Introduction

Achieving full ownership of your home by settling the mortgage is a significant milestone that brings both celebration and new responsibilities. As you transition from borrower to full owner, understanding the process of paying off a mortgage and securing the title to your property becomes crucial. In a survey, 78% of U.S. adults view homeownership as a key component of the American Dream.

However, diligent asset management is essential to make the most of this investment. This article provides authoritative and knowledgeable guidance on managing your mortgage, updating the title, and navigating the complexities of property ownership. With the right approach, you can ensure that your homeownership journey continues to align with your life goals and secures your financial future.

Understanding the Process of Paying Off a Mortgage

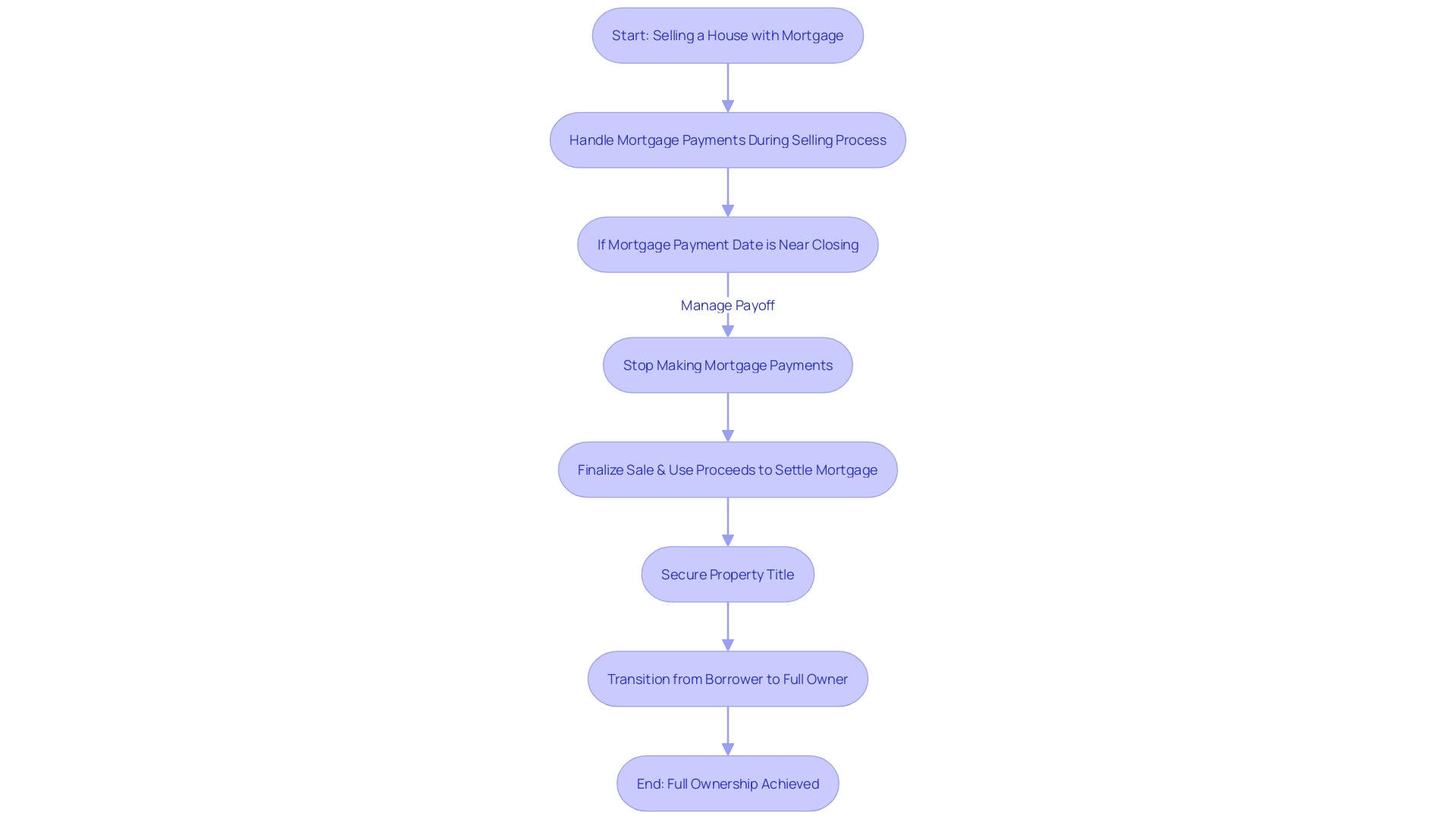

Achieving by settling the mortgage is a significant accomplishment, marking the end of one financial journey and the beginning of another. This transition requires not only a celebration but also a careful approach to managing the new responsibilities that come with outright homeownership. It's essential to recognize that while the physical house remains the same, its . The process involves understanding how to navigate the and , which is a crucial step in asserting your ownership and managing your asset effectively.

According to recent surveys, a staggering 78% of U.S. adults see homeownership as a key component of the American Dream, surpassing even the goals of retirement and a successful career. Yet, with this dream comes the need for . As John Bodrozic of HomeZada points out, a home is more than a physical space; it demands active oversight of both its value and upkeep. The mortgage payoff is a process that transitions you from borrower to full owner, and it's imperative to handle it with the same attention to detail that you would apply to any other significant financial transaction.

In the context of a fluctuating real estate market and wider economic concerns, such as predictions of a mild recession and the challenging choices some Americans face between essential expenses, clear guidance on managing your mortgage and property title is invaluable. With the right approach, you can ensure that your investment continues to serve your life goals and secures your financial future.

What Happens to the Title After Paying Off the Mortgage

Upon the completion of mortgage payments, it is crucial to take the necessary steps to update the title of your property. A title, distinct from a property deed, signifies legal ownership. It is not a physical document, but rather, it encapsulates the concept of ownership. The importance of a title cannot be overstated, as it confirms your legal claim over a property. Without the title being in your name, or that of your business or organization, you do not , regardless of any deeds you may hold.

