Overview

Title companies effectively manage disbursements through a structured process that encompasses gathering resources, verifying conditions, preparing distribution instructions, executing payments, and maintaining documentation. This article underscores the importance of leveraging advanced technologies—such as digital payment solutions and document management systems—to enhance operational efficiency. Furthermore, it highlights how these innovations minimize common challenges, including incomplete documentation and delays in fund approvals.

Introduction

Navigating the intricate world of real estate transactions necessitates a profound understanding of the pivotal role title companies play, particularly in managing disbursements. These firms are increasingly embracing advanced technologies to streamline processes, positioning themselves to enhance operational efficiency and elevate stakeholder satisfaction. However, the journey toward effective disbursement management is fraught with challenges, ranging from incomplete documentation to compliance issues.

How can title companies surmount these obstacles while ensuring timely and accurate fund distribution? This article delves into the essential steps and innovative solutions that can transform disbursement practices within the real estate sector.

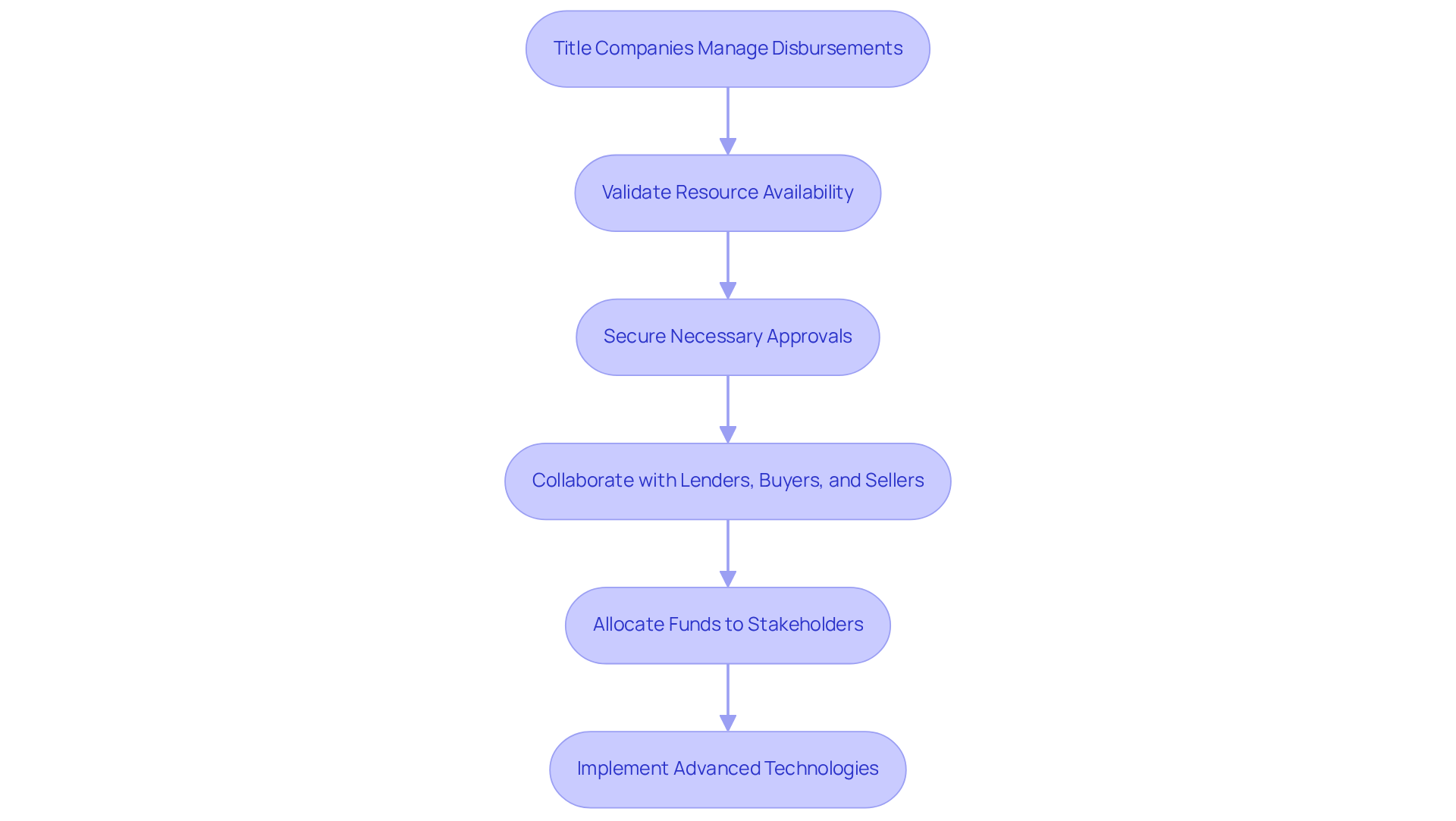

Understand the Role of Title Companies in Disbursement Management

Title firms play a crucial role in the real estate transaction process, particularly in how title companies manage disbursements. Their responsibilities encompass ensuring that all distribution requirements are fulfilled, which includes validating resource availability and securing necessary approvals, particularly in relation to how title companies manage disbursements. This coordination demands close collaboration with lenders, buyers, and sellers to achieve alignment among all parties. Furthermore, firms are tasked with allocating funds to various stakeholders, such as real estate agents, contractors, and other service providers, while considering how title companies manage disbursements during the transaction.

In 2025, the significance of firms managing property transactions is underscored by a striking statistic: 85% of global real estate leaders plan to increase their investment in new technologies aimed at enhancing operational efficiency. This trend reflects the sector's recognition of the need for streamlined procedures, particularly in how title companies manage disbursements.

Parse AI's advanced machine learning tools, including the example manager, are revolutionizing document processing and research automation, enabling firms to expedite their operations. With features like full-text search and machine learning extraction, Parse AI enhances courthouse document processing, facilitating quicker and more accurate information retrieval. These technological advancements directly address the challenges firms face in understanding how title companies manage disbursements, significantly improving their efficiency and precision.

Case studies illustrate how title companies manage disbursements by successfully integrating instant payments, transforming disbursement practices. For instance, the adoption of instant payments has enabled firms to operate continuously, illustrating how title companies manage disbursements by accelerating fee and commission payments while substantially reducing fraud risks. By replacing traditional methods such as checks and ACH payments, these organizations can enhance transaction speed and improve how title companies manage disbursements.

Understanding the vital role of title companies in fund management, alongside leveraging advanced tools like those provided by Parse AI, is essential for real estate professionals aiming to improve their workflows and elevate customer satisfaction.

