Overview

Title companies serve as neutral third parties, expertly managing escrow to oversee the transfer of funds and documents during real estate transactions, thereby ensuring that all legal obligations are fulfilled. This article delineates a comprehensive step-by-step process, emphasizing their critical roles in:

- Title searches

- Insurance provision

- Closing coordination

- Problem resolution

Collectively, these functions safeguard the interests of both buyers and sellers while streamlining the transaction process, reinforcing the reliability of title companies in facilitating successful real estate deals.

Introduction

Title companies are the backbone of real estate transactions, ensuring that the intricate process of escrow is managed with precision and integrity. Acting as neutral third parties, they facilitate the secure transfer of funds and documents, safeguarding the interests of both buyers and sellers.

However, navigating the complexities of escrow management can present significant challenges, including:

- Delays

- Financing issues

- Communication breakdowns

How do title companies effectively streamline this process while maintaining trust and efficiency? This article delves into the step-by-step procedures employed by title companies, highlighting their essential services and the innovative solutions they implement to overcome common obstacles in escrow management.

Define Title Companies and Their Role in Escrow Management

within the real estate industry, ensuring that property documents are valid and free from liens or encumbrances. Acting as neutral third parties in the escrow process, they demonstrate how by and documents between buyers and sellers. Their primary responsibilities encompass:

- Conducting comprehensive ownership searches

- Providing ownership insurance

- Overseeing the closing process

By meticulously confirming that all legal obligations are fulfilled, these firms protect the interests of all parties involved in a transaction. In fact, approximately 80% of real estate dealings involve title firms, underscoring their critical role in facilitating .

Furthermore, organizations with documented risk management procedures experience 40% fewer claims compared to those without, emphasizing the importance of and efficiency. As one industry expert noted, 'Success in the sector begins with rock-solid operations,' which highlights the necessity for robust operational frameworks.

Additionally, firms that have embraced automation tools report an impressive 35% , showcasing how title companies manage escrow and enhance their effectiveness through technology. Parse AI's innovative approach, which employs machine learning and optical character recognition, further aids firms in improving efficiency and accuracy in their operations. Overall, the in safeguarding property rights and ensuring the reliability of transactions.

