Introduction

In the complex world of real estate transactions, the importance of conducting thorough title searches cannot be overstated. Title searches play a critical role in confirming property ownership and uncovering any existing encumbrances, such as liens or easements, that may affect the transfer of ownership. By ensuring the legal right of the seller to transfer the property, title searches protect buyers from potential legal disputes and financial losses.

The advent of Attorney Opinion Letters, particularly the ACT® (Attorney Certified Title) product, has streamlined this process, providing a cost-effective and expedited solution that can save consumers significant amounts of money and time. Comprehensive title searches, supported by detailed market analysis and robust business plans, are essential for securing accurate and reliable property transactions. Industry news and analysis, such as those provided by the American Land Title Association (ALTA), offer valuable insights into the complexities of title insurance and regulatory requirements, further enhancing the reliability and security of title searches.

Why Are Title Searches Important?

Title searches are essential in , offering vital information about land titles and revealing any current liabilities. These searches validate the seller's legal authority to transfer ownership and notify the buyer about potential issues such as liens, easements, or other limitations that might affect their rights. The process also mitigates the risk of future legal disputes. The introduction of Attorney Opinion Letters, especially the ACT® (Attorney Certified Title) product, has further streamlined this process. ACT® is not only cost-effective, potentially saving consumers up to an entire mortgage payment, but also expedites post-closing procedures. Furthermore, thorough ownership investigations, backed by in-depth market evaluations and strong business strategies, are crucial for guaranteeing safe and precise real estate transactions. Sector updates and evaluations, like those offered by ALTA, provide important direction on managing the intricacies of insurance and regulatory obligations, additionally improving the dependability of property searches.

