Overview

To check a property for liens, one must gather essential property information, visit local government offices, utilize online search tools, consider hiring a title company, and meticulously review the findings for any existing claims. This process is critical, as unresolved liens can significantly affect ownership rights and the transfer process. Therefore, thorough due diligence is imperative to avoid complications in real estate transactions. By adhering to these steps, individuals can safeguard their investments and ensure a smoother transaction experience.

Introduction

In the intricate world of real estate, understanding liens is paramount for both buyers and sellers. A lien—essentially a legal claim against a property—can significantly impact ownership rights and the ability to transfer property. With a notable percentage of real estate transactions involving properties encumbered by existing liens, the stakes are high.

Furthermore, as the landscape of property transactions continues to evolve, professionals must navigate various types of liens, ranging from mortgage and tax liens to mechanic's and judgment liens, each carrying distinct implications.

This article delves into the nuances of liens, providing essential insights into conducting thorough lien searches and troubleshooting common issues that may arise during the process. By equipping themselves with this knowledge, stakeholders can safeguard their investments and ensure smoother transactions in an increasingly complex market.

Understand What a Lien Is

A legal claim represents an interest in an asset, serving as collateral to secure a debt. When a claim is established, it restricts the sale or refinancing of the asset until the associated debt is resolved. Liens can arise from diverse sources, such as unpaid taxes, mortgages, or contractor services.

In 2025, understanding encumbrances is crucial for real estate professionals, as they significantly impact ownership rights and the ability to transfer assets. Recent statistics indicate that a considerable portion of real estate transactions involve assets with existing encumbrances, underscoring the importance of thorough due diligence. A report advocating for a comprehensive title search for commercial properties in the United States reveals that numerous deals are influenced by outstanding claims, potentially complicating the purchasing process.

Expert insights, including those from Anju Vajja, a FHFA Research Officer, emphasize that claims not only complicate transactions but may also lead to legal disputes if not properly addressed. The FHFA's National Mortgage Database illustrates trends in outstanding first-position mortgages, providing valuable insights into the prevalence of claims in the current market. Case studies, such as the 'Commercial Full Title Report,' demonstrate that unresolved claims can hinder ownership, making it imperative for stakeholders to be aware of any assertions against an asset prior to proceeding with a transaction.

Furthermore, the Mortgage Bankers Association and Fannie Mae project that the house price index will decline by less than one percent by Q1 2024, with a modest recovery anticipated by the end of 2024. This potential shift may influence the dynamics of real estate transactions and the frequency of claims.

Identify Different Types of Liens

Several types of liens can significantly impact a property, each with distinct implications:

- Mortgage Liens: These voluntary liens are established by lenders when a borrower secures a mortgage to finance the purchase of a property. They typically hold priority over other claims, making them essential to comprehend in any real estate transaction.

- Tax Claims: Enforced by governmental organizations for unpaid real estate taxes, these claims can be federal, state, or local. They complicate real estate sales, as they must be resolved before ownership transfer.

- Mechanic's Claims: Submitted by contractors, subcontractors, or suppliers who haven't received payment for their work on the site, mechanic's claims can emerge from construction or renovation projects. These claims present considerable risks to landowners if not addressed promptly.

- Judgment Claims: Arising from court rulings against the owner, these claims enable creditors to seize the asset to fulfill unpaid obligations. Understanding the difference between judgment claims and other encumbrances is crucial for asset security and liability management.

Acknowledging these claims is essential for prospective purchasers and landowners, as it assists them in identifying specific risks linked to a piece of real estate. For instance, properties burdened by mechanic's claims can dissuade buyers, particularly if discovered late in the transaction process, jeopardizing sales and complicating ownership transfers. As Mark Williams, Director of Operations, emphasizes, "Understanding the various categories of claims is essential for effective decision-making in real estate transactions."

Furthermore, prior to executing a real estate deal, it is crucial to understand how to check a property for liens to confirm the asset's status regarding potential claims and prevent complications, as highlighted in the case study 'How to Deal with Asset Claims.' Utilizing tools that provide comprehensive real estate information can enhance effectiveness and mitigate risks associated with real estate investment, particularly in managing encumbrances.

Conduct a Lien Search on the Property

To effectively conduct a lien search on a property, adhere to the following steps:

- Gather Property Information: Begin by collecting essential details such as the property address, parcel number, and the owner's name. This fundamental information is crucial for precise inquiries.

- Visit Local Government Offices: Engage with the county recorder, assessor, or clerk’s office. Numerous jurisdictions now provide online access to records, simplifying the retrieval process.

