Introduction

A property title search is a crucial step in the real estate transaction process, providing a comprehensive examination of a property's ownership history. By meticulously analyzing public records and legal documents, a title search confirms the rightful owner and uncovers any potential hindrances, such as liens or easements, that could impede the transfer of ownership. This article explores the importance of conducting a title search, highlights key components of the process, and discusses common issues that may arise.

It also delves into the role of title companies and abstractors, the significance of title insurance, and the costs involved in a title search. Through a detailed exploration of these topics, professionals in the field can gain authoritative and knowledgeable insights to facilitate secure and informed real estate transactions.

What is a Property Title Search?

Conducting a thorough investigation into the property's historical and current ownership details is a crucial part of the . It requires meticulous examination of public archives and legal documents to confirm the rightful owner and reveal any potential hindrances, such as liens or easements, which might impede the transfer of ownership. The main purpose of performing a is to guarantee that the buyer or financial institution obtains a legitimate and transferable title, without any undisclosed burdens.

The importance of this process is emphasized by the experience of a client purchasing an Akiya in Chiba Prefecture. The client, an American residing in Japan, sought a tranquil life closer to the beach, away from Tokyo's hustle. The quest for the ideal countryside estate was started with a ¥220,000 investment. Diligent work was put in by consultants who examined multiple locations to discover those that matched the client's requirements, an undertaking symbolic of the meticulousness needed in title investigations.

In the realm of real estate data and analytics, companies like First American Data & Analytics are revolutionizing the way professionals approach research on properties. They provide extensive tools that enable instant access to a wide range of data reports and documents, along with advanced search features and interactive maps. This allows for a more effective and thorough investigation, serving both corporate clients and individuals seeking specific reports.

The emergence of AI solutions like Ellie, developed by Fifth Dimension AI, is transforming the industry by removing the monotony of repetitive tasks associated with real estate analysis. This empowers real estate professionals to focus on meaningful work, as underscored by Dr. Kate Jarvis and Johnny Morris, who envision a future where real estate agents can enhance their productivity and expertise exponentially, thanks to technological partners.

An assessment of a real estate's limits and characteristics, often confused with a title investigation, is a professional examination conducted by a licensed surveyor. It's a crucial element of owning a possession that defines exact boundaries and assists in avoiding conflicts. While a survey maps out the physical dimensions, a delves into the legal ownership and ensures there are no defects in the chain of ownership, which could include unsatisfied liens or illicit transfers. is subsequently available to safeguard against any such defects that might surface, ensuring the owner's rights are protected.

Indeed, household wealth is intricately linked to ownership of assets. Assets such as homes constitute a significant portion of a household's net worth, and a clear ownership document is paramount in securing this value. The procedure of conducting a thorough investigation, although intricate, is an essential measure that supports the financial security and peace of individuals who possess real estate.

Why is a Title Search Important?

Performing an investigation is a crucial phase in every real estate deal, acting as a defense for purchasers, lenders, and other parties involved from possible legal and financial risks. Through meticulous examination, it uncovers issues such as undisclosed liens, easements, and boundary discrepancies, which, if unaddressed, could lead to post-purchase. For instance, in the case of a client seeking to buy an Akiya property in the Chiba Prefecture, an extensive review of hundreds of properties was necessary to find the perfect match that met all specified criteria. This highlights the significance of conducting an investigation not just to uncover encumbrances but to guarantee that the buyer's needs are completely fulfilled without any potential issues later on.

Furthermore, the significance of conducting a thorough investigation extends to obtaining insurance to protect against defects or claims that may not have been evident during the transaction. The changing environment of the escrow and closing sector, with the incorporation of AI, is ready to simplify these inquiries, offering improved and precise outcomes. As First American Financial Corporation demonstrates, with more than $7.6 billion in revenue and its position as an industry innovator, the implementation of advanced data tools and technologies is transforming the way investigations for property ownership are conducted. Access to comprehensive data reports, interactive maps, and parcel boundaries through advanced research tools exemplifies the strides being made in providing immediate and precise real estate data to tackle the challenges at hand.

