Introduction

Title insurance is a pivotal component of home financing, offering protection to both lenders and buyers against potential losses stemming from title defects. This insurance ensures that property ownership is legitimate and free from encumbrances that could jeopardize the buyer's investment. Without title insurance, buyers are exposed to risks such as undisclosed liens, fraudulent claims, or legal disputes that may surface after the purchase.

Fannie Mae, a significant player in the mortgage market, imposes specific title insurance requirements to ensure the integrity of property transactions, protecting both borrowers and lenders. The risks associated with waiving title insurance are considerable, posing potential long-term financial repercussions for homeowners. Title insurance serves as a protective barrier by ensuring that the property title is free from defects and encumbrances, thereby securing investments and fostering trust and stability in the housing market.

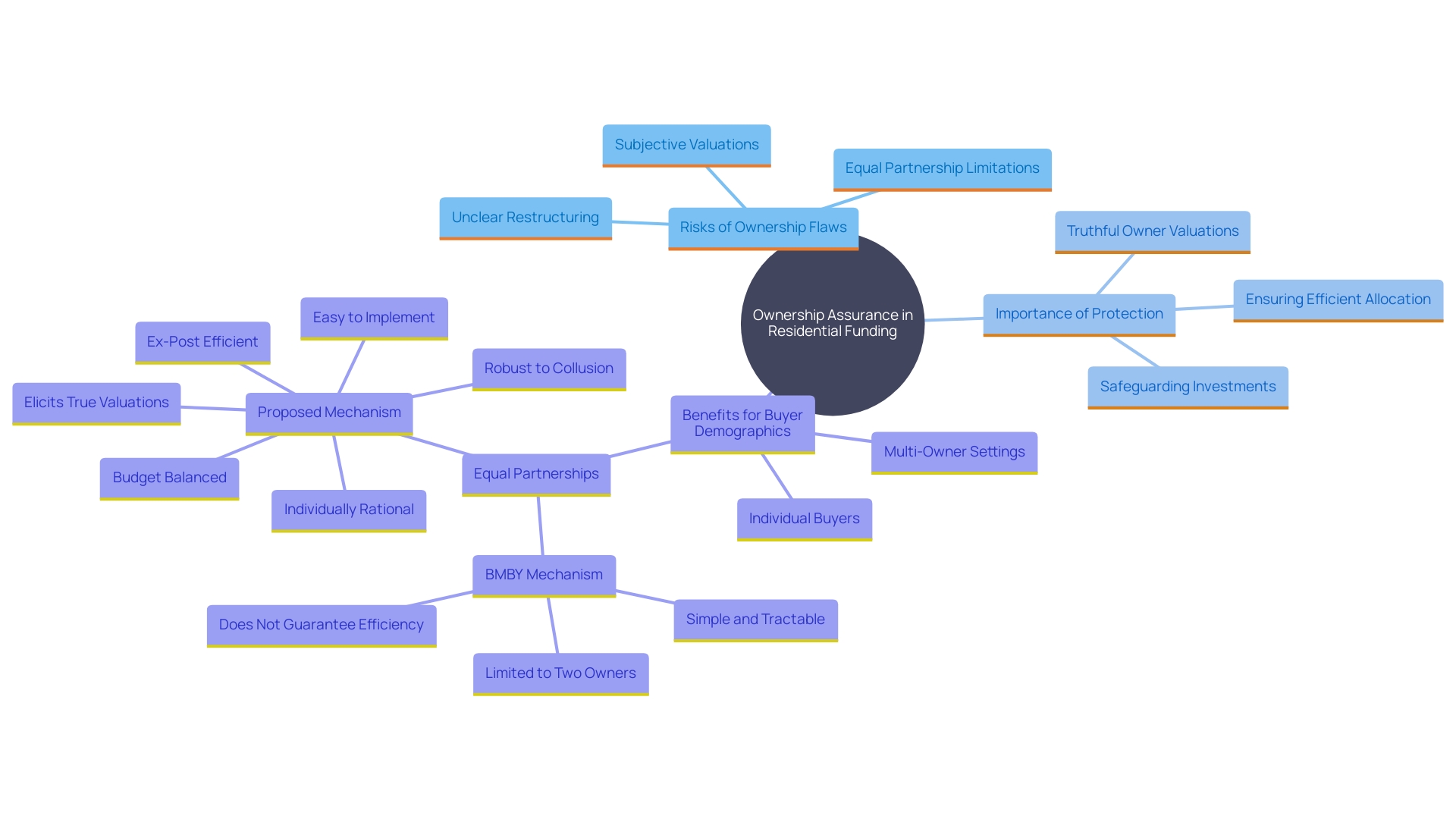

The Importance of Title Insurance in Home Financing

Ownership assurance is a crucial element of residential funding, providing safeguards to both creditors and purchasers against possible losses arising from . This coverage guarantees that is valid and devoid of claims that could threaten the buyer's investment. Without coverage for , purchasers are vulnerable to dangers like hidden liens, deceitful claims, or legal conflicts that might arise following the acquisition. For instance, Riverside Abstract's case emphasizes the significance of in stopping deceitful actions that can impact both purchasers and financiers. As Fleming observed, for under half a percent of the purchase cost, ownership protection secures one of the most important investments in a person's life, shielding homeowners from . This protection is particularly valuable for low- and moderate-income buyers who might otherwise struggle to afford the costs of defending their ownership rights. By obtaining ownership protection, homeowners and financiers can proceed with assurance, aware that they are .

