Overview

The article provides a comprehensive guide on determining the cost of a title search, which typically ranges from $200 to $600, depending on factors like property location and ownership history complexity. It emphasizes the importance of thorough research and obtaining multiple quotes to avoid unforeseen expenses, as well as the necessity of professional assistance to mitigate legal risks associated with property ownership disputes.

Introduction

In the realm of real estate, the significance of a title search cannot be overstated. This intricate process serves as a safeguard for prospective buyers, meticulously verifying the legal ownership of a property while uncovering any potential encumbrances that could jeopardize a transaction.

With the increasing complexity of property transfers and the rise of fraudulent activities, understanding the nuances of title searches becomes imperative. From revealing hidden liens and unpaid taxes to clarifying ownership disputes, a thorough title search is essential in navigating the often murky waters of real estate transactions.

As the stakes grow higher, equipping oneself with knowledge about the title search process not only protects financial interests but also ensures a smoother path to property ownership.

Understanding Title Searches: Definition and Importance

A document review is a comprehensive analysis of public records that confirms a real estate's legal ownership and discloses any claims or liens that may impact it. While individuals can perform their own title searches, they often question how much is , as this task is complex and time-consuming, making professional assistance advisable. This process is essential for prospective buyers, as it mitigates the risk of encountering legal disputes related to the asset.

Disputes can arise from transferring assets without proper verification, as documented in various case studies. For instance, ownership issues can stem from documentation errors or impersonation of legitimate owners, which may lead to voided transactions and the potential loss of property rights. An important example demonstrates this point: inadequate verification of ownership has led to significant legal issues, highlighting the need for carrying out a comprehensive examination of records.

As Elena Metzger from Print Bangor remarked,

We have relied on Rudman Winchell for years. They have competently and affordably helped us with everything from our business issues to helping ensure that our family is protected should anything happen.

This emphasizes the importance of expert support in managing the intricacies of ownership investigations.

Therefore, understanding how much is a title search is vital for buyers to avoid future legal issues and financial consequences associated with unresolved ownership disputes or financial encumbrances. Carrying out thorough research is not just a suggestion but an essential step in ensuring a successful real estate deal. Including pertinent statistics on the occurrence of ownership disputes and the advantages of professional inquiries could further bolster the case for their necessity.

Cost Breakdown: How Much Does a Title Search Really Cost?

