Overview

Understanding whether a property has a lien is crucial for property owners and investors. The essential steps to determine this involve:

- Gathering property information

- Visiting local government offices

- Utilizing online resources

- Checking tax records

- Potentially requesting a formal inquiry through a title company

This article outlines a structured process for conducting a lien search, addressing common challenges that may arise. Consequently, it equips property owners and investors with the knowledge to navigate the complexities of real estate transactions effectively.

Introduction

Navigating the complexities of property ownership necessitates a thorough understanding of liens, which can profoundly influence a buyer's investment. Liens, from mortgage liens securing financing to tax liens imposed by government entities, each carry distinct implications for property transactions.

Conducting a lien search is an essential step in the due diligence process, ensuring potential buyers are well-informed about any claims against a property. However, this task can present challenges, including incomplete records and confusing legal terminology.

By exploring the various types of liens, the process of conducting a search, and common obstacles, individuals can approach property transactions with greater confidence and clarity.

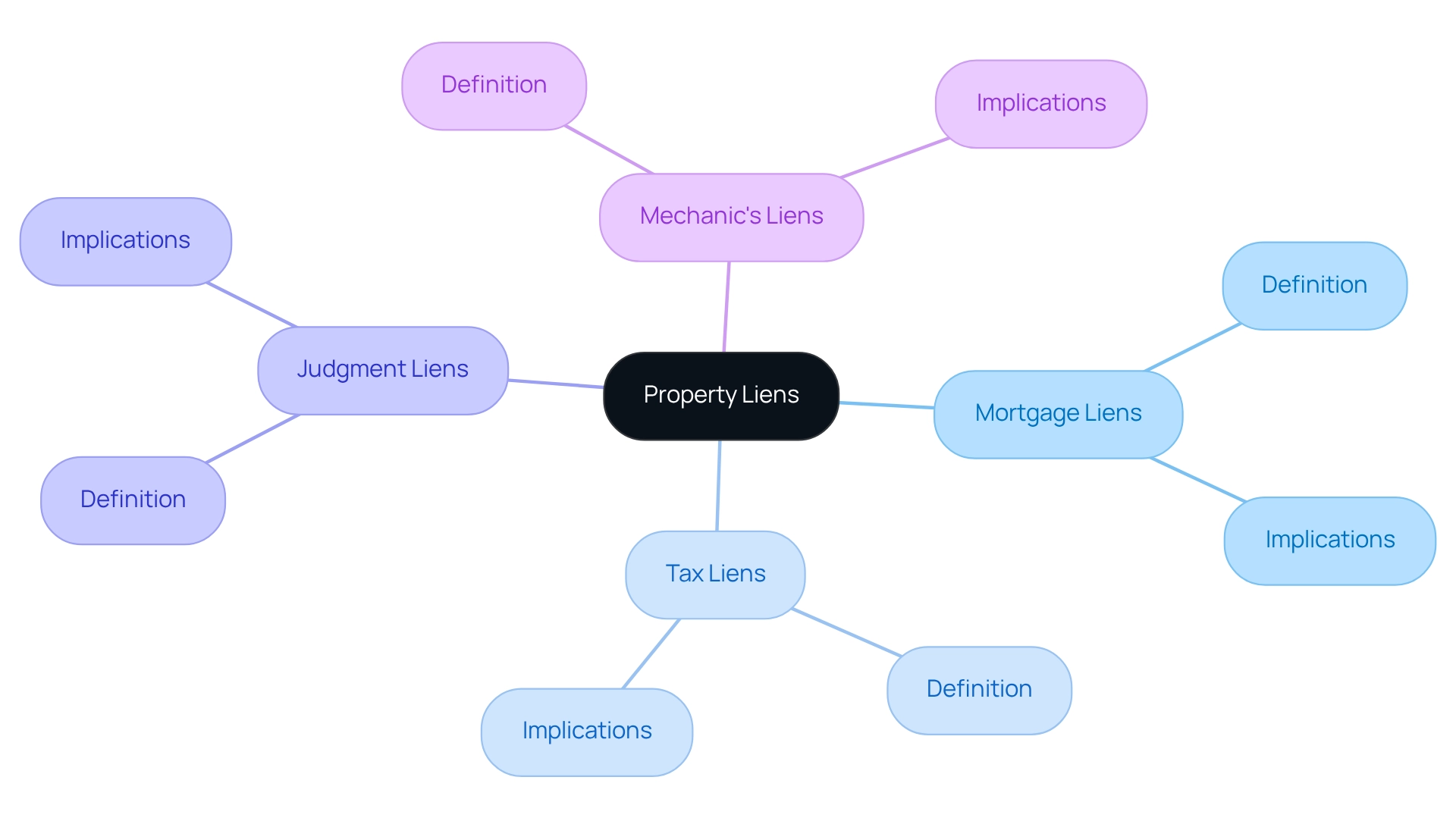

Understand Property Liens

A real estate encumbrance represents a legal claim against an asset, typically used as collateral to secure a debt. For any property owner or investor, understanding the various types of liens is crucial, particularly in how to find out if property has a lien.

- Mortgage Liens are voluntary liens established by lenders when financing a property.

- Tax Liens are imposed by government entities when real estate taxes remain unpaid.

- Judgment Liens emerge from court rulings against the asset's owner.

- Mechanic's Liens are filed by contractors or suppliers who have not received payment for work completed on the property.

Each category of claim carries distinct consequences for property ownership, potentially affecting the ability to sell or refinance the asset. Familiarizing yourself with these types will aid in recognizing potential issues during your inquiry on how to find out if property has a lien, ultimately empowering you to navigate the complexities of real estate transactions with confidence.

