Overview

The article delineates five essential steps for transferring mineral ownership. These steps encompass:

- Gathering necessary documentation

- Conducting a comprehensive title search

- Executing the transfer

- Troubleshooting common issues

Such measures are vital as they ensure legal compliance and mitigate risks associated with ownership disputes. This underscores the importance of thorough preparation and precise record-keeping throughout the transfer process.

Introduction

Understanding the complexities of mineral ownership is crucial in a landscape where resource rights often exist independently from land ownership. With millions of acres of federal resources lying beneath private properties, the stakes are high for individuals navigating the transfer of these valuable entitlements.

This guide outlines essential steps for transferring mineral ownership, addressing the necessary documentation and potential pitfalls that can arise during the process.

Furthermore, how can one ensure a seamless transition while avoiding common legal and administrative hurdles?

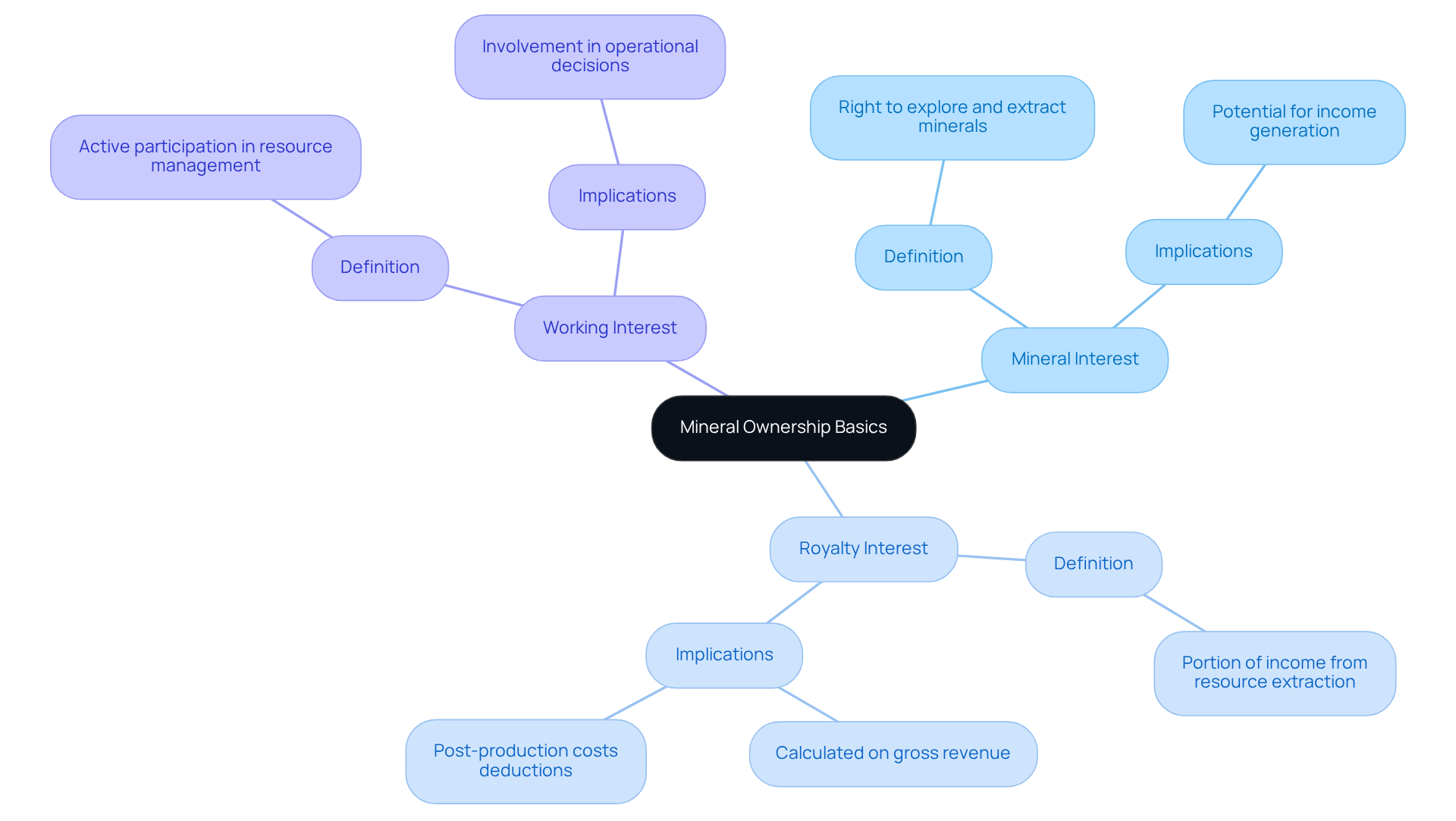

Understand Mineral Ownership Basics

Ownership of resources encompasses the entitlements linked to the extraction and management of substances located beneath a property's surface. It is crucial to recognize that resource ownership can exist independently of land ownership; thus, one party may own the land while another possesses the entitlements to the resources beneath. The U.S. government reports that there are 57.2 million acres of federal resources located beneath private surfaces, underscoring the extensive nature of resource ownership in the country. The primary types of mineral interests include:

- Mineral Interest: This grants the holder the right to explore and extract minerals from the land.

- Royalty Interest: This permits the holder to obtain a portion of the income generated from resource extraction, typically based on total revenue.

- Working Interest: This allows for active participation in the operation and management of a resource property.

Understanding how to transfer mineral ownership is vital for anyone involved in the conveyance of resource ownership, as it carries significant implications for possession and income generation. As Franklin D. Roosevelt aptly stated, "Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world." A comprehensive understanding of resource entitlements is essential for maximizing financial benefits and navigating the complexities of resource ownership. Notably, a substantial portion of resource entitlements exists independently from surface entitlements, which can significantly impact local economies and the distribution of royalties.

