Overview

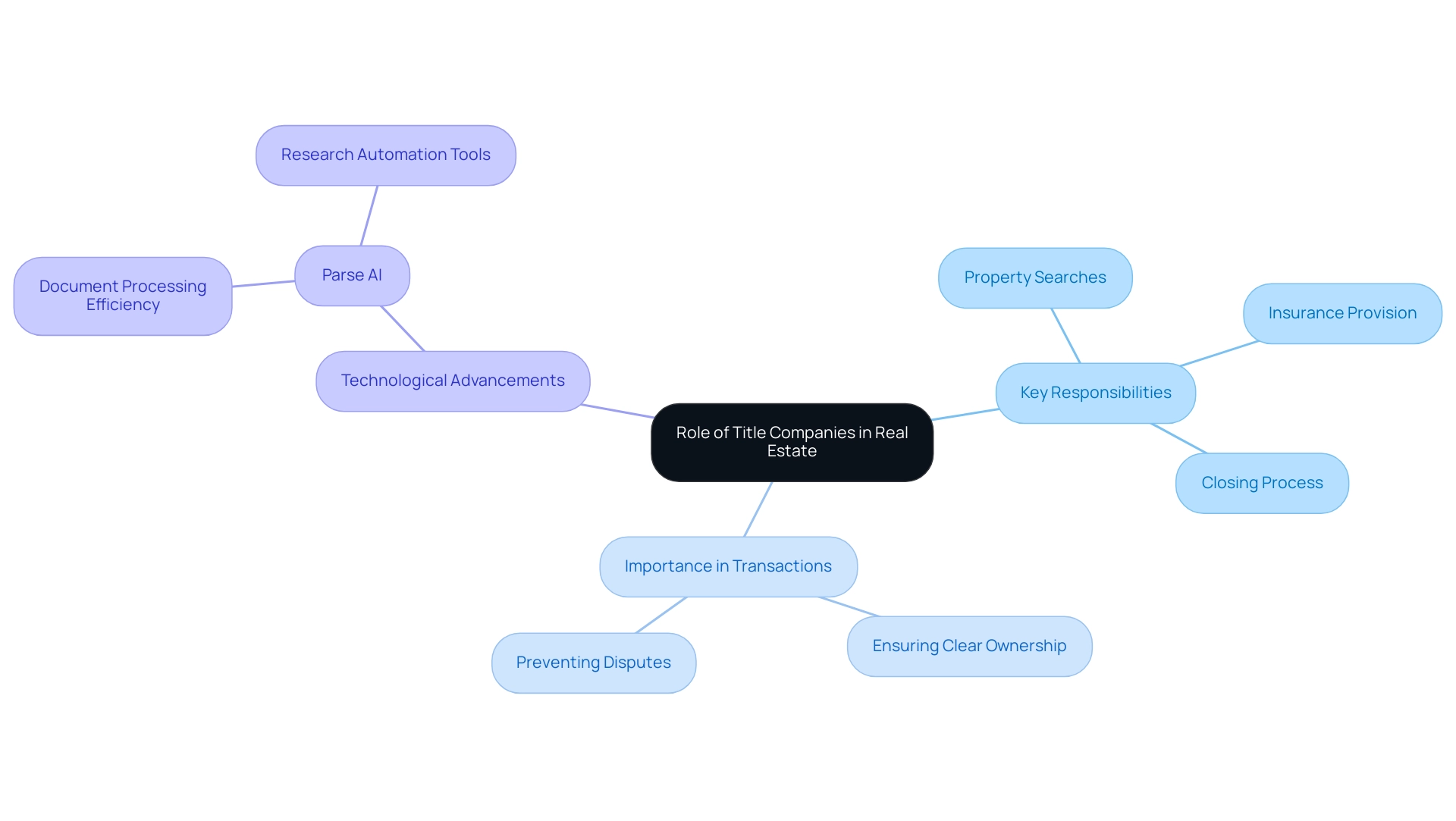

The article presents a comprehensive overview of title companies, underscoring their crucial role as intermediaries in real estate transactions. These companies ensure clear ownership and facilitate the transfer of property, a task of paramount importance. Their key responsibilities include:

- Conducting thorough property searches

- Providing essential title insurance

- Overseeing the closing process

Furthermore, the article discusses the transformative impact of technological advancements, such as Parse AI, in enhancing operational efficiency and accuracy in these critical tasks.