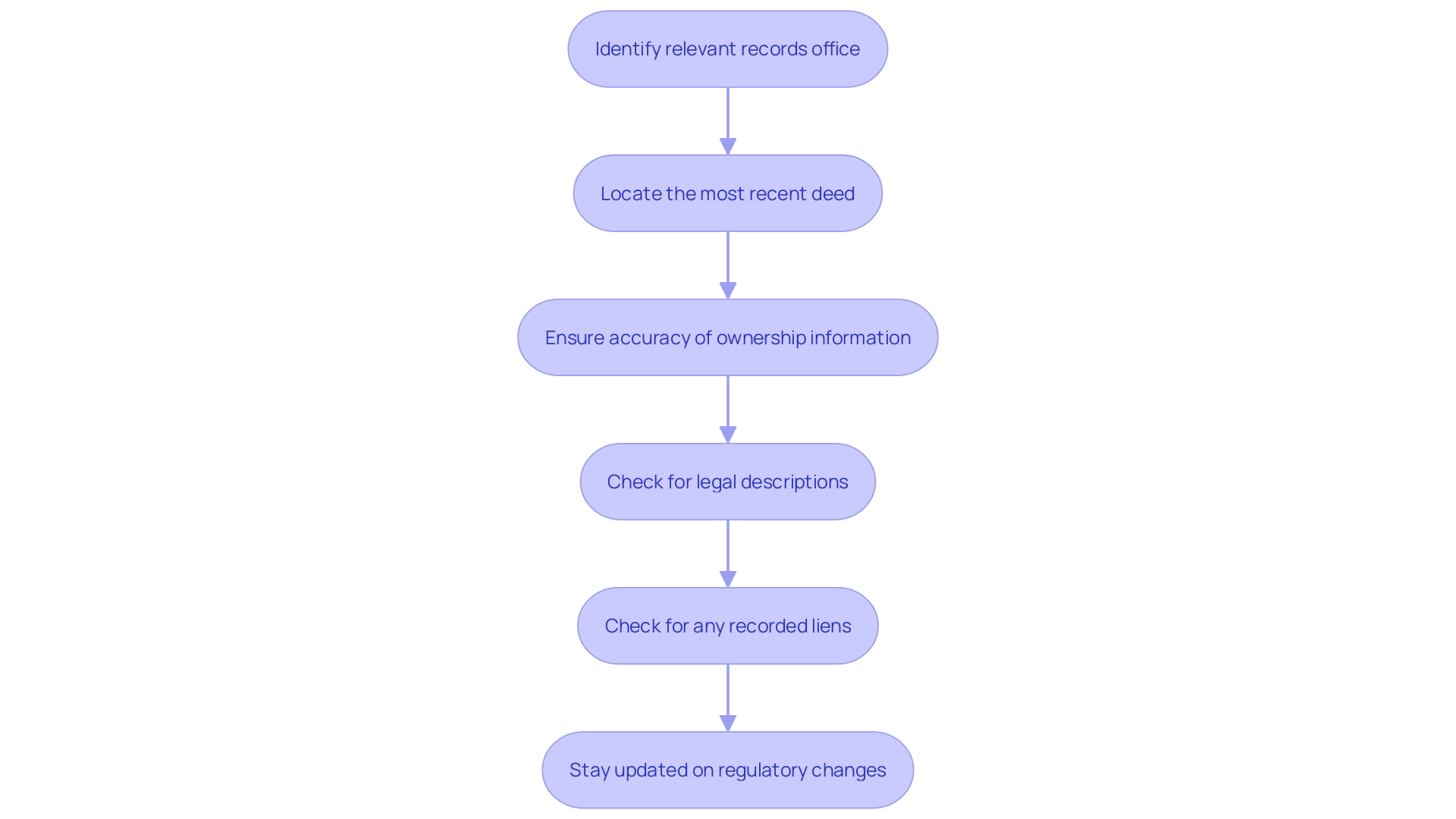

What Information Is Required to Perform a Title Search?

To conduct a thorough , you will need several key pieces of information about the real estate in question. Begin with the complete address of the real estate and the present owner's name. Additionally, gather any reference numbers from previous transactions or deeds, as these will be crucial for cross-referencing records. Incorporating the parcel number of the land, frequently located on tax documents, can greatly simplify the search process. Employing these details guarantees precision and aids in revealing any possible problems or inconsistencies in ownership information.

Step 1: Identify the Relevant Public Records Office

To start a title investigation, locate the appropriate public documents office within the authority of the asset. This is typically the county clerk or recorder's office. Check their website or reach out to them directly to discover where property information is stored and any fees linked to accessing this information. For instance, the Allegheny County Division of Real Estate Office provides for inspection and copies. It's essential to confirm the precision and dependability of the data acquired, as public archives are usually not responsible for mistakes. Furthermore, be mindful of any legislative modifications that may affect access to these documents, as openness in public information remains a vital concern, with continuous conversations on guaranteeing public access.