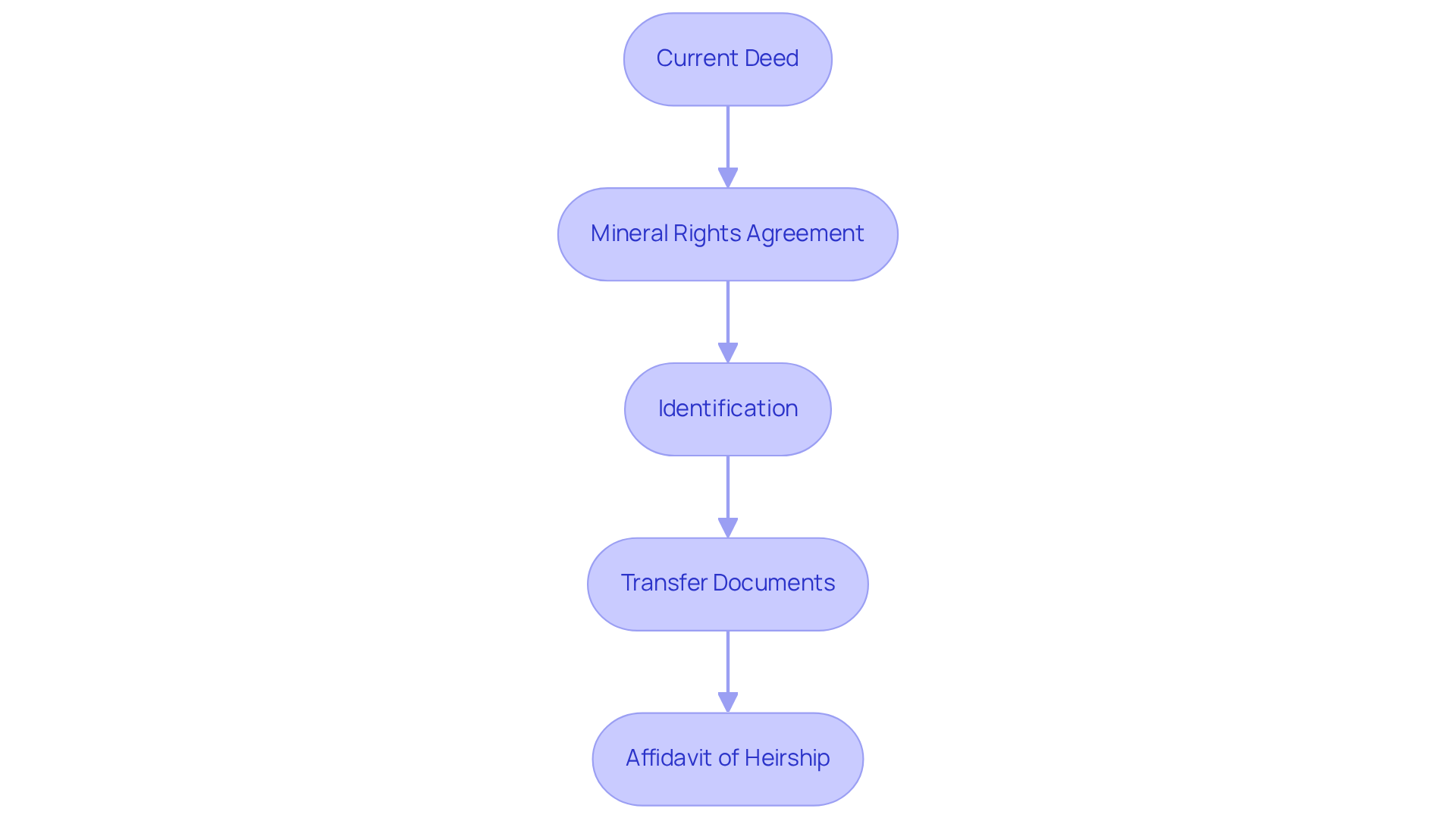

Gather Required Documentation for Transfer

Before initiating the transfer of mineral rights, it is crucial to gather the following documentation:

- Current Deed: This document verifies your possession of the resource privileges.

- Mineral Rights Agreement: If applicable, this outlines any agreements related to the mineral rights.

- Identification: A government-issued ID to verify your identity.

- Transfer Documents: Depending on the nature of the movement (sale, gift, inheritance), you may need specific forms such as a Bill of Sale or a Deed of Conveyance.

- Affidavit of Heirship: If the conveyance is due to inheritance, this document may be necessary to establish the rightful heirs.

Ensure that all documents are accurate and up-to-date to avoid complications when considering how to transfer mineral ownership.

