Overview

To conduct a CT lien search effectively, it is essential to follow a systematic approach. This includes:

- Gathering vital information

- Accessing the appropriate databases

- Thoroughly reviewing search outcomes

Understanding the various types of liens is crucial. Preparing relevant details, such as property addresses and owner names, is necessary. Furthermore, consulting with professionals can help navigate the complexities of lien implications on property transactions.

Introduction

Navigating the complex world of property ownership can be daunting, particularly when it comes to understanding liens. These legal claims against properties, often arising from unpaid debts, can significantly impact real estate transactions in Connecticut.

With various types of liens—ranging from mortgage and tax liens to judgment and mechanic's liens—property seekers must be well-informed to avoid potential pitfalls.

This article delves into the intricacies of liens, offering a comprehensive guide on:

- Conducting a thorough lien search

- The challenges one might face

- The implications of lien findings on property transactions

By equipping oneself with this knowledge, buyers and sellers can navigate the real estate landscape with confidence and clarity.

Understanding Liens: What You Need to Know Before Starting Your Search

A legal claim represents an assertion against an asset, typically used as collateral for a debt. In Connecticut, claims can originate from a variety of sources, such as unpaid taxes, mortgages, or judgments. Understanding the nature of claims is essential before conducting a Connecticut lien search, as they can significantly impact ownership and transactions.

Familiarizing yourself with the different types of claims that may exist will facilitate a more efficient Connecticut lien search.

