Overview

This article offers a comprehensive overview of title commitments, underscoring their critical role in securing property ownership. It outlines the essential conditions and exceptions that must be addressed prior to the closing of a real estate transaction. Understanding the structure of title commitments, particularly Schedules A and B, is paramount. Furthermore, it highlights common exceptions such as:

- Easements

- Zoning restrictions

These can significantly influence property value and usage. By grasping these elements, real estate professionals can navigate transactions more effectively and mitigate associated risks.

Introduction

Understanding the intricate world of title commitments is essential for anyone involved in real estate transactions. These legal documents not only provide assurances regarding property ownership but also outline potential pitfalls that could arise post-closing. As the landscape of real estate becomes increasingly complex, the ability to navigate the nuances of title commitments can significantly impact the success of a transaction.

What challenges might arise if these commitments are misunderstood? Furthermore, how can real estate professionals ensure they are safeguarding their clients’ interests?

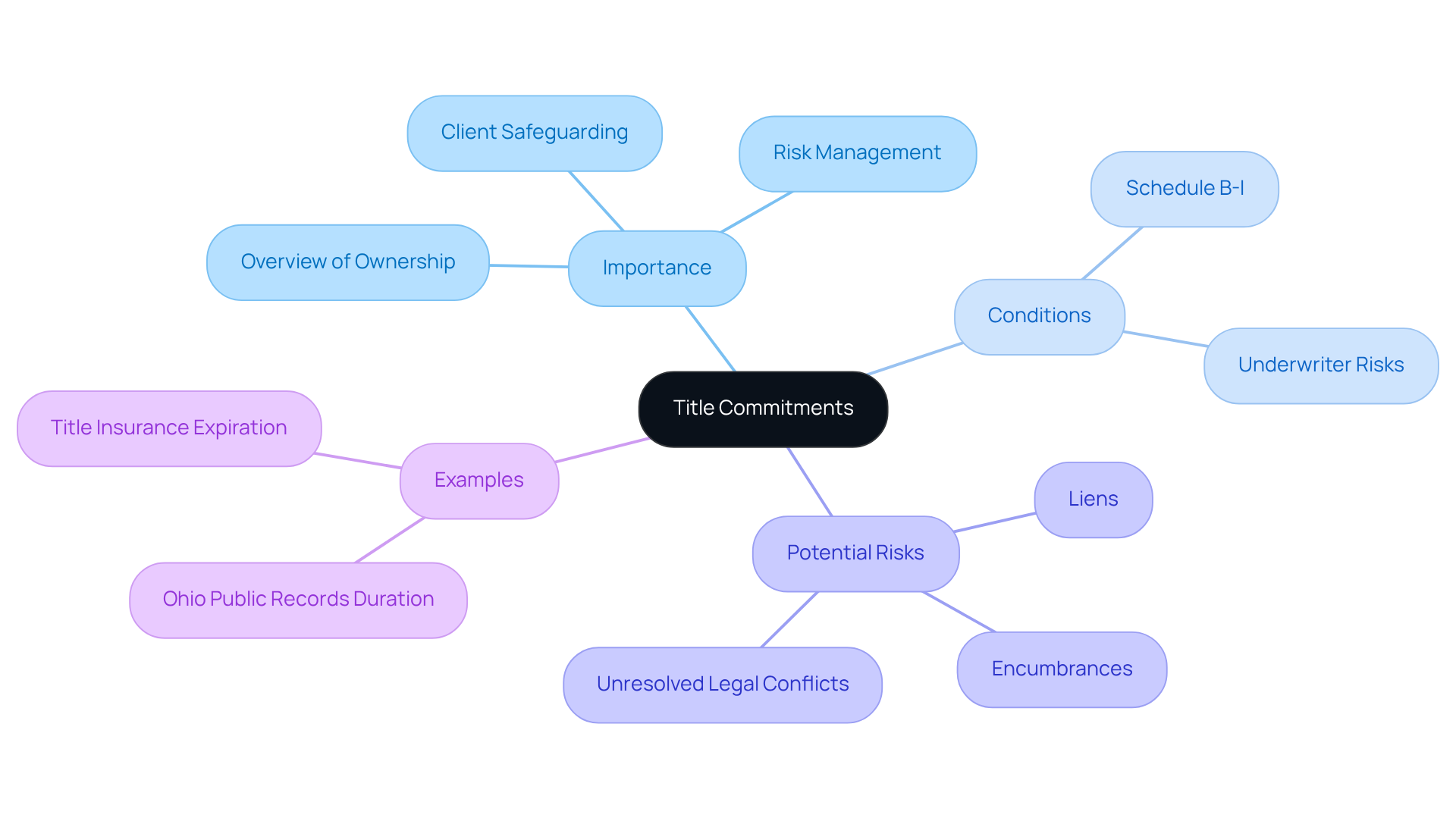

Define Title Commitments and Their Importance

A document of assurance is a legal paper supplied by an insurance firm, detailing the terms under which it will provide a policy for protection. This document serves as an overview of title commitments, acting as a guarantee to secure the ownership of a property after closing and outlining specific conditions that must be fulfilled before the policy is finalized.

Documents of assurance are crucial as they provide an overview of title commitments, which inform purchasers and vendors of possible ownership problems, including liens, encumbrances, or unresolved legal conflicts. However, it is important to acknowledge that a clear ownership assurance does not ensure the lack of future ownership issues. Grasping these obligations enables real estate experts to manage transactions more efficiently, minimizing risks linked to property ownership.

In Ohio, for example, the typical duration for accessing public records is sixty years for conveyancing transactions, highlighting the significance of comprehensive examination of ownership. Furthermore, the insurance agreement will end six months after the effective date indicated on Plan A, underscoring the necessity for prompt measures in addressing any identified concerns.

Schedule B-I details conditions that need to be addressed prior to closing, and underwriters may cover known risks without revealing them in the agreement. As noted by Franklin D. Roosevelt, 'Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.' This emphasizes the essential function of in the overview of title commitments that protect property investments.

By understanding the complexities of ownership agreements, real estate experts can improve their decision-making processes and ultimately safeguard their clients' interests.