Comprehending the intricacies of a property examination is crucial for professionals in the field. As Diane Tomb, CEO of the American Land Title Association, advocates, it's crucial to demystify the process for homebuyers to facilitate homeownership. Likewise, the understanding offered by industry news and legal evaluations contribute to a knowledgeable method to insurance on the deed and its essential function in confirming ownership legitimacy.

Key Components of a Title Search

In the detailed process of conducting a , different elements are vital to ensuring a comprehensive evaluation of a property's ownership history. The initial step is the examination of , which encompasses a . The objective is to establish a clear and pinpoint any recorded encumbrances that could affect the title.

The description of the is carefully examined for accuracy and conformity with historical records, an essential stage in verifying the boundaries and ownership details of the property. Attention is also paid to identifying any liens, such as those arising from unpaid taxes or existing mortgages. In addition, encumbrances or other lawful obligations on the premises are revealed during this stage.

Another important element of the search for the name is the examination of any past or ongoing , which may involve lawsuits or judgments that have the potential to affect the ownership or market value of the asset. This includes, but is not limited to, the analysis of court records to assess any impact on the title of the real estate.

Finally, survey records are thoroughly reviewed to detect any discrepancies or disputes over boundaries. This is a crucial step to prevent future conflicts and ensure the dimensions and boundaries of the premises are accurately represented.

These elements combined create a strong framework for performing a thorough examination of , which acts as a basis for making well-informed choices in real estate deals. The process is not just about verification but also about providing assurance and peace of mind to all parties involved in the transfer.

