Overview

To find liens on a property, individuals should follow a step-by-step process that includes gathering property information, searching local county records, examining court documents, and possibly consulting title companies for thorough investigations. The article emphasizes that understanding these steps is crucial for potential buyers and property owners to navigate the complexities of real estate transactions and avoid inheriting financial burdens associated with existing liens.

Introduction

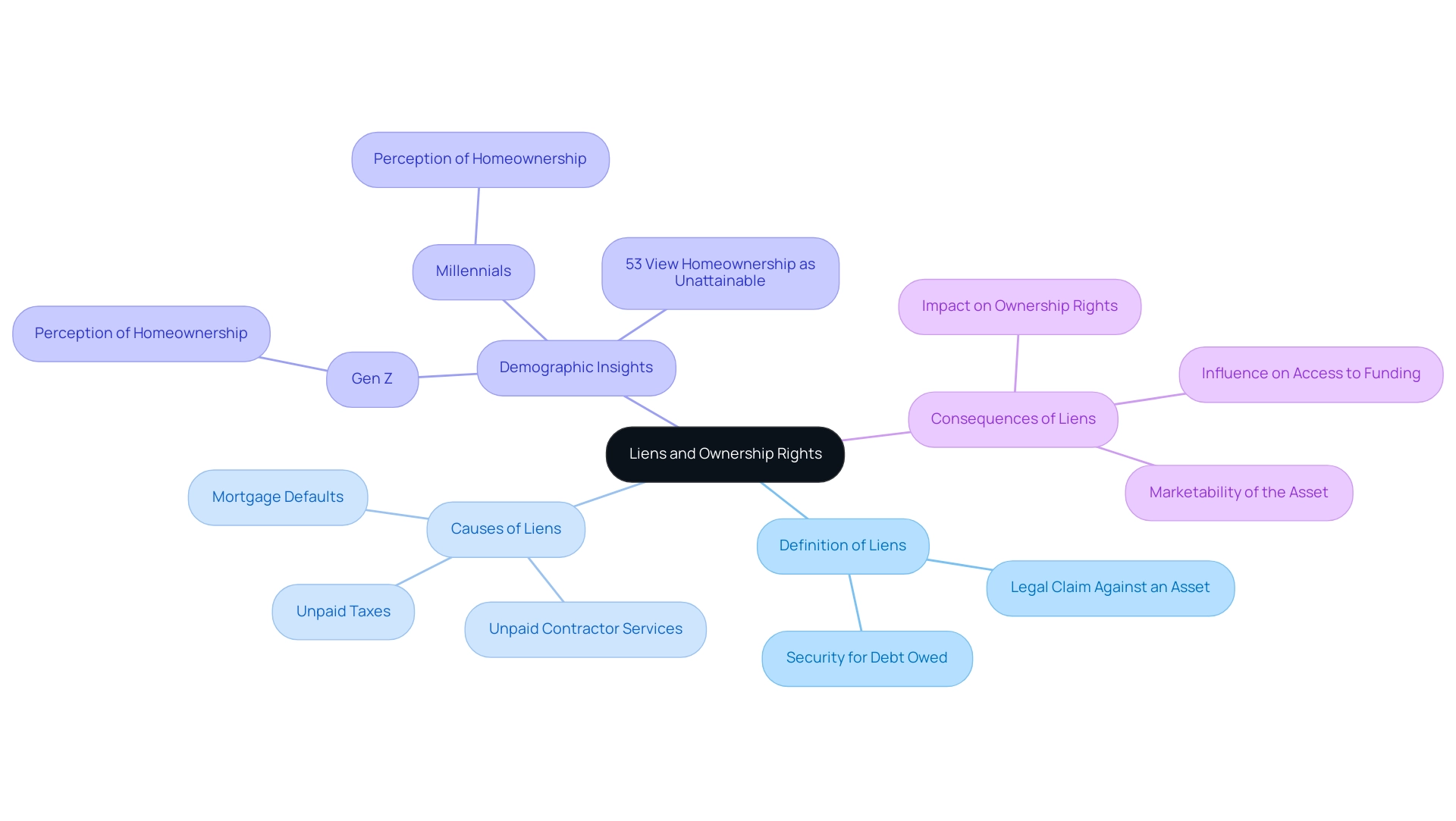

Navigating the complexities of property ownership requires a thorough understanding of liens, which serve as legal claims against a property to secure debts owed. As the real estate landscape evolves, the implications of these claims have become increasingly significant for both current owners and potential buyers. With the rising home prices and the challenges faced by younger generations in achieving homeownership, awareness of how liens function is paramount.

From mortgage defaults to unpaid taxes, various types of liens can drastically affect ownership rights and the marketability of properties. This article delves into the intricacies of liens, exploring their classifications, the processes for conducting searches, and the essential steps for resolution, ultimately equipping readers with the knowledge needed to navigate the property market effectively.

Understanding Liens: What They Are and How They Work

A legal claim is established against an asset, serving as a form of security for a debt owed. This legal mechanism grants the lender rights to the asset in the event that the borrower defaults on their obligations. For real estate owners and potential purchasers, understanding how to find liens on a property is crucial, as these encumbrances can greatly impact ownership rights.

Liens may arise from various scenarios, including:

- Unpaid taxes

- Mortgage defaults

- Unpaid contractor services

Dr. Selma Hepp, Chief Economist for CoreLogic, highlights the importance of understanding these dynamics by stating,

With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.

Considering that 53% of Americans view homeownership as unachievable—especially for Gen Z and Millennials who presently do not own real estate—knowledge of claims becomes essential in maneuvering through the housing market.

This demographic insight reflects the broader challenges faced by potential buyers. Moreover, the case study named 'Seriously Underwater Mortgage Rates by Region' shows that areas like Louisiana are facing significant proportions of seriously underwater mortgages, which can worsen the effects of claims on ownership rights. Familiarity with these concepts enables individuals to identify potential issues, such as how to find liens on a property, that may arise during real estate transactions.

The consequences of encumbrances on ownership are significant, as they not only influence access to funding but also dictate the marketability of the asset itself.

