Introduction

In the realm of real estate, understanding the intricacies of home title checks is paramount for ensuring secure property ownership and smooth transactions. A home title check serves as a comprehensive evaluation of a property's legal standing, shedding light on ownership history, potential liens, and any encumbrances that may pose challenges down the line. As the landscape of property ownership becomes increasingly complex, the importance of conducting thorough title searches cannot be overstated.

With rising statistics indicating an uptick in title disputes, this article delves into the essential steps for verifying home title status, managing liens, and leveraging available resources to safeguard real estate investments. Through a detailed exploration of the title check process, professionals and homeowners alike can equip themselves with the knowledge necessary to navigate the potential pitfalls of property ownership with confidence.

Understanding Home Title Checks: What You Need to Know

is a crucial procedure that verifies the legal ownership of an asset while identifying any claims or encumbrances that may impact it. This process involves a thorough examination of public records, which confirms the ownership history, outstanding liens, and any other potential issues that could impact the status of the asset. Comprehending the implications of these findings is essential, as they can significantly impact real estate transactions, mortgage applications, and development.

For instance, the cost of a document search can vary widely depending on location, complexity, and provider fees, typically ranging from several hundred to several thousand dollars. Furthermore, document binders act as a one-time expense that offers continual safeguarding for ownership rights, assisting in reducing possible conflicts. They can also address zoning and land use disputes by ensuring compliance with regulations and obtaining necessary permits.

Precise ownership verifications not only assist in avoiding disputes but also guarantee that buyers and existing proprietors have the right to sell or alter the property without facing legal issues. For instance, a recent case study illustrated how binders resolved a boundary dispute, enabling all parties to come to a satisfactory agreement.

Moreover, familiarity with the document verification process assists real estate professionals in protecting their transactions and ensuring adherence to legal requirements. Notably, statistics indicate that title disputes are on the rise in 2024, emphasizing the need for diligence in conducting thorough home title checks to mitigate potential conflicts.

