Introduction

Title insurance is a crucial aspect of real estate transactions, providing financial protection and legal defense against defects in property ownership. It ensures that any potential challenges to a title are effectively managed, covering legal expenses and compensating for losses. First American Financial Corporation, a leader in the industry, has been providing comprehensive title and settlement solutions for over a century, generating a revenue of $7.6 billion in 2022.

With their commitment to secure and efficient real estate transactions, title insurance has become an essential component of the industry, guaranteeing transparent property rights. From safeguarding against title defects to offering long-term protection and peace of mind, title insurance plays a vital role in ensuring smooth and secure real estate transactions.

What is Title Insurance?

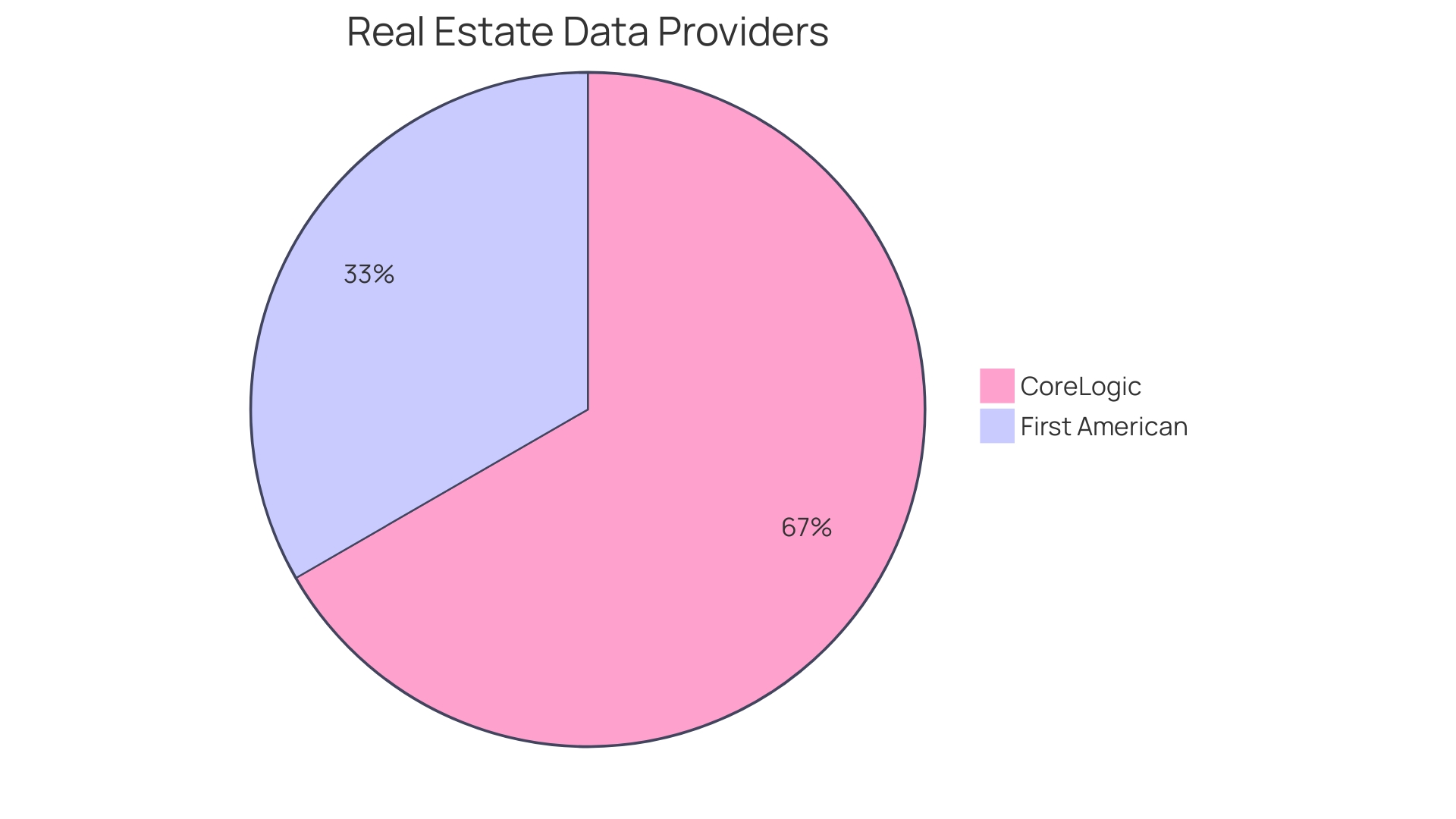

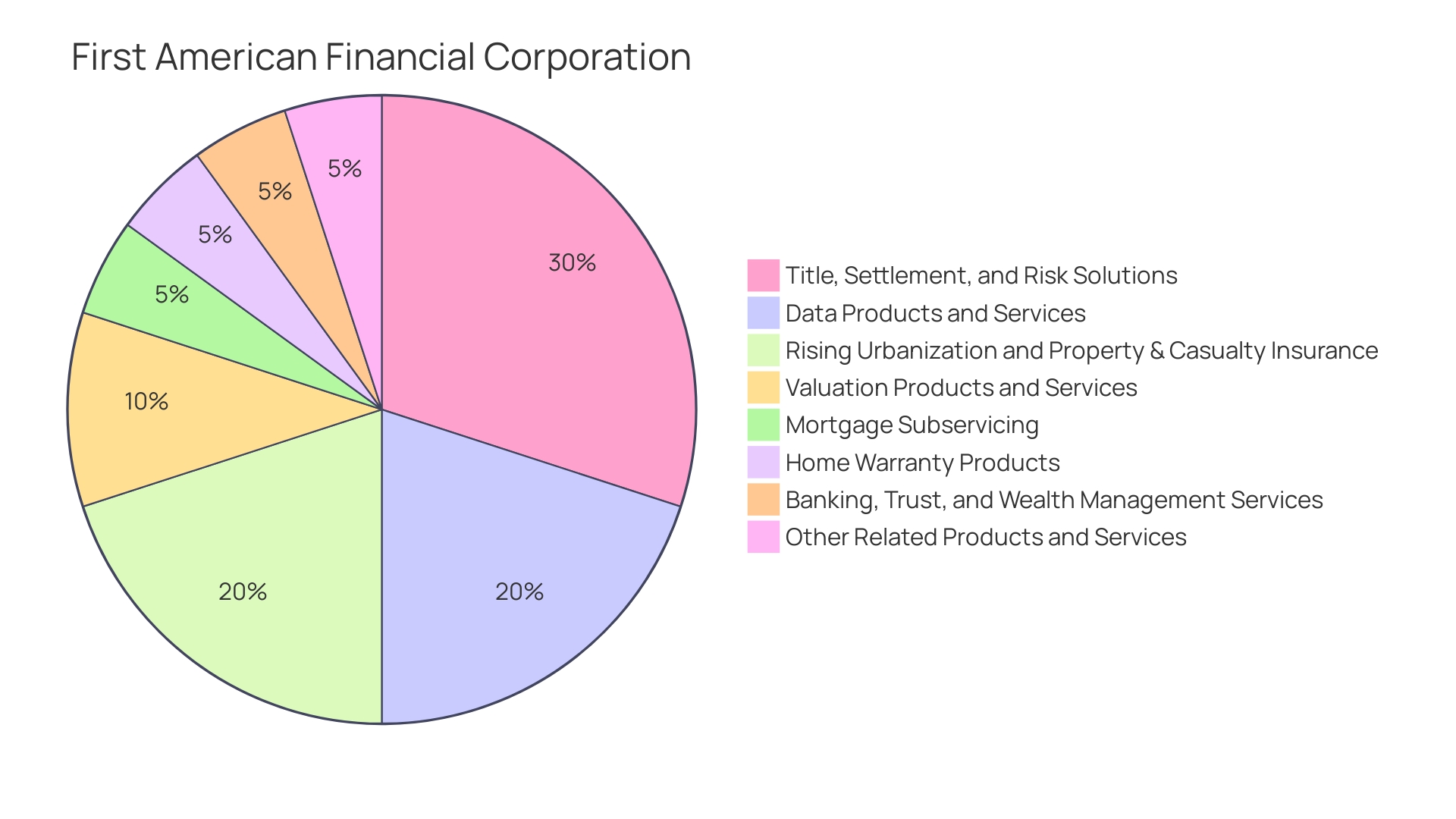

serves as a safeguard for property buyers and lenders, offering or disputes over property ownership. This type of coverage guarantees that any are handled efficiently, with the policy providing financial support for legal defense costs and reimbursing for eligible damages. The significance of [title protection](https://blog.parseai.co/understanding-title-report-cost-an-in-depth-tutorial-for-real-estate-professionals) has been underscored by leaders like First American Financial Corporation, which has been at the forefront of providing comprehensive ownership and settlement solutions in real estate for over a century. First American's financial strength, combined with its innovative technology and extensive data assets, underscores the company's commitment to facilitating secure and efficient real estate transactions. The company's services, which generated a revenue of $7.6 billion in 2022, cover data provision for the title sector and valuation services, highlighting the crucial function of title protection in real estate. A strong testament to their industry leadership is the recognition as one of the 100 Best Companies to Work For by Great Place to Work® and Fortune Magazine for the eighth consecutive year in 2023. With such endorsements, it is evident that is more than just a policy; it is a vital part of a strong real estate sector, ensuring that rights to ownership are securely and transparently handled.