Types of Liens: Exploring the Different Categories

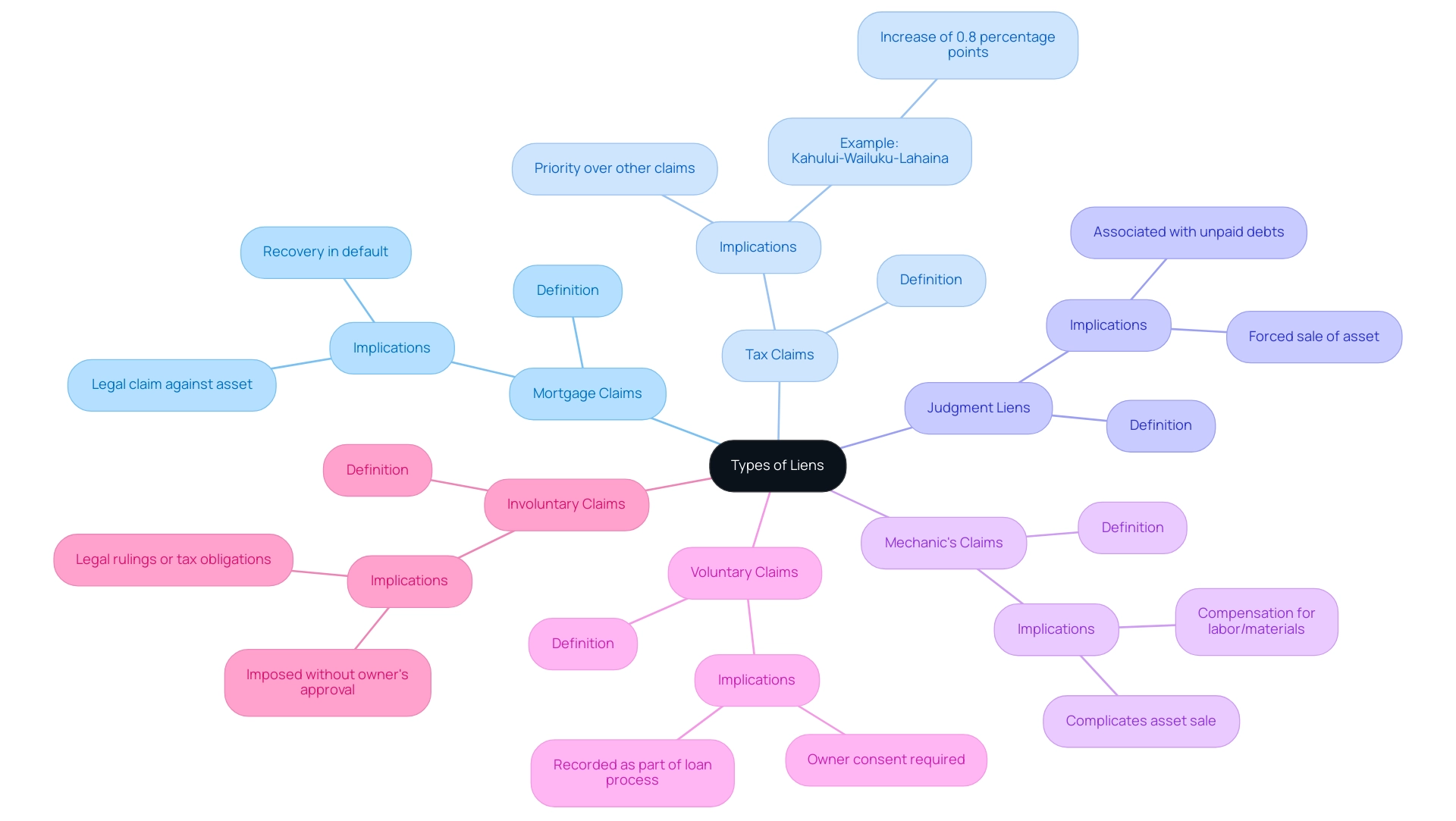

In real estate, encumbrances can be categorized into various distinct types, each with unique implications for asset ownership and financial responsibilities:

- Mortgage Claims: These claims are backed by the asset itself and are the most frequently encountered type. They signify a legal claim against the asset, allowing lenders to recover owed amounts in the event of default.

- Tax Claims: Imposed by governmental authorities for unpaid real estate taxes, tax claims can severely affect transactions and ownership rights. They take priority over other claims, meaning that tax obligations must be settled before any other demands. For example, in areas such as Kahului-Wailuku-Lahaina, Hawaii, where serious delinquency rates have risen by 0.8 percentage points, tax encumbrances can greatly affect landowners.

- Judgment Liens: These arise from court rulings against landowners, typically associated with unpaid debts or legal conflicts. A judgment claim can result in a forced sale of the asset to fulfill the court's decision.

- Mechanic's Claims: Submitted by contractors or suppliers for unpaid labor or materials, mechanic's claims guarantee that those who contribute to enhancements are compensated. These claims can complicate the sale of an asset if not resolved.

- Voluntary Claims: Established when an owner willingly consents to a claim, such as in the instance of a mortgage, these claims are generally recorded as part of the loan process.

- Involuntary Claims: Imposed on a property without the owner's approval, often due to legal rulings or tax obligations, involuntary claims can present considerable dangers to property rights and financial security.

Comprehending these categories is vital for evaluating potential risks and liabilities, particularly when considering how to find liens on a property. As of 2024, the landscape of mortgages and tax claims continues to evolve, with statistics indicating that mortgage claims represent a significant portion of all claims filed, reflecting ongoing market trends and economic factors. Significantly, Oklahoma has documented the largest yearly drop in delinquency rates at -0.3%, which emphasizes the differing effects of claims across various areas.

