Overview

To determine whether a property has liens, it is essential to access public records through local county offices or to utilize online databases that facilitate searches by property address or owner's name. This process underscores the significance of conducting thorough inquiries by leveraging local resources and tools. Additionally, one may find it necessary to seek professional assistance to navigate the complexities associated with property claims.

Introduction

Understanding the complexities of property ownership necessitates navigating the intricate world of liens—legal claims that can profoundly impact real estate transactions. With a staggering number of properties encumbered by various types of liens, from mortgages to tax claims, it is essential for both buyers and sellers to conduct thorough investigations prior to proceeding. This guide explores the critical steps for uncovering any liens on a property, providing valuable insights into local resources and effective search techniques. How can one ensure that a property is free from hidden claims that could complicate ownership and future transactions?

Understand Property Liens and Their Implications

A real estate encumbrance signifies a legal claim against an asset, frequently stemming from unpaid debts or obligations. Understanding the various categories of encumbrances—mortgage encumbrances, tax encumbrances, and judgment encumbrances—is crucial for landowners and real estate professionals. Each type carries unique implications for asset ownership and can greatly influence your ability to sell or refinance.

For example:

- Mortgage claims must be resolved before an asset can be sold.

- Tax claims can lead to foreclosure if not addressed.

Approximately 14.3 million individuals in the U.S. have a claim or judgment on record, underscoring the prevalence of these assertions. Furthermore, around 66% of American real estate is encumbered in some manner, complicating transactions as potential buyers may be deterred by possible encumbrances.

Familiarizing yourself with these concepts will equip you for the subsequent stages in the claim exploration process, ensuring informed decision-making in property dealings.

