Overview

The article delineates five essential steps that title companies undertake to generate title insurance policies. It underscores the significance of meticulous research, document analysis, legal collaboration, and the integration of technology. Each step, from conducting ownership research to leveraging advanced technologies, is pivotal in ensuring accuracy and compliance. This rigorous process safeguards property owners and lenders against potential financial losses stemming from ownership disputes.

Introduction

Title insurance is essential in real estate transactions, providing crucial protection for property owners and lenders against unexpected financial losses related to ownership disputes. As the title insurance market expands, it becomes increasingly important for real estate professionals to grasp the fundamental steps in generating these policies.

However, the intricacies of title research and compliance present significant challenges. What strategies can streamline this process and ensure comprehensive protection for all parties involved? By understanding these critical aspects, professionals can navigate the complexities of title insurance effectively.

Understand Title Policies and Their Importance

serves as that protect property owners and lenders from . Understanding the two primary types of title insurance—owner's coverage and —is crucial for . An owner's plan is designed to , ensuring protection against potential problems such as unpaid taxes, fraud, and claims from previous owners. Conversely, a lender's policy protects the lender's investment, addressing similar risks while emphasizing the financial interests of the lending institution.

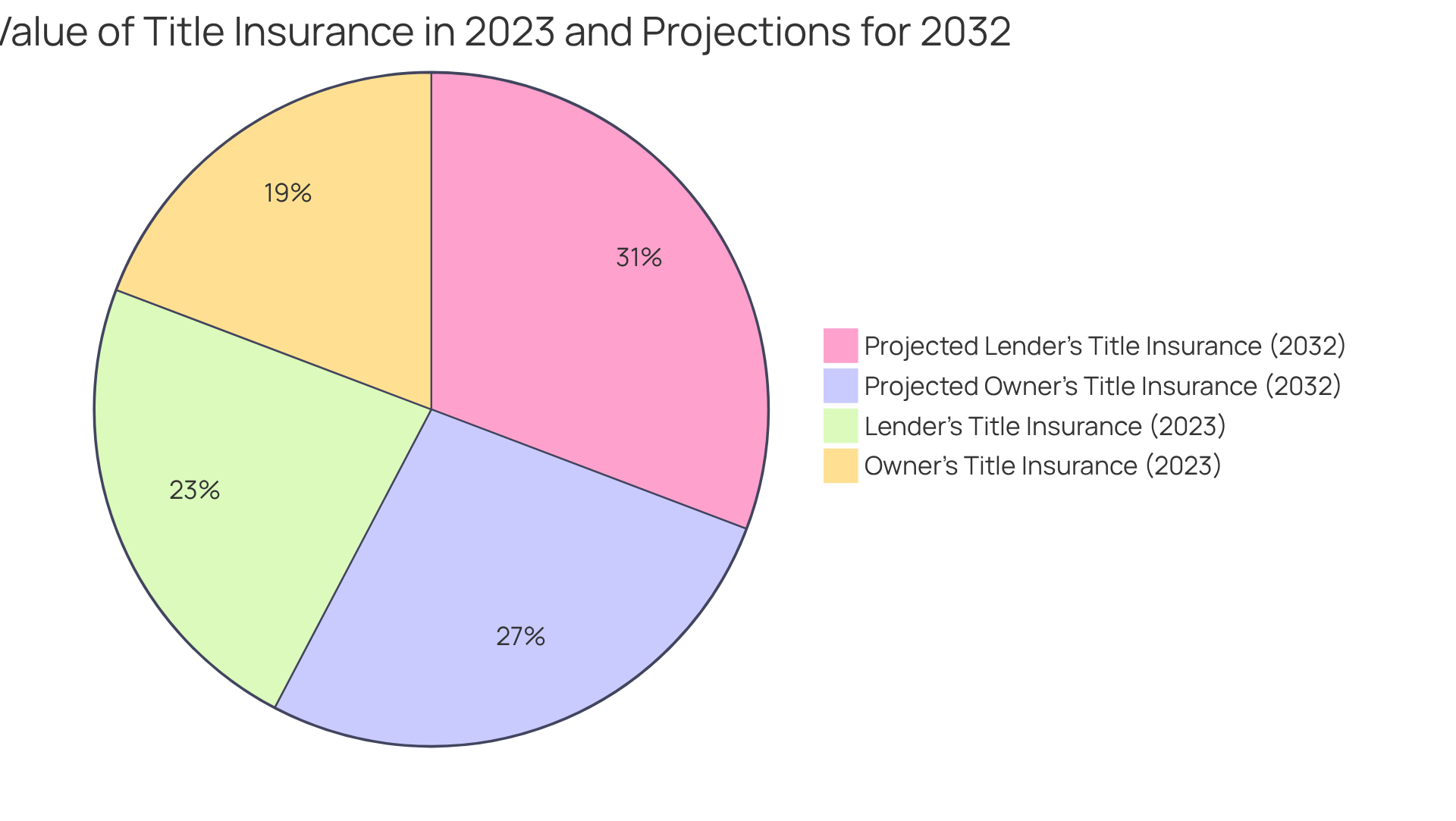

Both policies play a significant role in real estate transactions, providing to all parties involved. For instance, the Title Insurance Market is valued at 3.74 billion USD in 2023, with the owner's insurance valued at 1.5 billion USD and projected to increase to 2.1 billion USD by 2032, while lender's insurance is expected to reach 2.4 billion USD by the same year. This growth underscores the rising acknowledgment of the importance of insurance in safeguarding ownership rights and facilitating seamless transactions.

Familiarizing yourself with these guidelines not only enhances your ability to convey their significance to clients and stakeholders but also establishes you as an informed resource in the real estate sector. Case studies, such as , exemplify the critical role these guidelines play in mitigating risks and ensuring safe asset transfers.

