Introduction

Understanding the intricacies of property ownership is crucial for ensuring that real estate transactions are conducted smoothly and securely. This article delves into the concept of chain of title, a fundamental aspect of property law that documents the sequence of historical transfers of title to a property, ensuring legal ownership and freedom from prior claims. The importance of maintaining an accurate chain of title is highlighted through real-world examples, such as the case of Craig Adams in Raleigh, North Carolina, where a fraudulent deed transfer led to a significant legal battle.

The article also explores the various documents involved in establishing a chain of title, the meticulous process of conducting a title search, and the vital role of title companies and insurance in safeguarding property transactions. Additionally, it addresses common mistakes and disputes that can arise in the chain of title, emphasizing the need for thorough due diligence and legal expertise to mitigate risks and ensure accurate and reliable title records.

What is Chain of Title?

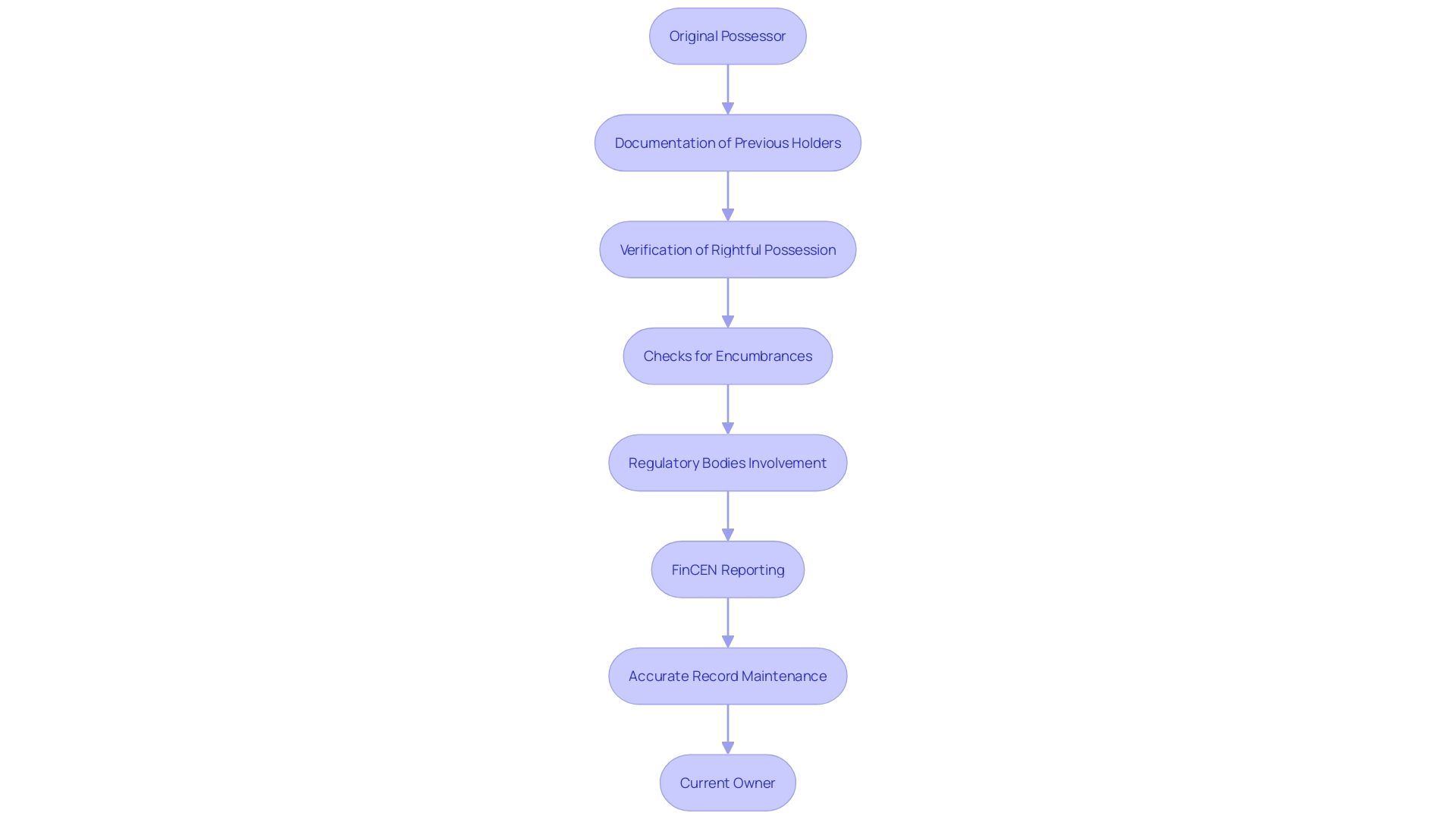

Chain of ownership refers to the chronological sequence of historical transfers of ownership to a real estate asset, documenting all previous holders from the original possessor to the current possessor. This is crucial for determining rightful possession, ensuring the asset is clear of encumbrances or assertions from former proprietors. The significance of precise documentation of the chain of rights is highlighted by instances such as the one concerning Craig Adams in Raleigh, North Carolina, where a deceitful deed transfer resulted in a dispute over asset claims despite Adams being current with his mortgage and land taxes. Furthermore, the U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN) is working on regulations to require detailed reporting of residential real estate transactions to prevent such fraudulent activities. The sector's crucial news publication and practical analysis of claims and court rulings associated with the insurance field also emphasize the importance of keeping precise and dependable records to reduce risks and guarantee adherence to regulatory standards.

Why is Chain of Title Important?