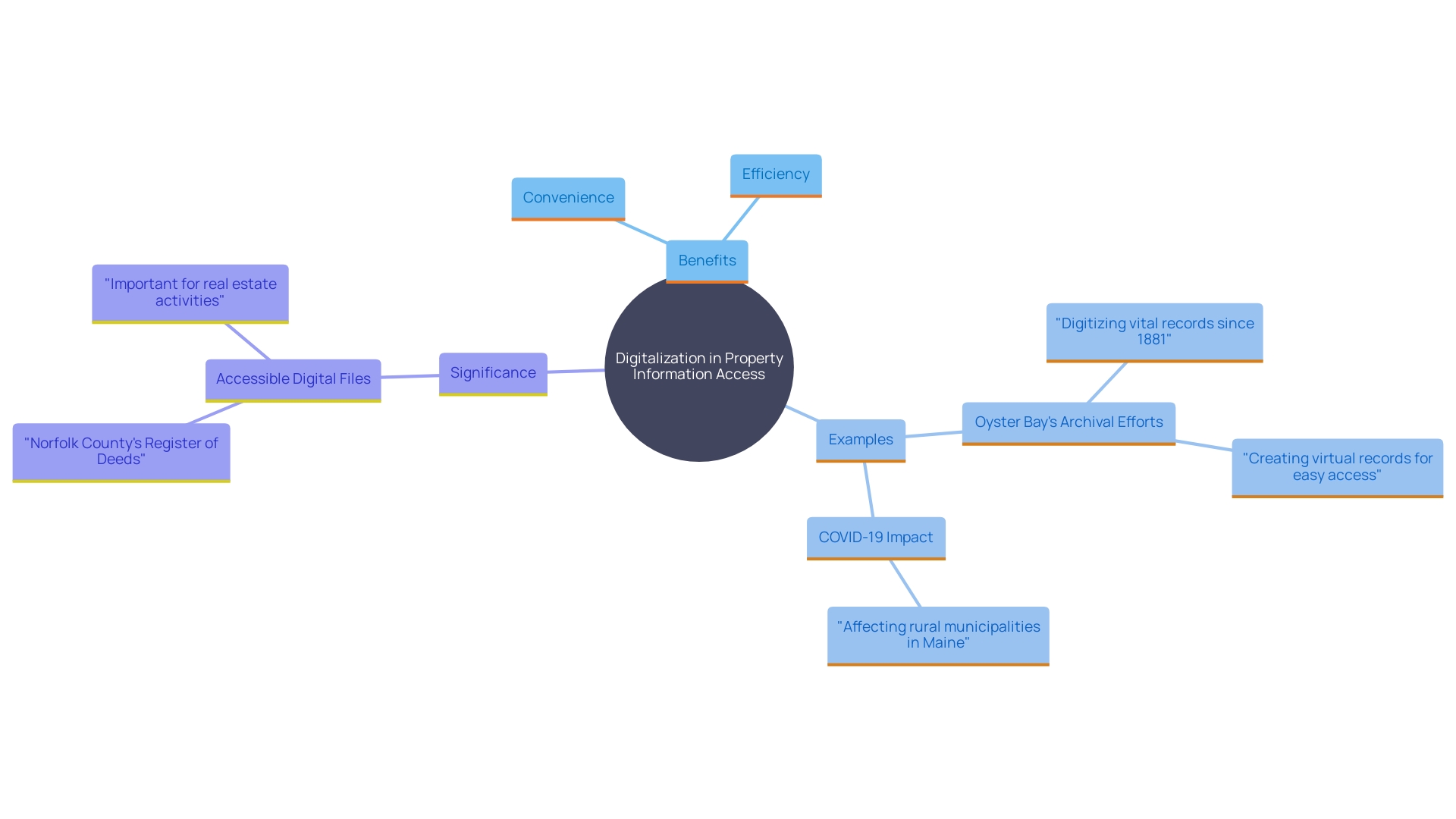

Step 2: Determine if Property Records Are Available Online

With the increasing trend towards digitalization, many counties are now providing online access to property information. By visiting the public documents office's website, you can often find a digital database available for public use. This digital shift is not only about convenience but also about efficiency. For instance, in Oyster Bay, an archival company has been dating back to 1881, ensuring easy access and preservation of historic materials. This initiative reflects a broader movement towards digital platforms, which was also evident during the COVID-19 pandemic, where rural municipalities in Maine expanded their digital services to better serve their communities. Utilizing these digital tools can greatly simplify your real estate documentation search, conserving your time and offering extensive information at your disposal. Norfolk County's Register of Deeds, for instance, reported a consistent rise in real estate documentation, emphasizing the significance of accessible digital files in facilitating real estate activities.

Step 3: Find the Property's Most Recent Title Deed

After identifying the relevant records office, either online or in person, it is crucial to locate the most recent deed associated with the asset. This document is crucial as it offers about the current owner, the legal descriptions of the asset, and any recorded liens. Ensuring the accuracy and completeness of this information is essential for verifying ownership and identifying potential discrepancies or legal encumbrances that could affect the asset's ownership document. It is also important to stay informed about recent developments and regulatory changes in the sector, as these can impact the process of searching and verification.

