Overview

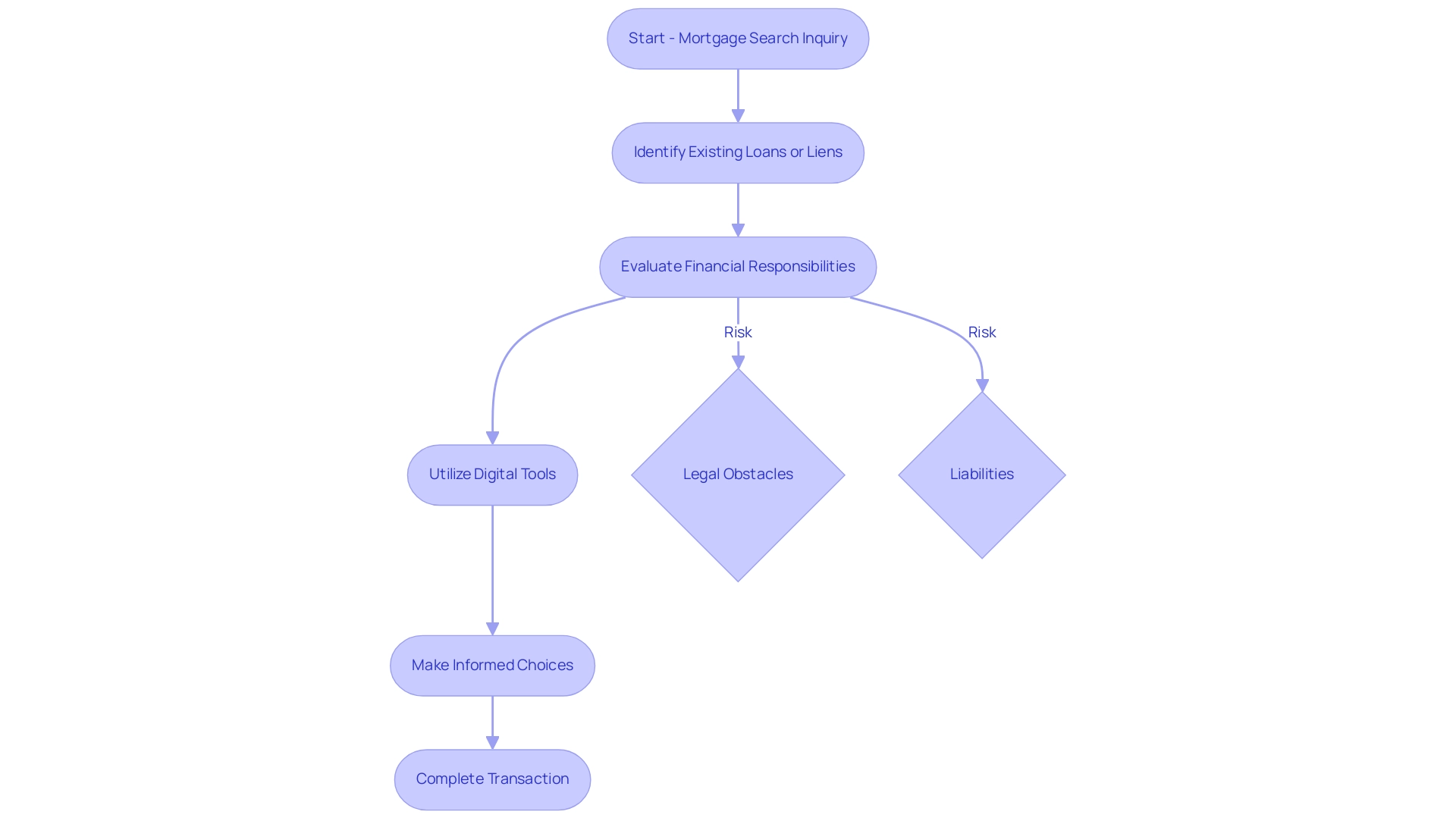

The article provides a comprehensive step-by-step guide on how to search for mortgages on property, emphasizing the importance of thorough investigations to uncover any existing financial obligations tied to the asset. This approach is supported by detailed steps, technological advancements, and the potential risks of neglecting such searches, ensuring that stakeholders make informed decisions in the real estate market.

