Introduction

First American Title Insurance Company, established in 1889, has established itself as a leading provider of title insurance and related services across the United States. Playing a critical role in real estate transactions, the company offers comprehensive protection against potential title issues. Their suite of services, including title searches, insurance policies, and escrow services, makes them an indispensable resource for real estate professionals.

In the ever-evolving landscape of the title industry, First American has consistently demonstrated resilience and adaptability. The company reported total revenue of $1.4 billion for the fourth quarter of 2023, despite a 15 percent decline compared to the previous year. Net income for the same quarter was $34 million, or 33 cents per diluted share, down from $54 million or 52 cents per diluted share in the fourth quarter of 2022.

This performance reflects the company's strategic efforts, including tax planning and investment adjustments, to navigate the financial challenges of the market.

Furthermore, First American's commitment to excellence and a positive workplace culture has been recognized repeatedly. They were named one of the 100 Best Companies to Work For by Great Places to Work and Fortune Magazine for the eighth consecutive year. This accolade underscores their dedication not only to their clients but also to their employees, fostering an environment that promotes growth, innovation, and superior service delivery.

By staying ahead of industry trends and maintaining rigorous standards, First American Title Insurance Company continues to be a cornerstone in the real estate sector, ensuring the smooth and secure transfer of property ownership.

Overview of First American Title Insurance

First American Title Insurance Company, founded in 1889, has solidified its standing as a prominent supplier of and associated services throughout the United States. The company plays a pivotal role in real estate transactions by offering comprehensive protection against potential . Their suite of services, including , insurance policies, and escrow services, makes them an indispensable resource for .

In the ever-evolving landscape of the , the company has consistently demonstrated resilience and adaptability. For instance, the company reported of $1.4 billion for the fourth quarter of 2023, despite a 15 percent decline compared to the previous year. Net income for the same quarter was $34 million, or 33 cents per diluted share, down from $54 million or 52 cents per diluted share in the fourth quarter of 2022. This performance reflects the company's strategic efforts, including tax planning and investment adjustments, to navigate the financial challenges of the market.

Moreover, the dedication of the leading company to excellence and a positive workplace culture has been acknowledged multiple times. They were named one of the 100 Best Companies to Work For by Great Places to Work® and Fortune Magazine for the eighth consecutive year. This accolade underscores their dedication not only to their clients but also to their employees, fostering an environment that promotes growth, innovation, and superior service delivery.

By staying ahead of industry trends and maintaining rigorous standards, the insurance company continues to be a cornerstone in the real estate sector, ensuring the smooth and secure transfer of property ownership.

Customer Reviews and Ratings

Customer feedback is an invaluable resource for assessing the performance of First Title. Reviews frequently commend the company for its efficiency, exceptional , and prompt responsiveness. Clients often highlight the thorough nature of their and the clarity of information provided throughout the closing process. For example, one recent review noted, ' was remarkable and kept us well-informed during every step of our transaction.' However, certain reviews have pinpointed , such as enhancing communication during more complex transactions or expediting services during peak demand periods. Addressing these is essential for maintaining their reputation and ensuring in an increasingly competitive market.

