Overview

AI plays a pivotal role in real estate underwriting by automating data extraction and analysis, which significantly enhances the speed and accuracy of property evaluations. This integration of AI tools into existing workflows not only reduces manual errors but also enables the efficient analysis of large datasets. Consequently, these advancements lead to improved decision-making and operational effectiveness.

Furthermore, the implementation of AI fosters a more reliable and streamlined process, allowing professionals to focus on strategic tasks rather than getting bogged down by tedious data management. By leveraging AI, real estate professionals can navigate the complexities of property evaluations with greater confidence and precision.

This article outlines a comprehensive guide for seamlessly incorporating AI into your operations, emphasizing the transformative potential of these technologies in the real estate sector. Embrace the future of underwriting with AI, and witness a remarkable enhancement in your operational capabilities.

Introduction

The real estate industry is experiencing a seismic shift as artificial intelligence (AI) revolutionizes the underwriting process, fundamentally transforming how properties are evaluated and assessed. By automating data extraction and analysis, AI accelerates workflows and enhances accuracy, significantly minimizing the potential for human error.

However, as professionals navigate this technological landscape, a pressing question emerges: how can they effectively integrate AI into their existing practices to maximize its benefits while overcoming inherent challenges? This integration is not merely a technical adjustment; it represents a pivotal evolution in the industry that demands both strategic foresight and practical application.