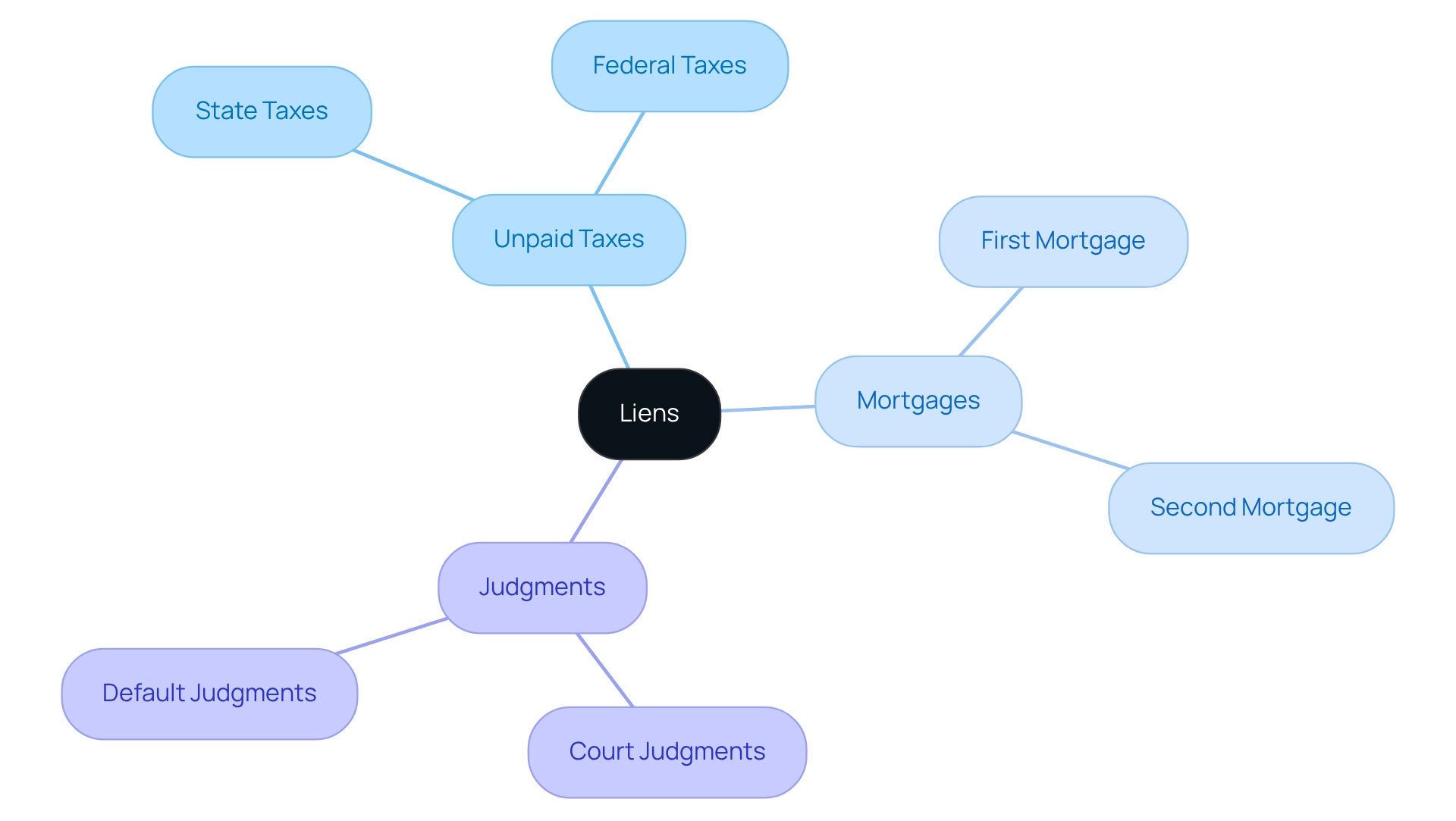

Types of Liens in Connecticut: A Comprehensive Overview

In Connecticut, various forms of encumbrances significantly impact ownership and transactions. Understanding these claims is crucial for conducting an efficient lien search during title investigations. The primary types include:

- Mortgage Obligations: Secured by the property itself, mortgage obligations arise from loans taken to purchase real estate. They are typically prioritized in the event of foreclosure, making them a critical factor in any claim search.

- Tax Claims: Imposed by the government for unpaid taxes, tax claims take precedence over most other demands. In 2025, approximately 15% of real estate in Connecticut had tax claims registered against them, underscoring the importance of verifying these burdens during asset evaluations. To establish a nominee claim scenario, it must be demonstrated that the taxpayer genuinely possesses the asset, despite a third party holding legal title. A certificate of release of the federal tax obligation can be issued under specific conditions, including payment of the assessed amount or if the amount becomes legally unenforceable.

- Judgment Claims: Arising from court rulings against an asset holder, judgment claims can complicate the sale of the asset. They remain attached to the asset until the debt is resolved, potentially deterring prospective purchasers.

- Mechanic's Claims: Filed by contractors or suppliers for unpaid labor or materials provided to enhance the premises, mechanic's claims are essential for protecting the rights of those who contribute to improvements. Maryland's historic mechanic's financial claim law, enacted in 1791 at the encouragement of Thomas Jefferson and James Madison, illustrates the lasting significance of these claims in real estate dealings.