Conduct Comprehensive Property Ownership Research

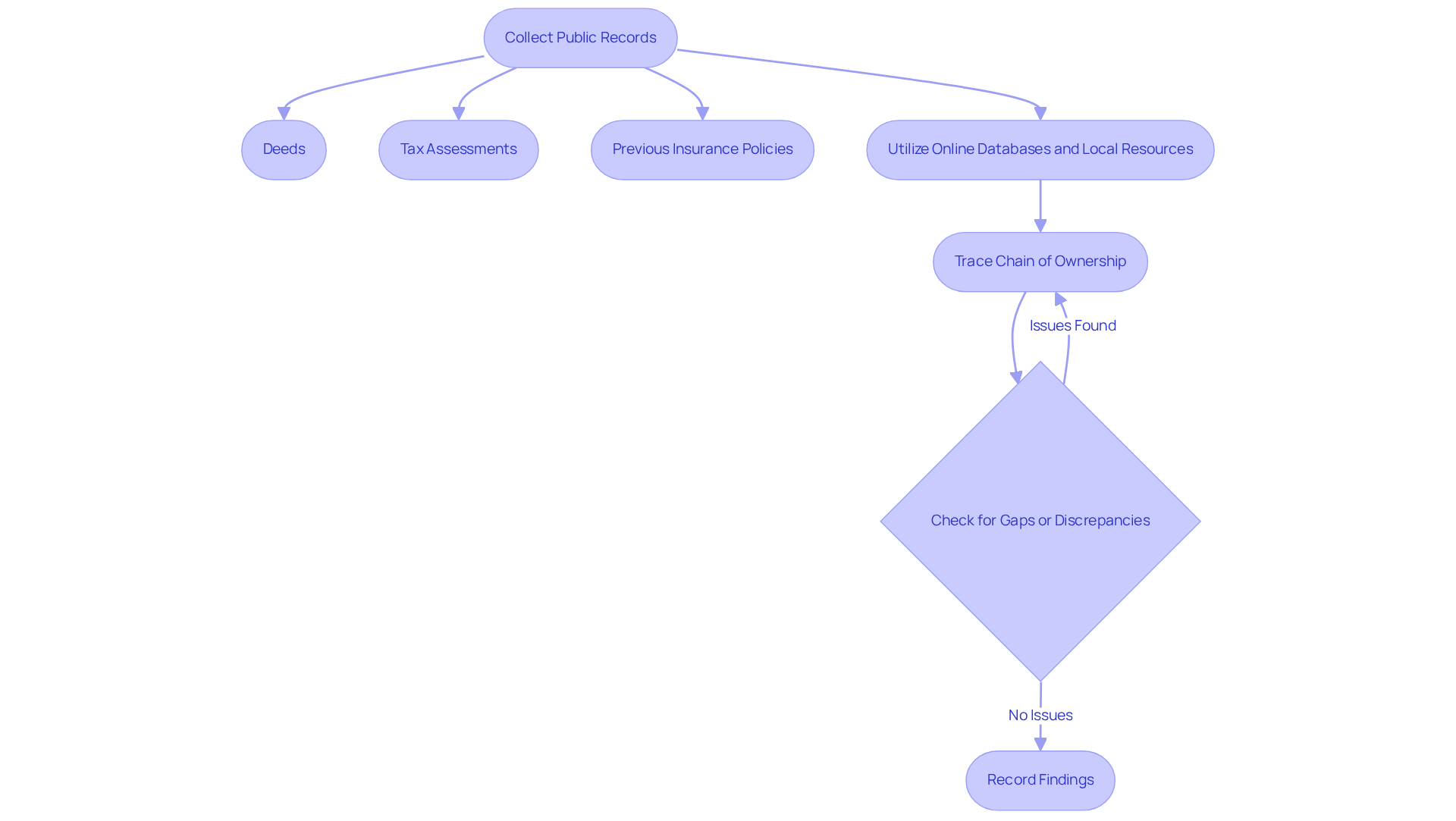

To conduct thorough , it is essential to begin by collecting all relevant , including:

- Deeds

- Tax assessments

- Previous insurance policies

Utilize and local government resources to access this critical information. Furthermore, pay special attention to the , which traces the history of the property. Look for any gaps or discrepancies that may indicate potential issues. Careful recording of your findings is crucial, as this information will be in the .

