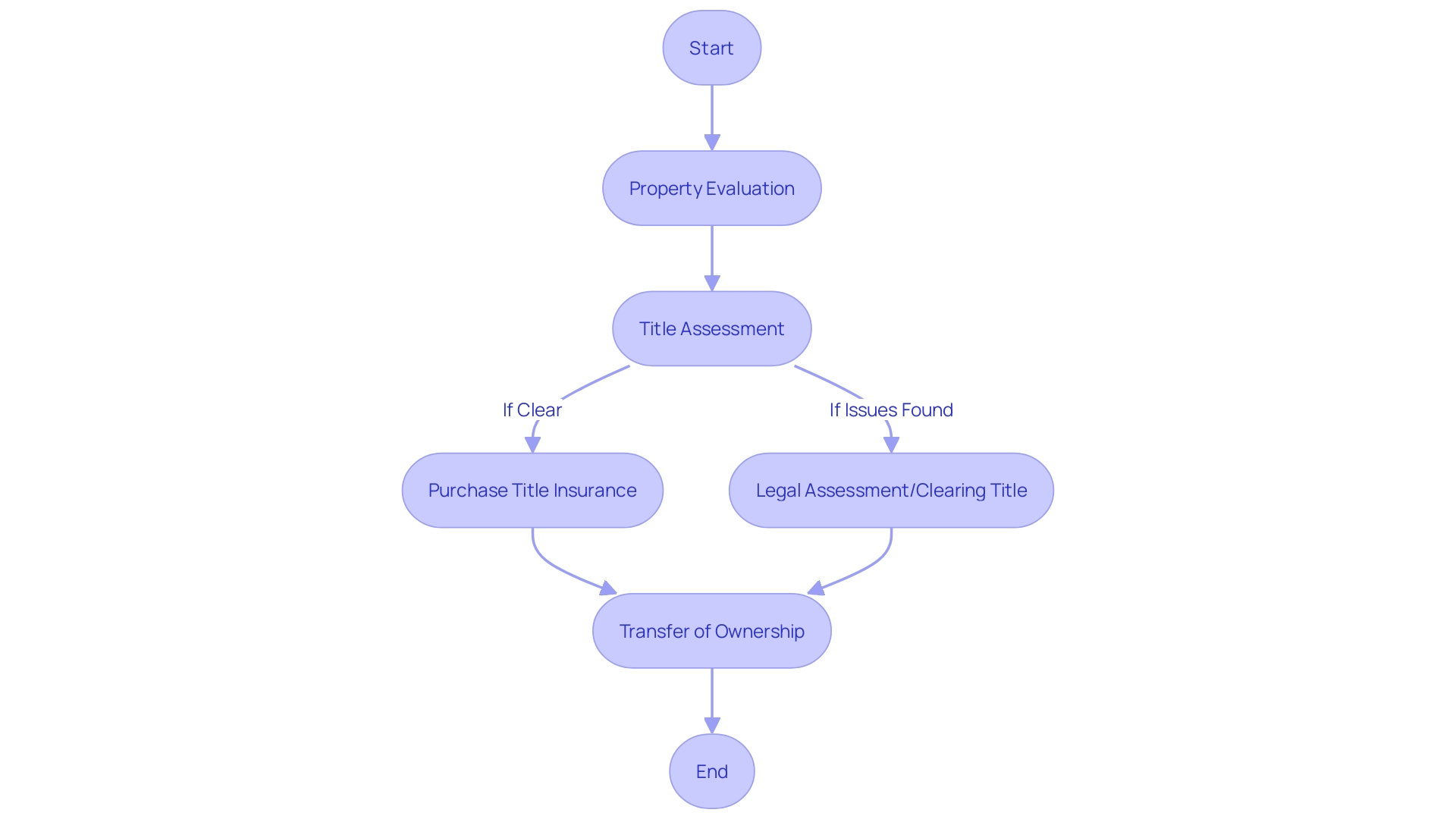

have a crucial function in real estate transactions, offering a thorough examination of the property's ownership. They meticulously examine potential concerns or encumbrances that could impact ownership rights, which is crucial for buyers and lenders to make well-informed decisions. A real-world illustration of their importance is seen in cases like an Akiya purchase, where specificity and understanding the nuances of a property's history are paramount. Personalized approaches are provided, taking into account the distinctive aspects of each transaction.

