Introduction

Understanding the complexities of property ownership is crucial in today's real estate landscape, where a seemingly minor issue can have significant consequences. A cloud on title—a legal term denoting any claim, lien, or encumbrance affecting ownership—can obscure the true titleholder, presenting challenges for both buyers and sellers. These clouds often arise from various sources, including recording errors, unpaid debts, or legal disputes, creating hurdles that can delay transactions and diminish property value.

As the industry evolves with technological advancements, the methods for identifying and resolving these issues are also transforming, offering new solutions to long-standing problems. This article delves into the nature of clouds on title, their common causes, the consequences they impose, and the steps necessary for their removal, highlighting the importance of diligent title searches and insurance in securing smooth real estate transactions.

What is a Cloud on Title?

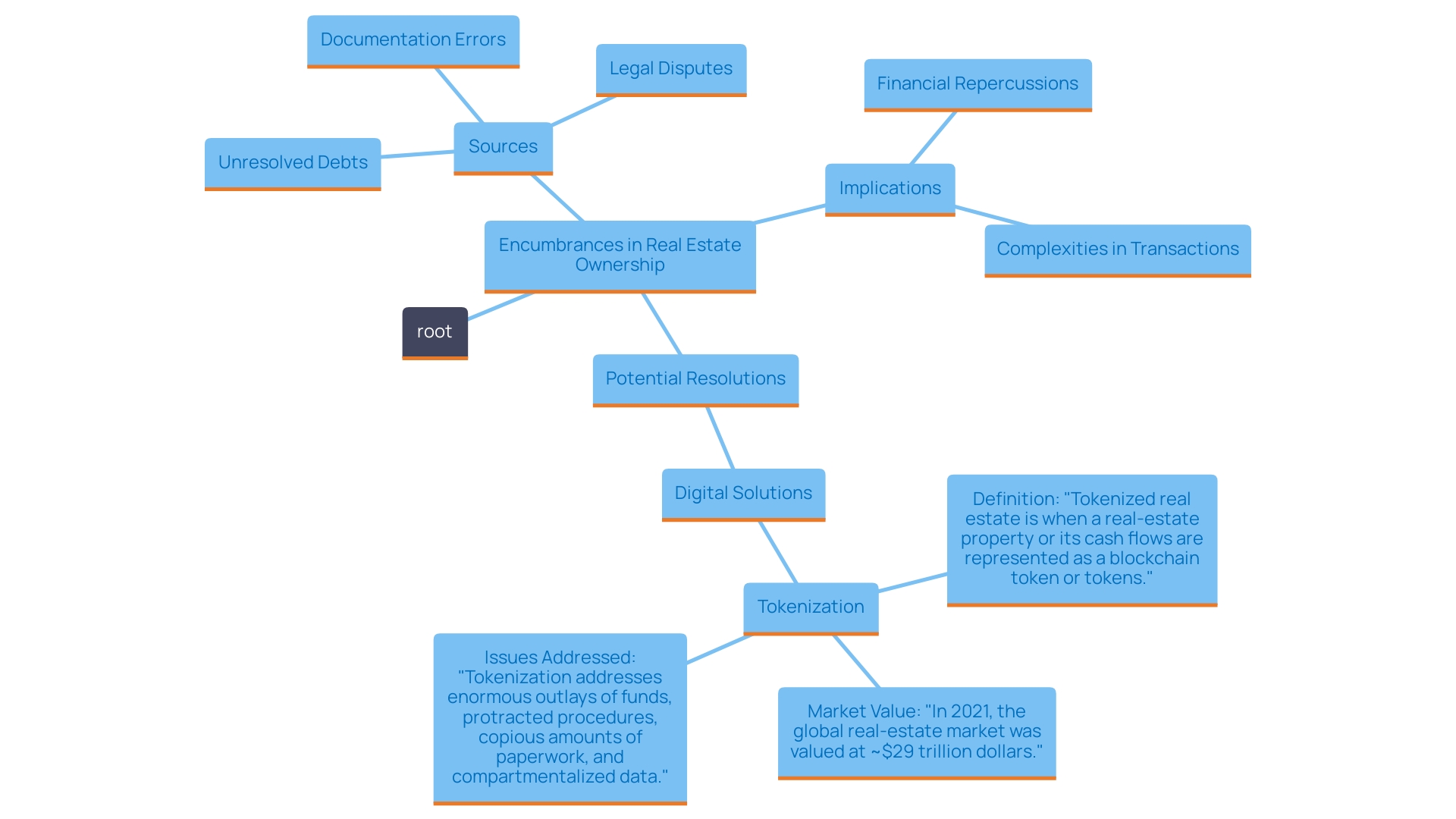

An issue on the record indicates any assertion, obligation, or hindrance that can influence a 's control, often obscuring the actual holder of the deed. This legal complication can significantly hinder an owner's ability to sell or transfer ownership, leading to potential . Frequent sources of formations in headings include unresolved debts, ongoing legal disputes, or mistakes in documenting records.

The implications of such encumbrances can be far-reaching. For instance, if a property has an or a lien due to unpaid taxes, these claims must be resolved before any transfer can occur. In numerous situations, the procedure of resolving an issue with ownership can entail prolonged legal actions, making transactions more complex.

Moreover, the rise of , such as tokenization, may provide innovative avenues to streamline the resolution of these issues. Tokenization enables the digital depiction of real estate assets, improving transparency and possibly streamlining the procedure of confirming possession. As new technologies develop, they assure to tackle some of the shortcomings linked to conventional real estate dealings, where issues with ownership often serve as major obstacles.