Introduction

In the intricate world of real estate, title companies emerge as pivotal players, ensuring smooth transactions and safeguarding the interests of all parties involved. With an estimated 85% of real estate transactions in 2025 incorporating their services, these companies are essential in validating property titles and preventing disputes. Their responsibilities extend beyond mere verification; they:

- Conduct exhaustive title searches

- Issue title insurance

- Manage the closing process

All while adapting to technological advancements that streamline operations. Furthermore, as the industry embraces innovations like Parse AI, which enhances document processing and research efficiency, the role of title companies is evolving to meet the demands of a dynamic market. Understanding their multifaceted functions not only highlights their importance but also underscores the necessity of their services in navigating the complexities of property ownership.

Understanding the Role of Title Companies in Real Estate

Organizations involved in property transactions serve a crucial function as intermediaries, guaranteeing that ownership documents are valid and clear of liens. In 2025, it is estimated that around 85% of real estate transactions involve ownership firms, underscoring their importance in the industry. These organizations act on behalf of buyers, sellers, and lenders to facilitate the seamless transfer of property ownership.

Their primary responsibilities encompass:

- Performing comprehensive property searches

- Providing insurance

- Overseeing the closing process

By meticulously confirming the legal ownership of a property, organizations help avoid disputes and protect the interests of all parties engaged in the transaction. An expert in the field observes, "According to the title company definition, title firms are essential in ensuring that all aspects of a property transfer are managed accurately, which ultimately safeguards the investment of buyers and lenders alike."

Furthermore, recent advancements in technology, particularly through solutions like Parse AI, are transforming the sector. Parse AI offers advanced machine learning tools that accelerate document processing and interpretation, enabling companies to enhance their operational efficiency. The platform's example manager allows for quick annotation of documents, facilitating the extraction of critical information from unstructured data.

This capability is particularly beneficial for researchers, who can complete abstracts and reports faster and more accurately. In addition, Parse AI's powerful research automation tools utilize OCR technology and interactive labeling, streamlining the document processing workflow. This technological integration not only enhances communication but also improves the precision of document searches and insurance issuance, aligning with the industry's shift towards technology-driven interactions. As an analyst stated, "Price is a crucial factor influencing consumers' value perceptions. Insurers can add value by tailoring their products to meet consumers' unique risk needs and situations."

The competitive environment is further demonstrated by the statistic that 2% of FSBO sellers find attracting potential buyers difficult, highlighting the significance of real estate professionals in assisting these sellers to navigate the complexities of property transactions.

In summary, the significance of real estate firms in property transactions cannot be overstated. They not only facilitate ownership transfers but also provide a layer of security and assurance that is crucial in today’s dynamic real estate market. With the incorporation of advanced tools such as those provided by Parse AI, firms can further enhance their services, ensuring they address the changing needs of their clients.

Parse AI was created by a group of energy, real estate, and technology professionals who possess over 50 years of industry experience. The founders have encountered a multitude of issues associated with the time and capital required to confirm real property ownership. By leveraging their expertise and industry connections along with top-notch developers, Parse has developed a platform capable of advancing the sector into the future.

Key Services Offered by Title Companies

The definition of a title company underscores the critical role these firms play in real estate transactions by offering a diverse range of services, including searches, insurance, escrow services, and closing coordination. A property search is a meticulous endeavor that involves scrutinizing public records to confirm ownership history and identify any potential issues, such as liens or claims that could jeopardize ownership rights. With the integration of advanced machine learning tools from Parse AI, this process can be significantly expedited, enabling researchers to swiftly annotate and extract vital information from unstructured documents using the example manager feature.

Ownership protection serves as a safeguard for buyers and lenders, shielding them from financial losses that may arise from defects in the ownership document that become apparent post-transaction. This protection is increasingly vital, especially as the market for coverage continues to grow; for instance, Texas leads the nation with $3.52 billion in premiums for property protection, followed closely by Florida at $2.89 billion and California at $2.82 billion. Furthermore, Pennsylvania reported $1.18 billion in policy premiums, reflecting a substantial 42.4% increase, highlighting the expanding market.