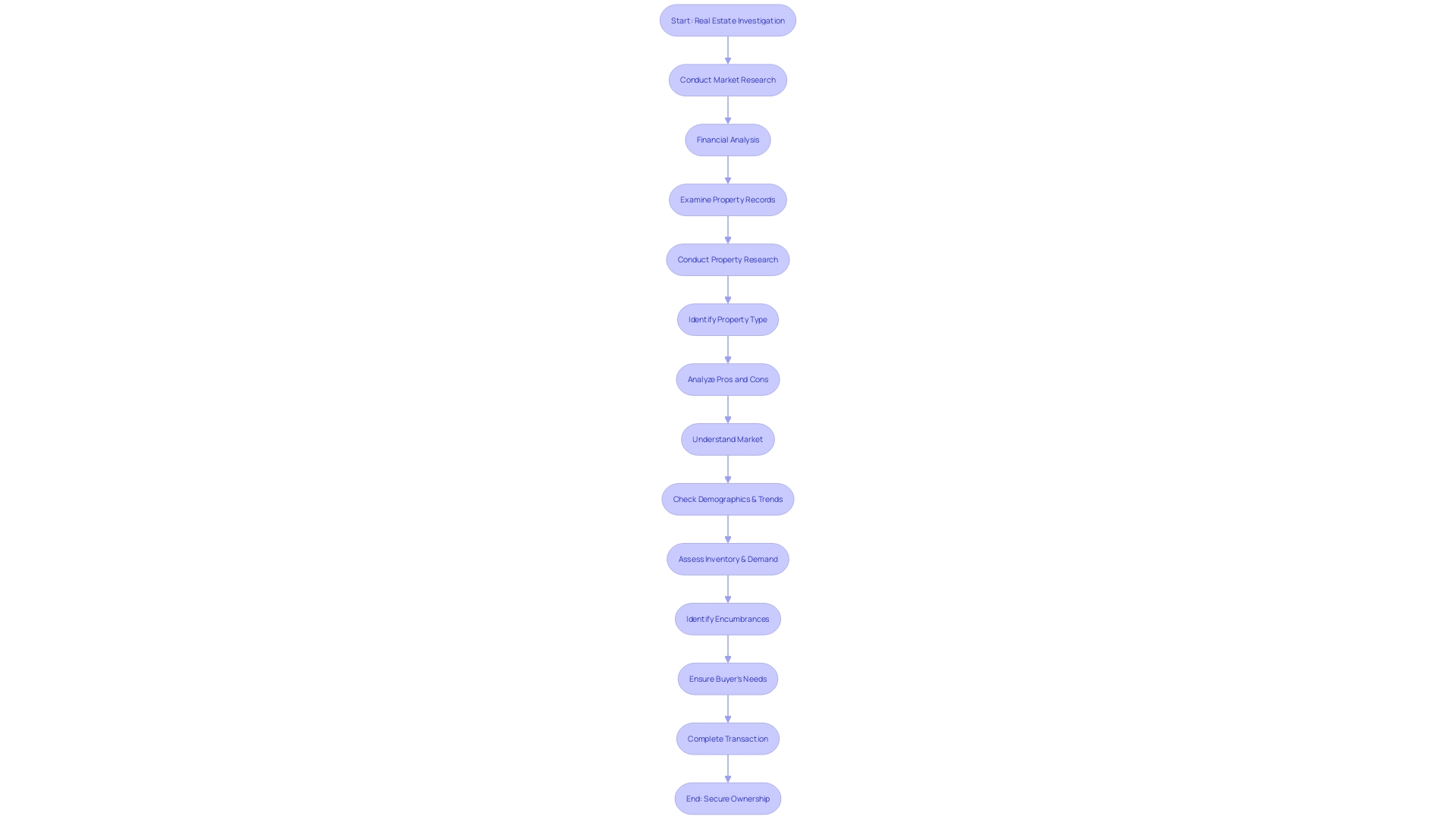

Step-by-Step Guide to the Title Search Process

Conducting a comprehensive is an intricate process that requires diligent research and keen attention to detail. It starts with a careful gathering of relevant , such as the address, its official description, and previous ownership records. This foundation sets the stage for an extensive examination of public records, including deeds, mortgages, tax records, and judicial documents. The objective is to build a and reveal any possible discrepancies or lawful concerns.

The accuracy of the real estate's is crucial, as it serves as a definitive identification in legal contexts. It is meticulously compared and cross-referenced with former records to ensure its correctness. Simultaneously, the researcher must identify any liens, easements, or other encumbrances that could affect the rights of ownership of the asset.

The completion of this investigation is the creation of a . This report , highlights any issues discovered, and offers recommendations for resolving these concerns. If any complications are found during the examination of the property's ownership, they must be resolved before the property is transferred. This may require cooperation with different stakeholders, such as lenders, lawyers, or insurance firms, to resolve any remaining liens or disputes.

In the end, after the examination for the name is completed and all worries have been dealt with, it is advisable to have insurance to protect the buyer and lender from future claims or undisclosed problems with the name. This all-encompassing method for researching ensures that all parties involved in the real estate transaction have a clear and unambiguous understanding of the property's ownership status.