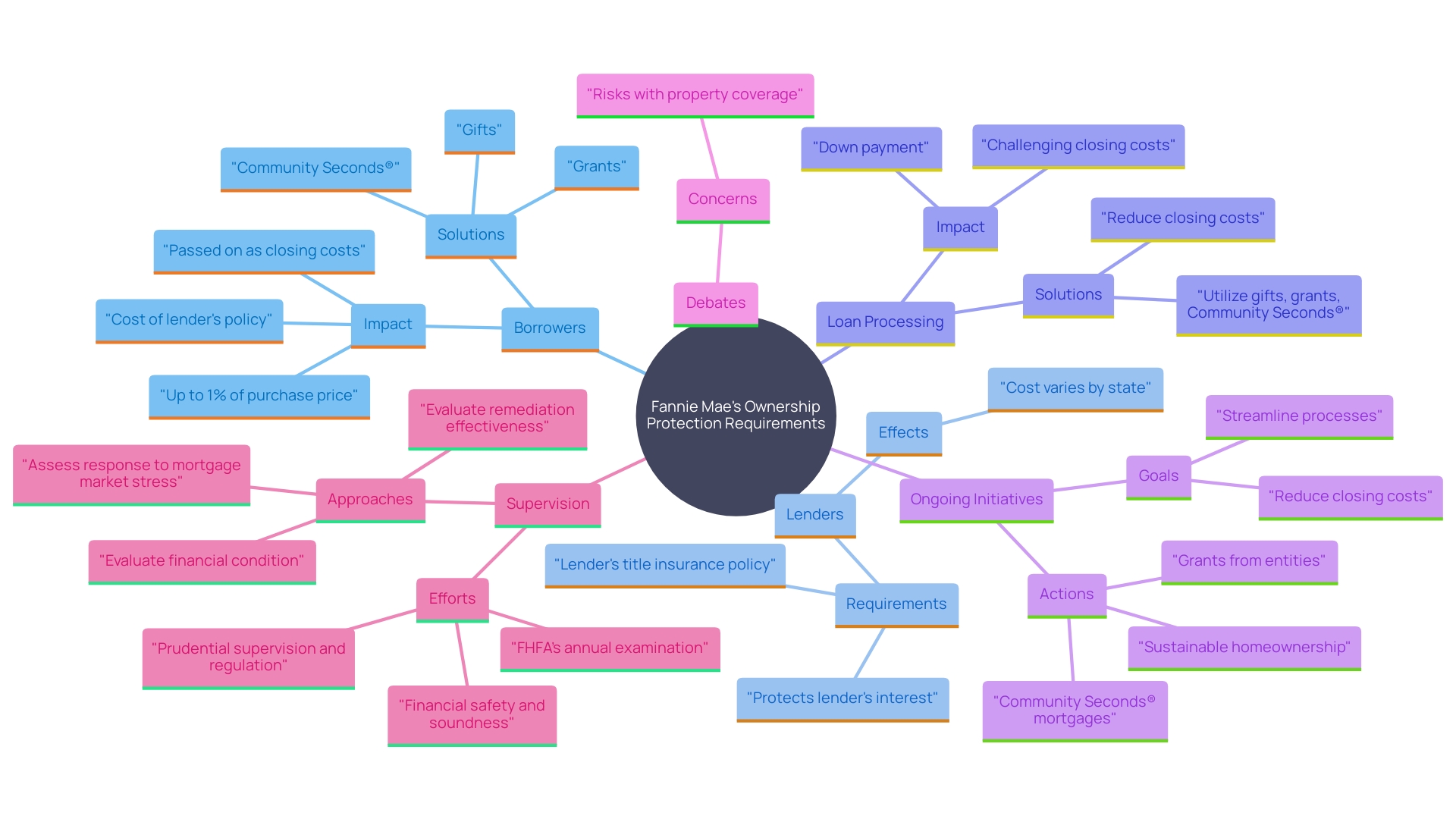

Fannie Mae's Title Insurance Requirements and Benefits

Fannie Mae's important role in the involves enforcing particular ownership protection requirements to ensure the integrity of property transactions. These criteria safeguard both borrowers and financiers by guaranteeing are devoid of flaws, which is essential considering that approximately one-third of all claims disbursed by property protection firms are for problems not identified in public records. Compliance with Fannie Mae's guidelines not only but also boosts lender confidence, potentially leading to more favorable loan terms for borrowers. This alignment can facilitate secondary market transactions, enhancing liquidity within the mortgage market.

Fannie Mae's initiatives reflect its ongoing efforts to and streamline processes. A recent pilot initiative aims to eliminate requirements for certain mortgage refinancings, a move that has sparked debate within the industry. Critics contend that Fannie Mae, lacking significant experience with property coverage, should steer clear of further risks. This initiative aligns with broader objectives to dismantle homeownership barriers, reflecting the industry's dynamic nature and the need for adaptive strategies to maintain both market stability and consumer protection.

