Overview

Machine learning is increasingly applied in real estate, particularly for:

- Asset valuation

- Predictive analytics

- Operational efficiency

This application significantly enhances decision-making and investment strategies. Notably, ML tools can evaluate property values with remarkable accuracy and predict market trends. Consequently, this capability reduces investment risks and improves returns, thereby demonstrating the transformative potential of these technologies within the industry.

Introduction

The real estate industry is experiencing a seismic shift as machine learning emerges as a powerful tool for analyzing vast amounts of data and predicting market trends. This technology not only enhances decision-making but also streamlines operations, offering real estate professionals a competitive edge in a rapidly evolving market. Furthermore, as the integration of machine learning becomes more prevalent, questions arise:

- How can stakeholders effectively harness these advanced algorithms to optimize their strategies?

- What challenges must they overcome to fully realize the benefits?

This article delves into the practical applications of machine learning in real estate, providing insights into its transformative potential and the essential steps for successful implementation.

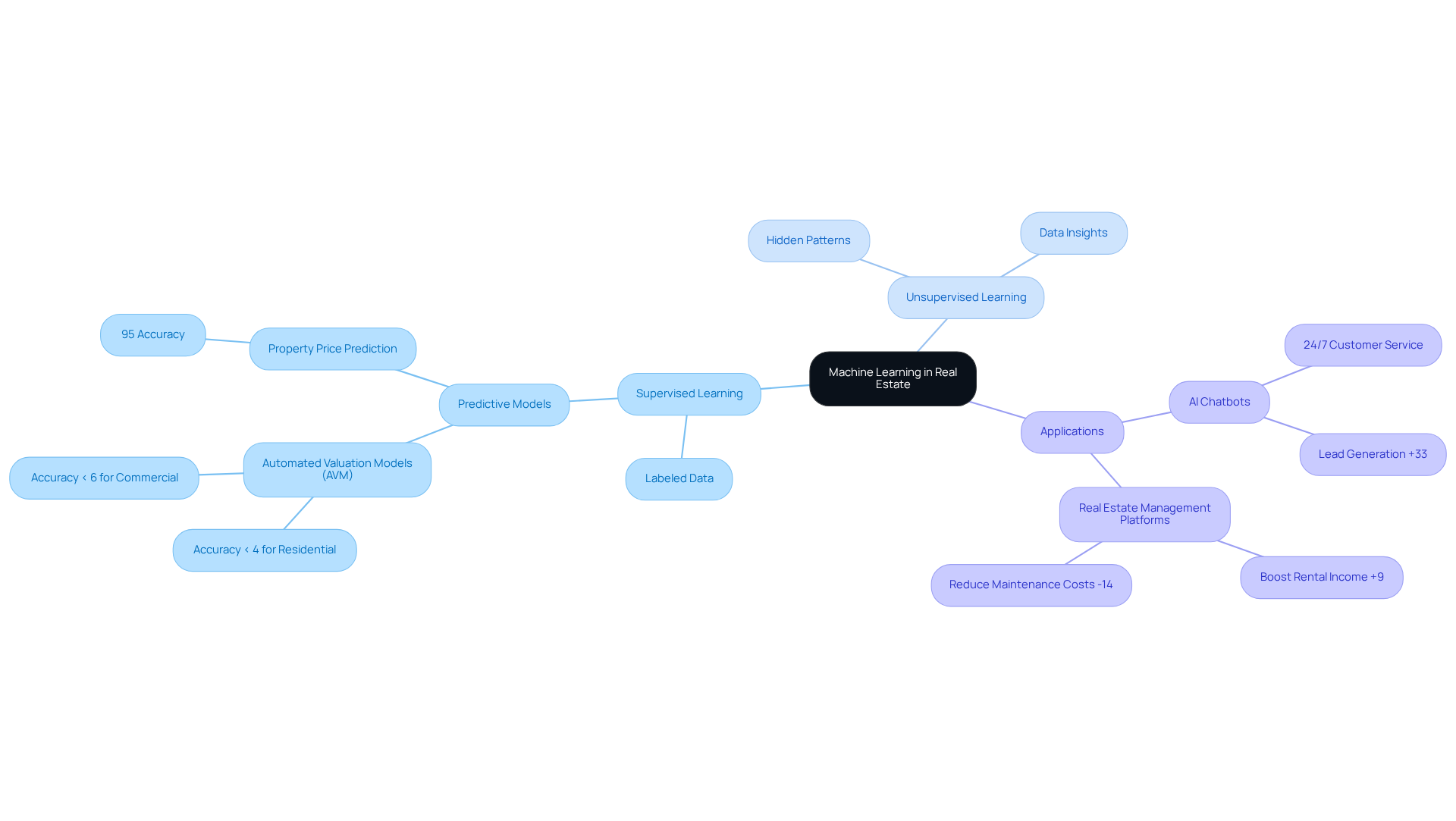

Understand Machine Learning Fundamentals in Real Estate

Machine intelligence (ML) encompasses algorithms and statistical models that empower computers to perform tasks independently, without explicit programming. In the real estate sector, how machine learning is used in real estate excels at analyzing extensive datasets to uncover patterns and generate predictions. Two fundamental concepts are pivotal: supervised learning, where models are