Introduction

In the intricate world of real estate, mortgage searches stand as a pivotal element in ensuring secure property transactions. These searches not only reveal existing financial obligations tied to a property but also empower buyers and lenders with crucial insights that can influence their decisions. With the rise of digital tools and technologies, the landscape of mortgage searches is evolving, making it essential for stakeholders to adapt and leverage these advancements. As homeownership continues to be a significant aspiration for many, understanding the nuances of mortgage searches becomes increasingly vital in navigating potential pitfalls and safeguarding investments.

This article delves into the importance of mortgage searches, offers a step-by-step guide for conducting them, addresses common challenges faced during the process, and highlights how technology can streamline these searches, ultimately equipping individuals with the knowledge needed for informed property transactions.

Understanding the Importance of Mortgage Searches in Property Transactions

A loan investigation is a crucial element of the real estate transaction process, helping to reveal existing loans or liens connected to an asset. This inquiry is not only crucial for prospective purchasers but also for financiers, as it offers a clear comprehension of any financial responsibilities associated with the asset. According to the Federal Reserve, in 2022, 66.1% of families owned their primary residence, highlighting the significance of informed homeownership decisions.

Moreover, with 37% of homebuyers aged 23-31 requesting financing online, the incorporation of digital tools has grown more pertinent in aiding these inquiries. Ignoring a thorough loan investigation may result in significant issues, such as taking on liabilities associated with the asset or facing legal obstacles that can hinder ownership. These risks highlight the necessity to search mortgage on property through thorough inquiries, enabling stakeholders to make informed choices and protect their investments in an increasingly competitive real estate market.

Recent advancements indicate that lenders are utilizing to process more loans with smaller teams, thus reducing origination costs that can be passed onto borrowers. Moreover, case studies like 'Innovation and Technology in Proptech' illustrate how data-driven advancements, such as AI for real estate algorithms and blockchain for secure transactions, improve the efficiency and transparency of real estate transactions. As the landscape evolves in 2024, the significance of these searches remains essential, reinforcing the need for robust practices in real estate transactions.

Step-by-Step Guide to Conducting a Mortgage Search

- Gather Necessary Information: Initiate the process by collecting essential details about the asset, including its address, legal description, and the names of current owners. This foundational information is vital for accurately locating the title records of the asset.

- Access Public Records: Navigate to the local county clerk or recorder's office, or leverage online databases that grant access to public records. Many jurisdictions now provide user-friendly searchable databases where you can input the details to retrieve associated documents.

- Review Title Documents: Examine the title deed along with any pertinent loan documents. It is crucial to scrutinize the specifics outlined in these documents, such as the names of lenders and the amounts owed. Considering that the average 15-year loan rate for 2022 was 4.3% (Freddie Mac), comprehending the financial obligations associated with the asset is crucial, particularly regarding the median selling price of homes, which currently stands at $435,000.

- Check for Liens: Beyond mortgages, it is essential to investigate for any liens attached to the property. These may include tax liens or mechanic's liens, which can significantly impact ownership rights. Awareness of these obligations is crucial in the research process.

- Consult with Professionals: Should you encounter complex legal jargon or discrepancies in the documentation, it is advisable to seek guidance from professional or a real estate attorney. Their expertise can elucidate any issues and ensure a comprehensive understanding of the implications of your findings.

- Document Findings: Keep careful records of your discoveries, including details of any existing loans or liens. This documentation will act as an essential reference for upcoming transactions and discussions concerning the asset.

By carefully adhering to these steps, potential buyers and homeowners can search mortgage on property, equipping themselves with the necessary understanding of any financial commitments related to the asset. This thorough approach is further underscored by the growing trend of homeowners, particularly among those aged 76 or older—33% of whom report they would never move—indicating a shift towards long-term residence and investment in their homes. Additionally, the growing involvement of Asian borrowers in the refinance market, which increased from 5.5% in 2019 to 7.1% in 2021, underscores changing patterns in financing.

Common Challenges in Conducting Mortgage Searches

Carrying out a financing search can pose various notable difficulties that necessitate focus and skill:

- Incomplete Records: Public records can frequently be absent or partial, hindering the capacity to determine the full history of a real estate asset. A recent analysis indicates that a notable percentage of public records remain unverified, which can hinder the mortgage process. Proactively reaching out to previous owners or local government offices can provide crucial additional information to fill these gaps. As the market faces challenges, it is important to note that dropped below 500,000 units in 2023, reflecting broader trends in real estate transactions.