Common Causes of a Cloud on Title

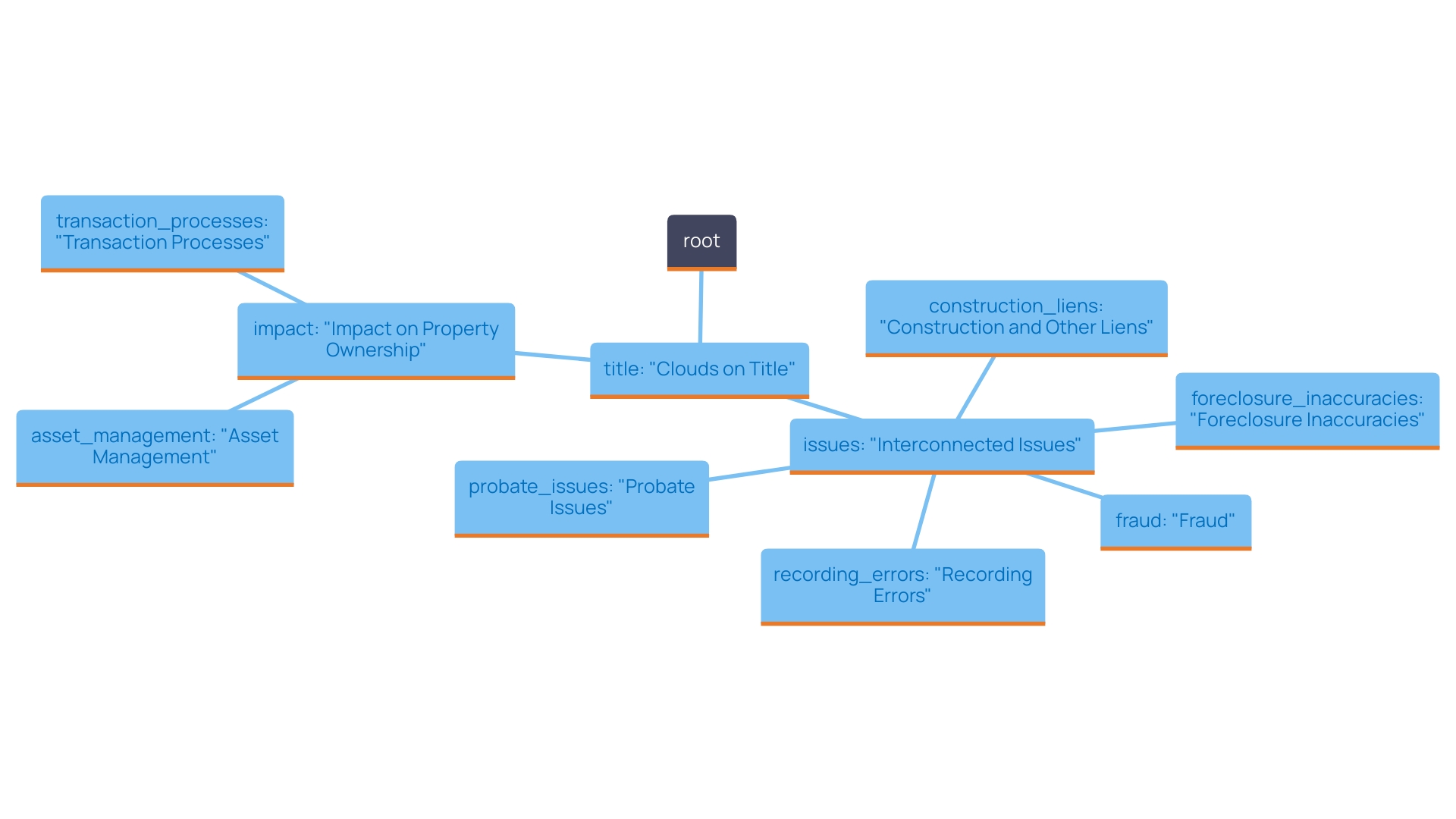

' can arise from various prevalent issues that complicate asset management and transaction processes.'. One significant source of these formations is recording errors, which can stem from inaccuracies during the documentation process. Such mistakes may lead to disputes regarding land boundaries, ownership, or even the existence of liens.

Liens are another common factor contributing to [clouds on title](https://blog.parseai.co/10-essential-ap-is-for-land-and-title-data-access-you-need). For instance, arise when contractors or subcontractors submit claims for unpaid labor, creating encumbrances that can obstruct an owner's capacity to sell or refinance the asset until the owed amounts are resolved. 'In fact, there are three primary types of liens—construction, mechanic's, and materialman's liens—each reflecting unpaid labor or materials delivered during renovations or constructions.'.

Additionally, the death of a property owner can introduce , leading to uncertainties about inheritance and rightful ownership. This frequently necessitates maneuvering through intricate legal structures to identify the legitimate heirs, which can further obscure the ownership.

Mistakes associated with foreclosure procedures also add to . Mismanagement or inaccuracies in foreclosure proceedings can lead to conflicting claims and legal challenges concerning rights of possession. Moreover, fraudulent activities, including mortgage fraud, worsen these complexities, as shown in recent reports emphasizing the effect of such fraud on insurance firms, resulting in substantial business losses.

These different elements not only generate uncertainties in property ownership but also require comprehensive due diligence and ownership searches to clarify and address potential issues before transactions can move forward.