trained using labeled data, and unsupervised learning, which detects hidden patterns within unlabeled datasets. Mastering these principles enables real estate professionals to understand effectively, enhancing decision-making, streamlining operations, and improving the accuracy of asset evaluations and ownership verifications.

The profound impact of how machine learning is used in real estate assessments is significant. For instance, ML-powered Automated Valuation Models (AVM) can evaluate the value of an asset with an absolute error margin of less than 4% for residential structures and under 6% for commercial assets. This level of precision greatly aids investors in making informed choices, consequently minimizing risks related to real estate investments. Furthermore, AI tools can predict real estate price trends with 90% accuracy, enabling industry professionals to foresee market shifts and adjust strategies accordingly.

Case studies illustrate how machine learning is used in real estate and its transformative potential. AI-driven real estate management platforms can boost rental income by as much as 9% while also lowering maintenance expenses by up to 14%. Additionally, AI chatbots provide 24/7 customer service, improving lead generation by 33% and facilitating smoother client interactions. As highlighted by Precedence Research, "AI-driven real estate management platforms have the potential to enhance rental income by up to 9% while reducing maintenance expenses by as much as 14%."

Grasping the nuances of supervised and unsupervised approaches is essential for real estate professionals seeking to leverage ML effectively. By applying these techniques, they can optimize operations, enhance customer experiences, and ultimately drive growth in a rapidly evolving market.