Analyze Title Documents for Discrepancies

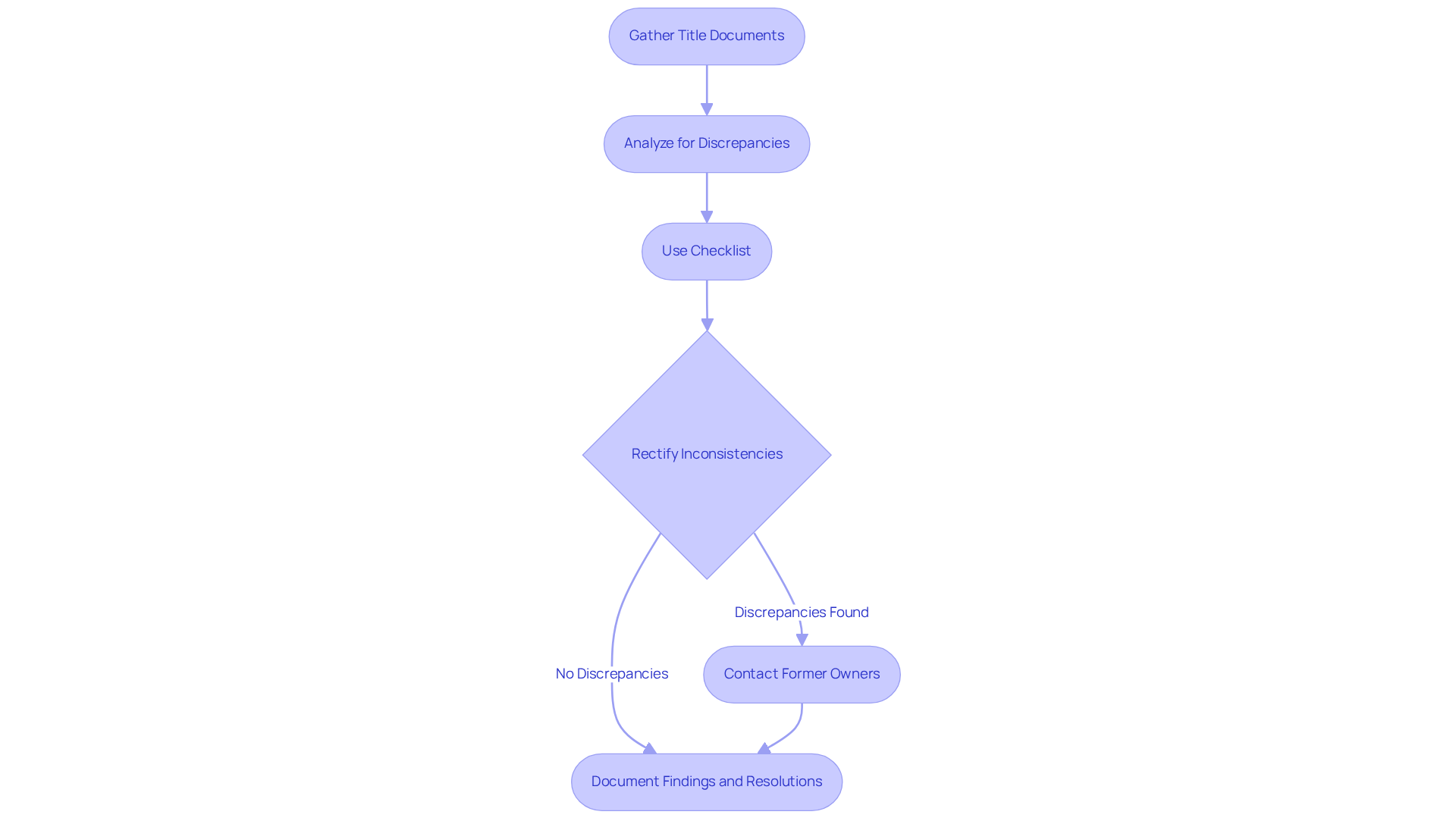

Upon gathering the necessary , it is imperative to analyze them meticulously for any discrepancies. Common issues to be vigilant for include:

- Misspelled names

- Incorrect

Employing a to ensure that all required documents are present and accurate. Should inconsistencies arise, it is crucial to take , which may involve contacting former owners or their representatives. Documenting all findings and resolutions is vital to maintain a .