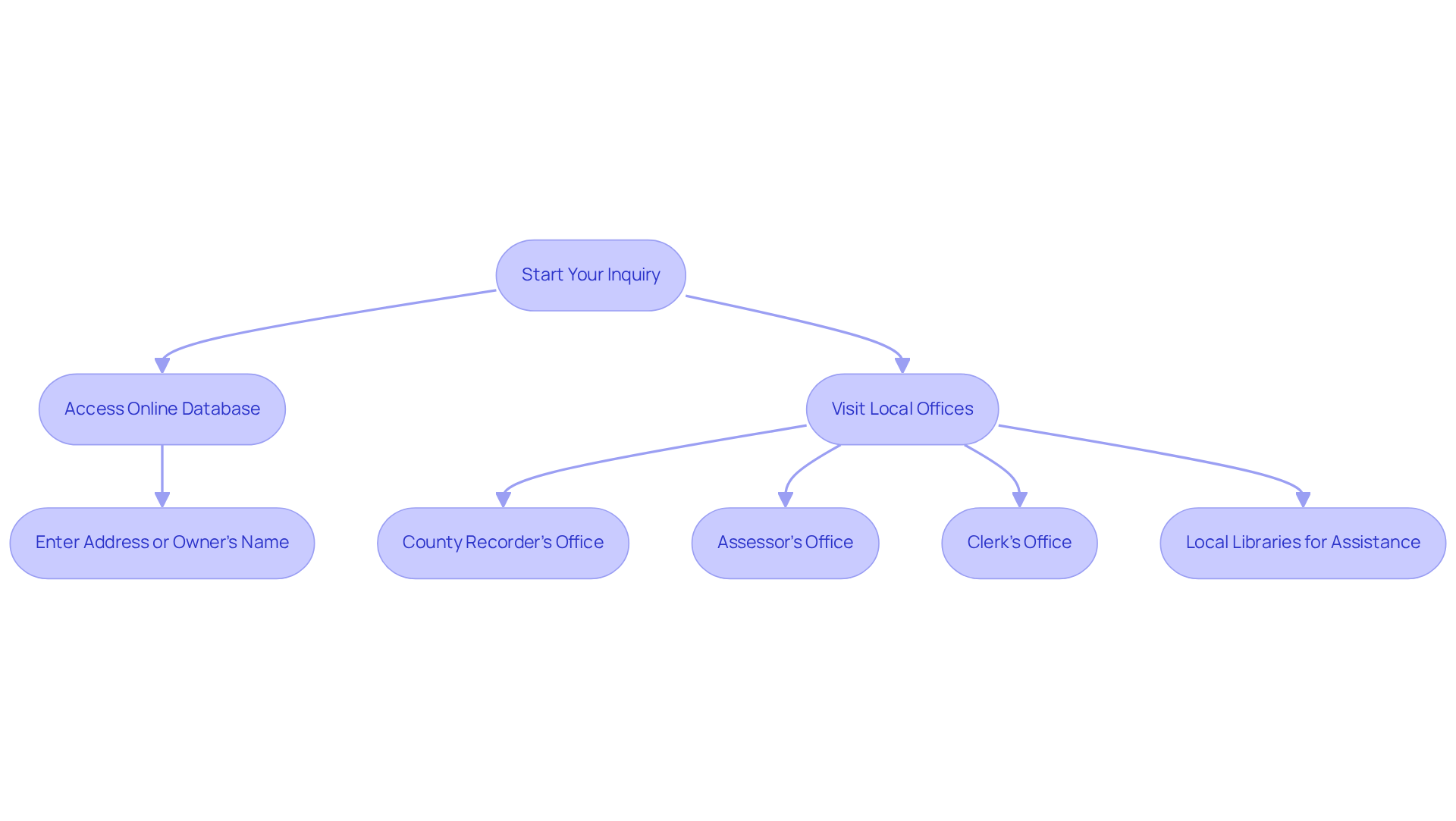

Start Your Search: Access Public Records and Local Resources

To understand how to find out if a property has liens, you should access public records through your local county recorder's office, assessor's office, or clerk's office. California operates as an 'open records' state, allowing public access to transfer documents, ownership, and value information. Many counties now provide online databases that show how to find out if a property has liens by entering the address or the owner's name. If online access is not available, visiting these offices in person remains a viable option. Additionally, local libraries can serve as valuable resources, often providing access to public records and staff assistance to navigate the information. As you conduct your inquiry, gather all pertinent details about the asset, including its assessed value and tax records, to streamline the process.

Effective inquiries into how to find out if a property has liens often rely on these regional resources. For example, individuals have successfully utilized county clerk offices to uncover tax claims that may impact real estate transactions. By leveraging these local tools and resources, you can discover how to find out if a property has liens and ensure a thorough investigation into any potential claims. It is crucial to understand the implications of these claims, as they can complicate future transactions and ownership clarity.