Awareness of these dynamics enables professionals to navigate the complexities of asset ownership more effectively. For questions, analysis, or interpretation of the data, contact Robin Wachner at [email protected].

Step-by-Step Process for Conducting a Lien Search

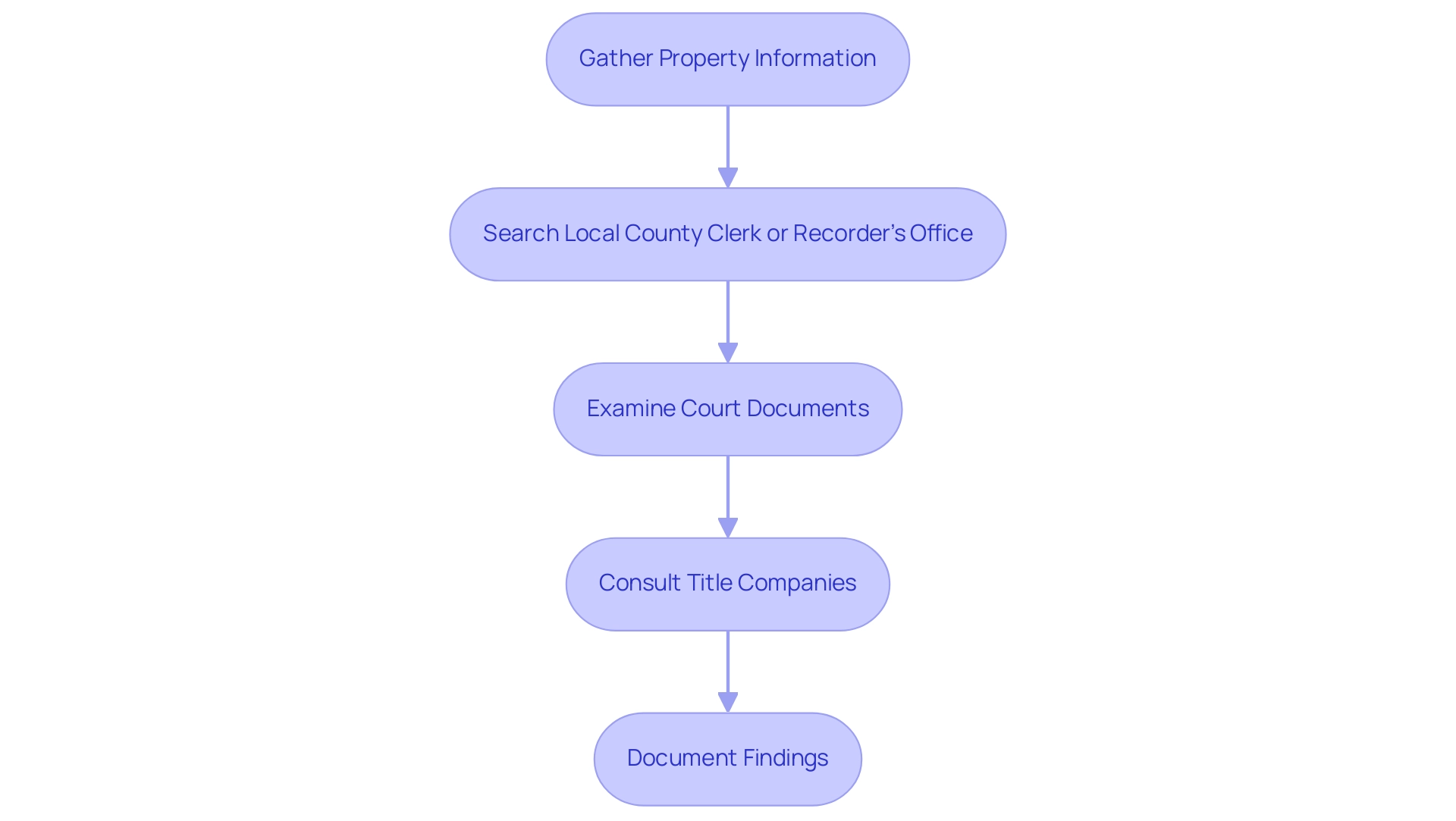

To efficiently perform a claim investigation, follow these detailed steps:

- Gather Property Information: Start by collecting essential details such as the property’s address, legal description, and the owner’s name. This foundational information is critical for narrowing down your search.