- Utilize Online Search Tools: Leverage online platforms, including local government portals, to access lien records efficiently. Tools such as Parse AI’s advanced machine learning capabilities can significantly decrease the time invested in inquiries by automating document processing and improving retrieval accuracy.

- Request a Title Search: For a thorough examination, consider hiring a title company. Their expertise can uncover potential issues that may not be immediately visible, especially crucial when purchasing property. Remember, title insurance premiums can cost between 0.5% and 1% of the purchase price, highlighting the financial implications of a thorough search.

- Review Findings: Carefully analyze the results for any existing claims. Understanding the consequences of these claims is essential, as they can influence ownership and the closing procedure. As Carmel Woodman, a former content manager, noted, "This step can make or break your deal so it’s vital that you do your homework ahead of time."

By following these steps on how to check a property for liens, you can confidently determine whether any claims exist on the property of interest, which will help protect your investment and ensure a smoother transaction process. Significantly, the average duration required to perform a lien inquiry can differ, but employing effective online tools, like those provided by Parse AI, can greatly accelerate this process. Mistakes in ownership documentation are frequent factors of holdups, as emphasized in the case study on typical delays in the title examination process.

Furthermore, be mindful that acknowledgment copies might require a few days to become accessible, depending on the jurisdiction's processing times, which is crucial for organizing your inquiry.