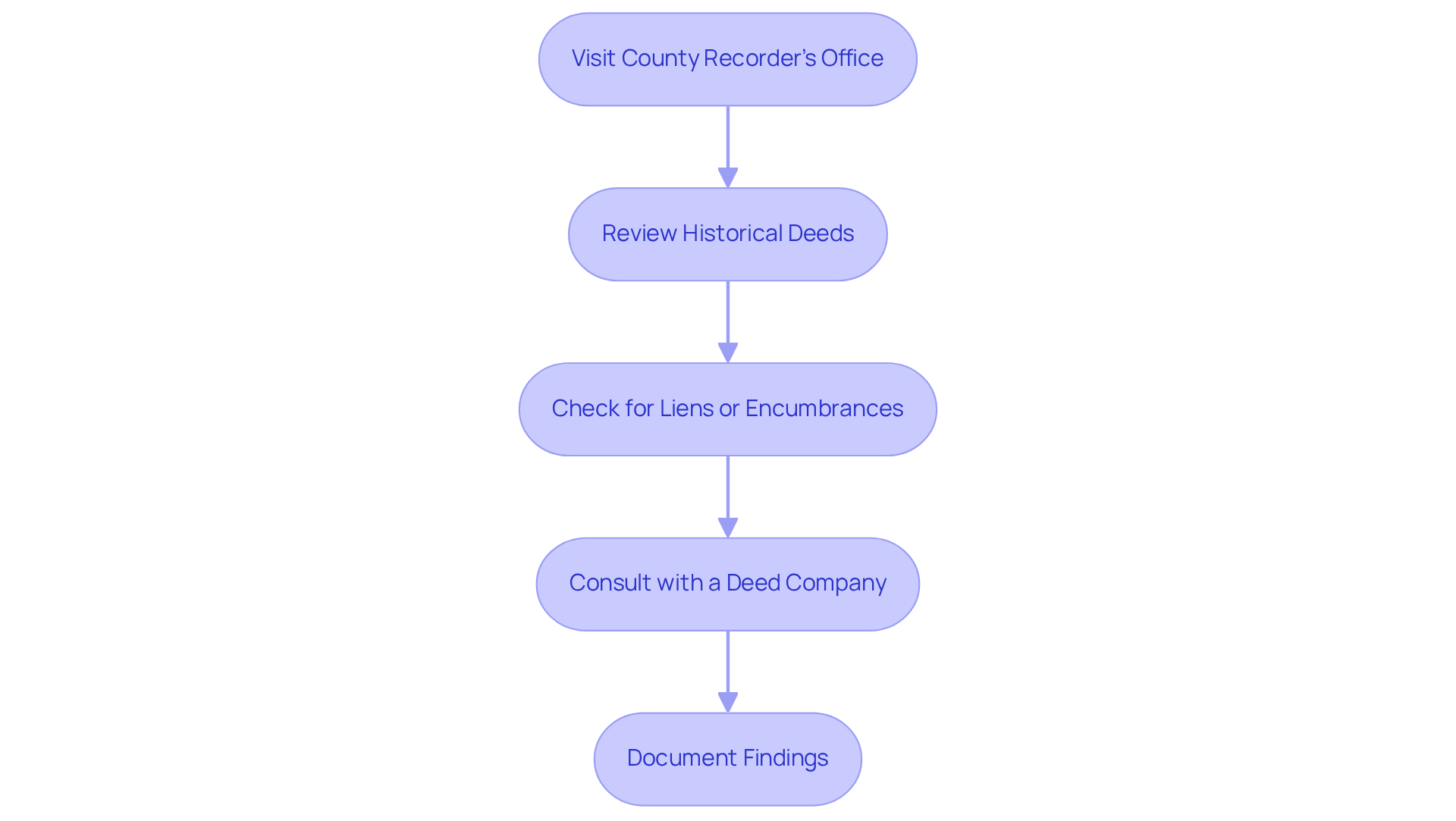

Conduct a Comprehensive Title Search

Conducting a comprehensive title search for mineral ownership is a critical process that involves several essential steps:

- Visit the County Recorder's Office: Start by accessing public records at the local county recorder's office where the mineral rights are situated. This step is fundamental for gathering foundational ownership information.

- Review Historical Deeds: Examine the chain of title by scrutinizing historical deeds. This process is vital for tracing ownership back to the original grantor, ensuring that all transfers are documented accurately.

- Check for Liens or Encumbrances: Investigate any existing liens, easements, or other encumbrances that could impact the mineral rights. Identifying these issues early can prevent costly complications later.

- Consult with a Deed Company: If the search becomes intricate, consider hiring a deed company or a professional landman. Their expertise can provide a comprehensive ownership report, which is crucial for confirming possession and identifying potential risks. As mentioned, "It’s always best to conduct a search of the ownership and rectify the issues before proceeding with the sale."

- Document Findings: Meticulously record all findings throughout the search process. This documentation is essential for the relocation process and can serve as a reference for any future disputes.

A thorough examination of documents not only uncovers potential concerns but also ensures that you are fully informed about how to transfer mineral ownership before proceeding with the transfer of resource ownership. The average expense of employing a company for mineral rights investigations generally varies from $75 to $200, depending on the complexity of the search. However, ownership insurance premiums can range from $500 to $3,500, highlighting the financial implications involved in ownership searches. Engaging professionals can significantly streamline the process and mitigate risks associated with ownership disputes. Furthermore, it is important to note that title searches typically take 10 to 14 days to complete, and challenges such as incomplete records or conflicting claims may arise, necessitating careful attention to detail.