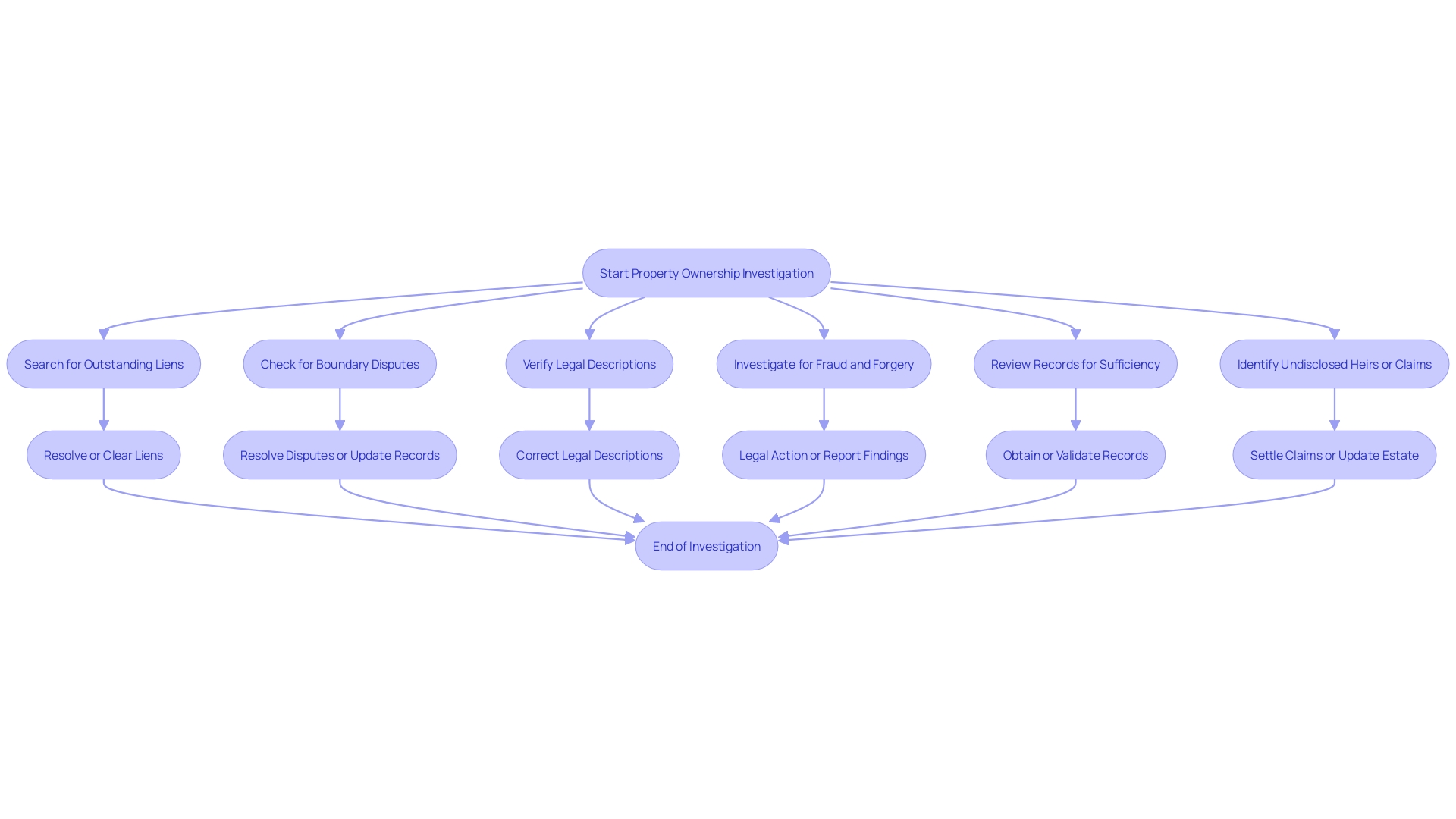

Common Issues Found in Title Searches

Conducting thorough investigations of is crucial for identifying possible problems that may impact the transfer and ownership of real estate. Some of the most frequent challenges encountered during these searches include:

- Outstanding Liens: Liens for unpaid obligations such as taxes, mortgages, or utility bills can encumber a title, complicating the sale and transfer process.

- Boundary Disputes: Conflicts regarding lines of possession, easements, or encroachments often arise during investigations of ownership and must be resolved to ensure a clear transfer of rights.

- Inaccurate Legal Descriptions: Discrepancies in the legal description of the property can lead to confusion and contentious legal disputes.

- Fraud and Forgery: When conducting an investigation, instances of forged or fraudulent documents may be uncovered, which can invalidate the legitimacy of the ownership.

- Absent or Insufficient Records: Occasionally, a examination of the deed might uncover interruptions in the title's past, rendering the process of confirming undisputed ownership more difficult.

- Undisclosed Heirs or Claims: Occasionally, a might reveal previously unknown heirs or claims, which can delay or impede the ownership transfer process.

Given the significance of thorough real estate research, First American Data & Analytics offers comprehensive tools for data access in real estate. These tools provide a variety of reports, document images, advanced inquiry features, and interactive maps to help users address , regardless of their complexity. With the ability to on an as-needed basis, these tools are invaluable for those seeking detailed and reliable real estate information. According to First American Financial Corporation, their commitment to providing such services has contributed to a revenue of $7.6 billion in 2022, reflecting the significance and demand for accurate real estate data in facilitating secure transactions.