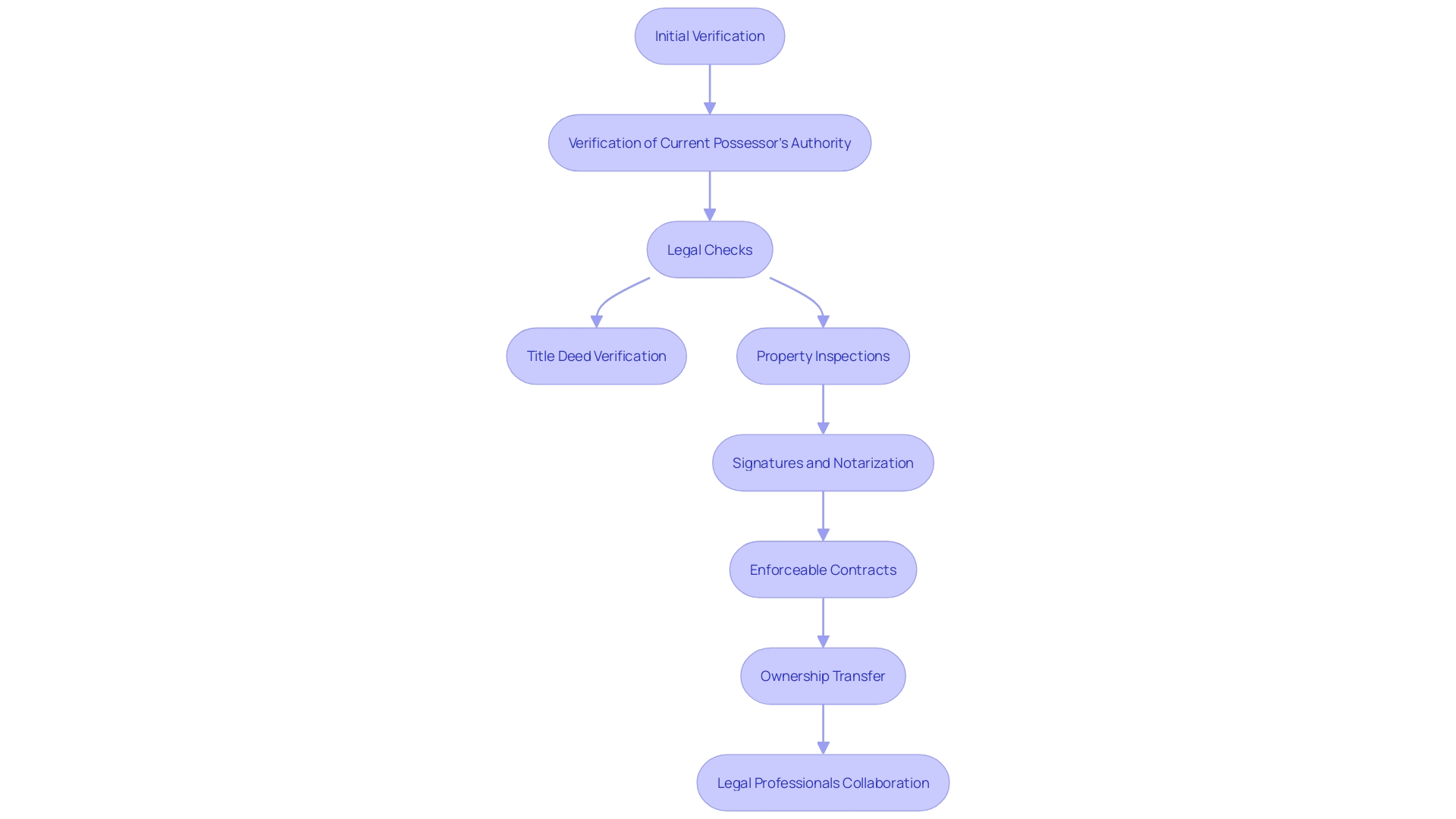

The sequence of rights is a fundamental element in real estate dealings, outlining the legal background of possession and ensuring clarity. It enables prospective purchasers to verify that the present possessor has the rightful authority to sell the asset, thus protecting them from future disputes regarding possession. This , as highlighted by Craig Adams's case, where his home was fraudulently transferred to another party despite his compliance with mortgage and tax obligations. Furthermore, a clear chain of ownership simplifies the financing and insurance processes, enhancing the overall efficiency of real estate transactions. As highlighted by industry specialists, crafting a legally enforceable contract, such as a joint title agreement, can offer additional protection to parties engaged in real estate transactions, especially in intricate title situations.