- UCC Claims: Registered under the Uniform Commercial Code, UCC claims can relate to personal assets used as security for loans. These claims are particularly significant for businesses that may leverage their assets to obtain funding.

By familiarizing yourself with these categories of claims, you can more effectively identify potential burdens on the assets you are investigating in a lien search, ensuring . Furthermore, understanding the legal distinctions between the release of a federal tax encumbrance and the discharge of an asset from the encumbrance is vital, as a release nullifies the encumbrance itself, while a discharge solely removes the encumbrance from a particular asset.

Preparing for Your Lien Search: Essential Information to Gather

Before initiating , gathering the following essential information is crucial to ensure a thorough and efficient process:

- Location Address: The full address of the site is essential. Correct are crucial, as inconsistencies can result in overlooked claims. Research indicates that nearly 30% of property searches are complicated by address inaccuracies, underscoring the need for precision. Furthermore, the 'no asset' rule established by the Supreme Court indicates that if there is no asset interest to which the federal tax claim connects, there is no necessity to assess priorities, emphasizing the essential nature of precise asset information.

- Owner's Name: Identifying the current real estate owner is essential, as liens are typically filed against individuals or entities. This information assists in conducting a lien search to identify the accurate records and prevent confusion with similarly titled assets.

- Parcel Number: If accessible, this unique identifier greatly reduces the inquiry. Parcel numbers are associated with particular locations in municipal records, making them invaluable for efficient searches.