Collaborate with Legal Experts for Compliance

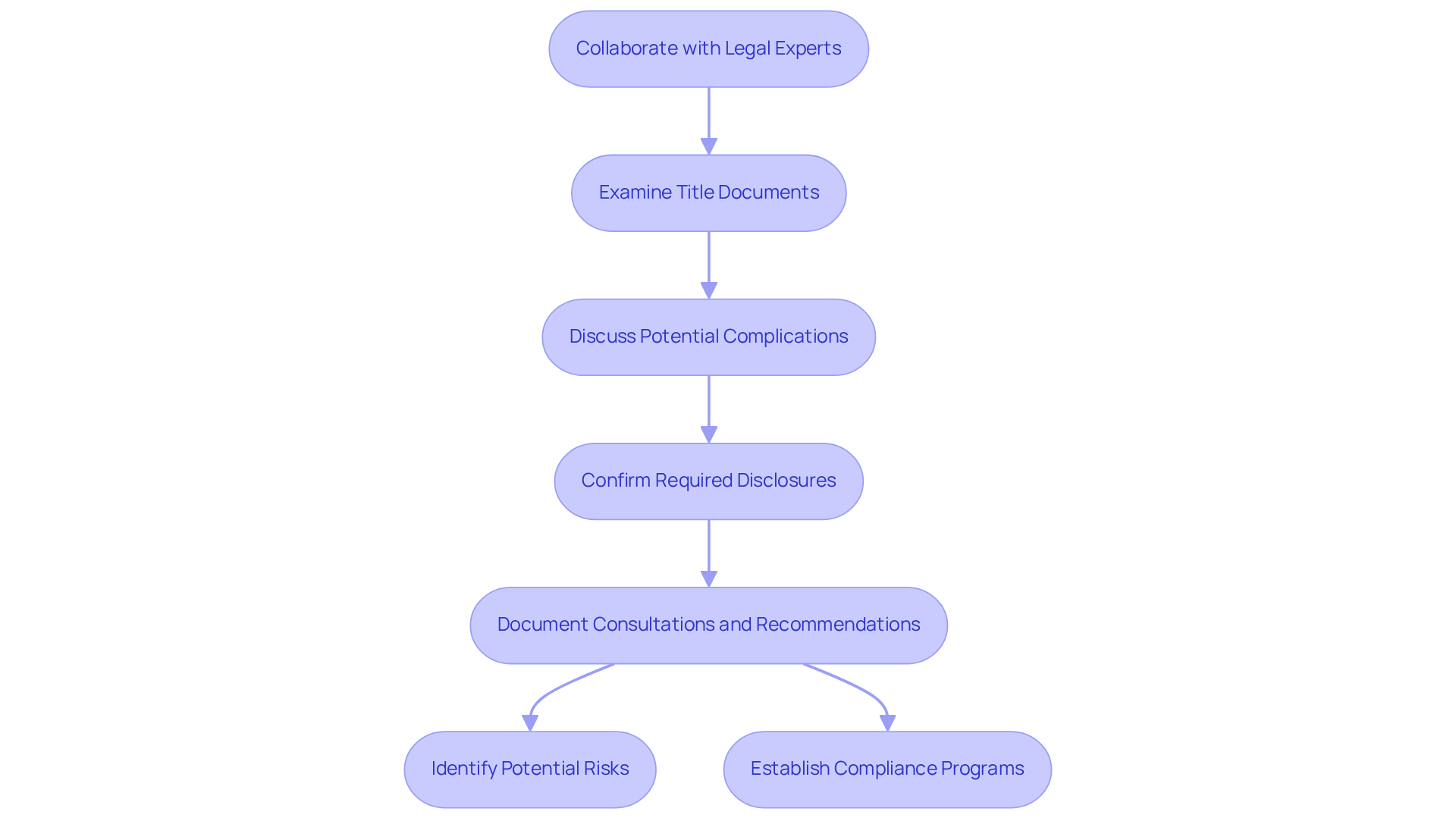

Collaborating with specialists in law at the outset of the insurance process is crucial for ensuring adherence to relevant statutes and guidelines. This partnership necessitates:

- A thorough examination of

- Proactive discussions regarding

- Confirmation that all required disclosures are provided

Furthermore, frequent communication with legal practitioners aids in identifying and offers them effectively. It is vital to meticulously document all consultations and recommendations, as this creates a that can be referenced in future transactions. Such diligence fosters trust and enhances of the research process.

Moreover, property insurers must establish to uphold ethical standards, ensuring that is not only effective but also aligned with industry regulations. Consequently, by leveraging , property firms can and improve compliance outcomes.