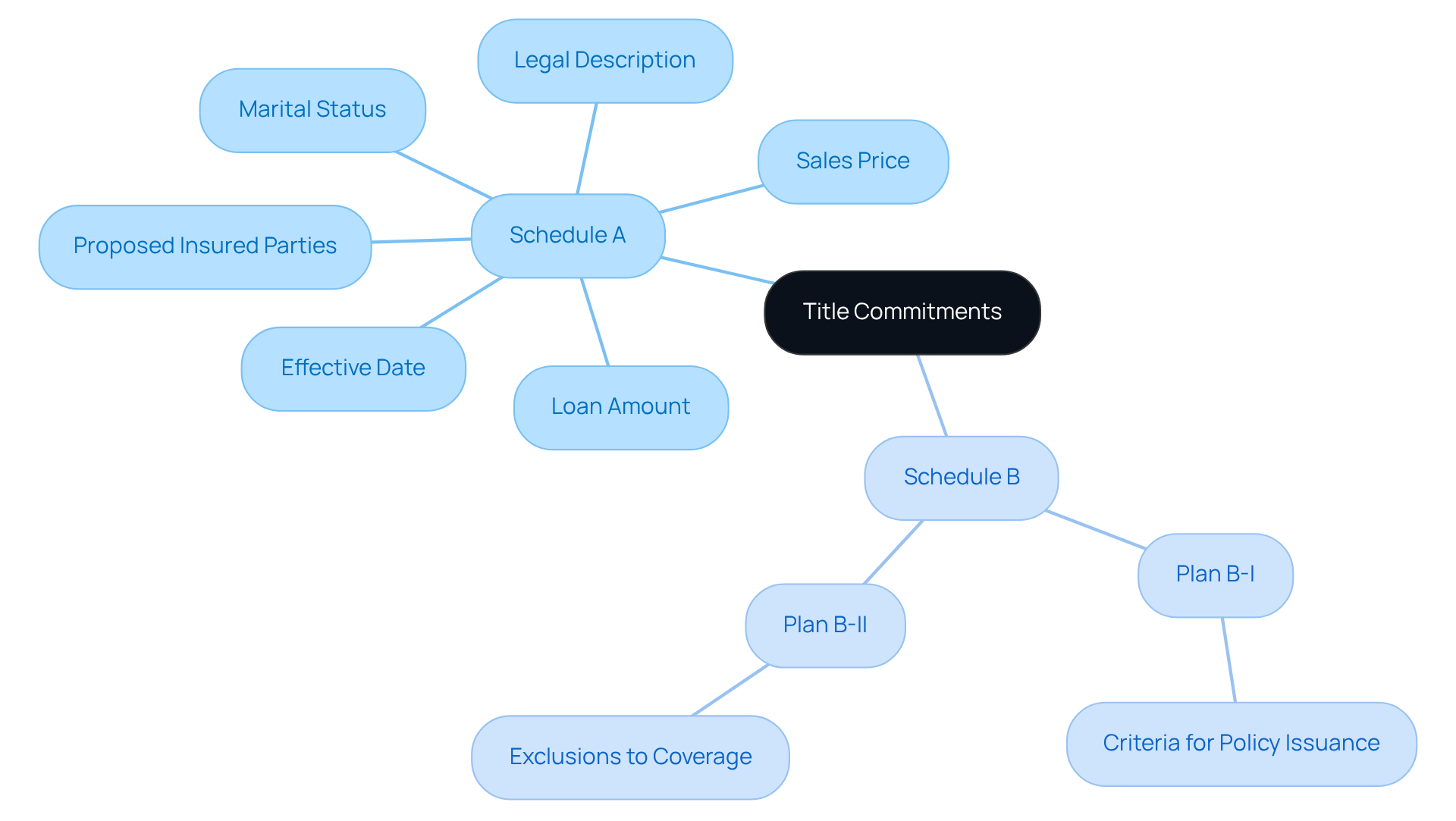

Analyze the Structure of Title Commitments: Schedules A and B

Title agreements are organized around crucial sections, particularly A and B. Document A provides essential transaction information, including the effective date, proposed insured parties, the legal description of the property, sales price, loan amount, and the marital status of the Buyer and Seller. This effectively summarizes the 'who, what, and where' of the commitment. In contrast, Plan B is divided into two parts:

- Plan B-I outlines the criteria that must be fulfilled before issuing the insurance policy.

- Plan B-II specifies exclusions to coverage, detailing matters that the insurance policy will not cover.

Understanding these schedules is vital for real estate professionals, as it provides an and enables them to ensure compliance while proactively addressing potential title issues before closing. A meticulous review with a seasoned real estate attorney can help identify potential pitfalls, particularly regarding the exceptions noted in Schedule B. Recent trends suggest an increasing focus on comprehensive evaluations of these schedules, especially considering the changing intricacies of real estate transactions and the need for transparent communication and cooperation among all parties involved.

Identify Common Exceptions and Conditions in Title Commitments

An overview of title commitments reveals that common exceptions include easements, rights of way, and zoning restrictions, all of which can significantly impact land use and value. For instance, an easement may allow a utility company access to install and maintain power lines, potentially restricting the owner's ability to develop that portion of the land. Additionally, zoning restrictions dictate how a property can be utilized, which can affect its marketability and overall value. Industry statistics indicate that easements are present in approximately 30% of registered documents, underscoring their prevalence in real estate transactions.

Furthermore, factors such as overdue tax obligations or pending legal conflicts must be addressed prior to the release of an insurance policy. As Emily Grant, a lawyer at , notes, "Clients should understand they’re not receiving the ownership guarantee because there’s an issue; it’s a typical part of the procedure that assists in identifying known conditions."