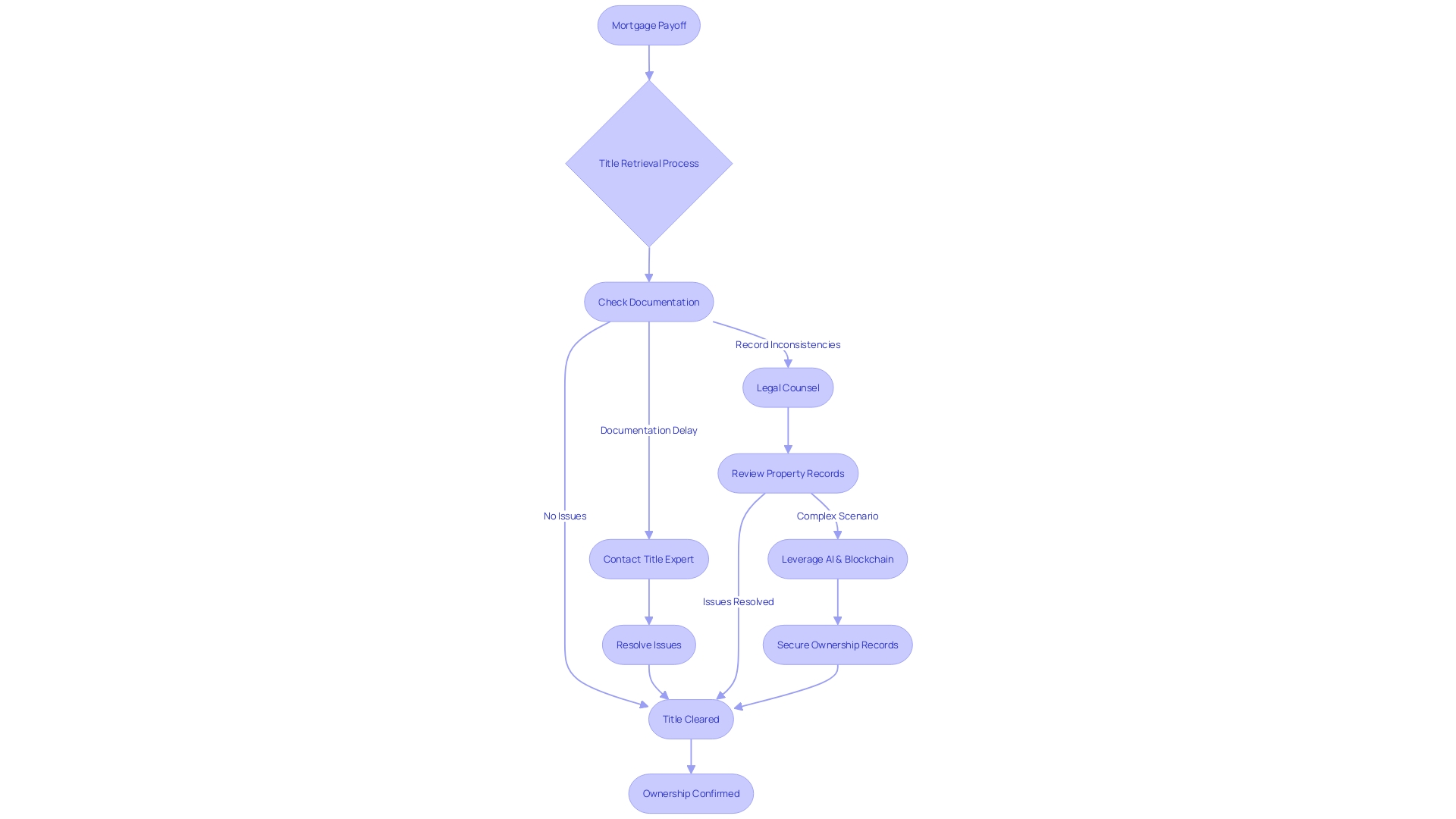

Updating the title post-mortgage payoff involves the release of the lender's lien, which must then be accurately reflected to indicate the rightful owner. This process is vital to establishing clear ownership, free of any previous financial encumbrances. It is recommended to engage with a reputable or who can ensure that your title is free of liens and has been correctly recorded. As articulated by industry expert Gelios, "Running a pre-title ensures that the title is free of any liens and that it was properly recorded in the last sale."

The significance of choosing a competent real estate agent or title specialist cannot be understated. These professionals, equipped with extensive knowledge of the local market, can provide invaluable guidance in navigating the complexities of and property transactions. Linda Schroder, a seasoned real estate investor, emphasizes, "A good real estate agent can be an immense asset when selling your home," highlighting their role in offering strategic advice on pricing, marketing, and negotiating the sale, and accessing a broader network of potential buyers to maximize the sale price.

In the rapidly evolving landscape of real estate transactions, entities like First American Financial Corporation stand at the forefront, offering a comprehensive suite of title, settlement, and risk solutions. Their long-standing tradition of stability, innovation, and a vast array of data assets underscore the importance of having a reliable partner in managing title and property ownership matters. With over $7.6 billion in total revenue for 2022, First American exemplifies the industry's shift towards digital transformation, emphasizing the need for accuracy and legal compliance in all aspects of title research and updating.

Receiving the Satisfaction of Mortgage Certificate

When you fulfill your , a critical document to anticipate is the . This certificate is not just a formality; it is a tangible validation that the mortgage on your property no longer holds and the lien has been legally discharged. Such a document is indispensable for your records, as it officially signifies a clear title to your property.

Upon repayment of your mortgage, it is also crucial to understand the implications on your . While repaying your mortgage, particularly if it is your sole installment debt, may initially lower your credit score, this effect can be neutralized or even reversed depending on your overall .

Moreover, homeowners looking to expedite their mortgage repayment can consider strategies such as prepaying the principal or refinancing. Prepaying allows you to decrease interest costs and accelerate the reduction of your principal balance, which can lead to earlier mortgage freedom and potential monthly cash savings. Refinancing to a loan with better terms can further align your financial goals with your payment plans.