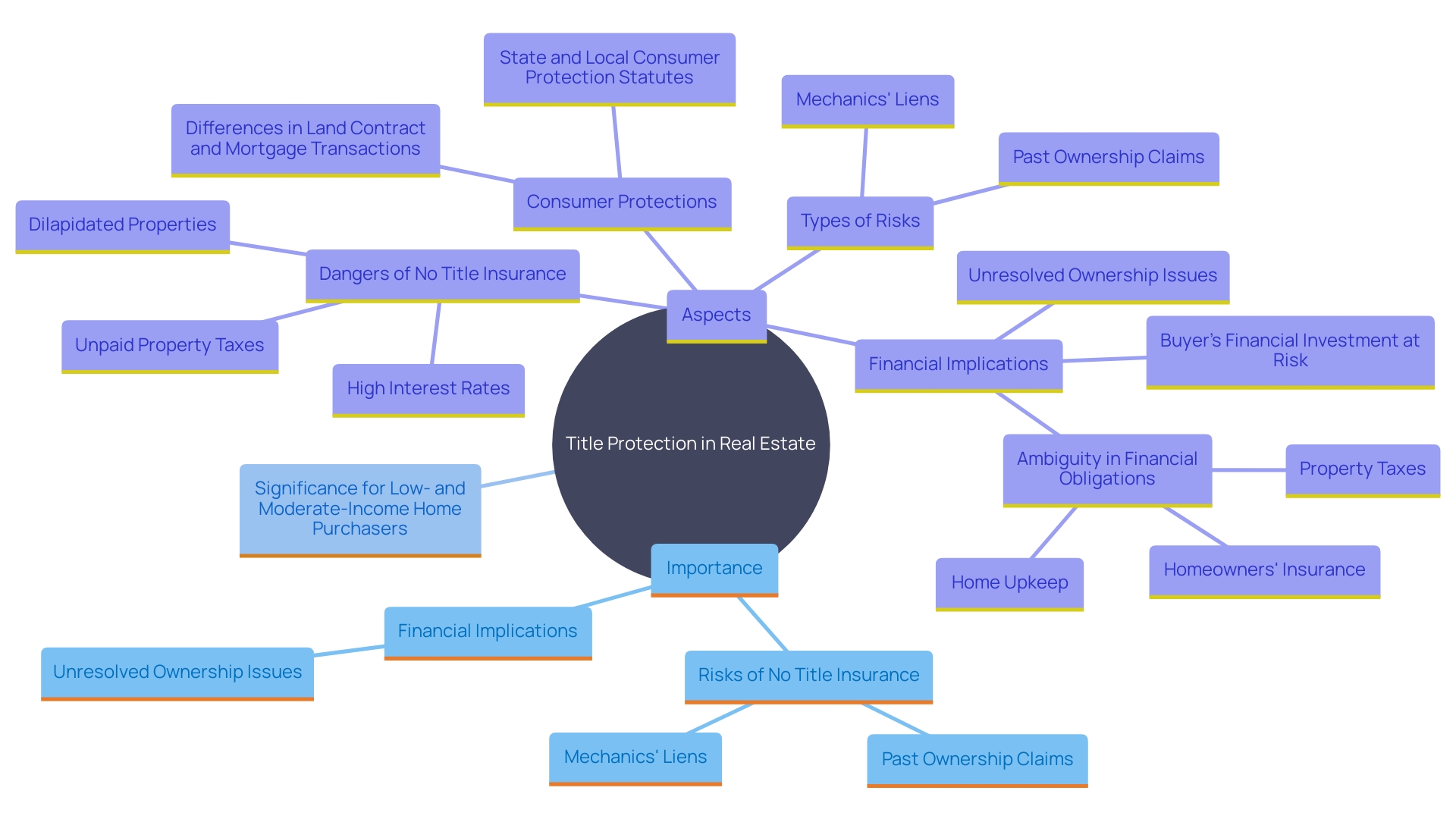

Understanding the Risks of Waiving Title Insurance

Forgoing may initially seem like a money-saving strategy for purchasers, but it presents considerable dangers with possible long-term . Title protection is crucial in from legal disputes linked to past ownership claims, unpaid taxes, or other encumbrances. Without this protection, homeowners may face costly litigation or even the loss of their property.

is especially vital as it covers not just catastrophic events but also common issues like mechanics' liens, which can amount to tens of thousands of dollars. Although the industry has high fixed and administrative costs, it remains the best option for reducing risk and securing property rights for consumers and lenders. The financial consequences of unresolved ownership issues can be severe, underscoring the importance of maintaining this coverage.

In 2023, the coverage sector experienced a 35.1% decline in premium volume in relation to the prior year, yet it continues to be a vital protection against possible risks to property ownership. For low- and moderate-income home purchasers, property protection is especially important, as they might otherwise be unable to afford the legal expenses needed to uphold their ownership rights. The safeguarding it offers is essential for ensuring peace of mind and financial security in real estate transactions.

The Role of Title Insurance in Protecting Homebuyers and Lenders

Ownership protection acts as a defensive shield for both home purchasers and financiers by guaranteeing that the property ownership is devoid of flaws and burdens. For homebuyers, this assurance means that their investment is secure, allowing them to enjoy their new home without the fear of unexpected legal challenges. Fleming emphasized that for under half a percent of the purchase price, or roughly the monthly cost of an Amazon Prime subscription, safeguards one of the most significant acquisitions in an individual's life. This safeguard is most valuable to low- and moderate-income homebuyers, who otherwise could not afford the thousands or even hundreds of thousands of dollars needed to defend a threat to their ownership rights. For lenders, ownership protection reduces the risk of financial loss due to problems associated with the property claim, which could threaten the loan. This dual protection emphasizes the crucial function of ownership coverage in the real estate transaction process, fostering trust and stability in the housing market. Despite its essential role, the sector has encountered difficulties, including the effort reported by The Wall Street Journal, where Fannie Mae tested a program to forgo the deed protection requirement on mortgage refinancings, aiming to lower closing expenses and encourage homeownership. This move, however, reignited debates about the cost and necessity of title insurance, reinforcing its importance in safeguarding property rights.

