Overview

The article offers a comprehensive step-by-step guide on conducting a free title lien search, underscoring its critical role in real estate transactions to prevent complications arising from outstanding claims. It delineates essential steps, including:

- Gathering property information

- Checking public records

- Consulting with legal experts

Furthermore, it highlights the potential financial and legal repercussions of unresolved liens, thereby reinforcing the necessity of thorough due diligence in property ownership.

Introduction

In the intricate world of real estate, understanding title liens transcends mere legal jargon; it is vital for safeguarding investments and ensuring seamless transactions. A title lien represents a legal claim on a property, often emerging from unpaid debts, and can significantly hinder an owner's ability to sell or refinance.

As the real estate landscape evolves, particularly in 2025, the consequences of unresolved liens have become increasingly pronounced, with statistics indicating that a substantial portion of transactions experience delays due to these encumbrances. From mortgage and tax liens to judgment and mechanic's liens, each type presents its own unique challenges and repercussions.

This article explores the critical importance of grasping title liens, the various types that exist, and the essential steps to conduct thorough searches, ultimately equipping real estate professionals and property owners with the expertise necessary to navigate this complex terrain successfully.

Understanding Title Liens: Definition and Importance

A designation encumbrance signifies a legal assertion against an asset, typically arising from unpaid debts or obligations. When a claim is placed on an asset, it indicates that the asset serves as collateral for a debt, significantly hindering the owner's ability to sell or refinance. Comprehending property claims is essential for anyone involved in real estate dealings. Performing a free title lien search is crucial, as these claims can result in substantial financial consequences if not addressed before a sale or change of ownership.

For instance, a mortgage claim indicates that the asset is financed, whereas a tax obligation may arise from unpaid real estate taxes. Both categories of claims must be resolved to establish definitive ownership. In 2025, the landscape of ownership claims is particularly significant, as statistics reveal that unresolved claims can complicate property sales, with a notable percentage of transactions experiencing delays due to these burdens.

In December 2024, all four U.S. regions faced month-over-month losses in transactions, underscoring the challenges in the current market.

Expert views underscore the importance of understanding ownership claims in real estate transactions. Lawrence Yun, NAR Chief Economist, notes that "mortgage rates have refused to budge for several months despite multiple rounds of short-term interest rate cuts by the Federal Reserve," which, combined with elevated home prices, contributes to housing affordability challenges. Neglecting to address these claims can lead to unforeseen expenses and legal obstacles, ultimately impacting the bottom line.

Case studies illustrate the effect of claims on real estate ownership, showcasing instances where assets were unable to close due to outstanding claims. This emphasizes the necessity for a free title lien search to ensure clear ownership. The case study titled "Need for Agility in the Real Estate and Title Industries" highlights the need for companies to adapt to changing conditions and invest in digital systems and data extraction solutions to enhance their responsiveness to market changes.

As evolves, particularly considering recent trends and economic factors, understanding the effects of ownership claims becomes progressively essential for ensuring successful transactions and safeguarding investments. The Housing Affordability Index further emphasizes the financial consequences of title claims and their impact on real estate transactions in 2025.