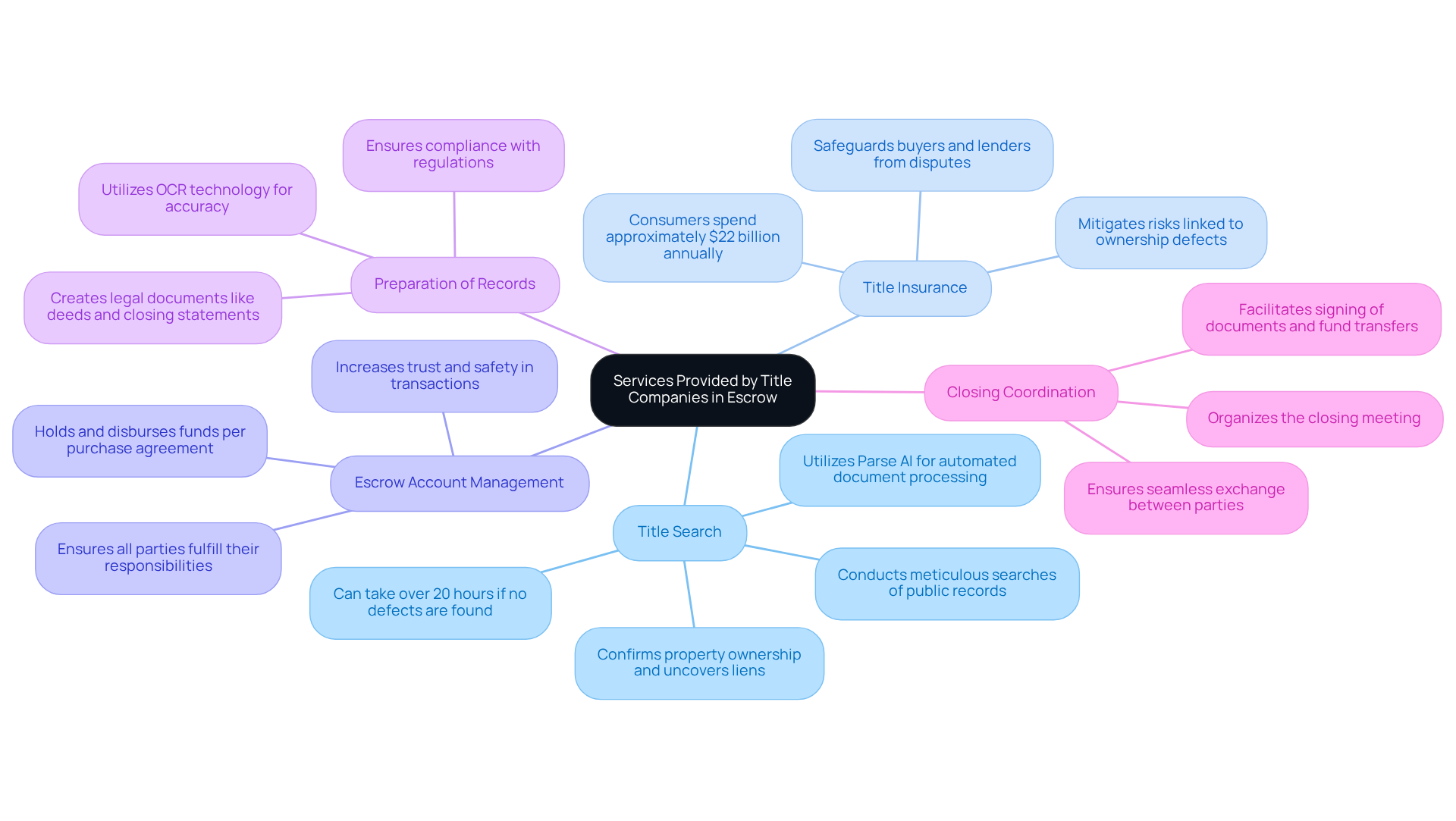

Explore Services Provided by Title Companies in Escrow

Title companies play a crucial role in escrow management by offering a variety of :

- : This involves conducting meticulous searches of public records to confirm property ownership and uncover any existing liens or claims against the property. The typical search for a property can take more than 20 hours to finish if no unusual defects are discovered, emphasizing the intricacy of this procedure. With 's advanced machine learning tools, researchers can expedite this process, utilizing automated document processing to handle large sets of unstructured documents efficiently.

- : Title companies provide insurance policies that safeguard buyers and lenders from potential disputes regarding property ownership. In 2025, the average expense of ownership insurance policies is anticipated to mirror ongoing trends in the housing market, where consumers spend roughly $22 billion each year on ownership insurance. This context highlights the in real estate deals.

- : They manage escrow accounts by holding and disbursing funds in accordance with the terms of the purchase agreement. This guarantees that all parties fulfill their responsibilities prior to the agreement being completed, thus increasing trust and safety in the process.

- : Title companies create all required legal papers, such as deeds and closing statements, ensuring adherence to state and federal regulations. This meticulous attention to detail is vital for the legality and smooth execution of real estate transactions. Parse AI improves this process through features such as OCR technology and interactive labeling, which simplify preparation and ensure accuracy.

- : They organize the closing meeting where all parties sign documents and funds are transferred. This coordination is crucial for ensuring a seamless exchange, allowing buyers and sellers to finalize their agreements efficiently.

Overall, the services offered by organizations in the industry are essential to , ensuring clarity, security, and compliance throughout. Moreover, industry leaders stress the significance of ownership insurance in reducing risks linked to ownership defects, which can total an each year. This emphasizes the vital function of real estate firms in safeguarding consumers and lenders equally, and with the incorporation of Parse AI's solutions, these businesses can further improve their operational efficiency and precision.