Consequences of a Cloud on Title

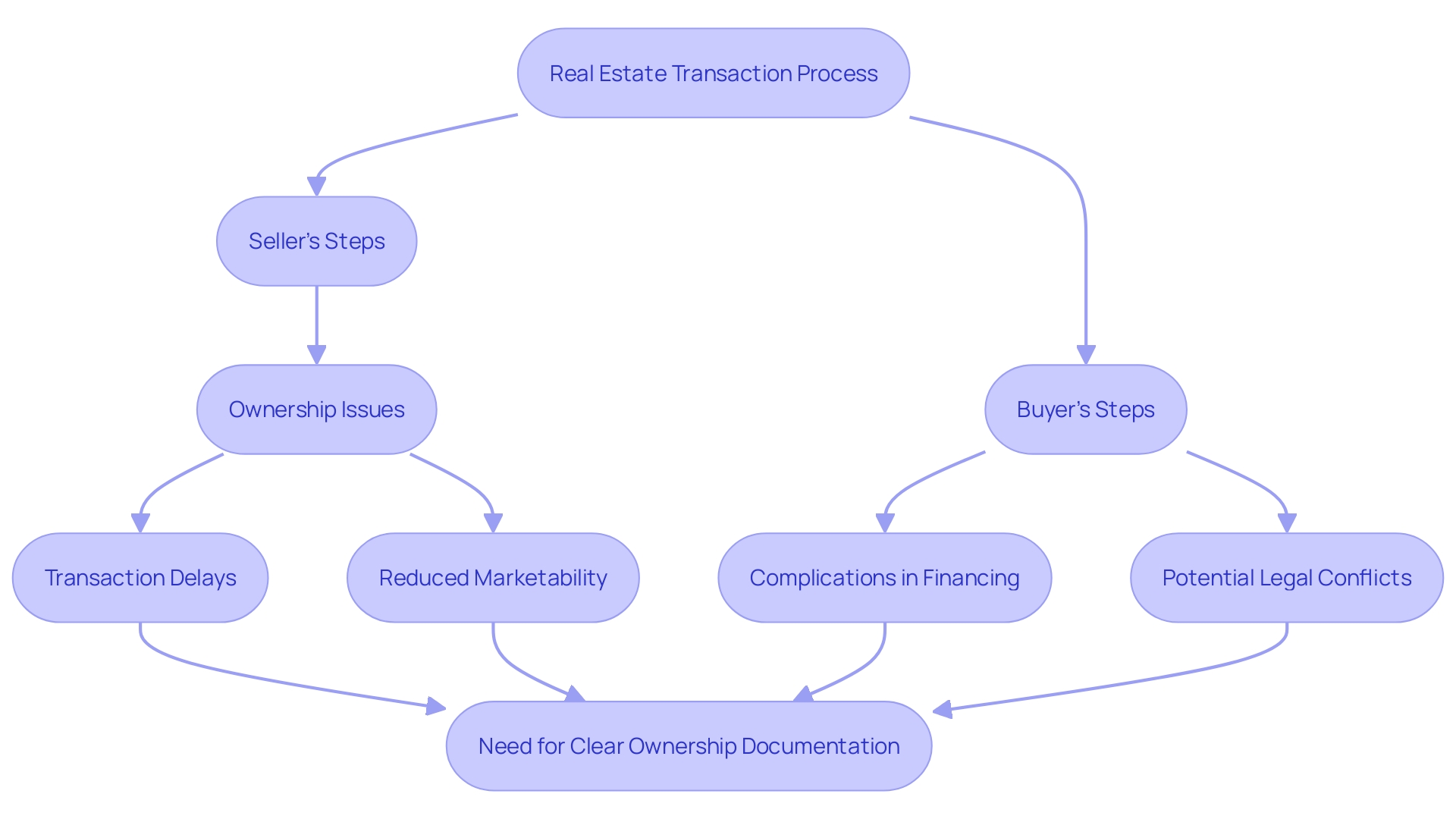

An issue with ownership can greatly affect both sellers and buyers in the real estate market. For sellers, the existence of such an obstacle can lead to transaction delays, hindering their ability to finalize deals swiftly. This situation not only reduces the property’s marketability but can also negatively impact its value, as potential buyers may be discouraged by unresolved .

On the buyer’s side, encountering a presents several challenges. It can complicate the financing process, as lenders often require a before approving loans. Moreover, purchasers might become embroiled in legal conflicts if the ownership matters are not sufficiently resolved before the deal. In recent reports, it has been noted that insurance firms have experienced a decrease in business due to connections with mortgage fraud schemes, emphasizing the significance of addressing any [ownership issues](https://blog.parseai.co/understanding-the-title-of-a-property-an-in-depth-tutorial-for-real-estate-professionals) before moving forward with sales.

The consequences of can reach further than just short-term monetary effects. For instance, the Japanese real estate sector, which heavily relies on manual processes and lacks standardization, faces unique challenges in managing ownership issues. This complexity often leads to unnecessary data duplication and difficulties in communication, further complicating transactions.

In a marketplace where purchasers and vendors are increasingly aware of the significance of transparent ownership, possessing an encumbrance on ownership can be seen as a concealed expense that complicates real estate dealings. Experts remind industry professionals that a thorough understanding of transfer taxes and other legal requirements is crucial in navigating these challenges effectively.