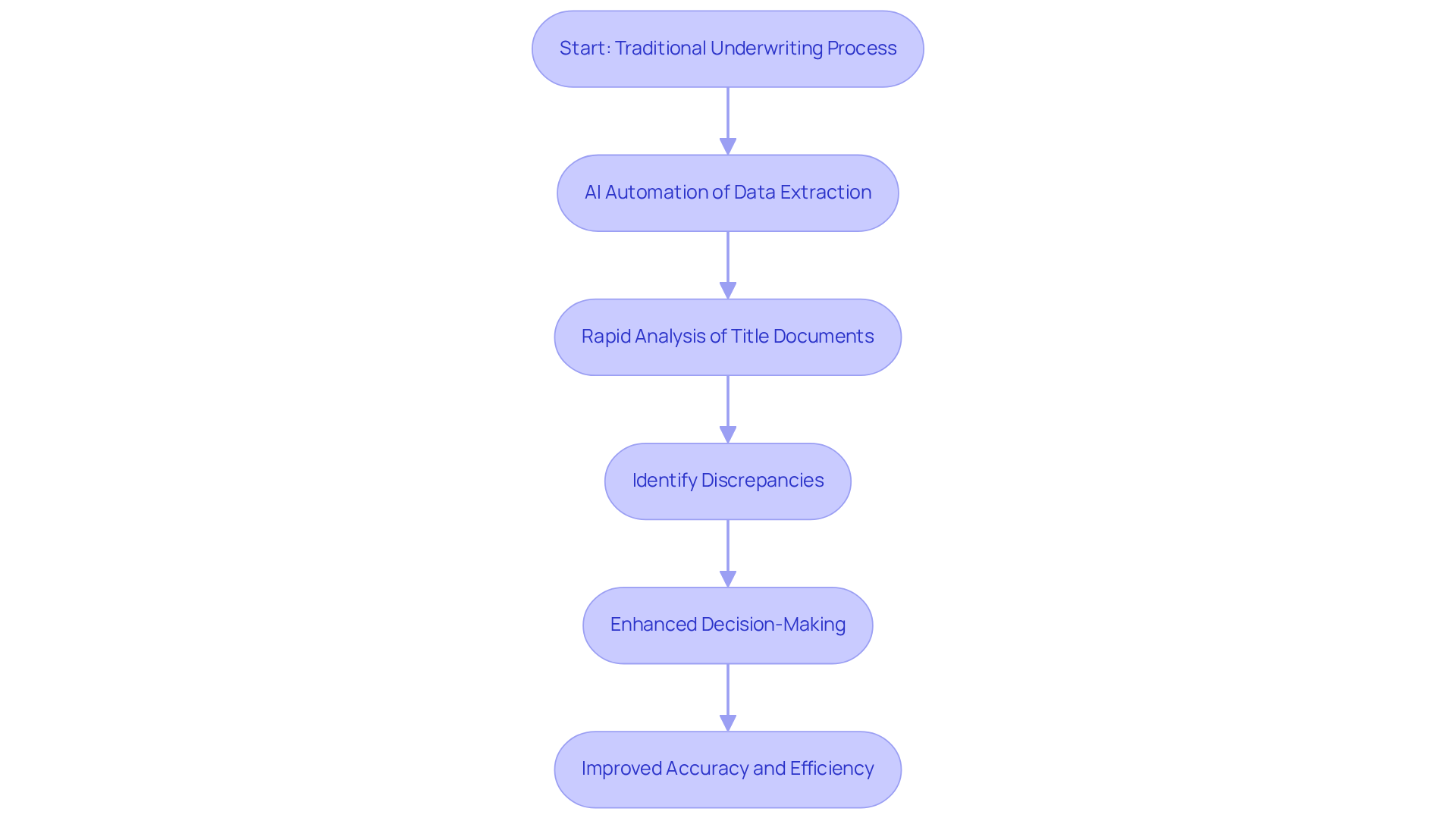

Understand AI's Role in Real Estate Underwriting

The transformative role of AI in real estate evaluation illustrates how AI supports real estate underwriting by automating data extraction and analysis, which traditionally required significant time and manual effort. By leveraging machine learning algorithms, AI can quickly analyze vast amounts of title documents, identify discrepancies, and provide insights that enhance decision-making. This not only accelerates the evaluation process but also minimizes the chance of human error, ensuring that property ownership information is precise and adheres to legal standards.

Furthermore, comprehending how AI supports real estate underwriting is crucial for real estate experts aiming to enhance their workflows and boost overall effectiveness in evaluation tasks. The integration of AI into real estate not only streamlines processes but also empowers professionals to make informed decisions based on accurate data.