Conclusion

Title insurance is essential in home financing, offering vital protection for buyers and lenders against potential losses from title defects. By confirming that property ownership is legitimate and free from encumbrances, title insurance helps mitigate risks such as undisclosed liens and fraudulent claims. This coverage is especially important for low- and moderate-income buyers, who may struggle with the legal costs of defending their ownership rights.

Fannie Mae's title insurance requirements further enhance the integrity of property transactions, streamline loan processing, and foster lender confidence, which can lead to more favorable loan terms for borrowers. However, the recent proposal to waive title insurance for certain refinancings has sparked industry debate, highlighting the need for careful evaluation of the risks involved.

Waiving title insurance may appear cost-effective but exposes homeowners to significant long-term risks, including expensive litigation and potential loss of property. The financial consequences of unresolved title issues can be severe, underscoring the necessity of maintaining this coverage. Despite a decrease in premium volume in 2023, title insurance remains a crucial safeguard, particularly for those who may lack the financial resources to address legal disputes.

In conclusion, title insurance is vital for protecting property rights and securing investments, fostering trust and stability in the housing market. Its importance in real estate transactions cannot be overstated, ensuring that the interests of all parties involved are adequately protected.

Frequently Asked Questions

What is ownership assurance?

Ownership assurance is a crucial aspect of residential funding that provides protection to both creditors and purchasers against potential losses due to ownership flaws. It ensures that property ownership is valid and free from claims that could jeopardize a buyer's investment.

Why is ownership assurance important for buyers?

Without ownership assurance, buyers face risks such as hidden liens, fraudulent claims, or legal disputes that may arise after the purchase. This protection helps secure one of the most significant investments in a person's life and shields homeowners from legal costs related to covered ownership claims.

How does ownership assurance benefit low- and moderate-income buyers?

Ownership assurance is particularly beneficial for low- and moderate-income buyers, as it provides essential coverage that they might otherwise struggle to afford. This protection helps them avoid the financial burden of defending their ownership rights, ensuring peace of mind and financial security.

What role does Fannie Mae play in ownership protection?

Fannie Mae enforces specific ownership protection requirements in the mortgage market to ensure the integrity of property transactions. These requirements help safeguard borrowers and financiers by confirming that ownership documents are free of flaws, which is essential since many claims arise from issues not listed in public records.

What are the consequences of forgoing title protection?

Forgoing title protection may seem like a cost-saving strategy, but it poses significant risks, including potential costly litigation or loss of property due to past ownership claims or unpaid taxes. Title insurance is vital to cover not only catastrophic events but also common issues like mechanics' liens.

How has the title insurance sector been affected recently?

In 2023, the title insurance sector experienced a 35.1% decline in premium volume compared to the previous year. Despite this decline, it remains a crucial form of protection against risks to property ownership, especially for low- and moderate-income buyers.

What are the financial implications of unresolved ownership issues?

Unresolved ownership issues can lead to severe financial consequences, including costly legal disputes and loss of property. Title insurance helps mitigate these risks by providing coverage for potential claims against ownership.

How does ownership protection foster trust in the housing market?

Ownership protection reduces the risk of financial loss for lenders due to problems related to property claims, thereby fostering trust and stability in the housing market. This dual protection underscores the importance of ownership coverage in real estate transactions.

What recent initiatives have been taken by Fannie Mae regarding title insurance?

Fannie Mae has tested a program to eliminate the deed protection requirement on mortgage refinancings, aiming to lower closing costs and promote homeownership. However, this initiative has sparked debates about the necessity and cost of title insurance, highlighting its importance in protecting property rights.