Overview

Title endorsements are crucial in real estate, offering tailored protection against specific risks that standard title insurance policies may not cover. This safeguarding is essential for both buyers and lenders, protecting them from potential claims or defects in the title. Furthermore, the article elaborates on various types of endorsements, such as zoning and access approvals, which clarify critical aspects of property ownership. These endorsements help prevent disputes, ultimately enhancing the security and efficiency of real estate transactions.

Introduction

Understanding the nuances of title endorsements is essential for real estate professionals navigating the complexities of property transactions. These endorsements provide critical protection against potential claims and defects in title, ensuring that buyers and lenders can confidently engage in deals. However, many still grapple with misconceptions about their necessity and effectiveness. Furthermore, what are the specific types of title endorsements available, and how can they safeguard stakeholders from unforeseen risks in real estate?

Define Title Endorsements and Their Role in Real Estate

Name modifications represent crucial alterations or additions to a coverage policy, offering enhanced protection and clarifying specific aspects of asset ownership. These approvals address distinct hazards linked to specific assets, thereby improving the standard insurance policy.

In the realm of real estate, the overview of title endorsements is essential for safeguarding buyers and lenders against potential claims or defects in the title that may arise post-transaction. For instance, the T19.1 addition, which encompasses Minerals, Encroachments, and Restrictions, is frequently associated with Owner’s Title Policies and can significantly mitigate risks related to land encroachments and mineral rights.

The cost of the T19.1 certification for residential real estate typically ranges from 5% with Survey Deletion to 10% without, while for non-residential real estate, the costs are 10% and 15%, respectively. Additionally, there is a one-time fee of $226 for this coverage, which insures a home valued at $350,000.

Expert opinions underscore the importance of these approvals; Dana Hendrix, Senior VP of Finance at DSLD Mortgage, asserts, "Every asset is distinct." It is imperative to consult with professionals for personalized advice. By investing in documentation approvals, stakeholders can avert costly disputes, potentially saving thousands in conflicts and bolstering their overall security in real estate transactions.

Furthermore, it is a common misconception that all policy types are identical; in reality, an overview of title endorsements shows that various levels of protection exist, making customized coverage essential.

