Introduction

In the realm of real estate transactions, the importance of conducting thorough title searches cannot be overstated. Title searches serve as a critical safeguard against potential legal disputes and financial losses by uncovering any hidden encumbrances, liens, or ownership issues that may affect the property. With the rise in real estate fraud and the complexities associated with property titles, understanding the processes and nuances of title searches is essential for ensuring secure property ownership.

This article delves into the significance of title searches, explores the intricate details of property ownership and title, and provides a step-by-step guide on how to conduct a meticulous title search. Additionally, it examines the role of title insurance, compares the benefits of hiring professionals versus conducting a DIY search, and addresses common challenges faced during the title search process. By gaining insight into these critical aspects, property buyers and investors can navigate the real estate market with confidence and safeguard their investments against unforeseen complications.

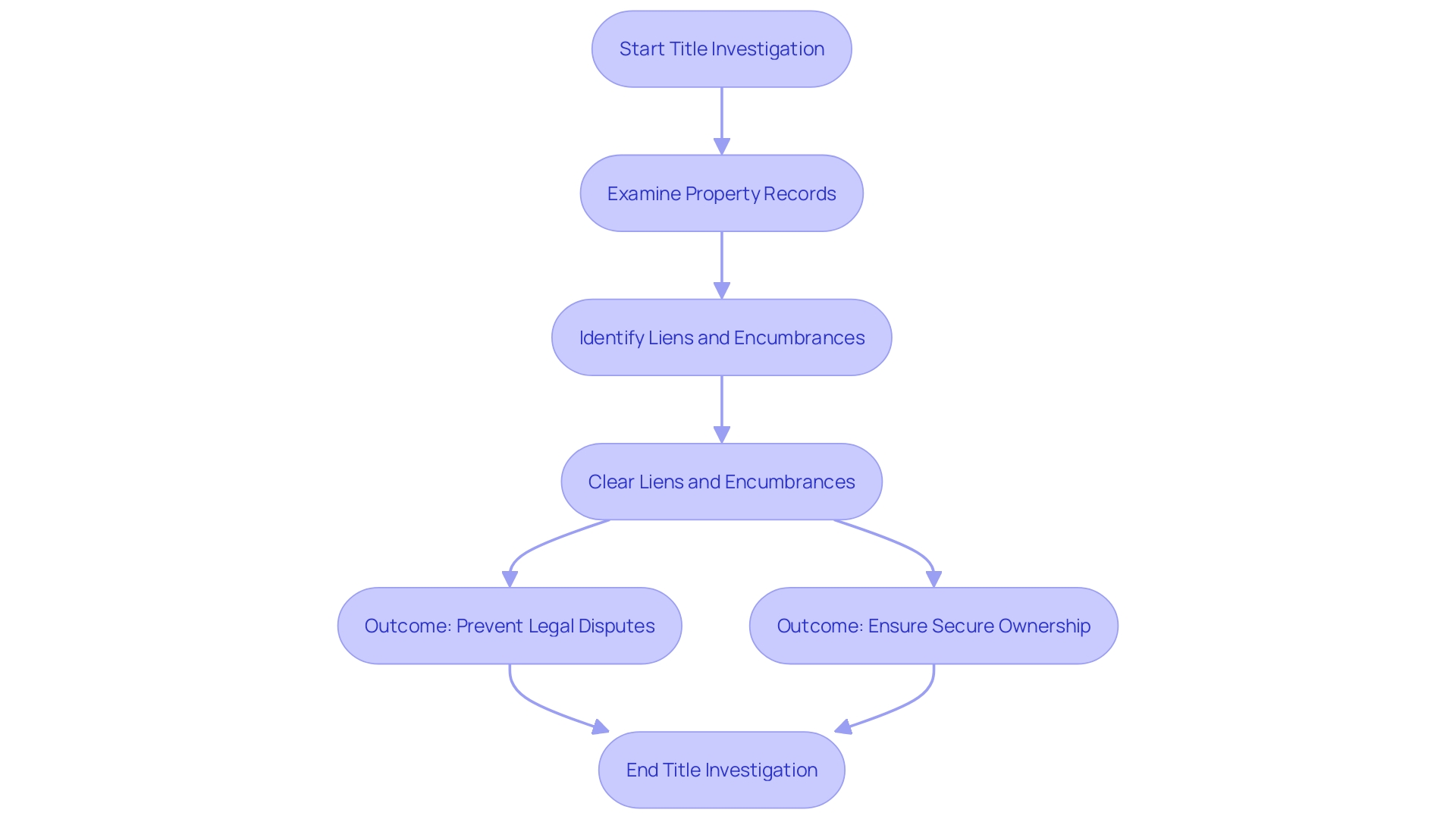

Why Title Searches Are Important

Title investigations are fundamental in ensuring that a property is devoid of legal complications before purchase or investment. They reveal any existing liens, encumbrances, or disputes that could impact ownership. A protects purchasers from possible legal disputes and monetary setbacks, thus providing reassurance in real estate dealings. The increase in real estate deception, as emphasized in recent reports, highlights the significance of thorough property examinations. For instance, in a notable case, out-of-state owners discovered their vacant lot had been fraudulently sold and developed without their knowledge. Such incidents emphasize the essential function of title searches in preventing similar fraudulent activities and ensuring secure possession of real estate.