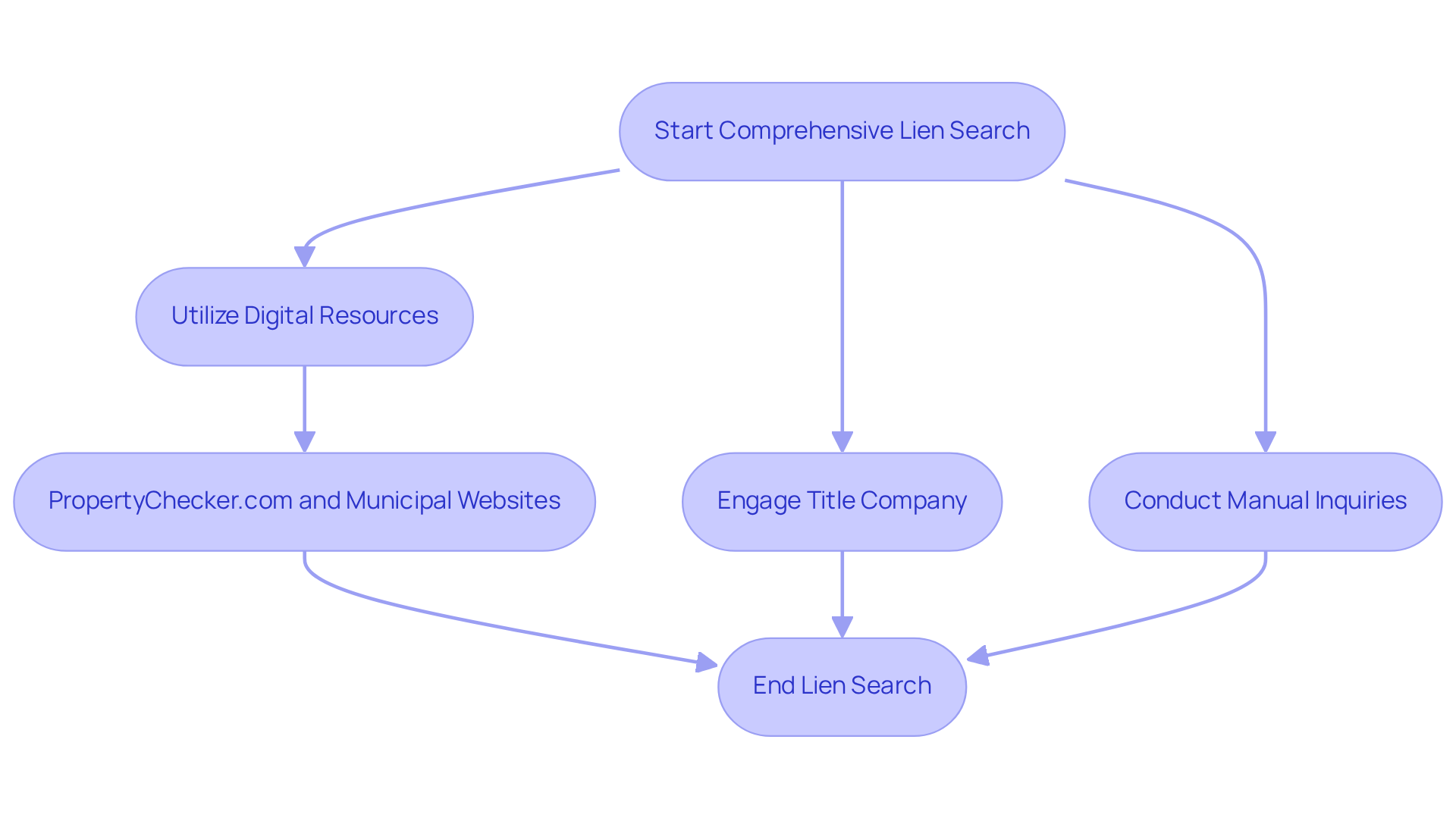

Conduct a Comprehensive Lien Search: Tools and Techniques

To conduct a comprehensive title investigation, it is essential to utilize both digital and traditional resources effectively. Websites such as PropertyChecker.com and municipal government pages offer quick access to encumbrance details, facilitating efficient inquiries. For instance, PropertyChecker.com features an intuitive interface that enables users to search for claims by entering property information, ensuring a thorough review of potential encumbrances. Moreover, engaging a title company can streamline the inquiry process, as these organizations possess extensive databases and specialized expertise in identifying encumbrances. Notably, approximately 75% of title firms outsource municipal inquiries, underscoring the value of professional assistance in this domain, especially considering that only 8.6% of participants believe there is no benefit to outsourcing title research.

When undertaking an inquiry, it is crucial to know how to find out if a property has liens, judgments, or encumbrances that could impact the asset. Neglecting these inquiries may lead to legal complications and a decrease in property value, making meticulous documentation of your findings imperative. Title experts emphasize that thorough title investigations are vital for mitigating such risks and protecting asset values. By leveraging these tools and strategies, you can ensure a comprehensive understanding of any potential claims associated with a real estate asset.