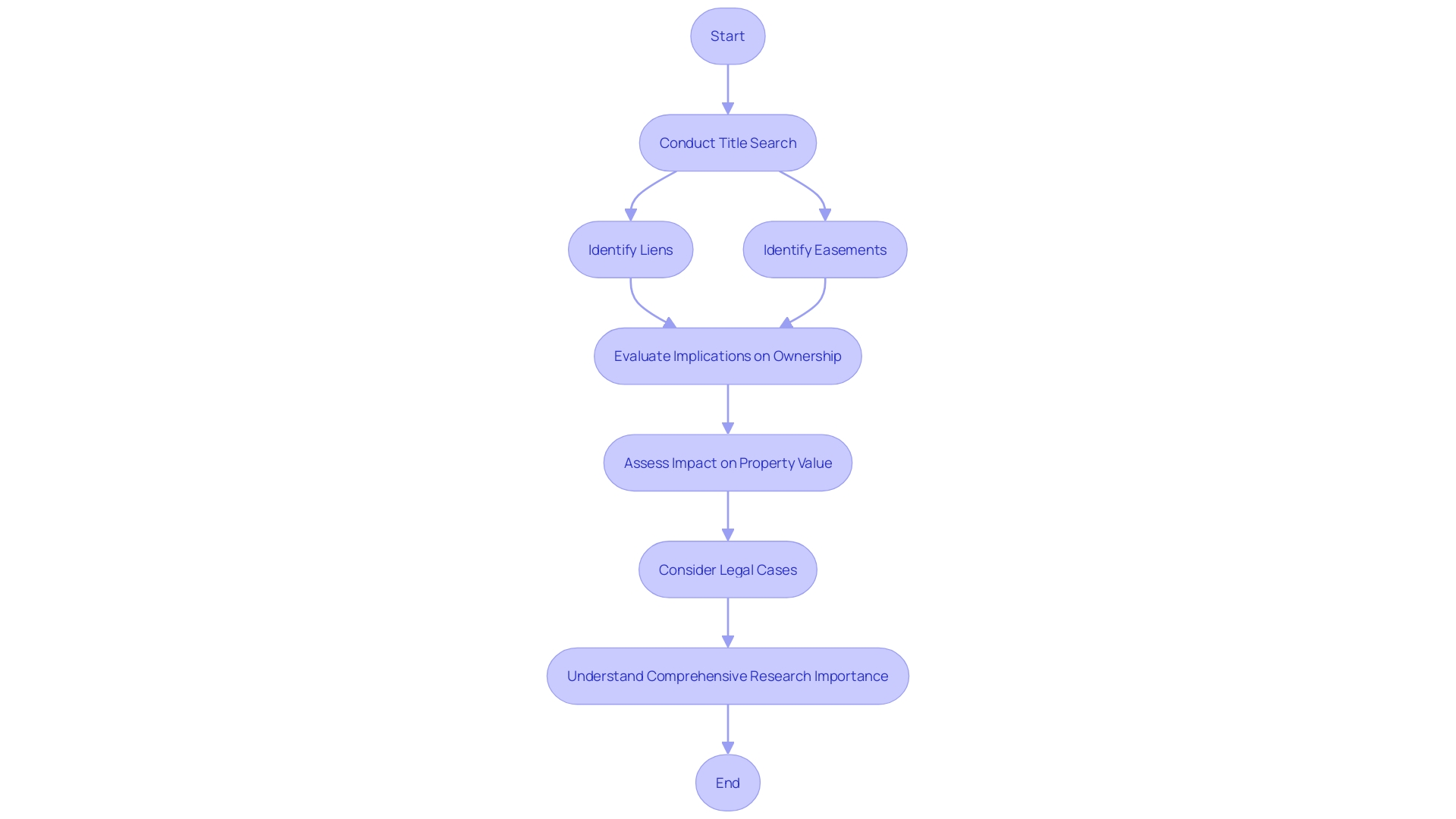

Understanding Liens and Easements

During a thorough title search, experts frequently come across different encumbrances and interests that can , like liens and easements. Liens signify a , usually as a result of unpaid obligations the owner has. Common types of liens include those related to taxes, mortgages, or mechanics' work on the premises. For instance, tax liens result from unpaid taxes on real estate, while mortgage liens are associated with the financing of the property, and mechanics' liens may arise when contractors have not received payment for their services. On the contrary, easements are a type of entitlement or concern that permits individuals or entities to utilize a section of the land for a particular objective, such as utility maintenance or right-of-way access. These agreements are crucial to comprehend, as they can greatly impact the value, usage rights, and the overall marketability of the real estate.