How to Remove a Cloud on Title

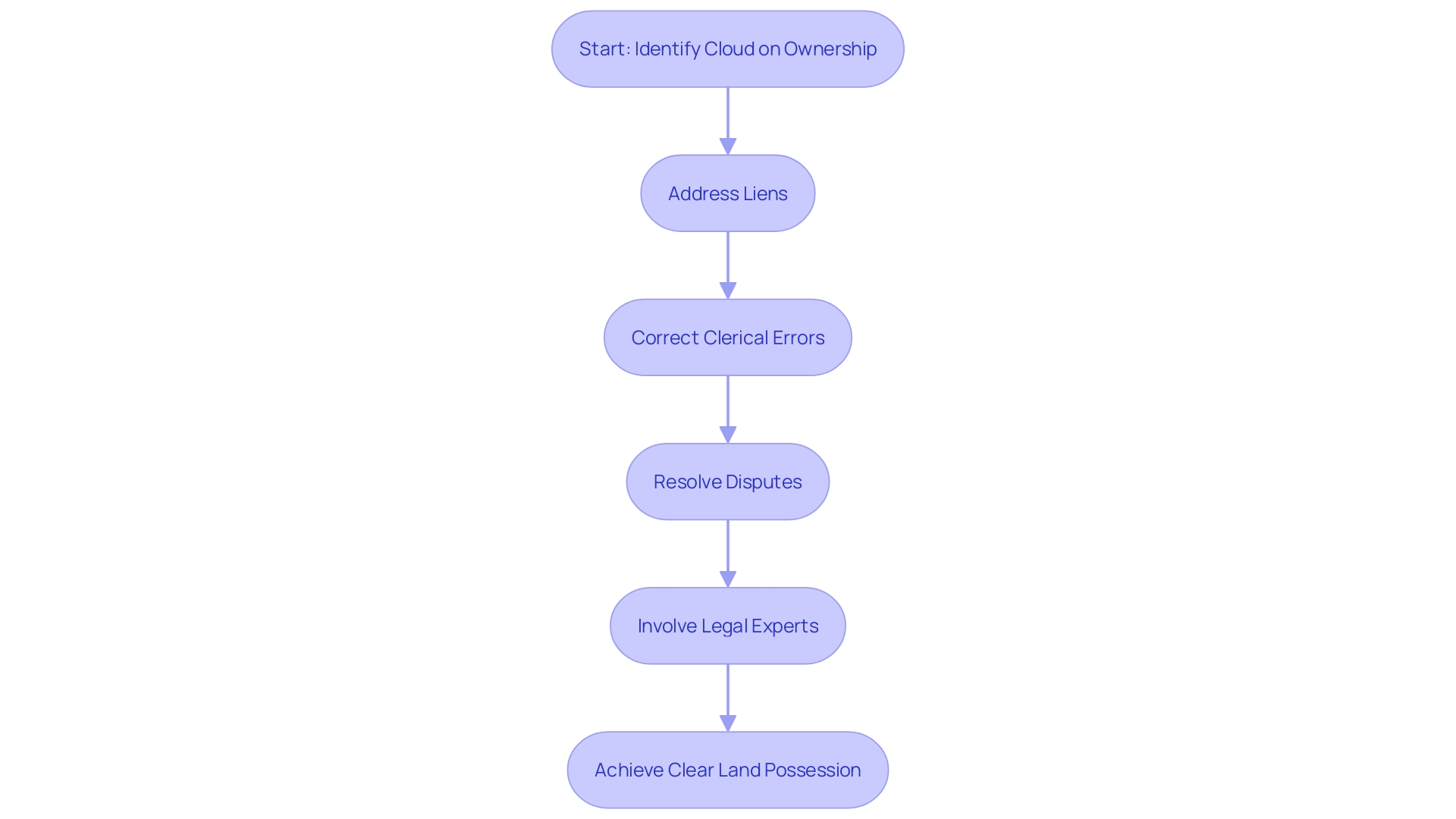

Eliminating a cloud on is a that generally necessitates multiple essential steps to guarantee that land possession is distinctly defined and legally valid. One primary action involves addressing and paying off any existing liens against the property. Liens can originate from different sources, such as unpaid taxes or contractor services, and their resolution is essential for clearing ownership.

Another important step is correcting clerical errors in public records. Errors in can result in disagreements concerning possession and may necessitate formal processes to modify these records, ensuring that the title represents the actual condition of possession.

Additionally, resolving disputes related to ownership or probate is essential. Such disputes can arise from or competing claims to the property, necessitating thorough investigation and potentially legal intervention to settle these issues.

Involving a document company or can significantly simplify this process. According to First American Financial Corporation, a prominent supplier in the ownership sector, their knowledge can aid not only in recognizing issues but also in carrying out effectively. 'Their cutting-edge technologies and extensive data services are essential in managing the intricacies related to ownership records.'.

Furthermore, the financial implications can be significant; First American reported a total revenue of $7.6 billion in 2022, underscoring the industry's robust nature and the value of utilizing professional services. Consequently, utilizing the expertise and assets of experienced individuals can not only speed up the resolution of issues with ownership documents but also improve the overall safety of real estate dealings.