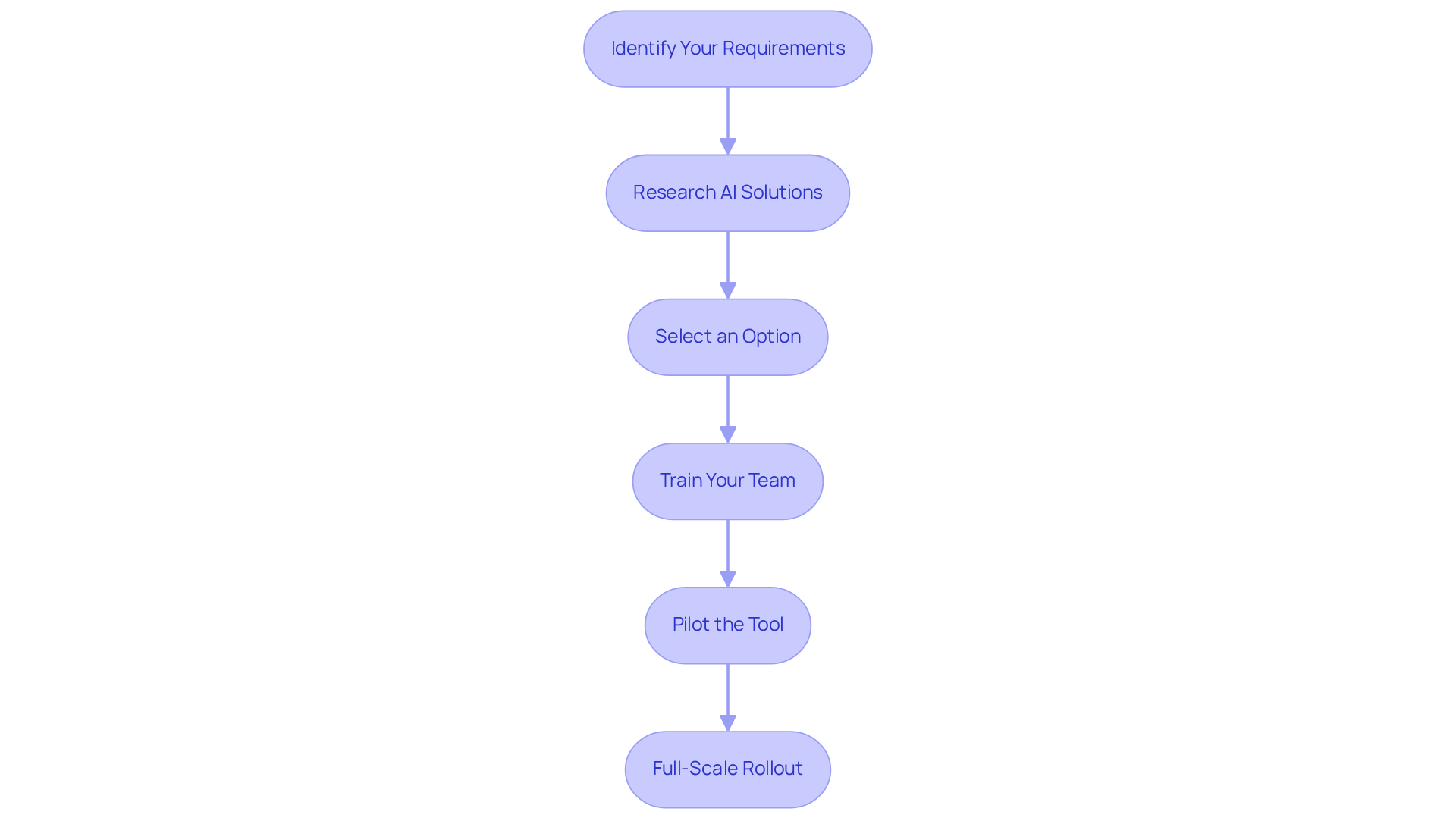

Implement AI Tools for Efficient Underwriting

To implement AI tools for efficient underwriting, follow these steps:

-

Identify Your Requirements: Begin by evaluating the specific obstacles within your current assessment process, such as time delays, inaccuracies in information, or inefficiencies in managing submissions.

-

Research AI solutions to understand how AI supports real estate underwriting by investigating platforms that specialize in this area. Focus on features like information extraction, analysis, and reporting functions that can enhance your workflows. For instance, platforms such as V7 Go are recognized for reducing manual data entry and processing times by as much as 80%.

-

Select an Option: Choose an AI solution that aligns with your operational needs and budget. Prioritize solutions that incorporate machine learning and optical character recognition to improve data processing accuracy and speed. As Casimir Rajnerowicz noted, 'AI won’t replace underwriters, but underwriters who understand how AI supports real estate underwriting will outcompete those who don’t.'

-

Train Your Team: Conduct comprehensive training sessions for your team to ensure they are well-versed in the new AI tools. This will empower them to utilize the technology effectively and maximize its benefits.

-

Pilot the Tool: Initiate a pilot project to test the AI tool in a controlled environment. This allows you to evaluate its performance, gather feedback, and make necessary adjustments before a full-scale rollout. Remember to consider ethical implications, as highlighted by Russell Page, who cautioned against using AI in ways that marginalize any group.