The consequences of liens and easements were emphasized in a case where Justice Jasvinder Basran evaluated the fair market worth of expropriated real estate in the Agriculture Land Reserve, taking into account its lawful encumbrances. Similarly, the emotional value of real estate and the complex relationships owners may have with their land were demonstrated by the George Brothers in Brentwood, Missouri, who inherited a plot built by their father. Eminent domain and its impact on ownership also became apparent in the historical case of Bruce's Beach, where a Black couple lost their resort to the city of Manhattan Beach despite lawful efforts to retain it. These real-world cases highlight the significance of of a land.

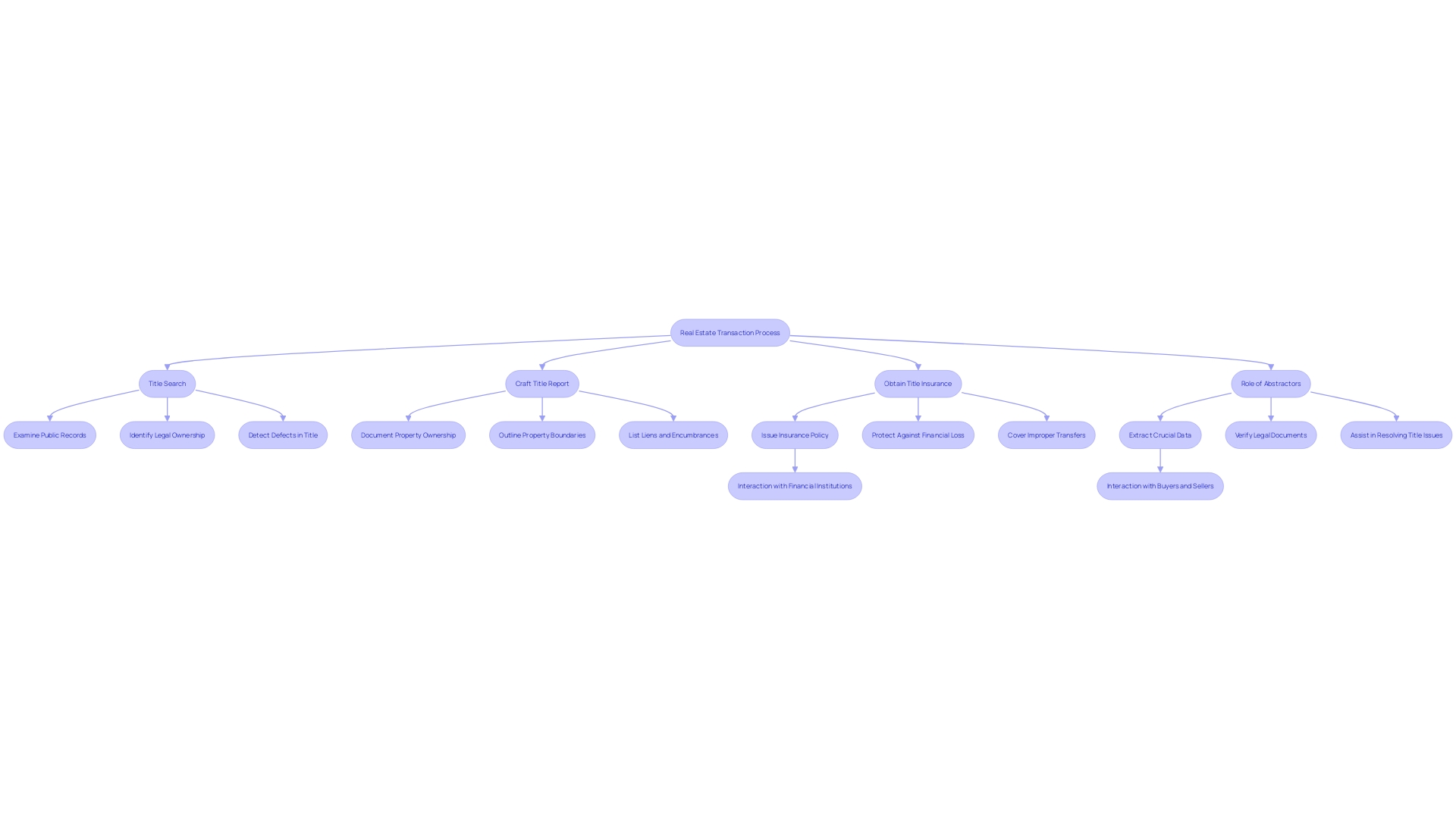

The Role of Title Companies and Abstractors

In the realm of real estate transactions, companies involved in the transfer of ownership and abstractors are indispensable entities that ensure the legitimacy and smooth transition of property ownership. serve as central hubs, orchestrating the intricate dance between buyers, sellers, and financial institutions. Their expertise extends to meticulous , crafting detailed title reports, and providing the safety net of , which guards against unforeseen claims and complications. Abstractors, with their specialized knowledge, delve into public records to extract crucial data pertaining to ownership history and any encumbrances that may affect the real estate. This attention to detail is not just about due diligence; it's about providing peace of mind and a clear roadmap of a property's lawful standing. As the industry evolves with digital transformation, these professionals adapt, employing innovative technologies to enhance accuracy and efficiency. Such advancements are evident in companies like First American Financial Corporation, which has been recognized for its workplace innovation and commitment to excellence in providing and settlement solutions. Their expansive suite of services, including valuation and mortgage subservicing, contributes to a robust $7.6 billion in revenue, demonstrating the substantial impact and necessity of these services in the industry. While professionals in the field navigate the complexities of the law and champion industry interests, they stay diligent in fighting against , guaranteeing the trustworthiness of real estate transactions in a constantly evolving environment.

Title Insurance and Its Importance

is not just a formality in the realm of ; it's a critical safeguard. This form of insurance serves as a bulwark, protecting both the buyer and the lender from possible future disputes or defects. Lenders often require insurance prior to approving a mortgage loan, as it provides a financial safety net against losses or legal fees resulting from undisclosed encumbrances, boundary disputes, or similar complexities. It's the guarantee that the ownership of the property is unencumbered and transferable, which not only secures the investment but also offers substantial peace of mind.

