Introduction

Verifying the legal ownership of a property through a title search is a critical step in real estate transactions. This meticulous examination of public records checks for any potential issues, such as liens, claims, or encumbrances, that could affect the title. Ensuring that the seller has the legal right to transfer ownership and that the title is free from complications is paramount.

Technologies like Artificial Intelligence (AI) have significantly enhanced the efficiency and accuracy of title searches, reducing the likelihood of overlooked details that could later jeopardize property ownership.

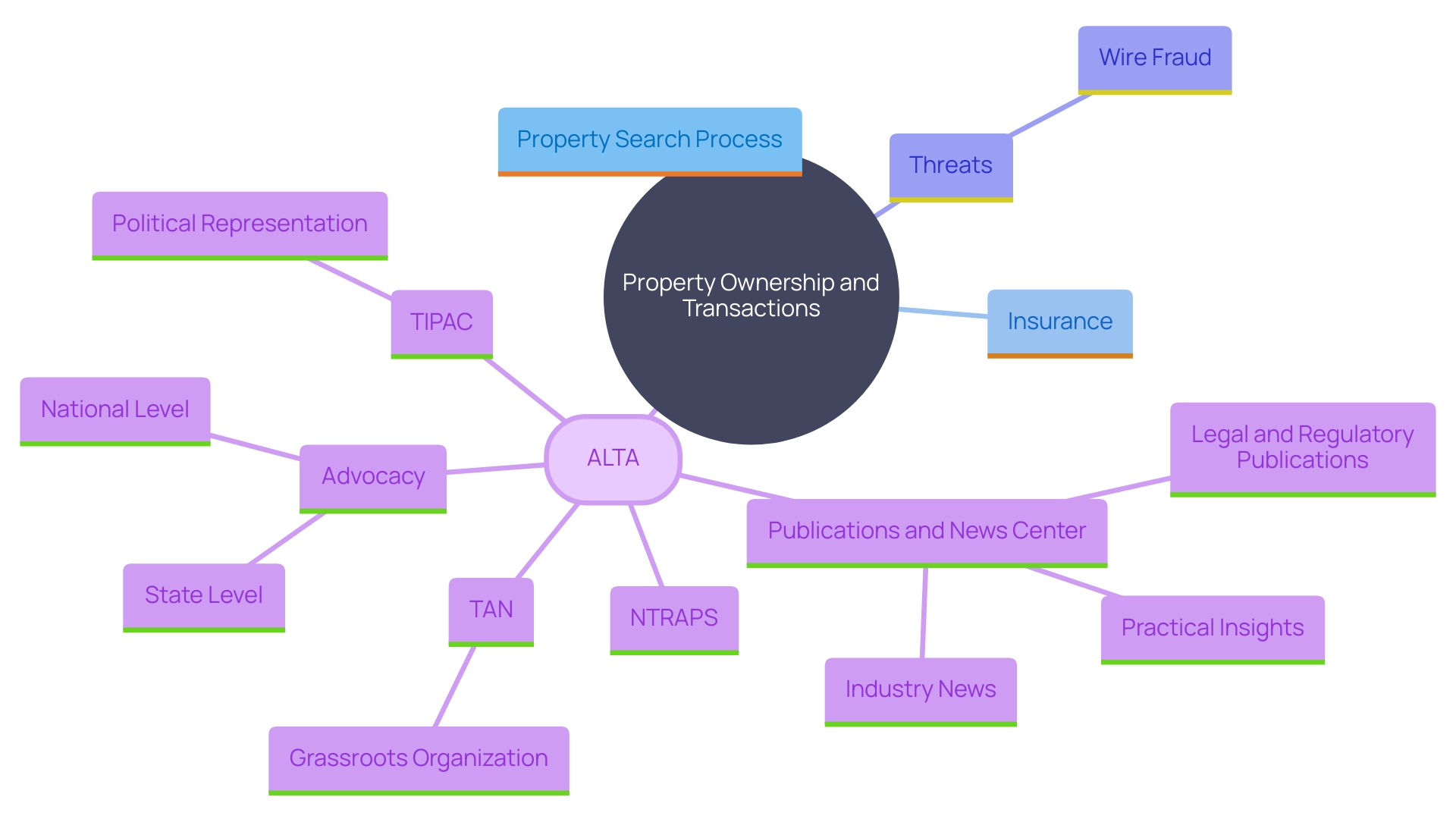

The title insurance industry provides crucial protection against various threats, including boundary disputes, fraud, and forgery, which is especially valuable for low- and moderate-income home buyers. Recent developments have underscored the importance of cybersecurity in the industry, with wire fraud emerging as a significant threat. The American Land Title Association (ALTA) has been proactive in combating fraud, offering resources and tools to protect both companies and customers.

