Overview

Accurate lien searches on property are paramount. To achieve this, one should leverage resources such as:

- The county clerk's office

- Online public records

- Title companies

These resources provide essential documentation of encumbrances. Understanding the types of liens is crucial; employing multiple search methods, including professional services and technology tools, can significantly enhance the efficiency and accuracy of these searches. Consequently, this approach helps prevent potential complications in real estate transactions.

Introduction

Navigating the complex landscape of property liens is crucial for anyone involved in real estate transactions. A lien—a legal claim against a property—can significantly impact ownership rights and the ability to sell or refinance. With various types of liens, such as mortgage, tax, and judgment liens, each carrying its own implications, understanding their nuances is essential for both buyers and sellers.

This article delves into the intricacies of liens, offering insights on how to identify them, effective search strategies, and common challenges faced during the process. By equipping oneself with knowledge and utilizing the right resources, stakeholders can ensure smoother transactions and avoid costly complications in their real estate endeavors.

Understand What a Lien Is and Its Implications

A legal claim signifies a right against an asset, frequently utilized as collateral to guarantee a debt. The primary types of liens include:

- Mortgage Liens: These are voluntary liens established by lenders when financing a property. They can significantly impact the sale process if not resolved. The statistic that low equity mortgages account for only 2.0 percent of Other Conventional loans as of Q1 2023 emphasizes the importance of understanding mortgage claims, as assets with low equity may encounter greater challenges in sales due to potential outstanding debts.

- Tax Claims: Enforced by governmental bodies for overdue real estate taxes, these claims can lead to foreclosure if the obligation remains unsettled. Grasping tax claims is vital for real estate owners, as they can greatly affect the ability to sell or refinance an asset.

- Judgment Claims: Originating from court decisions against the owner, these encumbrances can complicate ownership and transfer of the asset.

Comprehending how to find liens on property is crucial because these claims can significantly impact a title, obstructing the capacity to sell or refinance. For instance, if an asset has an outstanding claim, the claim holder may possess the right to foreclose to recover the owed amount. Bill Gassett, owner and founder of Maximum Real Estate Exposure, underscores the importance of addressing encumbrances swiftly, stating, "Anticipate that resolving these issues can prolong the sale process timeline and plan accordingly."

Real-world instances illustrate the effect of tax claims on real estate sales. In Maricopa County, Arizona, tax sales have shown trends such as a maximum interest rate limit of 16%, highlighting the financial repercussions for landowners. This statistic underscores the necessity for prospective purchasers to be aware of current tax claims, as they can greatly influence property value and marketability.

Moreover, specialists emphasize that understanding how to find liens on property is essential for both purchasers and vendors in property dealings. A case study titled 'Best Practices for Navigating Claims in Real Estate' highlights that by identifying the categories of claims and employing effective resolution strategies, parties can mitigate potential delays and complications, ensuring smoother transactions. Furthermore, the National Title Land Association (NTLA) plays a crucial role in the sector by providing education and training for professionals, advocating for stakeholders, and offering resources that can assist in comprehending and navigating the intricacies of real estate encumbrances.