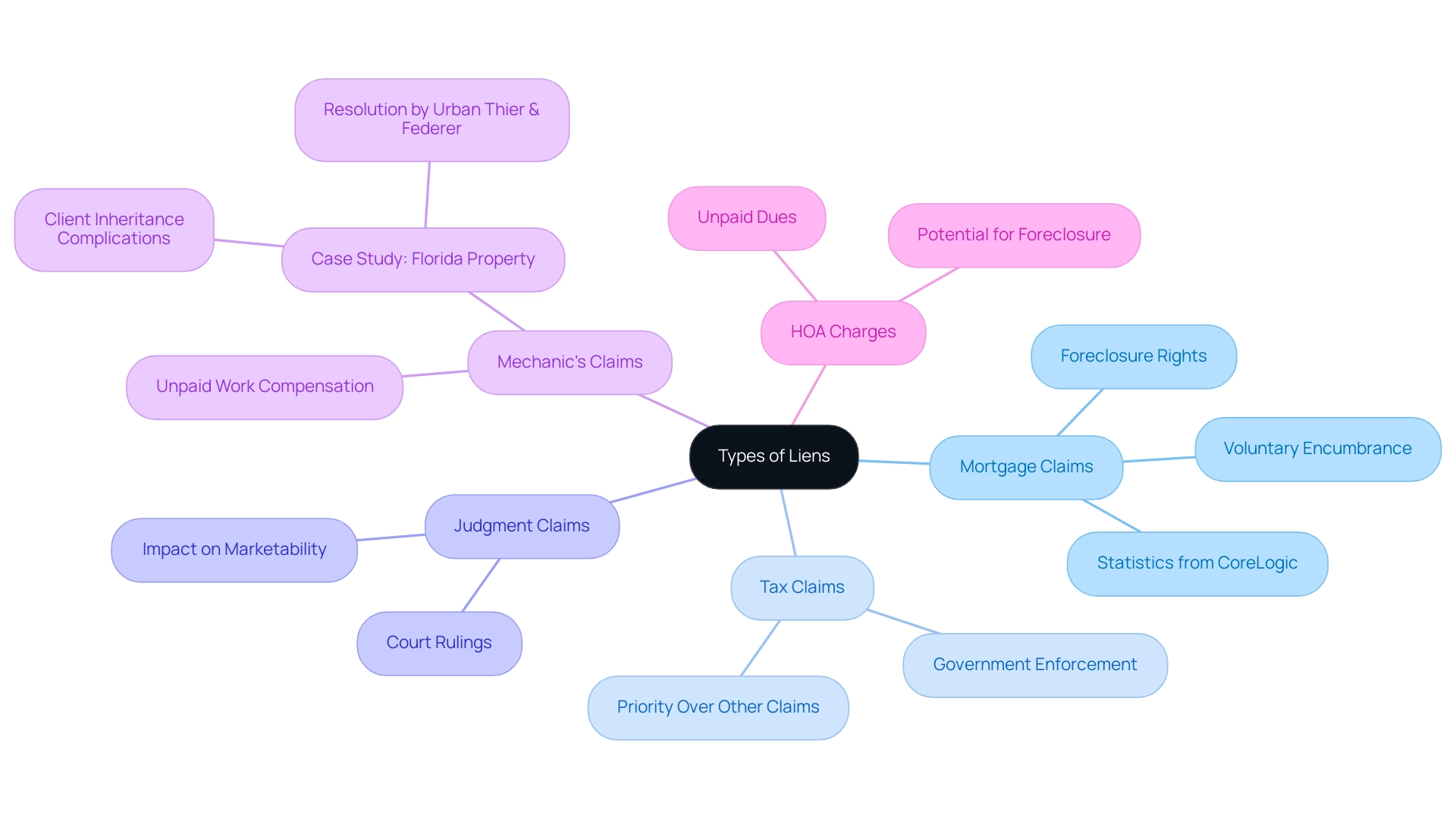

Types of Liens: Exploring the Landscape of Property Liens

Liens are critical elements in property ownership and can be categorized into several distinct types, each with unique implications:

- Mortgage Claims: These voluntary encumbrances are created by lenders when financing an asset. They grant the lender the right to foreclose if the borrower defaults on their mortgage obligations, making them a significant consideration for real estate buyers and investors. Recent statistics from CoreLogic indicate that a substantial percentage of real estate in the U.S. is encumbered by mortgage claims, underscoring the importance of thorough due diligence in real estate transactions.

- Tax Claims: Enforced by governmental organizations for unpaid taxes, tax claims can present significant difficulties for landowners. They hold priority over other claims, meaning that unpaid taxes must be resolved before any other demands against the asset can be addressed.

- Judgment Claims: These claims emerge from court rulings against an owner, frequently due to unpaid obligations. They can severely restrict the owner's ability to sell or refinance the asset until the judgment is resolved, impacting its marketability.