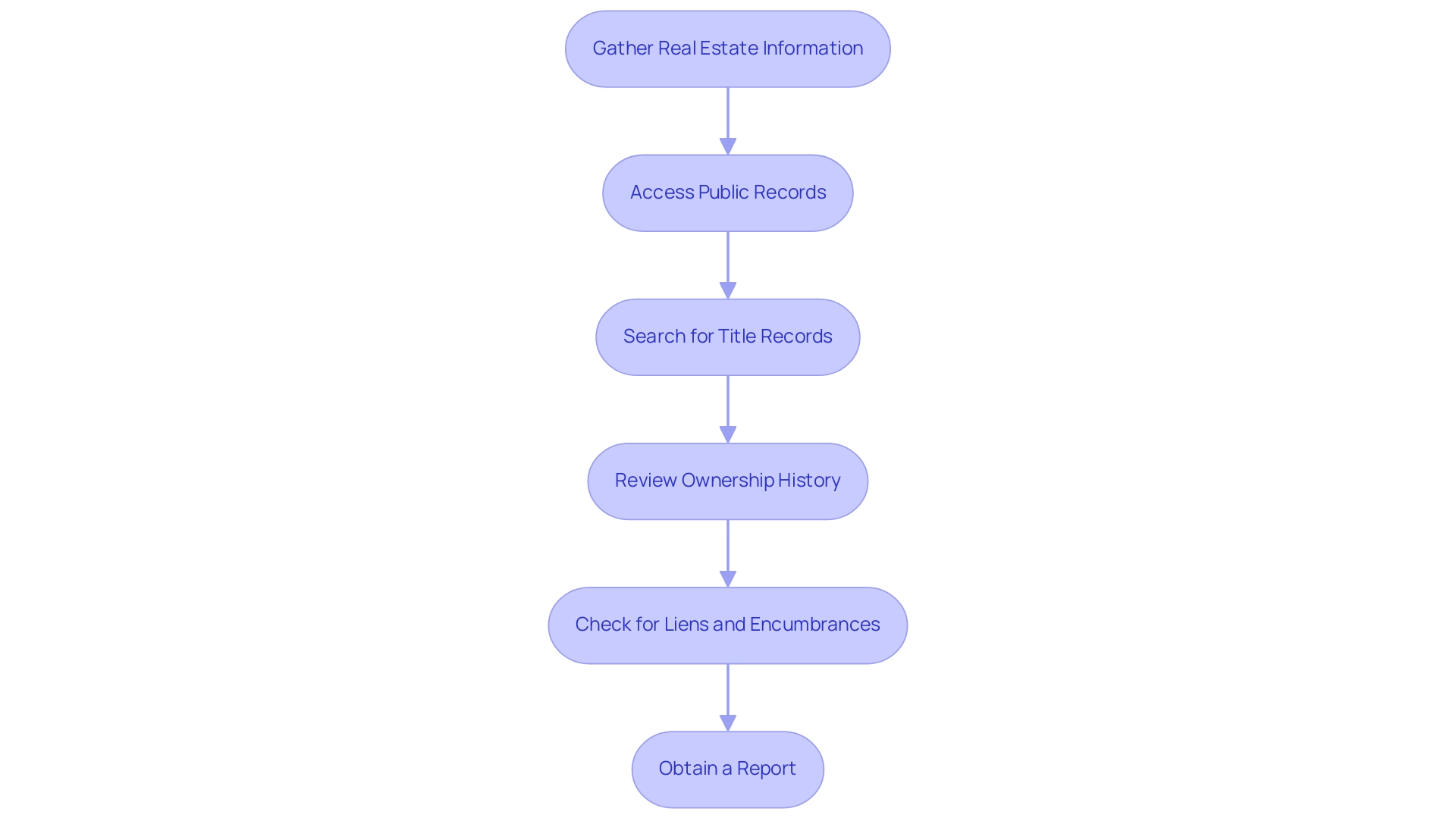

Step-by-Step Process for Checking Your Home Title Status

- Gather Real Estate Information: Begin by collecting vital details about the real estate, such as the address, parcel number, and the names of current owners. This foundational data is essential for accurately identifying the corresponding entries.

- Access Public Records: Visit the local county recorder’s office or utilize their online portal. Most counties now provide online access to land documents, including deeds and ownership information, enabling a more efficient search process. Based on recent data, around 80% of counties have established online access to public documents, greatly enhancing the efficiency of property searches.

- Search for Title Records: With the asset information in hand, search for title records. Concentrate on finding the deed, which provides the name of the current owner as well as details about any previous owners, forming the basis for ownership verification.

- Review Ownership History: Carefully examine the ownership history to confirm that the current owner possesses the legal right to sell the property. Be vigilant for any discrepancies or unusual transfers that may raise questions about the title's validity. As Paula stated, "I requested them from federal archives and had them documented in the County land files by the time everyone was prepared to close," emphasizing the significance of acquiring precise records.

- Check for Liens and Encumbrances: Investigate any existing liens, mortgages, or claims against the asset. This vital information is generally found in the documentation and is crucial for comprehending possible obligations or financial burdens associated with the asset.

- Obtain a Report: If the situation demands a deeper investigation, consider enlisting the services of a company to conduct a comprehensive ownership search. These experts can deliver that highlights any problems impacting the asset's ownership, ensuring that all possible concerns are tackled prior to moving forward with the transaction. For example, in a case study concerning a seller in the midst of litigation, comprehensive ownership research revealed that previous mortgages had been annulled by a Bankruptcy Court Order, enabling the buyer to successfully finalize the transaction despite initial complications.

Identifying and Resolving Liens on Your Property

Liens signify legal claims against an asset, frequently arising from unpaid debts, and their identification during a title check is crucial for ensuring clear ownership and transferability. Effective oversight of these claims is crucial for . Here are the steps to effectively manage claims:

-

Review the Title Report: Begin by examining the title report for any recorded claims on the property. Be aware that common types include tax claims, mechanic's claims, and mortgage claims. Statistics for 2024 indicate a 15% increase in tax claims and a 10% rise in mechanic's claims compared to the previous year, highlighting the importance of thorough checks. Utilizing advanced machine learning tools from Parse AI, such as automated document recognition and data extraction capabilities, can expedite this process, making it easier to identify and analyze any existing liens.

-

Contact the Creditor: If a claim is identified, promptly reach out to the creditor. This communication is vital to comprehend the nature of the claim and the total amount owed. Engaging directly with the creditor can often provide clarity and options for resolution. Recent news suggests that many creditors are adopting more adaptable negotiation strategies, making it a favorable time for landowners to engage. Parse Ai's platform can assist by providing templates for communication and data insights that can be used to support your position during negotiations.

-

Negotiate Payment: In many instances, it is possible to negotiate a settlement or establish a payment plan to resolve the obligation. Expert opinions highlight the significance of negotiation, suggesting that many claim holders may be willing to collaborate with property owners to find satisfactory solutions. For example, a recent case study revealed that a homeowner successfully negotiated a 30% decrease in their debt amount by demonstrating financial hardship and proposing a structured payment plan. Harbinger Land’s property curative services can assist in these negotiations, ensuring that clients navigate the process effectively.