Moreover, in cases where properties have complex ownership histories or in areas with high premiums for insurance on ownership rights, alternative options demonstrate their cost-effectiveness. This customized and particular emphasis is not only a theoretical benefit but is echoed in the experiences of industry professionals like Arnold, a transactional property lawyer, who emphasizes the significance of a thorough document examination and its role in facilitating a seamless closing procedure.

Moreover, the evolving landscape of property, marked by companies like First American Financial Corporation, which integrates innovative technologies and data solutions, highlights the growing significance of detailed examinations of that AOLs provide. With the real estate industry pushing towards digital transformation, the contribution of online legal services helps unlock the value of real estate by ensuring that each transaction is based on a solid understanding of the property's legal background.

Risks and Limitations of Attorney Opinion Letters Compared to Title Insurance

Opinions provided by attorneys serve as a professional assessment on the status of property ownership, yet they come with their inherent risks when compared to the more comprehensive protection of . The dependability of depends on the expertise of the attorney, which opens up the possibility for interpretation and error. On the contrary, insurance for ownership extends a broad shield of financial protection against discrepancies in the title. Some risks like undisclosed liens and fraudulent activities, which are typically protected by insurance, may go unnoticed by certain insurances. Purchasers and creditors must therefore consider the advantages versus the possible weaknesses that come with the utilization of online lending systems in property transactions. Considering recent changes in the industry, like those made by First American Financial Corporation - a company that specializes in services related to property ownership and legal agreements - it becomes clear how crucial it is to have creative approaches and trustworthy methods for minimizing potential risks in transactions involving real property. Additionally, the American Land Title Association (ALTA) has raised concerns with the Federal Housing Finance Agency (FHFA) about the restrictions of insurance options related to property ownership, specifically in relation to safeguarding consumer rights. Real estate investors and professionals must navigate these complexities with a clear understanding of the protections each option provides, as underscored by the significant role that in defending against one of the most common claims in the industry: fraud and forgery.

Fannie Mae's Guidelines for Attorney Title Opinion Letters

Following for is a crucial aspect of ensuring that these documents are acceptable for mortgage transactions. The guidelines established by Fannie Mae, a major participant in the residential mortgage credit market in the United States, outline essential requirements for alternative online lenders. These requirements comprise the qualifications of the attorney delivering the opinion, the scope and extent of the opinion itself, and the supporting documentation that substantiates the opinion. Lenders and borrowers looking to secure mortgage financing must comply with these guidelines to guarantee that the AOLs conform to industry standards and are deemed suitable for loan-related purposes.

In the context of the property sector's ongoing digital transformation, as exemplified by organizations like First American Financial Corporation with revenues of $7.6 billion in 2022, the significance of such compliance is underscored. It becomes increasingly crucial as Fannie Mae and Freddie Mac, after recovering from substantial losses in the 2008 financial crisis, explore new ways to reduce mortgage costs without compromising their financial integrity. As they purchase approximately 70% of the mortgages issued annually, their influence on the market is profound, and their guidelines play a significant role in maintaining the health of the mortgage ecosystem.

Furthermore, the need for insurance of ownership and the guarantee it offers against monetary damages caused by flaws in ownership—overlooked encumbrances, zoning problems, deceit—is a prompt of the possible hazards in property transactions. As noted by experts like Dave Ramsey and supported by the National Association of Insurance Commissioners, is an indispensable safeguard for both homeowners and lenders. Thus, not only aligns with regulatory standards but also serves as an integral component of risk management in property transactions.