- Mechanic's Claims: Submitted by contractors or suppliers who have not been compensated for work done on the premises, mechanic's claims can complicate real estate dealings. For example, a recent case involved a client in Germany who inherited property in Florida but encountered issues due to unpaid construction debts. The law firm Urban Thier & Federer successfully handled these complexities, demonstrating the significance of addressing mechanic's claims promptly to enable property transfers. This underscores the necessity for title researchers to ensure that all claims are resolved before proceeding with title transfers.

- Homeowners' Association (HOA) Charges: These obligations arise from unpaid dues to an HOA and can lead to foreclosure if not resolved. They emphasize the necessity for landowners to stay current on community obligations to avoid legal repercussions.

As Mark Williams observed, "In other terms, encumbrances allow creditors to assert their rights over assets," which highlights the essential importance of comprehending these claims. Grasping these categories of claims is crucial for anyone conducting , as each type has distinct implications for ownership. Furthermore, with the recent developments surrounding the Corporate Transparency Act, real estate professionals must stay informed about the evolving regulatory landscape impacting ownership.

As the terrain of real estate ownership changes, remaining updated on the latest trends in mortgages and tax claims is essential for real estate professionals.

Step-by-Step Guide to Conducting a Free Title Lien Search

To effectively conduct , adhere to the following comprehensive steps:

- Gather Property Information: Begin by collecting crucial details about the property, such as the address, parcel number, and the current owner's name. This foundational information is essential for precise inquiries.

- Visit the County Recorder's Office: Most counties maintain online databases for property claims. If an online option is unavailable, plan a visit to the county recorder's office to access public records directly.

- Search Public Records: Investigate any recorded claims against the property. This inquiry should include various forms of claims, such as tax claims, mortgage claims, and other encumbrances that may influence ownership. As Amanda (Rasizzi) Blooflat, Director of Marketing, states, "You’ll never miss anything with our fast, accurate multi-jurisdictional searches that yield the most current data."

- Check for Additional Claims: Beyond the obvious, inquire about mechanic's claims or homeowners association (HOA) claims that might not be readily apparent in public records. These can significantly impact property transactions. Lien Solutions offers quick, precise multi-jurisdictional searches for current tax data, ensuring comprehensive coverage.

- Document Your Findings: Maintain a detailed record of all claims discovered, noting their status and any pertinent details regarding the associated debts. This documentation will be invaluable for future reference.

- Confer with a Property Firm: If any claims are discovered, it is recommended to confer with a property firm. Their expertise can provide guidance on resolving these issues effectively, ensuring a smoother transaction process.

By following these steps, you can perform a comprehensive title search, including a free title lien search to identify potential issues that may occur during real estate transactions. This proactive approach not only saves time but also enhances the accuracy of your findings, ultimately leading to more informed decision-making. Furthermore, be aware that the maximum loan processing fee on installment loans in Michigan will change from $400 effective January 1, 2026, which may impact your financial considerations during property transactions.

In addition, Virginia's new law prevents landlords from imposing transaction or processing fees for electronic fund transfers associated with rent and security deposits, starting January 1, 2025, emphasizing the significance of comprehending financial implications in real estate transactions.

Essential Tools and Resources for Title Lien Searches

To conduct an effective title lien search, it is essential to utilize a range of tools and resources that can streamline the process and enhance accuracy:

- County Assessor's Website: Most counties offer online access to real estate records, including comprehensive claim information, making it a primary resource for preliminary inquiries.

- : Platforms like PropertyOnion.com provide a free title lien search, granting users access to extensive property records and lien inquiries. This enables the collection of vital information without incurring expenses.

- : Advanced tools such as SoftPro and DataTrace automate the inquiry process, delivering quick access to critical data. These software solutions are increasingly recognized for their effectiveness, with industry leaders noting that favorable labels can significantly enhance click-through rates (CTR) in relevant inquiries. Indeed, the average CTR is 1.91% for queries and 0.35% for display, underscoring the importance of optimizing headings. As Brian Dean states, "Positive titles may enhance your CTR," emphasizing the necessity of using optimized titles in queries.