- Prior Holders: Understanding the background of ownership can uncover additional claims that may still affect the asset. For instance, a case study concerning a gift tax claim demonstrates how such claims occur automatically when a donor responsible for tax makes a gift. The gift tax encumbrance applies solely to the asset that is the focus of the gift and does not reach the donor's other assets. This highlights the significance of reviewing previous ownership, as the receiver of the gift becomes personally responsible for any gift tax incurred by the giver, and the claim can shift to the recipient's property if the gifted asset is transferred.

- Type of Claim: Knowing the specific kind of claim you are searching for—be it a tax claim, mortgage claim, or judgment claim—can streamline your efforts and focus your research on relevant documents. As stated in the IRM, "The gift tax claim, similar to the estate tax claim, arises automatically, and requires no action by the Service," reinforcing the importance of understanding types of claims.

By carefully gathering this information, you can enhance the efficiency of your inquiry, ensuring that all possible encumbrances are recognized and addressed.

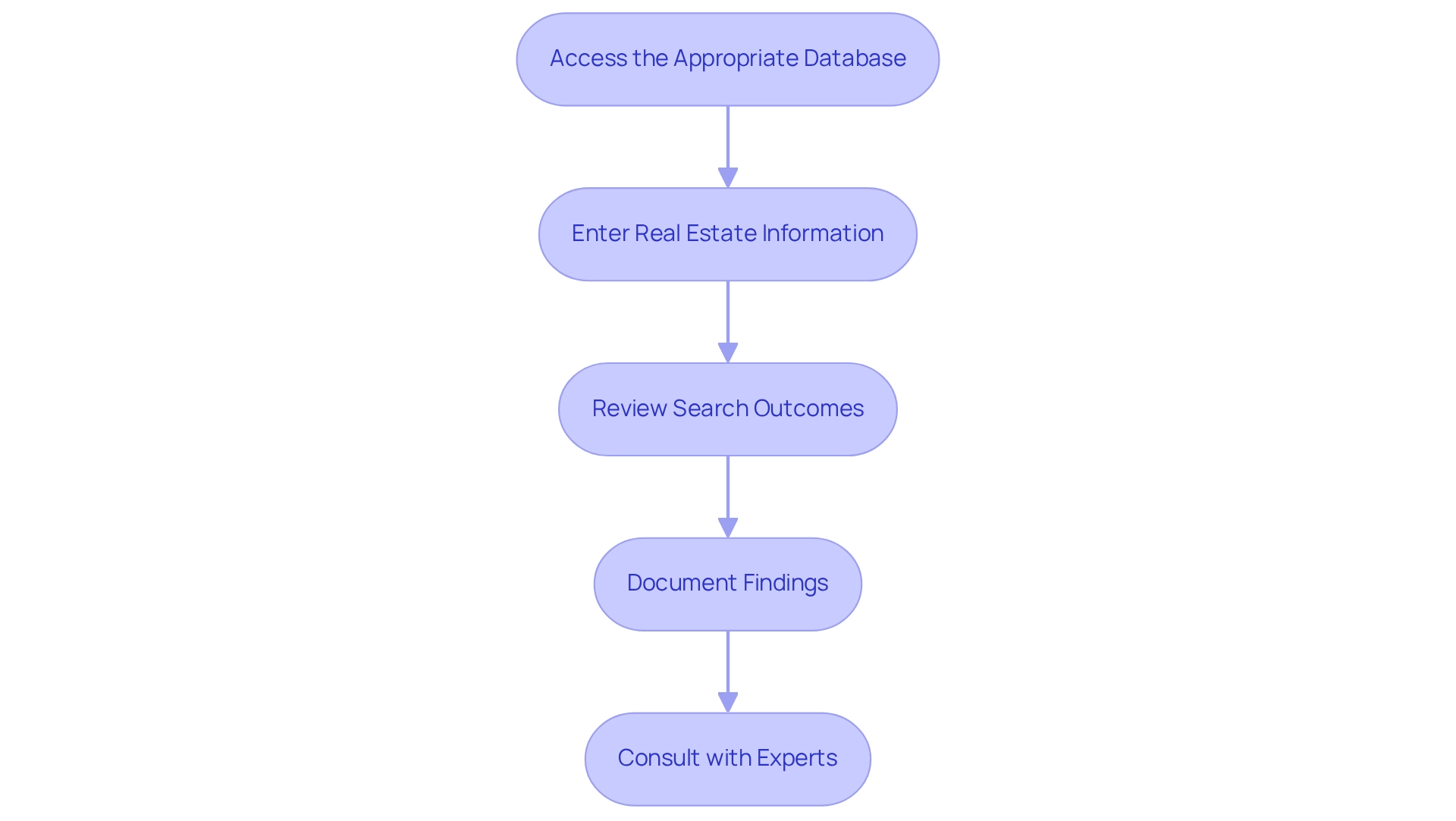

Step-by-Step Guide to Conducting a CT Lien Search

Conducting in Connecticut necessitates a methodical strategy to guarantee both comprehensiveness and precision. Here’s a step-by-step guide:

- Access the Appropriate Database: Begin by visiting the Connecticut Secretary of State's website or your local town clerk's office. These resources are crucial for performing a CT lien search to obtain accurate lien information.

- Enter Real Estate Information: Input relevant details such as the address, owner's name, or parcel number into the inquiry fields. This specificity is essential for narrowing down the search results effectively.

- Review Search Outcomes: Thoroughly inspect the results for any claims linked to the asset. Concentrate on the kind, date, and condition of each claim, as these elements can greatly influence ownership and transfer. As Erik J. Martin observes, "Title to real estate is merely its ownership status; the deed is the document utilized to convey the ownership," emphasizing the significance of grasping ownership in connection to claims.

- Document Findings: Take thorough notes on any claims found, including their effects on the asset. This documentation will be invaluable for future reference and decision-making.

- Consult with Experts: If you encounter intricate claims or require additional clarification, it is prudent to consult with a title company or legal expert. For instance, the Law Offices of Daniel P. Weiner in Stamford, CT, provide complimentary consultations to assist in understanding the consequences of finding a claim on a property during the title examination process. Their expertise can shed light on the nuances of claim implications and help navigate any potential issues.

By following these steps, you can conduct a thorough and efficient investigation, including a CT lien search, ensuring that all pertinent information is considered before proceeding with any real estate dealings. Furthermore, comprehending regulations concerning off-the-job behavior, such as credit history, can also be relevant in the context of property inquiries.