In October 2023, ALTA introduced a new brand identity to better reflect the industry's digital transformation, highlighting the ongoing evolution and modernization of title services.

This article delves into the key aspects of title searches, including the factors that affect their duration, the average timeframe for completion, and common issues that can arise. It also explores the role of title insurance and the industry's response to emerging cybersecurity threats, providing a comprehensive overview for professionals engaged in title research and related fields.

What is a Title Search?

A property search involves a careful review of public records to confirm the legal possession of a property. This process checks for any potential issues such as liens, claims, or encumbrances that may impact ownership. Making certain that the seller possesses the legal authority to convey possession and that the document is clear of issues is essential. 'With the arrival of innovations such as , the effectiveness and precision of have greatly enhanced, lowering the likelihood of overlooked details that could subsequently contest property rights.'.

The plays a crucial role in this process by offering protection against various threats, including boundary disputes, fraud, and forgery. This protection is particularly valuable for low- and moderate-income home buyers, who might otherwise be unable to afford the legal costs associated with defending their ownership rights.

Recent developments have highlighted the importance of , with wire fraud being one of the most significant threats. The American Land Title Association (ALTA) has been proactive in offering resources and tools to combat fraud and protect both companies and customers. In October 2023, ALTA introduced a new brand identity to better represent the industry's adjustment to the digital era, highlighting the continuous development and modernization of service offerings.

The sector's crucial news publication offers important information and analysis for professionals, addressing practical legal evaluations of claims and court rulings associated with insurance. ALTA also represents its members at both national and state levels, advocating for the interests of the through organizations like the Insurance Political Action Committee (TIPAC) and the Action Network (TAN).

Factors That Affect How Long a Title Search Takes

The duration of a is influenced by multiple factors. The intricacy of the land's background frequently determines the duration of the inquiry. For properties with a long or convoluted history, each transaction and ownership change must be meticulously verified. The also play a critical role; jurisdictions with well-organized and digitized records can expedite the process, whereas those with outdated systems may cause delays. The jurisdiction itself can impose additional requirements or complications, further affecting the timeframe.

Ownership concerns, such as liens or disputes, can significantly prolong the duration of the inquiry as these problems need resolution before a clear deed is issued. The expertise and effectiveness of the are equally significant. Experienced professionals, equipped with advanced technology and a deep understanding of local laws, can navigate the complexities more swiftly. The sector's gradual embrace of is set to improve efficiency, possibly decreasing retrieval times. According to the State of the Title Industry Report, 26% of respondents are already using or exploring AI in their workflows, indicating a shift towards more streamlined operations.

Average Timeframe for a Title Search

The timeframe for completing a can vary significantly based on the complexity of the asset. For assets with straightforward histories and , the process may take just a few days. In contrast, more complicated cases—such as those involving multiple owners, extensive histories of assets, or legal disputes—can extend the duration up to a month or more. For instance, residential real estate valuations typically take several days to about two weeks, while commercial evaluations can take longer due to their complexity and size. Additionally, the appraiser’s availability and workload can further impact the timeline. According to First American Financial Corporation, the company leverages its financial strength, innovative technologies, and extensive data assets to streamline these processes, yet intricate cases still require thorough investigation to ensure accuracy and compliance.

based on asset complexity. It highlights the steps involved and the factors affecting the duration of the process.](https://tely.blob.core.windows.net/telyai/this-flowchart-illustrates-the-varying-timelines-for-completing-a-title-search-based-on-asset-complexity-it-highlights-the-steps-involved-and-the-factors-affecting-the-duration-of-the-process.jpg)