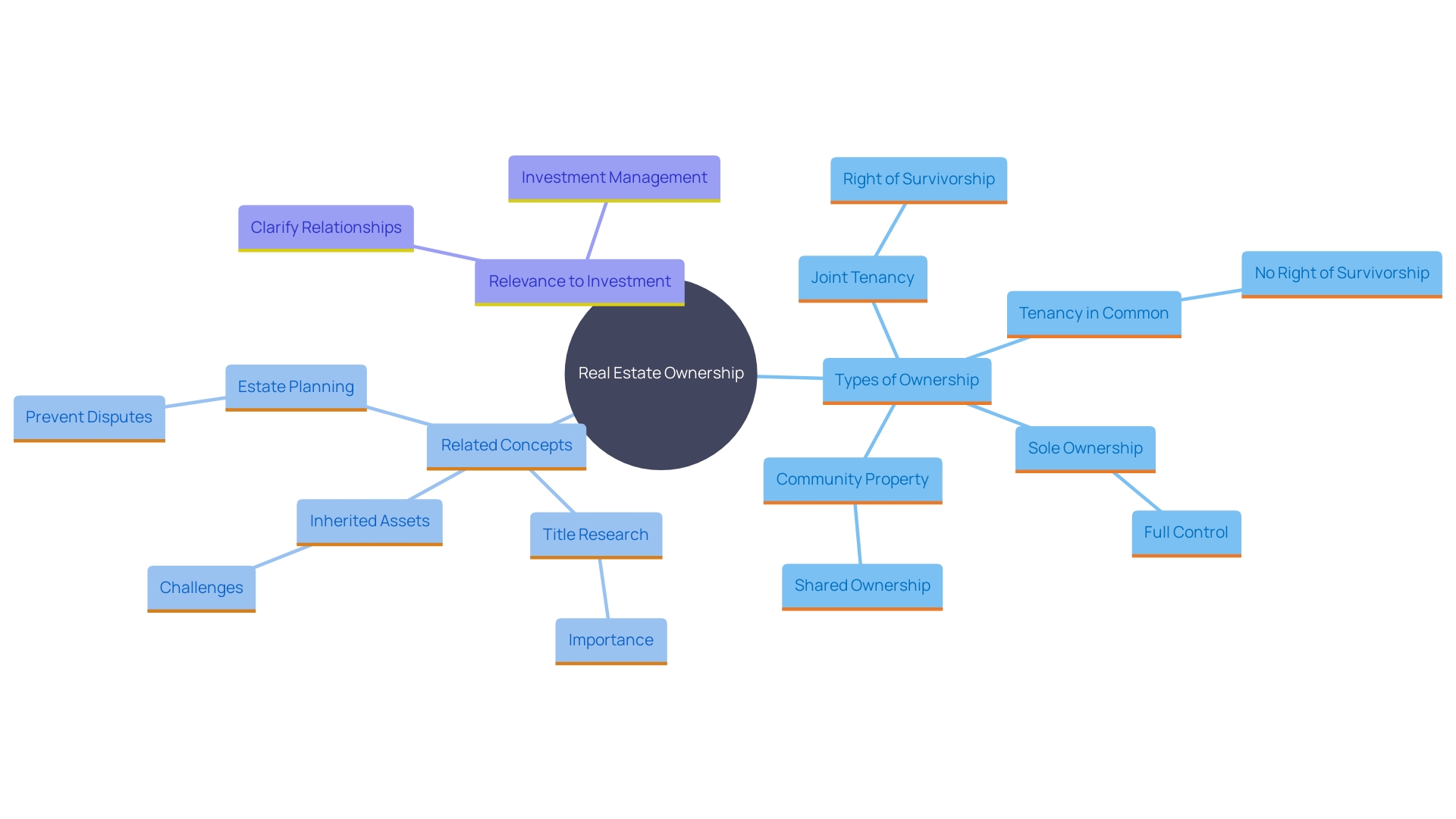

Understanding Title and Ownership

Title refers to the legal right to own and use an asset, and ownership can take various forms such as sole ownership, joint tenancy, or tenancy by the entirety. Grasping these forms is essential as they determine how ownership rights are transferred and inherited, influencing investment strategies. For example, joint tenancy includes a right of survivorship, meaning if one owner passes away, their share automatically transfers to the surviving owner. This can streamline the transfer of real estate but also complicates matters if all parties do not agree on the management or sale of the asset.

The intricacies of are emphasized by instances such as that of Craig Adams, whose 8,300-square-foot residence in Raleigh, North Carolina, was deceitfully transferred from his name. Despite being current on his mortgage and taxes, Adams discovered the deed to his home had been claimed by a stranger through a false warranty deed. Such incidents underscore the importance of thorough title research and legal safeguards.

Furthermore, inherited assets, frequently referred to as heirs’ assets, can pose considerable difficulties if title is not distinctly documented. According to a 2023 survey by Caring.com, only 34% of Americans have an estate plan, leaving many assets vulnerable to disputes. The American Land Association (ALTA) highlights the significance of estate planning to avoid such problems and suggests legal measures such as quiet ownership proceedings to settle conflicts and clarify ownership.

Maintaining transparent and precise ownership records is crucial not only for individual landowners but also for safeguarding generational wealth and fostering stable real estate markets. Comprehensive knowledge and proactive oversight of asset ownership can assist in reducing risks and safeguarding investments.