- Complex Legal Language: Title documents frequently contain intricate legal terminology that may pose a challenge to understanding. When confronted with intricate language, seeking guidance from a legal expert is recommended to clarify any uncertainties and ensure that you understand the implications of the documents completely.

- Discrepancies in Ownership Information: It is not unusual for real estate records to show conflicting information regarding ownership. In such situations, performing additional research or seeking assistance from experts may be essential to address any inconsistencies efficiently.

- Time Limitations: The loan investigation process can be especially lengthy, particularly for properties with a complex ownership history. Setting aside dedicated time for this crucial task is essential. Leveraging advanced machine learning tools like Parse AI can significantly streamline the process, allowing for more efficient handling of documentation and records. With features such as full-text retrieval, machine learning extraction, and interactive labeling, Parse AI enhances courthouse document processing, enabling title researchers to complete their tasks faster and more accurately. Additionally, the example manager allows users to quickly annotate documents, facilitating the extraction of relevant information from unstructured data. Major banks and non-bank lenders are investing in proprietary and third-party technologies to enhance loan processes, as emphasized in a recent case study on improvement of loan procedures.

Awareness of these common challenges enables individuals to take proactive measures to tackle them, ultimately ensuring a comprehensive and thorough search mortgage on property. Furthermore, it is significant that millennials constituted the largest portion of home purchasers at 37% in 2019, suggesting changing demographics that may affect future loan exploration dynamics.

Utilizing Technology for Efficient Mortgage Searches

Incorporating technology into the mortgage inquiry process is crucial for enhancing both efficiency and accuracy. Here are several key advancements that can be leveraged:

-

Online Title Search Tools: Numerous jurisdictions now offer online platforms that allow for rapid access to property records. These tools frequently offer filtering options, allowing users to narrow their searches based on various criteria, ultimately speeding up the search process.

Notably, a recent survey revealed that 37% of homebuyers aged 23-31 opted to apply for a mortgage online, exemplifying the shift toward digital solutions.

-

(OCR): This technology can be utilized to scan and extract data from physical documents, converting them into searchable digital formats. By implementing OCR, professionals can significantly reduce time spent on data entry while minimizing errors, enhancing the overall accuracy of document searches.

-

Machine Learning Algorithms: can analyze extensive datasets to identify patterns and discrepancies in record documentation. This capability not only simplifies the verification of ownership but also enhances the efficiency of the entire inquiry process, aligning with the trend that 79% of lenders plan to depend more on technology as market volume increases.

-

Mobile Applications: Utilizing mobile applications designed for real estate professionals grants access to records and information on-the-go. This flexibility facilitates faster responses to client inquiries and improves overall service delivery.

-

Virtual Home Inspections: The increase of virtual home inspections during the pandemic has changed how buyers perceive listings, offering them photos, videos, and detailed reports without needing to be present. This trend reflects the increasing reliance on technology in the real estate sector.

Furthermore, a significant 75% of industry professionals acknowledge that they will need to invest more in technology to maintain their position as market leaders when the market returns to growth mode. This emphasizes the urgent requirement for ongoing technological progress in loan processes.

By adopting these technological improvements, individuals in the title investigation field can carry out loan inquiries more efficiently, resulting in better-informed choices in their real estate dealings. As the market evolves, the need for further investment in technology is evident, with a significant majority of professionals recognizing that adapting to these changes is essential to maintaining competitiveness in a recovering economy.