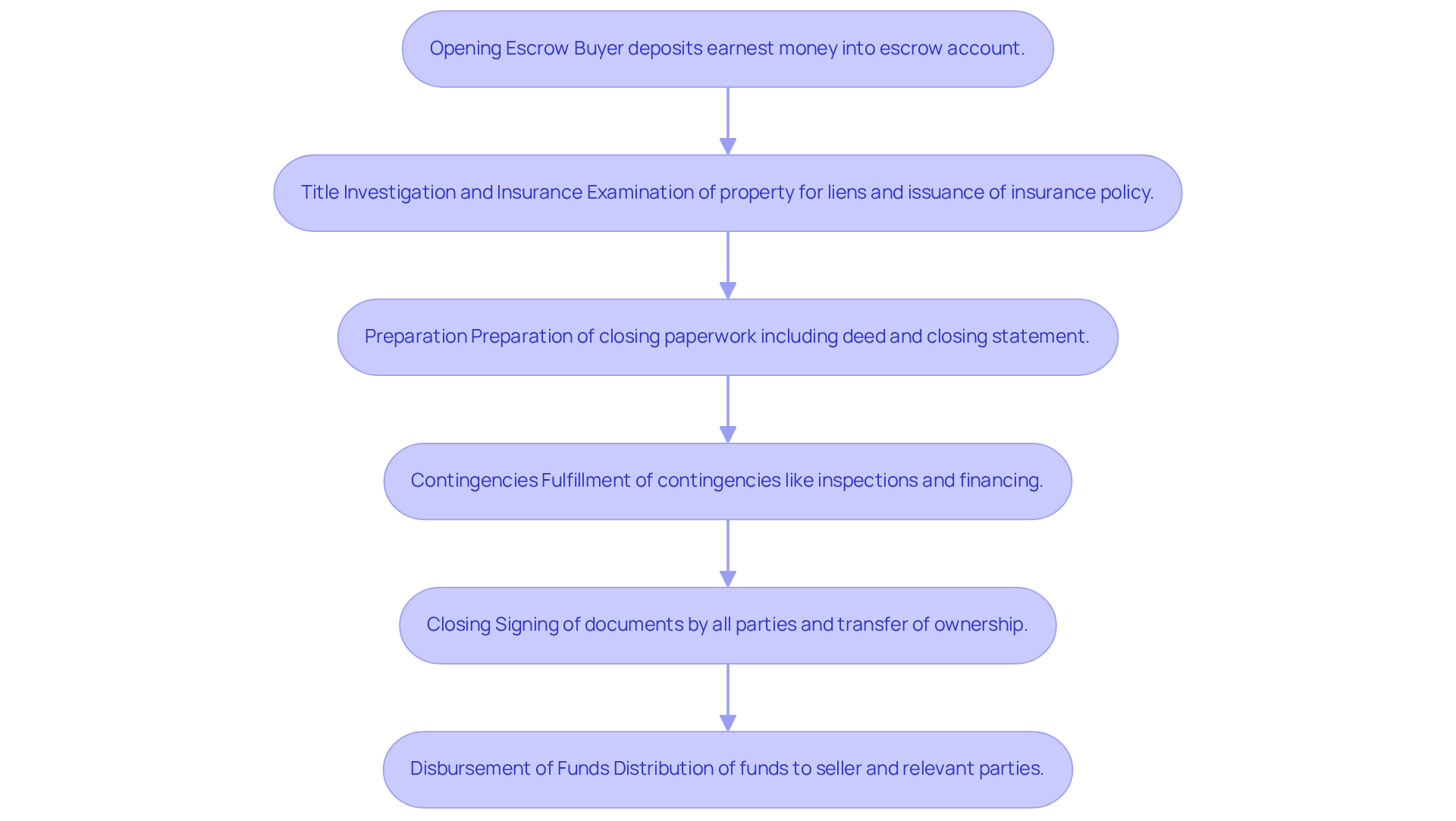

Detail the Escrow Process: Step-by-Step Guide

is crucial for ensuring a in real estate transactions. It typically involves several key steps:

- Opening Escrow: Once the purchase agreement is signed, the buyer deposits earnest money—typically between 1-5 percent of the purchase price—into an escrow account overseen by the firm. This initial deposit demonstrates the buyer's commitment to the transaction.

- Title Investigation and Insurance: The firm performs a and other concerns. Subsequently, an insurance policy is provided to safeguard against any unexpected claims.

- Preparation: The all necessary paperwork for closing, including the deed and closing statement. Proper , as it ensures that all legal requirements are met and helps prevent misunderstandings during the process.

- Contingencies: Both the buyer and seller must fulfill any contingencies outlined in the purchase agreement, such as completing inspections or securing financing. This step can significantly impact the timeline, as it may take anywhere from 30 to 60 days or more, depending on the complexity of the transaction.