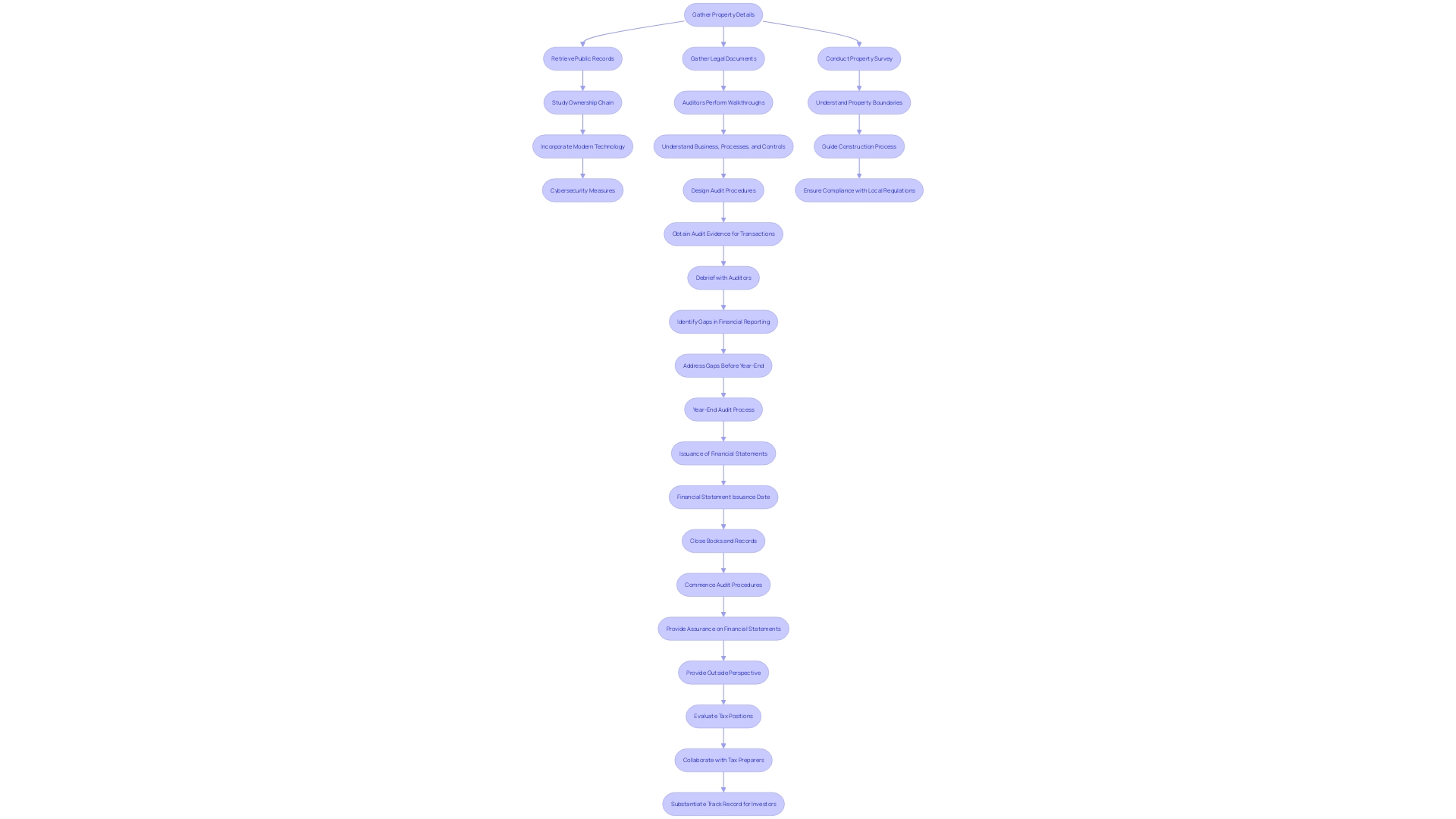

How to Conduct a Title Search

Performing a document examination is a detailed procedure that includes multiple essential stages to guarantee comprehensive and precise details regarding the asset's background and present condition. Initially, property details must be gathered, which includes identifying the property's legal description and boundaries. This is succeeded by retrieving public records from different sources such as county courthouses, online databases, and documentation plants to collect deeds, mortgages, liens, and other pertinent documents.