By identifying these exceptions and conditions early in the transaction process, real estate professionals can provide an overview of title commitments to proactively resolve issues, ensuring a smoother closing experience. This proactive approach not only safeguards the buyer's interests but also enhances the overall efficiency of the transaction, ultimately contributing to a more favorable outcome for all parties involved. Moreover, purchasers can engage with vendors to rectify, eliminate, or address unacceptable exceptions through endorsements or extended policies, further ensuring clarity and security in their real estate transactions.

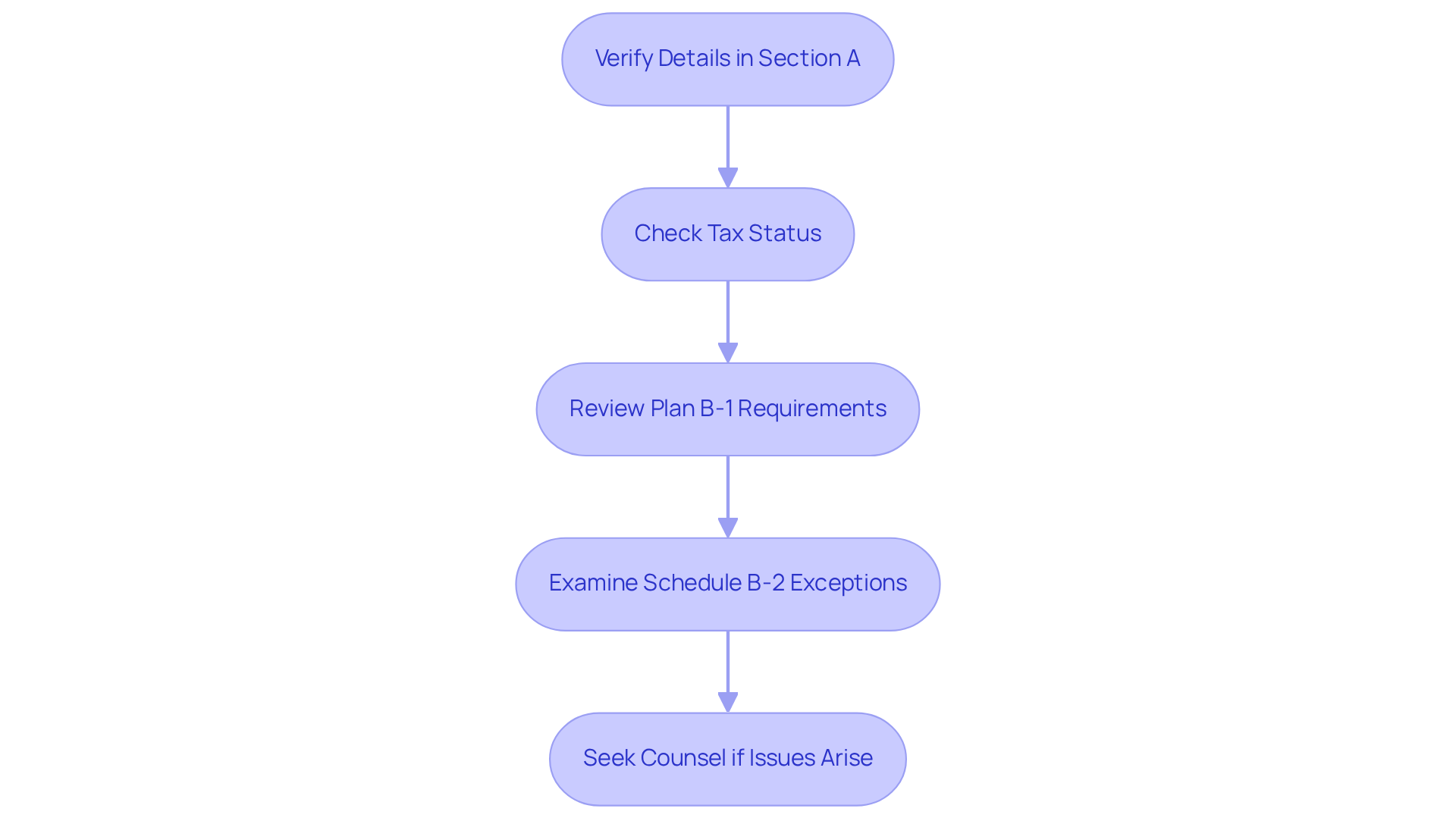

Review and Interpret Title Commitments Effectively

To efficiently assess a commitment document, begin by verifying the details in Section A, ensuring that the asset information aligns with the transaction particulars. It is imperative to check the tax status, confirming that all real estate taxes are current before providing insurance coverage.

Furthermore, review Plan B-1 for any requirements that must be fulfilled prior to closing, such as obtaining a survey or resolving outstanding liens. A meticulous review of these requirements can help avert unexpected legal and financial complications post-settlement.

Ultimately, examine Schedule B-2 for exceptions that could influence the asset's ownership. Common discrepancies may include unrecorded easements or boundary issues, which can complicate ownership rights.

As James Davenport observes, "The Commitment Document is a vital component of information that informs the buyer, lender, and other transaction participants of any problems that could obscure the ownership of the real estate or limit the use of the property."

If any inconsistencies or issues arise, it is advisable to seek counsel from a company or legal expert for clarification. By adhering to these steps and best practices, can gain a comprehensive overview of title commitments and their implications, enabling informed decision-making throughout the transaction process.

Conclusion

Understanding title commitments is essential for anyone involved in real estate transactions; these documents serve as a safeguard for property ownership. They outline the terms and conditions under which an insurance policy will be issued, highlighting potential issues such as liens or legal disputes that may affect ownership. By comprehensively grasping these commitments, real estate professionals can mitigate risks and enhance the security of property transactions.

Key insights from the article emphasize the structured nature of title commitments, particularly the significance of Schedules A and B.