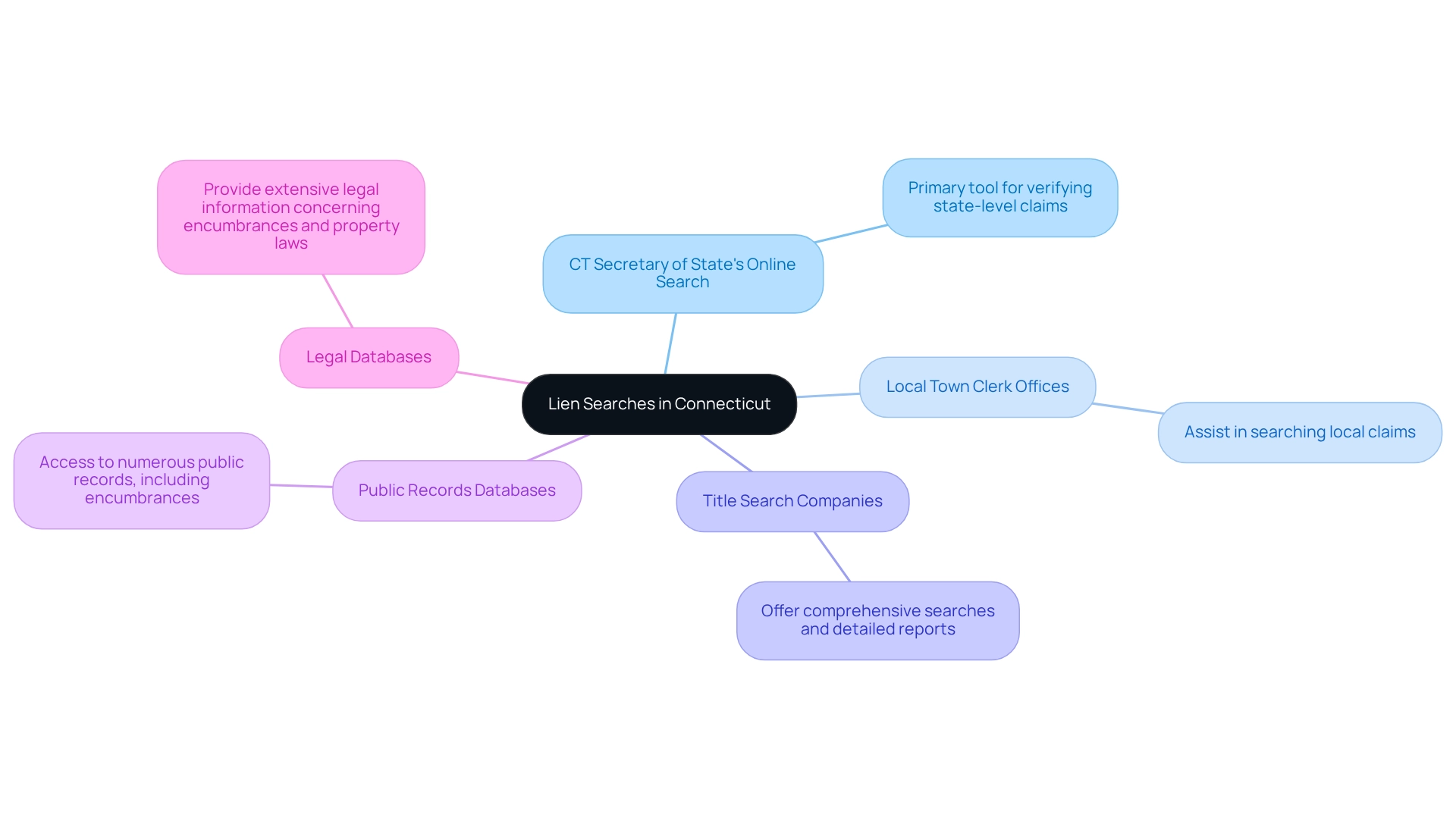

Tools and Resources for Effective Lien Searches in Connecticut

Conducting a lien search in Connecticut is crucial for ensuring accurate title research. Several tools and resources stand out as essential in this process:

- CT Secretary of State's Online Search: This is the primary tool for verifying state-level claims.

- Local Town Clerk Offices: Many municipalities maintain their own records and can assist in searching local claims.

- Title Search Companies: Professional services offer comprehensive searches and provide detailed reports.

- : Websites such as ConnecticutCourtRecords.us grant access to numerous public records, including encumbrances.

- Legal Databases: Resources like LexisNexis or Westlaw deliver extensive legal information concerning encumbrances and property laws.

Utilizing these resources not only simplifies your lien search process but also enhances the accuracy of your results. Consequently, leveraging these tools can significantly mitigate challenges faced during your search.