Understanding Title Defects

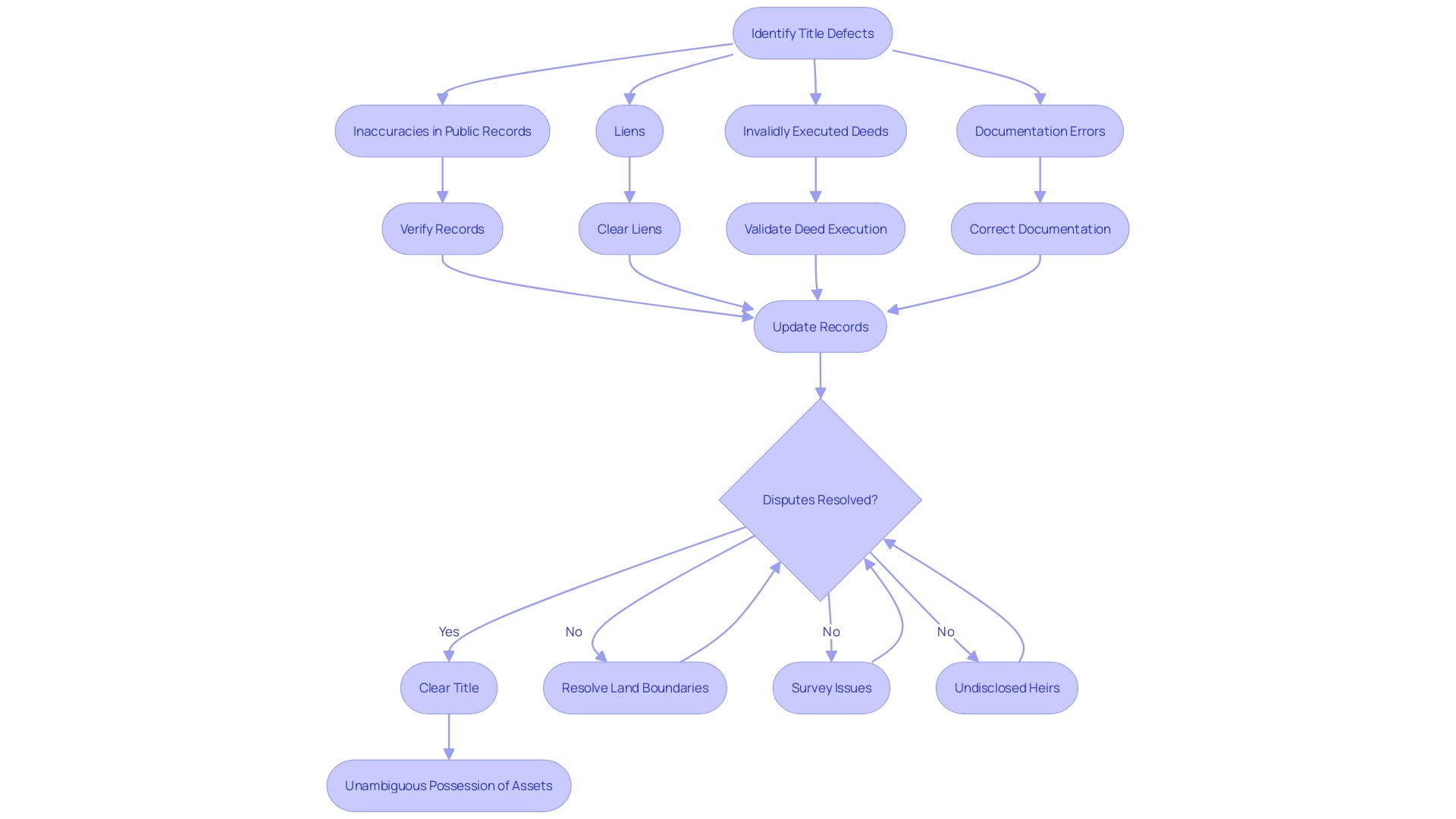

, which disrupt the straightforward transfer of ownership, may stem from a myriad of issues. These can include inaccuracies in public records or liens due to unsettled debts, which underscore the necessity for meticulous record-keeping and verification. Invalidly executed deeds or documentation errors further complicate ownership claims, necessitating rigorous attention to detail during transactions. Deceptive actions or counterfeiting introduce an additional level of intricacy, testing the reliability of ownership certificates and the that uphold them. In certain situations, undisclosed heirs or disputes over land boundaries and surveys can arise, unveiling the complex network of rights and claims associated with real estate. Moreover, possible unidentified burdens or easements can hide, often undiscovered until a comprehensive search is performed. These concerns underscore the crucial importance of thorough research on to protect against unexpected demands and to guarantee unambiguous possession of assets.