Types of Chain of Title Documents

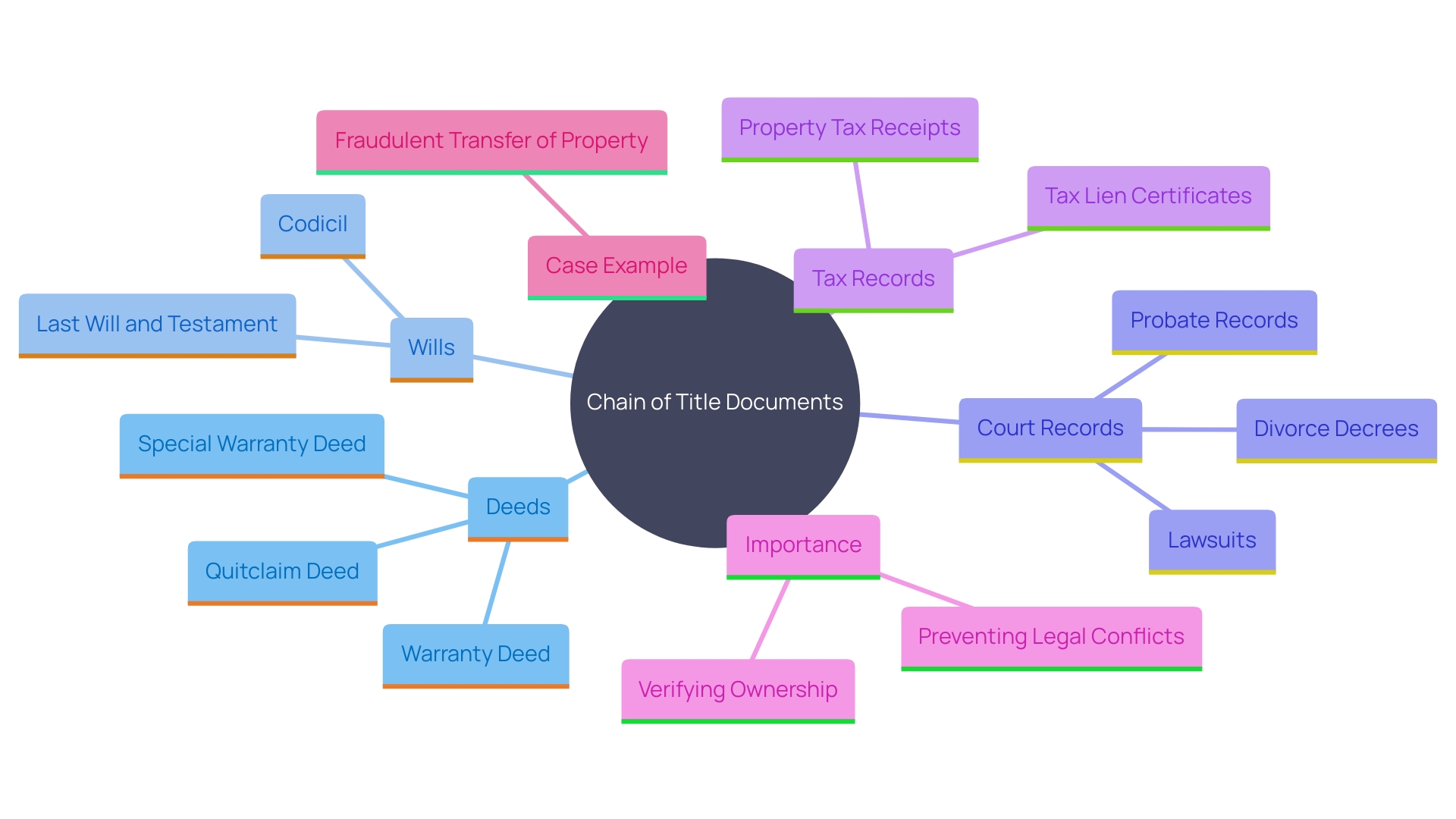

Numerous documents are essential in establishing the , including deeds, wills, court records, and tax records related to real estate. Each document meticulously records the transfer of ownership or the rights associated with the asset. For instance, the deed to a multi-million dollar residence in Raleigh, North Carolina, was fraudulently transferred to a stranger despite the legitimate owner, Craig Adams, being up-to-date with his mortgage and tax obligations. This highlights the importance of verifying the authenticity and accuracy of such documents. Grasping these various kinds of documents is essential for precisely rebuilding the sequence of ownership and avoiding possible legal conflicts.