- To learn how to find liens on a property, visit the local county clerk or recorder’s office, either in person or through their website, to search for any recorded liens. This is frequently the most straightforward method to access public documents that may impact the property. Utilize online real estate databases to understand how to find liens on a property by aggregating public information. These platforms can significantly streamline the search process, saving both time and effort while offering access to a broader range of information.

- Examine Court Documents: Investigate local judicial files to understand how to find liens on a property that may have been lodged against the owner. These records can reveal legal claims that could impact ownership and financial responsibilities.

- For more intricate real estate, consider consulting with title companies to understand how to find liens on a property through a comprehensive investigation. Their knowledge can reveal claims that may not be readily discovered through typical inquiries, ensuring a more thorough comprehension of the property’s condition.

- Document Findings: Maintain meticulous records of any claims discovered, including their types and current statuses. This documentation is essential for evaluating possible risks and liabilities linked to the property.

Conducting a property investigation is an investment in certainty and security that significantly surpasses the potential costs of oversight. Title examination costs generally vary from a few hundred to several hundred dollars, depending on location and complexity. Neglecting this vital step can result in significant repercussions for new homeowners, such as inheriting unpaid debts, as emphasized in the case study on the dangers of disregarding title examinations.

Additionally, when looking for UCCs that may involve intellectual assets as collateral, it is crucial to acknowledge the intricacies involved, as these searches necessitate more than a standard UCC and statutory claim search. Such negligence can result in decreased property value, legal complications, and even potential foreclosure.

Accessing Public Records: Where to Find Lien Information

Accessing public documents is essential for acquiring precise claim information, and employing advanced digital tools can greatly improve this process. Here are the primary resources that should be utilized:

-

County Clerk or Recorder’s Office: As the primary authority on documented liens, these offices generally provide online databases that guide users on how to find liens on a property, ensuring that they can swiftly access essential information.

Our platform surpasses conventional historical indexes, enabling users with a digital interface that features a bar at the top and a table displaying various entries with columns for viewer, name, grantor, grantee, book volume, book page, instrument type, instrument date, file date, and legal description. This interface allows for full-text search capabilities and machine learning extraction of vital document information. Under certain conditions, you may be entitled to have your request processed on an expedited basis, enhancing the efficiency of accessing public records.

-

Local Courts: Court documents are essential for learning how to find liens on a property, as they can reveal judgment claims and various other legal assertions against assets, offering important context for title research. If you encounter issues with information requests, you have the right to file an administrative appeal, and mediation services are available through the Office of Government Information Services.

State Tax Assessor’s Office: This office is essential for revealing tax claims and provides crucial information on how to find liens on a property, which may influence property ownership and transaction processes.

-

Online Property Search Tools: While platforms like Zillow and Realtor.com can provide some lien-related information, they are not exhaustive resources and should be supplemented with more authoritative sources. The advanced features of our digital interface, which include a user-friendly layout and detailed listing information, make it a superior option for thorough searches.

Title Companies have access to comprehensive databases and can perform thorough property searches for a fee, which is essential for understanding how to find liens on a property, delivering a level of detail often unmatched by other resources.

Additionally, users can sign up to receive email updates from San Bernardino County, encouraging proactive engagement with public record resources. Utilizing these key resources, along with advanced courthouse document processing tools, will significantly enhance your ability to locate and verify claim information effectively.

Understanding the Implications of Liens on Property Ownership

Recognizing a claim on an asset carries significant consequences that can influence various facets of real estate dealings:

- Impact on Sale Transactions: Liens must be cleared before a property is sold, which can significantly delay closing processes. This is particularly critical in competitive markets where timing is essential for sales.

