Introduction

Navigating the commercial real estate closing process is an intricate endeavor, requiring precision and thorough understanding of legal, financial, and logistical elements to ensure a smooth transition of property ownership. In an industry currently grappling with fluctuating inflation expectations, rising interest rates, and a cooling economy, the importance of mastering this process cannot be overstated. Investors are becoming increasingly selective, influenced by specific submarket dynamics and asset attributes, underscoring the need for a well-coordinated closing process to mitigate risks and facilitate successful transactions.

Despite these challenges, the commercial real estate market has demonstrated resilience, particularly in the multifamily and industrial sectors, highlighting the critical role of a robust closing procedure. As industry leaders like Gary Lipsky emphasize the era of a 'Great Reset,' redefining strategies and safeguarding against potential property value losses is paramount, making an in-depth understanding of the closing process more essential than ever.

Understanding the Commercial Real Estate Closing Process

The is a crucial step in property dealings, signifying the shift of ownership from seller to buyer. This complex procedure includes various legal, financial, and logistical components to guarantee that all parties meet their responsibilities and the deal is carried out seamlessly. In light of the evolving landscape of commercial real estate, characterized by fluctuating inflation expectations and the Federal Reserve's uncertain path, understanding this process becomes even more critical.

The industry has faced significant challenges, including rising interest rates and a cooling economy, which have impacted . A report by DLA Piper, analyzing 300 , noted that while there hasn't been a significant change in management fees as a percentage of revenue, the environment remains cautious. Investors are becoming more selective, focusing on specific submarkets and asset attributes to navigate the uncertainty.

Moreover, the commercial real estate market has shown remarkable resilience despite these challenges. Multifamily assets have continued to be especially dynamic, representing 39 percent of total sales, succeeded by industrial real estate at 22 percent. This resilience highlights the significance of a well-coordinated and ensure successful transactions in this dynamic environment.

As Gary Lipsky, President & CEO of Break of Day Capital, highlights, the industry is entering a 'Great Reset' era, where redefining strategies and safeguarding against potential property value losses are paramount. This sentiment is reflected in the ongoing partnership among industry experts to broaden services and address local market requirements, ensuring that the finalization remains strong and effective.