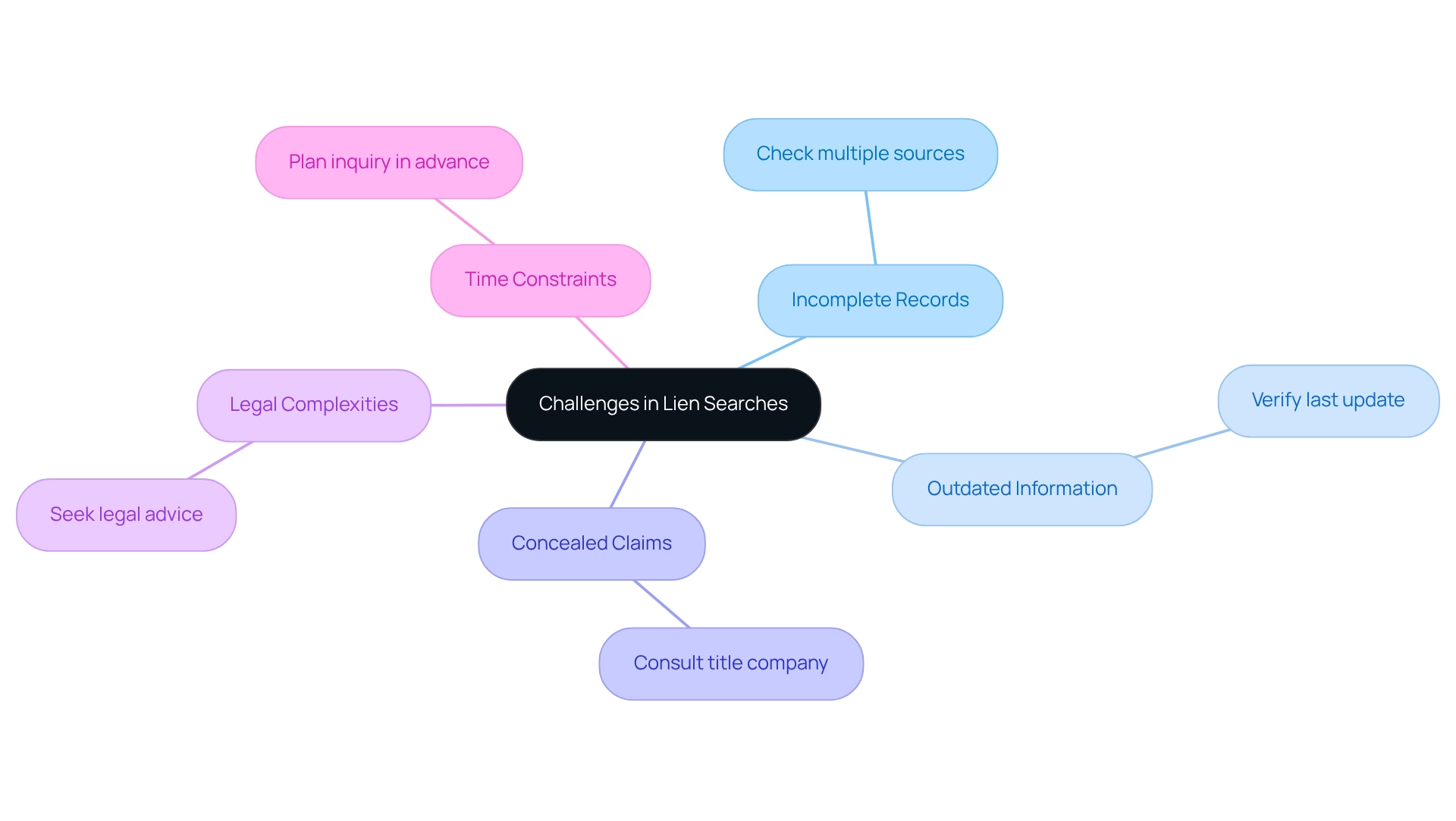

Common Challenges in Lien Searches and How to Overcome Them

When conducting a lien search, several challenges may arise:

- Incomplete Records: Records can sometimes be missing or incomplete. To mitigate this issue, it is advisable to check multiple sources and databases.

- Outdated Information: Public records may not always be current. Always verify the date of the last update and cross-reference with other sources.

- Concealed Claims: Certain claims might not be immediately apparent. Consulting with a title company can provide a more thorough investigation.

- Legal Complexities: The legal implications of specific liens can be intricate. It is prudent to seek legal advice when faced with complex situations.

- Time Constraints: Lien investigations can require significant time. Plan your inquiry in advance and allocate sufficient time to ensure thoroughness.

Being aware of these challenges will enhance your ability to navigate the claim investigation process effectively, particularly when conducting a CT lien search.