Step 4: Review the Title Deed for Easements and Liens

Upon obtaining the title deed, it is imperative to meticulously examine it for any easements or liens that may affect the asset. Easements grant others the right to use a portion of the land for specific purposes, such as utility access or shared driveways. On the other hand, lines indicate outstanding debts associated with the asset, which could stem from unpaid taxes, mortgages, or contractor fees. Recognizing these encumbrances is crucial for evaluating the property's overall and ensuring a smooth transaction. According to recent legal analysis, understanding the nuances of these legal constraints is essential for maintaining compliance and avoiding potential disputes. Participating in comprehensive due diligence can reduce risks related to incomplete or inconsistent ownership documentation, ultimately protecting the interests of all parties involved.

Step 5: Search Local Court and Tax Records

Beyond examining the title deed, it is imperative to delve into local court documents and tax files. Court documents can reveal legal conflicts related to the asset, which may encompass previous lawsuits or current litigation. In the meantime, tax documents provide essential information about real estate taxes, indicating whether they have been settled on time or if there are unpaid amounts. This meticulous scrutiny is vital, especially in light of recent issued by the Financial Transactions and Reports Analysis Center of Canada (FINTRAC) in partnership with the Canada Revenue Agency (CRA). These alerts highlight the risks of non-compliance with tax laws in the real estate sector, including potential tax evasion. By examining these documents, one can pinpoint questionable transactions and reduce the inherent weaknesses of tax evasion and money laundering, ensuring a strong and stable real estate sector. This thorough method of investigating asset possession and financial responsibilities aids in clarifying the asset's title status, protecting against potential legal and monetary issues.