Escrow services are crucial for ensuring that funds and documents are securely managed throughout the transaction process. This service instills confidence in all parties involved, guaranteeing that the transaction proceeds smoothly and that obligations are fulfilled prior to the final transfer of ownership. Closing coordination is another essential function, where firms oversee the concluding stages of the sale, ensuring that all necessary documentation is completed and that all parties meet their contractual obligations.

In 2025, the landscape of ownership insurance and escrow services is transforming, with a notable trend towards digital solutions. Factors such as specialization in local laws and the availability of online portals and e-signatures are becoming increasingly significant when selecting a firm for title services, as noted in the title company definition. As Amanda Farrell, a digital media strategist at PropLogix, observes, "The incorporation of technology in service provision is not merely a trend; it's essential for efficiency and accuracy in today's market."

Parse AI's powerful name investigation automation capabilities further enhance this integration, allowing for full-text search and machine learning extraction that streamlines runsheet creation.

Moreover, as agents managing property records encounter heightened workloads due to a surge in order volume and refinancing, many are outsourcing support services to effectively manage these growing demands while compensating for staffing shortages. This strategy enables them to maintain operational efficiency in a competitive market, with frequently outsourced tasks including municipal lien searches, document searches, and tax analysis. By leveraging Parse AI's advanced tools, including the example manager and research automation, companies can ensure clean chains of ownership and accurate leasing for property and mineral owners, ultimately enhancing their service offerings.

The Importance of Title Insurance in Property Transactions

Protection coverage plays an essential role in real estate dealings, as defined by title companies, shielding purchasers and lenders from possible claims or flaws in ownership documents that may arise post-sale. Unlike conventional coverage, which safeguards against future incidents, the title company definition encompasses protection addressing prior events, such as undisclosed heirs, fraudulent actions, or inaccuracies in public documentation. In 2025, approximately 80% of real estate transactions are anticipated to include ownership protection, underscoring its role in mitigating financial risks associated with ownership conflicts.

The significance of ownership protection is further reinforced by recent claims data, aligning with the title company definition that indicates an increase in disputes regarding ownership flaws. For instance, in 2025, claims against property coverage are expected to rise by 15%, reflecting the growing complexity of real estate dealings. This trend highlights the necessity for buyers and lenders to secure ownership protection, according to the title company definition, to avoid potentially costly legal disputes.

Real-world examples illustrate how ownership protection safeguards stakeholders. In one notable case, a buyer uncovered a previously unknown lien on a property after closing. Thanks to title coverage, the purchaser was able to reclaim expenses related to settling the lien, showcasing the policy's protective features.

Moreover, expert opinions from real estate lawyers consistently affirm that the title company definition underscores ownership protection as vital for ensuring fairness and transparency in transactions, particularly as compliance requirements evolve. The changing compliance landscape necessitates the involvement of a title company definition to guarantee equity and clarity in transactions.

The Iowa model of property protection, which offers coverage through a not-for-profit state-managed program, serves as an innovative alternative to traditional frameworks. This model provides a lender's guaranty for a flat fee and typically includes an owner's guaranty at no additional charge. However, participants in discussions about this model have pointed out potential hidden costs related to attorney work and opinion letters, indicating that while it may be cost-effective, overall expenses should be carefully evaluated.

This caution emphasizes the necessity for a thorough assessment of all expenses associated with ownership protection.

In summary, the title company definition highlights that ownership protection is not merely a formality; it is a critical safeguard in the real estate landscape of 2025, offering essential defense against ownership defects and ensuring smoother transactions for all parties involved. Furthermore, with Fidelity National Financial, Inc. commanding the largest market share in the US Title Insurance industry, understanding the competitive dynamics and market trends is vital for stakeholders. As the MEA region's market value is projected to decline from 0.14 USD Billion in 2023 to 0.12 USD Billion by 2032, it is evident that the insurance market is evolving, necessitating continuous adaptation and awareness among real estate professionals.

Conducting a Title Search: What You Need to Know

An ownership search constitutes a meticulous examination of public records, aimed at verifying the legal possession of a property while identifying potential issues. This process typically involves a thorough review of various documents, including deeds, mortgages, and tax records. Researchers diligently search for discrepancies, liens, or claims that could impact the property's ownership, ensuring that buyers are fully informed of any legal complications before proceeding with a purchase.