Key Stages of Commercial Real Estate Closing

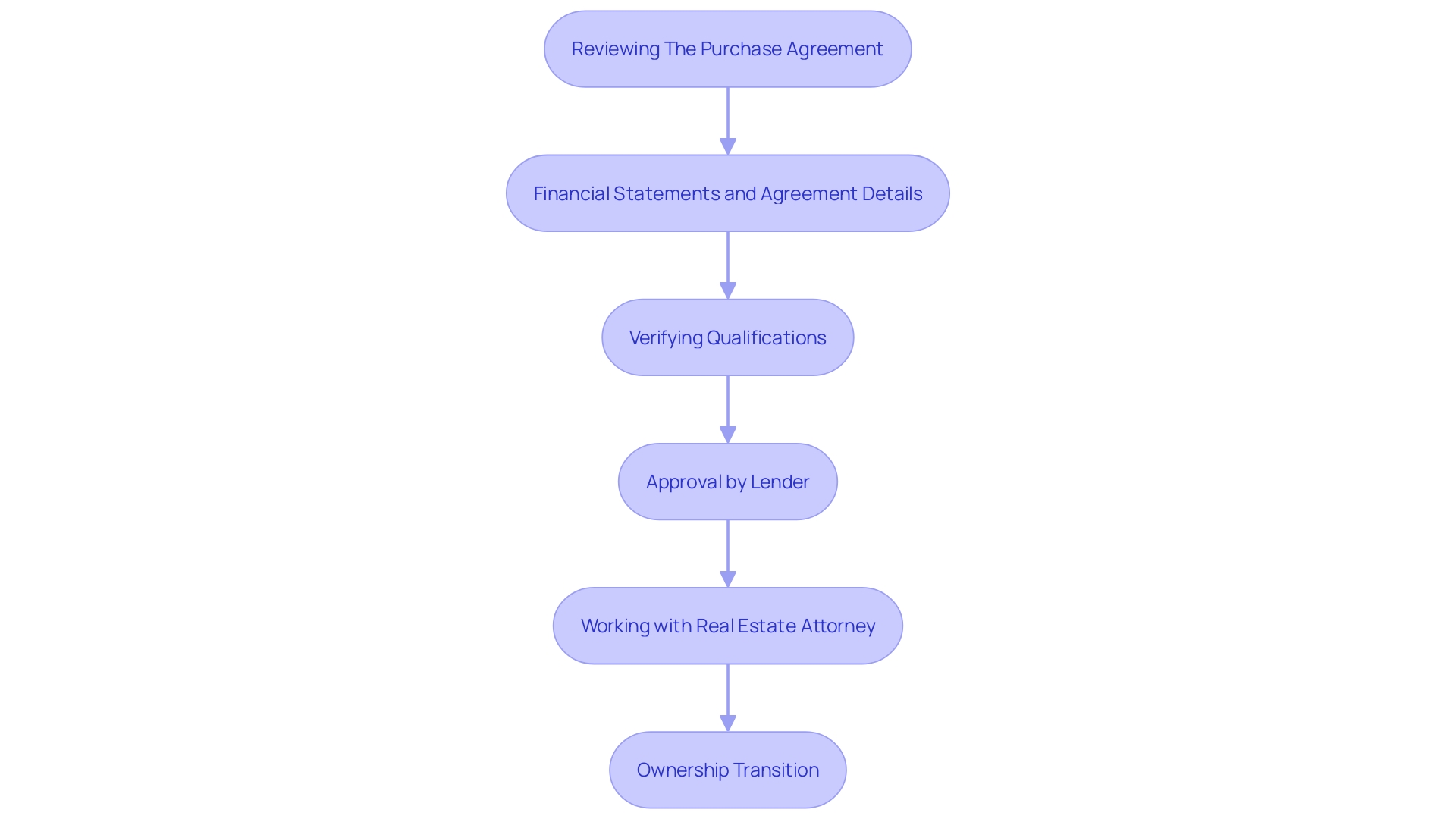

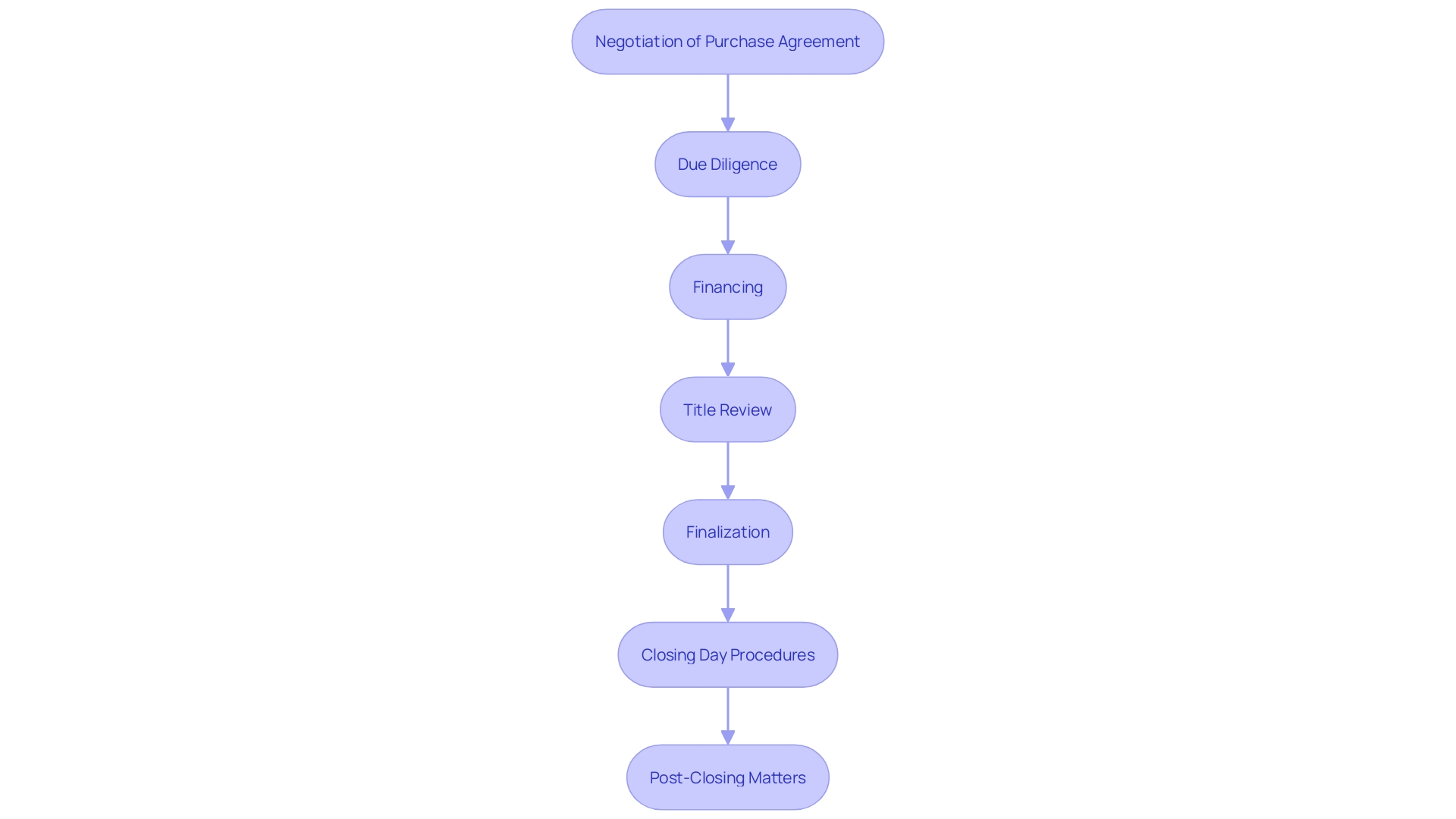

The consists of several critical stages, each demanding meticulous attention to ensure compliance with and the protection of all parties' interests. Initially, the negotiation of the purchase agreement establishes the groundwork for the deal, addressing essential terms and conditions. Conducting follows, where the buyer verifies , including environmental assessments and zoning laws, to mitigate risks.

Securing financing is another crucial step, with most deals in 2023 demonstrating a significant decrease in , as reported by DLA Piper. Only 3.5 percent of transactions included these contingencies, highlighting the importance of stable financing arrangements.

Reviewing the title involves examining ownership records and any encumbrances affecting the property. This stage is crucial to prevent future disputes and ensure clear . Preparing for the finalization involves collaborating with different parties, including lenders and title companies, to complete documents and address any unresolved matters.

Executing closing day procedures involves the actual signing of documents and the transfer of funds. This stage must be handled with precision to avoid any last-minute discrepancies. Finally, post-closing matters, such as recording the deed and addressing any post-closing adjustments, ensure the deal is fully completed and compliant with all legalities.

These stages reflect the complexities and evolving nature of , emphasizing the need for thorough preparation and expert guidance.