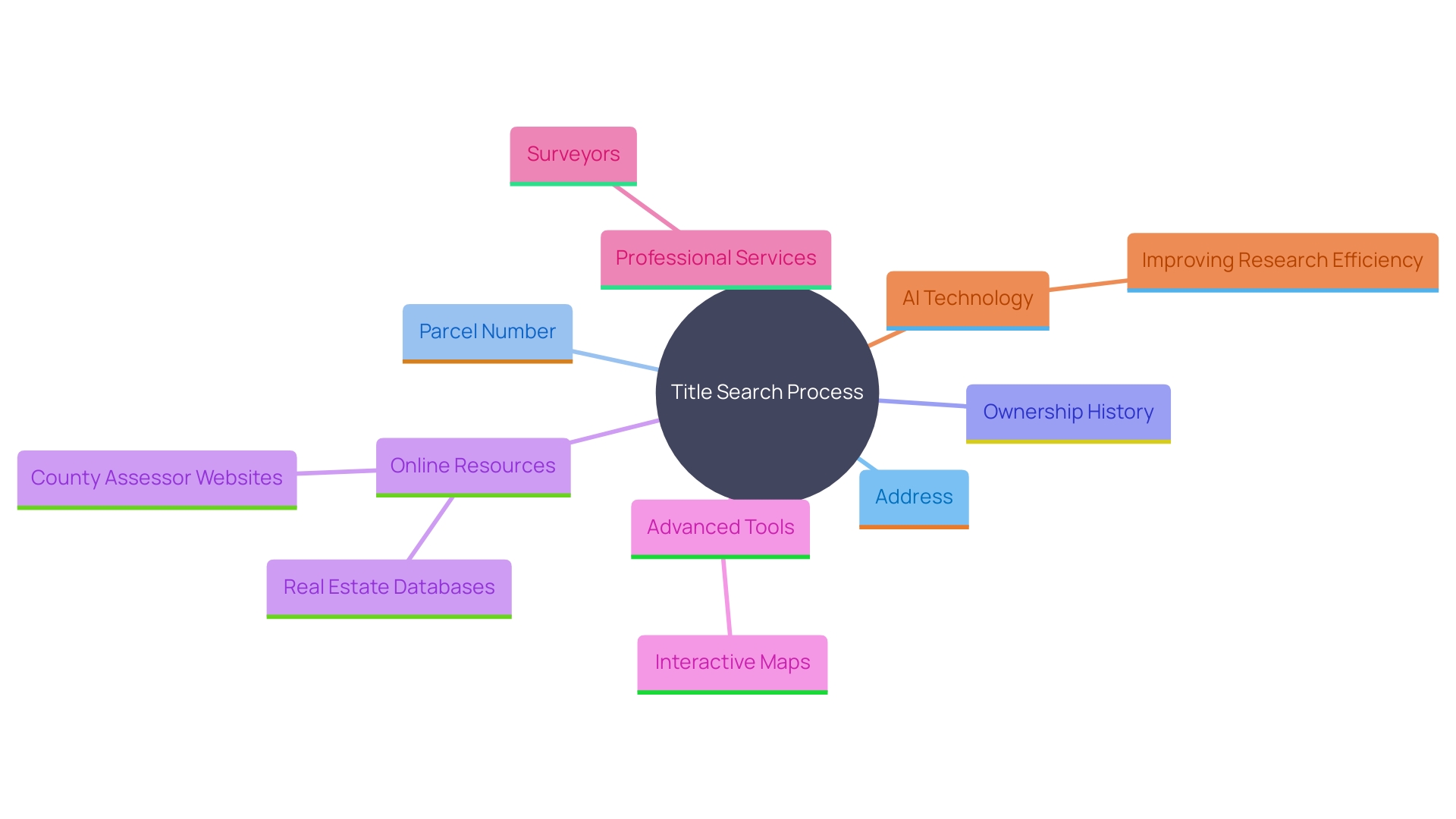

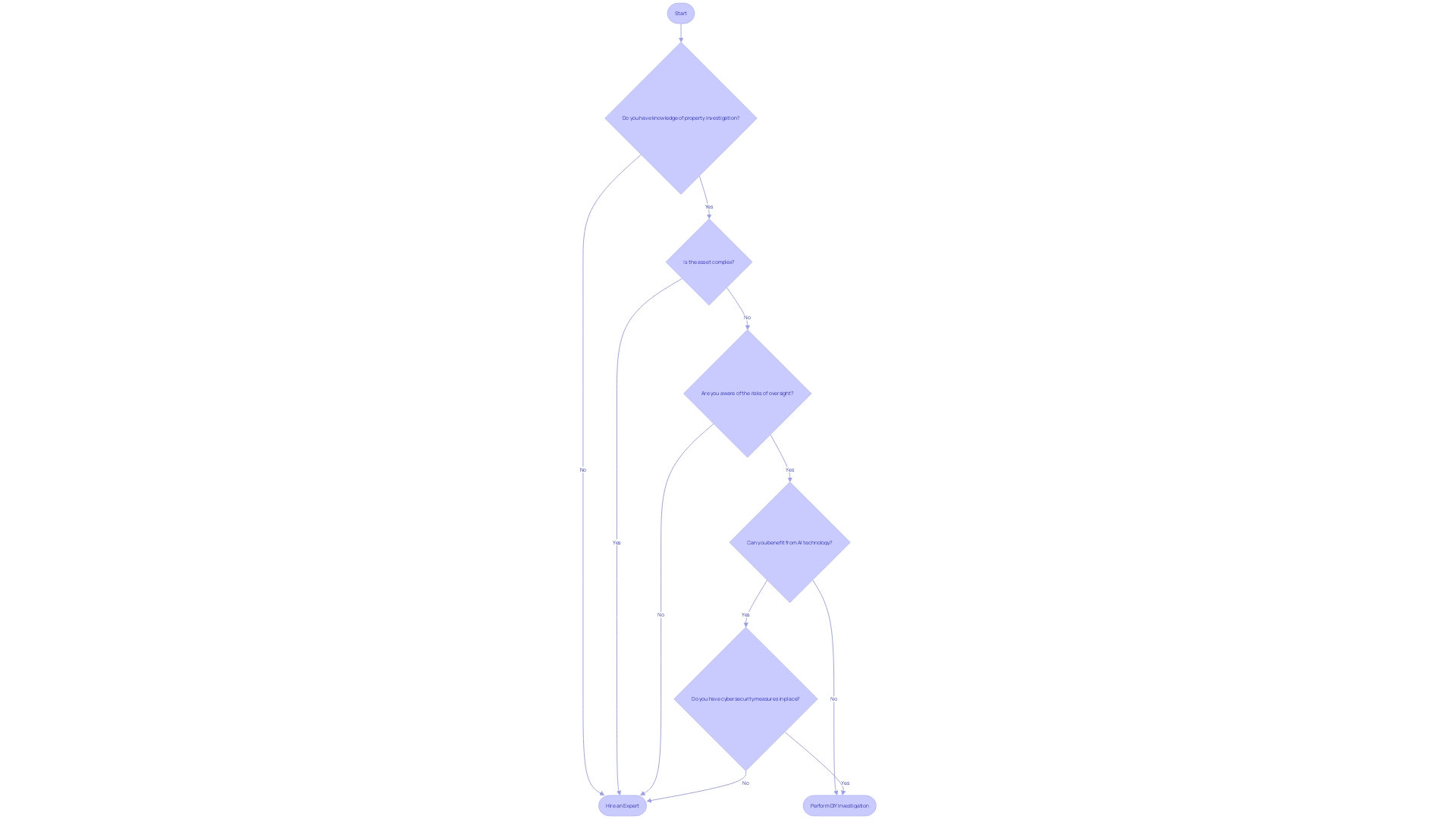

Studying the ownership chain, or the series of rights, is essential to recognizing any possible problems like gaps in ownership, undisclosed heirs, or fraudulent transfers. This step guarantees that the property has a clear ownership record, which is essential for a smooth real estate transaction. Additionally, , including Artificial Intelligence (AI), can significantly enhance the efficiency and accuracy of this process by quickly analyzing large volumes of data and identifying discrepancies.

Cybersecurity also plays a significant role in protecting the integrity of property investigations, safeguarding sensitive information from wire fraud and other cyber threats. As stated by the American Land Title Association (ALTA), wire fraud continues to be one of the greatest dangers, highlighting the necessity for strong security measures and awareness among professionals in the field.

In summary, a thorough examination of real estate involves detailed steps, including collecting land information, accessing public records, and reviewing the ownership chain, all while utilizing advanced technologies and ensuring cybersecurity to reduce potential risks.

Step 1: Gather Information and Resources

Kickstart your title search by assembling essential details about the asset, such as the address, parcel number, and names of current and previous owners. Utilize comprehensive online resources like county assessor websites and real estate databases. These platforms provide instant access to a wealth of real estate data, including construction permits, climate risks, rental rates, and valuation. Additionally, advanced tools like and parcel boundaries can aid in locating utilities, septic systems, and public access points, dramatically streamlining the research process. For more complex needs, professional surveyors can provide accurate and detailed reports, ensuring compliance with legal requirements and avoiding potential disputes. The incorporation of AI technology, like RealReports' AI assistant Aiden, can further improve efficiency by summarizing documents and addressing inquiries about real estate details in seconds.