Importance of Title Search and Insurance

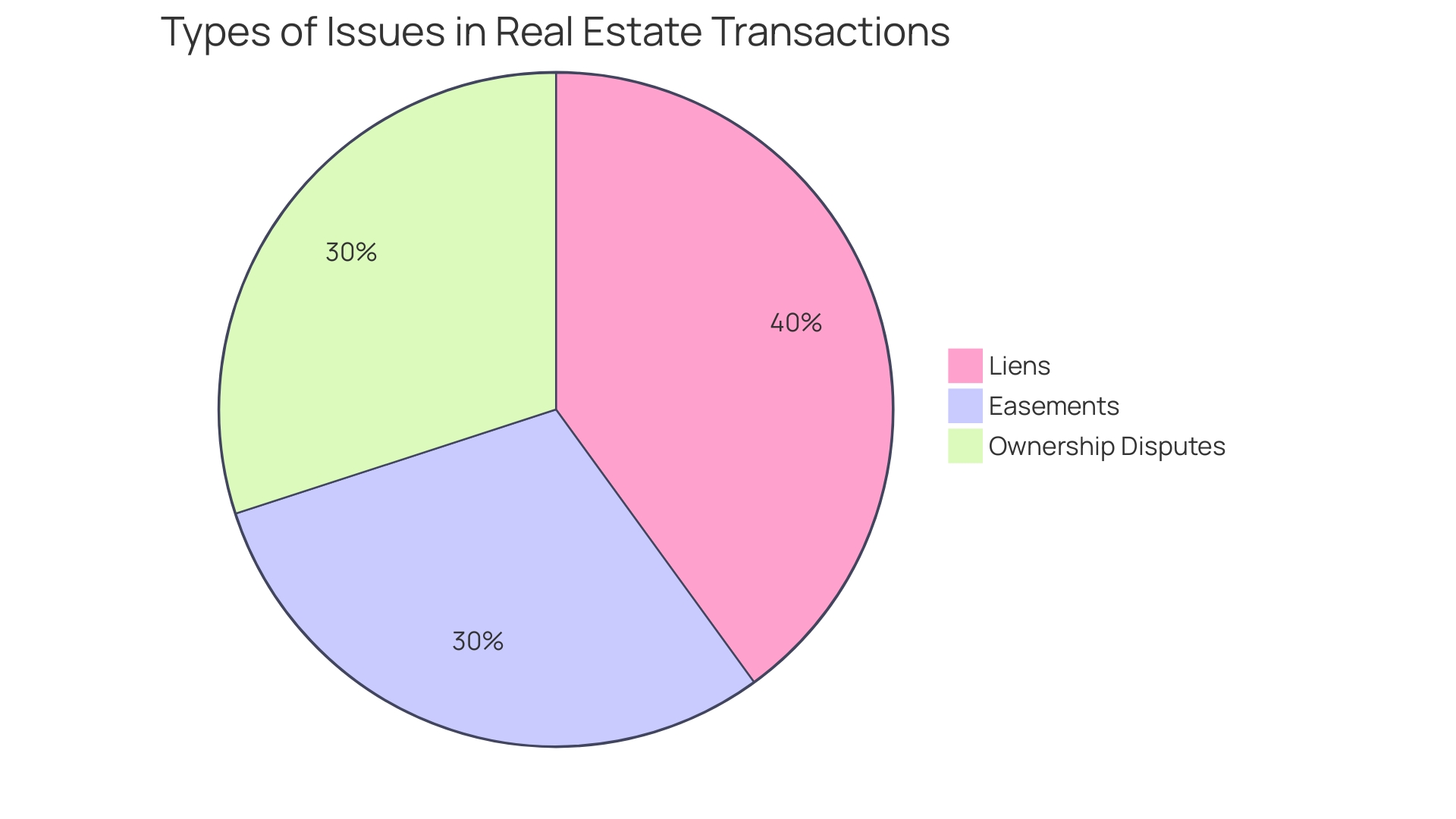

Carrying out a thorough examination of ownership is crucial for revealing any possible issues regarding ownership before finalizing a real estate deal. A —such as liens, easements, or disputes over property ownership—can complicate ownership and lead to significant financial repercussions for buyers. According to industry insights, ensuring clarity in ownership records can prevent unexpected claims that could arise post-purchase.

serves as a against such unforeseen issues, offering protection not just to buyers but also to lenders involved in the transaction. Notably, the American Land Title Association (ALTA) emphasizes the importance of improving homebuyer education to reduce confusion during the closing process. As Diane Tomb, CEO of ALTA, states, "Our goal is to improve homebuyer education and reduce barriers to homeownership, so everyone has access to the American dream of owning a home."