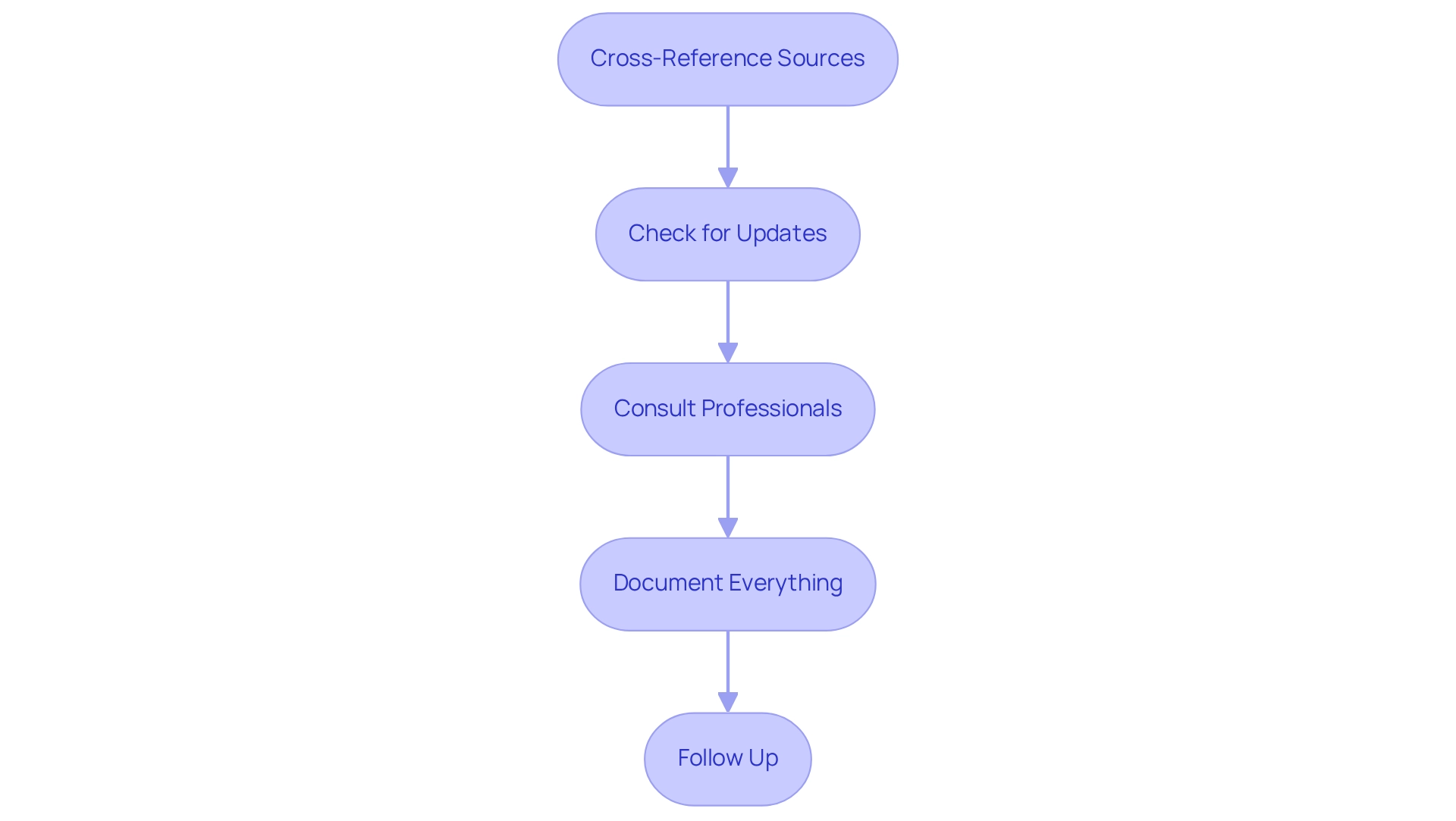

Verifying Your Lien Search Results: Best Practices

Upon completing your lien search, it is essential to adhere to to verify your results:

- Cross-Reference Sources: Compare findings from various databases and resources to ensure consistency.

- Check for Updates: Confirm that the information is current and investigate any recent filings that may not have been included in your initial inquiry.

- Consult Professionals: Should you have any uncertainties, seek the expertise of a title company or legal professional to validate your findings.

- Document Everything: Keep comprehensive records of your inquiry process and discoveries for future reference.

- Follow Up: If you identify any claims, reach out to the holder for clarification regarding the status and implications.

Implementing these practices will significantly enhance the reliability of your lien search results.

Understanding the Implications of Lien Findings on Property Transactions

Finding a lien on a property can have significant implications for .

A property that requires a lien search may encounter substantial obstacles in the sales process. Until the obligation is resolved, prospective purchasers may be discouraged, resulting in extended market exposure and a potential decrease in value.