Identify Where to Search for Property Liens

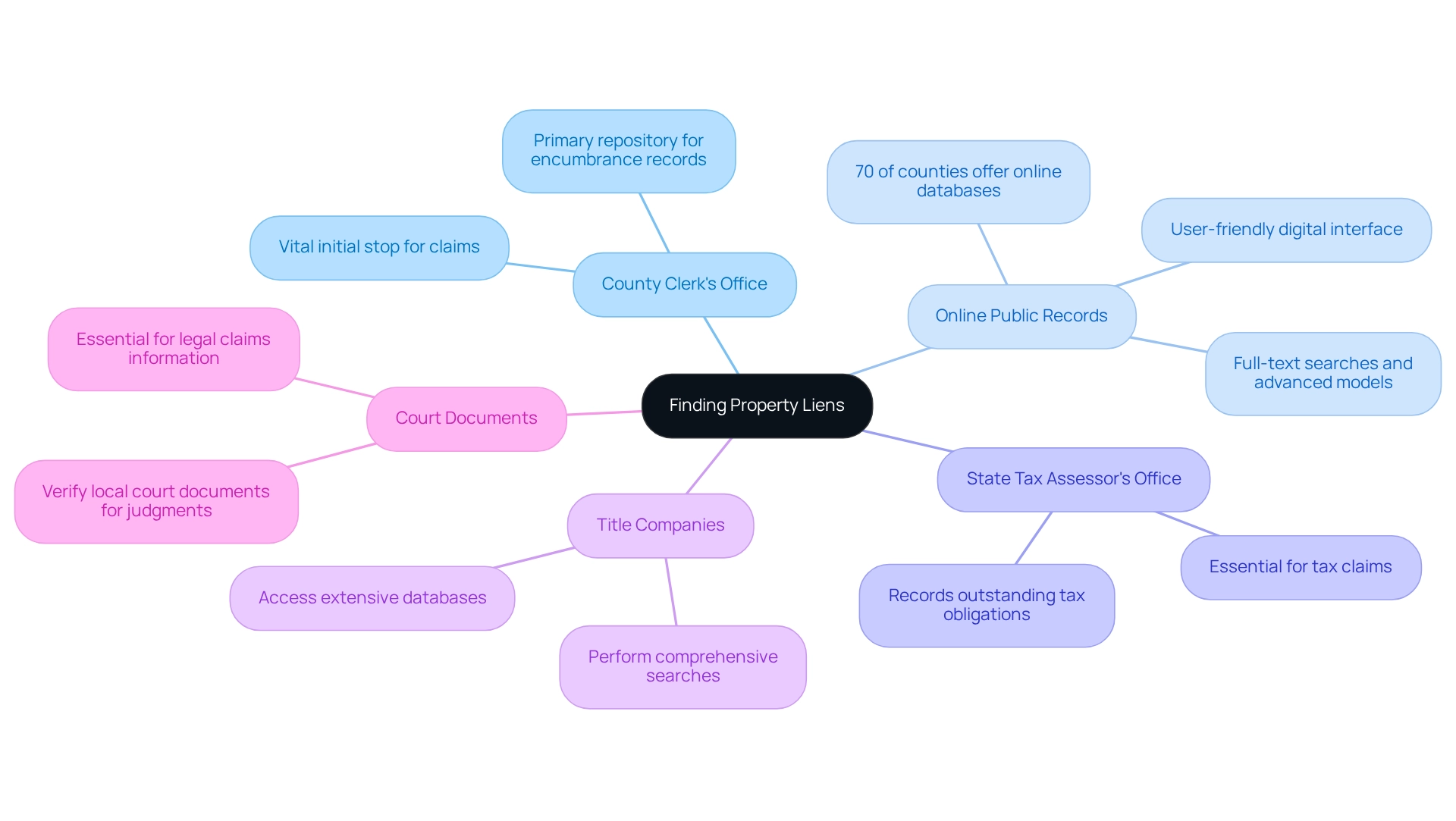

To effectively uncover claims on a property, it is essential to understand how do you find liens on property by exploring several key resources:

- County Clerk's Office: The primary repository for encumbrance records is the county clerk's office. Most claims are documented at this level, making it a vital initial stop. Engaging directly with the office can yield valuable insights into how do you find liens on property.

- Online Public Records: An increasing number of counties offer online databases that enable users to look up property liens by inputting the property address or the owner's name. As of 2025, approximately 70% of counties have transitioned to offering these digital resources, which significantly enhances how do you find liens on property accessibility. Parse AI's platform exemplifies this trend, showcasing a user-friendly digital interface for searching county clerk documents. This interface features a query bar and a comprehensive table listing various records with columns for viewer, name, grantor, grantee, book volume, book page, instrument type, instrument date, file date, and legal description. It empowers users to perform full-text searches and utilize advanced machine learning models that extract relevant information from documents, ensuring that all pertinent details are easily searchable.

- State Tax Assessor's Office: This office is another essential resource for revealing tax claims related to a property. They maintain records that can uncover outstanding tax obligations that may not be evident elsewhere.

- Title Companies: Partnering with a title company can significantly simplify the encumbrance investigation process. These companies can answer the question of how do you find liens on property by accessing extensive databases and performing comprehensive searches, ensuring that no possible claims are overlooked.

- Court Documents: For judgment claims, it is necessary to verify local court documents where the judgment was submitted. These records can offer essential information concerning any legal claims against the asset.

In South Carolina, for example, each county conducts Tax Lien auctions, drawing in over 500 bidders and auctioning approximately 1,000 assets per county. This emphasizes the significance of comprehending the lien environment in your region, particularly given the NTLA's substantial impact on tax lien investing and its role in informing professionals about best practices in lien investigations. Furthermore, assets with any form of ecological harm, such as dangerous substance accumulations, are also unwelcome, highlighting the importance of comprehensive investigations. With approximately 25% of property transactions facing title problems, being thorough in your inquiry can avert expensive complications later.

Utilize Tools and Resources for Efficient Lien Searches

To conduct efficient lien searches, knowing how do you find liens on property is essential to leverage a variety of tools and resources that enhance both accuracy and speed.

- Online Search Platforms: Websites such as Rocket Mortgage and Wolters Kluwer provide extensive access to public records and lien information, which is crucial for knowing how do you find liens on property during quick searches.

- Using Property Research Software, such as DataTree and Tracers, can greatly assist you in understanding how do you find liens on property by compiling information from various sources to simplify the discovery process and enhance efficiency. The adoption of cloud-based property management software has greatly impacted the market, accounting for 58% of the revenue in 2021, emphasizing its essential role in improving asset investigation capabilities. Furthermore, employing sophisticated machine learning tools from Parse AI can accelerate document processing and interpretation, enabling faster and more precise searches for claims.

- Mobile Applications: Numerous counties now offer mobile apps that provide users with information on how do you find liens on property. This trend demonstrates the increasing inclination among renters for online payment options and digital solutions, which is transforming how property investigations are performed.

- Professional Services: Hiring a title investigation firm can provide comprehensive and skilled support, especially for intricate assets where detailed inquiries are crucial. Parse AI's title research automation tools can further enhance the efficiency of these professional services by extracting critical information from title documents.