How Title Insurance Protects Against Title Defects

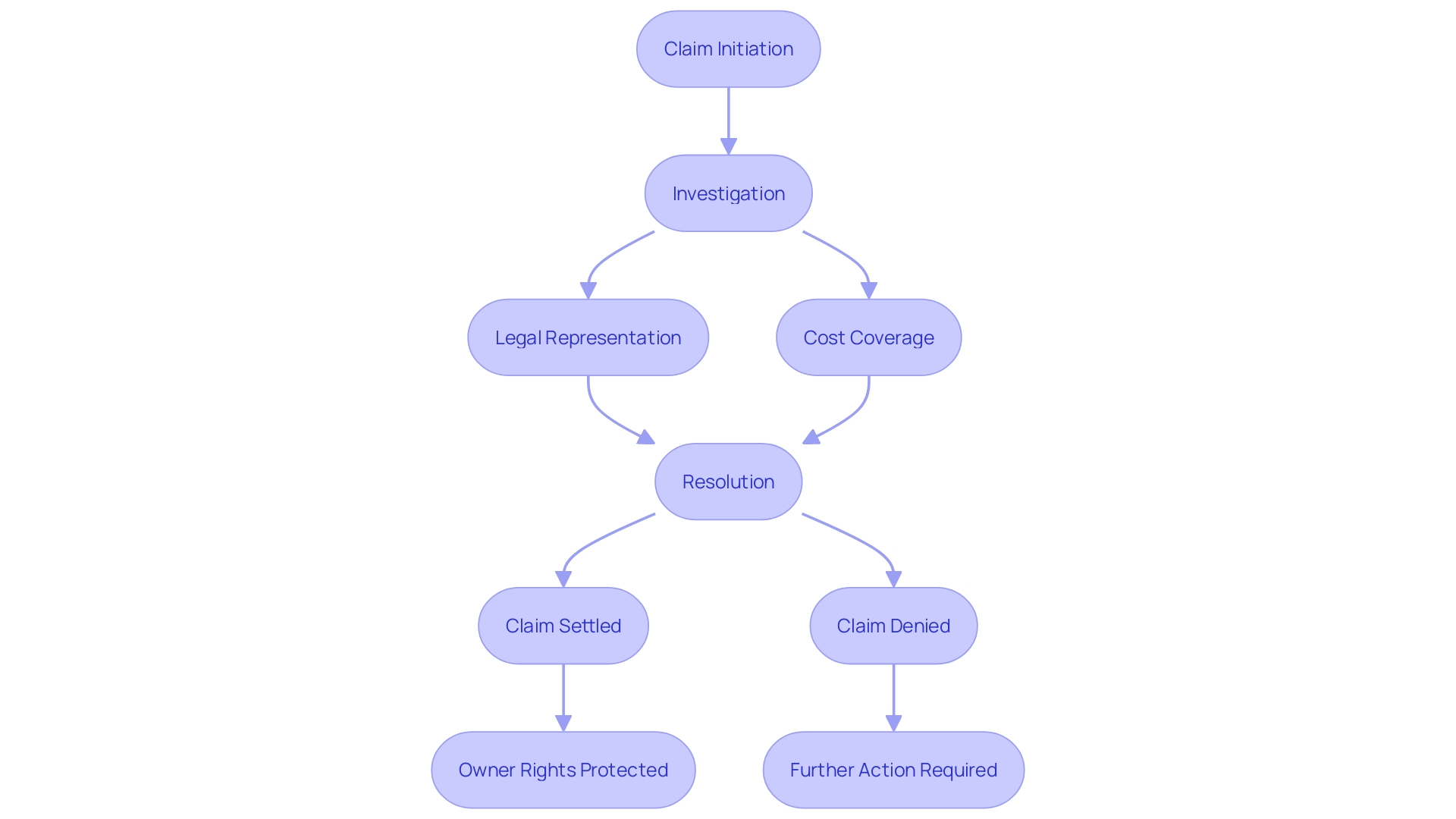

The affirmation of a deed serves as a safety measure, shielding buyers from unexpected that may occur after a purchase. When obtaining a , the company responsible for verifying conducts a thorough investigation and analysis of the property's past. Should any such defects come to light subsequent to the acquisition, the policyholder is indemnified for and any consequent monetary losses. Remarkably, the field is leading the way in digital transformation, with companies such as First American Financial Corporation incorporating groundbreaking technologies and utilizing vast data resources to improve the effectiveness and dependability of their offerings. Based on reports from the industry, coverage plays a crucial role in deals, relied upon for more than a century to protect ownership rights. This is evidenced by First American's impressive 2022 revenue of $7.6 billion, and its recognition as one of the best companies to work for. Furthermore, real-world cases highlight the importance of protecting property rights; for example, FCT, a company specializing in safeguarding real estate transactions, has recently refused to provide coverage for deals exceeding $539 million due to suspicious behavior, demonstrating the significant risks associated with real estate and the need for thorough examination of property titles.

The Role of Title Insurance in Covering Title Defects

is a crucial protection for parties involved in real estate deals, guarding against monetary damages stemming from flaws in the ownership of the premises. There are two main policies available: one for owners and one for lenders. A policy of protects the buyer of the real estate from any pre-existing problems that could question their ownership rights to the property, such as disagreements over ownership of the premises, inaccurately recorded documents, or undisclosed claims. Conversely, a policy of ownership protection for the mortgage lender guarantees the safety of the lender's investment by that could impact the ownership rights of the real estate.

Backed by the extensive expertise and strong financial base of First American Financial Corporation, which recorded a total revenue of $7.6 billion in 2022, the sector for insuring property ownership offers a blend of risk management solutions and assistance with property transfers. These services are an essential component of the real estate ecosystem, as they ensure clear ownership of assets and facilitate the secure transfer of ownership documents. With advancements leading the digital transformation of the sector, First American, a prominent entity in the field, has been acknowledged for its workplace excellence and innovation, indicating the high standards and dependability expected in this area. As the industry gets ready for a surge of home purchases and refinancing, and its function in safeguarding ownership rights becomes more and more crucial for buyers and homeowners.

Owner's Title Insurance Policy

When acquiring , buyers are not just purchasing the land or structure, but also the deed, which confers and the right to use and transfer the real estate. The reliability of the ownership can be undermined by different flaws, such as unpaid legal judgments or liens, which may lead to substantial . To protect against these risks, buyers can acquire a policy that provides coverage for the entire purchase value of the property. This policy operates as a safety net, covering any potential financial damage arising from pre-existing defects. Unlike the recurring models for insuring, stands out as it demands a single premium paid at the time of closing. This one-time investment provides continuous coverage and peace of mind, ensuring the buyer's property rights are secure. Prominent players in the industry, like First American Financial Corporation, have emphasized the in the real estate landscape. With over a century of experience and a robust financial foundation, companies like First American provide crucial settlement and risk solutions, facilitating smooth and secure real estate transactions. In 2022, First American reported revenues of $7.6 billion, showcasing the significant role and trust placed in the protection of property rights within the industry. Despite the lower occurrence of claims in the field of property coverage in contrast to other forms, it still plays a crucial role in safeguarding against unexpected problems that may not always be apparent in public records. These could vary from undisclosed heirs asserting their rights to the real estate to outstanding payments for repairs, where coverage steps in to and cover any resulting financial responsibilities.