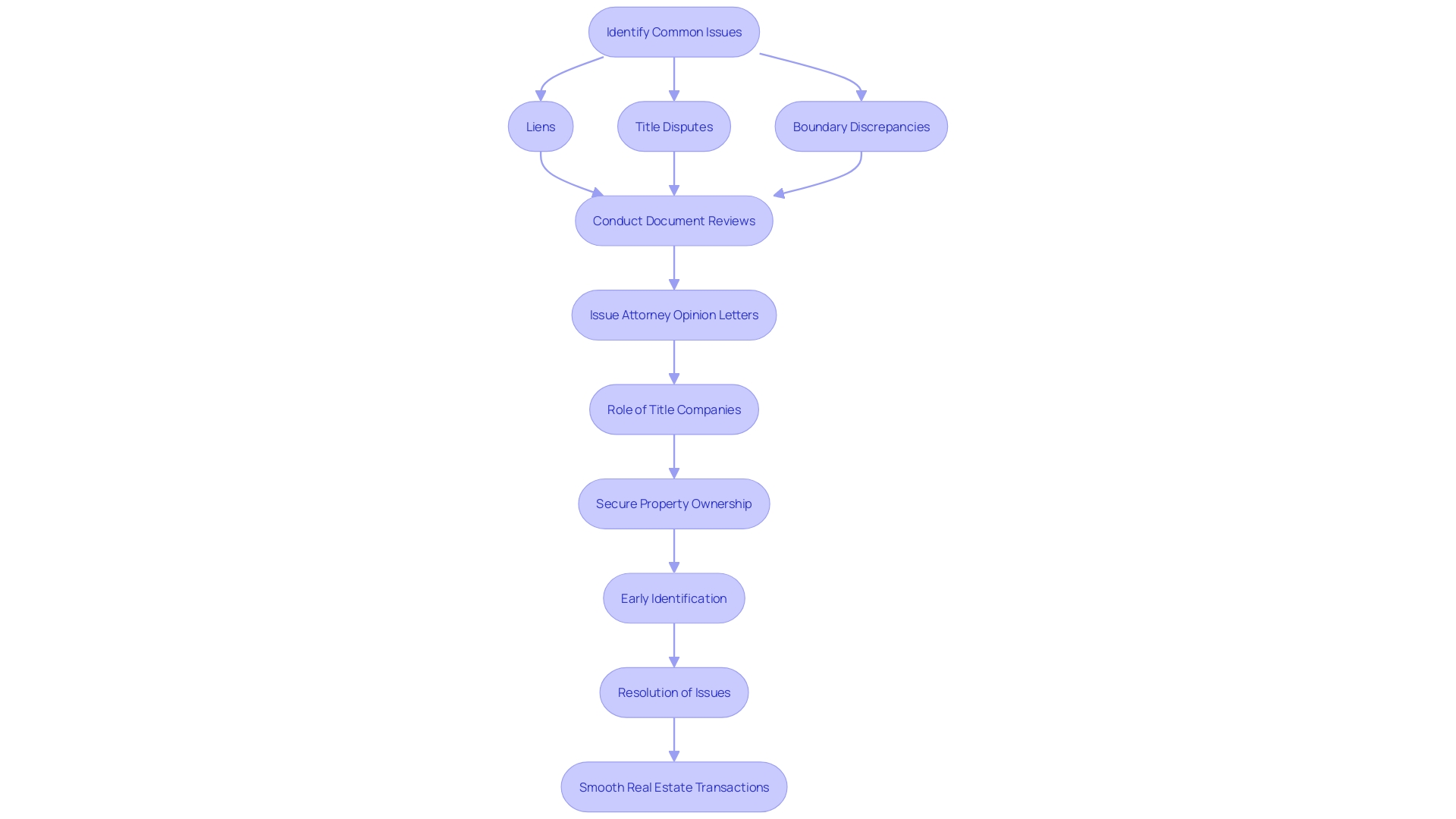

Common Issues Found in Title Searches

While conducting an ownership investigation, multiple typical problems might be revealed that can greatly affect real estate dealings. These consist of significant liens, unresolved title disputes, and discrepancies in land boundaries. For instance, a recent alarming case involved a multi-million dollar home in Raleigh, North Carolina, where the owner discovered that the deed to his home had been fraudulently transferred to a stranger. Such situations emphasize the significance of to prevent fraud and safeguard property ownership.