Common Challenges in Commercial Real Estate Closing

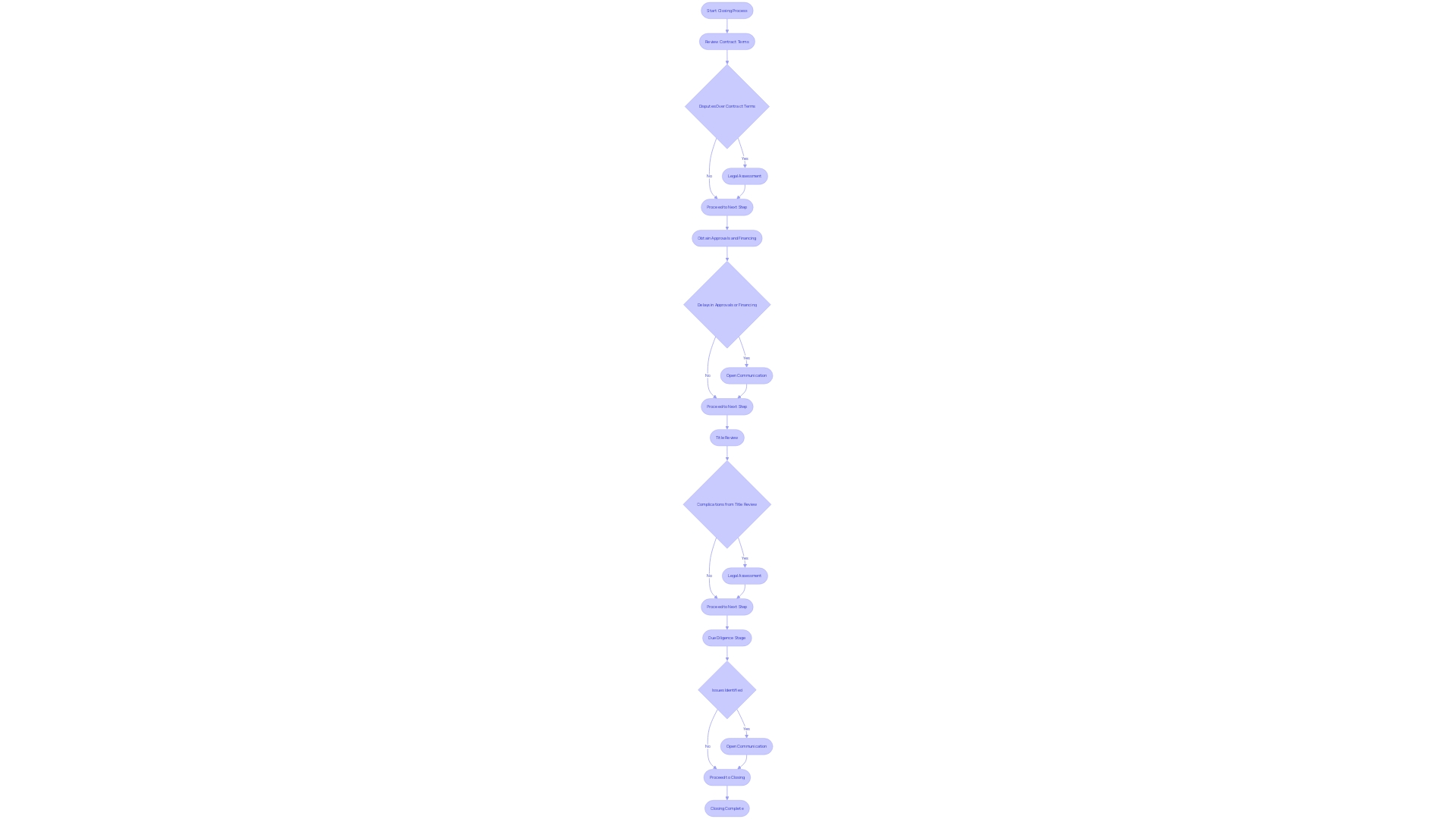

The closing procedure in , while structured, can encounter numerous hurdles. Disputes over contract terms are common, often stemming from ambiguities or differing interpretations of the agreement. Delays in obtaining necessary approvals or financing are another significant challenge, particularly in a volatile economic climate marked by rising interest rates and stringent lending conditions. Title review can also present complications, such as discovering undisclosed liens or unresolved claims that affect . During the , issues such as , , or structural deficiencies can surface, further complicating the situation. Tackling these challenges in advance by performing comprehensive , and ensuring transparent and open dialogue with all stakeholders, is essential to simplify the finalization and reduce the likelihood of disagreements.