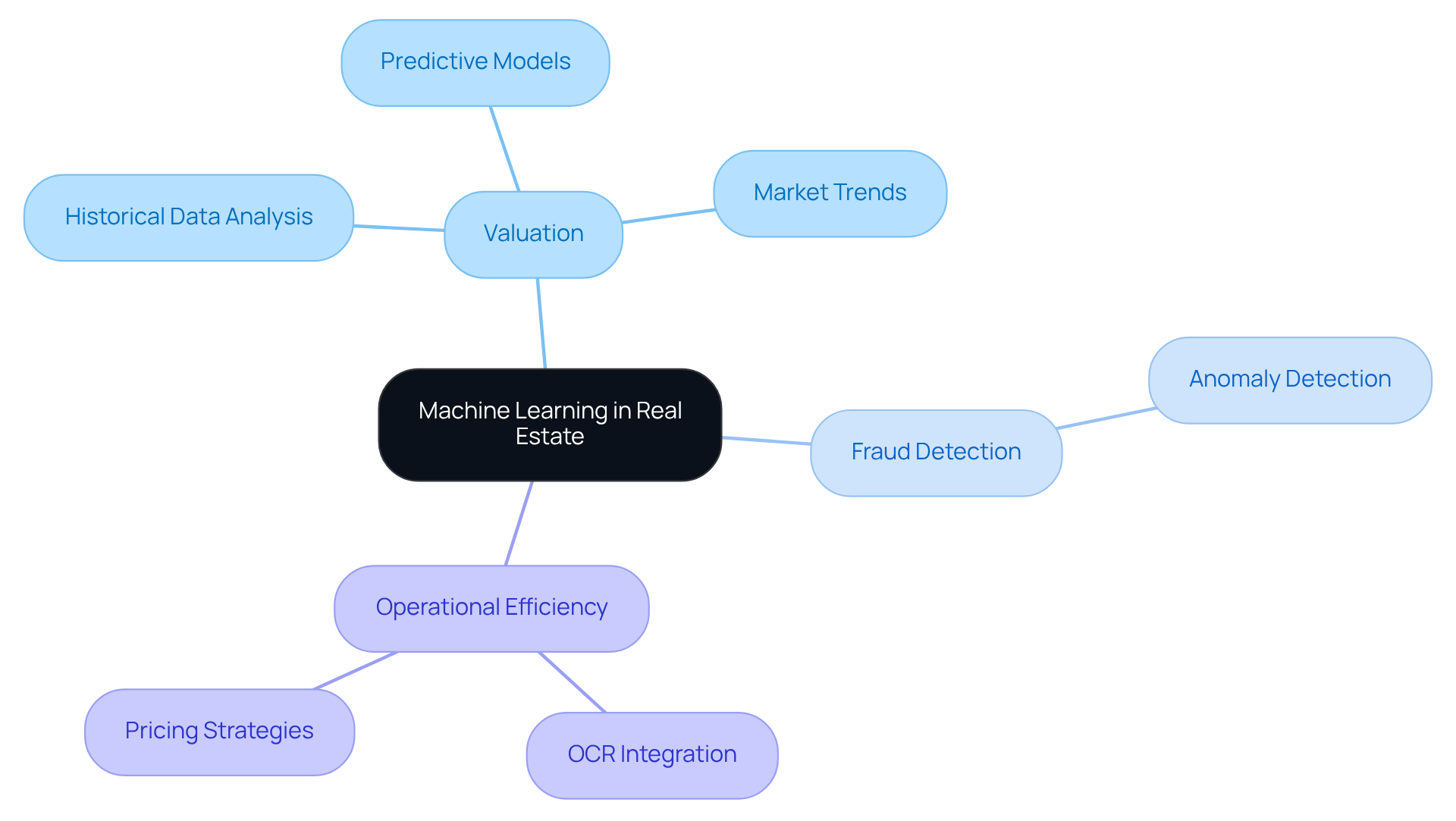

Explore Key Use Cases of Machine Learning in Real Estate

Machine learning is used in real estate valuation by employing algorithms that meticulously analyze historical sales data, asset characteristics, and prevailing market trends. This analytical prowess empowers real estate agents and investors to secure accurate asset valuations, facilitating informed decision-making. For example, advanced predictive models can forecast future property values and identify emerging markets, enabling investors to capitalize on lucrative opportunities before they reach the mainstream. Predictive analytics in real estate can reduce investment risk by as much as 40% while enhancing returns by an average of 25%, underscoring its critical role in the industry.

In addition to valuation, artificial intelligence significantly enhances fraud detection within the real estate sector. By identifying anomalies in transaction data, these algorithms fortify security and trust—elements vital for maintaining market integrity. Furthermore, integrating optical character recognition (OCR) with artificial intelligence streamlines title research processes. This technology of relevant information from title documents, dramatically accelerating research timelines and minimizing human error.

Recent trends reveal how machine learning is used in real estate, with companies increasingly depending on predictive analytics to refine pricing strategies and boost operational efficiency. For instance, Rentana's AI-powered platform has reported a $4.6 million increase in real estate value, exemplifying the effectiveness of algorithmic techniques in enhancing asset performance. As the market evolves, the application of artificial intelligence and understanding how machine learning is used in real estate for property valuation and predictive analytics continues to reshape the landscape, fostering more informed investment decisions and improving overall market performance. Notably, the predictive analytics market is projected to expand from $17.87 billion in 2024 to $249.97 billion by 2037, emphasizing the growing relevance of these technologies in the industry.