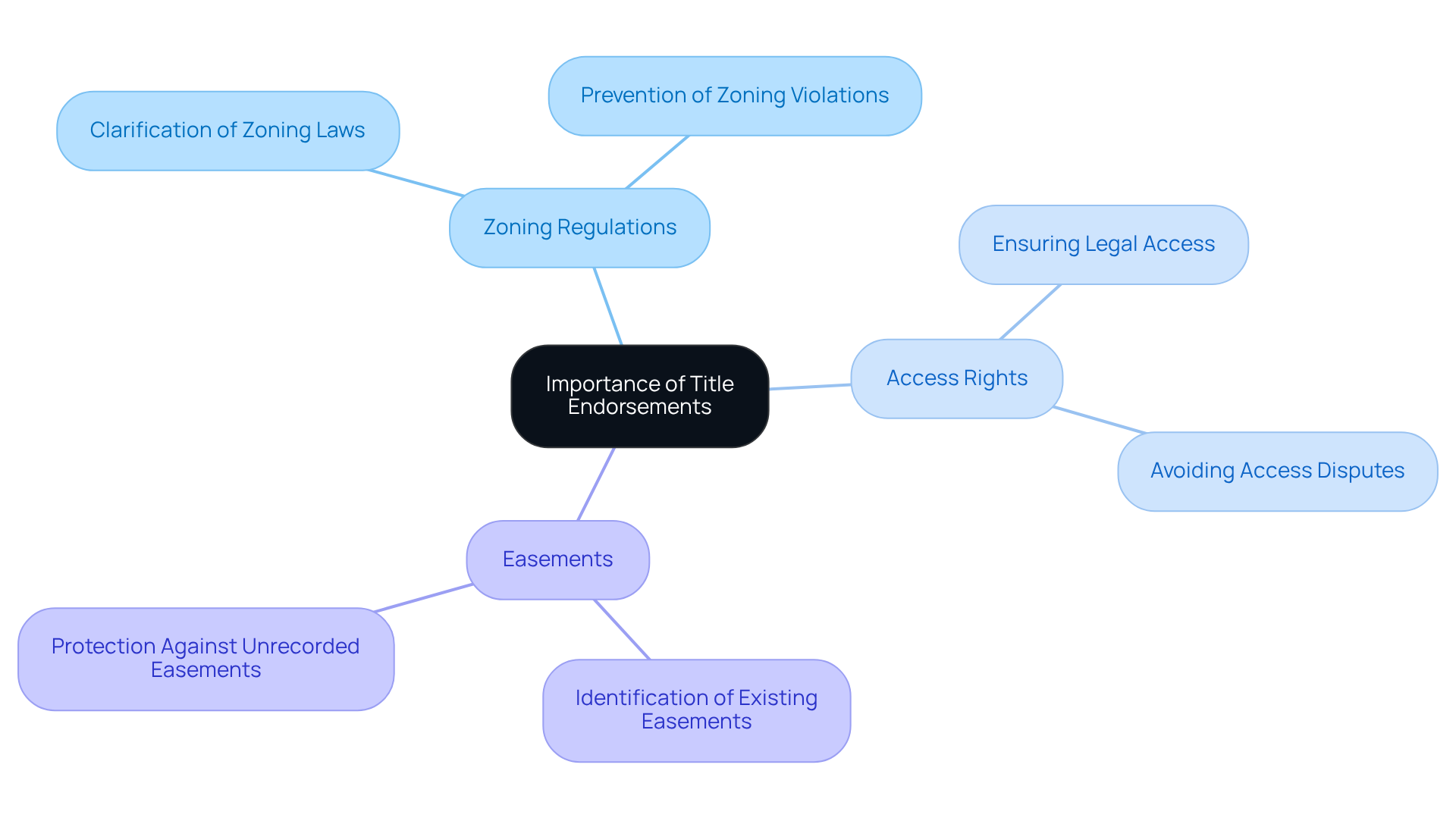

Explain the Importance of Title Endorsements in Property Transactions

Authorization confirmations play a pivotal role in real estate transactions, providing essential protection against unforeseen issues that may not be covered by standard insurance policies. For example, these approvals can specifically address concerns such as:

- Zoning regulations

- Access rights

- The presence of easements

By clarifying these critical aspects, title guarantees help prevent conflicts and ensure that buyers and financiers fully understand the condition of the title. This additional layer of security not only cultivates trust among the parties involved but also streamlines transactions, ultimately enhancing the efficiency of the real estate market.