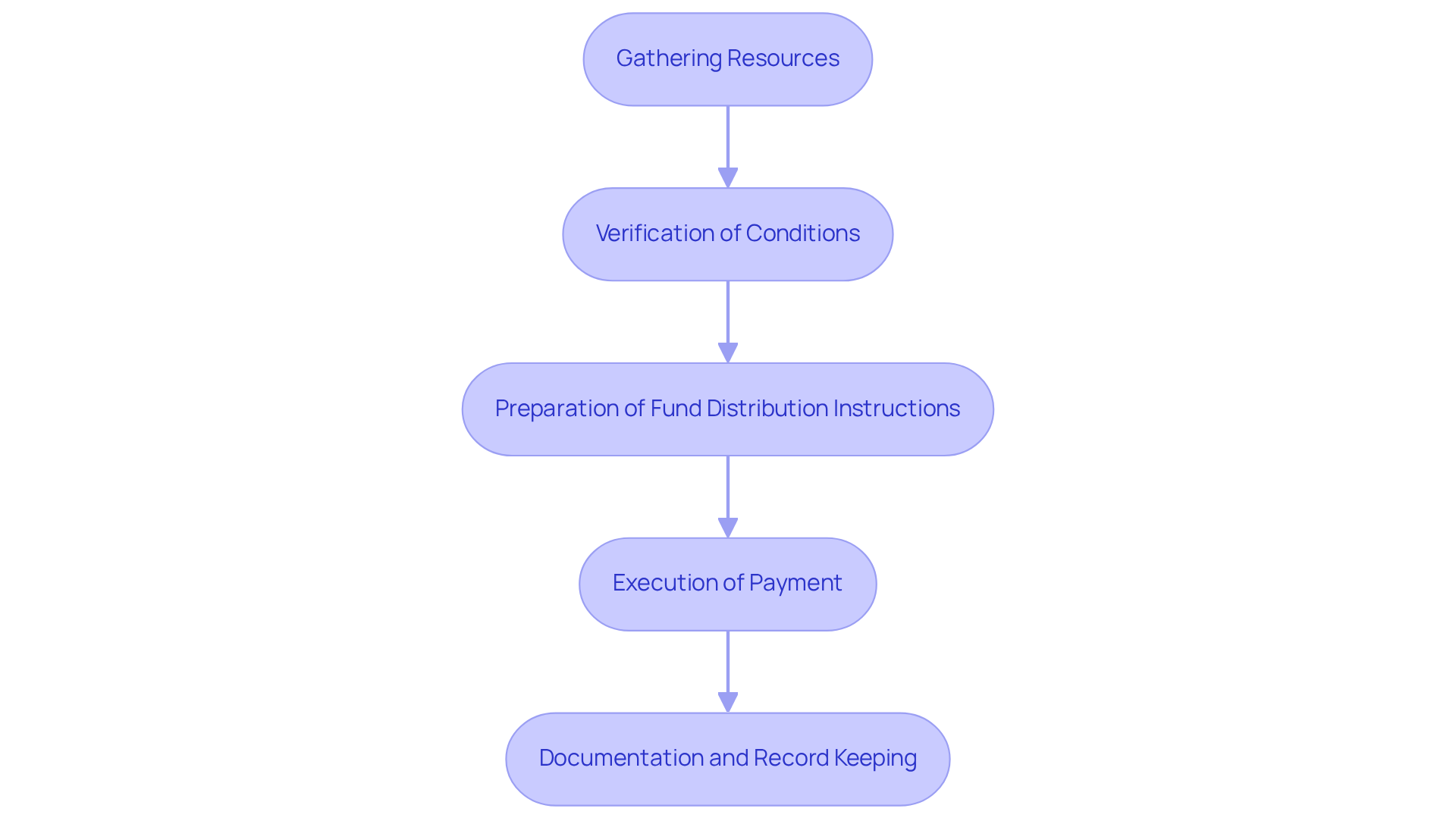

Follow the Disbursement Process: Steps from Collection to Distribution

-

Gathering Resources: The disbursement procedure initiates with the collection of resources from various sources, including buyer deposits and lender financing. It is imperative to securely hold all assets in an escrow account, ensuring their safety and compliance with regulations. As stated, 'Ninety percent of all millionaires achieve this through owning real estate,' which highlights how title companies manage disbursements and the importance of efficient capital management within the industry.

-

Verification of Conditions: Prior to allocating any resources, confirm that all terms of the sale have been satisfied. This includes verifying that the title is clear and that all requisite documents are duly signed. Engaging with legal professionals can significantly mitigate risks associated with this critical step.

-

Preparation of Fund Distribution Instructions: Develop comprehensive instructions that delineate how funds will be allocated. This should detail how title companies manage disbursements by specifying amounts and recipients for each payment. Adhering to best practices can help clarify how title companies manage disbursements and avert potential disputes.

-

Execution of Payment: After verifying all conditions and preparing instructions, proceed with the payment execution. This may involve electronic transfers or issuing checks to the respective parties, which demonstrates how title companies manage disbursements to ensure timely and accurate distribution of funds.

-

Documentation and Record Keeping: Following distribution, it is essential to maintain meticulous records of all transactions, including copies of checks, receipts, and distribution instructions. This documentation is crucial for understanding how title companies manage disbursements and for future reference. As emphasized, "Owning a home is a keystone of wealth - both financial affluence and emotional security," highlighting the importance of precise record-keeping in achieving financial success in real estate.