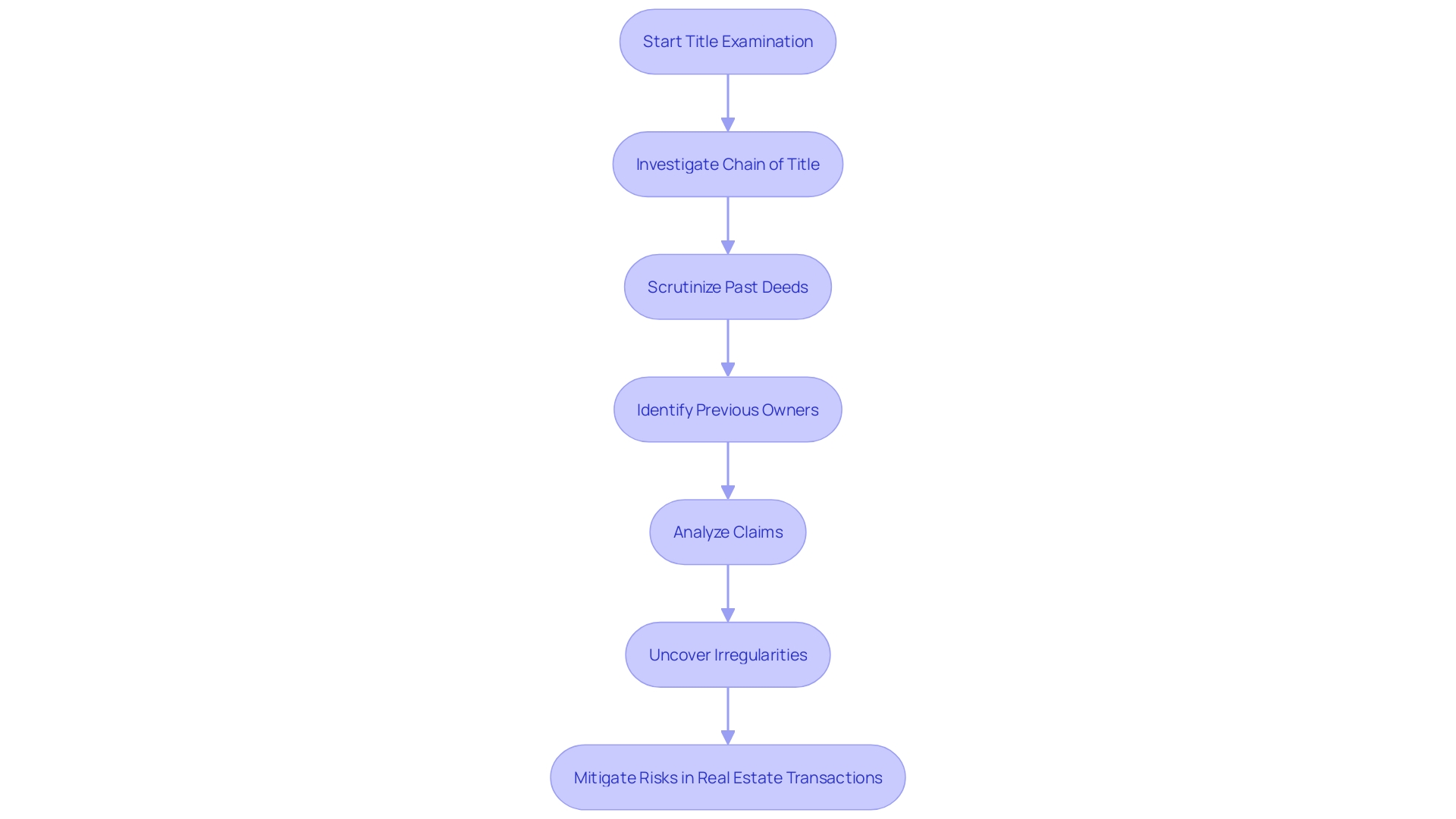

Step 6: Investigate Ownership History (Chain of Title)

Performing a thorough title examination entails investigating the chain of title, which documents the history of land possession. By scrutinizing past deeds, previous owners and ownership transfers can be identified. This process is essential for uncovering any irregularities or potential claims against the property. Practical legal analysis of claims and court decisions related to the insurance industry frequently highlights the importance of thorough ownership searches. ALTA, representing members on a national and state level, emphasizes that is critical for mitigating risks in real estate transactions. Instances of discrepancies in asset possession information are often uncovered during this meticulous examination, preventing future legal disputes.

Step 7: Review Results and Resolve Any Issues

After completing your search, compile all findings and meticulously review them for any discrepancies or unresolved issues. If you encounter potential problems such as outstanding liens or unclear ownership, it is crucial to address these immediately. Real estate fraud is on the rise, as highlighted in CertifID's 2024 State of Wire Fraud Report, making it essential to verify all details thoroughly. For example, out-of-state owners of a million-dollar vacant lot in Concord discovered their property had been sold and developed without their knowledge, underscoring the importance of vigilance. Think about seeking advice from a real estate lawyer or property management firm to address any concerns prior to completing deals. As Michelle Moore Smith from Jackson Walker LLP notes, recent regulations require detailed disclosures to prevent illegal activity, emphasizing the importance of due diligence in the process.