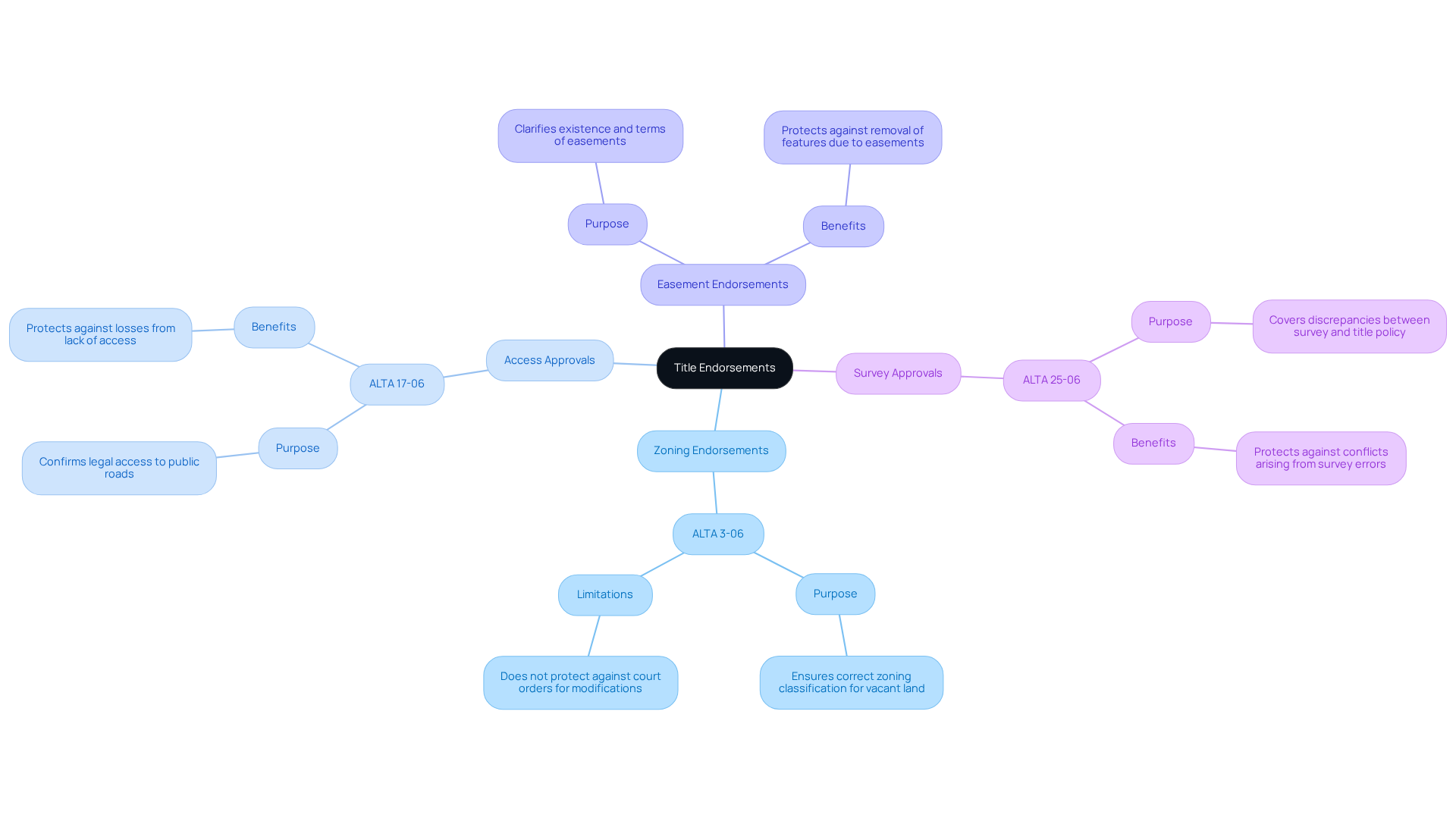

Outline the Different Types of Title Endorsements and Their Applications

An overview of title endorsements shows that title guarantees play a crucial role in real estate transactions, each designed to mitigate specific risks associated with ownership. The most prevalent types include:

-

Zoning Endorsements: These endorsements confirm that a property complies with local zoning regulations, protecting against potential future changes that could limit property use. For example, an ALTA 3-06 addition ensures that vacant land retains the correct zoning classification, shielding owners from unforeseen zoning issues. However, it is essential to acknowledge that zoning approvals may not shield landowners from court orders requiring modifications due to zoning misunderstandings.

-

Access Approvals: These are vital for confirming that a real estate asset has legal access to public roads, crucial for maintaining both the usability and value of the asset. An ALTA 17-06 endorsement, for instance, provides coverage against losses resulting from a lack of physical access to a public right-of-way.

-

Easement Endorsements: These endorsements clarify the existence and terms of any easements affecting the land, which can significantly influence ownership rights. They protect landowners from needing to remove features due to easements, ensuring compliance without compromising asset value.

-

Survey Approvals: These approvals address discrepancies between the boundaries indicated on a survey and the actual real estate lines. For instance, the ALTA 25-06 addendum, referred to as 'Same as Survey,' safeguards against inconsistencies between the survey and the policy, ensuring that owners are protected from potential conflicts.