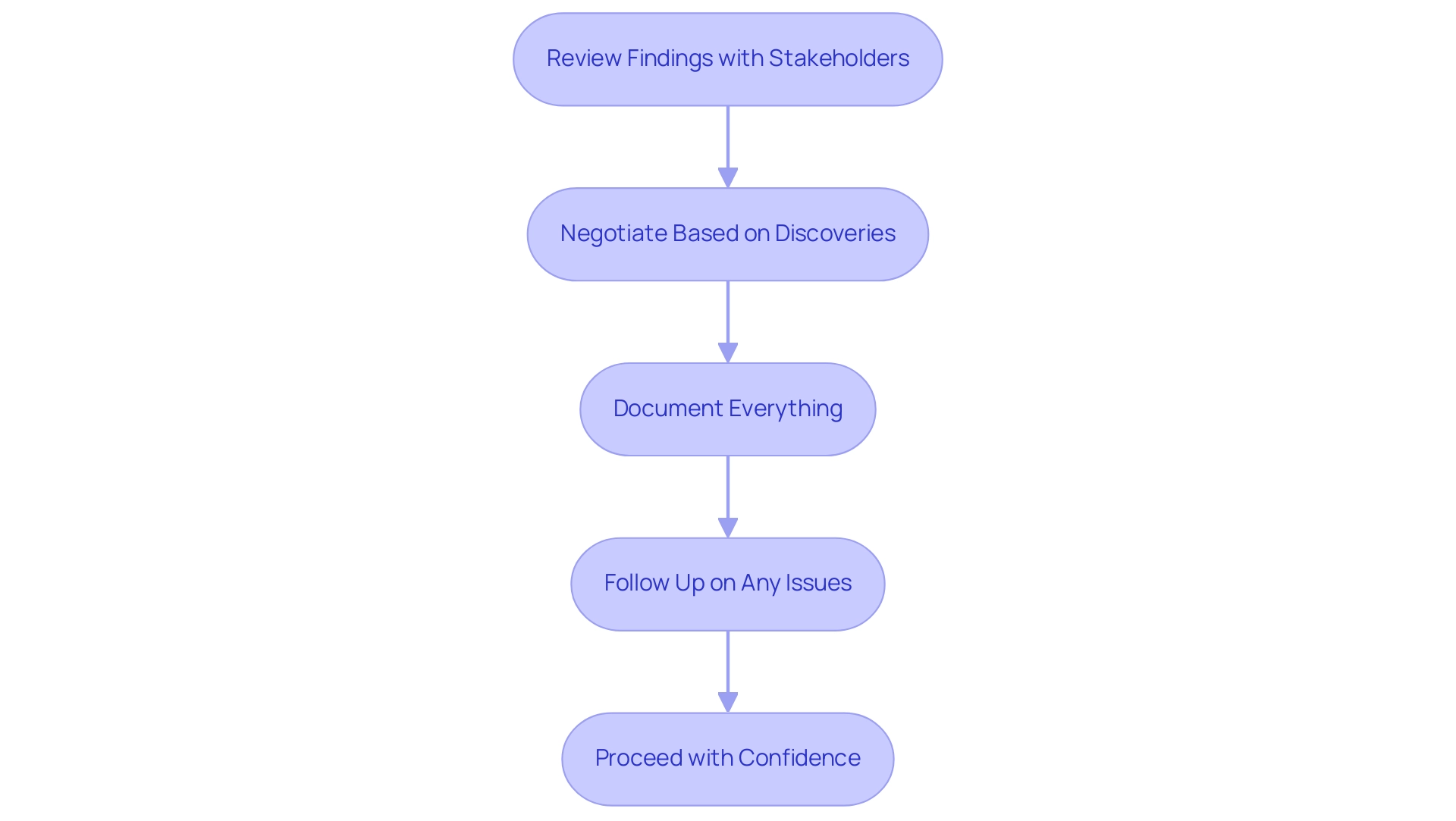

Final Steps After Conducting a Mortgage Search

Upon finishing a loan inquiry, it is essential to take the following final steps to ensure an informed and strategic approach to property financing:

- Review Findings with Stakeholders: Engage in discussions with key parties involved in the transaction, such as potential buyers, real estate agents, or lenders. Distributing the outcomes of your loan investigation can offer important perspectives that might affect the overall deal. For instance, understanding the significant fluctuations in loan rates—such as the largest one-week decrease from 7.08% to 6.61% on November 17, 2022—can inform stakeholders about current market conditions.

- Negotiate Based on Discoveries: If your investigation reveals existing liens or loans, utilize this information to negotiate advantageous terms with the seller or lender. Awareness of these obligations can enhance your negotiating power, potentially leading to better financing conditions. Historical data, such as the largest one-week increase in interest rates from 14.00% to 15.40% in March 1980, and the recent rise from 5.23% to 5.78% on June 16, 2022, illustrate the volatility of these rates and their implications for negotiations.