Conducting a Chain of Title Search

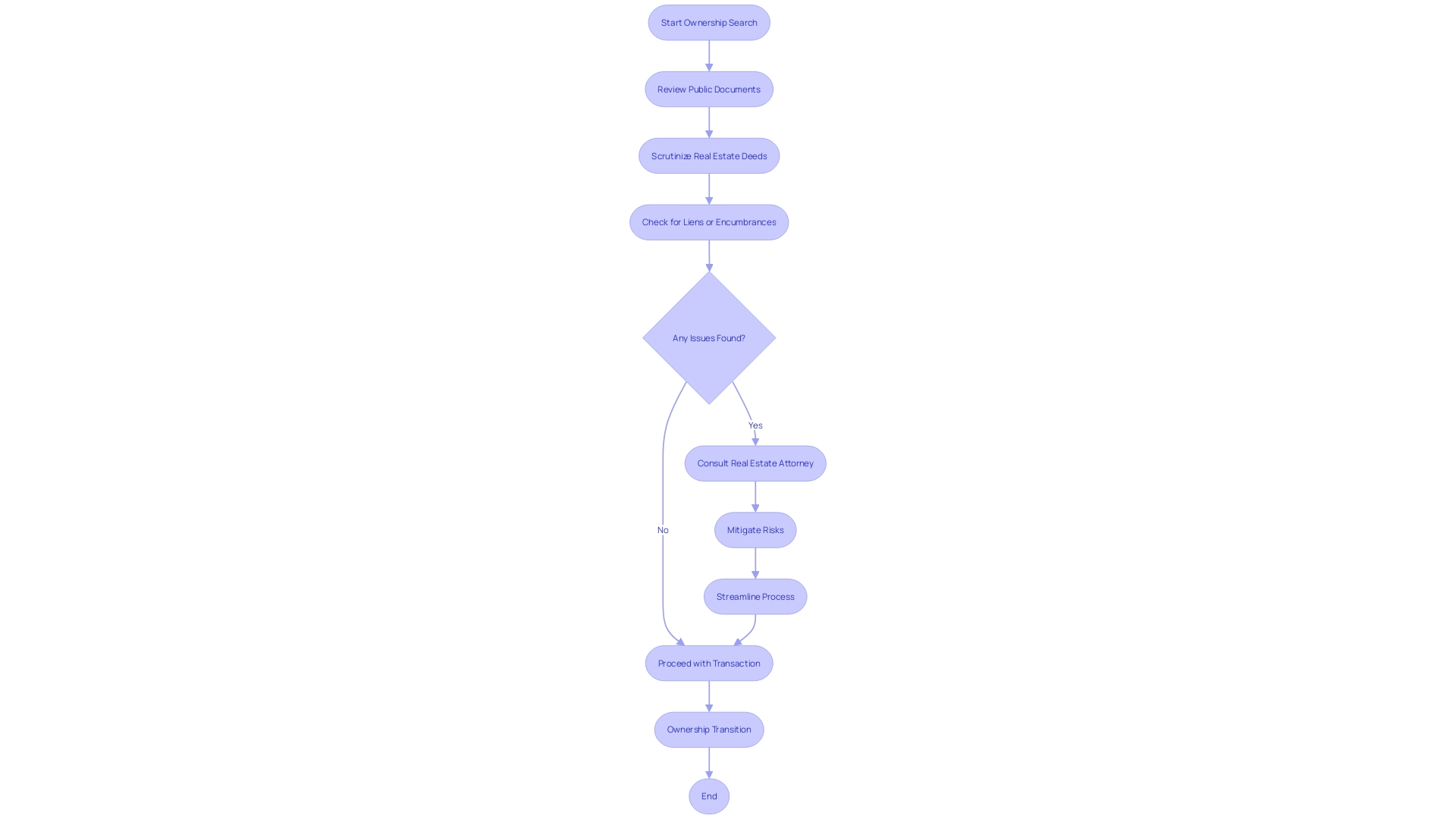

Carrying out a series of is a detailed procedure that includes reviewing public documents to gather a thorough account of a real estate's history. This comprehensive process typically includes scrutinizing real estate deeds, identifying past owners, and checking for any liens or encumbrances that could impact ownership rights. 'The significance of this comprehensive investigation is highlighted by the necessity to guarantee the validity of property transactions and to reduce risks related to ownership claims.'. According to industry insights, the insurance sector for property generated $3.35 billion in premiums during the first quarter of 2024, reflecting the critical role of thorough property searches in maintaining market stability. Moreover, cybersecurity and wire fraud remain significant threats in the real estate sector, highlighting the necessity for robust due diligence and compliance solutions to protect against fraudulent activities.