- Financial Responsibility: Property owners are often accountable for resolving any debts associated with the claim. This can involve substantial amounts, especially in the case of tax claims, which in Tennessee incur a 10% interest rate and come with a one-year redemption period. Such financial burdens can complicate financial planning and property management, making it crucial for owners to understand their mortgage history and its implications on property valuations as highlighted in the Mortgage History Analysis case study.

- Potential Foreclosure: Overlooking claims, particularly tax-related ones, can lead to foreclosure. Recent trends indicate increasing foreclosure rates associated with tax obligations, underscoring the importance of addressing these issues promptly to avoid losing one’s home. As Patricia Hill, a homeowner with a tax burden, expressed, her ongoing fear of unpredictable tax hikes highlights the precarious nature of such financial obligations.

- Negotiation Leverage: The presence of a claim can provide buyers with leverage during negotiations. They may insist on a lower purchase price or require the seller to address the claim before finalizing the sale. Real estate specialists recommend that purchasers should carefully examine how to find liens on a property, as unresolved claims can greatly reduce the marketability of an asset when assessing asset values.

- Key Processes in EDMP: Understanding the key processes in the EDMP, such as Property Address Standardization and Data Governance, is essential for effectively identifying and managing claims. These processes can help streamline the resolution of claims and ensure that property transactions proceed smoothly.

Understanding how to find liens on a property is vital for making informed decisions regarding property ownership and ensuring that all financial responsibilities are managed effectively.

How to Resolve or Remove Liens: A Guide for Property Owners

To effectively resolve or remove claims, it is essential to follow a structured approach:

- Contact the Holder: Initiate communication with the entity that placed the claim. Discuss available payment options or potential settlements that could lead to removal of claims.

- Pay Off the Debt: If feasible, paying off the debt associated with the claim is often the most straightforward method to secure a release. It's important to note that Florida mechanics claims have priority over unrecorded encumbrances but are subordinate to properly recorded encumbrances prior to the claim, which can affect your strategy.

- Negotiate a Settlement: In numerous instances, claim holders are open to negotiation. They may agree to accept a reduced payment to settle the debt, making it advantageous for property owners to explore this route. As noted by Cattie & Gonzalez,

Address claims earlier

to avoid complications.

- Document for Release: After resolving the debt, ensure the holder submits a release document with the appropriate public office. This step is critical to formally document the resolution of the lien.

- Seek Legal Assistance: If the claim situation is disputed or particularly complex, it is prudent to consult with a real estate attorney. Their expertise can provide guidance on the best course of action.

- Monitor Future Claims: After the settlement of a claim, it is essential to frequently review real estate records to ensure that no new claims have been established. Considering that claims recorded over a year ago without a foreclosure action become void by operation of law, remaining attentive can avert future problems.

Furthermore, keep in mind that a copy of the Claim of Charge must be served on the owner either before filing or within 15 days of filing. This requirement guarantees that landowners are notified of the claim, fostering clarity in the construction process. By following these steps, property owners can navigate the resolution process effectively, enhancing their ability to manage their real estate holdings successfully.