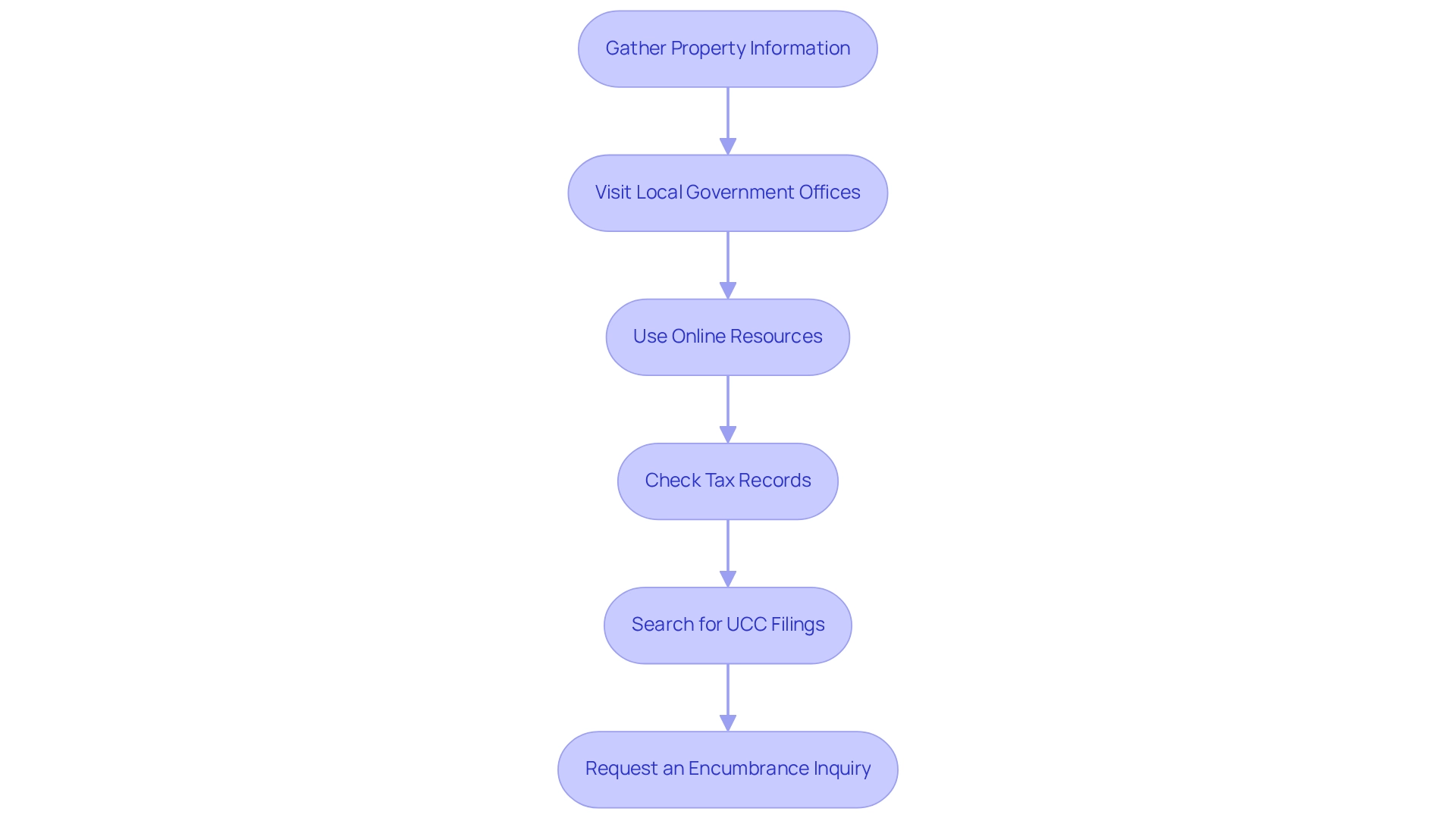

Conduct a Lien Search

To conduct a lien search, it is essential to understand how to find out if property has a lien by following these structured steps:

- Gather Property Information: Begin by collecting the property address, the owner's name, and any other pertinent details.

- Visit Local Government Offices: Start at the county clerk's office or the local land records office. Many counties maintain online databases where claims can be searched.

- Use Online Resources: Websites such as Maryland Land Records or your state’s department of revenue can provide access to claim records.

- Check Tax Records: Investigate any outstanding property taxes that may indicate a tax claim. This is often achievable through the local tax assessor's office.

- Search for UCC Filings: If applicable, review the Uniform Commercial Code (UCC) filings in your state, as these may reveal additional claims.

- Request an Encumbrance Inquiry: Alternatively, you may request a formal encumbrance inquiry through a title company or a legal expert to understand how to find out if property has a lien, which can yield a more comprehensive report.

By adhering to these steps, you can effectively ascertain any claims on the asset in question.