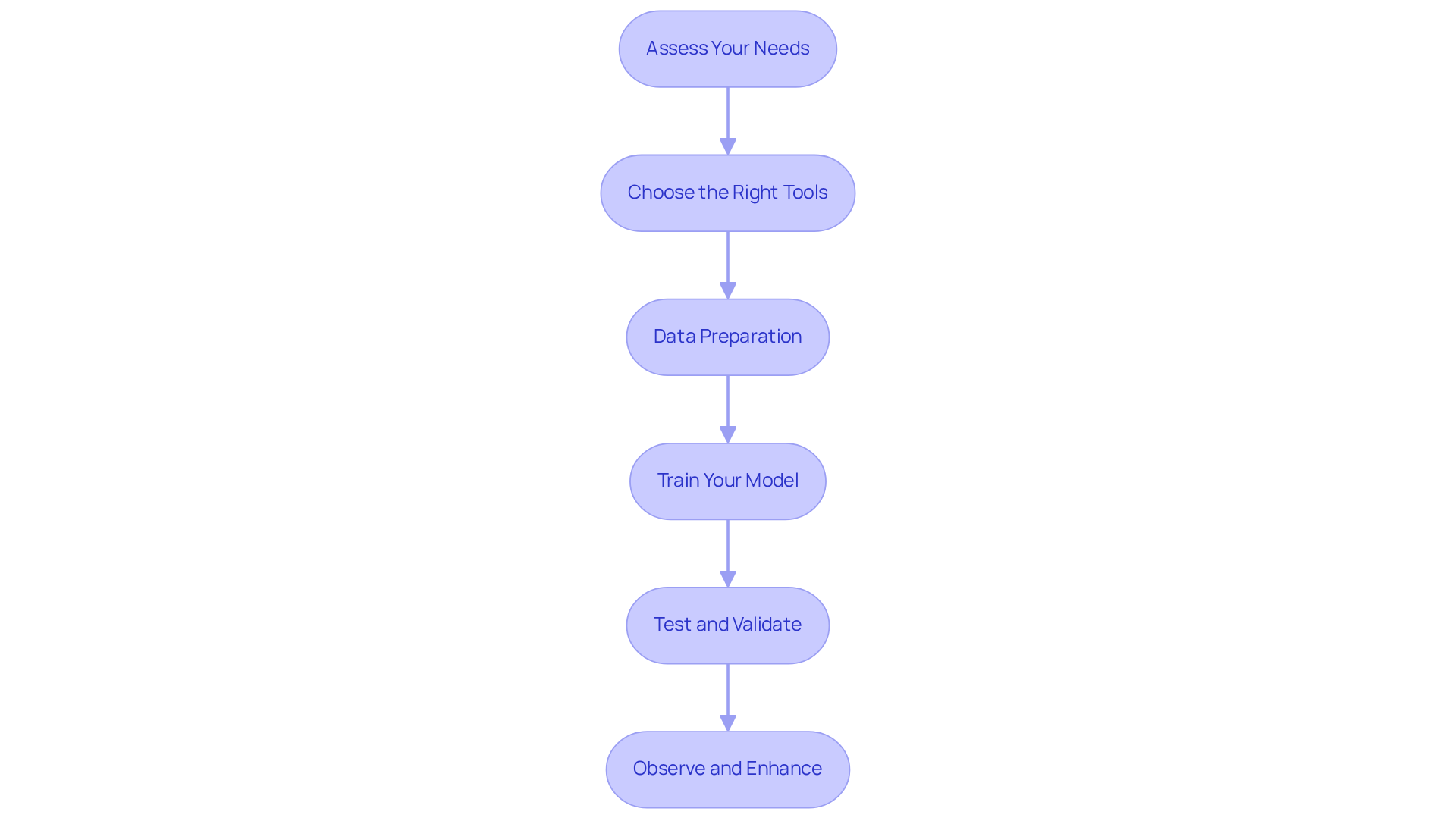

Implement Machine Learning Solutions for Title Research Efficiency

- Assess Your Needs: Begin by identifying the specific challenges within your title research process, such as time constraints or inaccuracies in data extraction. Comprehending these pain points is essential for selecting the appropriate artificial intelligence solutions that will effectively address your needs.

- Choose the Right Tools: Select artificial intelligence tools that seamlessly integrate with your existing systems. Prioritize platforms that offer optical character recognition (OCR) capabilities and robust analytical features, as these will significantly enhance your efficiency in processing title documents.

- Data Preparation: Ensure that your title documents are meticulously gathered and cleaned. This crucial step guarantees the provision of precise and relevant information to the artificial intelligence algorithms. It may involve digitizing paper documents and standardizing formats to facilitate smoother processing.

- Train Your Model: Utilize historical data to train your . This process involves supplying the model with examples of accurate information extraction, enabling it to learn and improve its precision over time.

- Test and Validate: Prior to full execution, conduct tests on a sample of data to verify the model's accuracy. This phase allows for necessary adjustments to enhance performance and ensure reliability in real-world applications.