- Schedule A summarizes critical transaction details.

- Schedule B addresses necessary conditions and exceptions that may arise.

Recognizing common exceptions, such as easements and zoning restrictions, is vital for ensuring a smooth transaction process. Furthermore, a meticulous review of these schedules, along with consultation from experienced legal professionals, can prevent unforeseen complications and promote informed decision-making.

Ultimately, the importance of title commitments in real estate cannot be overstated. They not only protect buyers and sellers but also facilitate transparent communication among all parties involved. Engaging proactively with these documents and understanding their implications is crucial for anyone navigating the complexities of property transactions. By prioritizing thorough evaluations and clear communication, stakeholders can foster a more secure and efficient real estate landscape.

Frequently Asked Questions

What is a title commitment?

A title commitment is a legal document provided by an insurance company that outlines the terms under which it will issue a policy for property protection. It acts as a guarantee to secure property ownership after closing and specifies conditions that must be met before the policy is finalized.

Why are documents of assurance important?

Documents of assurance are important because they provide an overview of title commitments, informing buyers and sellers of potential ownership issues, such as liens, encumbrances, or unresolved legal conflicts. They help real estate professionals manage transactions more efficiently and minimize risks related to property ownership.

How long is the typical duration for accessing public records in Ohio?

In Ohio, the typical duration for accessing public records related to conveyancing transactions is sixty years.

What does Schedule B-I outline?

Schedule B-I details the conditions that need to be addressed prior to closing on a property.

What happens to the insurance agreement after the effective date on Plan A?

The insurance agreement will end six months after the effective date indicated on Plan A, highlighting the need for prompt action to address any identified concerns.

Can a clear ownership assurance guarantee the absence of future ownership issues?

No, a clear ownership assurance does not guarantee that future ownership issues will not arise. It is important to understand that potential problems may still occur after the policy is issued.

How can understanding ownership agreements benefit real estate experts?

By understanding the complexities of ownership agreements, real estate experts can improve their decision-making processes and better safeguard their clients' interests.