Lender's Title Insurance Policy

is an essential safeguard for mortgage lenders, serving as a protective barrier against the financial turmoil that defects in the title can precipitate. This type of coverage is an when obtaining a home loan, guaranteeing the lender's interest in the asset is protected. It is a proactive measure, providing coverage for potential legal challenges or claims that could arise from complications in the property's ownership, such as unresolved liens or illicit ownership transfers. The is emphasized by leaders in the field like First American Financial Corporation, a powerhouse in settlement and closing services with a rich history of over 130 years. First American stands as a testament to the industry's evolution, embracing cutting-edge technologies and comprehensive data resources to refine the real estate transaction process. Their commitment to excellence is evident in their $7.6 billion revenue in 2022 and their recognition as one of the 100 Best Companies to Work For by Great Place to Work® and Fortune Magazine for the eighth year running. Such endorsements emphasize the significance of strong protection and the role of esteemed institutions in fostering trust and innovation within the market. As new homeowners and refinance navigate the intricacies of real estate, grasping the protective measures such as coverage for property rights becomes crucial. In contrast to conventional coverage plans that require continuous payments, lender's protection is a one-time policy implemented at the time of closing. This one-time investment not only offers comprehensive protection against future disputes concerning ownership but also ensures the due diligence of a clear property ownership prior to finalizing the transaction. Furthermore, taking into account the industry's decreased claim rates in comparison to other types of coverage, the is a distinguishing characteristic of the realm of title protection, which additionally solidifies its importance in safeguarding the interests of lenders.

What is Covered Under a Title Insurance Policy?

shields buyers from different potential defects in ownership that may not be immediately obvious during the purchase. These defects can range from liens, errors in public records, and invalid deed signatures, to fraud, forgery, and undisclosed heirs. It also protects against more complex issues like boundary disputes, survey inaccuracies, and encumbrances or easements that may surface later. If there is a claim regarding the ownership, a policy for insuring the rights of the owner will not only offer financial security but also provide legal support, guaranteeing the safety of the owner's rights.

For example, if a previous owner did not fulfill a lien or transferred the real estate unlawfully, it could lead to substantial financial loss for the new owner. A specific kind of coverage addresses these situations by reducing the possibility of monetary harm caused by these defects in ownership. Furthermore, with the advancement of technology and the rise in digital transactions, , with a revenue of $7.6 billion in 2022, are leading the way in offering innovative property ownership and settlement solutions, ensuring that property ownership is clear and undisputed before closing day.

In the present property market, where a substantial amount of home acquisitions and refinancing transactions are taking place, it is vital for buyers and homeowners to comprehend the significance of . It is a one-time payment during closing that not only offers coverage but proactively resolves potential ownership issues, which is why coverage protection companies generally have lower claims rates compared to other types of protection. This proactive approach is key to preventing claims related to mortgages, judgments, liens, and mechanic's liens, which are among the most common causes for loss in the industry.

Recent news emphasizes the significance of selecting trustworthy providers for safeguarding property rights, as certain companies have experienced financial setbacks due to connections with mortgage fraud conspiracies. This emphasizes the importance of conducting careful research when choosing a company that protects your rights over your asset.

In brief, the coverage for titles is a crucial element of transactions involving properties, offering assurance and protection for owners against a broad range of defects related to titles that might otherwise remain undetected.

Financial Loss and Legal Expenses

offers a crucial safety measure for buyers, protecting against unexpected legal and financial issues that may occur following the acquisition. When defects emerge, they can be as diverse as unsatisfied liens or illicit transfers, which can jeopardize the and result in significant . The importance of protecting is underscored by its role in addressing such defects, covering associated legal costs and potential court expenses. In more severe cases, it may even extend to reimbursing the full property purchase price.

With the real estate sector evolving, , a leader with over a century of experience in providing title and settlement solutions, underscores the importance of coverage for . In 2022, First American reported a substantial total revenue of $7.6 billion, reflecting the trust placed in their services, which range from risk solutions to valuation and mortgage subservicing. As the industry faces digital transformation, the significance of protecting property rights becomes even more relevant, given that it not only resolves issues prior to claims but also offers comprehensive coverage post-closing.

Recent reports indicate that fraud related to property ownership is a growing concern, with attempts occurring frequently, leading to companies like FCT refusing to insure suspicious transactions. This vigilance is crucial as professionals in the field of property coverage work diligently to mitigate risks before they escalate into claims, a practice that results in lower claim rates compared to other types of coverage. Moreover, it is calculated that approximately one-third of all claims related to the protection of property titles arise from problems that are not documented in the public records, demonstrating the extent of coverage this type of policy offers against various defects.

Defending Against Title Claims

acts as a vital shield for landowners and lenders, offering strong security against possible deed flaws that can result in monetary damage. If there is a claim regarding the ownership rights, companies that provide protection for the rights of property titles vigorously protect the interests of their clients. They enlist seasoned legal professionals to manage the claim and shoulder the costs that arise from such legal battles. These assertions can result from a variety of , such as unsatisfied liens or illicit transfers of ownership. is highlighted by the fact that it helps preserve , which include ownership, usage, and the ability to sell the property. The industry's dedication to safeguarding ownership rights remains unwavering even as it navigates through the fluctuations of market cycles, such as the 24% decline in premium volume in Q3 of 2023 reported by ALTA. This durability is evidence of the importance of safeguarding the legal rights to real estate amidst a changing real estate environment.