Liens can significantly influence negotiation dynamics. Purchasers frequently utilize the presence of a claim to negotiate repairs or price reductions, as they may view the claim as a risk that necessitates compensation. This can lead to extended negotiations and potential deal fallout if expectations are not aligned. Addressing claims often requires additional time for negotiation, payment, and obtaining release documents, complicating the process further.

Property owners are usually obligated to resolve any claims before transferring ownership. This legal requirement can complicate transactions, as unresolved claims may postpone closings or even disrupt sales entirely, necessitating extra time and resources to negotiate claim resolutions.

Unresolved claims create significant financial risks, including the possibility of foreclosure or other legal measures against the property owner. Such outcomes can result in considerable financial losses and harm to credit ratings, making it essential for owners to tackle encumbrances proactively.

The existence of encumbrances can complicate the acquisition of title insurance, which is essential for protecting against future claims. Without clear title, securing financing may also become problematic, further complicating the sale process.

Comprehending these implications is essential for managing real estate transactions effectively. A case study on due diligence in recognizing property claims highlights the significance of early detection. It emphasizes the dangers associated with uncovering claims late in the sales process, which can threaten the sale and result in wasted efforts.

As noted by professionals at Vanguard Title, "It’s one more way we add peace of mind to your real estate transactions." Addressing liens early with a lien search not only fosters a more efficient and secure buying experience but also mitigates potential complications that could arise during the transaction.

Conclusion

Navigating the complexities of property liens is essential for anyone involved in real estate transactions in Connecticut. This comprehensive guide has illuminated the various types of liens—including mortgage, tax, judgment, mechanic's, and UCC liens—each with its own implications for property ownership. Understanding these distinctions is not merely academic; it is a practical necessity for ensuring a smooth transaction process.

Furthermore, the article has highlighted the critical steps involved in conducting a thorough lien search. From gathering essential information to utilizing the right tools and resources, the importance of diligence cannot be overstated. By preparing adequately and knowing what to expect, property buyers and sellers can significantly mitigate risks associated with undisclosed liens.

Moreover, the implications of lien findings have been clearly outlined, emphasizing the potential hurdles that unresolved liens can create during property sales. From negotiation dynamics to legal obligations, the presence of liens can complicate transactions and pose financial risks. It is crucial for property owners and prospective buyers to address these issues proactively to safeguard their investments and streamline the sales process.

Ultimately, being well-informed about liens empowers individuals to navigate the real estate landscape with confidence. By taking the time to understand the nuances of liens and conducting thorough searches, buyers and sellers can ensure that their property transactions are not only successful but also secure.

Frequently Asked Questions

What is a legal claim in the context of Connecticut?

A legal claim represents an assertion against an asset, typically used as collateral for a debt. Claims can originate from sources such as unpaid taxes, mortgages, or judgments.

Why is it important to understand claims before conducting a lien search in Connecticut?

Understanding the nature of claims is essential because they can significantly impact ownership and transactions, making it crucial for an efficient lien search.

What are the primary types of claims that can affect ownership and transactions in Connecticut?

The primary types of claims include: 1. Mortgage Obligations 2. Tax Claims 3. Judgment Claims 4. Mechanic's Claims 5. UCC Claims

What are mortgage obligations?

Mortgage obligations are secured by the property itself and arise from loans taken to purchase real estate. They are prioritized in the event of foreclosure.

How do tax claims impact real estate in Connecticut?

Tax claims, imposed by the government for unpaid taxes, take precedence over most other demands. Approximately 15% of real estate in Connecticut had tax claims registered against them in 2025.

What are judgment claims, and how do they affect asset sales?

Judgment claims arise from court rulings against an asset holder and remain attached to the asset until the debt is resolved, potentially complicating the sale of the asset.

What are mechanic's claims?

Mechanic's claims are filed by contractors or suppliers for unpaid labor or materials provided to enhance the premises, protecting the rights of those who contribute to improvements.

What are UCC claims?

UCC claims are registered under the Uniform Commercial Code and relate to personal assets used as security for loans, which are particularly significant for businesses.

What is the difference between the release of a federal tax encumbrance and the discharge of an asset from the encumbrance?

A release nullifies the encumbrance itself, while a discharge only removes the encumbrance from a particular asset.