- Closing: All parties involved convene to sign the necessary documents. The organization plays a crucial role in enabling the transfer of funds and property ownership, ensuring that all conditions are met before concluding the sale.

- : After closing, the title company distributes funds to the seller and any other relevant parties, finalizing the deal. This step is critical for ensuring that all parties receive their due payments promptly.

[Understanding how title companies manage escrow](https://linkedin.com/pulse/understanding-escrows-real-estate-bill-gassett-realtor-k8pue) is essential for real estate experts, as it by securely retaining funds and paperwork during the deal. As highlighted by industry specialists, efficient paperwork preparation and compliance with the escrow schedule are essential elements in attaining successful real estate transactions.

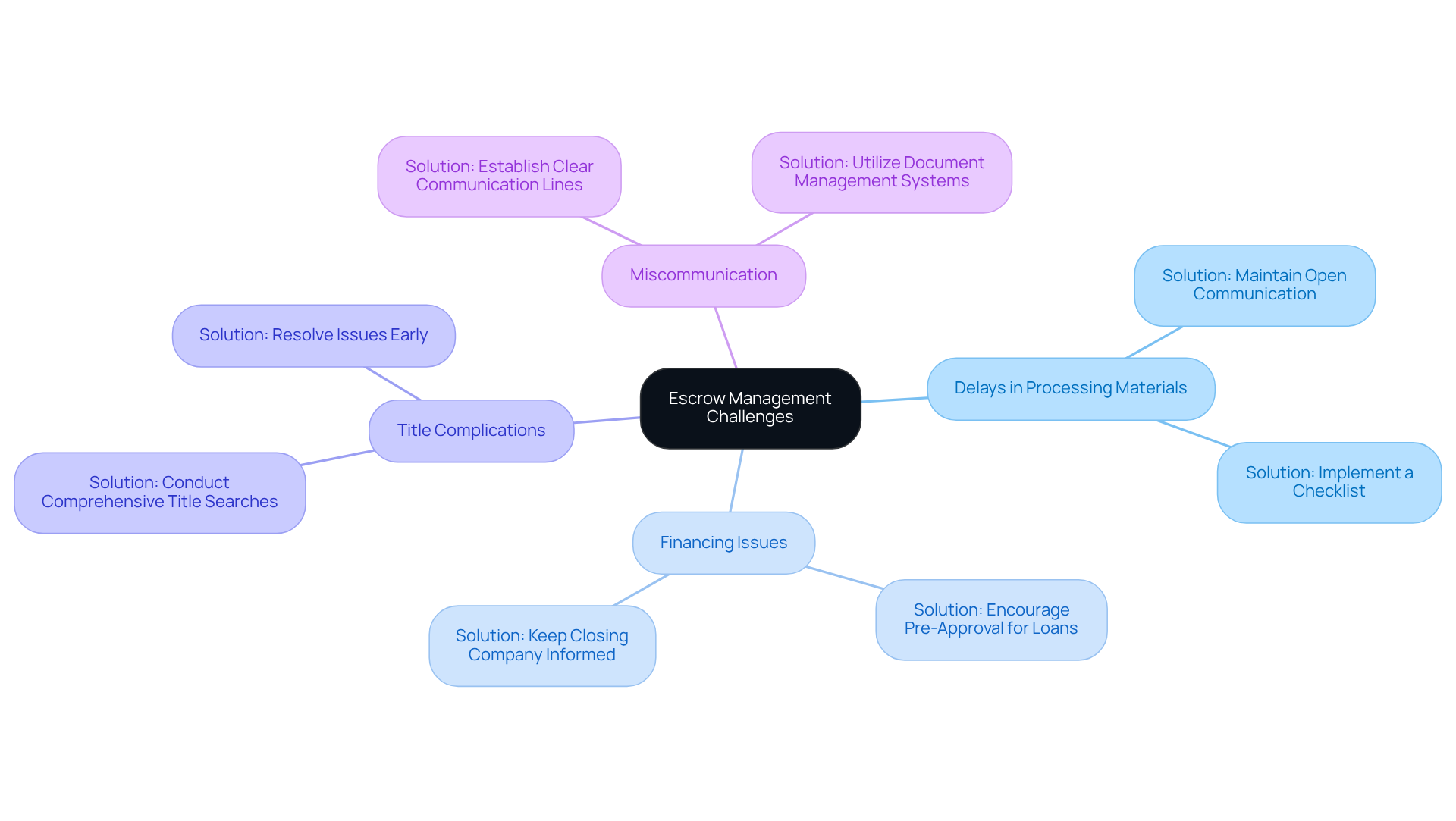

Identify Challenges in Escrow Management and Solutions

Common challenges in escrow management include:

- Delays in Processing Materials: can significantly slow down the closing process, leading to frustration for all parties involved. In reality, employees spend an average of two hours each day looking for files, which can worsen these delays. Furthermore, 95 percent of employees have felt frustrated when looking for files. Solution: Maintain and implement a checklist to ensure that all required documents are submitted promptly, much like how .

- : Last-minute changes in financing can jeopardize the deal, with 39% of buyers under 35 facing challenges due to insufficient savings for down payments. Younger Americans are often due to insufficient savings for a down payment and student debt. Solution: Encourage buyers to obtain pre-approval for loans and keep the closing company informed of any changes to their financial situation to mitigate risks.

- Title Complications: Discovering liens or claims against the property can complicate the transaction, often resulting in costly delays. A comprehensive document search can uncover possible problems early on. lead to a 21.3% decrease in productivity, highlighting the significance of tackling name complications early in the process. Solution: Conduct at the outset to identify and resolve any issues before closing, which demonstrates how title companies manage escrow to ensure a smoother transaction.

- Miscommunication: Lack of clear communication can lead to misunderstandings and errors, which are common in the fast-paced real estate environment. In fact, 46% of employees struggle to find the information they need to carry out their job. Solution: Establish a clear line of communication among all parties involved and utilize technology, such as document management systems, to share updates and documents efficiently, reducing the likelihood of errors.

Conclusion

Title companies serve a pivotal role in the escrow process, acting as impartial intermediaries that facilitate secure and efficient real estate transactions. Their expertise not only ensures that all legal obligations are met but also provides peace of mind to buyers and sellers alike. By managing the transfer of funds and documentation, title firms uphold the integrity of property transactions, demonstrating their indispensable value in the real estate industry.

Throughout this article, several key aspects of how title companies manage escrow have been explored. From conducting thorough title searches and providing essential title insurance to overseeing the entire closing process, these firms are integral to ensuring that all parties fulfill their commitments. Moreover, the challenges faced in escrow management, such as delays and miscommunication, have been highlighted, along with effective solutions to mitigate these issues. The incorporation of advanced technology, like Parse AI, further enhances their operational efficiency, illustrating how innovation can streamline the escrow process.

In light of the significant impact that title companies have on real estate transactions, understanding their role in escrow management becomes crucial for anyone involved in the property market. As the industry continues to evolve, adopting best practices and leveraging technology will be vital in overcoming challenges and ensuring smooth transactions. By recognizing the importance of these firms and their processes, stakeholders can navigate the complexities of real estate with greater confidence and security.

Frequently Asked Questions

What are title companies and what role do they play in escrow management?

Title companies are essential organizations in the real estate industry that ensure property documents are valid and free from liens or encumbrances. They act as neutral third parties in the escrow process, overseeing the transfer of funds and documents between buyers and sellers.

What are the primary responsibilities of title companies?

The primary responsibilities of title companies include conducting comprehensive ownership searches, providing ownership insurance, and overseeing the closing process to ensure all legal obligations are fulfilled.

How prevalent are title companies in real estate transactions?

Approximately 80% of real estate dealings involve title companies, highlighting their critical role in facilitating smooth and secure property transfers.

What impact do documented risk management procedures have on title companies?

Organizations with documented risk management procedures experience 40% fewer claims compared to those without, emphasizing the importance of operational integrity in maintaining trust and efficiency.

How does automation benefit title companies?

Title companies that have embraced automation tools report a 35% increase in processing efficiency, enhancing their effectiveness in managing escrow and other operations.

What innovative technologies are being used by title companies to improve their operations?

Title companies are using technologies such as machine learning and optical character recognition, as demonstrated by Parse AI's approach, to improve efficiency and accuracy in their operations.

Why are the contributions of title firms considered vital in real estate transactions?

The contributions of title firms are vital because they safeguard property rights and ensure the reliability of transactions, protecting the interests of all parties involved.