Overview

The article provides a comprehensive guide on conducting a lien search, outlining essential steps such as gathering asset details, utilizing online resources, and ensuring accuracy and compliance throughout the process. It emphasizes the importance of thoroughness and diligence in navigating challenges like incomplete records and legal complexities, which are crucial for making informed decisions in real estate transactions.

Introduction

In the intricate world of real estate, understanding liens is essential for anyone involved in property transactions. A lien, which serves as a legal claim against assets, can significantly influence ownership rights and the ability to sell or refinance a property.

With various types of liens—ranging from mortgage and tax liens to judgment liens—each carries unique implications that can complicate deals. As markets fluctuate, particularly in areas like Las Vegas, where negative equity is at an all-time low, the relevance of lien comprehension becomes even more pronounced.

This article delves into the nuances of lien searches, offering insights into effective strategies, common challenges, and the importance of accuracy and compliance in navigating this complex landscape.

Whether a seasoned investor or a first-time homebuyer, understanding the dynamics of liens is crucial for making informed decisions and safeguarding investments.

Understanding Liens: What You Need to Know

A legal claim represents a right against assets, often utilized as collateral to secure a debt. For professionals involved in real estate transactions, understanding the different categories of claims, including mortgage claims, tax claims, and judgment claims, is crucial. Each type of claim carries distinct implications for property ownership, potentially affecting a property's sellability or refinancing options.

For example, tax claims can complicate transactions, as they must be resolved before a sale can proceed. Furthermore, tax claim investing is characterized by low capital requirements and the potential for high fixed interest rates, making it an appealing option for investors. Recent statistics indicate that Las Vegas boasts the lowest negative equity share at just 0.6%.

This is particularly relevant as highlighted in the case study titled 'Negative Equity Trends in Major U.S. Metro Areas,' which emphasizes the importance of monitoring negative equity as home prices fluctuate. Grasping the dynamics of claims has become even more critical in such markets. Moreover, regulatory modifications impacting mortgages and tax claims are developing, making it crucial to remain informed.

Thus, getting acquainted with terminology related to claims and the associated legal consequences becomes vital in navigating the claim investigation process. As Marina Hubenova aptly puts it,

I highly recommend sending all orders to Rexera... They are number #1 with efficiency and detailed reports.

Such endorsements highlight the importance of reliable resources in managing lien-related tasks effectively.

Getting Started: Initial Steps for a Successful Lien Search

The initial phase in performing an encumbrance investigation entails carefully collecting all relevant asset details. Crucial details include the address, parcel number, and the names of both current and previous owners. This foundational data is crucial for efficiently searching through public records.

Subsequent to this, it is crucial to determine the suitable legal authority where the asset is situated, as different jurisdictions may possess unique processes and records for claims inquiries. As emphasized by Amanda Farrell, a mechanic’s claim is a security interest in the title to real or personal property for the benefit of those who have supplied labor or materials that enhance the property. This emphasizes the necessity of thoroughness in your inquiry.

Additionally, it is vital to be aware that corrective actions, such as drafting and recording a corrective deed, may be needed to resolve ownership issues, which can cause significant delays in the lien search. Real-world examples, such as those discussed in the case study titled 'Common Delays in the Title Search Process,' illustrate how errors in property ownership records can lead to time-consuming corrective actions, often delaying the closing process until a clear lien search is established. Furthermore, engaging with a title company or legal expert can provide invaluable guidance, particularly for those unfamiliar with the process.

Their insights can assist in navigating possible complexities, ensuring that your inquiry is both effective and adheres to local regulations. It's also important to mention that some title insurance premiums can be as low as $110, emphasizing the financial factors that may be involved during an inquiry.

Utilizing Online Resources for Lien Searches

A range of online resources, including lien search tools, are accessible to simplify property investigations, particularly county clerk websites, state databases, and specialized title research platforms. The National Association of Secretaries of State (NASS) serves as a valuable starting point, guiding users to state-specific resources. With 80% of trackable website visits originating from organic and paid inquiry, utilizing effective online resources in property assessments is crucial.

When performing inquiries, it is crucial to employ the retrieval functions efficiently, enabling the acquisition of claims based on the property details you have gathered during a lien search. Remember to perform a lien search to examine both current and historical records, as claims can be placed or released over time, affecting ownership status. Furthermore, leveraging advanced retrieval tools powered by machine learning can significantly enhance efficiency, enabling rapid extraction of pertinent information from extensive title documents.

Platforms such as Parse AI illustrate this innovation, providing advanced features that can transform the process of claims investigation in 2024. Furthermore, as mobile inquiries currently represent 58% of all queries, optimizing strategies for mobile platforms is becoming more crucial. Companies should also take into account the insights from the case analysis on voice query popularity, adjusting their strategies to rank for high-intent inquiries pertinent to lien search.