In 2025, the significance of performing a thorough search for ownership cannot be overstated. With commercial property ownership searches often taking several days or even weeks to complete thoroughly, the efficiency of this process is paramount. For instance, in Massachusetts, the average duration for a document search can range from one to two weeks, depending on the complexity of the documents involved.

Engaging a reputable firm not only streamlines this process but also provides buyers with peace of mind, knowing that their investment is protected. Effective searches can yield substantial beneficial outcomes. For instance, utilizing advanced technologies such as machine learning and optical character recognition, platforms like Parse AI have revolutionized the research landscape. By swiftly extracting essential information from extensive collections of document titles, Parse AI enables researchers to complete abstracts and reports more quickly and accurately, resulting in significant cost savings and enhanced workflow efficiency for real estate professionals.

However, common issues can arise during property searches, including undisclosed liens or claims that may not be immediately apparent. Statistics indicate that a significant percentage of document searches uncover such complications, underscoring the necessity for thoroughness in this process. Expert guidance highlights that property purchasers should prioritize collaborating with seasoned document providers who utilize technology efficiently and can assure specific turnaround times.

As Bill Gassett, owner and founder of Maximum Real Estate Exposure, notes, "A thorough document search is essential to avoid future complications and ensure a smooth transaction." This diligence not only safeguards their investment but also enhances the overall real estate transaction experience. When choosing a provider for titles, it is important to consider their experience, technology use, customer service, and whether they can guarantee specific turnaround times.

Challenges in Title Research and Verification

Title investigation and verification present a myriad of challenges that can significantly influence real estate transactions. Common issues include incomplete or inconsistent records, discrepancies in property ownership information, and the complexities inherent in interpreting legal language. Document researchers often encounter challenges such as absent papers, ambiguous property borders, and outstanding liens, which can lead to postponements and increased expenses for both purchasers and vendors.

In 2025, the landscape of document examination continues to evolve, with industry specialists emphasizing the urgent need for enhanced data precision and validation procedures. The impact of incomplete records can be profound, often resulting in legal disputes or financial losses. A significant case study illustrates how a firm successfully navigated these challenges by implementing a robust document management system that streamlined the retrieval of essential records, thereby reducing transaction times and enhancing client satisfaction.

Furthermore, the integration of advanced technologies, such as machine learning and optical character recognition, is transforming the property examination process. These innovations enable companies to swiftly and accurately extract essential information from extensive collections of documentation. By utilizing these tools, firms can address common problems in document examination, such as document retrieval and data verification, ultimately improving efficiency and reducing costs.

Parse AI exemplifies this approach by leveraging its advanced machine learning tools to expedite document processing and automate title evaluation, directly addressing the challenges faced by professionals in the field.

Parse AI's platform features an example manager that facilitates quick annotation of documents, allowing for the extraction of information from large sets of unstructured data. Additionally, its robust document investigation automation features enable investigators to finalize abstracts and reports more swiftly and with greater precision, significantly enhancing the overall inquiry process.

Industry leaders underscore the importance of ongoing enhancement in document examination methodologies. Overcoming the challenges in project investigation necessitates not only technological advancements but also a commitment to collaboration among experts in the field. This collaborative approach ensures that the most pressing challenges are tackled efficiently, paving the way for a more streamlined and reliable investigation process.

Moreover, the case study titled 'Quantitative Precision-X' highlights the application of statistical and machine learning techniques in addressing challenges in naming studies, demonstrating how technology can improve outcomes.

Innovations in Title Research: The Role of Technology

Recent advancements in property research, particularly through the integration of machine learning and artificial intelligence, are fundamentally transforming the operations of ownership companies across the United States. These technologies enable the swift and accurate extraction of information from extensive collections of document titles, significantly decreasing the time required for searches. For instance, Parse AI utilizes optical character recognition to enhance this process, allowing researchers to focus their efforts on higher-level analysis instead of monotonous manual data entry.