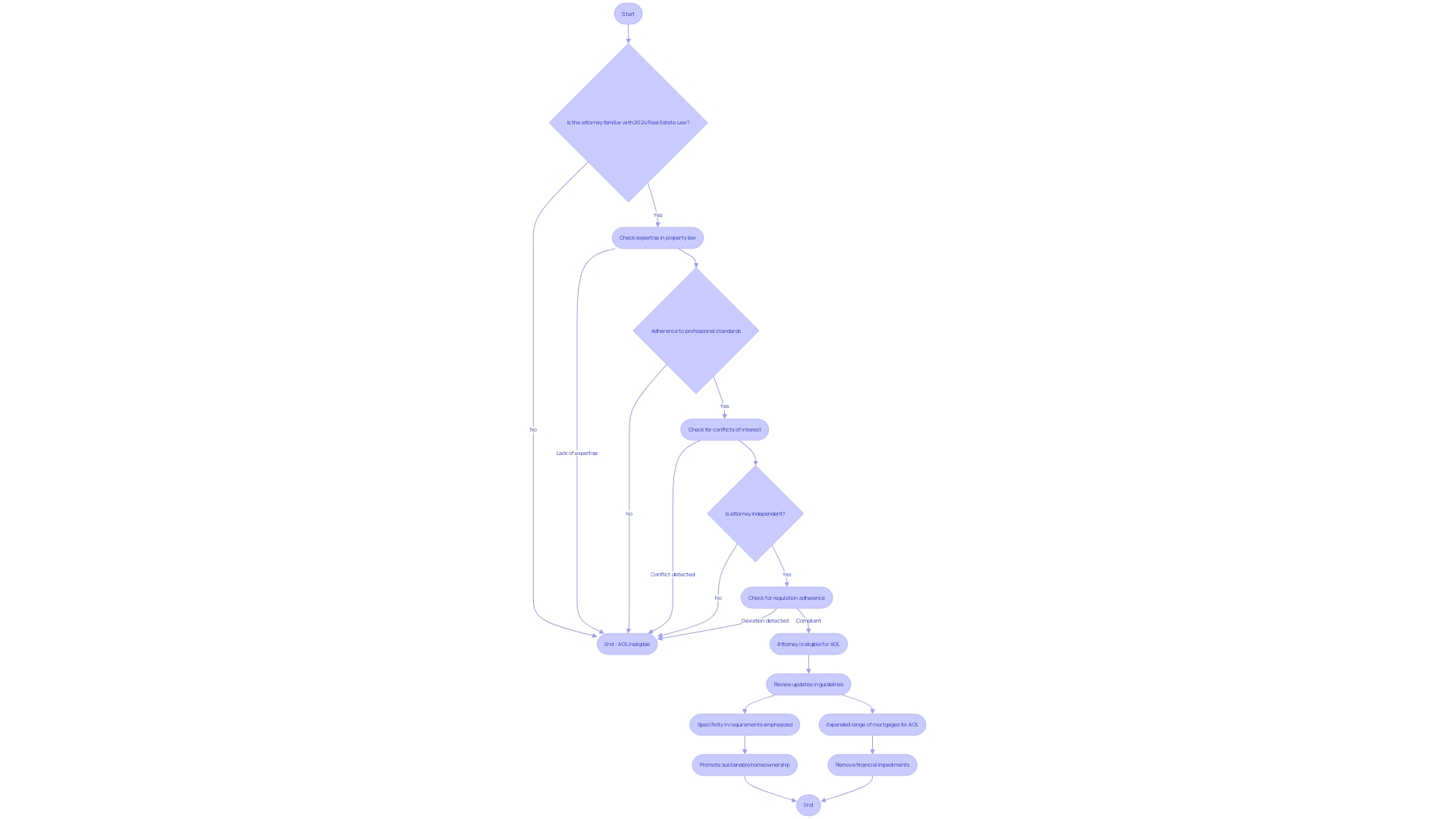

Eligibility and Ineligibility Criteria for Attorney Opinion Letters

The credibility and dependability of (AOLs) in rely on a set of established criteria which can differ by jurisdiction and the individual requirements of lenders and other relevant parties. Usually, these criteria evaluate the lawyer's credentials, their expertise in property law, and their adherence to professional standards. Conversely, an AOL may be deemed ineligible if it is tainted by conflicts of interest, a lack of independence, or deviation from the prevailing regulations. With the , practitioners are required to navigate a complex framework of statutes, including the Business and Professions Code Sections 10000 through 11288, among others. Given the nuanced nature of these laws, it is crucial for those involved in to meticulously evaluate the eligibility and integrity of the attorney issuing the AOL. Recent updates in guidelines underscore the importance of specificity in attorney requirements and expand the range of mortgages that may be delivered with an AOL, reflecting a proactive approach to facilitating sustainable homeownership and removing financial impediments.