- Legal Assistance: Consulting with a real estate attorney can provide invaluable insights, particularly when navigating complex property claims. Their expertise helps clarify legal nuances that may arise during the inquiry process.

- Local Firms: Collaborating with local firms offers expert support in performing comprehensive investigations and addressing any identified claims. Their familiarity with regional regulations and practices enhances the reliability of the findings.

By utilizing these resources, you can greatly improve your property claim investigation process, ensuring a thorough assessment of the property's condition. In 2025, the effectiveness of document review software remains emphasized by case studies showing enhanced efficiency and precision, rendering these tools essential for real estate experts. Organizations investing in analytics will possess a competitive advantage by predicting market shifts and personalizing services, further highlighting the significance of employing advanced tools in property assessments.

Navigating Challenges: Common Issues in Title Lien Searches

Conducting a title lien search presents several significant challenges that professionals must navigate effectively:

- Incomplete Records: A staggering percentage of public records are incomplete, with estimates suggesting that nearly 30% may lack crucial information. This gap obstructs the recognition of all current claims.

- Outdated Information: Records often suffer from delays in updates, leading to discrepancies in claim status. In 2025, the need for timely information is more critical than ever, as outdated records can result in costly errors.

- Hidden Claims: Certain claims, such as mechanic's claims or private agreements, may not be recorded in public databases, complicating the search process. This lack of visibility poses significant risks to asset transactions.

- Legal Complexities: surrounding various claims can be intricate. Without proper guidance, understanding these complexities can be daunting, potentially leading to misinterpretations that affect ownership rights.

- Time Constraints: The thoroughness required in conducting a lien search can be time-consuming, particularly when multiple properties are involved. This challenge is exacerbated by the increasing demand for rapid turnaround times in real estate transactions.

- Data Protection: As cyber threats escalate in 2025, companies specializing in real estate transactions must prioritize the safeguarding of sensitive client and transaction information. This is essential not only for compliance but also for maintaining client trust and safeguarding against potential breaches.

To effectively tackle these challenges, collaborating with a document company or legal professional to conduct a free title lien search is advisable. Their expertise guarantees a thorough inquiry and assists in resolving any problems that may arise, ultimately improving the effectiveness and precision of the document investigation process. As Jason Keller aptly stated, "In an era where operational efficiency increasingly determines success, modernizing compliance technology isn’t just an investment—it’s an imperative."

Furthermore, concentrating on customer service can act as a secret weapon in a competitive market, enabling companies to distinguish themselves and better meet the diverse needs of their clients.

Verifying Your Findings: Ensuring Accuracy in Title Lien Searches

Confirming results after performing a free title lien search and property record investigation is essential for maintaining precision and reducing risks in real estate dealings. Here are key steps to follow:

- Cross-Reference Records: It is vital to compare your findings against multiple sources, such as county records and reputable online databases. This practice not only enhances the reliability of your results but also aligns with the industry’s emphasis on accuracy and transparency, which are essential for thriving in 2025.

- Consult Experts: Should you encounter any discrepancies or uncertainties, do not hesitate to consult with a property company or a real estate attorney. Their expertise can offer clarity and assist in navigating complex situations, especially when addressing non-consensual liens, which may have varying naming protocols and can complicate inquiries. As Diane Tomb, CEO of , states, "the amount of research and corrective action from expert professionals needed to provide homeowners and lenders with assurance about their ownership remains significant."

- Document Everything: Maintain meticulous records of your exploration process and findings. This includes documenting dates, sources, and any communications with relevant parties. Such thorough documentation supports your conclusions and is invaluable in case of disputes or claims, especially since title companies that offer a free title lien search and have documented risk management procedures experience 40% fewer claims than those without.