The Process of Obtaining Title Insurance

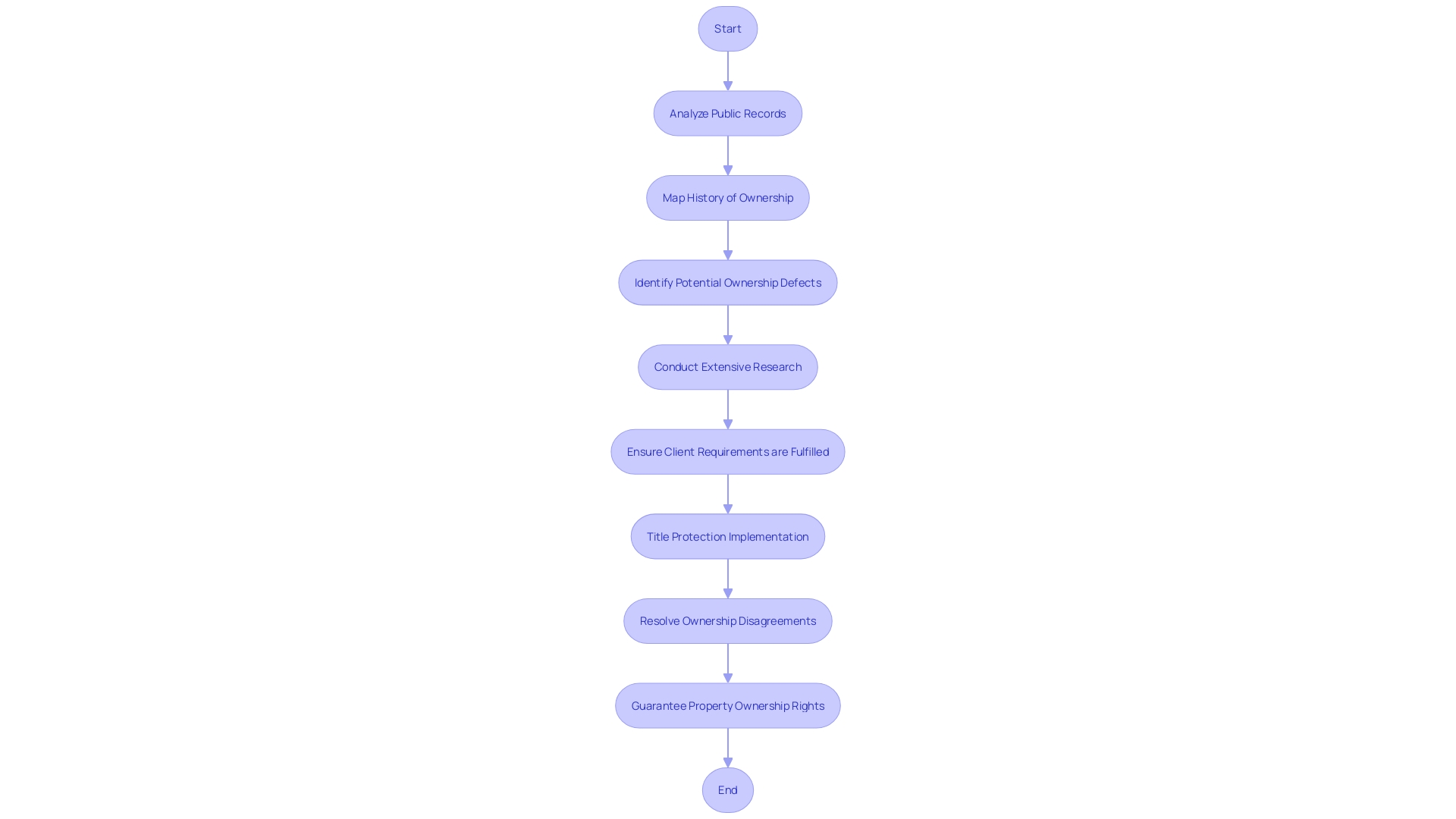

Ensuring insurance of ownership is an essential measure in safeguarding one's rights to possess. This process initiates with an exhaustive search of the accurate name, where professionals scrutinize public records to confirm the legal possession, revealing any disparities or assertions that may impact the ownership. Following this, the examination of the name goes deeper, evaluating the validity and legal standing of the document. Once these necessary due diligence steps are finished, a policy offering against any future of the property is issued.

The significance of coverage cannot be exaggerated, as it offers buyers with a protection against possible legal problems that could emerge from . By paying a one-time premium, property buyers secure the peace of mind that their investment is defended against challenges to their ownership rights. This coverage is exceptional as it not only reimburses for financial loss caused by defects in ownership but also includes the expenses of legal protection if required.

Title protection companies, with as a prime example, have been leading the way in providing such services. With a history spanning over a century, companies like First American have solidified their position by harnessing advanced technologies and extensive data assets to streamline the insurance process. As a testament to their commitment to excellence and innovation, First American was recognized among the 100 Best Companies to Work For and the 100 Best Workplaces for Innovators in 2023. Their success highlights the industry's evolution and the ongoing improvement of services provided to real estate buyers and professionals.