By utilizing these approvals, real estate professionals can customize insurance policies to address the unique characteristics and risks associated with each asset, providing an overview of title endorsements that ultimately enhances security and facilitates smoother transactions. With approximately 100 approvals available for tailored coverage, it is prudent for professionals to consult with lenders and companies for guidance on which approvals to select. Furthermore, while some approvals may be complimentary, others could incur costs of several hundred dollars or a percentage of the loan amount, making it vital to consider the financial implications of these decisions. Understanding the chain of ownership is also critical for ensuring clear title and preventing disputes in property transactions.

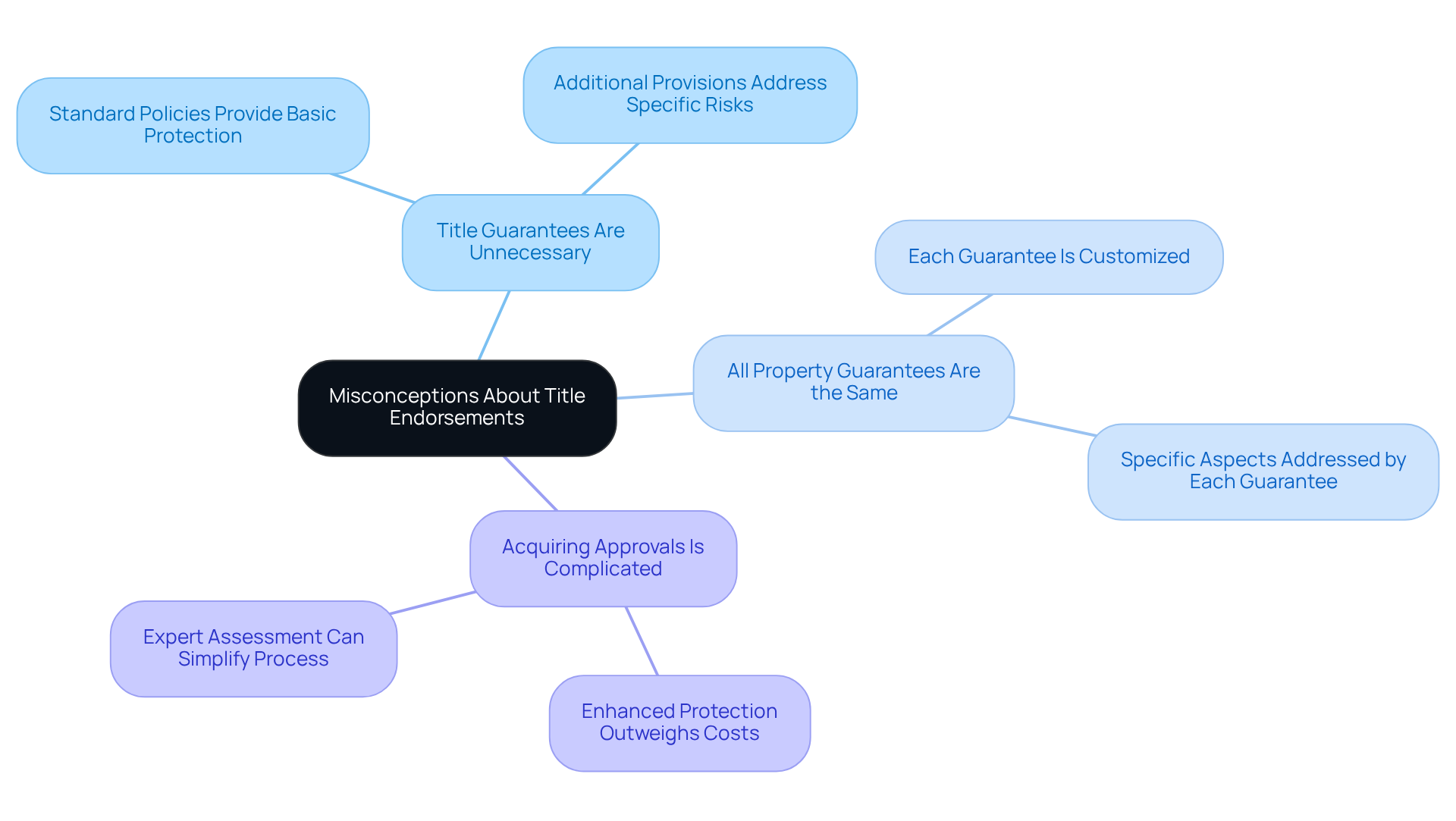

Debunk Common Misconceptions About Title Endorsements

Misunderstandings regarding property assurances frequently create uncertainty among real estate experts. A prevalent misconception is that title guarantees are unnecessary if a standard title insurance policy is in place. In practice, while standard policies provide a basic level of protection, additional provisions are crucial for addressing specific risks that standard policies might not encompass.

For instance, the 3 Series approvals offer protection for adherence to zoning code classifications, underscoring the distinctive features of these approvals. Another common misconception is that all property guarantees are the same; however, each is distinctly customized to address specific aspects of a property, rendering them highly particular.

Furthermore, some experts believe that acquiring approvals is excessively complicated or costly. In many instances, the enhanced protection they provide significantly outweighs the associated costs. As Richard Biemiller, a stakeholder at Pender & Coward, states, "A seasoned commercial real estate lawyer can assess the land, building, loan conditions, and other elements to request the approvals relevant to a specific transaction to offer the client the utmost possible level of property protection."

By dispelling these myths and understanding the differences in title insurance costs and requirements across states, real estate professionals can provide an overview of title endorsements that allows them to navigate the complexities more effectively and offer informed guidance to their clients.

Conclusion

Title endorsements represent a vital component in the realm of real estate, offering tailored protections that extend beyond standard title insurance policies. By understanding the nuances of these endorsements, real estate professionals can significantly enhance the security of property transactions, ensuring that buyers and lenders are safeguarded against potential title defects and claims.