Utilizing Technology for Efficient Lien Searches

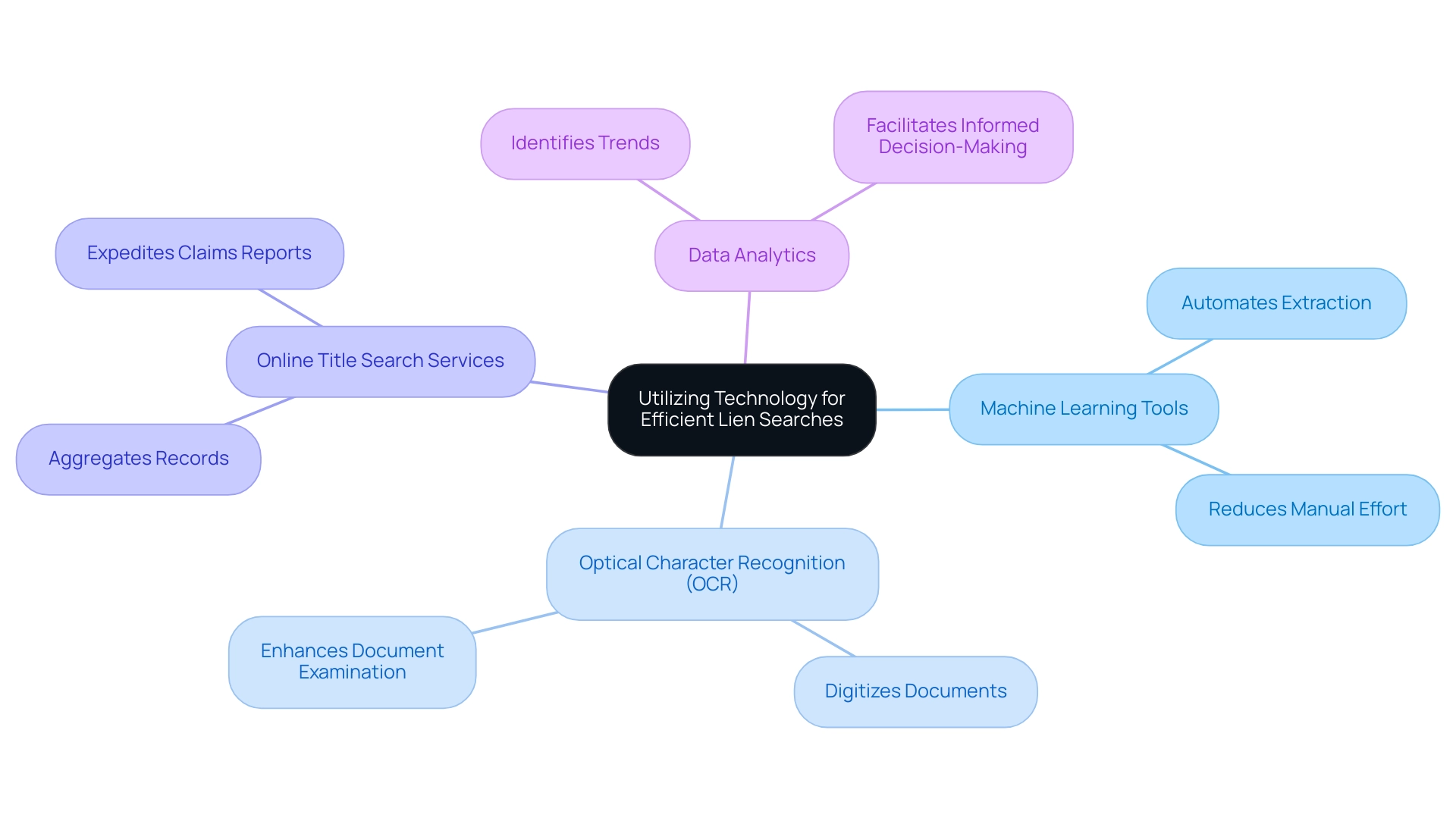

To significantly enhance the efficiency of lien searches, it is essential to embrace cutting-edge technology:

- Machine Learning Tools: Platforms such as Parse AI are transforming information extraction from extensive datasets. By automating this process, they drastically reduce the manual effort traditionally required, enabling quicker and more precise retrievals.

- Optical Character Recognition (OCR): The application of OCR technology facilitates the digitization and examination of paper documents, enhancing the search for claims. This transformation makes it considerably easier to locate and assess relevant documents.

- Online Title Search Services: Engaging with comprehensive online services that aggregate public records can provide title researchers with quick and thorough claims reports. This expedites access to necessary information, enhancing overall productivity.

- Data Analytics: Implementing advanced analytics tools can help identify trends and patterns within financial data. Such insights facilitate informed decision-making, further enhancing efficiency in the claim retrieval process.