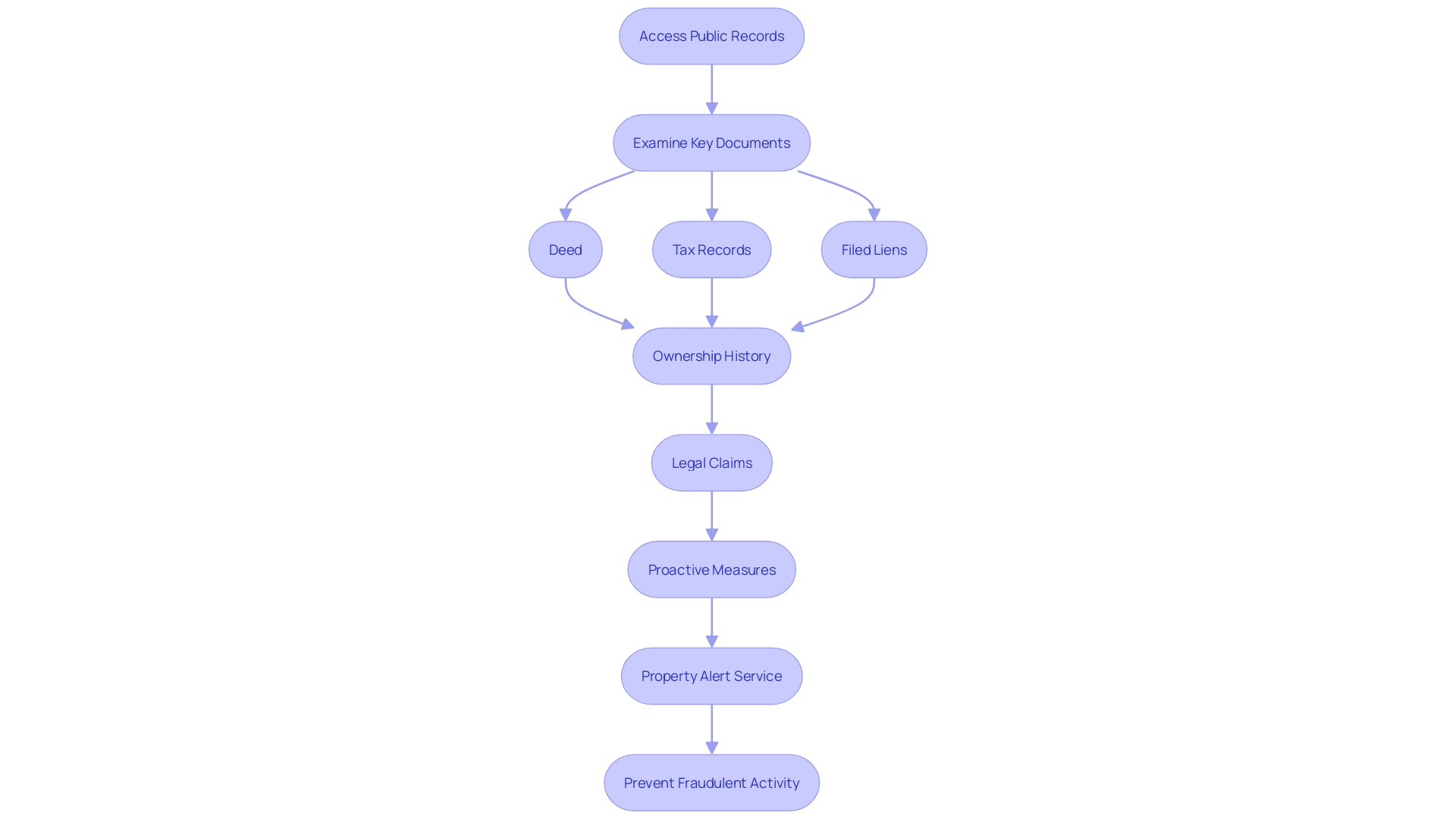

Step 2: Review Public Records

To obtain a comprehensive understanding of a real estate title, access public records available at your local county clerk's office or through online databases. Important documents to examine consist of the deed, tax records, and any filed liens. These records illuminate the ownership history of the asset and disclose any legal claims against it. For instance, the Boulder County Clerk and Recorder's office provides a to detect fraudulent activity, protecting your investment from unauthorized changes. 'As stated by Jeff Chostner, the District Attorney for the 10th Judicial District, proactive measures like these can help prevent issues such as unexpected liens, which often only become apparent during real estate transactions.'.

Step 3: Check for Liens and Encumbrances

Identifying any outstanding liens or encumbrances that may impact the asset is crucial. Such liens include mortgages, tax liens, or judgments, which can significantly impact the acquisition process. For instance, negotiating the resolution of a lien involves communication between the landowner, the lienholder, and sometimes legal representatives. Strategies may include paying off the lien in full, arranging for its transfer to another asset, or negotiating a reduced payment to satisfy the lien. Successful negotiation is vital to moving forward with the sale, as one of the most immediate effects of a lien is the potential delay in closing. These delays occur because liens must be resolved before a sale can close, often requiring additional time for negotiation, payment, and the acquisition of release documents.

Real estate fraud is a growing concern, highlighted by the 2024 State of Wire Fraud Report, which underscores the importance of understanding liens. For example, out-of-state owners of a million-dollar vacant lot in Concord discovered their land had been sold without their knowledge, leading to unexpected legal and financial complications. Therefore, conducting thorough due diligence, even in cash sales, is essential. It is advisable to conduct a thorough search of ownership records to identify any existing liens on the asset and seek professional advice to understand the implications of these liens and explore potential resolutions.

Furthermore, mortgage lenders are unlikely to finance a purchase until all liens are cleared. This highlights the significance of recognizing and addressing any existing liens to prevent complications and extra expenses during the acquisition process. By addressing these obligations early on, both sellers and buyers can ensure a smoother transaction and avoid potential pitfalls.