The Importance of Having a Commercial Real Estate Attorney

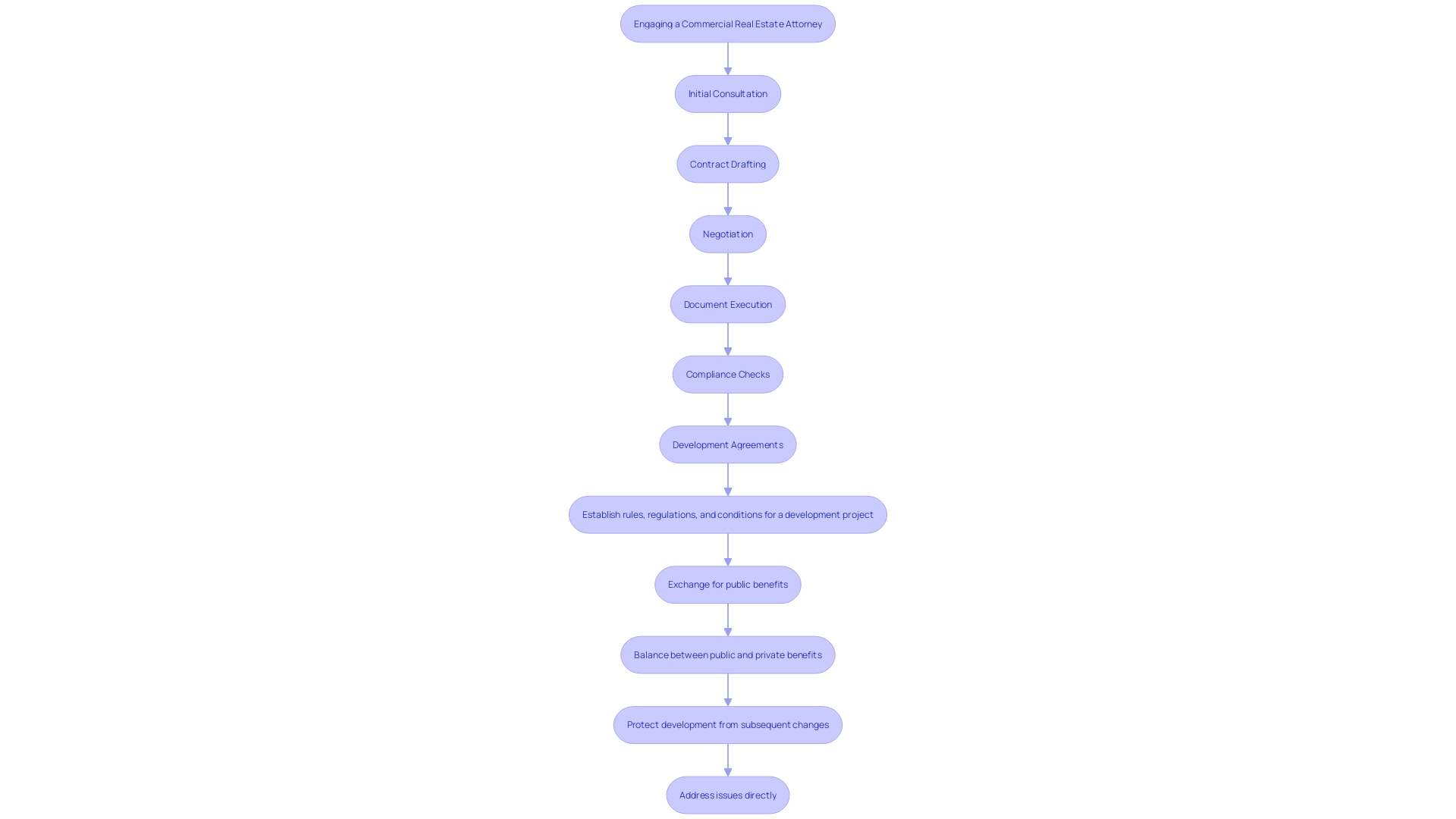

Engaging a is essential for navigating the complexities of the . An experienced attorney offers invaluable guidance on legal requirements, assists in drafting and negotiating contracts, and ensures that all documents are properly executed. Their expertise helps safeguard against potential legal pitfalls, ensuring that the transaction complies with applicable laws and regulations. According to Gary Lipsky, President & CEO of Break of Day Capital, “You will be more successful over the long term by doing the right thing.” This emphasizes the importance of maintaining in the real estate industry. Additionally, Robert C. Volpe of Holtzman Vogel highlights the volatility in today’s commercial real estate market, characterized by rising interest rates and a dynamic retail landscape. Amidst this uncertainty, can be a crucial tool for maintaining stability and ensuring smooth project execution. These agreements, which are contracts between property owners or developers and local governments, establish the rules, regulations, and conditions for development projects, offering a pathway for long-term viability.

Conclusion

Navigating the commercial real estate closing process is a multifaceted endeavor that requires a nuanced understanding of various legal, financial, and logistical aspects. The importance of mastering this process is amplified in the current economic landscape, characterized by fluctuating inflation expectations and rising interest rates. Investors are increasingly selective, focusing on specific submarkets and asset attributes, which underscores the necessity of a well-coordinated closing process to mitigate risks and facilitate successful transactions.

Key stages of the closing process, including the negotiation of the purchase agreement, due diligence, securing financing, and conducting a thorough title review, highlight the intricate nature of these transactions. Each stage demands meticulous attention to detail to ensure compliance with legal requirements and to protect the interests of all parties involved. Challenges such as disputes over contract terms, delays in approvals, and title complications can arise, making proactive measures and open communication essential for a smooth closing.

Engaging a commercial real estate attorney is critical in navigating these complexities. Their expertise not only aids in compliance with legal standards but also provides invaluable guidance throughout the transaction. As the commercial real estate market continues to evolve, maintaining ethical and operational standards becomes paramount for long-term success.