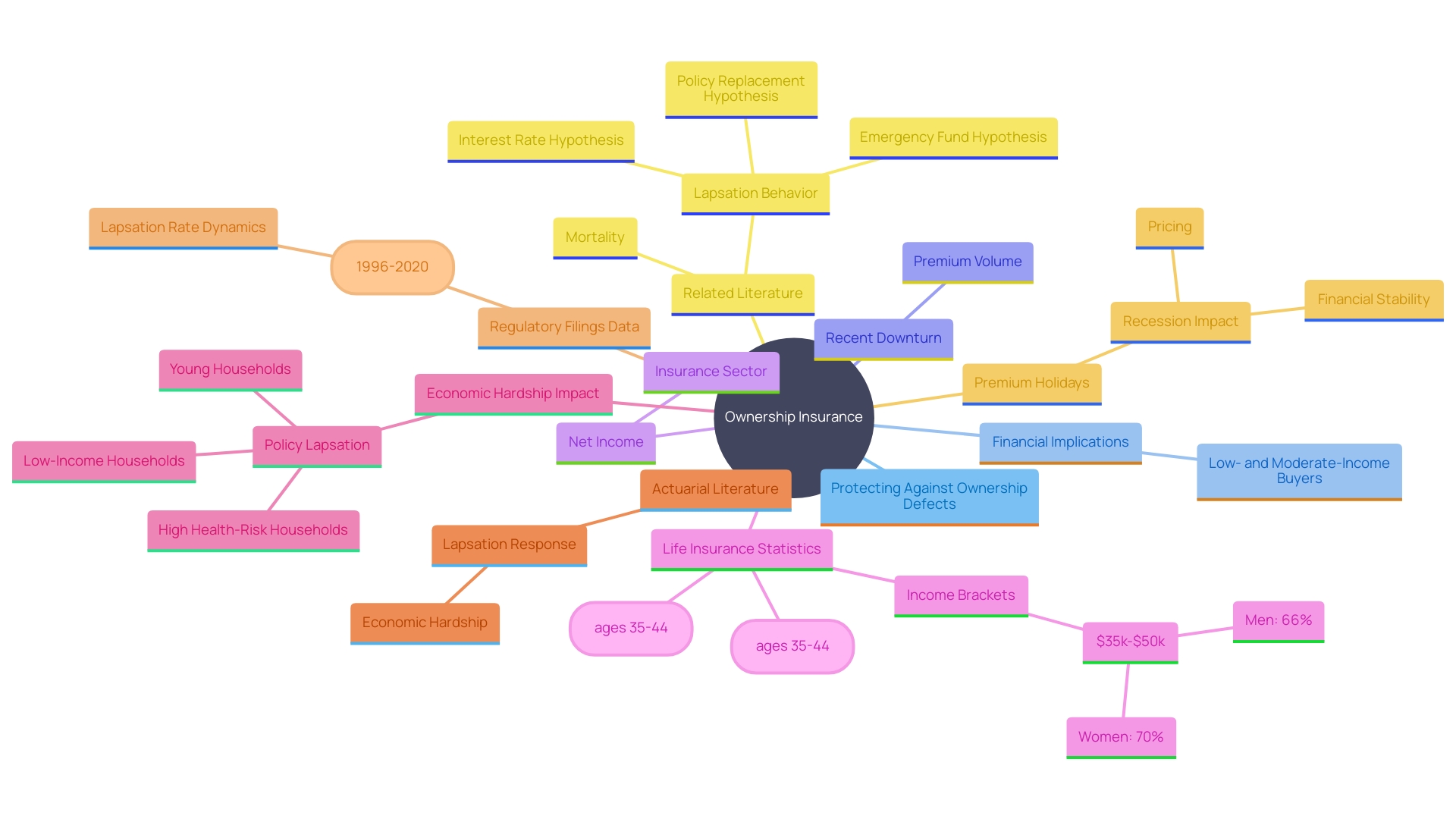

The Importance of Title Insurance

Insurance for ownership acts as a crucial safeguard for both purchasers and lenders, protecting them from possible ownership defects and monetary losses. This coverage is essential for dealing with , such as undiscovered liens or rival claims to property. As stated by industry specialists, "real estate ownership can be disputed due to issues overlooked in the deed investigation and assessment before finalization, a boundary conflict with a neighbor, or even deception and falsification among various other possible risks." The safeguard that ownership insurance offers is especially important for low- and moderate-income home purchasers, who may lack the financial means to address challenges to their rights of ownership.

The insurance sector related to property, while facing a reduction in premium volume by 35.1% in the first nine months of 2023 compared to the same timeframe in 2022, continues to be an essential element of real estate dealings. Despite this downturn, the industry still saw a net investment gain of $128.9 million, resulting in a net income of $306.5 million for the third quarter of 2023.

For those seeking to reduce risk and ensure their asset rights effectively, ownership insurance stands out as the best choice. This sentiment is echoed by professionals who note that “title insurance is the best option to reduce risk and protect property rights for consumers and lenders.” Ensuring you have this insurance in place can provide much-needed peace of mind and financial security throughout property ownership.