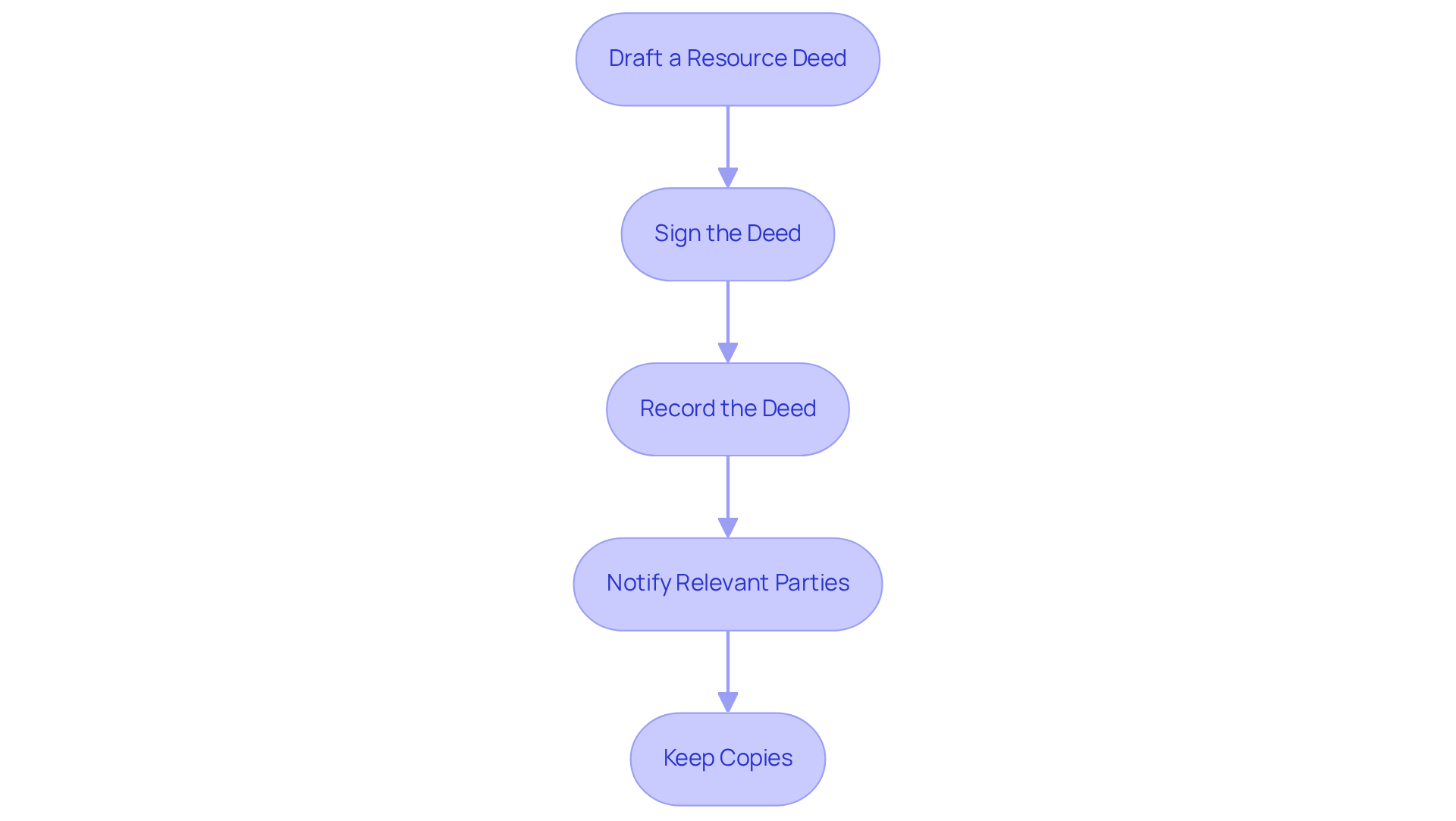

Execute the Transfer of Mineral Rights

To execute the transfer of mineral rights effectively, adhere to the following steps:

- Draft a Resource Deed: Prepare a resource deed that explicitly outlines the rights being transferred, detailing the specific resources and providing a clear property description.

- Sign the Deed: Ensure that both the seller and buyer sign the deed in the presence of a notary public. Notarization is crucial as it adds a layer of authenticity and legal validity to the document, as emphasized by legal experts.

- Record the Deed: Submit the signed deed to the county recorder's office for official recording. This step is essential, as it renders the transaction public and legally binding. In many states, the average time to document a property deed can differ, but it usually takes a few days to a few weeks.

- Notify Relevant Parties: If there are existing leases or operators involved, promptly notify them of the ownership change to ensure accurate royalty payments. This is essential to avoid any disruptions in revenue flow.

- Keep Copies: Maintain copies of all documents concerning the transaction, including the recorded deed and any correspondence. This documentation is important for future reference and to safeguard against potential disputes.