- Document Everything: Keep detailed records of your loan investigation results and any associated correspondence. This thorough documentation is essential not only for future reference but also for any legal matters that may arise, ensuring that you have a comprehensive account of the transaction process.

- Follow Up on Any Issues: Should your inquiry reveal discrepancies or concerns, it is imperative to address them promptly. This may involve conducting additional research or consulting with professionals to resolve outstanding issues and safeguard your interests.

- Proceed with Confidence: With the insights gained from your search mortgage on property, you can approach the transaction with heightened confidence. The U.S. Census Bureau reports that for households with income below the median family income is 52.7%, highlighting the importance of informed decision-making in financing real estate. Being well-informed allows you to make decisions that protect your investment and align with your financial goals.

By diligently following these final steps, individuals can enhance their decision-making capabilities and navigate the complexities of property financing with greater assurance.

Conclusion

The significance of conducting thorough mortgage searches cannot be overstated in the realm of real estate transactions. As detailed throughout the article, these searches unveil existing financial obligations tied to properties, thereby equipping buyers and lenders with essential insights to make informed decisions. The integration of digital tools has transformed how these searches are conducted, making them more efficient and accessible, particularly for the growing number of online mortgage applicants.

Navigating the mortgage search process involves several critical steps:

- Gathering necessary information

- Accessing public records

- Consulting with professionals when faced with complex legal terms

Understanding the common challenges, such as incomplete records and discrepancies in ownership information, empowers individuals to proactively address potential issues.

Leveraging technology, including online title search tools and machine learning algorithms, enhances the accuracy and speed of these searches, ultimately leading to better-informed property transactions.

In conclusion, a comprehensive mortgage search lays the foundation for successful property transactions, minimizing risks and safeguarding investments. By embracing the advancements in technology and adhering to best practices, stakeholders can navigate the complexities of the real estate market with confidence. As the landscape continues to evolve, the importance of diligent mortgage searches remains paramount, reinforcing the necessity for robust processes that protect the interests of all parties involved.

Frequently Asked Questions

What is a loan investigation in real estate transactions?

A loan investigation is a crucial process that reveals existing loans or liens connected to an asset, helping prospective purchasers and financiers understand any financial responsibilities associated with the property.

Why is a loan investigation important for homebuyers?

It helps homebuyers avoid taking on liabilities associated with the asset and prevents potential legal obstacles that could hinder ownership, ensuring informed decision-making.

What percentage of families owned their primary residence in 2022?

According to the Federal Reserve, 66.1% of families owned their primary residence in 2022.

How has the trend of financing home purchases changed among younger homebuyers?

In 2022, 37% of homebuyers aged 23-31 requested financing online, indicating a growing reliance on digital tools for mortgage inquiries.

What risks are associated with neglecting a thorough loan investigation?

Ignoring a thorough loan investigation may lead to significant issues, such as assuming liabilities tied to the property or facing legal challenges that can complicate ownership.

How are lenders improving the loan processing experience?

Lenders are utilizing digital tools to process more loans with smaller teams, which reduces origination costs that can be passed onto borrowers.

What advancements are enhancing the efficiency of real estate transactions?

Data-driven advancements, such as AI algorithms for real estate and blockchain technology for secure transactions, are improving efficiency and transparency in real estate transactions.

What are the steps involved in conducting a loan investigation?

The steps include gathering necessary information, accessing public records, reviewing title documents, checking for liens, consulting with professionals, and documenting findings.

What should be included in the necessary information for a loan investigation?

Essential details include the asset's address, legal description, and the names of current owners.

Where can one access public records for a loan investigation?

Public records can be accessed at the local county clerk or recorder's office or through online databases that provide searchable records.

What should be reviewed in the title documents during a loan investigation?

The title deed and any relevant loan documents should be examined for details such as the names of lenders and the amounts owed.

What types of liens should be investigated during a loan investigation?

It is essential to check for any liens, including tax liens or mechanic's liens, as these can significantly affect ownership rights.

When should one consult with professionals during a loan investigation?

If there are complex legal terms or discrepancies in the documentation, it is advisable to seek guidance from a title research professional or a real estate attorney.

Why is it important to document findings during a loan investigation?

Keeping careful records of discoveries, including details of any existing loans or liens, serves as a critical reference for future transactions and discussions regarding the asset.