Overview

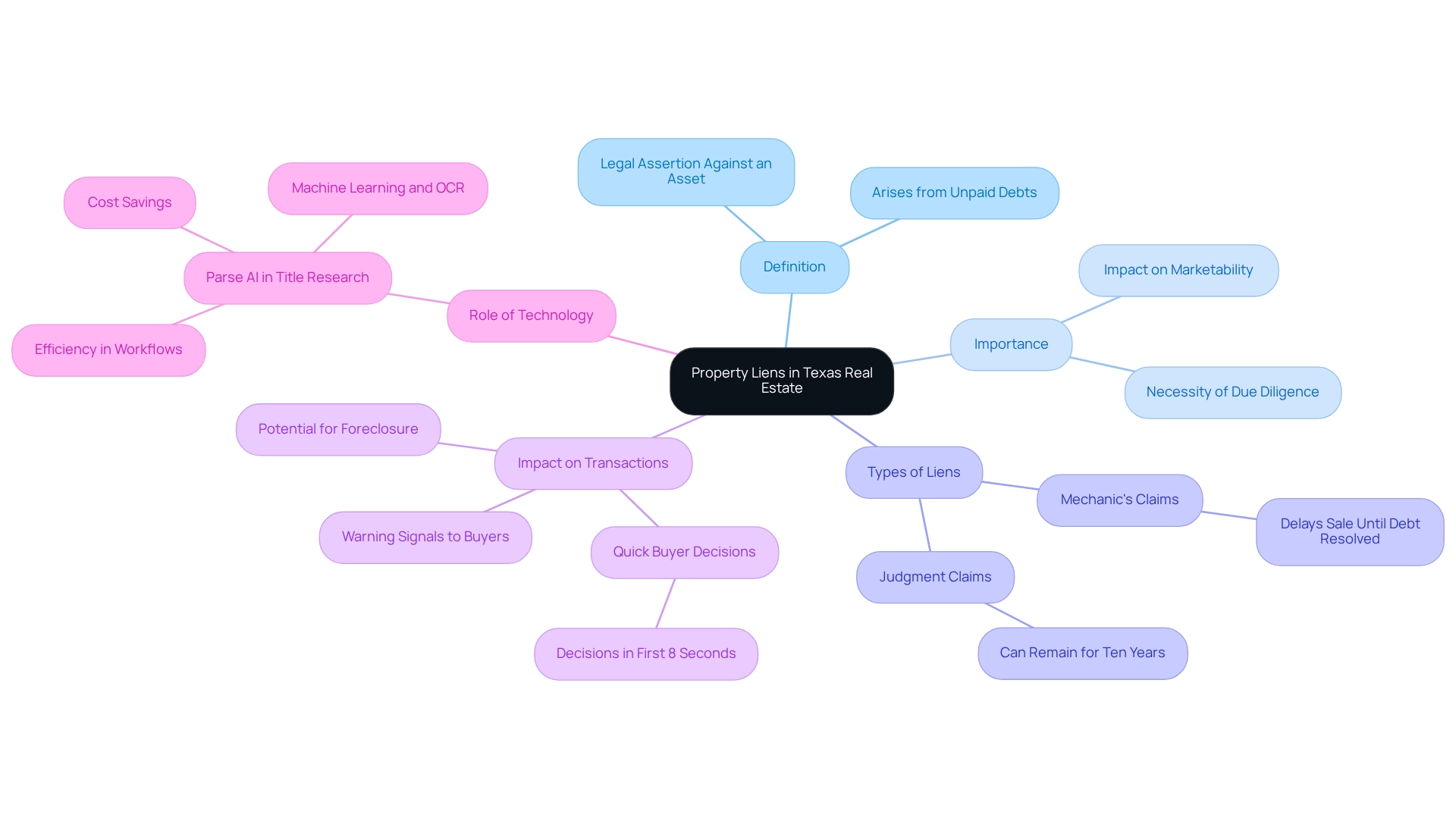

The article underscores the significance of property liens in Texas real estate, highlighting their impact on transactions and the imperative for thorough title research. Understanding the various types of liens—voluntary, involuntary, statutory, and judicial—is essential for real estate professionals. These claims can hinder marketability, complicate financing, and lead to legal disputes if not properly addressed. Consequently, a comprehensive grasp of these elements is crucial for navigating the complexities of the real estate market.

Introduction

In the dynamic realm of Texas real estate, understanding property liens is crucial for both buyers and sellers. These legal claims, arising from unpaid debts, can significantly affect property transactions, often serving as red flags for potential buyers. By delving into the various types of liens—ranging from voluntary to involuntary—real estate professionals can navigate the complexities of property ownership and ensure clear titles. Furthermore, the legal framework governing these liens, as outlined in the Texas Property Code, provides essential guidelines that impact everything from marketability to financing options. Ultimately, recognizing the implications of property liens safeguards the interests of all parties involved and facilitates smoother, more successful real estate transactions in Texas.