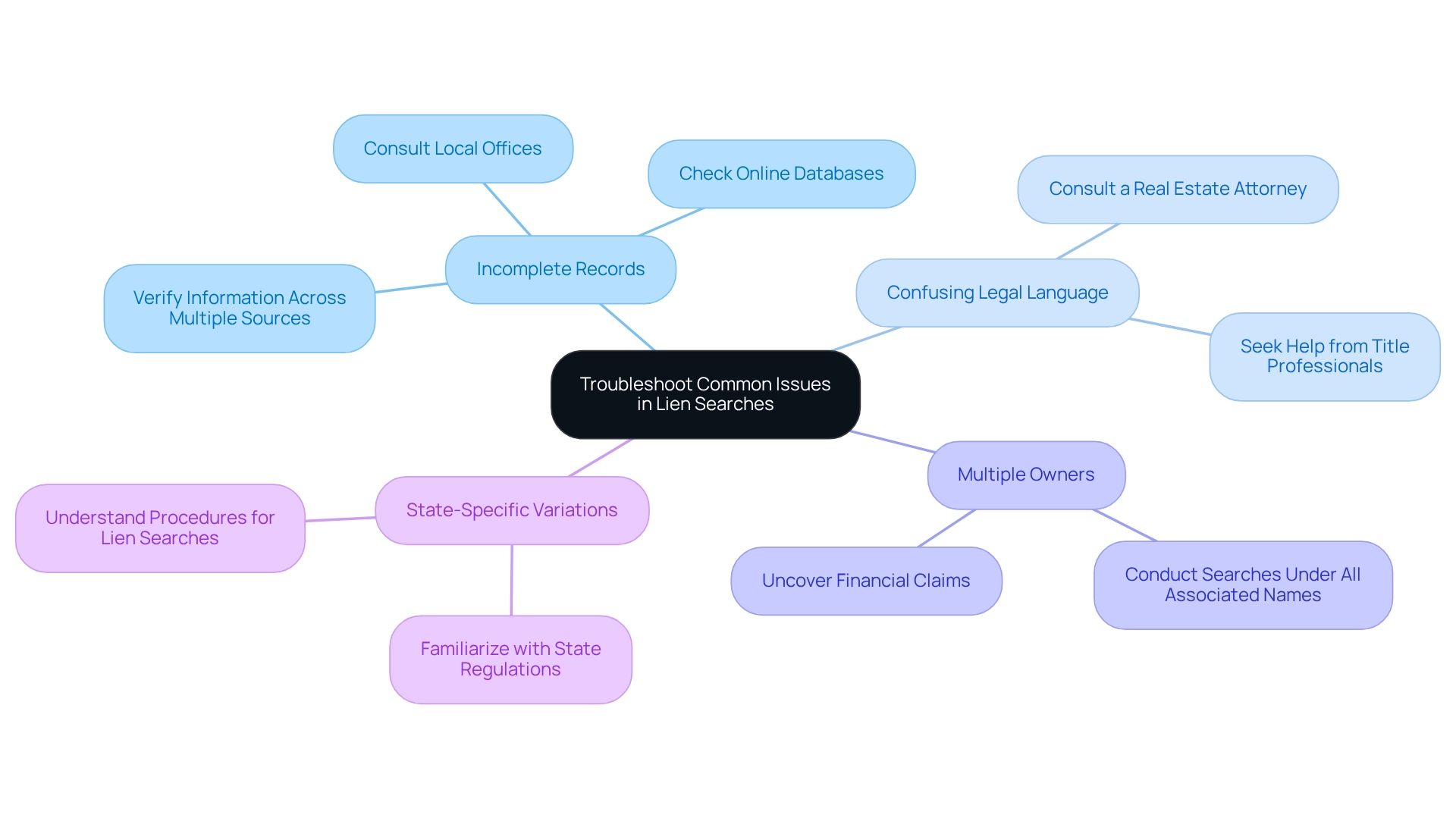

Troubleshoot Common Issues

When conducting a lien search, it is crucial to be aware of several common issues that may arise:

- Incomplete Records: Records may occasionally be missing or outdated. If you suspect this, it is essential to verify information across multiple sources, including online databases and physical records at local offices.

- Confusing Legal Language: The complexity of legal documents can be daunting. Should you encounter unclear terms or clauses, it is advisable to consult a real estate attorney or a title professional for clarification.

- Multiple Owners: In cases where the property has multiple owners, ensure you conduct searches under all names associated with the property. This practice can uncover financial claims that may not be immediately evident.

- State-Specific Variations: Regulations concerning claims differ from state to state. It is imperative to familiarize yourself with your state’s specific regulations and procedures to avoid overlooking critical information, particularly about how to find out if property has a lien, as recognizing these issues and knowing how to address them can significantly enhance the effectiveness of your lien search.

Conclusion

Understanding the intricacies of property liens is essential for anyone looking to invest in real estate. The various types of liens—mortgage, tax, judgment, and mechanic's liens—each present unique challenges and implications for property ownership. Recognizing these distinctions enables potential buyers to identify risks that could impact their investments.

Conducting a thorough lien search is a critical step in the due diligence process. By gathering relevant property information and utilizing local government resources, individuals can uncover any existing claims against a property. Although the search process may present challenges, such as incomplete records or confusing legal terminology, being prepared to troubleshoot these common issues can lead to a more successful outcome.