Statistics show that in a standard database with 7,500 records, only 150 records—about 2%—are required to form an initial training set for machine learning models. This efficiency highlights the potential for considerable time savings and accuracy enhancements in workflow processes. Consequently, as the industry increasingly adopts these innovations, the overall efficiency and accuracy of ownership verification are expected to improve, yielding substantial benefits for all parties involved in real estate transactions.

Expert opinions underscore the critical role of machine learning in elevating ownership verification efficiency. Leaders in technology emphasize that the combination of qualitative and quantitative data through advanced machine learning techniques can lead to more informed decision-making processes. Janeth Gabaldon notes that courses are equipping students with the skills and mindset to thrive in an AI-enhanced world, reinforcing the importance of adapting to these technological changes.

Furthermore, case studies demonstrate how innovative uses of technology are transforming property examination practices, highlighting the need for ongoing adaptation and enhancement in response to changing market requirements. The limitations of the REF2014 evaluation framework also emphasize the necessity for comprehensive data to enhance the accuracy and predictive capabilities of machine learning models. As we advance further into 2025, the impact of these technological advancements will only grow, reinforcing the importance of embracing innovation within the title company definition. The ongoing collaboration between technology providers and land service professionals will be vital in addressing the industry's most pressing challenges, ultimately leading to enhanced service delivery and cost savings compared to traditional methods.

Conclusion

The pivotal role of title companies in real estate transactions is paramount. As essential intermediaries, they guarantee the legitimacy of property titles, conduct comprehensive title searches, issue title insurance, and oversee the closing process. With an estimated 85% of transactions in 2025 involving their services, title companies are indispensable in protecting the interests of buyers, sellers, and lenders alike.

Furthermore, the integration of advanced technologies, such as Parse AI, is revolutionizing the title industry by enhancing operational efficiency and accuracy. These innovations streamline the title research process, facilitating quicker document processing and improved communication. As the real estate landscape evolves, title companies' ability to adapt to these changes will be crucial in meeting the demands of a dynamic market.

Ultimately, understanding the multifaceted functions of title companies and the significance of title insurance is essential for navigating the complexities of property ownership. Their services provide a layer of security that protects against unforeseen title defects and disputes, ensuring smoother transactions for all parties involved. As the industry continues to embrace technological advancements, the future of title companies promises to enhance the integrity and efficiency of real estate transactions, solidifying their role as a cornerstone of the property market in 2025 and beyond.

Frequently Asked Questions

What role do organizations involved in property transactions play?

Organizations involved in property transactions serve as intermediaries, ensuring that ownership documents are valid and free of liens. They facilitate the transfer of property ownership on behalf of buyers, sellers, and lenders.

What are the primary responsibilities of these organizations?

Their primary responsibilities include performing comprehensive property searches, providing insurance, and overseeing the closing process.

How do these organizations help protect the interests of parties involved in a transaction?

By confirming the legal ownership of a property, these organizations help avoid disputes and protect the interests of buyers, sellers, and lenders.

What is the significance of ownership firms in the real estate industry?

It is estimated that around 85% of real estate transactions involve ownership firms, highlighting their importance in facilitating seamless property transfers and providing security in transactions.

How is technology, particularly Parse AI, impacting the property transaction sector?

Parse AI is transforming the sector by offering advanced machine learning tools that accelerate document processing and interpretation, enhancing operational efficiency and improving communication.

What specific features does Parse AI provide to assist in property transactions?

Parse AI provides tools for quick annotation of documents, research automation, and the ability to extract critical information from unstructured data, streamlining document processing workflows.

Why is ownership protection important in real estate transactions?

Ownership protection safeguards buyers and lenders from financial losses that may arise from defects in ownership documents that become apparent after the transaction.

What services do title companies offer?

Title companies offer a range of services, including property searches, insurance, escrow services, and closing coordination.

What is the role of escrow services in property transactions?

Escrow services ensure that funds and documents are securely managed throughout the transaction process, instilling confidence in all parties and ensuring obligations are fulfilled before ownership transfer.

How is the landscape of ownership insurance and escrow services evolving?

The landscape is shifting towards digital solutions, with increasing importance placed on specialization in local laws and the availability of online portals and e-signatures.

What challenges are property record agents facing in the current market?

Agents are experiencing heightened workloads due to increased order volume and refinancing, leading many to outsource support services to manage these demands effectively.