Define Property Liens and Their Importance in Texas Real Estate

A real estate claim signifies a legal assertion against an asset, often arising from unpaid debts or obligations. In Texas, property liens can significantly impact real estate dealings, as they must be resolved prior to any sale or refinancing. For real estate professionals, understanding the implications of these claims is essential, as they can directly affect both the marketability and value of an asset. Liens act as warning signals to potential buyers, indicating unresolved debts tied to the asset, which could ultimately lead to foreclosure if not addressed.

For instance, a mechanic's claim may delay or restrict the sale of an asset until the associated debt is settled. In Texas, a judgment claim can remain attached for as long as ten years, underscoring the importance of thorough due diligence in real estate transactions.

As Kathy Fettke, CoFounder of RealWealth, states, "We simplify the process of investing in real estate by connecting investors with vetted resources..." This highlights the necessity of understanding asset claims within the realm of real estate deals.

Furthermore, the effectiveness of Parse AI in title research showcases how technology can aid real estate experts in navigating challenges related to asset claims, ultimately facilitating smoother transactions. Acknowledging the critical role of property liens in Texas is vital for ensuring clear ownership and fostering successful real estate dealings in the state. Given that buyers often make their decision within the first eight seconds of viewing a property, addressing claims promptly is essential for maintaining marketability.

Explore Different Types of Property Liens in Texas

In Texas, property liens are classified into several distinct categories, each characterized by unique implications:

- Voluntary Claims: These claims are willingly accepted by asset owners, typically in the form of mortgages. They occur when an asset owner takes out funds, using the asset as security, thereby consenting to the claim as part of the loan conditions.

- Involuntary Claims: Imposed without the owner's consent, involuntary claims often arise from unpaid debts. Typical instances include tax claims, which emerge when real estate taxes are overdue, and judgment claims, imposed after a court decision favors a creditor.

- Statutory Claims: Established by law, statutory claims encompass mechanics' claims that protect contractors and suppliers who have not received compensation for services rendered on a site. These claims ensure that individuals who invest in enhancements to real estate are rewarded.

- Judicial Claims: These claims stem from court rulings against real estate owners, allowing creditors to seize assets to settle outstanding obligations. In Texas, a judgment encumbrance can remain linked to an asset for up to ten years if the debtor fails to settle the court-mandated sum, significantly affecting the owner's ability to sell or refinance. A case analysis titled "Judgment Liens in a Southern State" delves into this legal framework and highlights its implications for landowners.

- Tax Claims: Enforced by governmental entities for unpaid real estate taxes, tax claims can lead to foreclosure if not addressed. In Texas, property liens in Texas are established when an owner neglects to fulfill their tax obligations, highlighting the importance of making timely payments. The prevalence of tax claims as involuntary encumbrances emphasizes the necessity for vigilance in ownership and management.

Understanding these categories of claims, particularly property liens in Texas, is vital for real estate professionals, as each entails distinct legal consequences and resolution procedures. Recent statistics indicate that voluntary claims constitute a significant portion of real estate encumbrances, with property liens in Texas being a prime example; however, the increasing frequency of involuntary claims, particularly tax and judgment claims, highlights the need for heightened awareness. As Gabriele G. noted, "Lien Lawyers are very professional. A customer withheld payment without any reason, and Lien Lawyers explained to me what my available recourse was." This perspective underscores the importance of comprehending claims within the real estate sector.

Understand the Legal Framework for Property Liens in Texas

The legal framework governing property claims in Texas is primarily regulated by the Texas Property Code, which establishes essential guidelines for various types of claims. Key provisions include:

- Chapter 53: This chapter delineates the requirements for mechanics' claims, specifying necessary notice requirements and deadlines for filing. Understanding these conditions is crucial for ensuring that contractors and subcontractors can effectively protect their rights.

- Chapter 52: This chapter addresses judgment claims, detailing how they are established and upheld. It is imperative for title researchers to grasp the implications of judgment claims, as they can significantly impact property ownership and transfer.

- Chapter 54: This chapter focuses on landlord's claims, empowering landlords to assert property for unpaid rent. Familiarity with these provisions aids real estate professionals in managing tenant-landlord relationships and safeguarding their interests.

Furthermore, it is essential to highlight recent modifications in state law, such as the removal of notarization requirements for waiver exchanges made prior to submitting a claim. This change streamlines the process for contractors and reduces unnecessary administrative burdens, facilitating the navigation of related transactions. Additionally, Texas law distinguishes between constitutional and statutory claims, each with specific filing requirements. Constitutional claims are self-executing, while statutory claims necessitate adherence to particular notice and filing protocols. Understanding these distinctions is vital for title researchers to effectively navigate the legal landscape.