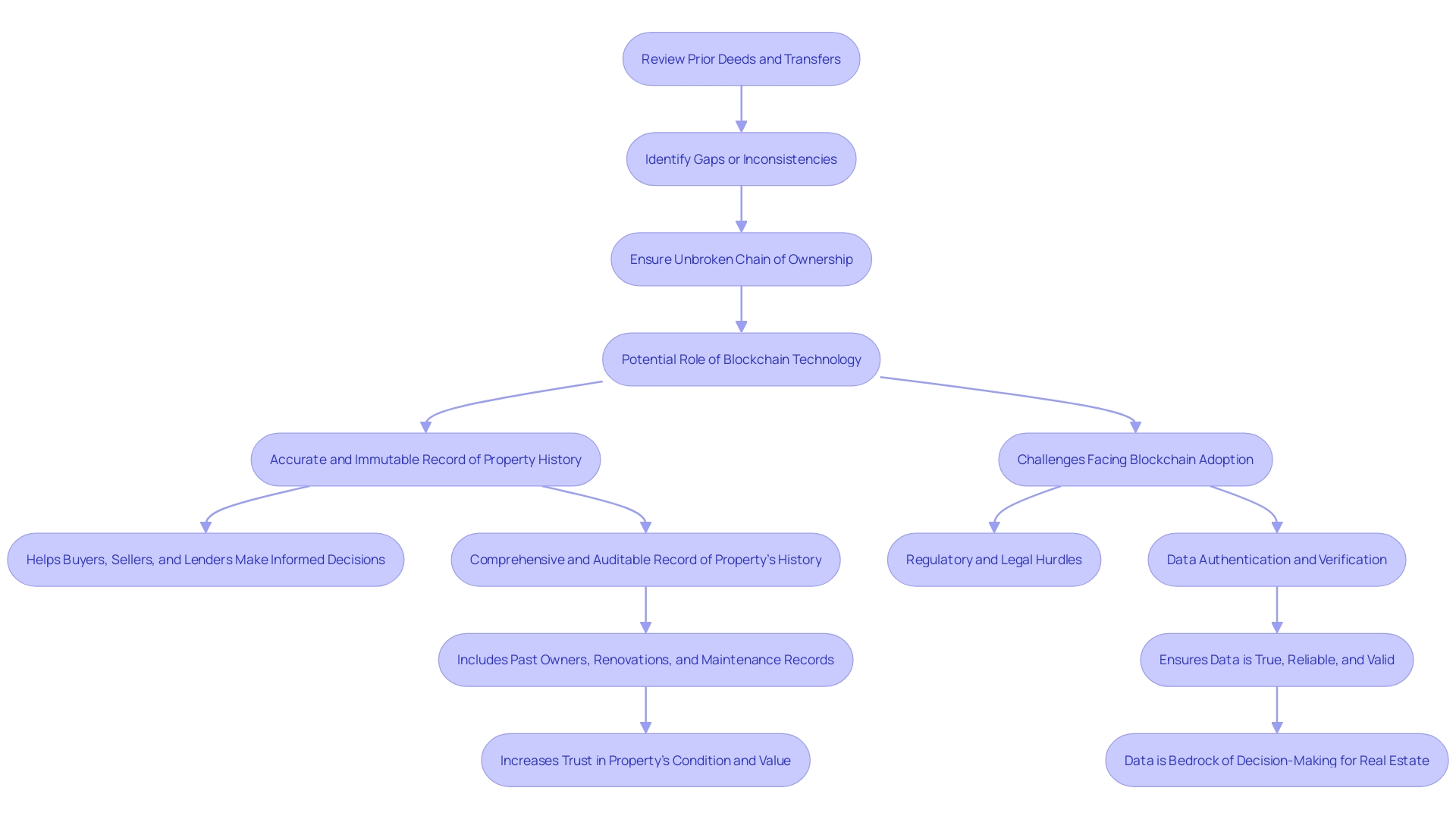

Step 4: Investigate Ownership History (Chain of Title)

Examining the chain of rights is essential in comprehending a property's history of possession. This process entails a thorough review of prior deeds and transfers to pinpoint any gaps or inconsistencies that could influence possession. The significance of an cannot be overstated, as it confirms clear possession and prevents legal challenges. 'Blockchain technology, with its capability to provide an immutable and auditable record of a real estate's history, including past owners and renovations, offers a promising solution to enhance the accuracy and reliability of title records.'. However, the real estate industry must address technical challenges and resistance to change to fully leverage this technology.

Step 5: Look for Easements and Restrictions

To fully assess a real estate's potential, it is essential to investigate any easements or restrictions associated with it. Easements grant others the right to use a portion of the land for specific purposes, which might include utility access or shared driveways. Limitations, on the other hand, may restrict how the asset can be utilized, often found in legal agreements like deed restrictions or ground leases. These legal constraints can significantly impact and strategic development, particularly for holdings that are tax-delinquent, abandoned, or otherwise underutilized. Therefore, understanding these elements is crucial for making informed decisions and optimizing the property's value.