- Follow Up on Claims: If your inquiry uncovers any claims, it is crucial to reach out to the relevant parties to verify their status and comprehend any required steps to address them. This diligence is essential, particularly considering recent case studies emphasizing the complexities related to non-consensual encumbrances, such as federal and state tax claims, which can impact priority over entitlements. For example, the case study on difficulties with non-consensual claims illustrates how these claims may be filed under different names than those required by UCC rules, highlighting the necessity for comprehensive investigations and diligence.

- Stay Informed: Regularly monitor updates related to the asset, as new claims can emerge at any time. Staying proactive in this regard can prevent potential issues and ensure that you are always working with the most current information.

By implementing these strategies, you can significantly enhance the accuracy of your title searches, thereby safeguarding your real estate transactions and fostering trust with clients and stakeholders alike. Embracing innovation while maintaining core values of accuracy, transparency, and trust will be essential for success in 2025.

The Impact of Liens on Property Ownership: What You Need to Know

Liens can profoundly affect ownership of assets in various critical ways:

- Transfer Restrictions: Properties burdened by outstanding claims often encounter significant transfer restrictions. Until these claims are resolved, the sale of the asset can be complicated, leading to delays and possible loss of buyer interest.

- Financial Liability: Property owners may bear the financial burden of debts associated with encumbrances. This responsibility can escalate to severe consequences, including foreclosure, if the debts remain unaddressed. In 2025, it is estimated that around 3% of real estate in the U.S. is impacted by some kind of claim, highlighting the necessity for vigilance. Significantly, markets such as Las Vegas and Los Angeles possess negative equity shares of all mortgages at 0.6% and 0.7%, respectively, emphasizing the financial consequences of claims in these regions.

- Market Value Reduction: The existence of claims generally decreases a real estate's market value. Properties with unresolved claims are often seen as less appealing, which can discourage potential buyers and result in reduced sale prices. Recent statistics show that assets with claims can experience a market value decrease of up to 15% compared to comparable assets without such burdens.

- Legal Complications: Liens can introduce legal complexities, particularly when multiple claims exist against a single property. This situation can lead to disputes that may require legal intervention, further complicating the transaction process.

- Increased Closing Costs: The process of resolving encumbrances can incur additional costs, which may not have been initially anticipated. These costs can significantly affect the overall financial viability of a transaction, making it crucial for real estate professionals to incorporate them into their calculations.

must verify for claims as part of their due diligence, as claims can dissuade buyers and complicate transactions. Understanding these implications is vital for anyone engaged in real estate transactions. Performing comprehensive title searches, such as a free title lien search, and proactively resolving any concerns can protect against potential issues, ensuring smoother transactions and safeguarding asset values.

Additionally, tax encumbrances can be a feasible investment for seasoned investors, but they present hazards for inexperienced investors lacking adequate research. As Dr. Selma Hepp, Chief Economist for CoreLogic, noted, persistent home price growth has continued to fuel home equity gains for existing homeowners, who now average about $315,000 in equity, almost $129,000 more than at the onset of the pandemic. Incorporating these insights can instill confidence in agents' abilities to assist clients in buying, selling, or renting properties.