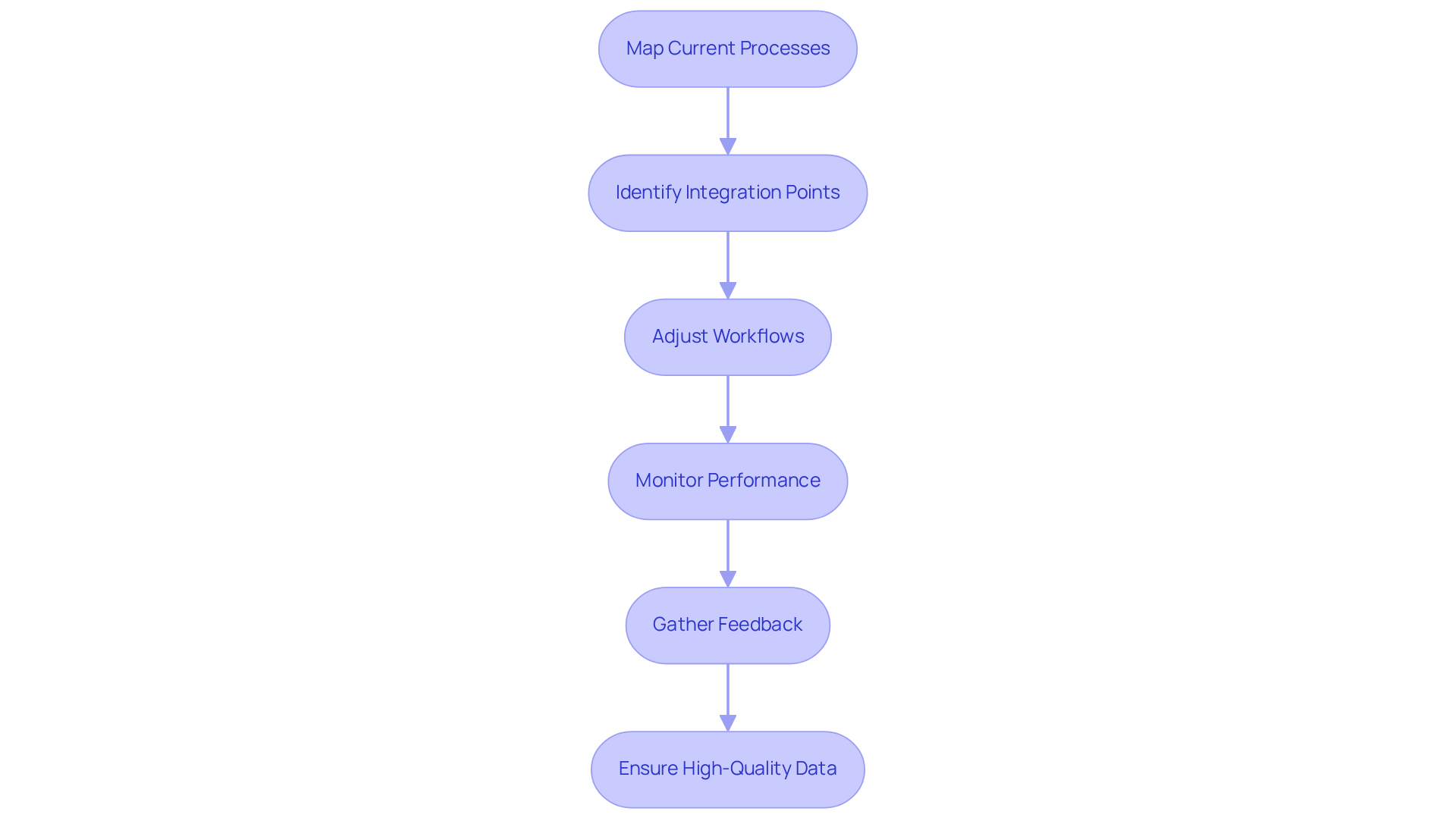

Integrate AI into Existing Underwriting Workflows

Incorporating AI into current assessment workflows entails a systematic method to improve efficiency and precision. Here are key steps to consider:

-

Map Current Processes: Begin by documenting your existing underwriting workflow. This will assist in pinpointing particular areas in how AI supports real estate underwriting, such as minimizing manual information entry or enhancing risk assessment precision.

-

Identify Integration Points: Evaluate where AI resources can be effectively integrated into your workflow. This could include stages like data collection, analysis, or reporting, allowing for seamless transitions between human and AI tasks.

-

Adjust Workflows: Modify your current processes to ensure that AI resources complement your workflow rather than complicate it. This may involve redefining roles or responsibilities to leverage AI capabilities fully, such as automating routine tasks to free up underwriters for more complex decision-making. Successful AI adoption requires careful planning and human expertise, particularly in how AI supports real estate underwriting, which is crucial for effective risk management in insurance.

-

Monitor Performance: After integrating AI, continuously track the performance of these tools within your workflow. This ongoing evaluation will help identify any issues or areas for improvement, ensuring that the AI systems are functioning optimally and delivering the expected benefits. AI-driven underwriting illustrates how AI supports real estate underwriting by decreasing costs by up to 50% and improving operational efficiency, making this monitoring essential.