Resolving Issues in the Chain of Title

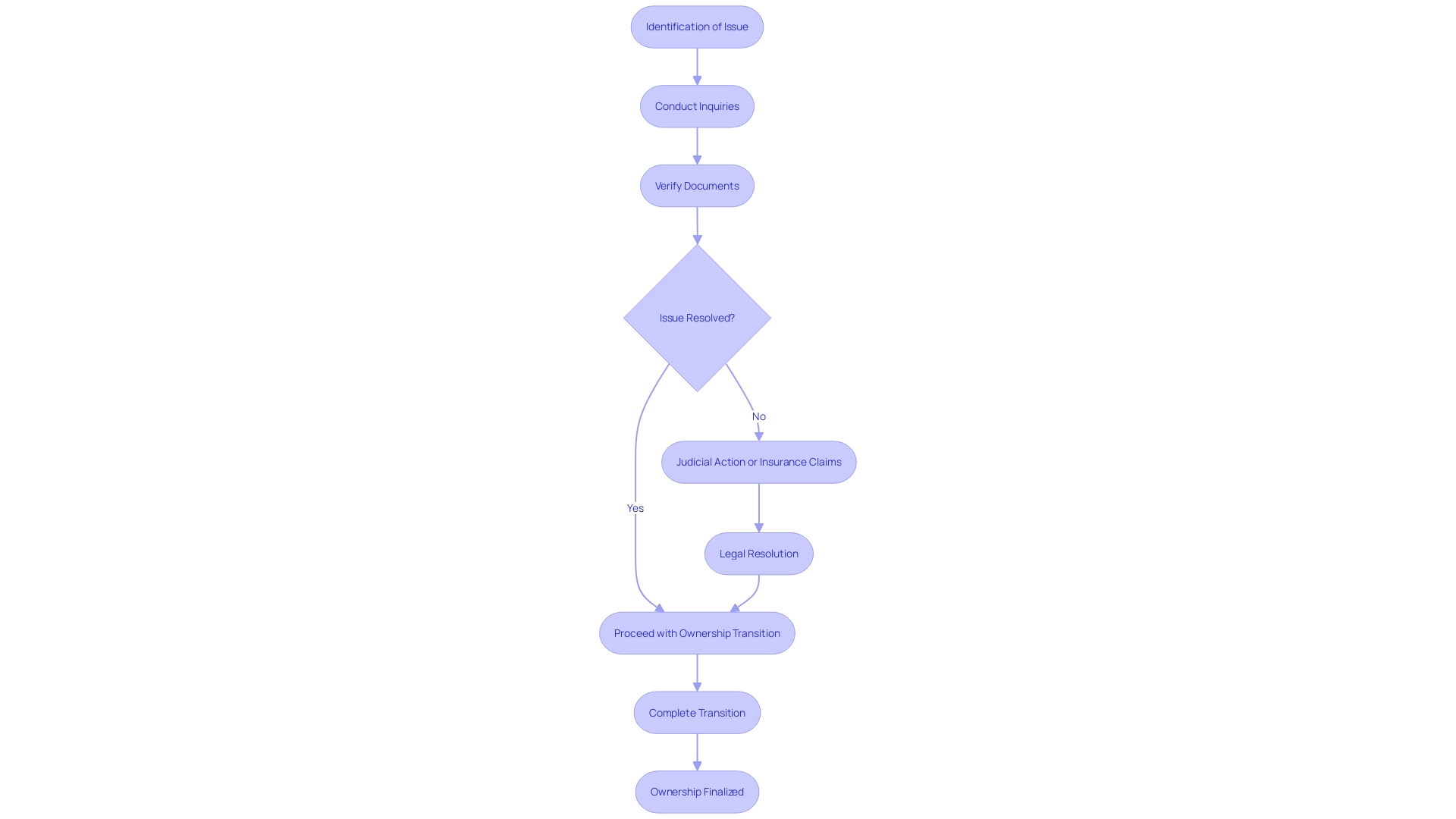

Inconsistencies in the chain of ownership can lead to significant challenges in property transactions. These issues may stem from missing documents, misfiled records, or as seen in the case of Craig Adams in Raleigh, North Carolina. Adams discovered his multi-million dollar home was no longer in his name due to a false warranty claim deed filed by an unknown individual. Researchers in property matters often need to conduct thorough inquiries to resolve such issues, which may involve judicial action or insurance to address potential risks. According to the Register of Deeds, verifying the legal validity of every document is nearly impossible due to the high volume of daily processed documents. This demonstrates the intricacy and significance of precise ownership research to protect real estate rights.

The Role of Title Companies and Insurance

Title firms are essential in guaranteeing safe and seamless property dealings by offering extensive services such as performing ownership investigations and providing ownership insurance. These companies assist with the escrow of funds, guarantee the appropriate completion of all required documents, and from seller to buyer. Insurance for ownership plays a crucial role in safeguarding purchasers and financiers from possible losses caused by ownership defects, thus ensuring that the chain of ownership is clear and possession is legally secure.

In recent years, alternative methods such as Attorney Opinion Letters have emerged, providing a more affordable solution compared to conventional insurance. The ACT® (Attorney-Certified Title) is a GSE-approved iteration that speeds up the post-closing process and is available at a fraction of the cost, saving consumers significantly. Despite these options, the function of certification firms remains essential, as they offer the required lawful and practical knowledge to manage intricate property dealings. The industry is backed by organizations like ALTA, which represent their interests at national and state levels, ensuring the industry's standards and practices are upheld.