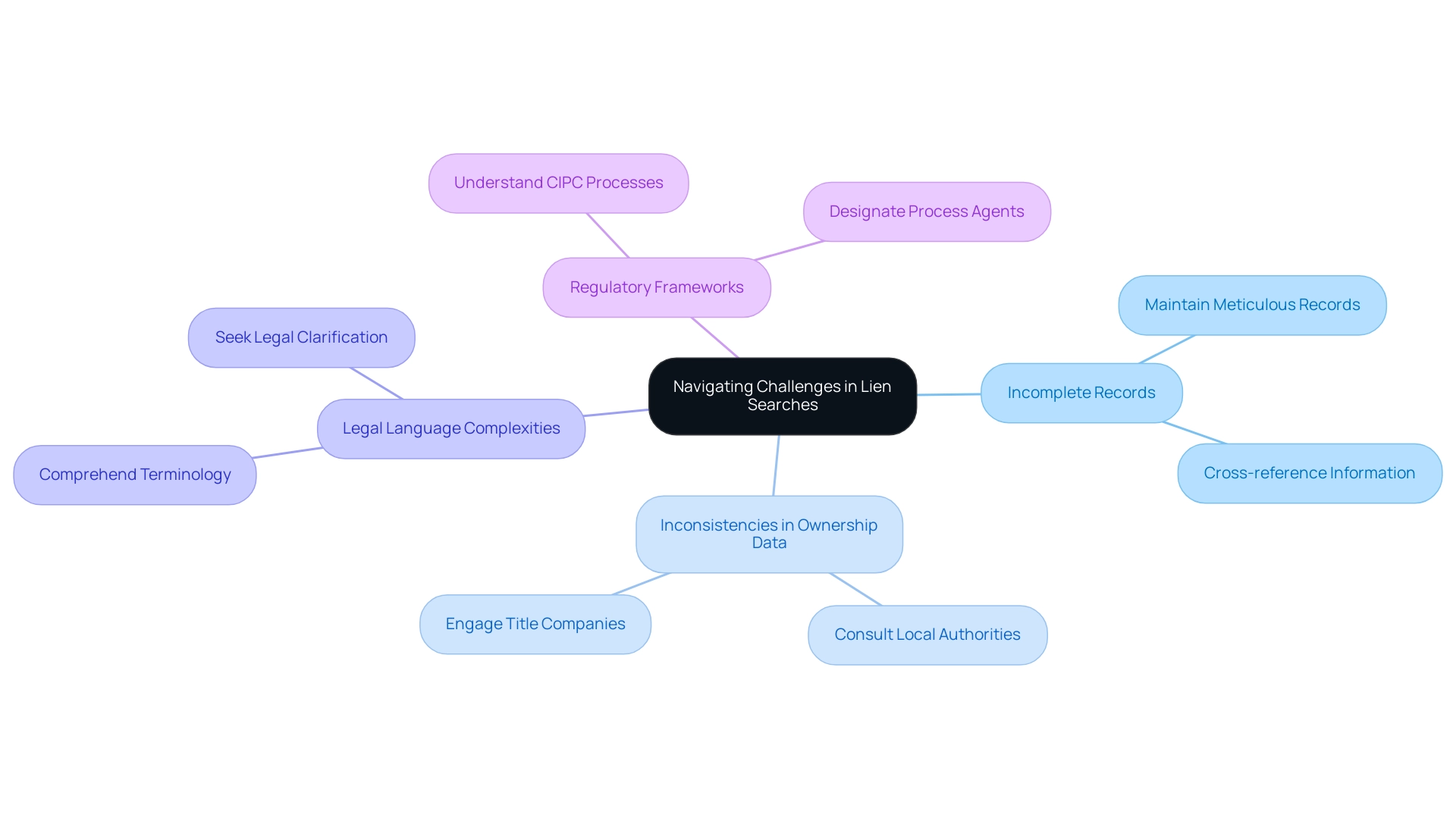

Navigating Challenges: Common Issues in Lien Searches

A lien search often presents a variety of challenges, including incomplete records, inconsistencies in property ownership data, and the complexities inherent in legal language. In South Africa, the Companies and Intellectual Property Commission (CIPC) plays a vital role in managing registrations and inquiries for commercial transactions, making it essential to understand their processes. These obstacles can significantly impact the accuracy of your lien search results.

To effectively navigate these issues, it is crucial to:

- Maintain meticulous records of your inquiries

- Conduct a lien search while cross-referencing information from multiple sources

Should you encounter discrepancies, do not hesitate to consult with local authorities or title companies, as they can provide valuable clarification about the lien search. Legal expert Maria Harutyunyan highlights, "Enhance your online visibility and stimulate growth with highly-rated SEO partners," which aligns with the necessity for dependable information in claims investigations.