In the present market, where 61.5% of individuals believe that institutional landlords will impact buying capacity, comprehending claims investigations becomes progressively crucial. By utilizing these resources, including the innovative solutions provided by Parse AI, you can significantly improve the efficiency of your claims investigations, especially when considering how do you find liens on property, and stay ahead in a swiftly changing real estate management environment. As industry leaders emphasize, "The efficiency of property research software is paramount in navigating today’s complex real estate environment.

Troubleshoot Common Issues in Lien Searches

When conducting lien searches, understanding how to find liens on property can help avoid several common issues that may complicate the process.

- Incomplete Records: A significant percentage of public records—estimated to be around 30%—are often incomplete or outdated, which can hinder accurate searches. In such cases, it is advisable to consult multiple sources or directly contact the relevant office for clarification. This proactive strategy can assist in reducing the risks linked to absent information.

- Outdated Data: Public documents may not always represent the most up-to-date information. Always confirm the date of the last update and consider revisiting the files if you suspect recent changes. This diligence is essential, as outdated information can result in expensive mistakes in real estate dealings.

- Mistakes in Public Documentation: Discrepancies in public documentation can occur, leading to confusion and possible legal complications. If you encounter errors, gather supporting documents and promptly contact the office responsible for maintaining the records to rectify the situation. Understanding the 'superpriority' protection, as mentioned in the Internal Revenue Code, is crucial, as it can influence the legal position of claims. This step is vital to ensure that your results are precise and trustworthy.

- Hidden Claims: Some claims may not be documented correctly, making them challenging to identify. To reveal these concealed claims, perform a comprehensive investigation that involves verifying municipal obligations and contacting former owners. The case study on 'Landlord's Lien and Federal Tax Liens' demonstrates that a landlord must secure a judgment to create a choate claim, which is essential for it to have precedence over a federal tax claim. This thorough approach can uncover potential liabilities that might otherwise go unnoticed, and by understanding these common issues and employing effective troubleshooting strategies, you can enhance the accuracy and efficiency of how to find liens on property. Furthermore, insights from real estate experts emphasize the importance of addressing incomplete or outdated records to avoid pitfalls in property transactions.

Conclusion

Navigating the intricate world of property liens is essential for anyone engaged in real estate transactions. Understanding the different types of liens—mortgage, tax, and judgment—along with their implications, is crucial for both buyers and sellers. Each lien type can significantly affect ownership rights and the ability to sell or refinance a property. Therefore, it is imperative to address them promptly and effectively.

Identifying where to search for property liens is equally important. Resources such as the county clerk's office, online public records, and title companies provide valuable insights and access to critical information. Furthermore, utilizing modern tools and technologies can streamline this process, enhancing both the accuracy and efficiency of lien searches. From property research software to mobile applications, leveraging these resources can greatly improve the chances of uncovering any existing liens before finalizing a transaction.

Finally, being prepared to troubleshoot common issues that arise during lien searches can facilitate smoother real estate dealings. Incomplete records, outdated information, and hidden liens can pose significant challenges. However, with proactive strategies and a thorough approach, these obstacles can be overcome. By equipping oneself with knowledge and utilizing the right resources, stakeholders can navigate the complexities of property liens, ensuring successful and hassle-free real estate transactions. Understanding and addressing liens not only protects investments but also fosters a more efficient and transparent property market.

Frequently Asked Questions

What is a legal claim in relation to real estate?

A legal claim signifies a right against an asset, often used as collateral to secure a debt.

What are the primary types of liens?

The primary types of liens include mortgage liens, tax claims, and judgment claims.

What are mortgage liens?

Mortgage liens are voluntary liens created by lenders when financing a property, which can significantly impact the sale process if not resolved.

How do low equity mortgages affect real estate?

Low equity mortgages, which account for only 2.0 percent of Other Conventional loans as of Q1 2023, may face greater challenges in sales due to potential outstanding debts.

What are tax claims?

Tax claims are enforced by governmental bodies for overdue real estate taxes and can lead to foreclosure if the obligation remains unpaid.

Why is it important for real estate owners to understand tax claims?

Understanding tax claims is vital for real estate owners as they can greatly affect the ability to sell or refinance an asset.

What are judgment claims?

Judgment claims arise from court decisions against the owner and can complicate the ownership and transfer of the asset.

Why is it crucial to find liens on property?

Finding liens on property is crucial because these claims can significantly impact a title, obstructing the ability to sell or refinance.

What happens if an asset has an outstanding claim?

If an asset has an outstanding claim, the claim holder may have the right to foreclose to recover the owed amount.

How can tax claims affect real estate sales?

Tax claims can lead to financial repercussions for landowners, as evidenced by trends in Maricopa County, Arizona, where tax sales have a maximum interest rate limit of 16%.

What are best practices for navigating claims in real estate?

Best practices include identifying the categories of claims and employing effective resolution strategies to mitigate delays and complications in transactions.

What role does the National Title Land Association (NTLA) play?

The NTLA provides education and training for professionals, advocates for stakeholders, and offers resources to assist in understanding and navigating real estate encumbrances.