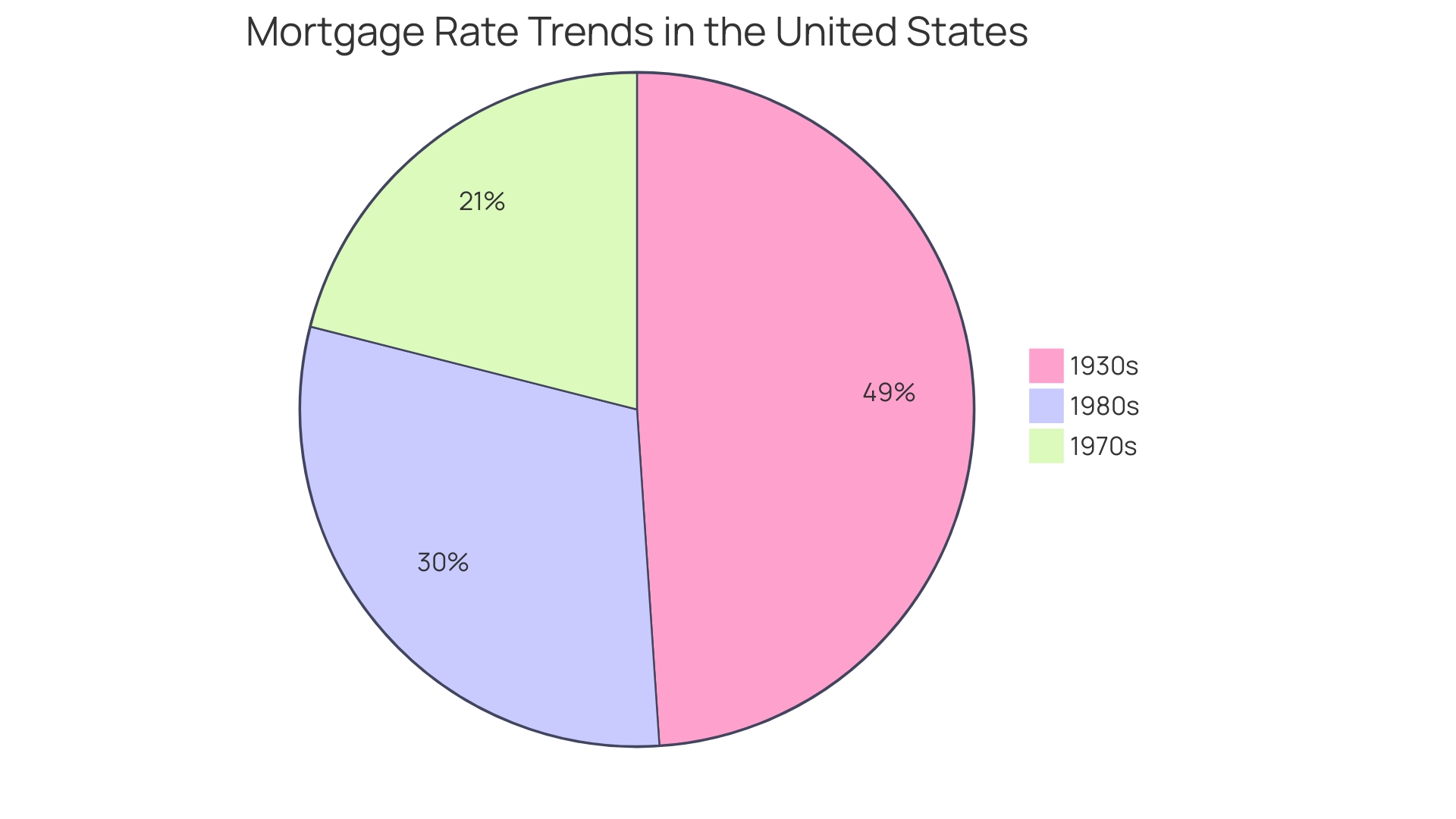

As you navigate through the mortgage payoff process, keep in mind the broader financial landscape, such as the current mortgage environment. For instance, at the close of the first quarter of 2024, there were 50.8 million outstanding mortgages totaling $11.7 trillion. Among these, a significant 21.9 percent held interest rates below 3 percent, indicating a shift from just two years prior.