Title Search and Examination

The procedure of guaranteeing that a property's ownership is free of imperfections is a careful analysis of public records and other relevant documents. The company undertakes this review with precision to map the history of ownership and pinpoint any potential . For example, when purchasing an Akiya in Chiba Prefecture, extensive research is carried out to identify appropriate properties, a process that includes evaluating hundreds of listings to fulfill a client's particular requirements. This level of detail is echoed in the search for the document, where the goal is to preempt any issues that might jeopardize the legal and financial rights of the buyer or lender.

Having legal ownership grants the privilege to utilize, trade, and appreciate the asset. However, the can reveal defects like unsatisfied liens or unlawful transfers, posing a risk of financial loss. is the safeguard against such defects, offering a one-time payment at closing that affords coverage against unforeseen problems and ensures clear property ownership rights. It's an investment in peace of mind, backed by over a century of trust in the industry. Claims typically stem from mortgages, judgments, and liens, with about a third arising from issues not found in public records. In case of a disagreement, a protection policy acts as a defense, encompassing the expenses and legal charges required to settle the matter.

The significance of protecting property ownership cannot be emphasized enough. Recent statistics from ALTA report a 24% decrease in insurance premium volume in the third quarter of 2023, reflecting the current housing market challenges. Yet, its value remains paramount, especially for who might not have the means to defend their ownership rights otherwise. According to First American Financial Corporation, a prominent supplier of settlement and property rights solutions, the ongoing digital revolution in this sector is further enhancing the effectiveness of these services, guaranteeing the proper safeguarding of real estate rights in a changing landscape.

Issuance of the Title Insurance Policy

After meticulously conducting a search for the document name and confirming that no significant defects exist, a policy for safeguarding is granted, underscoring the protection it offers. The policy delineates the scope of coverage and delineates any stipulations or exceptions. In the midst of a substantial digital revolution, companies such as First American Financial Corporation, which has been leading the way for more than a century, have a crucial part in offering strong policies to protect property ownership. They offer an array of services including risk solutions for , as noted by their $7.6 billion revenue in 2022, highlighting the industry's substantial financial influence. Since possession and entitlements are fundamental to the real estate industry, safeguarding against potential flaws in the sequence of ownership, like unpaid claims or unauthorized property transfers, can prevent . With the undergoing fluctuations, such as the 24% decrease in in the third quarter of 2023 reported by ALTA, the necessity for comprehensive coverage remains crucial for both consumers and lenders in protecting their ownership rights.

Cost and Benefits of Title Insurance

Title coverage is a singular premium paid at closing, with the cost influenced by the value and whereabouts of the real estate. Its value is evident when considering the it provides to property buyers and lenders. As clarified by First American Financial Corporation, a leading provider in the field of title and settlement, title coverage safeguards against losses from defects in the title, ensuring peace of mind for stakeholders in real estate transactions. With over 130 years of experience, First American has been instrumental in advancing the industry through innovative technology and comprehensive data resources, boasting a robust $7.6 billion revenue in 2022.

Recent news highlights the significance of , with cases such as companies specializing in safeguarding property titles severing ties due to involvement in mortgage fraud conspiracies. Furthermore, FCT Canada's statistics reveal that attempts of fraud involving property titles and mortgages occur approximately every four business days, resulting in the rejection of insurance policies for transfers that are considered too suspicious, emphasizing the crucial importance of in today's real estate landscape.

John Tracy, senior legal counsel at FCT Canada, highlights the appealing reward for fraudsters targeting the real estate sector, further emphasizing the significance of protecting against such fraudulent activities. As the industry prepares for a surge in home purchases and refinancing, comprehending the advantages of title coverage, including potential discounts, becomes increasingly relevant for buyers and homeowners alike. Title protection is more than just a policyâit is a dedication to guarantee unambiguous ownership before the transaction concludes, working proactively to avoid demands and safeguard ownership rights.

One-Time Premium and Long-Term Protection

differentiates itself from other forms of coverage by being a single-premium policy, acquired at the moment of property closing, designed to safeguard the owner's or lender's interest in the for the duration of their stake in it. This one-time payment ensures that property buyers and lenders receive protection against complications arising from defects related to the ownership, which could include unresolved legal or financial claims or issues with the transfer of ownership. First American Financial Corporation, a leader in the field of protecting , states that this specialized coverage is essential in safeguarding against potential losses caused by these defects. With the changing real estate market and an expected increase in home buying and refinancing, the importance of protecting property rights is amplified. It is a critical tool that performs dual functions: preemptive problem-solving before closing and protective coverage after, with the benefit of a one-time payment providing peace of mind in an otherwise complex legal territory.

Peace of Mind and Financial Security

is a vital instrument for real estate buyers and lenders, intended to protect their interest in real estate from concerns that are not readily visible. These concealed risks can involve a range of defects regarding ownership, such as previous deception, forgery, undisclosed beneficiaries, or errors in public records, that could result in legal conflicts or financial detriment. In contrast to customary coverage, which safeguards against forthcoming incidents, offers security for preceding happenings that might impact the rights to a possession. It is a one-time investment made at closing that ensures the buyer's peaceful enjoyment of their property, backed by the diligence and financial strength of the insurer.

First American Financial Corporation, with a long and storied past surpassing 130 years, stands as proof of the field's development, providing a range of services that encompasses protection for . As one of the 100 Best Companies to Work For, as recognized by Great Place to Work® and Fortune Magazine, First American is at the forefront of innovating and streamlining the research process. This advancement is especially important in a sector where approximately one-third of all claims for property protection arise from matters that are not detected in publicly available records.