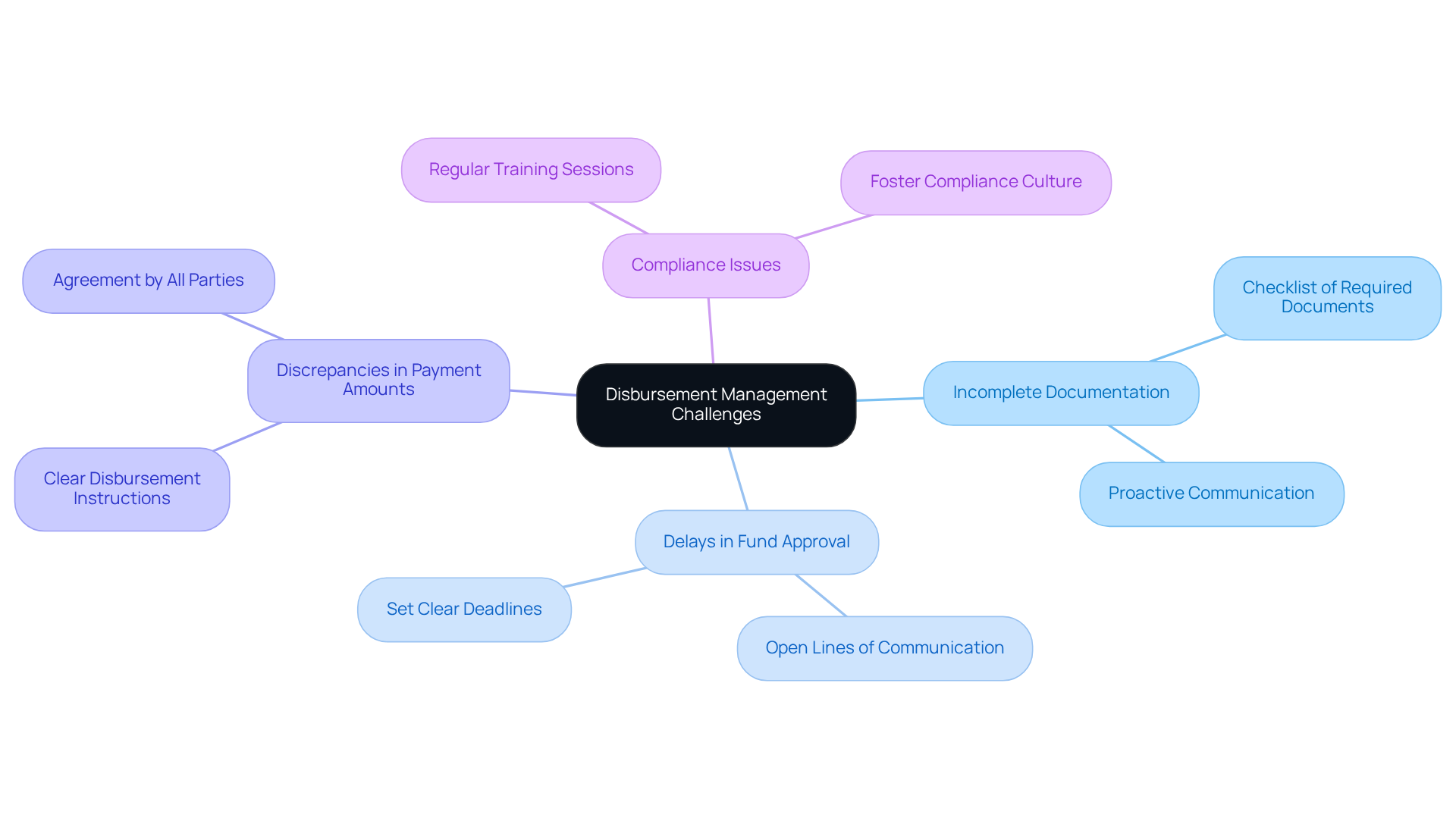

Address Common Challenges in Disbursement Management and Solutions

-

Incomplete Documentation: A prevalent challenge in disbursement management is the handling of incomplete or missing documentation. Statistics indicate that incomplete documentation can lead to significant delays, with estimates suggesting that these delays could cost title companies up to $30 billion annually. To mitigate this issue, it is essential to establish a comprehensive checklist of required documents and ensure that all parties involved are fully aware of how title companies manage disbursements and their responsibilities. As noted by industry experts, proactive measures are crucial in addressing this challenge.

-

Delays in Fund Approval: Delays often arise when approvals from lenders or other stakeholders are not received promptly. According to recent data, the average delay in fund approval can extend up to several days, impacting overall transaction timelines. To combat this, maintaining open lines of communication with all parties is crucial. Setting clear deadlines for approvals can help streamline the process of how title companies manage disbursements and reduce waiting times, ultimately enhancing overall efficiency.