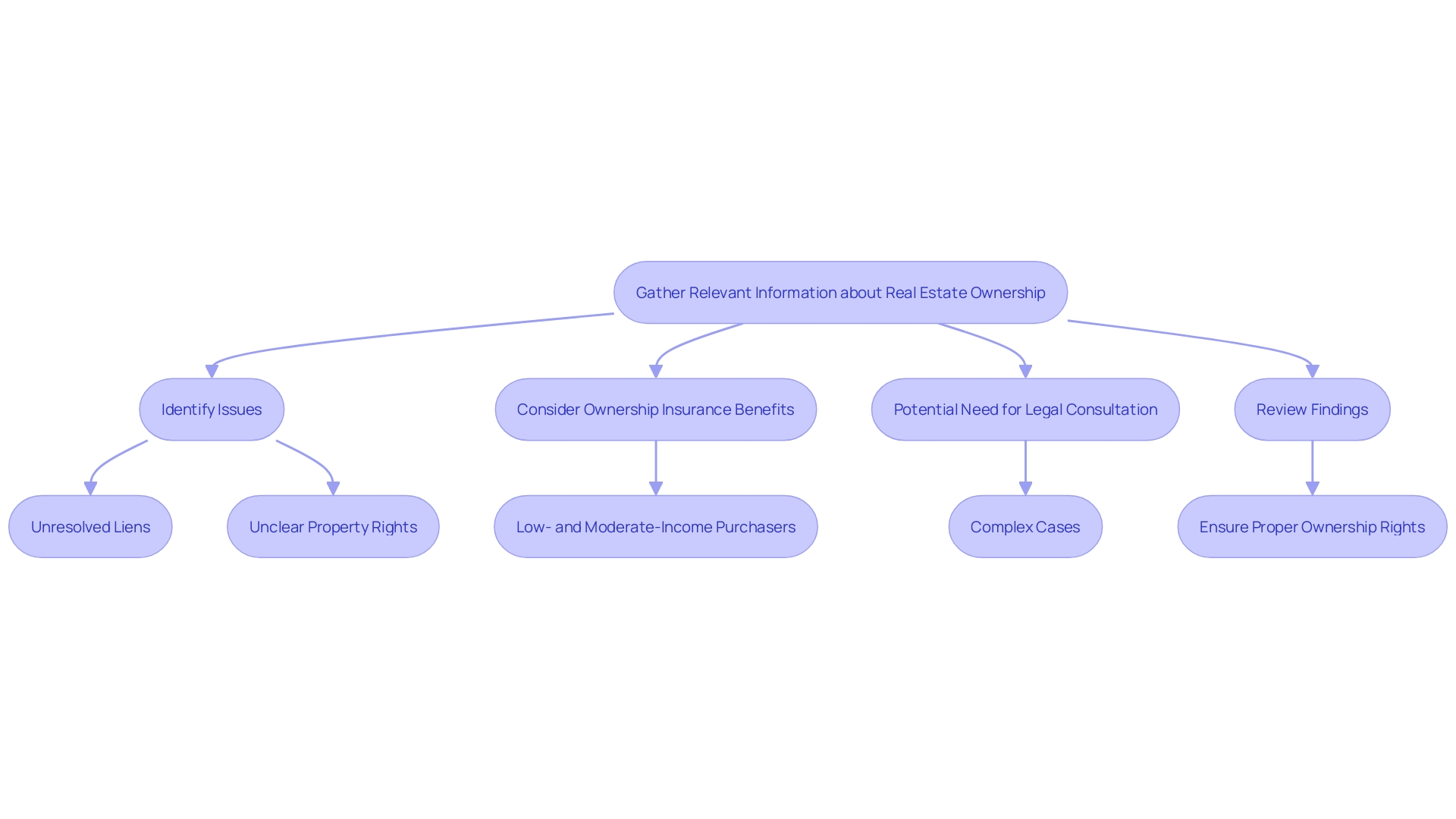

Step 6: Review Results and Resolve Issues

Once all relevant information has been gathered, it is essential to thoroughly review your findings. Address any issues identified during your inquiry, such as unresolved liens or unclear property rights. Possession of real estate can be challenged by something overlooked in the document examination, a boundary line disagreement, or even deception and falsification. The coverage offered by is especially beneficial for low- and moderate-income home purchasers, who may otherwise find it difficult to manage the expenses linked to safeguarding their ownership rights. In complex cases, consulting with a real estate attorney may be necessary to resolve matters effectively. Practical legal analysis of claims and court decisions related to the insurance sector can provide insights into handling such issues.

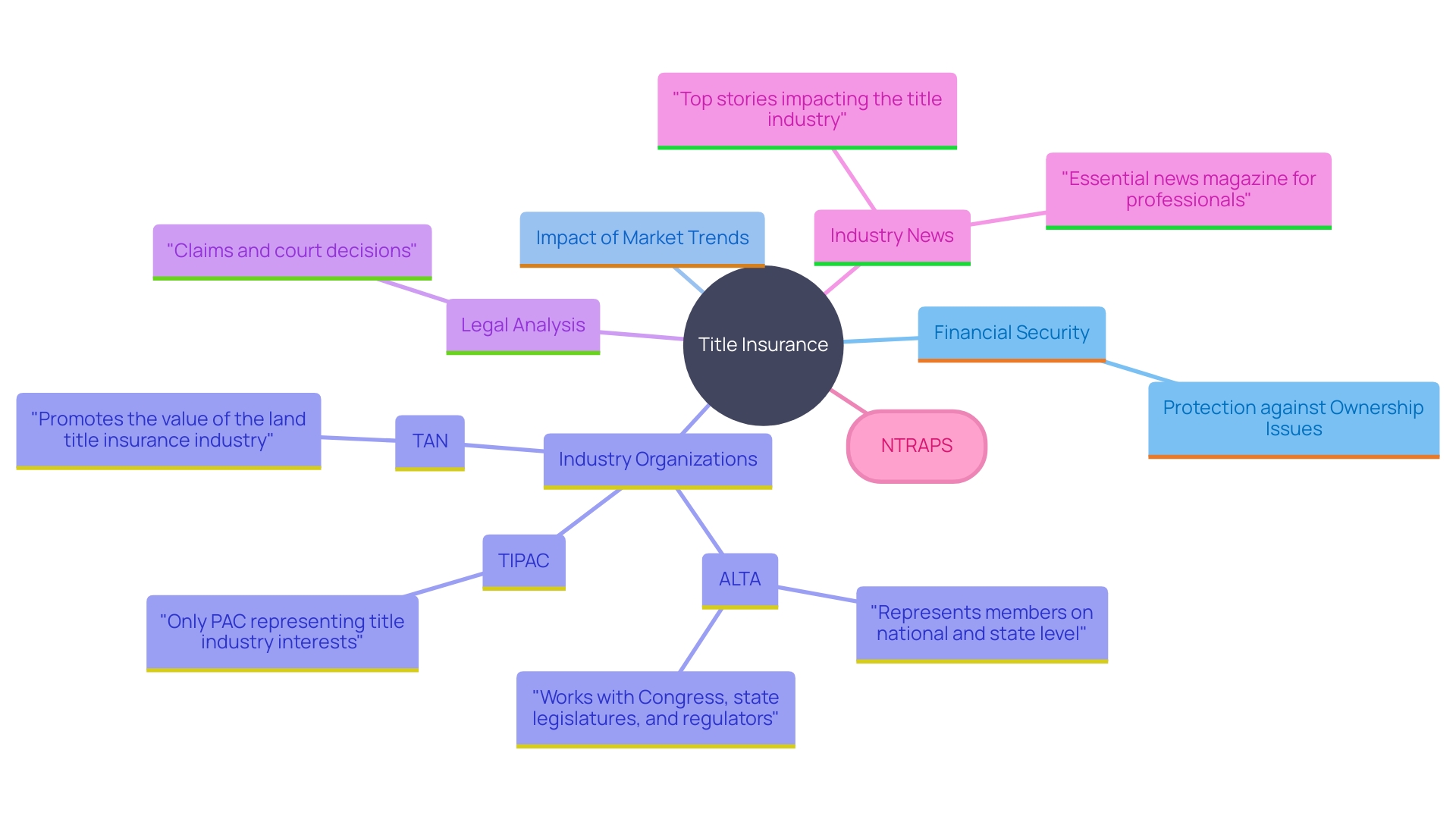

The Role of Title Insurance

Title insurance offers crucial safeguarding against possible losses stemming from flaws in the ownership document that were not recognized during the examination. This safeguard is crucial for buyers, ensuring financial security against unforeseen ownership issues that may arise post-purchase. The significance of deed protection is highlighted by the fact that property possession can be threatened by overlooked problems in the deed examination, boundary conflicts, or even deceit and counterfeiting. For numerous individuals, particularly those with low and moderate earnings, ownership insurance is essential, as it protects them from the significant expenses related to defending their property rights. Despite a recent downturn in the insurance market, with a 35.1% during the first nine months of 2023 compared to the same period in 2022, the protection it offers remains unparalleled. Furthermore, the sector's initiatives, represented by groups such as ALTA, persist in promoting the significance and essential nature of insurance related to ownership, ensuring that it stays a fundamental aspect of real estate transactions.