- Observe and Enhance: Continuously monitor the performance of your artificial intelligence solution and actively gather user feedback. This ongoing evaluation is essential for refining the model and enhancing its capabilities, ensuring that it evolves to meet the changing demands of title research.

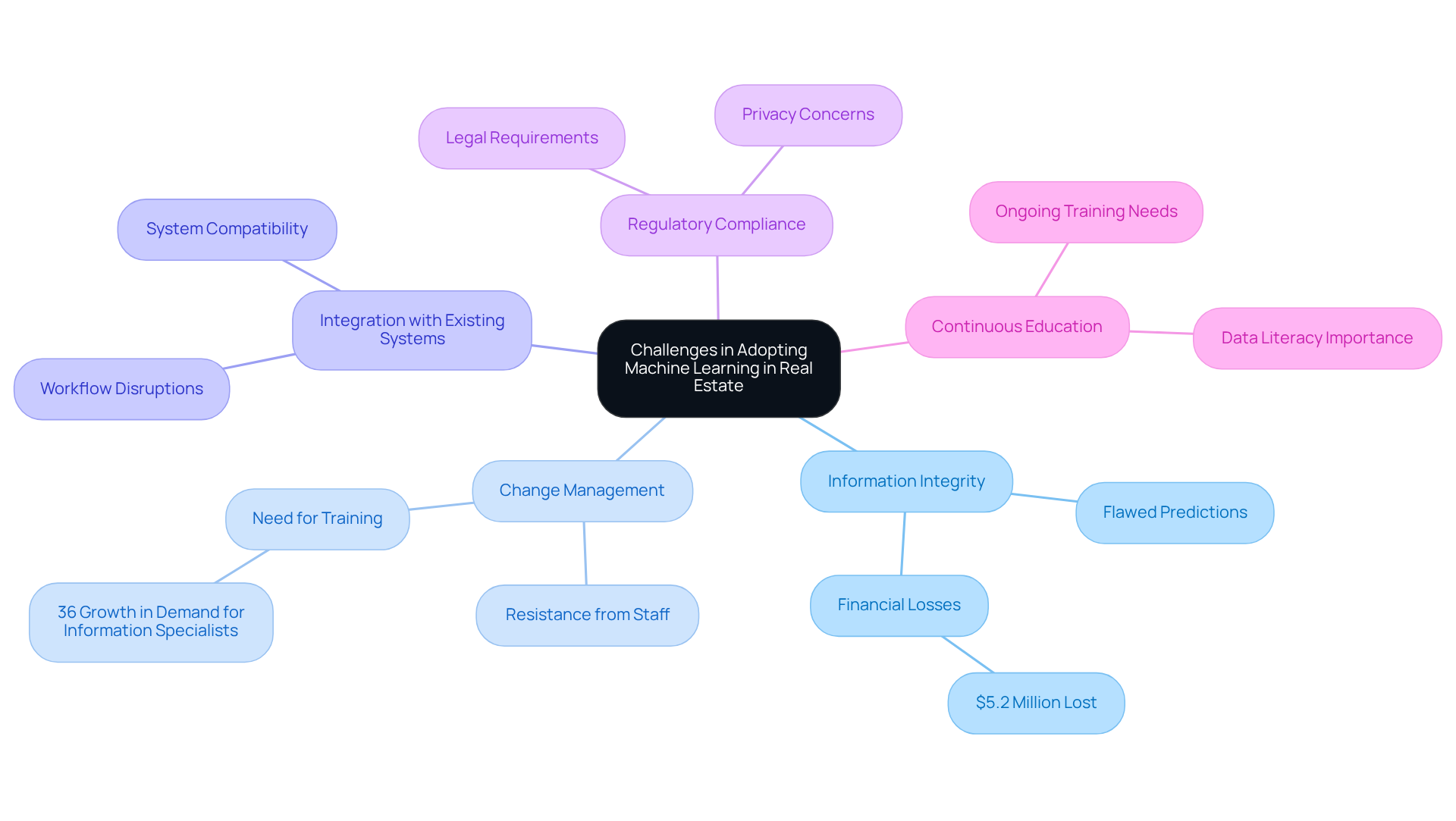

Navigate Challenges in Adopting Machine Learning in Real Estate

- The efficiency of machine learning models, especially in how machine learning is used in real estate, is fundamentally rooted in the integrity of the information used for training. Flawed predictions and analyses arise from incorrect or insufficient information, jeopardizing the entire process. As Peter Sondergaard aptly observes, information holds value only when it is effectively mined and analyzed, underscoring the necessity for high-quality information to achieve successful outcomes. Furthermore, companies risk forfeiting approximately $5.2 million in income due to unutilized information, highlighting the financial repercussions of inadequate information quality.