-

Discrepancies in Payment Amounts: Misunderstandings related to payment amounts can lead to discrepancies that complicate distribution processes. To prevent such issues, it is vital to ensure that all disbursement instructions are clearly articulated and agreed upon by all parties before execution, as this relates to how title companies manage disbursements. This clarity can significantly reduce the likelihood of disputes and facilitate smoother transactions. Experts emphasize the importance of clear communication in avoiding these common pitfalls.

-

Compliance Issues: Navigating the intricate terrain of legal obligations can present difficulties for title firms. Regular training sessions and updates on compliance regulations are essential for keeping staff informed and equipped to handle potential pitfalls. By fostering a culture of compliance awareness, companies can minimize risks and enhance their operational integrity. The recent settlement involving the National Association of Realtors highlights the critical nature of compliance in maintaining industry standards.

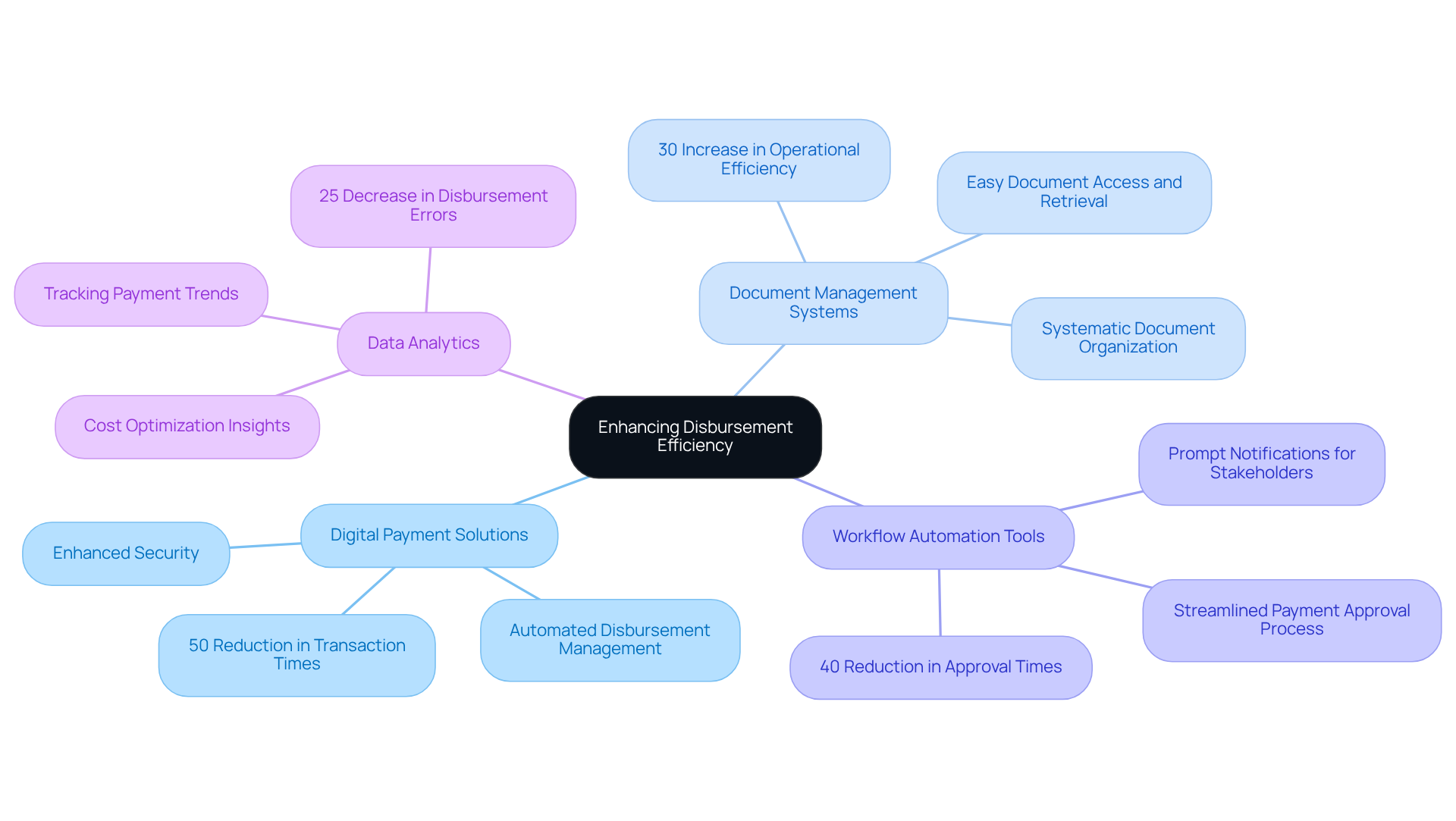

Utilize Technology and Tools to Enhance Disbursement Efficiency

- Digital Payment Solutions: The implementation of digital payment platforms is crucial for secure and efficient fund transfers in real estate transactions. These platforms automate various aspects of how title companies manage disbursements, which significantly reduces manual entry errors and enhances overall accuracy. Statistics indicate that businesses utilizing digital payment solutions can reduce transaction times by up to 50%, thereby facilitating quicker closings and enhancing client satisfaction.

- Document Management Systems: The adoption of document management software enables title firms to systematically arrange and preserve all pertinent documents in a digital format. This system ensures easy access and retrieval, which is essential for understanding how title companies manage disbursements during the distribution process. For instance, companies that have embraced advanced document management systems report a 30% increase in operational efficiency, as staff can swiftly locate necessary documents without the need to sift through physical files.

- Workflow Automation Tools: Workflow automation tools can streamline the approval process for payments by sending reminders and notifications to stakeholders. This technology ensures prompt approvals, minimizing delays in the payment process. By automating these processes, firms can achieve a 40% reduction in approval times, positively impacting how title companies manage disbursements and allowing for faster fund distribution and improved service delivery.

- Data Analytics: The utilization of data analytics empowers title firms to track payment trends and identify areas for enhancement. Analyzing how title companies manage disbursements can help optimize processes and reduce costs. Companies leveraging data analytics report a 25% decrease in disbursement-related errors, resulting in more reliable financial management and increased profitability.

Conclusion