Moreover, with the sector evolving due to technological progress, firms such as First American Financial Corporation are at the forefront of the digital transformation. Their innovative solutions enhance the accuracy of ownership searches, thereby minimizing the risk of issues on ownership. The importance of these measures is underscored by the fact that First American reported a total revenue of $7.6 billion in 2022, reflecting the industry's growth and resilience. This financial stability allows for continued investment in technology that protects both buyers and lenders, reinforcing the vital role of thorough in real estate transactions.

Conclusion

Understanding the implications of a cloud on title is essential for navigating the complexities of property ownership. These legal encumbrances can arise from various sources, such as recording errors, unpaid debts, and legal disputes, posing significant challenges for both buyers and sellers. The consequences can be profound, affecting transaction timelines, property values, and the financing process.

For sellers, unresolved title issues may lead to delays and deter potential buyers, while buyers may face complications in securing loans or even legal disputes if issues are not resolved prior to the transaction.

The process of removing a cloud on title involves several critical steps, including addressing outstanding liens, correcting clerical errors, and resolving disputes related to ownership. Engaging with professionals such as title companies can streamline this process, leveraging their expertise and resources to ensure a clear title is established. The financial impact of these actions underscores the importance of thorough due diligence and the utilization of experienced professionals in navigating these complexities.

Finally, conducting a comprehensive title search and obtaining title insurance are indispensable practices in safeguarding against potential clouds on title. These measures not only protect the interests of buyers and lenders but also foster a smoother transaction process. As the real estate landscape continues to evolve with technological advancements, the importance of diligent title research and the role of title insurance in mitigating risks cannot be overstated.

A proactive approach to understanding and addressing clouds on title is vital for ensuring successful real estate transactions.

Frequently Asked Questions

What are ownership issues in real estate?

Ownership issues, often referred to as 'clouds on title,' include any assertions, obligations, or hindrances that may impact the control of a property. These can obscure the actual holder of the deed and complicate the sale or transfer of ownership.

What are common sources of ownership issues?

Common sources include unresolved debts, ongoing legal disputes, errors in documentation, construction liens due to unpaid labor, probate complications following an owner's death, and inaccuracies in foreclosure procedures.

How can ownership issues affect sellers?

For sellers, ownership issues can cause transaction delays, reduce the property’s marketability, and negatively impact its value, as potential buyers may be deterred by unresolved claims.

What challenges do buyers face with ownership issues?

Buyers may encounter complications in financing, as lenders require clear ownership documentation. They could also face legal disputes if ownership matters are not resolved before the transaction.

What is the role of technology in resolving ownership issues?

Emerging technologies, such as tokenization, enhance transparency and may streamline the resolution of ownership issues by creating digital representations of real estate assets, thereby addressing some challenges associated with traditional real estate dealings.

What steps are involved in resolving a cloud on title?

Key steps include paying off existing liens, correcting clerical errors in public records, resolving ownership or probate disputes, and potentially involving legal experts or document companies to facilitate the resolution process.

How does title insurance help in real estate transactions?

Title insurance protects buyers and lenders from unforeseen issues regarding ownership, such as liens or disputes. It helps mitigate the financial risks associated with unexpected claims that could arise after a purchase.

Why is due diligence important in real estate transactions?

Thorough due diligence is essential to reveal any potential ownership issues before finalizing a deal. It ensures clarity in ownership records, which can prevent unexpected complications and financial repercussions for buyers.

What financial implications can arise from ownership issues?

Ownership issues can lead to transaction delays and decreased property values, potentially resulting in significant financial losses for both buyers and sellers. It can also complicate financing options, impacting the overall marketability of the property.

How can professionals assist in managing ownership issues?

Experienced professionals, such as those from document companies or legal firms, can provide expertise in identifying and resolving ownership issues, thus enhancing the safety and efficiency of real estate transactions.