Moreover, dedicating time to comprehend terminology is crucial; a strong understanding of the language can help avoid misinterpretations that could result in mistakes during your lien search. For instance, consider the case study of a secured lending transaction governed by New York law, where collateral assets are located in the UK. This scenario requires the designation of a process representative in the area where the assets are located, demonstrating how adherence to regulatory frameworks can complicate asset inquiries.

By actively tackling these frequent obstacles, you can improve the dependability of your claims investigation results and ensure adherence to applicable regulatory structures through a lien search.

Ensuring Accuracy and Compliance in Your Lien Search

Ensuring accuracy in property searches is essential to prevent legal complications and facilitate informed decision-making in real estate transactions. It is essential to cross-check your results with official documents, following the local laws and regulations that oversee ownership and encumbrance placements. A critical aspect of this process involves understanding the methodology for determining equity, which compares the estimated current value of an asset against the outstanding mortgage debt.

Furthermore, Maine saw the highest average national equity increase at $58,000, emphasizing the importance of precise property assessments in determining value. To establish a comprehensive audit trail, meticulously document each step of your inquiry process, noting sources and dates. In situations where complexities occur—such as multiple claims or conflicting information—consulting with legal experts becomes essential.

Robin Wachner emphasizes the importance of this practice by stating,

For questions, analysis or interpretation of the data, contact Robin Wachner at newsmedia@corelogic.com.

Furthermore, the case study titled 'Why Clients Choose Cogency Global' illustrates how a thorough and accurate lien search can combine the reach of a global firm with personalized care, ultimately enhancing client confidence. Adhering to compliance requirements not only safeguards your operations but also enhances the credibility and reliability of your findings in the eyes of clients and stakeholders alike.

Conclusion

Understanding liens is not merely an academic exercise; it is a foundational element for anyone engaged in real estate transactions. The complexity of various lien types—from mortgage and tax liens to judgment liens—demands a thorough comprehension to avoid pitfalls that could jeopardize property ownership and investment viability. As the real estate market continues to evolve, particularly in dynamic areas like Las Vegas, the importance of conducting meticulous lien searches cannot be overstated.

The process of a lien search requires diligence, from gathering essential property information to utilizing online resources effectively. Challenges such as incomplete records and legal complexities can hinder progress, but by leveraging the right strategies and tools, these obstacles can be navigated successfully. Engaging with professionals and employing advanced technology can streamline the search process, ensuring accuracy and compliance with legal requirements.

Ultimately, taking the time to understand and implement effective lien search practices is crucial for safeguarding investments and making informed decisions in real estate. By prioritizing accuracy and thoroughness, investors and homebuyers alike can protect their interests and enhance the credibility of their transactions. In a landscape where knowledge is power, mastering the nuances of liens will undoubtedly lead to more secure and successful property dealings.

Frequently Asked Questions

What is a legal claim in the context of real estate?

A legal claim represents a right against assets, often used as collateral to secure a debt. It is essential for professionals in real estate to understand various types of claims, such as mortgage, tax, and judgment claims, as they can impact property ownership and its sellability or refinancing options.

How do tax claims affect real estate transactions?

Tax claims can complicate real estate transactions because they must be resolved before a sale can proceed. Therefore, understanding and addressing these claims is crucial for a smooth transaction process.

What are the benefits of tax claim investing?

Tax claim investing is characterized by low capital requirements and the potential for high fixed interest rates, making it an attractive option for investors.

Why is it important to monitor negative equity in real estate?

Monitoring negative equity is important because it can impact home prices and the overall market. Recent statistics indicate that Las Vegas has the lowest negative equity share at just 0.6%, highlighting the significance of being aware of equity trends.

What is the initial step in performing an encumbrance investigation?

The initial step involves collecting all relevant asset details, including the address, parcel number, and names of current and previous owners. This foundational data is crucial for searching public records efficiently.

Why is it important to determine the suitable legal authority for claims inquiries?

Different jurisdictions may have unique processes and records for claims inquiries, making it essential to identify the appropriate legal authority where the asset is located.

What is a mechanic’s claim?

A mechanic’s claim is a security interest in the title to real or personal property for the benefit of those who have supplied labor or materials that enhance the property. This highlights the need for thoroughness in property inquiries.

What corrective actions may be necessary during an encumbrance investigation?

Corrective actions, such as drafting and recording a corrective deed, may be needed to resolve ownership issues, which can delay the lien search process.

How can engaging with a title company or legal expert assist in the lien search process?

Engaging with a title company or legal expert can provide valuable guidance, especially for those unfamiliar with the process, ensuring that inquiries are effective and comply with local regulations.

What are some financial considerations during an encumbrance investigation?

Title insurance premiums can be as low as $110, which is an important financial factor to consider during an inquiry into property claims and liens.