The importance of the protection policy has never been more relevant, as new homeowners may come across the phrase for the first time during the process of buying a home. It is crucial they comprehend that the coverage for ownership is a regulated service that has effectively safeguarded rights to possessions for more than one hundred years. With the expected surge in , title protection serves as a bulwark against the most common losses caused by mortgages, judgments, liens, and mechanic's liens, among others. First American's commitment to this protection is evident in their impressive $7.6 billion revenue in 2022, reflecting both their legacy and their continued service to clients domestically and internationally.

References

Title protection is a crucial aspect of owning real estate, offering legal proof of ownership and safeguarding against any future disputes over rights to the property. Unlike a deed for a property, which is a physical document, a designation signifies the legal ownership of a real estate. To safeguard this ownership and avoid potential issues, a plays a crucial role. According to First American Financial Corporation, a prominent provider of title, settlement, and risk solutions, the coverage for ownership rights is a one-time payment made at closing that not only addresses potential issues but also ensures clear beforehand. This is particularly important as the industry anticipates a surge in home purchases and refinances, leading to a proliferation of inquiries regarding the safeguarding of property rights. As emphasized by experts, the kind of coverage referred to as stands out from other types of insurance by actively preventing problems before they have the chance to result in claims, leading to a reduced claims rate for companies specializing in title insurance. It's reported that about one-third of all title insurance claims arise from issues that are not recorded in public records, such as undisclosed heirs or outstanding payments, emphasizing the importance of this coverage for homeowners. With First American's impressive $7.6 billion revenue in 2022 and accolades such as being named one of the 100 Best Companies to Work For, it's clear that the industry is evolving with innovative technologies and comprehensive services to ensure property buyers are well-protected.

Conclusion

In conclusion, title insurance is a crucial aspect of real estate transactions, providing financial protection and legal defense against defects in property ownership. First American Financial Corporation, a leader in the industry, has been providing comprehensive title and settlement solutions for over a century, generating a revenue of $7.6 billion in 2022.

Title insurance protects against a wide range of title defects, ensuring that any potential challenges to a title are effectively managed. It covers legal expenses and compensates for losses, offering peace of mind and long-term protection for property buyers and lenders.

By conducting meticulous searches and examinations of property histories, title insurance uncovers latent issues and indemnifies policyholders for legal defense expenses and monetary losses. Companies like First American Financial Corporation leverage innovative technologies and extensive data assets to enhance the efficiency and reliability of their services.

Title insurance plays a vital role in covering title defects for property owners and lenders alike. It shields buyers from pre-existing issues that might challenge their rights to the property and ensures the security of mortgage lenders' investments.

In summary, title insurance is an essential aspect of property transactions, providing peace of mind and long-term coverage. It safeguards against a wide array of title defects, ensuring transparent property rights in the real estate industry. With the expertise and commitment of industry leaders like First American Financial Corporation, title insurance continues to play a vital role in ensuring smooth and secure real estate transactions.

Protect your property rights with comprehensive title insurance coverage. Click here to learn more.

Frequently Asked Questions

What is title insurance?

Title insurance is a form of protection for property buyers and lenders that safeguards against financial losses related to defects or disputes in property ownership. It covers legal defense costs and damages arising from ownership disputes.

Why is title insurance important?

Title insurance ensures that property rights are handled securely and transparently, protecting against potential ownership claims that could arise after a property purchase. It has been a critical component of real estate transactions for over a century.

What are title defects?

Title defects are issues that disrupt the clear transfer of property ownership. They can include inaccuracies in public records, liens due to unpaid debts, invalidly executed deeds, and undisclosed heirs, among others.

How does title insurance protect against title defects?

Title insurance offers financial compensation for legal expenses and damages if any defects emerge post-purchase. The insurance company conducts a thorough investigation of the property's history before issuing a policy.

What types of title insurance policies are available?

There are two main types of title insurance policies: Owner's Title Insurance, which protects the buyer from issues that could affect ownership rights, and Lender's Title Insurance, which protects the lender's investment by safeguarding against similar risks.

What does a title insurance policy cover?

A title insurance policy covers a range of potential defects, including liens, errors in public records, fraud, boundary disputes, and undisclosed heirs, providing legal support and financial security against these issues.

How much does title insurance cost?

Title insurance is typically a one-time premium paid at the closing of the property sale, with the cost depending on the property's value and location.

What is the process of obtaining title insurance?

The process involves a thorough search of public records to confirm legal ownership and identify any potential defects. Once the search is complete and no significant issues are found, a title insurance policy is issued.

What is the difference between title insurance and other types of insurance?

Unlike conventional insurance that covers future incidents, title insurance protects against past defects that could impact ownership rights. It is a one-time payment that provides ongoing coverage for as long as the insured holds an interest in the property.

How does title insurance contribute to peace of mind for property buyers?

Title insurance provides security against hidden risks related to property ownership, ensuring that buyers can enjoy their property without the fear of unexpected legal issues arising from title defects.

Why should I choose a reputable title insurance provider?

Selecting a trustworthy provider is essential to ensure that you receive reliable coverage. Recent incidents of fraud in the industry highlight the importance of conducting thorough research when choosing a title insurance company.

How does First American Financial Corporation relate to title insurance?

First American Financial Corporation is a leading provider of title and settlement solutions, with over a century of experience. They reported $7.6 billion in revenue in 2022, showcasing their strong position in the industry and commitment to innovative services.