Common Mistakes and Disputes in Chain of Title

Mistakes in understanding chain of ownership documents can lead to , especially regarding property rights. Frequent errors consist of not documenting all former owners, ignoring liens, or misunderstanding terminology within documents. As Michelle Moore Smith from Jackson Walker LLP notes, recent developments in mortgage lending and related real estate matters highlight the complexities involved. Understanding these potential pitfalls is essential for researchers to mitigate risks and ensure accurate ownership transfers. The industry's essential news magazine emphasizes the importance of practical legal analysis of claims and court decisions related to the title insurance industry, underscoring the need for vigilance in legal interpretation to avoid costly errors.

Conclusion

Maintaining an accurate chain of title is paramount in real estate transactions, as it establishes the legal ownership of a property and protects against potential disputes. The chronology of ownership transfers not only ensures that buyers can trust the legitimacy of their transactions but also safeguards them from future claims. The case of Craig Adams serves as a cautionary tale, illustrating the devastating consequences of fraudulent deeds and the importance of rigorous due diligence in verifying title history.

Various documents play a critical role in establishing a reliable chain of title, including deeds, wills, and court records. Each document must be meticulously examined to reconstruct ownership history and identify any encumbrances that could impact property rights. Conducting a thorough chain of title search is essential to mitigate risks associated with title claims and to maintain confidence in property transactions.

Title companies and insurance significantly enhance the security of real estate transactions by providing essential services such as title searches and protection against defects. While alternative methods, like Attorney Opinion Letters, have emerged, the expertise offered by title companies remains vital in navigating the complexities of property ownership. Awareness of common mistakes and disputes in chain of title documentation is crucial for title researchers, as it underscores the need for diligence in legal interpretation and record-keeping.

In summary, a well-documented and verified chain of title is the foundation of secure property ownership. By emphasizing the importance of thorough title searches, accurate documentation, and the role of title companies, the real estate industry can work towards reducing risks and ensuring that property transactions are conducted smoothly and securely.

Frequently Asked Questions

What is the chain of ownership?

The chain of ownership refers to the chronological sequence of historical transfers of ownership to a real estate asset. It documents all previous holders from the original possessor to the current possessor, which is crucial for determining rightful possession and ensuring the asset is free of encumbrances.

Why is documenting the chain of ownership important?

Thorough documentation is essential to ensure that the current possessor has the rightful authority to sell the asset and to protect against future disputes regarding ownership. It also helps in verifying that the asset is clear of claims from former proprietors.

Can you provide an example of a situation where ownership documentation was critical?

A notable case involved Craig Adams from Raleigh, North Carolina, who faced a dispute over his home due to a fraudulent deed transfer. Despite being current with his mortgage and taxes, the fraudulent transfer created confusion regarding rightful ownership, highlighting the significance of keeping accurate records.

What types of documents are necessary to establish the chain of title?

Key documents include deeds, wills, court records, and tax records related to real estate. Each document meticulously records the transfer of ownership or rights associated with the asset, and verifying their authenticity is vital to avoid legal conflicts.

How are ownership searches conducted?

Ownership searches involve a detailed review of public documents to gather a comprehensive history of real estate, including scrutinizing deeds, identifying past owners, and checking for liens or encumbrances that may affect ownership rights.

What are the risks of inconsistencies in the chain of ownership?

Inconsistencies can lead to significant challenges in property transactions, such as disputes over ownership rights, especially if documents are missing, misfiled, or if there are fraudulent claims. Thorough inquiries may be needed to resolve these issues, sometimes requiring judicial action or insurance.

What role do title firms play in real estate transactions?

Title firms are essential in ensuring safe and seamless property dealings. They perform ownership investigations, provide ownership insurance, manage the escrow of funds, ensure all documents are correctly completed, and supervise the transfer of ownership from seller to buyer.

Are there alternative solutions to traditional title insurance?

Yes, alternatives like Attorney Opinion Letters have emerged, providing a more affordable option compared to conventional insurance. The ACT® (Attorney-Certified Title) is a GSE-approved version that accelerates the post-closing process at a lower cost.

What common mistakes should be avoided in understanding chain of ownership documents?

Common mistakes include failing to document all former owners, ignoring liens, and misunderstanding terminology within documents. Such errors can lead to considerable conflicts regarding property rights, emphasizing the need for careful legal analysis and diligence in document interpretation.