Conclusion

The significance of conducting thorough title searches in real estate transactions cannot be overstated. These searches are vital for confirming property ownership and identifying any encumbrances that may affect ownership rights. By utilizing tools like Attorney Opinion Letters, particularly the ACT® product, the process has become more efficient and cost-effective.

This not only saves consumers money but also expedites post-closing procedures, ensuring a smoother transaction experience.

To perform a comprehensive title search, essential information such as the property's address, current owner, and relevant transaction details must be gathered. Engaging with public records offices, either in person or online, is crucial for accessing accurate data. The investigation should include a review of the title deed for any liens or easements, local court and tax records, and a detailed examination of the chain of title.

This thorough approach helps to uncover any potential issues that could lead to legal disputes or financial complications.

Finally, securing title insurance is a critical step in protecting both buyers and lenders from potential title defects. Despite fluctuations in the insurance market, the protection offered by title insurance remains invaluable, particularly for low- and moderate-income home buyers. By adopting a meticulous approach to title searches and ensuring adequate insurance coverage, stakeholders can safeguard their investments and enjoy peace of mind throughout the property ownership journey.

Frequently Asked Questions

What is a title search and why is it important in real estate dealings?

A title search is a process that investigates the legal ownership of a property and reveals any current liabilities that might affect the sale. It validates the seller's authority to transfer ownership and notifies the buyer of potential issues such as liens or easements, thereby mitigating the risk of future legal disputes.

What are Attorney Opinion Letters and how do they relate to title searches?

Attorney Opinion Letters, particularly the ACT® (Attorney Certified Title) product, streamline the title search process. They are cost-effective and can save consumers significant money, potentially equivalent to an entire mortgage payment, while also expediting post-closing procedures.

What information is needed to conduct a thorough title search?

To conduct a title search, you need the complete property address, the current owner’s name, reference numbers from previous transactions or deeds, and the parcel number of the land. This information helps ensure accuracy and reveals any ownership issues.

Where can I start a title investigation?

You should begin at the public documents office, typically the county clerk or recorder's office. Check their website or contact them to find out where property information is stored and what fees are associated with accessing this information.

Is it possible to access property information online?

Yes, many counties now offer online access to property information. This digital shift allows for more efficient searches and easier access to public records, especially during the COVID-19 pandemic when many jurisdictions expanded their digital services.

What should I look for when examining the title deed?

When reviewing the title deed, look for any easements that may grant others rights to use a portion of the land, and liens that indicate outstanding debts related to the property. Identifying these encumbrances is crucial for determining the property’s marketability.

Why is it important to check local court documents and tax files?

Checking local court documents can reveal any legal conflicts related to the property, while tax files provide information about any outstanding real estate taxes. This scrutiny is essential to avoid non-compliance with tax laws and potential legal issues.

What does investigating the chain of title involve?

Investigating the chain of title involves reviewing past deeds to track ownership history and identify any irregularities or claims against the property. This thorough examination is vital to prevent future legal disputes.

What should I do if I find discrepancies or unresolved issues after my title search?

If you find potential problems, such as outstanding liens or unclear ownership, it’s crucial to address these issues immediately. Consider seeking advice from a real estate lawyer to navigate any concerns before finalizing the transaction.

How does ownership insurance protect property buyers and lenders?

Ownership insurance safeguards buyers and lenders from potential ownership defects and financial losses that may arise after purchase, such as undiscovered liens or competing claims. It is particularly important for lower-income buyers who may lack the means to resolve ownership challenges.

What is the current state of the ownership insurance industry?

Despite facing a reduction in premium volume in 2023, the ownership insurance industry remains essential in real estate transactions, with significant net investment gains reported. Title insurance is considered the best option for reducing risk and protecting property rights.

Why is due diligence important in real estate transactions?

Due diligence is critical for ensuring compliance, preventing fraud, and protecting all parties involved in a real estate transaction. Thorough investigations and accurate documentation help identify and mitigate risks associated with property ownership.