Resolving Liens: Steps to Take if You Encounter Issues

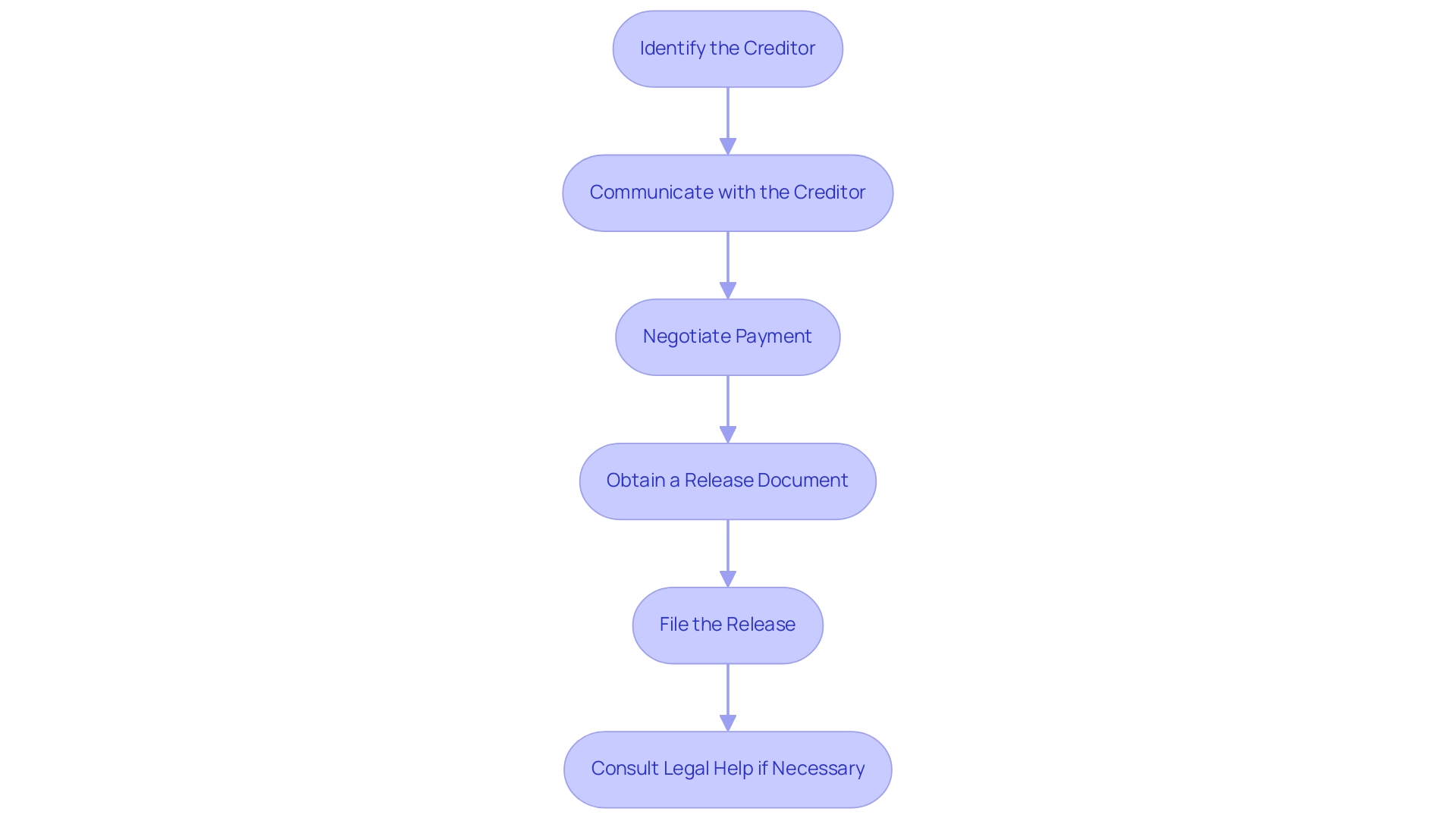

When facing claims during a title search, it is essential to follow a systematic approach to resolve them effectively.

- Identify the Creditor: Start by determining the entity that possesses the claim. Collect their contact information to facilitate communication.

- Communicate with the Creditor: Initiate a conversation with the creditor to discuss the situation and any outstanding amounts. Clear communication can often lead to quicker resolutions.

- Negotiate Payment: If there are amounts owed, negotiate a payment plan or settlement. Many lienholders are open to discussions, especially if it means recovering some of the owed funds. Notably, that 75% of seller's agents were paid by the seller, highlighting the financial dynamics at play in real estate transactions.

- Obtain a Release Document: After settling the debt, ensure you receive a release document from the holder. This document is essential as it confirms that the claim has been satisfied.

- File the Release: Submit the release of claim to the county recorder's office. This step is essential to officially eliminate the encumbrance from the property records, ensuring that future transactions are not hindered.