The urgency of adopting these technologies is underscored by the World Economic Forum's projection that 50% of employees will need significant reskilling by 2025, as industries shift towards digital-first business models. Furthermore, 60% of companies intend to evolve into composable businesses by 2025, highlighting the necessity for advanced technology in asset investigations. A relevant case study titled "Digital Transformation and the Job Market" highlights how digital transformation is altering job roles, with 54% of hiring managers recognizing the necessity for collaboration with workforce development organizations.

By leveraging these state-of-the-art technologies, title researchers can vastly improve their efficiency and accuracy in conducting lien searches, which is essential for understanding how to find liens on a property, while staying ahead in an evolving digital landscape.

Conclusion

Understanding liens is crucial for anyone involved in property ownership or transactions. This article has outlined various aspects of liens, including their definitions, types, and the significant implications they hold for property owners and potential buyers. By recognizing the different categories of liens—such as mortgage, tax, judgment, mechanic's, voluntary, and involuntary—individuals can better assess the risks associated with property purchases and ownership.

The process of conducting a lien search has been detailed, emphasizing the importance of thoroughness in gathering information and utilizing available resources, from county clerk offices to online databases and title companies. This proactive approach helps uncover any existing liens that could affect property transactions. Furthermore, understanding how to resolve or remove liens through communication with lien holders, negotiating settlements, and ensuring proper documentation is vital for maintaining clear property titles.

The implications of liens extend beyond mere ownership; they can influence sale transactions, financial liabilities, and even foreclosure risks. As the real estate landscape continues to evolve, especially with rising home prices and shifting demographics, it becomes increasingly important for individuals to stay informed and vigilant regarding liens. By leveraging technology and embracing efficient search methods, property owners and researchers can navigate these complexities with greater confidence, ensuring a more secure and informed approach to property ownership. In an environment where awareness and understanding of liens can significantly impact financial decisions, equipping oneself with this knowledge is not just beneficial—it is essential.

Frequently Asked Questions

What is a lien in the context of real estate?

A lien is a legal claim established against an asset that serves as security for a debt owed. It grants the lender rights to the asset if the borrower defaults on their obligations.

Why is it important to understand liens for real estate owners and buyers?

Understanding liens is crucial because they can significantly impact ownership rights and the ability to sell or finance a property.

What are some common scenarios that can lead to liens on a property?

Liens may arise from unpaid taxes, mortgage defaults, and unpaid contractor services.

How do tax claims affect property ownership?

Tax claims imposed by governmental authorities for unpaid real estate taxes take priority over other claims, meaning they must be settled before any other demands can be addressed.

What are the different types of liens in real estate?

The main types of liens include: 1. Mortgage Claims: Legal claims backed by the asset itself. 2. Tax Claims: Claims for unpaid real estate taxes that prioritize over other claims. 3. Judgment Liens: Arise from court rulings against landowners for unpaid debts. 4. Mechanic's Claims: Submitted by contractors for unpaid labor or materials. 5. Voluntary Claims: Established when an owner consents to a claim, such as a mortgage. 6. Involuntary Claims: Imposed without the owner's approval, often due to legal rulings or tax obligations.

How can unpaid contractor services lead to complications in property transactions?

Mechanic's claims for unpaid services can complicate the sale of an asset if they are not resolved, potentially affecting the buyer's ability to obtain clear ownership.

What demographic challenges are associated with homeownership in the current market?

A significant portion of Americans, particularly Gen Z and Millennials, view homeownership as unachievable, highlighting the importance of understanding claims in navigating the housing market.

How do encumbrances influence the marketability of a property?

Encumbrances can dictate the marketability of an asset, impacting access to funding and the overall ability to sell or transfer ownership.

What recent trends have been observed regarding delinquency rates and claims in different regions?

Oklahoma has documented the largest yearly drop in delinquency rates at -0.3%, while areas like Kahului-Wailuku-Lahaina, Hawaii, have seen rising delinquency rates, indicating varying effects of claims across different locations.

Where can one find more information or analysis regarding liens and claims?

For further questions, analysis, or data interpretation, individuals can contact Robin Wachner at [email protected].