Regulatory Considerations and Industry Perspectives on AOLs

The development of requires adherence to a set of regulatory considerations that may differ across various jurisdictions. State bar associations and other regulatory entities often issue guidelines and stipulations for legal professionals to preserve their integrity and safeguard client interests. Acknowledging that viewpoints on Alternative Ownership Limitations can differ within the sector, certain experts emphasize the importance of as a more comprehensive protection against defects in ownership. It is imperative for those involved in the real estate sector, particularly those who , to remain abreast of the evolving regulatory landscape and industry standards concerning AOLs. This is essential to ensure both adherence to legal requirements and the making of well-informed decisions in property transactions.

Conclusion

In conclusion, Attorney Opinion Letters (AOLs) are vital in real estate transactions, offering a comprehensive analysis of property titles. They provide transparency, protection, and cost-effective alternatives to title insurance. AOLs play a critical role in certifying title soundness, especially in the digital landscape of online homebuying platforms.

While AOLs have their limitations compared to title insurance, such as the reliance on the attorney's expertise and the potential for interpretation and error, they offer a personalized approach and address unique transaction facets. Compliance with Fannie Mae's guidelines is crucial to ensure the acceptability of AOLs in mortgage transactions and maintain industry standards.

The eligibility and reliability of AOLs depend on established criteria that vary by jurisdiction and the requirements of lenders and other parties involved. Evaluating the attorney's qualifications, proficiency in real estate law, and adherence to professional standards is essential.

Regulatory considerations and industry perspectives on AOLs differ within the real estate sector. Staying informed about the evolving regulatory landscape and industry standards surrounding AOLs is crucial for making well-informed decisions in property transactions.

In summary, AOLs are indispensable in real estate, providing a thorough analysis of property titles. They offer transparency, protection, and cost-effective alternatives to title insurance. Compliance with guidelines and careful evaluation of attorney qualifications are crucial.

Keeping up with regulatory considerations and industry perspectives is essential for navigating the evolving landscape of AOLs in real estate.

Get a comprehensive analysis of your property title with Attorney Opinion Letters (AOLs) today!

Frequently Asked Questions

What are Attorney Opinion Letters (AOLs)?

AOLs are legal documents that provide an attorney's professional assessment of the ownership of a property. They evaluate the legality and transferability of property ownership, helping lenders, buyers, and sellers understand potential legal risks involved in property transactions.

Why are AOLs important in property transactions?

AOLs are crucial for verifying property ownership and identifying any legal intricacies or risks that could affect a transaction. They offer a thorough examination of ownership, which is essential for making informed decisions.

How do AOLs differ from property ownership insurance?

AOLs offer a professional evaluation of property ownership based on legal documents, while property ownership insurance provides financial protection against losses due to defects in ownership. Insurance typically covers issues like unresolved liens or fraud, which may not be fully addressed by an AOL.

What role do AOLs play in the current real estate market?

With the increasing significance of online platforms for homebuying, AOLs help ensure transparency and protect consumer interests. They provide clarity in an evolving digital landscape where many buyers start their search online.

What criteria are used to evaluate the credibility of an AOL?

The credibility of an AOL depends on the attorney's qualifications, expertise in property law, and adherence to professional standards. An AOL may be deemed ineligible if it shows conflicts of interest or does not comply with prevailing regulations.

How does Fannie Mae influence the use of AOLs?

Fannie Mae has established guidelines that dictate the qualifications and requirements for attorneys issuing AOLs. Compliance with these guidelines is necessary for AOLs to be accepted in mortgage transactions, thereby maintaining the integrity of the mortgage ecosystem.

Are there any risks associated with using AOLs?

Yes, the reliability of AOLs can vary based on the attorney's expertise, which may open the door for interpretation and potential errors. Unlike insurance, which broadly protects against discrepancies, AOLs may not cover all risks.

What is the role of First American Financial Corporation in the property sector?

First American Financial Corporation plays a significant role in transforming property and settlement solutions by leveraging advanced technologies and data to enhance security and efficiency in property transactions.

How do recent legal challenges affect the importance of AOLs?

Recent legal cases have raised concerns about traditional commission structures, emphasizing the need for transparency in property transactions. This reinforces the importance of AOLs in ensuring legal soundness and protecting consumer interests.

What should real estate professionals consider when using AOLs and insurance?

Real estate professionals must weigh the advantages and potential weaknesses of both AOLs and property ownership insurance. Understanding the protections offered by each option is crucial for navigating the complexities of property transactions.