In essence, the receipt of your Satisfaction of Mortgage certificate marks not just the end of your loan term but the beginning of new financial possibilities and should be considered a significant milestone in your homeownership journey.

Ensuring the Lien is Removed from the Property Records

When a property's mortgage has been fully paid off, it's crucial to have the correctly recorded to reflect the change in legal status. The process involves submitting a Satisfaction of Mortgage document to the designated local government entity, often the county recorder or clerk's office. Each jurisdiction will have its own set of procedures and requirements, so property owners should ensure they are familiar with the specific protocols in their area to facilitate a smooth transition of title records.

For instance, , such as unexpected liens that can arise from unpaid labor or materials on a property, is vital. These can include construction or mechanic's liens, which are legal claims filed by contractors or subcontractors to secure payment for their services. It's important to address these promptly to prevent hindrances in selling or refinancing the property. Moreover, , such as new regulations on liens and property records, can prevent future disputes or fraudulent claims against the property.

In the context of real estate transactions, managing the timing of mortgage payments during the sale process is another aspect that requires attention. Homeowners should be well-informed about when to cease making mortgage payments to avoid financial overlap as they transition to the closing phase. Additionally, maintaining awareness of your credit situation post-mortgage payoff is beneficial, as credit scores may fluctuate according to changes in your debt profile. By staying educated on these matters, property owners can navigate the complexities of with confidence and efficiency.

Following Up with the County Recorder or Clerk of Court

After successfully submitting the Satisfaction of Mortgage certificate, it's crucial to verify with the county recorder's office that the mortgage lien has indeed been lifted from your property's records. This verification is a critical step as it assures that all subsequent and potential transactions will display the correct ownership details. This is not just a bureaucratic box-ticking exercise; rather, it is about safeguarding the integrity of your property's title, ensuring that all is in order should you decide to sell or refinance your property.

Take, for instance, the situation where a family renting a home discovered it was listed for sale. The event underscores the importance of clear and accurate . If, at any point, there was a mortgage on that property that had been paid off, ensuring that this was properly recorded would be fundamental for a smooth sale process.

In fact, accurate record-keeping and are more than just administrative tasks; they are integral to maintaining property value and ensuring legal ownership is beyond dispute. CoreLogic's extensive foreclosure data—covering approximately 75% of U.S. foreclosure data—highlights the critical nature of maintaining precise records. Furthermore, ATTOM's comprehensive data collection from over 3,000 counties, representing more than 99 percent of the U.S. population, indicates the vast scale at which property information must be managed accurately. These steps and verifications may seem tedious, but they are the bulwark against future legal complications and are essential for protecting one's real estate investment.

Potential Issues and How to Address Them

Navigating the post-mortgage payoff can sometimes encounter hiccups, such as delays in documentation or inconsistencies in property records. These complications can pose significant challenges, particularly in the context of heirs' property, where ownership is passed informally without proper title documentation. The American Land Title Association (ALTA) emphasizes the gravity of this issue, noting its prevalence in low- to moderate-income communities and its implications for generational wealth. With only 34% of Americans having an according to a 2023 survey by Caring.com, the risks of heirs' property issues are increasingly apparent.

Industry leaders like Paul Yurashevich of Verus Title Inc. advocate for leveraging to streamline , thereby reducing the likelihood of such issues. Innovative technologies like blockchain offer a more secure and efficient way to manage , with each block's unique fingerprint ensuring a transparent and tamper-evident record, as described by Johns Hopkins University Magazine. This digital transformation, championed by companies such as First American Financial Corporation, is reshaping the industry and raising consumer expectations.

In light of these advancements and challenges, professionals seeking to mitigate the risks associated with title retrieval are encouraged to or legal counsel. These professionals can help navigate complex scenarios, leveraging both traditional expertise and emerging technologies to secure property ownership records and support wealth-building initiatives.