- Change Management: The introduction of new technologies frequently meets resistance from staff. To ensure a seamless transition, it is imperative to offer comprehensive training and ongoing support. This strategy alleviates apprehensions and cultivates a culture of acceptance and enthusiasm for innovation. With a , investing in training and support is essential for adapting to the evolving landscape of analytics.

- Integration with Existing Systems: For machine learning tools to deliver their full potential, they must integrate seamlessly with existing systems. Disruptions in workflow can impede productivity and generate frustration among users. Ensuring compatibility is vital for maximizing the advantages of new technologies. Successful integration cases illustrate this importance, as poor integration can lead to significant operational challenges.

- Regulatory Compliance: Staying abreast of legal requirements concerning information usage and privacy is critical. Adhering to these regulations is necessary to avoid potential legal complications stemming from improper data handling or breaches of privacy. Understanding the specific legal landscape in your region ensures that your machine intelligence solutions comply with essential guidelines.

- Continuous Education: Machine learning models are dynamic; they necessitate ongoing training and updates to maintain effectiveness. Establishing a structured approach for consistently assessing and enhancing models ensures they adapt to evolving information and retain their predictive accuracy. Additionally, fostering data literacy within your organization is crucial for empowering teams to effectively leverage machine learning applications.

Conclusion

Harnessing the power of machine learning is revolutionizing the real estate sector. It provides professionals with tools that enhance decision-making, streamline operations, and improve asset valuations. By understanding and applying both supervised and unsupervised learning techniques, real estate stakeholders can leverage extensive datasets to uncover valuable insights and trends. This ultimately transforms how the industry operates.

Key applications of machine learning in real estate include:

- Automated valuation models that achieve remarkable accuracy

- Predictive analytics that minimize investment risks

- AI-driven platforms that optimize rental income while reducing maintenance costs

- Advancements in fraud detection and title research efficiency that illustrate the technology's vast potential to enhance security and operational effectiveness

As the market continues to evolve, the integration of these technologies becomes increasingly vital for maintaining a competitive edge.

The significance of embracing machine learning in real estate cannot be overstated. By investing in training, ensuring data integrity, and fostering a culture of continuous improvement, professionals can navigate the challenges associated with adopting these technologies. Ultimately, the successful implementation of machine learning solutions will not only drive growth and profitability in the real estate sector but also empower stakeholders to make more informed decisions in an ever-changing market landscape.

Frequently Asked Questions

What is machine learning in the context of real estate?

Machine learning (ML) in real estate refers to the use of algorithms and statistical models that enable computers to analyze extensive datasets, uncover patterns, and generate predictions without explicit programming.

What are the two fundamental concepts of machine learning?

The two fundamental concepts of machine learning are supervised learning, where models are trained using labeled data, and unsupervised learning, which detects hidden patterns within unlabeled datasets.

How does machine learning enhance decision-making in real estate?

By mastering machine learning principles, real estate professionals can improve decision-making, streamline operations, and enhance the accuracy of asset evaluations and ownership verifications.

What is the accuracy of machine learning-powered Automated Valuation Models (AVM) in real estate assessments?

ML-powered Automated Valuation Models (AVM) can evaluate the value of residential structures with an absolute error margin of less than 4% and under 6% for commercial assets.

How accurately can AI tools predict real estate price trends?

AI tools can predict real estate price trends with 90% accuracy, allowing industry professionals to foresee market shifts and adjust their strategies accordingly.

What are some benefits of AI-driven real estate management platforms?

AI-driven real estate management platforms can boost rental income by up to 9% and reduce maintenance expenses by as much as 14%.

How do AI chatbots improve customer service in real estate?

AI chatbots provide 24/7 customer service, improving lead generation by 33% and facilitating smoother client interactions.

Why is it important for real estate professionals to understand supervised and unsupervised learning?

Understanding supervised and unsupervised learning is essential for real estate professionals to effectively leverage machine learning, optimize operations, enhance customer experiences, and drive growth in a rapidly evolving market.