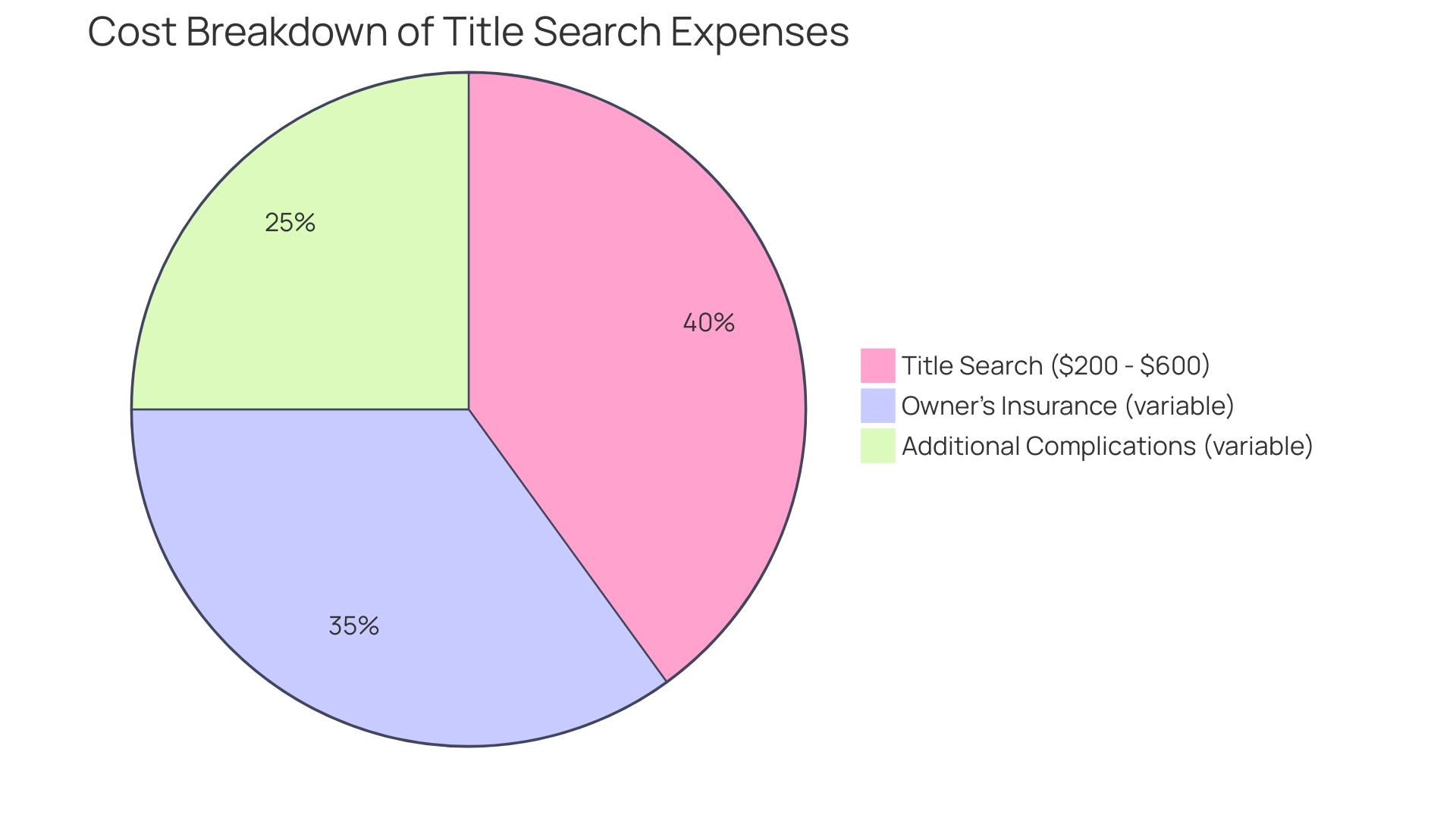

The costs related to a property examination, including how much is , can vary significantly, affected by aspects such as the property's geographical location, the complexities of its ownership history, and the selected service provider. Typically, the average expense for a document review raises the question of how much is a title search, which ranges from $200 to $600. However, it's essential to consider how much is a title search because additional costs might arise if complications emerge during the search, necessitating further investigation, or if extra services, like insurance for ownership, are involved.

Owner's insurance costs can vary from a few hundred to a few thousand dollars, which is a crucial element to consider in your overall budgeting for related expenses. Comprehending transfer costs aids buyers and sellers in budgeting efficiently and making informed choices. To ensure you receive competitive pricing, it is advisable to obtain quotes from several search firms.

This not only allows for a comparison of fees but also ensures clarity regarding which services are included in the quoted price. As a best practice, always discuss the scope of work and any potential extra charges beforehand to avoid unforeseen expenses, thereby facilitating a smoother transaction process. For instance, property insurance is often required by lenders and protects against claims that may arise after the sale.

Having the support of a major underwriter is an excellent backup plan should a claim arise because they will pay the claim and provide your insurance.

Uncovering Hidden Risks: What Issues Can a Title Search Reveal?

is essential in uncovering a variety of potential issues that can significantly affect property ownership. Common findings include unpaid taxes, contractor liens, easements, and claims from prior owners. These complications can disrupt the sale process and lead to costly legal disputes in the future.

For instance, if a lien is discovered during the investigation, the seller may be obligated to resolve the outstanding debt before proceeding with the sale. Furthermore, easements can impose restrictions on how a property is utilized, potentially impeding future development plans. The case study named 'Identifying Impersonators in Property Transactions' emphasizes the significance of performing a property examination to confirm seller identities and avert fraudulent sales.

As mentioned in the report 'The Double Trouble of the Housing Market,' the increase in home prices and the substantial decline in inventory since 2019 have made comprehensive property examinations even more vital in today's competitive market.

Moreover, understanding the differences between military and non-military buyers and sellers can provide valuable insights into the specific challenges they face during property transactions. According to statistics, problems uncovered through document examinations can result in disputes in roughly 10-15% of transactions, highlighting the need for a thorough review as an essential protective measure for purchasers.

As Aly J. Yale, a recognized real estate author, fittingly remarks,

If problems are identified during , they must be addressed before moving forward with the acquisition.

This highlights the significance of protecting against unexpected liabilities and ensuring a smoother transaction.

The Title Search Process: Steps and Key Players

The process of investigating ownership is a critical undertaking in real estate transactions, typically involving several methodical steps to ensure thoroughness and accuracy:

- Hiring an Ownership Investigation Company: Engage a reputable company that specializes in this field, as their expertise is vital for a successful inquiry.

- Collecting Information: Provide the examination company with crucial details about the real estate, including the address and legal descriptions, to enable a thorough review.

- Carrying Out the Investigation: Using sophisticated machine learning tools from Parse AI, the records examination company will meticulously review public documents, such as deeds, tax records, and court files, to compile a detailed report on the asset's history.