Hiring a Professional vs. Doing It Yourself

Determining whether to perform a property investigation independently or engage an expert relies heavily on your knowledge and the intricacy of the asset. While conducting a DIY investigation might initially seem cost-effective, it comes with substantial risks, especially given the increasing complexity and potential for oversight. Experts in insurance of ownership hold sophisticated instruments and considerable experience to recognize and tackle problems that might be easily missed by an untrained observer.

In today's digital era, the introduction of (AI) has transformed the insurance sector, enhancing efficiency and productivity in ways manual searches cannot match. AI tools can swiftly analyze vast amounts of data, identifying discrepancies and potential legal issues with remarkable accuracy. This technological advantage is something that individual property buyers may not have access to or the expertise to utilize effectively.

Moreover, the insurance sector encounters substantial cybersecurity risks, including wire fraud, which is an increasing worry. Professional classification investigation companies are equipped with strong cybersecurity measures to safeguard data and transactions, a guarantee that DIY inquiries lack. The American Land Title Association (ALTA) provides numerous resources and tools to help professionals stay ahead of these threats, ensuring the highest levels of security for their clients.

Ultimately, while a DIY title investigation might save money upfront, the potential costs of missed information, legal complexities, and cybersecurity risks make professional services a prudent choice. The expertise and advanced technology that professionals bring to the table provide invaluable peace of mind and comprehensive protection, ensuring a smoother and more secure property transaction process.

Common Challenges and Considerations

Title searches can present significant challenges, including incomplete records, false identities, or missing historical documents. These issues can lead to serious complications, such as ownership disputes or legal battles. According to recent reports, the number of has increased by 20 percent compared to last year. This uptick emphasizes the significance of thorough document searches to avoid potential pitfalls. Practical legal analysis of claims and court decisions related to the insurance industry emphasizes the critical role of thorough examinations of property ownership. The Allegheny County Division of Real Estate Office highlights that mistakes in ownership documents can lead to significant losses. Therefore, approaching title searches with diligence and thoroughness is essential to ensure a clear understanding of the property’s title.

Conclusion

Title searches are a fundamental aspect of real estate transactions, providing essential protection against legal disputes and financial losses. By uncovering hidden liens and ownership issues, these searches enable buyers and investors to make informed decisions, particularly in an era marked by increasing real estate fraud.

A solid understanding of title and ownership complexities is crucial. Different ownership forms can impact property rights and investment strategies, while challenges like inherited properties underscore the need for diligent title management to ensure clear ownership and protect generational wealth.

Conducting a comprehensive title search involves several key steps, including gathering property details, reviewing public records, and analyzing the chain of title. Each step is vital for identifying potential issues that could complicate ownership. Advanced technologies, such as AI, can enhance the search process and bolster cybersecurity against emerging threats.

Ultimately, whether opting for a DIY approach or hiring professionals, the intricacies of title searches demand careful consideration. While DIY searches may seem cost-effective, the potential for oversight can lead to significant legal challenges. Title insurance offers additional protection against unforeseen title defects that may surface after purchase.

By emphasizing thorough title searches and understanding property ownership intricacies, buyers and investors can confidently navigate the real estate market, ensuring their investments remain secure.

Frequently Asked Questions

What is the purpose of title investigations in real estate?

Title investigations are essential to ensure that a property is free from legal issues before purchase or investment. They uncover any existing liens, encumbrances, or disputes that could affect ownership, protecting buyers from potential legal conflicts and financial losses.

Why are thorough property examinations increasingly important?

The rise in real estate fraud highlights the need for detailed property examinations. Cases of properties being fraudulently sold without the owner's knowledge emphasize the critical role of title searches in safeguarding ownership.

What are the different forms of property ownership?

Property ownership can take various forms, including sole ownership, joint tenancy, and tenancy by the entirety. Understanding these forms is crucial as they affect how ownership rights are transferred and inherited.

What can happen if property titles are not properly documented?

Inadequate documentation can lead to significant issues, such as disputes over inherited assets or fraudulent transfers. Many Americans lack estate planning, making their assets vulnerable to conflicts if titles are not clearly established.

What steps are involved in performing a document examination for real estate?

The process includes gathering property details, accessing public records, studying the ownership chain, and utilizing technology to enhance accuracy. Cybersecurity measures are also vital to protect sensitive information during this process.

How can I start a title search for a property?

Begin by gathering essential information about the property, such as its address, parcel number, and ownership history. Utilize online resources like county assessor websites to access real estate data.

What documents should I examine during a title search?

Important documents include the deed, tax records, and any filed liens. These records provide insight into the property's ownership history and any legal claims against it.

How can outstanding liens affect a real estate transaction?

Outstanding liens, such as mortgages or tax liens, can delay the sale process, as they must be resolved before closing. Negotiating their resolution is crucial for a smooth transaction.

What is the importance of an unbroken chain of ownership?

An unbroken chain of ownership confirms clear possession of the property and helps prevent legal challenges. Reviewing prior deeds and transfers is essential to identify any gaps or inconsistencies.

What are easements, and how do they impact property use?

Easements grant others the right to use a portion of the land for specific purposes (e.g., utility access), while limitations may restrict how the property can be used. Understanding these factors is vital for effective asset management.

What role does title insurance play in real estate transactions?

Title insurance protects buyers against potential losses from undiscovered defects in ownership documents after purchase. It is especially important for low- and moderate-income buyers, providing financial security against ownership disputes.

Should I conduct a title investigation myself or hire a professional?

While a DIY approach may seem cost-effective, it carries risks of oversight. Professionals have advanced tools and expertise to identify issues that may be missed by an untrained individual, making their services a prudent choice.

What challenges might arise during a title search?

Title searches can encounter issues such as incomplete records, false identities, or missing historical documents, which could lead to ownership disputes or legal complications. Thoroughness in investigation is essential to avoid these pitfalls.