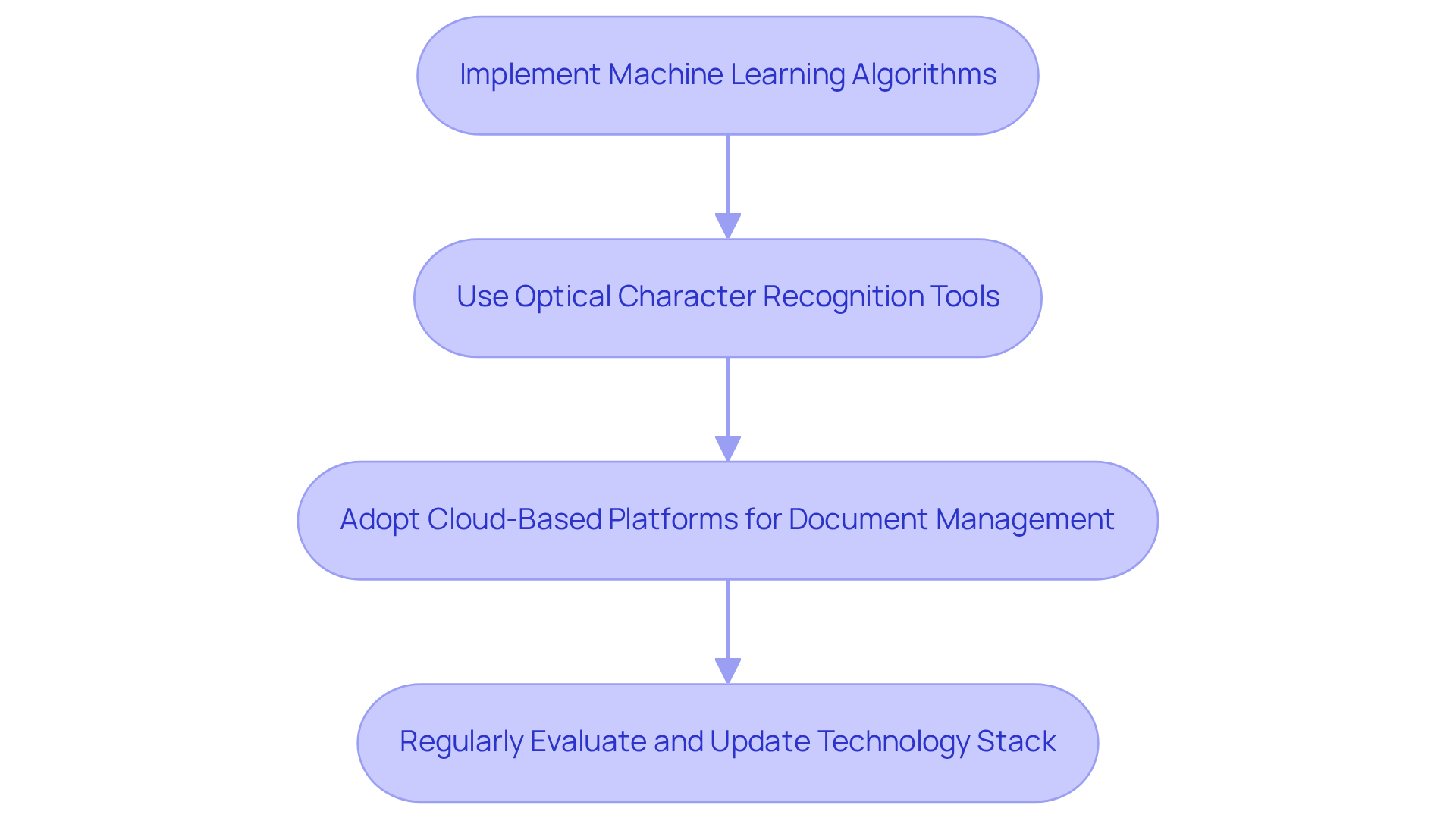

Leverage Technology for Efficient Title Research

To enhance the efficiency of research on titles, it is imperative to implement such as and . automate , significantly reducing the time required for manual analysis.

Furthermore, utilizing and collaboration allows team members to access and share information in real-time, fostering a more productive work environment.

Regularly evaluating and updating your technology stack is essential to ensure that you are leveraging the latest advancements in the field, thereby maintaining a .

Conclusion

Title companies play a pivotal role in the real estate landscape by generating title insurance policies that protect the interests of property owners and lenders alike. Understanding the process behind this creation is essential for real estate professionals, as it encompasses various steps that ensure thorough protection against potential ownership issues.

The article outlined five crucial steps in generating title insurance policies:

- Understanding the types of coverage

- Conducting comprehensive property ownership research

- Analyzing title documents for discrepancies

- Collaborating with legal experts for compliance

- Leveraging technology for efficient title research

Each of these steps contributes to a robust framework that safeguards ownership rights and facilitates smooth real estate transactions.

In an ever-evolving market, the significance of title insurance cannot be overstated. As property values continue to rise, so does the need for meticulous research and compliance in the title insurance process. By embracing technology and collaborating with legal experts, title companies can not only streamline their operations but also enhance the level of protection they provide. This proactive approach ensures that all parties involved in real estate transactions can proceed with confidence, knowing that their investments are secure.

Frequently Asked Questions

What is the purpose of title insurance?