Verifying Title Ownership After Payoff

After settling your mortgage, it is essential to confirm that the is updated to reflect your sole ownership. To do this, request an from the local county recorder or clerk's office. Once you have the document, review it meticulously to verify the accuracy of all details, particularly your name listed as the property's owner. This careful scrutiny is crucial, as even minor discrepancies can lead to significant complications. For instance, Virginia's DMV inadvertently issued a title for a stolen vehicle because it wasn't listed as stolen in the NCIC database at the time of processing. Such errors underscore the importance of thorough verification to prevent potential legal and financial issues. Moreover, with the digital transformation of the , companies like First American are innovating to improve accuracy and efficiency in title records. By taking these proactive steps, you ensure the integrity of your property rights, safeguarding one of your most valuable assets.

Conclusion

Achieving full ownership of your home by settling the mortgage is a significant milestone that brings celebration and new responsibilities. Understanding the process of paying off a mortgage and securing the title to your property is crucial for effective asset management. With 78% of U.S. adults considering homeownership as a key component of the American Dream, it's essential to handle this investment with care.

Updating the title of your property after mortgage payoff is vital to establish clear ownership, free of any financial encumbrances. Working with a reputable title company or real estate professional ensures that your title is free of liens and accurately recorded.

Receiving the Satisfaction of Mortgage certificate validates that your mortgage has been legally discharged, signifying a clear title to your property. Consider prepaying the principal or refinancing to expedite mortgage repayment and align your financial goals with your payment plans.

Ensuring the lien is removed from the property records involves submitting a Satisfaction of Mortgage document to the local government entity. Staying informed about real estate laws and potential complications, such as unexpected liens, is crucial for smooth property transactions.

Verifying with the county recorder's office that the mortgage lien has been lifted is essential to safeguard the integrity of your property's title. Innovative technologies like blockchain can streamline title and escrow processes, reducing complications. Consulting title experts or legal counsel can help navigate complex scenarios and secure property ownership records.

After settling your mortgage, verify that the property title is updated to reflect your sole ownership. Request an updated title document from the local county recorder or clerk's office and review it meticulously for accuracy.

In conclusion, managing your mortgage, updating the title, and navigating property ownership require a knowledgeable approach. By following these guidelines, you can ensure that your homeownership journey aligns with your life goals and secures your financial future.

Frequently Asked Questions

What does it mean to pay off a mortgage?

Paying off a mortgage means fulfilling your loan obligations, which enables you to achieve full ownership of your home. This transition ends your borrower status and starts a new phase of managing your property without a mortgage.

Why is updating the title after mortgage payoff important?

Updating the title after mortgage payoff is important because it legally confirms your ownership of the property. It involves removing the lender's lien and ensures that your title is free of any financial encumbrances.

What is a Satisfaction of Mortgage certificate?

A Satisfaction of Mortgage certificate is a document you receive once your mortgage is fully paid off. It legally indicates that the lien on your property has been discharged and that you now have a clear title.

How can paying off a mortgage affect my credit score?

Paying off a mortgage may initially lower your credit score if it was your only installment debt, but the impact can be neutralized or even reversed depending on your overall credit utilization and payment history.

What should I do if there are unexpected liens on my property?

If there are unexpected liens on your property, such as from unpaid labor or materials, it's important to address them promptly. This will prevent any hindrances if you plan to sell or refinance your property.

After paying off my mortgage, how do I ensure the lien is removed from property records?

You should submit the Satisfaction of Mortgage document to the local government entity, usually the county recorder or clerk's office, and verify that the lien has been correctly recorded as lifted from your property records.

What potential issues might arise during the title retrieval process after mortgage payoff?

Potential issues include delays in documentation, inconsistencies in property records, and complications with heirs' property. Engaging with a title company or legal counsel can help navigate these challenges.

How can I confirm that I am the sole owner of the property after mortgage payoff?

To confirm sole ownership, request an updated title document from the county recorder or clerk's office and review it to ensure your name is listed correctly as the property owner.

Why is it important to have a competent real estate agent or title specialist?

A competent real estate agent or title specialist can provide invaluable guidance in navigating title updates, property transactions, and ensuring that your title is accurately recorded and free of liens.

What role do companies like First American Financial Corporation play in the title and property ownership process?

Companies like First American Financial Corporation offer comprehensive title, settlement, and risk solutions. They are instrumental in managing title and property ownership matters, particularly with their focus on digital transformation and legal compliance.