Troubleshoot Common Issues in Lien Searches

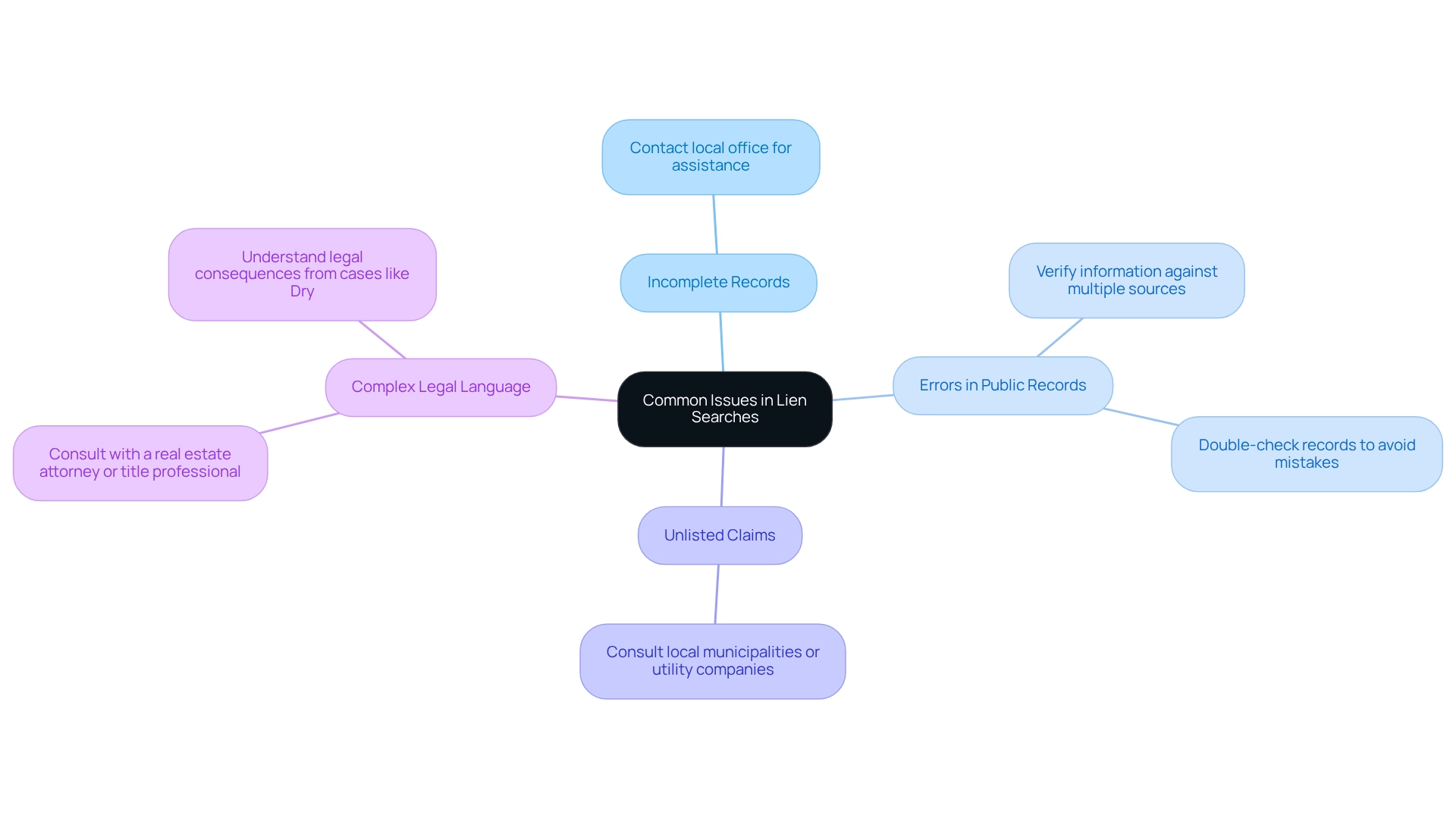

When conducting a lien search, it is crucial to recognize several common issues that may complicate the process:

- Incomplete Records: Public lien databases frequently exhibit a significant percentage of incomplete records, with studies indicating that as much as 30% of records may be missing or outdated. Should you encounter such challenges, it is advisable to contact the local office directly for assistance.

- Errors in Public Records: Discrepancies within public records are not uncommon. To ensure accuracy, it is essential to verify the information against multiple sources. This practice can help identify and rectify potential errors. As one real estate professional aptly noted, "Double-checking records can save you from costly mistakes down the line."

- Unlisted Claims: Certain claims may not appear in public databases. Therefore, it is prudent to consult local municipalities or utility companies for any outstanding obligations that may not be officially recorded.

- Complex Legal Language: Legal documents often contain intricate terminology that can be challenging to interpret. In such instances, consulting with a real estate attorney or a title professional can provide the necessary clarification. The Supreme Court case of Dry exemplifies the importance of understanding legal consequences, as it determined that disclaimers do not prevent federal tax claims from being imposed on property.

Being aware of these challenges and knowing how to address them can significantly enhance the effectiveness of your lien search, ensuring that you uncover all relevant information and avoid potential pitfalls.

Conclusion

Understanding liens is essential in the real estate landscape, as they represent legal claims that can complicate property transactions. This article outlines the various types of liens—mortgage, tax, mechanic's, and judgment liens—each carrying unique implications that can significantly affect ownership rights and the ability to transfer property. Recognizing these distinctions is crucial for buyers and sellers alike; unresolved liens can lead to substantial delays and legal disputes.

Conducting a thorough lien search is vital for safeguarding investments. The steps outlined—from gathering property information to utilizing online tools and consulting professionals—equip stakeholders with the necessary knowledge to navigate potential pitfalls. Being proactive in this process ensures that any existing liens are identified and addressed before finalizing a transaction.

Furthermore, troubleshooting common issues encountered during lien searches, such as incomplete records and unrecorded liens, is critical for successful property transactions. By understanding and mitigating these challenges, real estate professionals can foster smoother transactions and protect their clients' interests.

In conclusion, an informed approach to understanding and managing liens not only streamlines real estate transactions but also enhances the overall security of property investments. As the market continues to evolve, staying vigilant and knowledgeable about liens will empower buyers and sellers to navigate the complexities of real estate with confidence.

Frequently Asked Questions

What is a legal claim in the context of real estate?

A legal claim represents an interest in an asset, serving as collateral to secure a debt. It restricts the sale or refinancing of the asset until the associated debt is resolved.

What are some common sources of liens?

Liens can arise from various sources, including unpaid taxes, mortgages, or contractor services.

Why is understanding encumbrances important for real estate professionals?

Understanding encumbrances is crucial as they significantly impact ownership rights and the ability to transfer assets, which can complicate real estate transactions.

What do recent statistics indicate about real estate transactions and encumbrances?

A considerable portion of real estate transactions involves assets with existing encumbrances, highlighting the importance of thorough due diligence.

What does the FHFA recommend regarding title searches for commercial properties?

The FHFA advocates for a comprehensive title search for commercial properties, as numerous deals are influenced by outstanding claims, which can complicate the purchasing process.

What insights do experts provide about claims in real estate transactions?

Experts emphasize that claims can complicate transactions and may lead to legal disputes if not properly addressed.

What does the FHFA's National Mortgage Database illustrate?

It illustrates trends in outstanding first-position mortgages, providing insights into the prevalence of claims in the current market.

How can unresolved claims affect ownership?

Unresolved claims can hinder ownership, making it imperative for stakeholders to be aware of any assertions against an asset prior to proceeding with a transaction.

What projections are made by the Mortgage Bankers Association and Fannie Mae regarding house prices?

They project that the house price index will decline by less than one percent by Q1 2024, with a modest recovery anticipated by the end of 2024, which may influence the dynamics of real estate transactions and the frequency of claims.