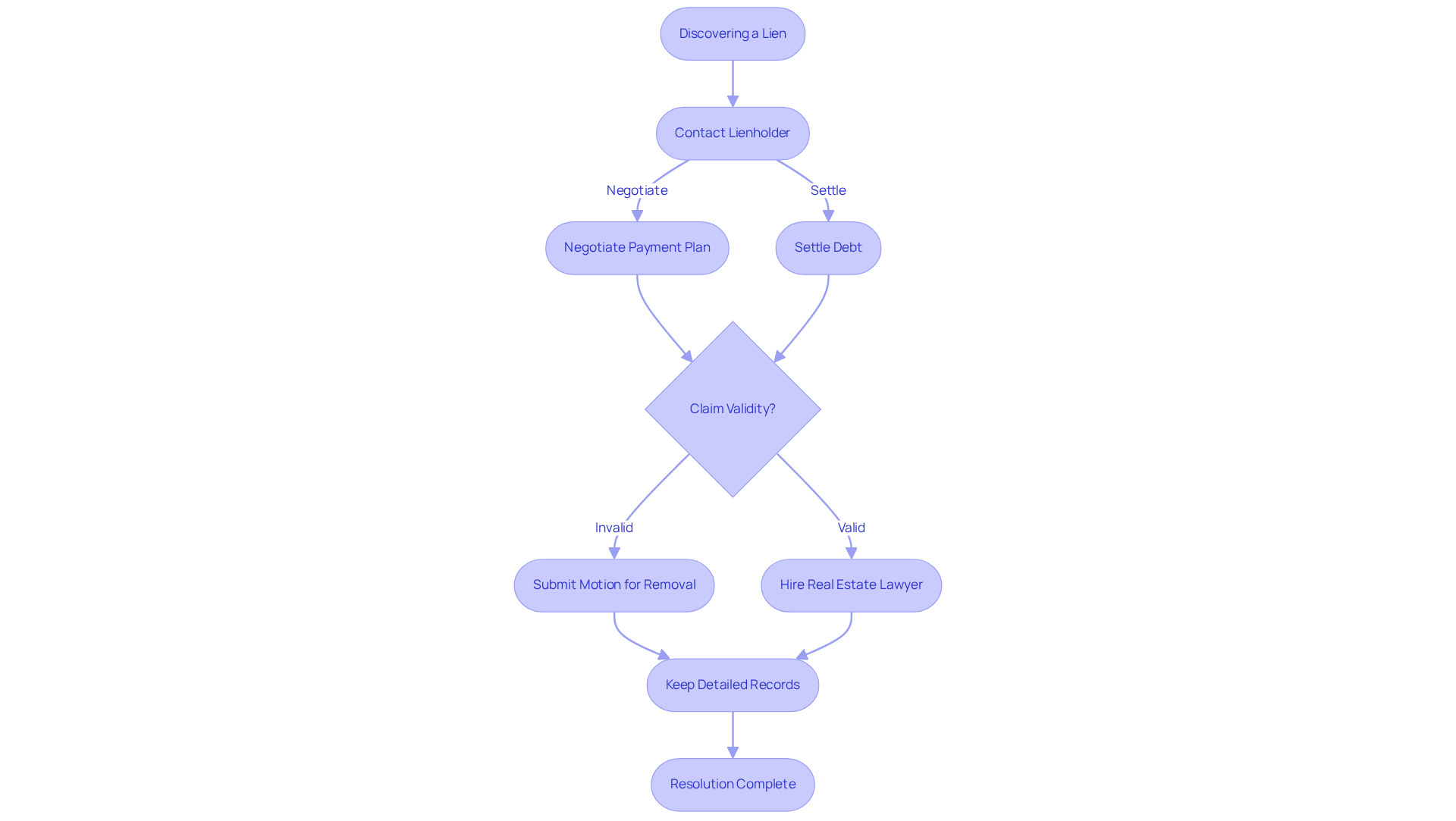

Address Findings: Options for Resolving Discovered Liens

Upon discovering claims against a property, swift action is essential. Begin by reaching out to the lienholder to discuss the situation and explore potential resolution options. This may involve negotiating a payment plan or settling the debt outright. Comprehending the order of claims is crucial, as it assists in deciding which obligations need to be prioritized and which may be flexible. If the claim is considered invalid, it may be necessary to submit a motion in court for its removal.

Furthermore, hiring a real estate lawyer can be especially advantageous, as they can maneuver through the intricacies of property claims and offer professional advice during the procedure. As noted by Michael Thompson, Founding Partner at Thompson Law Group, "Title work is the detective work of real estate law. It's about uncovering the full history of a property and ensuring that there are no hidden surprises lurking in the title."

It is crucial to keep detailed records of all interactions and agreements associated with the resolution, as this documentation can be important in any court proceedings. Effective resolution strategies often involve:

- Clear communication with creditors

- Understanding the regulatory framework surrounding the claim

- Utilizing professional assistance when necessary

Typically, the resolution of property claims can require between 30 to 90 days, depending on the complexity of the situation and the responsiveness of the claimant. Consequently, failure to address liens promptly can lead to significant obstacles in real estate transactions, including clouded titles and potential legal disputes.

Conclusion

Understanding property liens is essential for anyone involved in real estate transactions. These legal claims against properties can significantly impact ownership rights, sales, and refinancing options. By recognizing the various types of liens—such as mortgage, tax, and judgment liens—property owners and potential buyers are equipped with the knowledge necessary to navigate these complexities effectively.

This article outlines a clear process for discovering whether a property has liens, emphasizing the importance of accessing public records through local offices and online databases. It highlights practical tools and resources, such as title companies and municipal websites, which can aid in conducting thorough lien searches. Furthermore, it stresses the necessity of documenting findings and addressing any discovered liens promptly to avoid potential legal complications and preserve the property’s value.

Ultimately, being proactive in lien investigation and resolution is crucial for safeguarding investments in real estate. Engaging with lienholders, understanding the hierarchy of claims, and seeking professional legal assistance can lead to effective outcomes. By taking these steps, individuals can ensure a clearer path in their real estate endeavors, reinforcing the significance of diligence in property transactions.

Frequently Asked Questions

What is a property lien?

A property lien is a legal claim against an asset, often arising from unpaid debts or obligations.

What are the main types of property encumbrances?

The main types of property encumbrances are mortgage encumbrances, tax encumbrances, and judgment encumbrances.

Why is it important to understand property encumbrances?

Understanding property encumbrances is crucial for landowners and real estate professionals as they can significantly affect asset ownership and influence the ability to sell or refinance properties.

What happens if mortgage claims are not resolved?

Mortgage claims must be resolved before an asset can be sold.

What are the consequences of unresolved tax claims?

Unresolved tax claims can lead to foreclosure.

How prevalent are claims or judgments in the U.S.?

Approximately 14.3 million individuals in the U.S. have a claim or judgment on record.

What percentage of American real estate is encumbered?

Around 66% of American real estate is encumbered in some manner.

How can encumbrances affect property transactions?

Encumbrances can complicate transactions as potential buyers may be deterred by possible claims against the property.