- Consult Legal Help if Necessary: If complications arise during the negotiation or resolution process, consider hiring a real estate attorney. Their knowledge can be crucial in managing intricate situations.

In 2025, statistics show that settling claims in real estate transactions can take an average of 30 to 60 days, depending on the intricacy of the case and the responsiveness of the claimant. Expert advice suggests that maintaining open lines of communication and being prepared to negotiate can significantly expedite this process. Additionally, recent case studies highlight successful negotiations where lienholders agreed to reduced settlements, showcasing the importance of persistence and strategy in these discussions.

Furthermore, the current real estate market is influenced by inventory shortages driven by homeowners' reluctance to sell in a high-interest-rate environment, which may complicate resolutions. By following these steps, you can effectively address any liens encountered during your title search, ensuring a clear title for your property. As noted by REsimpli, 28.75% of Americans believe that certain policies may create challenges and instability for the American real estate market, emphasizing the need for strategic negotiation with lienholders.

Conclusion

Understanding title liens is crucial for anyone involved in real estate, as these legal claims can significantly impact property ownership and transactions. A comprehensive grasp of the various types of liens—mortgage, tax, judgment, mechanic's, and HOA liens—enables property owners and investors to navigate potential pitfalls effectively. With the evolving real estate landscape in 2025, the ramifications of unresolved liens are more pronounced than ever, leading to transaction delays and financial repercussions.

Conducting thorough title lien searches is essential in safeguarding investments and ensuring seamless transactions. By following systematic steps and leveraging essential tools and resources, individuals can identify potential issues before they escalate. Furthermore, understanding the challenges associated with title lien searches, such as incomplete records or hidden liens, highlights the need for diligence and expertise in this area.

When encountering liens, taking appropriate steps to resolve them—communicating with lienholders and securing lien releases—is vital for maintaining clear property titles. As the real estate market continues to evolve, staying informed about lien implications and the latest regulatory changes will empower real estate professionals and property owners alike. Ultimately, prioritizing the understanding and management of title liens can lead to more successful transactions and a stronger foundation for property investments.

Frequently Asked Questions

What is a designation encumbrance?

A designation encumbrance signifies a legal assertion against an asset, typically arising from unpaid debts or obligations, indicating that the asset serves as collateral for a debt.

Why is understanding property claims important in real estate?

Understanding property claims is essential for anyone involved in real estate dealings as unresolved claims can complicate property sales and may lead to substantial financial consequences if not addressed.

What is the significance of performing a free title lien search?

Performing a free title lien search is crucial to identify any claims against the property, ensuring clear ownership and preventing unforeseen expenses and legal obstacles.

What types of claims can affect property ownership?

The main types of claims that can affect property ownership include: 1. Mortgage Claims: Created by lenders for financed assets. 2. Tax Claims: Enforced for unpaid taxes and hold priority over other claims. 3. Judgment Claims: Result from court rulings against the owner for unpaid obligations. 4. Mechanic's Claims: Arise from unpaid work by contractors or suppliers. 5. Homeowners' Association (HOA) Charges: Result from unpaid dues to an HOA.

How do mortgage claims impact property owners?

Mortgage claims grant lenders the right to foreclose if the borrower defaults, significantly affecting the owner's ability to sell or refinance the asset.

What are the implications of tax claims on property?

Tax claims must be resolved before any other demands against the asset can be addressed, making them a priority for landowners.

What challenges do judgment claims pose for property owners?

Judgment claims can severely restrict the owner's ability to sell or refinance the asset until the judgment is resolved, impacting its marketability.

How can mechanic's claims complicate real estate transactions?

Mechanic's claims can arise from unpaid work done on the property, complicating transfers and requiring prompt resolution to facilitate property transactions.

What can happen if homeowners' association charges are not resolved?

Unpaid HOA charges can lead to foreclosure, emphasizing the need for landowners to stay current on community obligations.

Why is it important for real estate professionals to stay informed about ownership claims?

Staying informed about ownership claims is essential for real estate professionals to navigate the evolving regulatory landscape and ensure successful transactions.