-

Gather Feedback: Encourage team members to share their experiences and insights regarding the integration procedure. Their feedback can be invaluable in refining the use of AI tools, ultimately enhancing overall efficiency and job satisfaction as underwriters focus on higher-value tasks. Moreover, as AI technologies develop, they will allow agents to analyze unstructured information such as images and videos, demonstrating how AI supports real estate underwriting by further improving assessment capabilities.

-

Ensure High-Quality Data: Recognize the importance of high-quality data for training AI systems. This foundational requirement is critical for successful AI integration in assessment workflows, illustrating how AI supports real estate underwriting by directly impacting the accuracy and effectiveness of AI-driven processes.

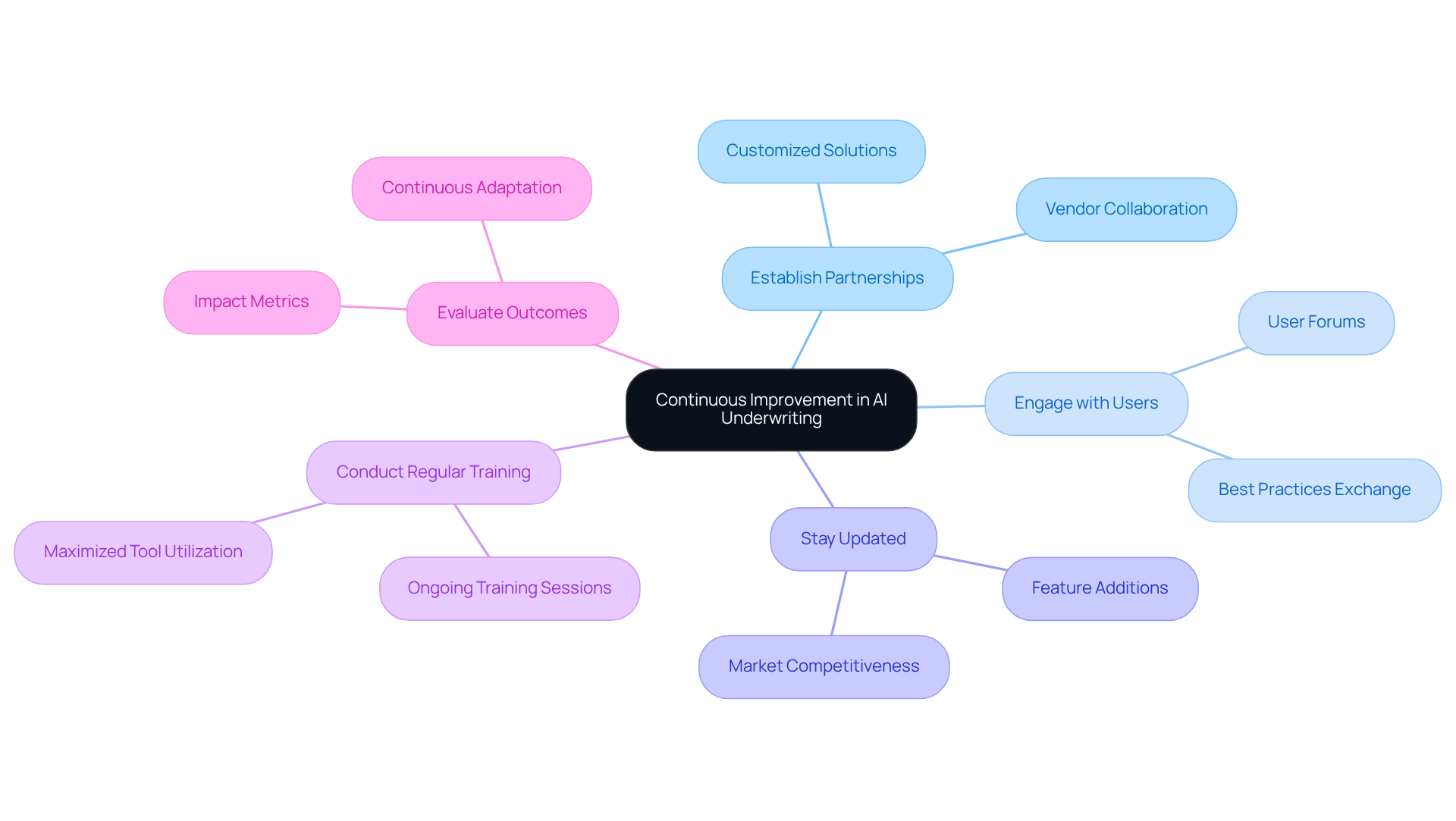

Collaborate for Continuous Improvement in AI Underwriting

To foster continuous improvement in AI underwriting, consider implementing the following strategies:

-

Establish Partnerships: Collaborate with AI technology vendors to exchange insights and feedback on performance and usability. This collaboration can lead to customized solutions that more effectively demonstrate how AI supports real estate underwriting.

-

Engage with Users: Create forums or regular meetings for users to share their experiences with AI resources. This engagement not only facilitates the exchange of best practices but also helps identify common challenges that can be addressed collaboratively. For instance, AI-enhanced CRM systems have been shown to boost customer retention rates by 15%, illustrating the benefits of user engagement.

-

Stay Updated: Keep abreast of advancements in AI technology. Consistently adding new features or resources can greatly improve your assessment process, guaranteeing that your team stays competitive in a swiftly changing market. AI can predict property price trends with 95% accuracy, showcasing how AI supports real estate underwriting and demonstrates the importance of leveraging AI advancements for competitive advantage.

-

Conduct Regular Training: Offer ongoing training sessions for your team to maximize the utilization of AI tools. Making sure that employees are informed about updates and new features can result in enhanced efficiency and precision in assessment tasks.

-

Evaluate Outcomes: Regularly assess the impact of AI on your risk assessment processes. Utilize metrics such as time savings, accuracy improvements, and user satisfaction to guide future enhancements. For instance, Deloitte reports that how AI supports real estate underwriting can lead to a reduction in policy issuance times by up to 80%, showcasing the tangible benefits of continuous evaluation and adaptation. Firms that have integrated AI-driven platforms report a 60% increase in efficiency and a significant boost in claims accuracy, demonstrating the value of these strategies.