By adhering to these procedures, you ensure that the conveyance of resource entitlements, specifically how to transfer mineral ownership, is legally enforceable and acknowledged by all participants, thus safeguarding your interests and promoting a seamless exchange.

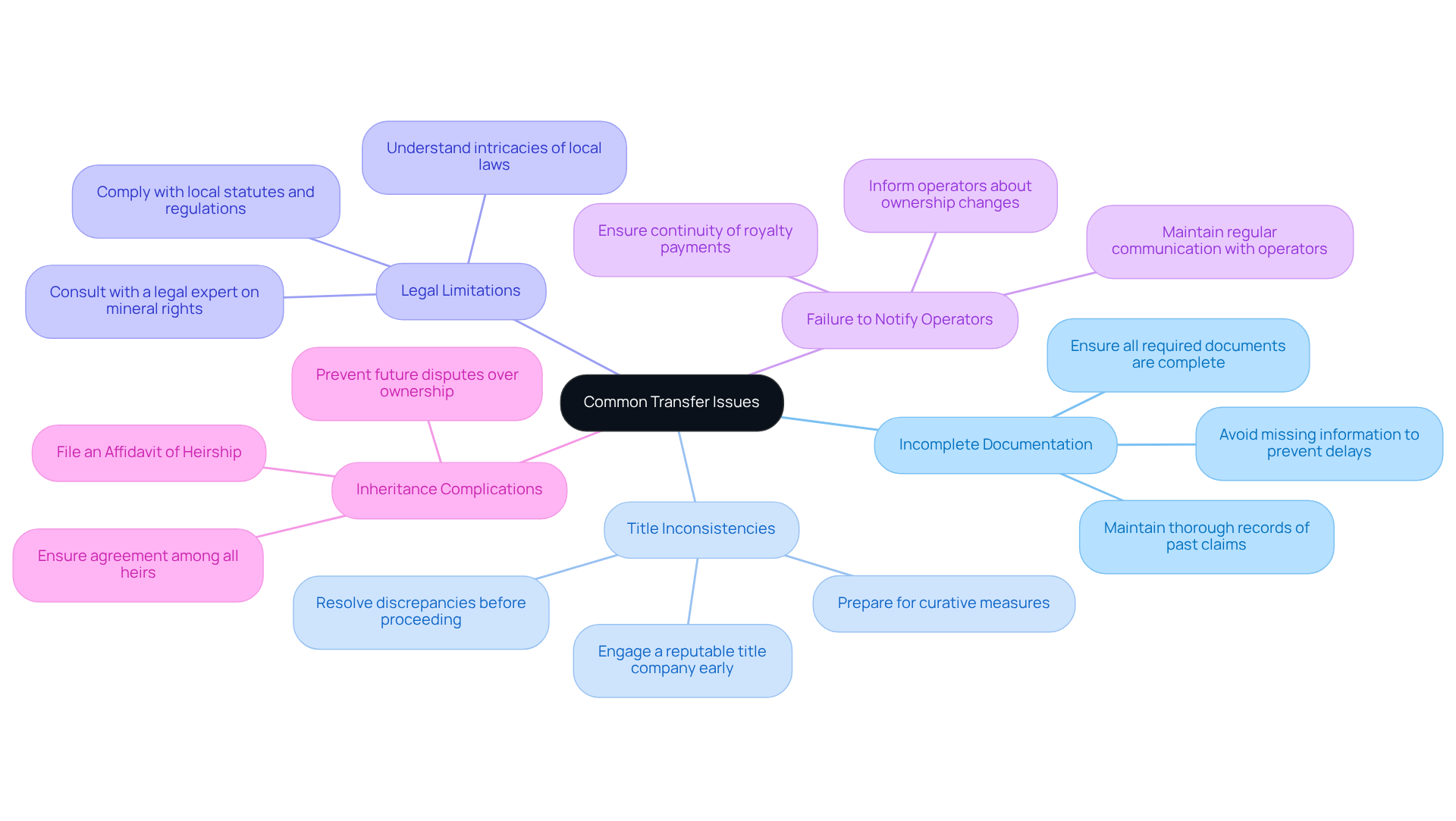

Troubleshoot Common Transfer Issues

Understanding how to transfer mineral ownership can present several challenges that require careful attention. Common issues that may arise during the process include:

-

Incomplete Documentation: It is imperative to ensure that all required documents are complete and accurate. Missing information can significantly delay the transfer process, potentially leading to disputes or financial losses. Incomplete records of past mineral claims can create confusion in property transactions, underscoring the importance of thorough documentation.