Advancements in Title Underwriting Technology

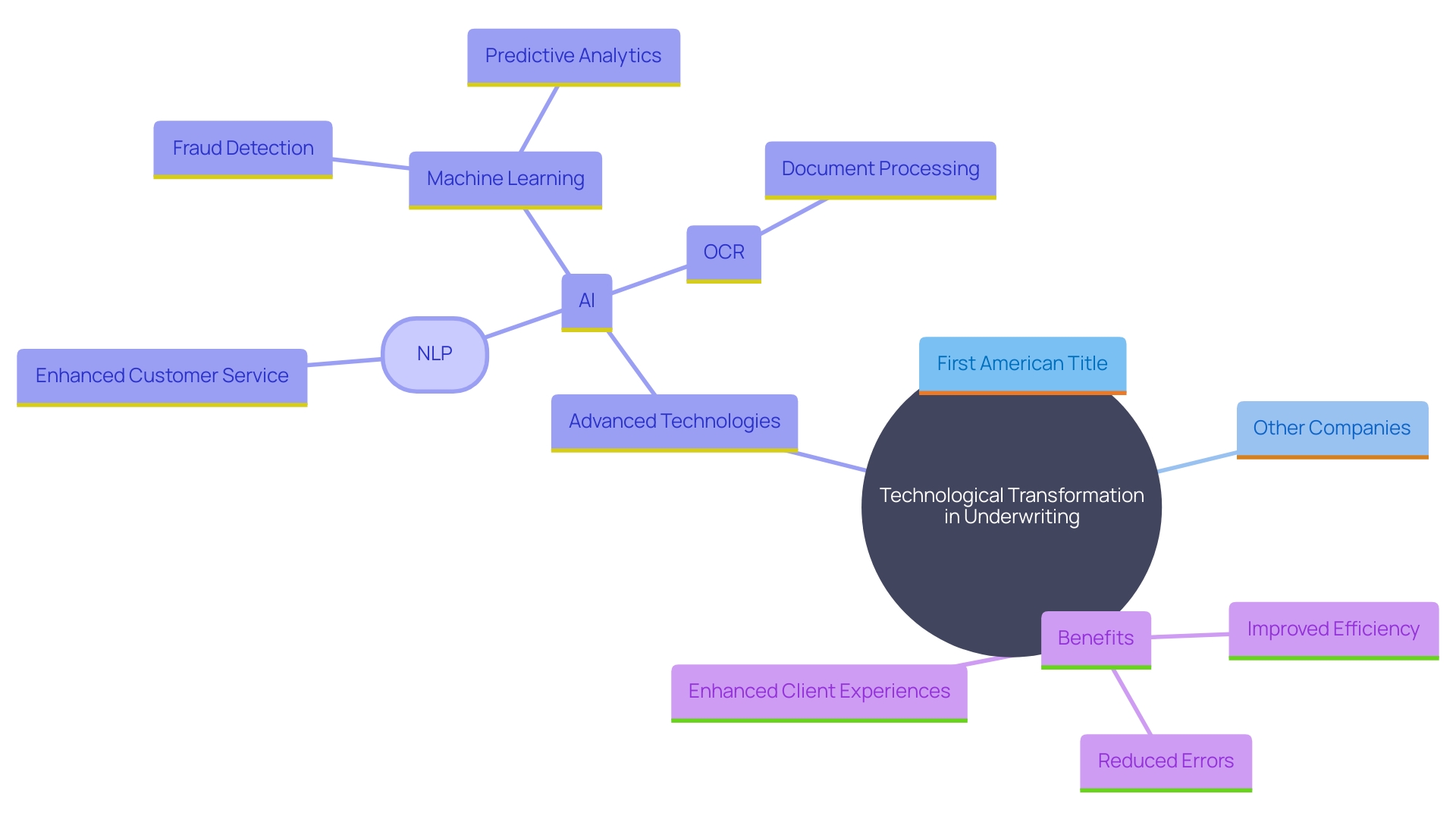

First American Title is transforming the underwriting process through the incorporation of . Utilizing advanced tools and software, the company is optimizing operations, minimizing errors, and improving the precision of search results. Innovations such as machine learning and automated systems not only enhance efficiency but also reduce risks related to defects in ownership, ensuring a smoother transaction experience for clients.

The insurance sector for property, historically viewed as resistant to technology, has made significant progress in recent years. As noted by Sam Trimble, vice president of strategic growth and development at Fidelity National Financial, the industry is working to shed its antiquated reputation by adopting more technology in title search and production processes. Artificial intelligence (AI) stands out as a , with the potential to propel the industry from the 19th century into the 21st and beyond. offer a plethora of operational opportunities, from to enhancing fraud detection and predictive analytics.

For instance, AI-powered optical character recognition (OCR) technology can automatically extract information from documents, reducing manual data entry errors and speeding up processing times. AI algorithms can also analyze data to detect potentially fraudulent claims, preventing fraudulent payouts and saving resources. Furthermore, predictive analytics help insurers make informed decisions by forecasting claim outcomes and optimizing resource allocation.