A comprehensive understanding of these sections and recent changes is critical for title researchers and real estate professionals, as they dictate the processes for submitting, enforcing, and resolving claims. Compliance with these regulations not only affirms real estate transactions but also protects the rights of all parties involved under state law. As Vanderhider noted, 'I certainly haven’t seen anything in the statute,' underscoring the importance of remaining informed about these legal frameworks.

Analyze the Impact of Property Liens on Real Estate Transactions

Property liens can significantly influence real estate transactions in Texas through various critical dimensions:

- Marketability is a primary concern. Properties encumbered by property liens in Texas often deter potential buyers, as these liens signify financial obligations that must be resolved. In fact, assets with claims can experience a substantial drop in marketability, with purchasers typically demanding that vendors resolve any claims before closing.

- Furthermore, challenges in financing can arise due to property liens in Texas. Lenders generally exhibit restraint when evaluating assets that have property liens in Texas. Property liens in Texas complicate the title and elevate the risk of foreclosure, making it difficult for sellers to secure financing. Statistics suggest that assets affected by property liens in Texas encounter a greater rate of financing denials, adversely impacting overall transaction smoothness. Engaging trustworthy contractors and ensuring prompt payments can help prevent property claims, thereby enhancing financing opportunities.

- In addition, closing delays can occur. The existence of claims can result in considerable setbacks in the closing procedure. All outstanding debts must be addressed and settled before a transaction can be finalized, which can prolong the timeline and frustrate both buyers and sellers.

- Consequently, legal complications may arise due to property liens in Texas. Unresolved claims can lead to legal disputes, potentially resulting in expensive litigation and additional ownership issues. Legal experts stress the significance of understanding the varied framework of real estate claims regulations, particularly property liens in Texas, which differ greatly between states and can be enforced for as long as eight months after construction concludes. As noted by Davis Business Law, "the legal stipulations regulating these types of claims differ from state to state and can be enforced for up to eight months following the completion of construction projects."

Real estate experts must understand these effects to navigate the intricacies of real estate dealings efficiently. By engaging reputable contractors and ensuring timely payments, they can mitigate the risk of liens, promoting smoother transactions and enhancing property marketability.

Conclusion

Understanding property liens is crucial for navigating the Texas real estate landscape. These legal claims, which arise from unpaid debts, can significantly affect property transactions, influencing aspects such as marketability and financing options. By distinguishing between the various types of liens—voluntary, involuntary, statutory, judicial, and tax—real estate professionals can effectively assess the potential risks associated with property ownership. Each lien type carries distinct implications, making it essential for buyers and sellers to conduct thorough due diligence.

The legal framework provided in the Texas Property Code outlines essential guidelines for managing these liens. Key chapters detail the processes for mechanics' liens, judgment liens, and landlord's liens, among others, ensuring that all parties comprehend their rights and responsibilities. Recent legislative changes, including the removal of notarization requirements for lien waivers, further streamline the resolution of lien-related issues, facilitating smoother transactions.

Ultimately, recognizing the implications of property liens not only safeguards the interests of buyers and sellers but also enhances overall transaction success in Texas real estate. By proactively addressing outstanding debts and understanding the legal landscape, real estate professionals can cultivate a more efficient marketplace, ensuring that properties remain attractive and financially viable for potential buyers. In a competitive market, knowledge of property liens is not merely an advantage; it is an essential component of effective real estate practice.

Frequently Asked Questions

What is a real estate claim?

A real estate claim is a legal assertion against an asset, often arising from unpaid debts or obligations.

How do property liens affect real estate transactions in Texas?

Property liens must be resolved prior to any sale or refinancing in Texas, as they can significantly impact the marketability and value of an asset.

Why is it important for real estate professionals to understand asset claims?

Understanding asset claims is essential for real estate professionals because they can directly affect the marketability and value of a property, as well as signal unresolved debts to potential buyers.

What could happen if a lien is not addressed before a property sale?

If a lien is not addressed, it could lead to foreclosure or delay the sale of the asset until the associated debt is settled.

How long can a judgment claim remain attached to a property in Texas?

A judgment claim can remain attached for as long as ten years in Texas.

What role does technology play in managing real estate claims?

Technology, such as Parse AI in title research, can aid real estate experts in navigating challenges related to asset claims, facilitating smoother transactions.

Why is it crucial to address claims promptly in real estate dealings?

Addressing claims promptly is crucial because buyers often make their decision within the first eight seconds of viewing a property, and unresolved claims can negatively impact marketability.