Title companies play a pivotal role in managing disbursements during real estate transactions, ensuring that funds are allocated accurately and efficiently among all stakeholders involved. Understanding the intricacies of the disbursement process—from gathering resources to executing payments—enables real estate professionals to enhance their workflows and improve client satisfaction. This comprehensive approach emphasizes the importance of collaboration and communication, while also highlighting the need for meticulous documentation and adherence to compliance standards.

Key insights reveal that leveraging technology, such as digital payment solutions and document management systems, can significantly boost efficiency in disbursement management. Furthermore, automation tools and data analytics streamline processes, reduce errors, and accelerate transaction timelines. Addressing common challenges, such as incomplete documentation and delays in approvals, is essential for title companies to maintain operational integrity and uphold industry standards.

Ultimately, the integration of advanced technology and best practices in disbursement management is not merely an operational necessity; it is a strategic advantage that can lead to improved financial outcomes and enhanced customer experiences. Real estate professionals are encouraged to embrace these innovations and continuously seek ways to refine their disbursement processes, ensuring they remain competitive in an evolving market.

Frequently Asked Questions

What is the role of title companies in disbursement management?

Title companies play a crucial role in real estate transactions by managing disbursements, ensuring that all distribution requirements are met, validating resource availability, and securing necessary approvals. They coordinate closely with lenders, buyers, and sellers to align all parties involved.

Who are the stakeholders that title companies allocate funds to during a transaction?

Title companies allocate funds to various stakeholders, including real estate agents, contractors, and other service providers involved in the transaction.

What trend is influencing title companies to invest in new technologies?

In 2025, 85% of global real estate leaders plan to increase their investment in new technologies to enhance operational efficiency, highlighting the need for streamlined procedures in disbursement management.

How is Parse AI contributing to the efficiency of title companies?

Parse AI utilizes advanced machine learning tools to revolutionize document processing and research automation, enabling title companies to expedite operations, improve information retrieval, and enhance efficiency in disbursement management.

What are the benefits of integrating instant payments in disbursement practices?

The integration of instant payments allows title companies to operate continuously, accelerating fee and commission payments, reducing fraud risks, and improving transaction speed compared to traditional methods like checks and ACH payments.

Why is understanding the role of title companies important for real estate professionals?

Understanding the role of title companies in fund management, along with leveraging advanced tools, is essential for real estate professionals to improve their workflows and elevate customer satisfaction.