Ultimately, a well-informed approach to property transactions empowers buyers to navigate the complexities of liens with confidence. By taking the necessary steps to understand and investigate liens, buyers can protect their investments and ensure a smoother transaction process. Emphasizing the importance of due diligence in understanding liens not only safeguards individual interests but also fosters a more transparent and equitable real estate market.

Frequently Asked Questions

What is a real estate encumbrance?

A real estate encumbrance represents a legal claim against an asset, typically used as collateral to secure a debt.

Why is it important for property owners or investors to understand liens?

Understanding the various types of liens is crucial for property owners or investors, particularly in how to find out if a property has a lien, as it can affect their ability to sell or refinance the asset.

What are Mortgage Liens?

Mortgage Liens are voluntary liens established by lenders when financing a property.

What are Tax Liens?

Tax Liens are imposed by government entities when real estate taxes remain unpaid.

What are Judgment Liens?

Judgment Liens emerge from court rulings against the asset's owner.

What are Mechanic's Liens?

Mechanic's Liens are filed by contractors or suppliers who have not received payment for work completed on the property.

How do different types of liens affect property ownership?

Each category of claim carries distinct consequences for property ownership, potentially affecting the ability to sell or refinance the asset. Familiarizing oneself with these types can help in recognizing potential issues during property inquiries.