-

Obtain a Release: After resolving the claim, ensure that you receive a release document that officially confirms the obligation has been satisfied. This document must be recorded with the county recorder’s office to ensure that ownership is cleared. As Franklin D. Roosevelt wisely stated,

Real estate cannot be lost or stolen... it is about the safest investment in the world.

Managing liens effectively, with the assistance of Parse Ai's document processing abilities and Harbinger Land's research expertise, is a critical aspect of protecting this investment and ensuring a smooth real estate transaction.

Resources and Assistance for Home Title Checks

For those conducting home ownership checks, several resources can provide assistance:

- County Recorder’s Office: This is the main source for accessing public property documentation. They can provide guidance on how to search for title information.

- : Numerous online platforms, including the advanced digital interface provided by Harbinger Land for Comanche County Clerk documentation, enable comprehensive searches. This interface showcases an intuitive layout with a search bar and detailed tables that list essential information, including types of documents such as deeds and easements. Furthermore, it provides complete text search functionalities and employs machine learning models to extract pertinent information from documents, improving the efficiency of verification checks.

- Title Firms: Employing a firm can save time and guarantee a comprehensive review of ownership documents. They can also assist in addressing any problems that occur during the verification process.

- Document Imaging Services: Harbinger Land specializes in digitizing property data, allowing agents to conduct research and leasing efficiently. By deploying imaging agents to courthouses or acquiring documents through records requests, they can quickly obtain large datasets needed for precise research.

- Legal Assistance: If complications arise, consulting with a real estate attorney can provide legal guidance and support in navigating complex title issues.

Conclusion

Thorough home title checks are an indispensable aspect of real estate transactions, providing essential insights into property ownership and potential complications. By understanding the nuances of a title check, including the examination of ownership history and the identification of any existing liens, both professionals and homeowners can protect their investments. The step-by-step process outlined emphasizes the importance of diligent research and the utilization of available resources, such as county records and professional title companies, to ensure a clear title.

Moreover, effectively managing liens is critical to safeguarding property ownership. Engaging with lien holders, negotiating settlements, and obtaining official releases are vital steps that can prevent future disputes and ensure smooth transactions. The statistics indicating a rise in title disputes and liens further underscore the necessity of thorough title checks in today's complex real estate landscape.

In conclusion, prioritizing home title checks not only mitigates risks but also empowers property owners to navigate the real estate market with confidence. By leveraging the tools and resources available, individuals can secure their investments and foster a smoother transaction process, ultimately contributing to a more stable and transparent property ownership environment.

Frequently Asked Questions

What is a home title check?

A home title check is a procedure that verifies the legal ownership of a property and identifies any claims or encumbrances that may affect it. This involves examining public records to confirm ownership history, outstanding liens, and potential issues impacting the asset.

Why is a home title check important?

A home title check is crucial as it can significantly impact real estate transactions, mortgage applications, and property development. It helps avoid disputes and ensures that buyers and existing owners have the right to sell or alter the property without legal issues.

How much does a document search typically cost?

The cost of a document search can vary widely based on location, complexity, and provider fees, generally ranging from several hundred to several thousand dollars.

What are document binders, and how do they help?

Document binders are a one-time expense that provides ongoing protection for ownership rights, helping to reduce potential conflicts. They can also address zoning and land use disputes by ensuring compliance with regulations and obtaining necessary permits.

What are the steps involved in conducting a home title check?

The steps include: 1. Gather real estate information. 2. Access public records. 3. Search for title records. 4. Review ownership history. 5. Check for liens and encumbrances. 6. Obtain a report if deeper investigation is needed.

What types of claims should be checked during a title check?

Common types of claims include tax claims, mechanic's claims, and mortgage claims. Identifying these claims is essential for ensuring clear ownership and transferability of the property.

What should be done if a lien or claim is identified?

If a claim is identified, it is important to contact the creditor to understand the nature of the claim and negotiate possible resolutions. After resolving the claim, ensure to obtain a release document confirming the obligation has been satisfied.

What resources are available for conducting home title checks?

Resources include: 1. County Recorder’s Office for public documentation. 2. Online title search services for efficient searches. 3. Title firms for comprehensive reviews of ownership documents. 4. Document imaging services for digitizing property data. 5. Legal assistance for navigating complex title issues.