Conclusion

The integration of AI into real estate underwriting signifies a transformative shift in evaluation practices, markedly enhancing efficiency and accuracy in what has traditionally been a labor-intensive process. By automating data extraction and analysis, AI not only accelerates the evaluation timeline but also mitigates the potential for human error. This advancement allows professionals to concentrate on informed decision-making grounded in reliable data.

Key strategies for implementing AI in underwriting have been delineated, including:

- The identification of specific needs

- The selection of appropriate tools

- Team training

- The continuous monitoring of performance

The emphasis on high-quality data and collaboration for ongoing improvement underscores how AI can bolster risk assessment and streamline workflows within the real estate sector.

Embracing AI technologies in real estate underwriting transcends mere trendiness; it represents a vital evolution necessary for maintaining competitiveness in a swiftly changing market. Real estate professionals are urged to explore these tools and strategies to harness AI's capabilities, optimizing their workflows and enhancing overall operational efficiency. By doing so, they position themselves for success in an increasingly data-driven industry.

Frequently Asked Questions

How does AI support real estate underwriting?

AI supports real estate underwriting by automating data extraction and analysis, which traditionally required significant time and manual effort. It leverages machine learning algorithms to quickly analyze vast amounts of title documents, identify discrepancies, and provide insights that enhance decision-making.

What are the benefits of using AI in real estate evaluation?

The benefits of using AI in real estate evaluation include accelerated evaluation processes, minimized chances of human error, and ensured precision in property ownership information that adheres to legal standards.

Why is it important for real estate experts to understand AI's role in underwriting?

It is important for real estate experts to understand AI's role in underwriting to enhance their workflows and boost overall effectiveness in evaluation tasks, allowing them to make informed decisions based on accurate data.

How does AI impact the speed of the evaluation process in real estate?

AI impacts the speed of the evaluation process by quickly analyzing large volumes of data, which significantly reduces the time required for manual analysis and enhances overall efficiency.