Identifying these issues early on is crucial, as they can affect the timeline of the real estate transaction and may require additional research or legal action. Attorney opinion letters, such as the new ACT® program, can expedite the process by providing a data-driven Decision Report, followed by a Preliminary ACT®. This innovation not only accelerates the closing process but also provides a , benefiting consumers by potentially saving them substantial amounts of money.

Furthermore, with the increase in wire fraud and monetary losses in the real estate sector, and precise documentation are more essential than ever. Title companies play a vital role in by coordinating the closing process, handling escrow funds, and ensuring all necessary documents are executed properly. These efforts are essential to maintaining secure property ownership and mitigating potential risks that can arise from incomplete or inaccurate title records.

Conclusion

Title searches are crucial in real estate transactions, ensuring properties are free from encumbrances and confirming the seller's legal right to transfer ownership. The integration of technologies like Artificial Intelligence has enhanced the efficiency and accuracy of these searches, minimizing the risk of oversights.

The time required for a title search varies based on factors such as the property's complexity and record accessibility. Complicated ownership histories or outdated systems can prolong the process, while experienced professionals with advanced tools can expedite it.

Common issues found during title searches, such as liens and ownership disputes, can significantly impact transactions. Recent cases of fraudulent property transfers highlight the need for diligent investigations. Innovations like the ACT® program offer faster resolutions and cost-effective alternatives to traditional title insurance, addressing concerns about wire fraud and cybersecurity threats.

In summary, the thoroughness of title searches, bolstered by technological advancements and proactive industry responses, is essential for protecting property ownership rights. By prioritizing detailed investigations and embracing innovation, the title insurance industry fosters confidence in real estate transactions, ensuring secure outcomes for buyers and sellers alike.

Frequently Asked Questions

What is a property search?

A property search is a careful review of public records to confirm the legal possession of a property. It checks for potential issues such as liens, claims, or encumbrances that might affect ownership.

Why is it important to confirm the seller's legal authority to convey possession?

Ensuring the seller has the legal authority to transfer ownership is crucial to avoid future disputes or challenges to property rights.

How has technology, like Artificial Intelligence (AI), impacted the property search process?

AI has enhanced the effectiveness and precision of document searches, reducing the likelihood of overlooked details that could contest property rights.

What role does property insurance play in the property search process?

Property insurance provides protection against various threats, such as boundary disputes, fraud, and forgery, which is especially valuable for low- and moderate-income home buyers.

What cybersecurity threats exist in the property insurance sector?

Wire fraud is a significant threat in the industry. Organizations like the American Land Title Association (ALTA) are proactive in providing resources and tools to combat such fraud.

What recent developments have occurred in the property insurance sector?

In October 2023, ALTA introduced a new brand identity to better represent the industry’s adaptation to the digital era, reflecting ongoing developments and modernization of services.

How long does a title inquiry typically take?

The duration of a title inquiry varies based on the complexity of the property’s history. Simple cases may take a few days, while complex cases can extend up to a month or more.

What factors influence the timeframe of a title search?

Factors include the complexity of the property’s background, the availability of organized records, jurisdictional requirements, ownership concerns, and the expertise of the document evaluation specialist.

What typical problems can be revealed during an ownership investigation?

Common issues include significant liens, unresolved title disputes, and discrepancies in land boundaries. Identifying these problems early is crucial to prevent complications in real estate transactions.

How can attorney opinion letters expedite the title inquiry process?

Programs like the new ACT® provide data-driven Decision Reports and Preliminary ACT® letters, which can accelerate the closing process and serve as a cost-effective alternative to traditional insurance.

Why is thorough documentation important in the real estate sector?

With the rise in wire fraud and monetary losses, comprehensive property searches and accurate documentation are essential to secure property ownership and mitigate risks from inaccurate title records.

What role do title companies play in real estate transactions?

Title companies facilitate the closing process, handle escrow funds, and ensure that all necessary documents are executed correctly, which is vital for maintaining secure property ownership.