With the real estate industry evolving, companies like have been at the forefront, combining over a century's worth of financial robustness with cutting-edge technology to deliver comprehensive ownership and settlement solutions. Their services cover a wide range, from facilitating insurance for property ownership to providing additional data products, valuation services, and mortgage subservicing, contributing to a revenue of $7.6 billion in 2022. The precise work of professionals is evident in the industry's low claim rates compared to other insurance sectors. They preemptively address issues, ensuring that the are clear before the transaction concludes, a practice that significantly reduces the likelihood of future claims.

The importance of insurance is further emphasized by the American Land Title Association (ALTA), which actively advocates for the industry at both national and state levels. ALTA's educational resources and legal analyses serve as vital tools for industry professionals, keeping them informed about the latest developments and legal precedents. Furthermore, organizations like the Title Action Network (TAN) stress the importance of land title insurance in safeguarding rights to real estate, while the Title Industry Political Action Committee (TIPAC) represents the industry's interests in the political arena.

Costs and Who Pays for a Title Search

Calculating the expense of an investigation is affected by various elements such as the site of the real estate, the complexity of the ownership records, and or abstractor. It is generally anticipated that the purchaser will take care of these costs, which vary from the examination itself to protection and any supplementary services required to resolve problems or conflicts that emerge through the examination.

For instance, when embarking on an Akiya property purchase in the picturesque Chiba Prefecture, buyers must consider upfront costs. These costs were exemplified by an American resident in Japan who invested ¥220,000 at the onset of their search, underlining the financial commitment required in these transactions.

The is crucial in protecting against financial loss caused by defects in the chain of ownership. Issues such as unsatisfied liens or unlawful transfers can pose significant risks. First American Financial Corporation, a leader in the settlement industry with over a century of experience, exemplifies the critical nature of these services. In 2022, they reported substantial revenue, reflecting the industry's importance and their commitment to innovation, recognized by prestigious accolades from Great Place to Work® and Fortune Magazine.

The industry's landscape is constantly changing, as shown by recent legal and regulatory changes. ALTA's advocacy work highlights the significance of political action and grassroots organization in promoting the value of land insurance. Digital closings, AI enhancements, and cybersecurity are emerging as key areas where companies must adapt to stay ahead of threats like wire fraud, which remains a significant concern.