As the sector keeps adopting AI and other technological innovations, early users like a leading title company are positioning themselves at the forefront, gaining a competitive advantage and ensuring improved service for their clients.

Benefits of First American Title Services

Selecting the initial national agency provides considerable benefits for property experts and purchasers. Their extensive national network and resources ensure that all necessary documents are executed accurately and efficiently, facilitating smooth property transactions. Moreover, the dedication of the organization to promotes a setting of trust and dependability, which is crucial in the current competitive real estate market. As mentioned by the Chief Economist of the organization, title and settlement fees are neither regressive nor a significant component, emphasizing the . Moreover, the company's active involvement in through organizations like ALTA and TIPAC further strengthens their role as a leader in the industry. By handling escrow funds and coordinating the closing process, First American Title helps ensure and seamless transaction experiences.

Conclusion

First American Title Insurance Company has consistently established itself as a leader in the title insurance industry since its inception in 1889. By offering a comprehensive suite of services, including title searches, insurance policies, and escrow services, the company plays a vital role in real estate transactions, safeguarding against potential title issues. Despite facing financial challenges, as evidenced by a decline in revenue and net income in the fourth quarter of 2023, First American's strategic initiatives have allowed it to navigate these obstacles effectively.

Customer feedback highlights the company's strengths, particularly in efficiency and customer service, while also pointing out areas for improvement. The integration of advanced technology, including AI and machine learning, has further positioned First American at the forefront of the industry, enhancing accuracy and streamlining operations. These technological advancements not only improve efficiency but also mitigate risks associated with title defects, thereby ensuring smoother transactions for clients.

The benefits of choosing First American Title are manifold, including access to a vast national network, operational transparency, and a commitment to customer satisfaction. Their leadership role is further reinforced through active involvement in legislative advocacy, which solidifies their reputation as a trusted partner in the real estate sector. Overall, First American Title Insurance Company remains a cornerstone of the industry, dedicated to ensuring secure property ownership and facilitating seamless transactions.

Frequently Asked Questions

What is First American Title Insurance Company?

First American Title Insurance Company, founded in 1889, is a major provider of property protection and related services in the United States. The company is crucial in real estate transactions, offering comprehensive protection against ownership issues.

What services does First American Title offer?

The company provides a range of services, including property searches, insurance policies, and escrow services, making it an essential resource for real estate professionals.

How has First American Title performed financially in recent years?

In the fourth quarter of 2023, First American Title reported total revenue of $1.4 billion, a 15% decline from the previous year. The net income for this period was $34 million, down from $54 million the previous year.

How does First American Title maintain a positive workplace culture?

The company is recognized for its commitment to a positive workplace culture. It was named one of the 100 Best Companies to Work For by Great Places to Work® and Fortune Magazine for eight consecutive years, highlighting its dedication to employee growth and superior service.

What do customer reviews say about First American Title?

Customer reviews often commend First American Title for its efficiency, excellent customer service, and thorough document searches. However, some reviews suggest improvements in communication during complex transactions and faster service during busy periods.

How is First American Title innovating in the underwriting process?

First American Title is incorporating advanced technology, such as machine learning and automated systems, to streamline operations, reduce errors, and enhance search result accuracy. This modernization aims to improve transaction experiences for clients.

What role does artificial intelligence (AI) play in the title industry?

AI is transforming the title industry by automating document processing, enhancing fraud detection, and providing predictive analytics. These innovations help reduce manual errors and optimize decision-making.

Why is selecting a national agency like First American Title beneficial for property transactions?

Choosing First American Title offers advantages such as a vast national network, efficient document execution, and a commitment to transparency and client satisfaction, fostering trust in the competitive real estate market.

How does First American Title contribute to legislative advocacy?

The company actively participates in legislative advocacy through organizations like ALTA and TIPAC, reinforcing its leadership role in the industry and ensuring secure property ownership and seamless transactions.