By understanding the intricacies of the closing process and leveraging professional legal support, stakeholders can enhance their ability to navigate the current market dynamics effectively.

Frequently Asked Questions

What is the commercial real estate closing phase?

The closing phase is a crucial step in property transactions where ownership shifts from the seller to the buyer. It involves a complex process of legal, financial, and logistical components to ensure all parties fulfill their obligations and the deal is executed smoothly.

Why is understanding the closing process important?

Given the evolving commercial real estate landscape, marked by fluctuating inflation and rising interest rates, understanding the closing process is vital to navigate risks and ensure successful transactions.

What are the critical stages in the commercial closing process?

The closing process consists of several stages: Negotiation of the Purchase Agreement, Due Diligence, Securing Financing, Title Review, Preparation for Finalization, Executing Closing Day Procedures, and Post-Closing Matters.

What challenges can arise during the closing process?

Common challenges include disputes over contract terms, delays in obtaining approvals or financing, complications during title review, and issues during the due diligence stage.

How can these challenges be mitigated?

Performing comprehensive legal and financial assessments and maintaining open communication with all stakeholders can help simplify the finalization and reduce the likelihood of disputes.

Why is it important to engage a commercial real estate attorney?

An experienced attorney provides essential guidance on legal requirements, assists in drafting and negotiating contracts, and ensures proper execution of all documents, helping to safeguard against potential legal issues.

What role do development agreements play in the current market?

Development agreements establish rules and conditions for development projects, which can help maintain stability and ensure smooth execution amidst the volatility in the commercial real estate market.

How is the commercial real estate market currently performing?

Despite challenges such as rising interest rates, the market has shown resilience, with multifamily assets representing a significant portion of total sales. Investors are focusing on specific submarkets to navigate the current environment.

What is the ‘Great Reset’ era mentioned in the article?

This term refers to a phase in the industry where redefining strategies and protecting against potential property value losses are essential, as emphasized by industry leaders.