Throughout this article, the importance of title endorsements has been underscored, highlighting their role in addressing specific risks such as zoning regulations, access rights, and easements. The exploration of various types of endorsements, including zoning, access, and survey approvals, illustrates how these tools can be leveraged to create customized coverage that aligns with the unique characteristics of each property. Furthermore, debunking common misconceptions about title endorsements emphasizes the necessity of these protections and the benefits they bring to real estate transactions.

In conclusion, the significance of title endorsements cannot be overstated. They not only mitigate risks and clarify property ownership but also foster trust and efficiency in real estate dealings. Real estate professionals are encouraged to educate themselves on the various endorsements available and consult with experts to ensure comprehensive coverage for their clients. By doing so, they can navigate the complexities of property transactions with confidence, ultimately leading to smoother and more secure outcomes for all parties involved.

Frequently Asked Questions

What are title endorsements in real estate?

Title endorsements are modifications or additions to a coverage policy that enhance protection and clarify specific aspects of asset ownership, addressing distinct hazards linked to specific assets.

Why are title endorsements important for buyers and lenders?

Title endorsements are essential for safeguarding buyers and lenders against potential claims or defects in the title that may arise after a real estate transaction.

What is the T19.1 endorsement, and what does it cover?

The T19.1 endorsement covers Minerals, Encroachments, and Restrictions, and is often associated with Owner’s Title Policies. It helps mitigate risks related to land encroachments and mineral rights.

What are the typical costs associated with the T19.1 endorsement for residential and non-residential real estate?

For residential real estate, the cost typically ranges from 5% with Survey Deletion to 10% without. For non-residential real estate, the costs are 10% and 15%, respectively. There is also a one-time fee of $226 for this coverage, which insures a home valued at $350,000.

What do experts say about the importance of title endorsements?

Experts emphasize that every asset is unique, and it is crucial to consult with professionals for personalized advice. Investing in title endorsements can help avoid costly disputes and enhance overall security in real estate transactions.

Is it true that all title policies provide the same level of protection?

No, it is a common misconception that all title policies are identical. An overview of title endorsements reveals that various levels of protection exist, making customized coverage essential.