Title insurance protects property owners and lenders from financial losses that may arise from issues related to a property's ownership.

What are the two primary types of title insurance?

The two primary types of title insurance are owner's coverage, which safeguards the buyer's interests, and lender's coverage, which protects the lender's investment.

What does an owner's title insurance policy cover?

An owner's title insurance policy protects against potential problems such as unpaid taxes, fraud, and claims from previous owners.

What does a lender's title insurance policy cover?

A lender's title insurance policy addresses risks similar to those covered by an owner's policy but emphasizes the financial interests of the lending institution.

How significant is the title insurance market?

The title insurance market is valued at 3.74 billion USD in 2023, with projections indicating growth in both owner's insurance and lender's insurance by 2032.

What is the projected value of owner's insurance by 2032?

The projected value of owner's insurance is expected to increase from 1.5 billion USD in 2023 to 2.1 billion USD by 2032.

What is the projected value of lender's insurance by 2032?

The projected value of lender's insurance is expected to reach 2.4 billion USD by 2032.

Why is it important to understand title insurance guidelines?

Understanding title insurance guidelines enhances the ability to convey their significance to clients and stakeholders and establishes one as an informed resource in the real estate sector.

What steps should be taken to conduct comprehensive property ownership research?

To conduct thorough ownership research, collect relevant public records such as deeds, tax assessments, and previous insurance policies, and pay attention to the chain of ownership for any gaps or discrepancies.

Where can one access public records for property ownership research?

Public records can be accessed through online databases and local government resources.