-

Title Inconsistencies: Inconsistencies found during the search for ownership can complicate the conveyance. Engaging a reputable title company or attorney early in the process is crucial to resolve these issues before proceeding, as unresolved discrepancies can lead to legal conflicts. As noted by Rodrigo Sertek, "Title discrepancies are common. Failure to prepare for curative measures can be detrimental to the success of any project."

-

Legal Limitations: Local statutes and regulations may impose limitations on the conveyance of resource ownership. Consulting with a legal expert familiar with mineral rights is essential to navigate these complexities and ensure compliance with all applicable laws. Comprehending the intricacies of local regulations is vital for a successful transfer.

-

Failure to Notify Operators: If current leases are in place, neglecting to inform operators about the change can lead to missed royalty payments. Regular communication with the operator or managing company is essential to ensure that royalty distributions continue without interruption.

-

Inheritance Complications: In cases where the conveyance is due to inheritance, it is critical to ensure that all heirs are in agreement. Proper legal documentation, such as an Affidavit of Heirship, must be filed to prevent future disputes over ownership.

By proactively addressing these potential issues, you can facilitate a smoother transfer process on how to transfer mineral ownership and minimize the risk of complications that could arise during the transaction.

Conclusion

Understanding how to transfer mineral ownership is a crucial endeavor that involves navigating a complex landscape of legal documentation, title searches, and potential issues. The transfer process not only impacts the financial aspects of resource ownership but also the legal rights associated with the minerals beneath the surface. By grasping the intricacies of mineral ownership, individuals can ensure that their transactions are both profitable and legally sound.

This article outlines essential steps for successfully transferring mineral rights, starting with:

- A solid understanding of mineral ownership basics

- Gathering the necessary documentation

- Conducting a thorough title search

- Executing the transfer effectively

- Troubleshooting common issues that may arise

Each step is designed to provide clarity and prevent complications, emphasizing the importance of meticulous preparation and legal compliance throughout the process.

In conclusion, engaging with the mineral ownership transfer process is not merely a matter of paperwork; it is a strategic move that requires careful consideration and planning. By following the outlined steps and being proactive about potential challenges, individuals can safeguard their interests and ensure a smooth transition of mineral rights. Whether for personal investment or managing inherited resources, the knowledge gained from this guide empowers stakeholders to maximize their benefits and navigate the complexities of mineral ownership with confidence.

Frequently Asked Questions

What is mineral ownership?

Mineral ownership refers to the entitlements linked to the extraction and management of substances located beneath a property's surface. It can exist independently of land ownership, meaning one party may own the land while another has rights to the resources beneath it.

What are the primary types of mineral interests?

The primary types of mineral interests include: - Mineral Interest: Grants the holder the right to explore and extract minerals from the land. - Royalty Interest: Allows the holder to obtain a portion of the income generated from resource extraction, typically based on total revenue. - Working Interest: Permits active participation in the operation and management of a resource property.

Why is understanding mineral ownership important?

Understanding mineral ownership is vital for anyone involved in the conveyance of resource ownership, as it has significant implications for possession and income generation. A comprehensive understanding can help maximize financial benefits and navigate the complexities of resource ownership.

What documentation is required for transferring mineral rights?

The required documentation for transferring mineral rights includes: - Current Deed: Verifies possession of resource privileges. - Mineral Rights Agreement: Outlines any agreements related to the mineral rights, if applicable. - Identification: A government-issued ID to verify identity. - Transfer Documents: Specific forms such as a Bill of Sale or a Deed of Conveyance, depending on the nature of the transfer (sale, gift, inheritance). - Affidavit of Heirship: Necessary if the conveyance is due to inheritance to establish rightful heirs.

How can I ensure a smooth transfer of mineral ownership?

To ensure a smooth transfer of mineral ownership, it is important to gather and verify that all documents are accurate and up-to-date. This helps avoid complications during the transfer process.