This method may involve reviewing property ownership regulations from 70-100 years ago because of the intricacy of ownership investigations. The use of and interactive labeling enables efficient extraction of critical information, ensuring a streamlined runsheet creation. These characteristics greatly improve precision and velocity in document reviews, enabling faster detection of possible problems.

- Reviewing Findings: Upon completion of the report, it is crucial to review the findings with your real estate agent or attorney to identify any potential issues that may require resolution. Essential participants in this complex procedure include document examination specialists, who perform the research, real estate brokers, who provide guidance on implications, and legal consultants, who ensure adherence to regulations. Furthermore, ownership insurance plays a significant role in protecting lenders against losses from unpaid taxes and judgments, ensuring a smoother transaction process.

As Melanie Martin aptly states,

Remember, maintaining clear and accurate property records and boundaries is key to avoiding future disputes.

This highlights the crucial aspect of diligence in the document review to protect against unexpected challenges. Additionally, a case study on safeguarding against real estate wire fraud underscores the financial dangers linked to document reviews, emphasizing the necessity for measures like verifying wiring instructions and utilizing secure communication.

By leveraging , professionals in the field can enhance their processes, ultimately minimizing the risk of fraud and ensuring secure transactions.

What Happens Next? Addressing Issues Found in a Title Search

When problems occur during a document search, prompt action is crucial. Depending on the specific concerns identified, buyers may need to:

- Negotiate repairs with the seller

- Obtain insurance to safeguard against future claims

- Resolve any liens before finalizing the sale

For instance, if a tax lien arises, the company will investigate whether the debt remains outstanding, emphasizing the need for thorough scrutiny.

Additionally, cybercriminals are constantly finding new ways to trick their targets, underscoring the importance of due diligence in property transactions. In certain situations, enlisting legal counsel may be necessary to navigate intricate disputes or clarify ownership rights effectively. It is imperative for buyers to refrain from proceeding with the transaction until all issues are adequately addressed; failing to do so could lead to substantial legal and financial ramifications.

A case study on fraud and forgery illustrates how such issues can result in significant financial losses, highlighting the protective role of title insurance against . Engaging with specialists in real estate law can provide essential guidance, ensuring that all potential risks are mitigated and that the transaction proceeds smoothly.

Conclusion

A thorough title search is essential in real estate transactions, serving as a vital safeguard for buyers. This process verifies legal ownership and uncovers hidden claims or liens that could jeopardize a purchase. Given the complexities involved, seeking professional assistance is crucial to avoid costly legal disputes arising from overlooked details.

Understanding the associated costs is equally important, as title searches typically range from $200 to $600. Additional expenses may arise from complications or necessary services like title insurance. Buyers should budget carefully and obtain multiple quotes to ensure transparency, reinforcing the necessity of a diligent title search.

The risks identified during a title search—including unpaid taxes, liens, and ownership disputes—can disrupt transactions and lead to future legal challenges. Addressing these issues promptly is imperative. Collaborating with real estate agents and legal advisors ensures that all concerns are resolved before proceeding, thereby protecting against potential liabilities.

In conclusion, the title search process is a foundational element of real estate transactions that requires careful attention and expertise. By prioritizing this critical step, buyers can safeguard their investments, mitigate risks, and facilitate a smoother path to successful property ownership.

Frequently Asked Questions

What is a document review in real estate?

A document review is a comprehensive analysis of public records that confirms a property's legal ownership and discloses any claims or liens that may impact it.

Why is it advisable to seek professional assistance for a title search?

Performing a title search can be complex and time-consuming, making professional assistance advisable to mitigate the risk of encountering legal disputes related to the asset.

What are the potential legal issues that can arise from inadequate verification of ownership?

Legal issues can stem from documentation errors or impersonation of legitimate owners, potentially leading to voided transactions and loss of property rights.

How much does a title search typically cost?

The average cost for a title search ranges from $200 to $600, but additional costs may arise if complications occur or if extra services, like ownership insurance, are needed.

What factors can affect the cost of a title search?

Factors affecting the cost include the property's geographical location, the complexities of its ownership history, and the selected service provider.

What should buyers consider regarding owner's insurance costs?

Owner's insurance costs can vary significantly, ranging from a few hundred to a few thousand dollars, and should be included in the overall budgeting for related expenses.

How can buyers ensure they receive competitive pricing for a title search?

Buyers should obtain quotes from several search firms to compare fees and clarify which services are included in the quoted price.

What is a best practice when discussing title search services with providers?

It is advisable to discuss the scope of work and any potential extra charges beforehand to avoid unforeseen expenses during the transaction process.