Moreover, the National Association of Realtors' regulation changes suggest a shift in how real estate transactions, including searches for property rights and associated costs, may be conducted going forward. With the real estate landscape in flux, in adapting to new regulations and to continue providing reliable and comprehensive title services.

Conclusion

In conclusion, a property title search is a crucial step in the real estate transaction process. It confirms the rightful owner and uncovers any potential hindrances, such as liens or easements, that could impede the transfer of ownership. Key components of a title search include examining public records, reviewing the property's legal description, investigating legal actions, and surveying records.

The title search process involves gathering property data, conducting a thorough examination of public records, ensuring the accuracy of the legal description, and preparing a detailed title report. Resolving any complications found during the search is necessary before transferring the property, and obtaining title insurance is recommended for buyer and lender protection.

Common issues found in title searches include outstanding liens, boundary disputes, inaccurate legal descriptions, fraud and forgery, missing or incomplete records, and undisclosed heirs or claims. Thorough property research and access to comprehensive real estate data tools are essential for addressing these challenges.

Title companies and abstractors play a vital role in ensuring the legitimacy and smooth transition of property ownership. They conduct meticulous title searches, provide detailed reports, and offer title insurance to protect against future disputes. Integration of technology enhances accuracy and efficiency in their work.

Title insurance is a critical safeguard, protecting both the buyer and lender from future title disputes or defects. It provides financial security against losses or legal fees resulting from undisclosed encumbrances or boundary disputes. Title professionals deliver comprehensive title and settlement solutions to ensure the integrity of real estate transactions.

The cost of a title search depends on factors such as location, complexity of records, and fees. Typically, the buyer covers these expenses, including the search, title insurance, and any necessary services to address issues. Title companies must adapt to new regulations and technological advancements to continue providing reliable and comprehensive title services in an evolving real estate landscape.

Contact our title company today for a smooth and legitimate transition of property ownership.

Frequently Asked Questions

What is the purpose of conducting a property ownership investigation?

The primary purpose of a property ownership investigation is to confirm the rightful owner and identify any potential issues, such as liens or easements, that could impede the transfer of ownership. This process ensures that the buyer or financial institution receives a legitimate and transferable title without undisclosed burdens.

What does a thorough investigation entail?

A thorough investigation involves examining public records and legal documents, reviewing deeds, mortgages, tax documentation, and assessing any past or ongoing legal actions. It aims to establish a clear chain of ownership and identify any encumbrances that may affect the title.

How does technology influence property investigations?

Companies like First American Data & Analytics provide advanced tools that enable instant access to various real estate data reports and documents, enhancing the efficiency and effectiveness of property investigations. AI solutions like Ellie also help reduce repetitive tasks, allowing real estate professionals to focus on more meaningful work.

What is the difference between a title investigation and a property survey?

A title investigation focuses on legal ownership and potential defects in the ownership chain, while a property survey, conducted by a licensed surveyor, examines the physical boundaries and characteristics of the property. Both processes are essential for ensuring clear ownership and preventing future disputes.

What common challenges might arise during a title investigation?

Common challenges include outstanding liens from unpaid taxes or mortgages, boundary disputes regarding property lines, inaccurate legal descriptions of the property, instances of fraud or forgery in ownership documents, absent or insufficient ownership records, and undisclosed heirs or claims affecting ownership.

Why is title insurance important?

Title insurance protects both buyers and lenders from potential future disputes or defects that may not have been evident during the transaction. It serves as a financial safety net against losses or legal fees resulting from undisclosed issues, ensuring peace of mind for all parties involved.

What costs are associated with conducting a property ownership investigation?

Costs can vary based on the property's location, complexity of ownership records, and fees from the title company or abstractor. Typically, the buyer is responsible for these costs, which can include the investigation itself, title insurance, and any additional services needed to resolve issues identified during the examination.

How does the process of ownership investigation contribute to real estate transactions?

Conducting a thorough ownership investigation is crucial for identifying potential problems that might impact the transfer of real estate. It ensures that all parties involved have a clear understanding of the property's ownership status, thus facilitating smoother transactions and reducing the risk of future disputes.